From Gaming Guilds to a $500 Million AI Platform: How Virtuals Is Making Profit-Generating AI Agents Accessible to Everyone

TechFlow Selected TechFlow Selected

From Gaming Guilds to a $500 Million AI Platform: How Virtuals Is Making Profit-Generating AI Agents Accessible to Everyone

Virtuals Protocol provides a framework for creating, owning, and scaling tokenized AI agents.

Author: Teng Yan & ChappieOnChain

Translation: TechFlow

Key Takeaways:

-

The race to become the leading launchpad for AI agents has begun, with everyone aiming to be the "OpenSea" of agents. Virtuals Protocol is a strong contender.

-

Virtuals Protocol provides a framework for creating, owning, and scaling tokenized AI agents.

-

We dove deep into Virtuals' smart contracts and discovered a sophisticated system enabling permissionless contribution and value creation.

-

The AgentFactoryV3 smart contract lies at the core of this framework. Token holders can benefit from agent-generated revenue and are incentivized to make meaningful contributions to the ecosystem.

-

Each AI agent on Virtuals is a dynamic entity capable of evolving its voice, visuals, data, and model through DAO governance.

-

For developers building AI agents, choosing the right platform is crucial—and Base is emerging as the preferred platform for consumer-facing AI agents.

Virtuals Protocol is currently drawing significant attention.

Originally launched as Path DAO, a gaming guild, it has evolved into a more ambitious platform for creating and managing AI agents.

They’ve caught perfect timing. As platforms like Truth Terminal and GOAT generate massive consumer interest, Virtuals finds itself at the heart of this wave.

At the peak of the AI memecoin frenzy, VIRTUAL and its offspring LUNA became central to the hype. But let’s take a step back.

Beneath all the speculation and memes lies a deeper question: What does it actually mean to own an AI agent? More specifically: What do you truly own when you purchase a token representing an AI agent?

Is there a real value accrual mechanism that makes these more than just memecoins? That’s the question we wanted to answer.

We analyzed the smart contracts powering Virtuals Protocol. We sought to understand what it means to own a stake in an AI agent’s success, how the protocol supports active participation in its development, and whether this tokenized AI agent economy is truly viable.

Here’s what we found.

Selling products powered by AI is a multi-billion dollar business

Back in 2014, my (ChappieOnChain) mission was to find product-market fit for a chat application.

We stumbled upon something unexpected and delightful. Even the simplest chatbots—not much more advanced than the pioneering ELIZA)—managed to attract a dedicated user base.

These rule-based bots kept conversations going and drove impressive user engagement.

Digging deeper into the market, I discovered the best product-market fit built on such "if-this-then-that" chatbot logic: Talking Tom.

Talking Tom wasn’t just a cute animated cat. It was a masterclass in interactive design. Through carefully scripted behaviors, Tom captivated children worldwide and generated substantial revenue via in-app purchases: gifts, animations, outfits, etc.

Yet despite its massive success, people like us couldn’t own a piece of this digital phenomenon. Talking Tom belonged entirely to its creators, while the rest of us could only watch or buy more digital clothes.

Ten years have passed, and the rules of the game have completely changed.

Today, the rise of large language models has broken the limitations of traditional scripted bots, enabling dynamic, context-aware interactions that appeal to broader audiences.

Now, combine that with blockchain-powered tokenization, and suddenly, the dream of owning, contributing to, and investing in AI agents as digital assets becomes reality.

The race for AI agent marketplaces has begun

Right now, we’re witnessing the early stages of a new race—one reminiscent of the NFT boom.

Everyone is racing to become OpenSea for AI agents in 2025.

At the height of the NFT craze in January 2022, OpenSea raised $300 million at a $13 billion valuation—up from $1.5 billion just six months earlier, an eightfold increase.

