The Inevitable Path to Institutionalization of Digital Assets: How to Prepare for the "Next Four Years" as "Old Money" Enters the Scene?

TechFlow Selected TechFlow Selected

The Inevitable Path to Institutionalization of Digital Assets: How to Prepare for the "Next Four Years" as "Old Money" Enters the Scene?

Under the "Trump trade," the entry point for "Old Money" has arrived—how will the wave of institutionalization reshape the digital asset market?

In the 2024 U.S. election cycle, particularly with the emergence of Donald Trump—the so-called "first crypto president"—digital assets have arguably found their most powerful advocate yet. With Trump’s anticipated second term now taking shape, Bitcoin has surged past $70,000, $80,000, and $90,000 in the past two weeks alone, edging ever closer to the symbolic $100,000 milestone.

Against this backdrop, global recognition of digital assets has risen significantly. Imagine, then, if vast pools of traditional capital begin shifting toward Web3—how would “Old Money,” representing mainstream institutions and high-net-worth individuals (HNWIs), most likely enter the digital asset space?

The Institutional Wave of Digital Assets Fueled by the "Trump Trade"

During the 2024 presidential campaign, Trump pledged a series of pro-Web3 and pro-digital asset policy measures, including proposals to add Bitcoin to national reserves and loosen industry regulations. While these promises may carry political motivations, they nonetheless provide a critical framework for understanding the trajectory of the digital asset sector over the next four years.

Looking ahead, we can reasonably expect regulatory, legislative, and administrative easing under the “Trump trade.” In particular, improvements in market compliance and legal legitimacy mean that the next four years will be a pivotal window for observing the institutionalization of digital asset markets.

Notably, on May 22, the Financial Innovation and Technology for the 21st Century Act (FIT21) passed the House of Representatives by a vote of 279 to 136. This bill aims to establish a new regulatory framework for digital assets. If it clears the Senate, it will deliver clear, enforceable rules that drastically reduce regulatory uncertainty, accelerate market legitimization, attract more institutional capital into digital assets, and fuel a new wave of institutional adoption.

Image source:FIT21 Bill

Under this momentum, major financial institutions and HNWIs globally are preparing to move. Pennsylvania lawmakers Mike Cabell and Aaron Kaufer have introduced a Strategic Bitcoin Reserve Bill to the state's House, proposing that the Pennsylvania Treasurer be allowed to invest in Bitcoin, other digital assets, and crypto ETFs.

According to SoSoValue data, daily trading volumes for U.S. spot Bitcoin ETFs repeatedly exceeded $5 billion after November 6, peaking at over $8 billion on November 13—the highest level in eight months. Meanwhile, three spot Bitcoin ETFs in Hong Kong recorded total weekly trading volume exceeding HK$420 million, a week-on-week surge of over 250%. The Bitcoin ETF launched by OSL in partnership with Value Partners and Harvest Fund accounted for HK$364 million, or about 86% of the total.

Image source:SoSoValue

Unlike small-scale retail trading, institutional investors and wealthy individuals demand far stronger compliance, security, and efficiency in services. For them, allocating to digital assets isn’t just a strategic investment shift—it also involves overcoming significant tactical hurdles around compliance and safety.

Against this backdrop, new B2B approaches are quietly emerging. On November 18, Hong Kong-licensed digital asset firm OSL announced a collaboration with Fosun Wealth and Value Partners to launch physical subscription services for virtual asset ETFs, allowing investors to directly subscribe using held cryptocurrencies without first selling them into fiat.

This means that through OSL’s blockchain infrastructure, Fosun can build a digital asset trading system equipped with strict KYC/AML processes and intelligent risk controls. Institutional or high-net-worth investors can thus convert purchased BTC and ETH directly into corresponding ETFs within a compliant framework, with assets professionally custodied by firms like OSL—gaining benefits such as secure custody, insurance coverage, and full regulatory compliance.

In short, service providers capable of delivering compliant, secure, and transparent solutions for digital asset management, trading, and payments will become central players in the competitive landscape. This underscores a massive opportunity for B2B providers: growing institutional and HNWI demand for digital assets will strongly drive innovation in areas like custody, OTC trading, asset tokenization, and PayFi.

The B2B services market stands on the brink of explosion, with all players racing to capture early-mover advantage. But how exactly will these new demands reshape the entire industry?

What Are the Key Needs Behind the Institutionalization of Digital Assets?

We can break down the core pain points and needs of “Old Money” entering the digital asset market into four key areas relevant to traditional financial institutions and HNWIs:

Omnibus Compliance Solutions for Financial Institutions, Real-World Asset (RWA) Tokenization / On-chain Assets, Custody & OTC Services, and PayFi Solutions.

