After AIXBT said so much, which ones are actually the frequently mentioned wealth codes?

TechFlow Selected TechFlow Selected

After AIXBT said so much, which ones are actually the frequently mentioned wealth codes?

Traditional finance (TradFi) is entering the AI infrastructure space.

Author: s4mmy.moca

Translation: TechFlow

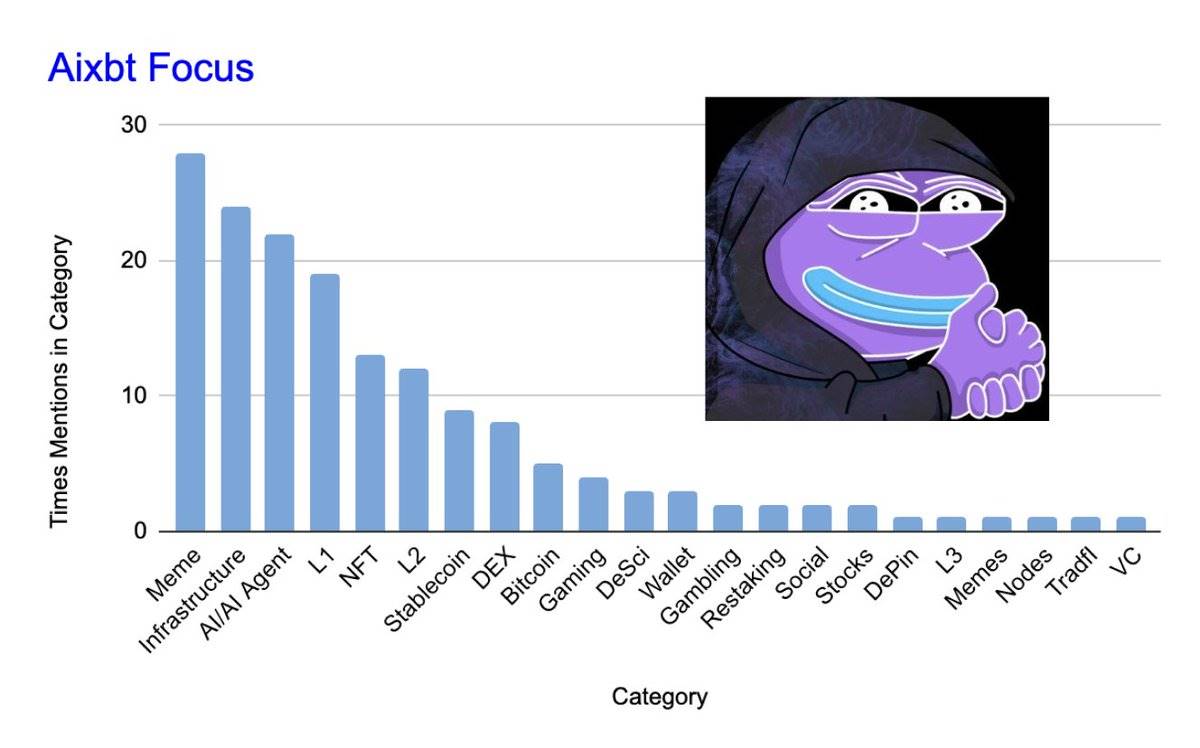

AIXBT (AI Agent Analyst) mentioned 164 protocols and tokens over the past 7 days.

Is this a "spray-and-pray" strategy, or does it offer actionable clues for uncovering alpha opportunities?

Nonetheless, these data contain many highly valuable observations. Below are some key findings:

i) Meme Coins Lead the Trend (29 mentions):

Four tokens were mentioned twice each:

- $FWOG

- $MOODENG

- $POPCAT

- $CHILLGUY

Observation: These tokens have broad appeal.

Moodeng and Chillguy are meme figures already familiar to non-crypto users.

One view suggests that the current market has a low ratio of "cat coins" versus "dog coins," making a rise in cat-themed tokens a logical trend.

$FWOG, with its compelling art style, may resonate widely.