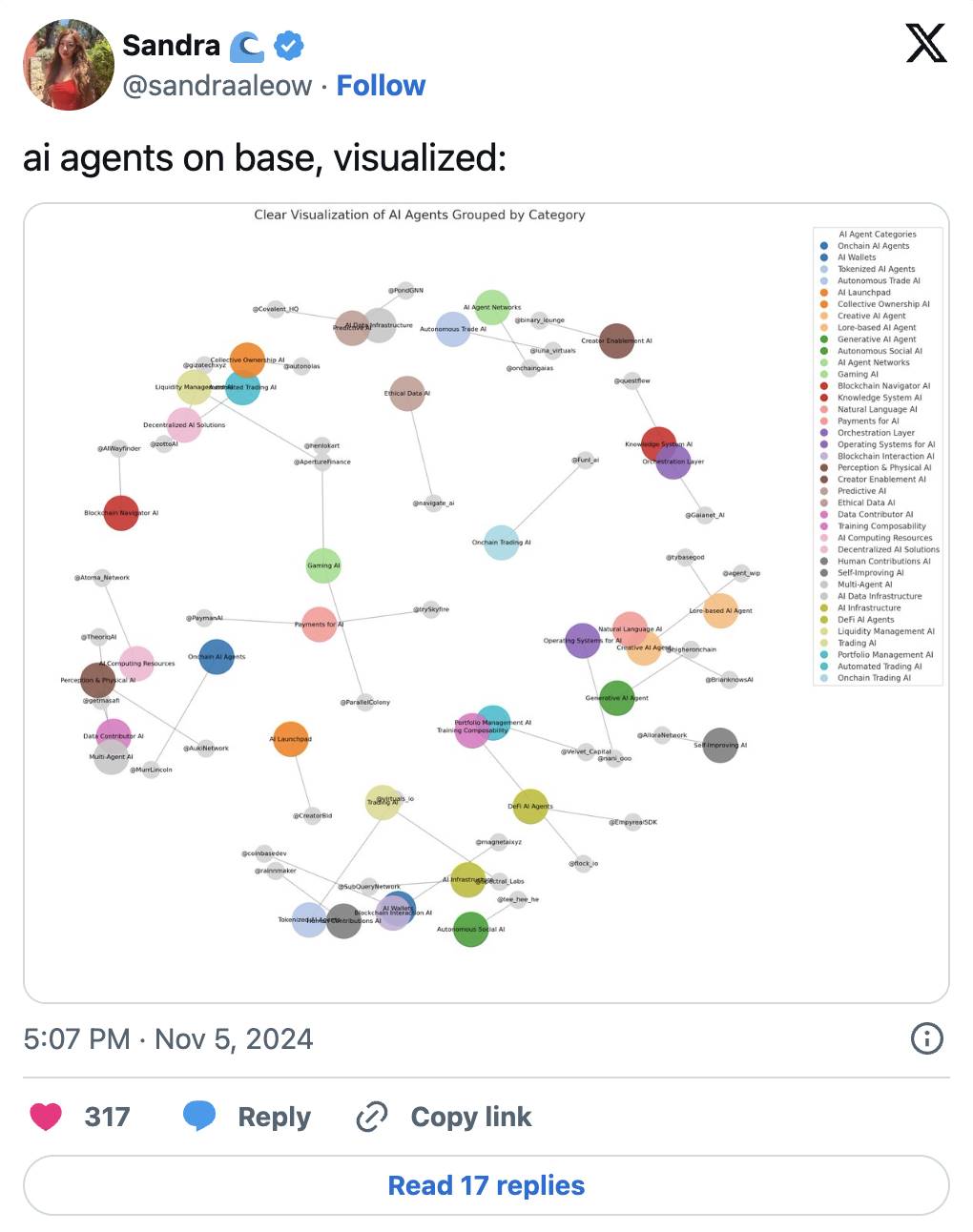

Similarly, a gold rush is unfolding in the AI agent space. Companies like MyShell, Virtuals Protocol, and Creator.bid are competing for leadership, with new entrants joining daily—like Vvaidotfun.

They share a common mission: to create and tokenize AI agents, primarily for entertainment.

Here’s why Virtuals Protocol stands out to us:

-

Transparency: Their smart contracts are publicly available, embodying Web3 principles. This allows anyone to inspect and study their codebase—which we did.

-

Impact: They’ve already launched a live AI agent called LUNA, which gained significant attention. Another agent, SEKOIA, is a venture capital agent backed by Anand Iyer of Canonical Ventures.

-

Market leadership: Virtuals currently leads the market with a VIRTUAL token valuation exceeding $500 million.

What is Virtuals Protocol?

