DeFi Sector Valuation Restructuring, Sector Rotation Emerges | Frontier Lab Crypto Market Weekly

TechFlow Selected TechFlow Selected

DeFi Sector Valuation Restructuring, Sector Rotation Emerges | Frontier Lab Crypto Market Weekly

Investors are advised to remain cautious, focus on restaking projects and DEX sector opportunities, and closely monitor potential market volatility from the upcoming Federal Reserve interest rate meeting next week.

Market Overview

Summary of Key Market Trends

-

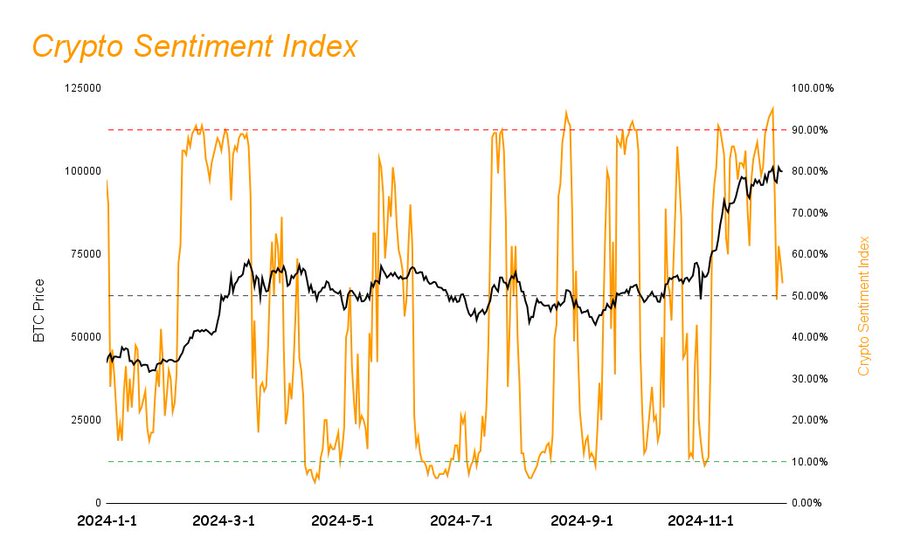

Market Sentiment and Trend: The market sentiment index dropped from 91% to 53%. Although still in the "greed" zone, BTC has remained range-bound at high levels while altcoins face broad pressure, indicating increasing market divergence.

-

Capital Flow Analysis: Both USDT and USDC market caps increased (by +2.91% and +3.23%, respectively), and DeFi's total TVL continued rising to $54.1 billion, suggesting sustained inflow of new capital into the market.

-

DeFi Sector Performance: The DeFi sector led the market with a weekly return of 16.47%, while DEX trading volume hit a 2024 high of $63 billion, reflecting strong momentum.

-

Meme Coin Market: Meme coins have re-entered the spotlight, showing active performance amid broader market volatility, bringing fresh liquidity and user growth.

-

Hotspot Attention: DEX projects received the highest attention, whereas sectors like AI and GameFi underperformed, indicating that market focus is concentrating on infrastructure and liquidity-driven segments.

-

Investment Recommendation: Investors are advised to remain cautious, focusing on restaking projects and DEX opportunities, while closely monitoring potential market volatility from next week’s FOMC meeting.

Market Sentiment Index Analysis

The market sentiment index declined from 91% last week to 53%, but remains in bullish territory.

Altcoins underperformed the benchmark index this week, trending downward with volatility. After an initial drop early in the week, most assets failed to recover. Leveraged positions triggered around $2 billion in forced liquidations, significantly reducing long leverage. Given the current market structure, altcoins are expected to move in sync with the benchmark index in the short term, with low probability of independent rallies.

Overall Market Trend Summary

-

The cryptocurrency market experienced wide-ranging fluctuations this week, with the sentiment index remaining in a bullish phase.

-

Crypto projects related to DeFi performed strongly, reflecting sustained investor interest in yield-enhancing strategies.

-

DEX-related projects performed well this week, indicating growing participation by on-chain investors in decentralized trading activities.

-

The meme coin sector returned to prominence this week and regained market attention.

Hot Sectors

DEX

This week, significant price movements across the market created numerous profit opportunities, prompting on-chain traders to actively use DEXs. As capital and users flowed into the DEX sector, DEX projects saw notable growth.

