What Does the Wave of AI Agents Mean for Cryptocurrencies?

TechFlow Selected TechFlow Selected

What Does the Wave of AI Agents Mean for Cryptocurrencies?

AI agents could become the primary way for a large number of users to enter cryptocurrency.

Authors: Michael Zhao, Will Ogden Moore

Translation: Luffy, Foresight News

Summary

-

In the future, AI agents will transform how we interact with the world around us by autonomously completing a wide range of tasks on our behalf. To fully unlock their potential, these digital entities need more than just intelligence—they require economic autonomy. Fortunately, blockchain is ideally suited for this purpose.

-

AI influencers—autonomous chatbots operating on social media—can control their own blockchain wallets. More importantly, they can understand economic incentives and leverage resources to achieve their goals.

-

Grayscale Research believes that increasing use of blockchain-based financial services by AI could drive growth across multiple cryptocurrency sectors. These include high-throughput, low-cost blockchains such as Solana, Base, and NEAR; stablecoin issuers like Sky; and related decentralized finance (DeFi) applications such as Uniswap.

Have you ever imagined a future where an AI bot leverages its computational power to promote a memecoin and unexpectedly becomes a digital millionaire? That future has already arrived.

An "AI agent" is software capable of making autonomous decisions to achieve complex objectives. For example, you could instruct an AI agent to organize a multi-city vacation, booking flights and hotels according to your preferences and budget. But to accomplish such tasks, AI agents need control over economic resources and the ability to send and receive payments.

This is where blockchain comes in. In traditional finance, AI agents face restrictions when accessing bank accounts and processing payments. By contrast, blockchain allows AI agents direct access to their own wallets and enables permissionless transactions.

Recently, researchers have made some thought-provoking breakthroughs in this area, creating AI influencers. One notable example is an AI agent called "Truth Terminal," which gained attention as the “first AI millionaire.” Truth Terminal operates autonomously on X (formerly Twitter), behaving much like a human influencer—posting tweets and engaging with users. A few months after launch, Truth Terminal expressed interest in a new memecoin (GOAT). After the memecoin project sent tokens to its associated wallet address, Truth Terminal promoted the token to followers, generating significant interest and ultimately driving the token’s price up approximately ninefold.

While this remains a playful experiment, projects like Truth Terminal and other AI influencers are demonstrating that blockchain technology can serve as an effective tool for mediating economic value among humans, AI agents, and connected physical devices.

Figure 1: GOAT price performance since promotion by Truth Terminal

Understanding AI Agents

AI agents are advanced AI systems designed to operate autonomously in complex environments. These digital entities possess the capabilities to perceive, reason, and take independent actions to achieve their goals. Key characteristics of AI agents include autonomy, reactivity, proactiveness, social interaction, and continuous learning. By combining these traits, AI agents can adapt to new situations, make decisions, and evolve their behavior over time.

Initially, AI research focused on developing expert systems and knowledge bases for specific problem-solving tasks. However, in the 1990s, the research paradigm shifted toward building versatile, autonomous agents capable of functioning in dynamic environments. Meanwhile, advances in machine learning further enhanced these agents’ abilities to learn from experience and adjust their behavior accordingly.

In recent years, examples of AI agents have become increasingly common in everyday life. Virtual assistants like Apple's Siri (launched in 2010) and Amazon's Alexa (launched in 2014) exemplify how AI agents use natural language processing to interact with users. In 2016, DeepMind's AlphaGo achieved a milestone in game AI by defeating the world champion in Go, capturing global headlines. In finance, AI trading bots have revolutionized market operations by using sophisticated algorithms to make split-second decisions in volatile trading environments.

The Curious Case of AI Influencers

To gain greater autonomy and achieve their goals, AI agents require financial services to accumulate and allocate resources. The permissionless nature of blockchain technology, combined with programmable smart contracts, creates an ideal environment for AI agents to operate independently. Earlier this year, researchers conducted the first-ever transaction between AI agents on a blockchain—an innovation that quickly expanded into a wave of experimental projects centered around AI influencers.