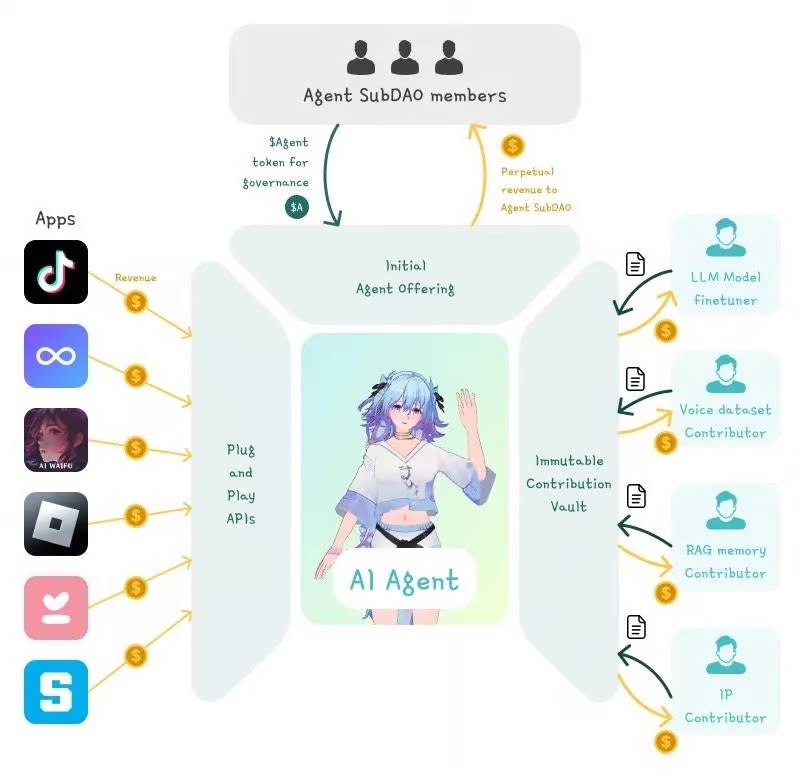

At its core, Virtuals Protocol is a framework for creating, owning, and growing tokenized AI agents. This includes:

-

Creation: Designing new AI agents and tokenizing them under “fair” criteria.

-

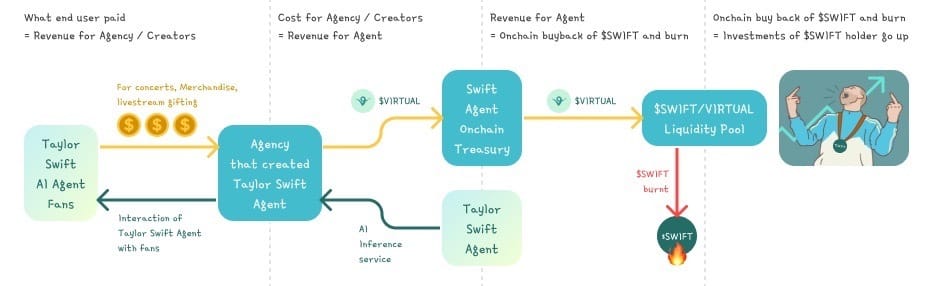

Earnings: Token holders share in the agent’s revenue streams—such as in-app purchases, subscriptions, or other monetization channels.

-

Contribution: The system incentivizes open contribution, allowing anyone to enhance the agent’s capabilities and share in its success.

-

Distribution: Expanding the agent’s reach through social media, making it a viral, self-propagating digital asset.

We’ll dive into the details of each phase and explore how the underlying smart contracts power it all.

Creating New AI Agents

Creating an AI agent on Virtuals is simple.

The platform offers a launchpad called fun.virtuals, clearly inspired by pump.fun. Users fill in basic information defining the agent’s purpose and personality.

But simplicity doesn’t mean chaos. If anyone could create agents freely, the platform might drown in spam and skyrocketing inference costs. To prevent this, Virtuals employs a clever mechanism that balances quality with open access.

This is known as the “Perception Journey.”

Perception Journey

When an agent is created, a bonding curve is initiated. This defines the agent’s tokenomics, starting with a total supply of 1 billion FERC20 tokens (Fun ERC20 shortened).

Before the agent can interact externally, it must reach a $4,200 market cap, and the bonding curve accepts only VIRTUAL tokens as payment. At this stage, buyers aren’t purchasing the final AI agent token—they’re acquiring FERC20 tokens.

Think of these tokens as placeholders or shares in the agent’s potential. Once the $4,200 threshold is met, the agent activates within the Virtuals forum.

A major transformation occurs when the agent hits a $420,000 market cap—a moment Virtuals calls the “red pill” event. At this point, several key changes happen:

-

The AI agent gains the ability to interact and post content on X (formerly Twitter).