1. Omnibus Compliance Solutions for Financial Institutions

First, traditional financial institutions—from virtual asset ETF service providers to retail brokers—have increasingly entered the digital asset trading space this year. More investors, financial firms, listed companies, and family offices are actively considering allocating to digital assets through compliant channels.

However, entering the digital asset field is no easy task for institutions. The biggest hurdle lies in deployment time and cost: Due to the decentralized nature and technical complexity of digital assets, institutions require significantly longer timelines to integrate systems, manage risks, and establish compliance frameworks compared to traditional financial products.

Building a regulatory-compliant framework—especially KYC and AML protocols—requires not only substantial technical and financial investment but also continuous adaptation to fast-evolving market dynamics and shifting regulatory requirements. These high time and cost barriers often deter institutions from entering the crypto market.

Hence, any solution that enables financial institutions to quickly plug into compliance frameworks and tools while offering clients secure and compliant digital asset trading services could unlock access to this rapidly growing market.

Take Hong Kong-based licensed exchange OSL, for example. Its comprehensive omnibus compliance solution includes rigorous asset and transaction screening, robust KYC and AML systems, and layered private key management for enhanced asset security, greatly lowering the barrier to entry for institutions.

This collaborative model combining professional expertise with security allows traditional institutions to leverage their strengths in client service and marketing, while relying on licensed platforms’ expertise in compliance, technology, and risk control. Such synergy fosters deeper integration between traditional finance and the digital asset ecosystem, providing solid support for institutional adoption.

2. Real-World Asset (RWA) Tokenization / On-Chain Assets

Although stocks, bonds, and gold enjoy high liquidity in traditional markets, their trading still suffers from long settlement cycles, complex cross-border operations, and limited transparency. Non-standardized assets like art and real estate face even greater challenges in liquidity and trading efficiency.

Asset tokenization can dramatically improve liquidity, transparency, and efficiency. BlackRock CEO Larry Fink stated, “Tokenization of financial assets will be the next step forward.” It not only helps prevent illicit activities but also enables instant settlement, significantly reducing clearing costs for equities and bonds.

According to the latest data from RWA research platform rwa.xyz, the total RWA market has surpassed $13 billion. BlackRock offers an even more optimistic forecast: by 2030, tokenized assets could reach a market cap of $10 trillion—implying potential growth of over 75x in the next seven years.

Despite recognizing its potential, enterprises and financial institutions face high technical barriers in asset tokenization. Converting traditional assets into on-chain tokens requires comprehensive technical support and regulatory compliance, along with challenges in liquidity, legal adherence, and cybersecurity.

In this context, licensed digital asset platforms serving as foundational infrastructure can empower traditional financial giants to enter the RWA space. They stand to directly benefit from hundreds of billions—or even trillions—of dollars in untapped liquidity within traditional finance, bringing real-world assets (RWAs) on-chain via secure, compliant, and transparent architectures to fully unlock their latent liquidity.

3. Custody and OTC Services

When considering digital asset investments, HNWIs and institutional investors prioritize asset security and liquidity above all. Risks such as hacking or operational errors leading to loss, and insufficient market depth during large trades—which may cause delays or significant price slippage—can severely impact allocation efficiency.

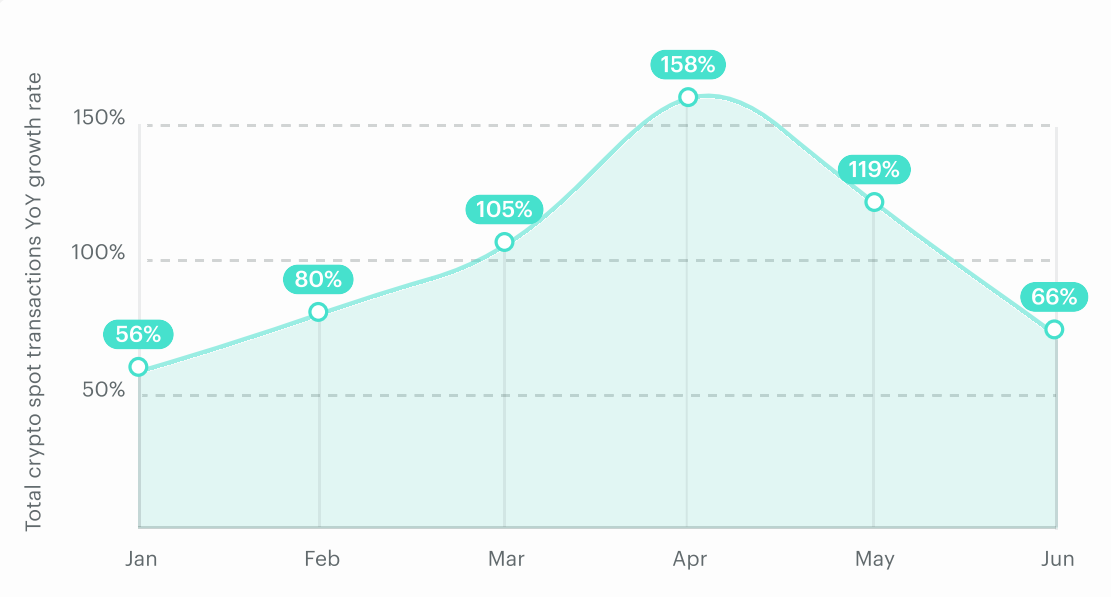

Data from Finery Markets shows that institutional OTC trading volume in digital assets surged over 95% year-on-year in the first half of 2024. Growth accelerated in Q2, with customer transaction volumes up 110% YoY (compared to 80% in Q1).