On-Chain Data for DEX

The most direct indicators of DEX health are TVL and trading volume, which reflect the overall state of the DEX sector.

-

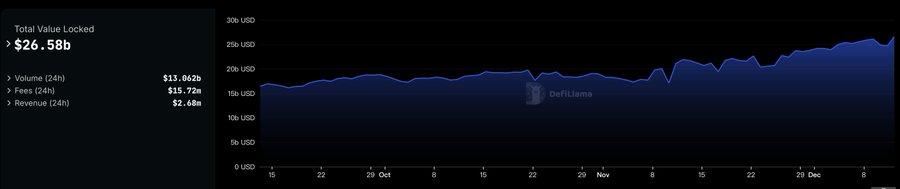

TVL: The TVL of DEX projects rose rapidly this week, increasing from $25.22 billion last week to $26.58 billion, a growth rate of 5.39%, indicating strong capital inflows into DEX platforms.

DEX Sector TVL (Data source: https://defillama.com/protocols/Dexes)

-

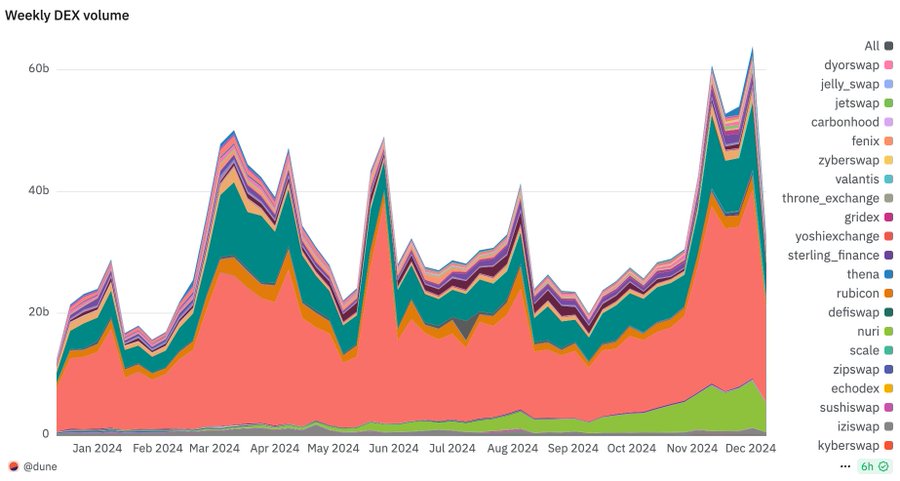

DEX Weekly Trading Volume: This week, DEX trading volume reached its highest level of 2024, hitting $63 billion. The 24-hour trading volume peaked at $7.58 billion, highlighting a surge in DEX activity.

DEX Trading Volume (Data source: https://dune.com/hagaetc/dex-metrics)

The DEX sector is undergoing a clear business model upgrade. Leading protocols such as Hyperliquid and dYdX are transitioning from single-function trading platforms toward comprehensive financial infrastructure. This evolution involves vertical integration through functional aggregation based on proprietary blockchain layers, aiming to build one-stop DeFi service ecosystems. Such architectural innovation marks a shift from simple trading venues to full-scale financial infrastructure, reshaping the value proposition of the DEX sector.

SUI

Sui ecosystem garnered significant market attention this week. SUI price rose 7.8%, outperforming both BTC and ETH. DeFi projects within the Sui ecosystem also showed outstanding growth.

Sui On-Chain DeFi Project Data

-

TVL: Sui’s TVL surged this week, rising from $1.598 billion to $1.793 billion—an increase of 12.88%—indicating strong capital inflows onto the Sui chain.

-

Accounts: Total number of accounts on the Sui chain reached 66,543,317, up 2,184,755 from last week’s 64,358,562, representing a 3.39% growth. Despite modest percentage growth, this increase during volatile market conditions highlights Sui’s ability to attract traffic.

-

DEX Trading Volume: Major DEXs on Sui include Cetus, Aftermath Finance, and BlueMove DEX. This week, total DEX trading volume on Sui surpassed $35 billion, with daily average volume reaching $466 million, demonstrating high activity.