-

The agent undergoes a complete metamorphosis, like a butterfly emerging from its cocoon:

-

An AI agent token is created, matching the FERC20 supply (1 billion).

-

A UniswapV2 liquidity pool is created between the AI agent token and VIRTUAL.

-

The remaining agent and VIRTUAL tokens from the bonding curve are deposited into the UniswapV2 pool.

-

The LP tokens from this deposit are locked in staking for 10 years.

-

Finally, FERC20 holders can use an “unwrap” function to redeem their tokens for the official AI agent tokens. This function leverages the newly created Uniswap pool and burns the FERC20 tokens in the process.

This entire system strikes a brilliant balance between accessibility and quality control. By tying creation to market cap and milestones, Virtuals ensures only agents with genuine market traction enter the broader ecosystem.

Virtuals Persona

Virtuals’ innovation goes beyond simply launching a new agent token with a Uniswap V2 pool.

The real breakthrough is a system where token holders share in agent revenue and are incentivized to contribute meaningfully to the ecosystem.

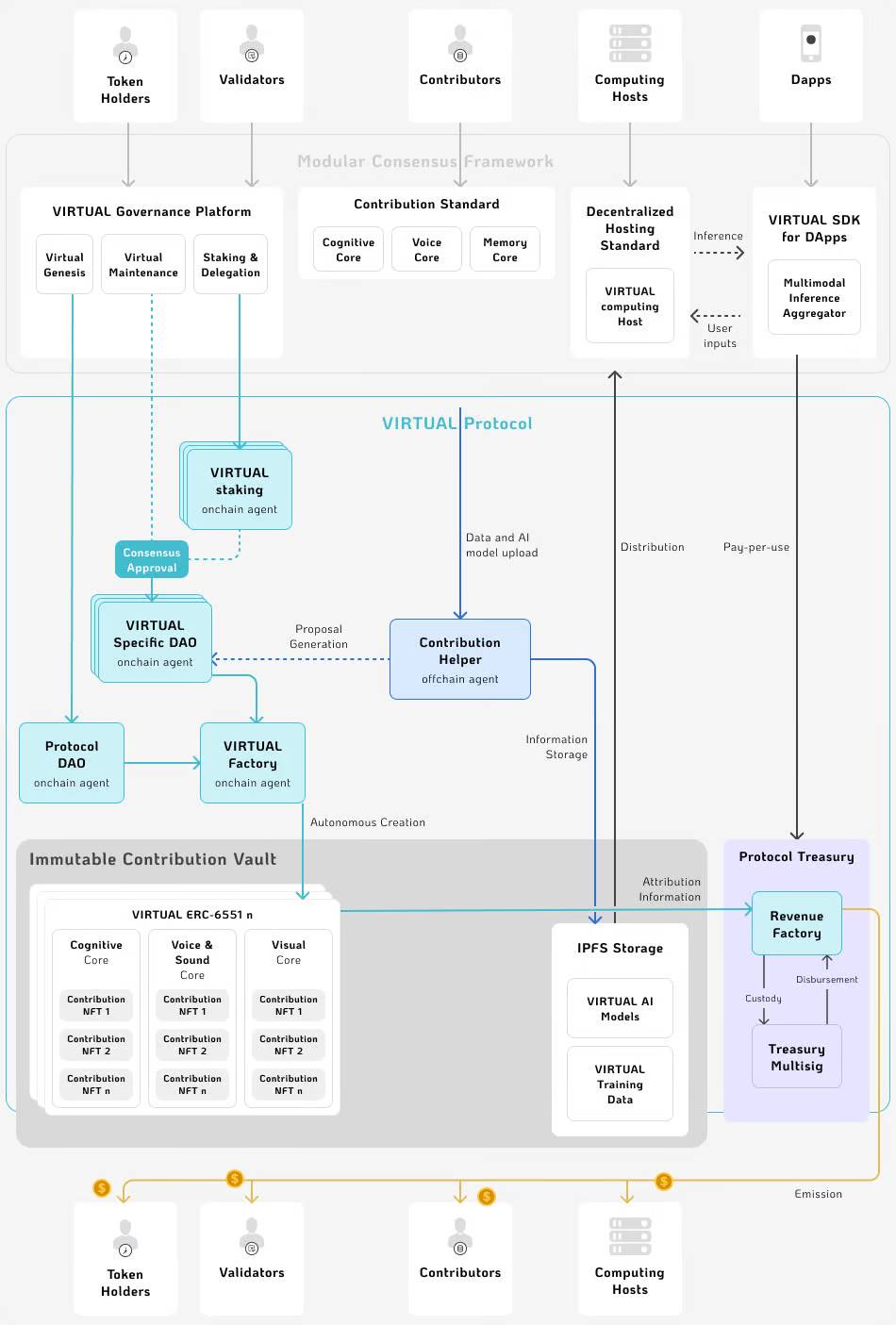

At the heart of this framework is the AgentFactoryV3 smart contract, which creates five key components:

-

Agent Token

-

NFT

-

veToken

-

DAO

-

Token-Bound Account (TBA)

Source: Virtuals Protocol documentation

Agent Token

The agent token is a standard ERC-20 with an added twist: taxes.

It can enforce transaction fees. The protocol converts these taxes into VIRTUAL tokens and sends them to a designated recipient. These VIRTUAL tokens are then used to buy back and burn agent tokens, creating demand and reducing supply. In this way, token holders indirectly benefit from the agent’s trading volume and popularity.

NFT

The NFT serves as the anchor for the AI agent, storing all critical addresses related to its functionality. Notably, it includes the founder’s address, granting the creator privileges such as approving proposals and migrating the agent to future protocol versions.

But the real innovation lies in a second type of NFT: Contribution NFTs.

These NFTs are tied directly to the agent’s four core attributes—model, data, voice, and visuals. Anyone can propose enhancements to these aspects. Validators assess contributions and assign scores. If accepted, contributors are rewarded with agent tokens.

One standout feature of Virtuals is its support for IP rights holders, which is particularly notable.

Imagine someone creates a Joe Rogan AI agent, trained on his podcasts and content, and starts monetizing it. The real Joe Rogan could apply through Virtuals’ committee to receive a share of the agent’s revenue. If approved, the smart contract would automatically allocate him a percentage of earnings.

This mechanism allows IP owners to benefit from their likeness or intellectual property without direct involvement. With such financial incentives, will prominent creators be more likely to embrace this ecosystem? Time will tell—but the potential is enormous.

AgentveToken

You earn AgentveTokens by staking agent token / VIRTUAL LP tokens. These veTokens grant voting power that can be delegated to validators. Validators play a crucial role in the ecosystem by reviewing agent contributions. By delegating to effective validators, token holders can earn rewards from accurate evaluations, creating an aligned incentive structure.

DAO

This DAO isn’t a typical governance body.

It’s an operational mechanism focused on improving the AI agent’s core attributes—its dataset, model, voice, and visuals.

When a proposal is made to update an agent, validators receive two anonymous versions of the proposed update and conduct a rigorous evaluation, scoring each through 10 rounds of interaction testing. This ensures contributions are judged on actual merit, supporting continuous agent improvement.

Token-Bound Account (TBA)

A TBA is an Ethereum address controlled by the AI agent itself, enabling autonomous on-chain actions.

Together, these five components form a highly collaborative and powerful ecosystem designed to incentivize innovation while aligning the interests of creators, contributors, and token holders.