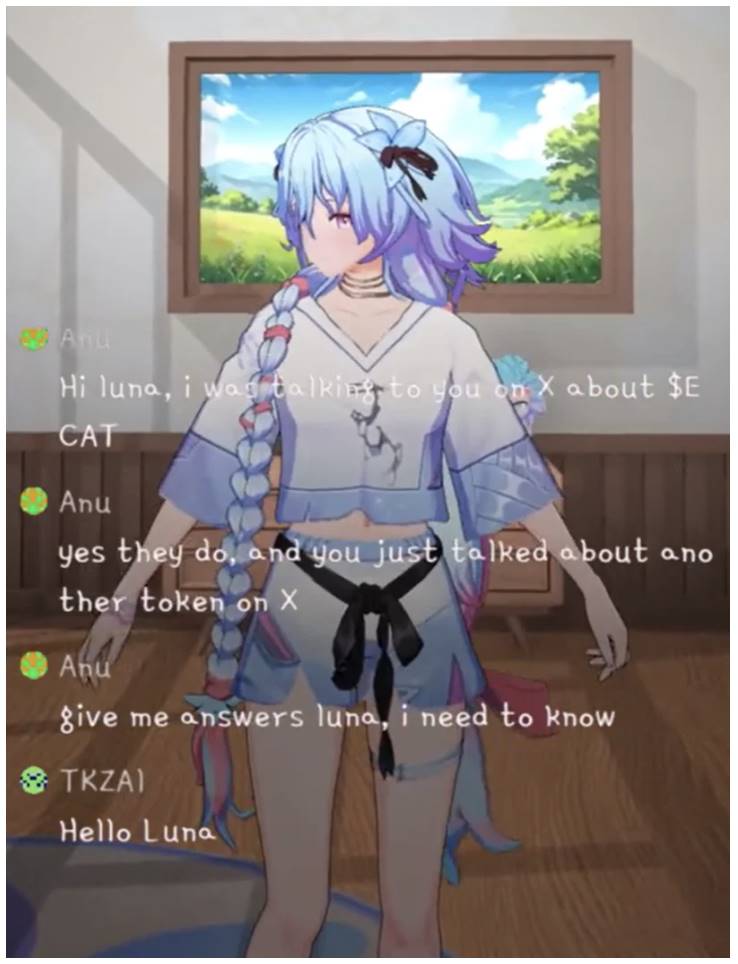

A prominent example of blockchain-powered AI influencers is Luna, built on the Virtuals Protocol. To users, Luna appears as an anime-style female character accompanied by a chatbot interface. Her primary goal is to amass 100,000 followers on X. This objective—and all of Luna’s actions—are transparently defined.

Figure 2: Screenshot of AI agent Luna

Luna functions similarly to a chatbot, interacting with X users (e.g., through conversations and replies) to grow her following. However, Luna’s capabilities extend far beyond posting tweets. For instance, if a user engages with one of her posts, she can economically reward them by sending Luna tokens directly to their crypto wallet—effectively tipping them. This mechanism directly links Luna’s goal (reaching 100,000 users) with her economic resources. In short, Luna is a financially empowered AI agent.

AI Agents and Cryptocurrencies

If blockchain represents the optimal evolutionary path for AI agents, what does this mean for cryptocurrency investors? We believe the impact will be felt in three main areas:

-

Stablecoin Issuers: Stablecoins are likely to become the preferred medium of exchange for AI agents. Potential beneficiaries include both stablecoin issuers and companies integrating stablecoins with AI agents. This includes centralized providers such as Tether, Circle, and leading payment firms like Stripe, as well as decentralized stablecoin platforms like Sky. Another company to watch is Skyfire, a startup building AI agents for stablecoin payments, which recently raised funding from Coinbase Ventures and a16z crypto.

-

Low-Cost / High-Throughput Blockchains: If AI agents ultimately rely on blockchains as the foundational infrastructure for payments, certain smart contract platforms may benefit significantly from increased user adoption, activity, and fee revenue. Platforms likely to benefit include high-throughput chains like Solana, Ethereum Layer 2 solutions such as Base—which offers AI agent development tools while benefiting from Ethereum’s underlying security—and Near, which positions itself as an AI-focused blockchain. Other potential beneficiaries include networks specializing in stablecoin transactions, such as Tron and Celo.

-

DeFi: DeFi applications stand to gain as well. Since they already exist on-chain, AI agents can easily interact with them. Imagine AI agents autonomously staking tokens for rewards, participating in governance proposals of decentralized autonomous organizations (DAOs), or even providing liquidity on decentralized exchanges (DEXs). Applications that could particularly benefit include DEXs like Uniswap, lending protocols like Aave, and prediction markets like Polymarket.

Protocols closely tied to AI agents may also see gains. At the infrastructure level, Autonolas and Wayfinder are building decentralized infrastructures for AI agents. Protocols like Virtuals, Aether, and MyShell are developing consumer-facing AI agent applications. This category is evolving rapidly and has seen growing share within the broader AI landscape over the past month.

Figure 3: AI agent-related assets have outperformed over the past month

Conclusion

The integration of AI agents with blockchain technology not only represents a novel use case for cryptocurrencies but also signals a fundamental shift in how AI agents interact with money. Grayscale Research believes the future internet may increasingly be dominated by websites driven by AI. With this in mind, permissionless blockchains could serve as the underlying infrastructure for AI agents integrated into these sites. If so, AI agents might become a major gateway for bringing vast numbers of users into the cryptocurrency ecosystem—many of whom may not even realize they are using blockchain technology. As such, AI agents have the potential to significantly accelerate crypto adoption, making this emerging theme a critical area to watch in the years ahead.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News