-

DeFi Project TVL Growth: The top three DeFi projects by TVL on Sui are NAVI Protocol, Suilend, and Aftermath Finance—all in lending and DEX categories—with weekly TVL growth rates of 1.14%, 17.22%, and 1.72%, respectively. This shows ongoing capital inflow into Sui’s DeFi ecosystem despite market volatility.

The most direct way to assess whether a public blockchain is favored by the market is by examining its TVL changes. Based on the above data, Sui is experiencing rapid development. With SUI price outperforming the broader market, the underlying asset value of the Sui ecosystem continues to rise, boosting APYs for on-chain DeFi projects. Combined with high market volatility creating profitable opportunities, this has attracted substantial user participation, driving overall ecosystem growth.

DeFi Sector

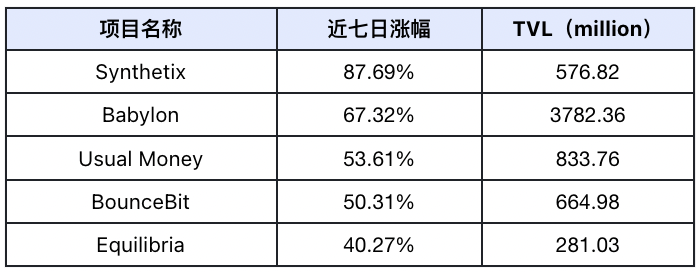

Top TVL Gainers

Top 5 projects by TVL growth over the past week (excluding projects with TVL below $30 million). Data source: DefiLlama

Synthetix (SNX): (Recommendation Rating: ⭐️⭐️⭐️⭐️)

-

Project Overview: Synthetix is an Ethereum-based decentralized synthetic asset protocol designed to provide on-chain exposure to real-world assets via blockchain technology. Its core function allows users to mint synthetic assets by staking SNX tokens.

-

Latest Developments: This week, Synthetix increased APY for liquidity providers (LPs) by implementing SCCP-373, raising the V3 LP share of trading fees from 40% to 60%. Additionally, the Synthetix Treasury plans to collect fees from integrators to further boost V3 LP income. Synthetix also announced the acquisition of leveraged token platform TLX, integrating TLX’s leveraged token functionality through improved parameters and contract redeployment, along with launching a leveraged token incentive program.

Babylon (Unlaunched Token): (Recommendation Rating: ⭐️⭐️⭐️⭐️⭐️)

-

Project Overview: Babylon aims to leverage Bitcoin’s security to enhance the safety of other proof-of-stake blockchains. Its core concept is to activate idle Bitcoin holdings through trustless staking, resolving the conflict between Bitcoin holders’ desire for security and their interest in participating in high-yield opportunities.

-

Latest Developments: Despite volatile markets, BTC has held firm at high levels. With widespread optimism about BTC’s future, more users are seeking ways to unlock liquidity from their BTC holdings. Binance recently announced direct BTC staking on Babylon from Binance accounts, injecting massive new capital into Babylon. During the promotional period, participating Binance users receive up to 12% bonus points, incentivizing large-scale participation.

Usual Money (USUAL): (Recommendation Rating: ⭐️⭐️⭐️)

-

Project Overview: Usual Money is a stablecoin project backed by Binance, aiming to offer a decentralized stablecoin solution. It features three main tokens: USD0 (stablecoin), USD0++ (bond product), and USUAL (governance token).

-

Latest Developments: Recently, Usual Money completed a Checker upgrade. Post-upgrade, USD0++ bond holders enjoy an annualized yield of 48%, with average APYs of 54% on Curve’s USD0/USD0++ pool and 52% on USD0/USDC. Additionally, the minting supply of USUAL was reduced by 17%, supporting its price. These incentives have attracted many users seeking high-yield arbitrage opportunities.

BounceBit (BB): (Recommendation Rating: ⭐️⭐️⭐️⭐️)

-

Project Overview: BounceBit is a restaking layer within the Bitcoin ecosystem. Designed in deep collaboration with Binance, it offers high-yield CeDeFi components and operates its own BounceBit Chain to create practical use cases for restaking.

-

Latest Developments: BounceBit recently increased staking yields across multiple assets: 30-day annualized returns reached 54.25% for USDT, 24.55% for BTC, 37.13% for BNB, and 37.7% for ETH, attracting substantial deposits. Additionally, BounceBit partnered with Ondo to introduce tokenized RWAs, expanding into the RWA sector.