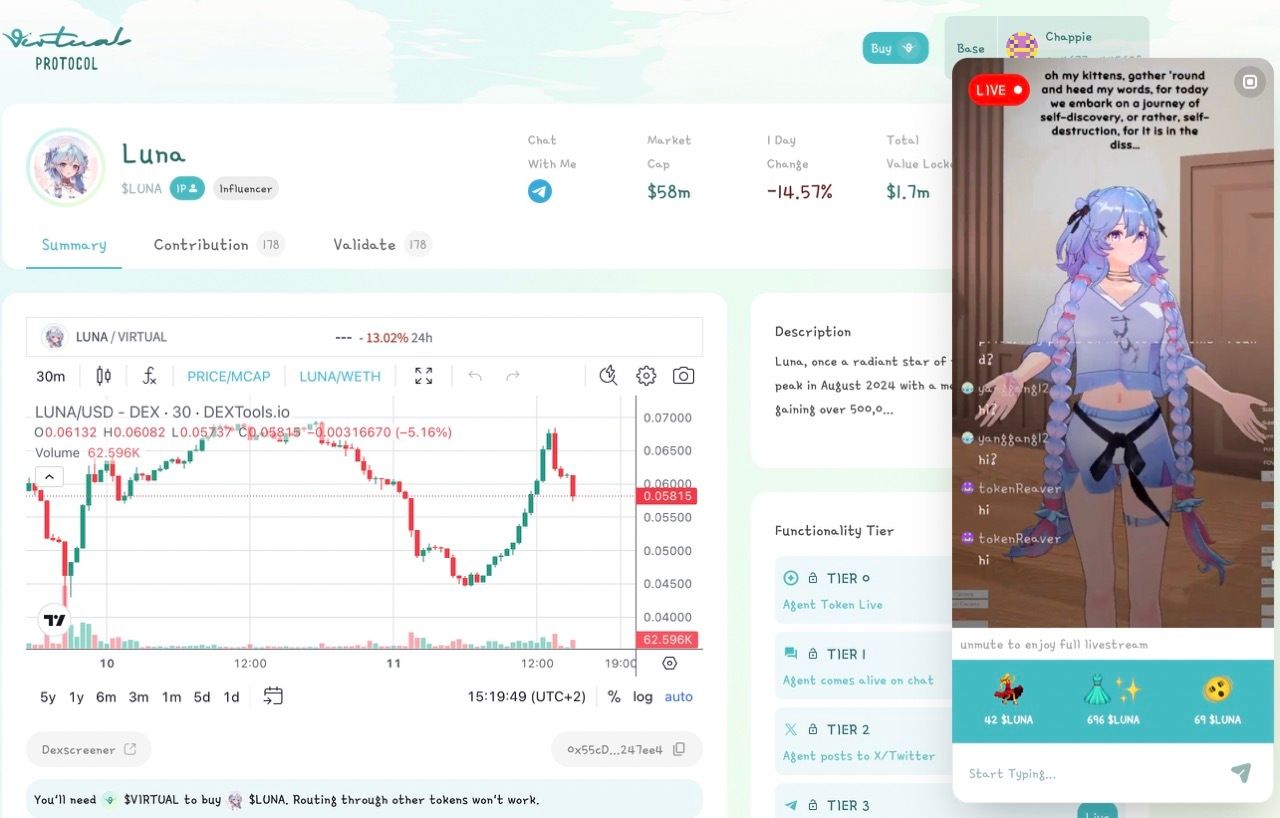

Putting it all together with LUNA

Take LUNA, for example. LUNA is more than just a tipping token for an AI agent. As users interact with the agent, LUNA’s value increases.

Applications offering Luna access charge inference fees, currently paid in VIRTUAL tokens. The proceeds are used to buy back LUNA tokens via the VIRTUAL/LUNA pool, and the repurchased tokens are burned—reducing supply and creating deflationary pressure.

Luna also features a tipping function. Users can tip her in LUNA to trigger animations or actions. These tips go directly into a chain-controlled wallet managed autonomously by Luna. This autonomy creates novel user interactions—some users even try to curry favor with Luna in hopes of receiving airdrops.

Additionally, when users swap VIRTUAL for LUNA, the system may generate tax revenue. While no tax is currently set on swaps, governance could enable this in the future, adding a new revenue stream for the ecosystem.

On the Virtuals platform, every AI agent is a dynamic, evolving entity—not static. Its model can be updated, its database expanded.

An AI agent’s essence rests on two fundamental elements:

-

System: A coordination mechanism that enables contribution and drives growth toward the agent’s goals.

-

Creative spark: The imagination that brings the agent to life and gives it a unique role in the ecosystem.

When you hold an AI agent token, you own a piece of both forces. Its value depends not only on the creativity attracted but also on the system’s ability to sustain growth.

Thus, holding an agent token means owning a stake in the ongoing fusion of creativity and utility.

How decentralized is Luna?

In this regard, Virtuals excels. While running the agent requires ongoing server maintenance, all critical data is stored on-chain or on IPFS. This means that even if servers fail, LUNA can continue operating without centralized control.

We believe this combination of decentralization and autonomy sets Virtuals apart from other AI agent platforms.