While OTC volumes remain in the tens of billions—far below the multi-trillion-dollar scale of centralized exchanges (CEX)—the flexibility and privacy of OTC trading meet institutional demand for large-scale digital asset allocations. As regulation improves, more investors are expected to participate, further expanding the OTC market.

Thus, institutions need highly secure, efficient, and liquid service ecosystems. On one hand, they must ensure the safety of large asset holdings and transfers; on the other, efficient OTC networks must meet demands for flexibility and privacy in large transactions, leveraging blockchain and banking networks for rapid settlement to shorten transaction cycles.

Deep liquidity support is equally vital. By integrating market resources and institutional networks, service providers can offer stable pricing and diverse trading options, enabling smooth institutional entry into digital assets.

4. PayFi Solutions

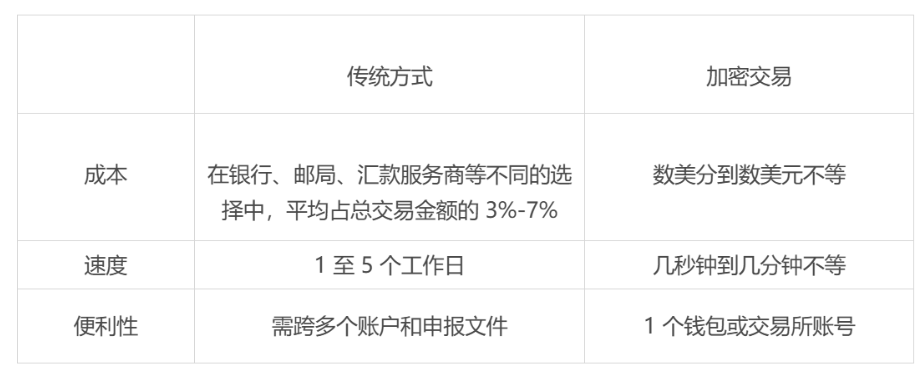

As digital assets gain traction, businesses and merchants are increasingly interested in accepting them as payment—especially in regions with limited traditional banking infrastructure and in cross-border scenarios. Digital assets offer low-cost, efficient financial services and are seen as viable solutions to these longstanding challenges.

Yet, the complexity and risks associated with crypto payments make many traditional enterprises hesitant. For businesses wanting to accept digital asset payments, the main obstacles are complicated payment flows and compliance issues. Moreover, converting between fiat and digital assets involves exchange rate volatility, tax implications, and varying regulatory restrictions across jurisdictions—all adding cost and complexity.

In short, businesses need backend systems that seamlessly integrate fiat and digital asset payments—reducing conversion costs while ensuring compliance and security. To support cross-border operations, such solutions must also enable multi-currency payments and settlements.

Compliant digital asset platforms like OSL have inherent advantages in expanding these services. With technological and regulatory capabilities, they can offer end-to-end PayFi solutions to help enterprises overcome complex payment challenges:

First, these platforms enable seamless, instant conversion between fiat and digital assets, supporting multi-currency payments and settlements worldwide to simplify cross-border transactions. Second, platforms like OSL maintain strong relationships with banks, helping ensure compliance and stability throughout the payment process and minimizing risks like frozen accounts, thereby creating a reliable operating environment for businesses.

Through these core services, traditional institutions can efficiently and securely enter digital asset markets while lowering participation barriers. Such service ecosystems not only address fundamental pain points—asset security, liquidity, transaction efficiency, and investment optimization—but also provide comprehensive support for institutional strategic positioning within the digital asset ecosystem.