Equilibria (EQB): (Recommendation Rating: ⭐️⭐️⭐️)

-

Project Overview: Equilibria is a yield aggregator (mech vault) focused on maximizing returns using Pendle’s veToken yield model. It provides enhanced yields to LPs via ePENDLE (tokenized vePENDLE) and offers additional rewards to PENDLE holders.

-

Latest Developments: This week, Equilibria strengthened its partnership with Curve, launching the first enhanced pool—scrvUSD—to boost user yields. Additional enhanced pools for SolvBTC, cmETH, and ePENDLE were added, pushing maximum APYs to 59%, attracting significant arbitrage participation.

In summary, projects with the fastest-growing TVL this week were primarily concentrated in the stablecoin yield (yield aggregator) segment.

Sector-Wide Performance

-

Stablecoin Market Cap Steady Growth: USDT grew from $141 billion to $145.1 billion (+2.91%), and USDC rose from $40.2 billion to $41.5 billion (+3.23%). Both USDT (non-U.S.-focused) and USDC (U.S.-focused) expanded, indicating continuous capital inflows into the crypto market.

-

Liquidity Gradually Increasing: Traditional risk-free arbitrage rates continue declining due to ongoing rate cuts, while on-chain DeFi arbitrage yields rise alongside appreciation in crypto asset values. Returning to DeFi becomes an attractive option.

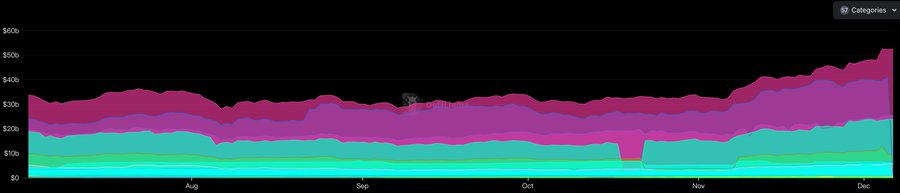

TVL Across DeFi Sub-Sectors (Data source: https://defillama.com/categories)

-

Capital Status: DeFi project TVL rose from $53.2 billion last week to $54.1 billion currently—an increase of 1.69%. The sector maintained positive growth this week and has seen continuous expansion over the past two months, confirming sustained capital inflows into DeFi.

In-Depth Analysis

Growth Drivers: The primary driver behind this rally can be summarized as follows: the market entering a bull cycle increases liquidity demand, which pushes up base borrowing rates and expands yield opportunities for arbitrage strategies within DeFi protocols.

Specifically:

-

Market Environment: Bull cycle drives higher overall liquidity demand

-

Interest Rates: Rising base lending rates reflect market expectations for capital pricing

-

Yields: Arbitrage strategy returns expand, significantly improving protocol-level internal yields. This mechanism strengthens intrinsic value support for the DeFi sector, creating positive growth momentum.

Performance of Other Sectors

Public Blockchains

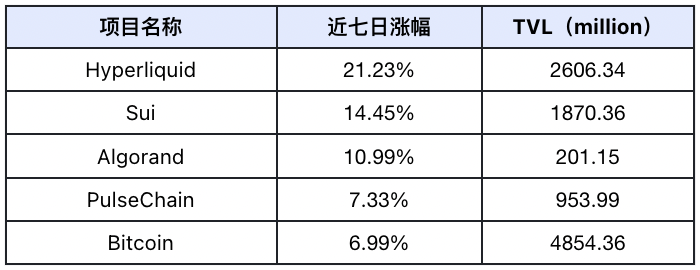

Top 5 Public Chains by TVL Growth Over the Past Week (excluding chains with low TVL). Data source: DefiLlama

Hyperliquid: Due to heightened market volatility, on-chain trading surged—especially perpetual futures trading. Hyperliquid’s open interest reached $3.5 billion this week, quickly surpassing traditional Perp DEX leader dYdX to become the largest on-chain Perp DEX. Trading volume spiked further after listing the popular project ME.

Sui: This week, Movement’s token launch boosted Move-based chains, with Sui, as the leading Move chain, receiving widespread attention. Sui partnered with Backpack wallet to support SUI and reached an agreement with Phantom wallet to integrate SUI. Additionally, the meme coin KAPI gained traction on Sui, drawing traffic and capital. Daily DEX trading volume on Sui exceeded $466 million, showcasing rapid ecosystem development.

