Placeholder: On the Dilemma of Crypto Entrepreneurs: Stick to Purism or Go with the Flow?

TechFlow Selected TechFlow Selected

Placeholder: On the Dilemma of Crypto Entrepreneurs: Stick to Purism or Go with the Flow?

The integration of cryptocurrency with traditional business and mainstream finance seems to be an inevitable trend, but this does not mean the demise of blockchain's original vision.

Author: Mario Laul

Translation: Luffy, Foresight News

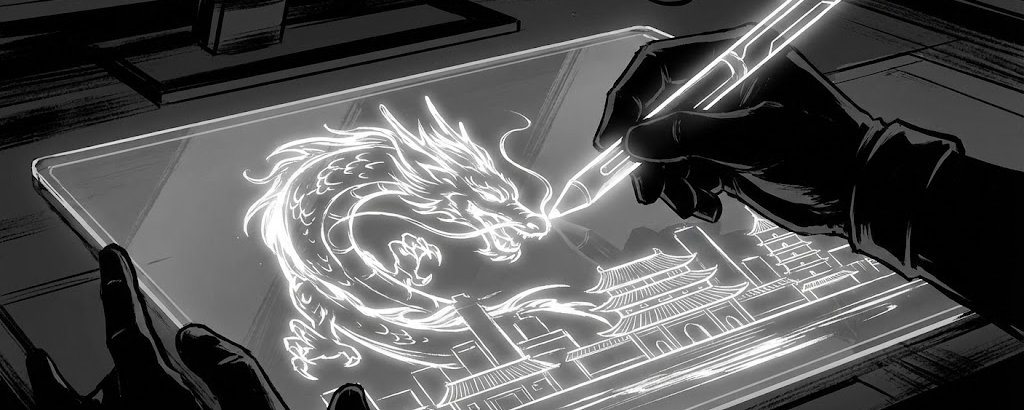

The foundation of public blockchains was laid by cypherpunks. While the crypto industry was destined to give rise to a wide range of ideas and practices, it is the principles of decentralization, open-source software, cryptographic security, privacy, and self-sovereignty that underpin its most disruptive achievements. Yet there is a problem: due to the lack of regulatory frameworks that foster innovation and legitimize blockchains as infrastructure with unique capabilities, crypto entrepreneurs face a difficult choice: should they adhere strictly to purist ideals—greatly complicating their project’s structure and operations—or compromise on those original ideals in exchange for regulatory approval and more conventional mainstream adoption? I call this the crypto entrepreneur's dilemma.

Since its inception, blockchain has been associated with grand ambitions: separating money from the state, creating censorship-resistant global payment and coordination networks, building software services without single points of failure, and enabling entirely new forms of digital organization and governance. Spreading such revolutionary aspirations required specific conditions—and in the case of cryptocurrency, these were provided by the aftermath of the global financial crisis and the evolving data practices and business models of big tech companies. Combined with the global adoption of digital technologies and the built-in incentive mechanisms of tokens, crypto had nearly ideal conditions for early ecosystem development. Since then, the accumulation of social and financial capital across individual blockchain networks and the industry as a whole has made crypto a force to be reckoned with—one demonstrated clearly by its prominent role in the 2024 U.S. presidential election.

Revolutionary ambition also requires courage and naivety. Attempts to disrupt any social structure—especially those grounded in law—often end in failure. Cryptocurrency leveraged public discontent, positioning itself against incumbent institutions, but this stance has always been difficult to reconcile with the goal of building digital platforms serving vast global user bases. Likewise, blockchain-based transactions bypassed regulatory requirements imposed on underlying infrastructure operators or traders within various jurisdictions, making them vulnerable to local enforcement actions. The ultimate price of crypto’s growth has been the formalization of its regulatory status and everything that comes with it. To paraphrase a well-known saying: you may not be interested in government, but government is interested in you.

While much of today’s regulation remains fluid, this is precisely what we are observing in practice. From taxing crypto-related activities and classifying tokenized assets to enforcing anti-money laundering / counter-terrorism financing rules and assigning legal liability within DAO governance, cryptocurrency is gradually being integrated into existing regulatory regimes centered around national jurisdictions. More importantly, however, this process also involves the creation of new case law and regulatory frameworks—the primary battleground where the original values of crypto must be preserved from being erased amid ideological and political struggles that will determine the balance of power among all stakeholders. The crypto entrepreneur’s dilemma exists because, like any innovation with far-reaching implications, the path to legitimacy is slow and contentious. This is especially challenging for crypto, given that the misconduct of certain bad-faith actors has led to widespread external misunderstandings about the industry.

Another critical factor worth emphasizing is the increasing convergence between blockchain and more traditional business and financial models. For those who view crypto as a parallel system designed to compete with or replace traditional institutions, blurring the lines between the two becomes a source of cognitive dissonance and internal conflict. For others, it is a sign of success—the only sustainable path for blockchains to become systemically important infrastructure. As the crypto industry matures and risks decrease, builders, operators, and user bases will grow and diversify. While this makes crypto an attractive market for traditional enterprises beyond its original value proposition, it will further amplify narrative ambiguity around crypto—especially when combined with various forms of institutionally controlled infrastructure. This is a persistent threat that will grow proportionally with continued crypto adoption.

So how should we appropriately assess the relevance of the crypto entrepreneur’s dilemma as public blockchains enter the next phase of the adoption curve? On one hand, mainstream success for crypto appears to depend less on adhering to an idealized, all-encompassing vision of decentralization and more on tight integration with existing systems. It is not heresy to accept that most "crypto projects" will eventually merge with traditional enterprises or open-source software initiatives, or that most blockchain users are unlikely to internalize cypherpunk ideals to the extent that they become primary drivers of their consumption choices. Ultimately, there may be nothing inherently beneficial about decentralization, nor anything controversial about centralized firms using and operating public blockchains—at least as long as these systems remain publicly verifiable and more resilient than alternative solutions. Thus, once crypto’s regulatory status is sufficiently clarified, this dilemma becomes irrelevant for most entrepreneurs.

However, it would be wrong to conclude from this that the original vision has ended. Technologies such as autonomous agents and artificial intelligence are introducing new and profound challenges to the digital revolution, and the need for robust computing and information management services has never been greater. Blockchain, as an innovation platform, can offer alternatives to legacy systems vulnerable to corruption, mass surveillance, and single points of failure—but it will only endure if a significant number of entrepreneurs and supporters continue committing to the difficult path of building truly decentralized, privacy-enhancing, and censorship-resistant systems. While commercial success no longer depends on this mission, crypto’s long-term societal legacy certainly does.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News