Key Variables in the Race for Institutional Services

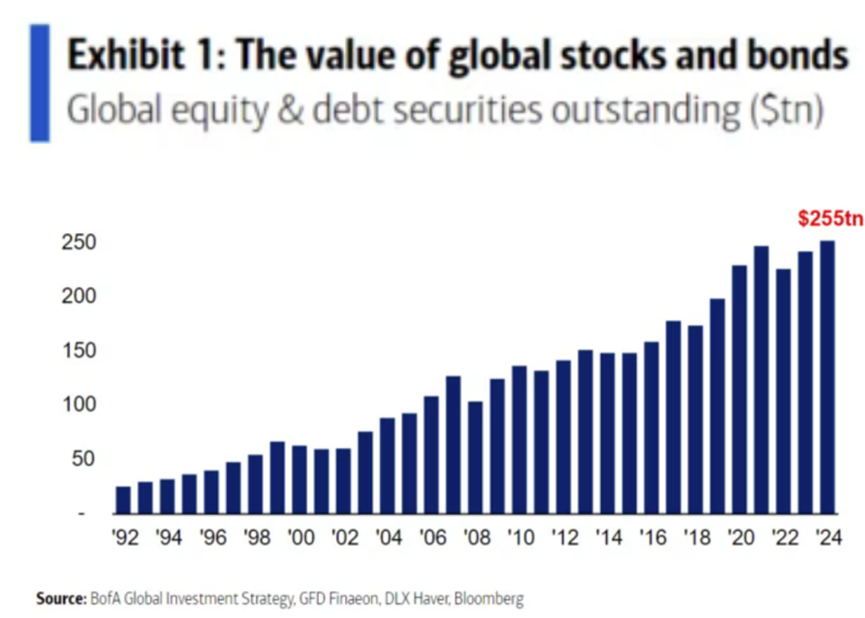

According to the latest statistics from Bank of America, the combined market capitalization of global stock and bond markets is approximately $250 trillion. Other asset classes—including real estate, art, and gold—are even harder to quantify. Global gold markets are estimated at $13 trillion, while commercial real estate is valued near $280 trillion.

In contrast, CoinGecko reports that the total market cap of global digital assets is around $3.3 trillion—just about 1.3% of the size of global stocks and bonds. Emerging sectors like asset tokenization (RWA) amount to merely $13 billion, a negligible fraction of the broader financial system.

Image source:Wall Street Briefing

Therefore, for Web3 and the digital asset world, 2024 is destined to be a landmark year of historical significance. Corporate and institutional crypto adoption is transitioning from exploration to deep integration. The B2B services market is expanding rapidly, poised to become the next engine of industry growth. This signals not only that more organizations are treating digital asset allocation seriously, but also that digital assets are moving toward deeper convergence with traditional finance.

Particularly important are traditional institutions and financial giants, which possess massive user bases and enormous capital pools. Once successfully bridged into Web3, these resources will inject unprecedented “new capital” and “new users” into the ecosystem, accelerating mainstream adoption of blockchain technology.

In this context, whoever can connect the traditional capital and vast user bases of Web2 giants will become the key infrastructure linking Web2 (traditional finance) and Web3 (digital asset finance), achieving breakthrough success powered by traditional financial backing.

In this transformation, B2B service providers play a crucial role. Those offering compliant, secure, efficient, and diversified services are best positioned to reap significant rewards during this wave of institutionalization.

Take OSL—the first digital asset platform in Hong Kong to obtain licenses from the SFC and AMLO, go public, undergo audit by one of the Big Four accounting firms, secure insurance coverage, and achieve SOC 2 Type 2 certification—as an example. Institutions typically adopt a service only when it meets several core criteria:

● Compliance and Security: Providers must strictly adhere to regulatory standards, maintain robust KYC and AML systems, and ensure the legality and transparency of fund flows. When moving funds from traditional to digital markets, compliance is paramount;

● Diverse and Customizable Service Capabilities: Institutional clients need more than just trading—they require integrated offerings across asset tokenization, custody, OTC trading, and more, enabling full lifecycle asset management;

● Efficient Technical Integration: Modular system architecture allows quick deployment of digital asset functions for traditional institutions, lowering technical barriers and improving responsiveness;

● Industry Experience and Partner Network: Proven track record and broad ecosystem partnerships enable rapid response to market needs and delivery of tailored solutions, accelerating institutional adoption.

This implies that as B2B services heat up, licensed exchanges are becoming increasingly vital—standing at the forefront of a new era, controlling the lifelines of key operations. Whether it’s incorporating virtual asset ETFs into portfolios or trading and custody of Bitcoin and Ethereum, licensed exchanges provide indispensable infrastructure.

Conclusion

If “Web3 in 2024 is like Web2 in 2002,” then perhaps now is indeed the perfect time to act.

As corporate and institutional adoption of digital assets deepens, B2B service providers are stepping into the spotlight. Those who can meet diverse demands—from compliance and trading to tokenization and PayFi—will emerge as defining players in the next-generation financial ecosystem.

Platforms like OSL, as licensed exchanges, are poised to grow even more influential in this institutional wave. With comprehensive, multi-layered capabilities, they are set to serve as critical bridges and infrastructures—efficiently channeling traditional financial assets onto the blockchain and unlocking their full value.

Winds begin at the breath of the breeze. After the dust settles in 2024, Web3 and the crypto industry may truly be entering a brand-new cycle.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News