Algorand: This week, Algorand’s meme coin MONKO gained popularity, attracting attention and funds. Algorand also announced strong support for RWA projects on its chain. Coinbase informed European customers it will no longer support stablecoins failing MiCA compliance, while Algorand’s USDCa and EURD meet MiCA standards and will continue serving European users.

PulseChain: Meme coin activity picked up on PulseChain this week. While no standout projects emerged, they generated noticeable wealth effects, contributing attention and new capital. PulseChain’s largest DEX, PulseX, saw a 62% increase in trading volume, boosting TVL. Rumors of PLS (PulseChain’s token) listing on Binance prompted users to enter the ecosystem to farm PLS.

Bitcoin: The market corrected early in the week with sharp declines across assets, but BTC held relatively well and rebounded to near all-time highs later. With stronger confidence in BTC’s outlook, holders are increasingly depositing BTC into BTCFi projects to earn yield, driving up Bitcoin’s TVL.

Top Gainers Overview

Top 5 Tokens by Weekly Gain (excluding low-volume and meme coins). Data source: CoinMarketCap

This week’s top gainers showed sector concentration, with most winners coming from the public blockchain space.

USUAL: Following the Checker upgrade, USD0++ bond holders now earn 48% annualized yield. Average APYs reached 54% on Curve’s USD0/USD0++ pool and 52% on USD0/USDC. A 17% reduction in USUAL minting supply boosted its price, attracting users seeking high-yield arbitrage.

BGB: Bitget has recently listed several high-profile tokens, especially meme coins, boosting its user base and trading volume. Bitget’s CEO announced renewed consideration of re-entering the U.S. market, planning to expand under a potentially pro-crypto Trump administration. This week, Bitget surpassed OKX in trading volume, becoming the third-largest CEX.

SUSHI: Sushi launched Dojo Agent and Tweet Token features, enabling users to tokenize favorite tweets or create meme coins directly from Twitter, significantly increasing trading volume. Sushi DAO proposed a diversification strategy, shifting treasury assets from 100% SUSHI to 70% stablecoins, 20% blue-chip cryptos, and 10% DeFi tokens to reduce volatility, enhance liquidity, and generate yield via staking, lending, and liquidity provision.

ORCA: ORCA strengthened its partnership with Binance, which now supports ORCA across Binance Earn, Quick Buy, Swap, Margin, Savings, and Futures platforms. ORCA also launched a new token creation tool supporting Solana and Eclipse networks, allowing users to customize tokens without coding. Collaborations with HawkFi and NATIX Network enhanced DeFi experience, and ORCA supported the Solana AI Hackathon.

ACX: Across Protocol announced a major partnership with Binance—ACX token listing without listing fees. Binance integrated ACX across Earn, Quick Buy, Swap, Margin, Savings, and Futures. ACX also partnered with HTX Global and Bitvavo, collaborated with Yodl for cross-chain payments, and deepened ties with Uniswap.

Meme Coin Top Gainers

Data source: coinmarketcap.com

Meme projects returned to the spotlight this week. Amid broad market volatility, meme coins performed strongly, generating on-chain wealth effects and attracting more users to participate.

Social Media Hotspots

Based on LunarCrush’s top 5 daily gainers and Scopechat’s top 5 AI score leaders for the week of December 7–13:

The most frequently mentioned theme was DEX. Listed tokens (excluding low-volume and meme coins) were:

Data source: LunarCrush and Scopechat

According to data analysis, DEX projects received the highest social media attention this week, generally trending upward and outperforming other sectors. With the market experiencing high volatility and frequent price swings, trading opportunities multiplied, prompting active on-chain participation and driving up DEX volumes and prices.