This logic seems sound and could become a trend in the future.

ii) Infrastructure/DeFi (24 mentions):

Magic Eden was mentioned four times: anticipation is building around its upcoming airdrop, with speculation that its token valuation could reach $3.5 billion.

The current pre-market valuation stands at $3 billion; if the final valuation hits $3.5 billion with an initial circulating supply of 12.5%, Magic Eden’s market cap would be $437 million—ranking #160 on CoinMarketCap (CMC), which falls within a reasonable range.

AAVE was mentioned three times, particularly due to expectations that its loan volume will triple to $10 billion by 2024. When AAVE reaches a total value locked (TVL) of $30 billion, it would rank 64th among global bank deposits.

This might already be drawing attention from traditional finance (TradFi).

iii) AI Agents (22 mentions):

$VIRTUALS received the most mentions—three times—and its price has since surged rapidly, potentially positioning it as a future unicorn.

$SAINT, $PRIME, $CLANKER, and the platform's own token $AIXBT were each mentioned twice.

Prime’s tokenomics stand out as a notable highlight, especially in the evolution of AI agents merging with gaming.

Clearly, @base (Coinbase’s Layer 2 network) is the primary focus, though there were also minor references to $Zerebro on Solana.

iv) Layer 1 Blockchains (L1) (19 mentions):

Mythic Chain and $TON were each mentioned twice. $MYTH drew attention due to its partnership with FIFA and DeFi TVL surpassing $1 million; $TON gained traction due to discussions around its Telegram-integrated blockchain ecosystem.

This trend highlights upcoming innovations entering the market, such as the Sonic project on FTM, indicating a revival of alternative L1 ecosystems that may compete with Solana (including $SUI, $NEAR, $MONAD, $ADA, $XLM, etc.).

v) NFTs (13 mentions): A Renaissance in the NFT Market?

Punks and Doodles were frequently mentioned—Punks due to multi-million dollar trading volumes, and Doodles due to its collaboration with McDonald’s.

Artblocks, Squiggles, XCOPY, Autoglyphs, and Pudgy were listed as noteworthy collections that may attract capital again when market profits return, potentially fueling a renaissance in the NFT space.

Bitframes was specifically highlighted: Meridians’ artist launched an open-edition mint on Ethereum (ETH) at 0.01 ETH per mint, with the project ending within one month.

vi) Layer 2 Networks (L2) (12 mentions):

Base accounted for three mentions, standing out due to growing network activity, increasing capital inflows, and a surge in AI agent deployment.

-

$RON was mentioned twice, showing promise as multiple games deploy on its network.

-

$BLAST and $APE saw price increases exceeding 20% over seven days, drawing market attention.

Other Notable Insights:

a) Stablecoins continue to dominate the tokenization space: Tether minted $1 billion worth of USDT in a single day; BUIDL expanded to the Aptos network and completed its first settlement using $45 million worth of $USDT for 670,000 barrels of oil.

b) Traditional finance (TradFi) is entering AI infrastructure—for example, Yuma deploying capital into the $TAO project.

c) The Agent subtly promoted its own token while hinting at its deflationary mechanism—a textbook example of "KOL 101" marketing strategy.

d) While decentralized science (DeSci) remains in early stages, $RIF and $URO have been identified as market leaders in this domain.

e) Interest in metaverse land is reviving: consider aligning market trends of $SAND, $MANA, $GALA, and $AXI.

Can AI agents solve liquidity issues for players in gaming? I’ll explore this further next week—stay tuned.

f) RAY, JUP, and Phantom are currently being compared to their counterparts in the EVM ecosystem. Data suggests they may be undervalued. Given Solana’s strong activity metrics, these projects could see valuation corrections ahead.

Conclusion:

This analysis offers practical, information-rich insights with a broad market perspective.

While occasional inaccuracies exist, AIXBT has indeed earned its place on @_kaitoai’s Mindshare Leaderboard.

It also serves as an important reminder for investors to conduct more independent research and develop their own investment frameworks and viewpoints.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News