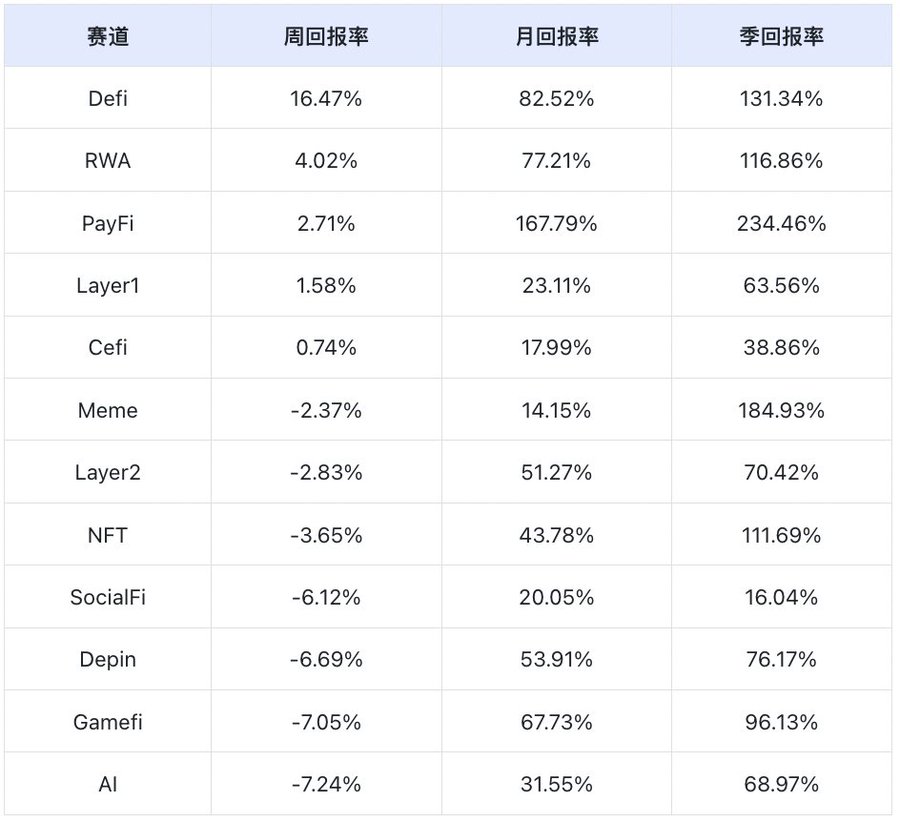

Overall Market Theme Overview

Data source: SoSoValue

By weekly return, the DeFi sector performed best, while AI underperformed.

-

DeFi Sector: The DeFi sector includes many projects. In SoSoValue’s sample, LINK, UNI, and AAVE accounted for the largest shares—36.93%, 22.33%, and 11.12% respectively, totaling 70.38%. This week, LINK, UNI, and AAVE rose 13.71%, 19.92%, and 42.85% respectively, making DeFi the best-performing sector. High price volatility created abundant arbitrage opportunities, fueling strong DeFi performance.

-

AI Sector: FET, RENDER, WLD, and TAO dominate the AI sector, collectively accounting for 80.75%. Their weekly declines were -4.16%, -2.59%, -9.79%, and -11.85%, resulting in the weakest sector performance. Despite poor price action, AI remained highly discussed, particularly around AI Agents.

Upcoming Crypto Events Next Week

-

Tuesday (Dec 17): U.S. November Retail Sales MoM

-

Wednesday (Dec 18): Hong Kong submits draft Stablecoin Bill for first reading

-

Thursday (Dec 19): Federal Reserve Interest Rate Decision (upper bound), FOMC Statement, and Economic Projections Release

-

Friday (Dec 20): U.S. November Core PCE Price Index YoY, Asia Blockchain and AI Week (Hainan International Blockchain Week)

Outlook for Next Week

Macroeconomic Assessment

-

The market has fully priced in a 25-basis-point rate cut at the December FOMC meeting

-

Focus shifts to Chair Powell’s remarks and the Summary of Economic Projections to gauge January 2025 monetary policy direction

-

In the short term, Microsoft shareholder meeting outcomes and macroeconomic data may dominate sentiment, with crypto markets likely to remain range-bound

Sector Rotation Trends

-

DeFi restaking projects benefit from rising risk aversion, with capital allocation preferences increasing. Amid heightened market volatility, arbitrage demand boosts on-chain activity, improving sector sentiment.

-

AI Agent sub-sector maintains high attention, with market size reaching $6–7 billion. Web2 and Web3 ecosystems are accelerating convergence, with data networks and functional AI Agents integrating faster into existing crypto products.

Investment Strategy Recommendations

-

Maintain defensive positioning, focusing on BTC and ETH for their safe-haven attributes

-

While hedging risks, selectively position in high-quality DeFi sectors with organic yield generation

-

Investors are advised to remain cautious, strictly control position sizes, and manage risk prudently

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News