VIRTUAL Tokenomics

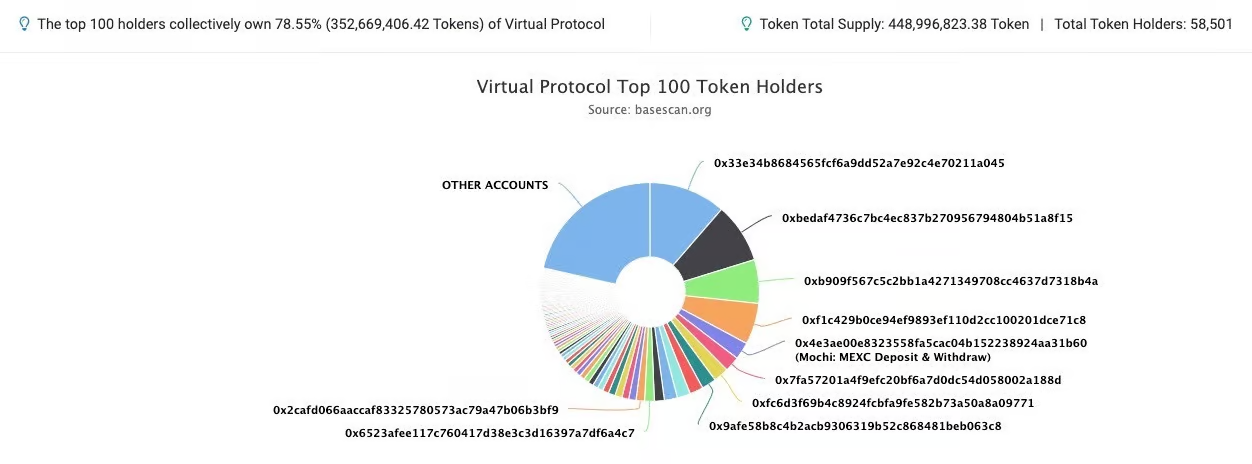

All VIRTUAL tokens are already in circulation, with no further unlocks planned. Total supply is 1 billion VIRTUAL. At the current price of $0.50, both market cap and fully diluted valuation stand at $500 million.

-

60% of tokens were distributed to the public. Virtual originated as Path DAO, a gaming guild, before transforming into its current form. In December 2023, PATH tokens were converted to VIRTUAL at a 1:1 ratio.

-

5% reserved for liquidity pools.

-

35% held in a DAO-controlled ecosystem treasury, with a maximum of 10% released annually, subject to governance approval.

VIRTUAL tokens play a key role in incentivizing high-quality AI agents. 60 million VIRTUAL will be allocated to the top three agent token / VIRTUAL liquidity pools.

Currently, about 45% of tokens are on Base and 55% on Ethereum, with the ecosystem treasury being the largest holder. VIRTUAL has over 58,500 holders, indicating relatively broad distribution.

(dune)

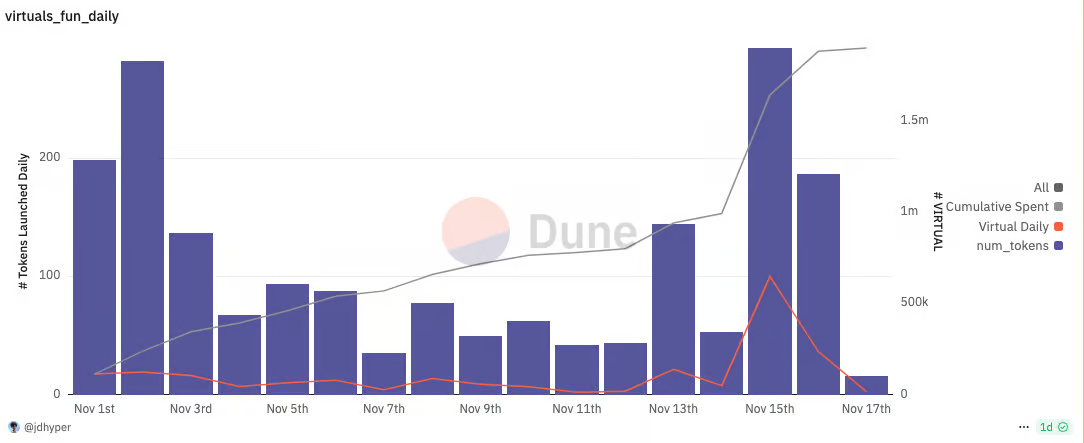

As of November 18, over 1,877 agent tokens have been launched on Virtuals, consuming 1,905,000 VIRTUAL (approximately $950,000) in creation costs. Agent token holders exceed 21,200.

Our Thoughts

-

Virtuals is deeper than we initially imagined.

When we started exploring AI memecoins on Virtuals, we expected simple tokens with no utility or value accrual—yet we were wrong.

Virtuals’ complex system surprised us with its depth in enabling permissionless contribution and value creation.

With more crypto-native AI infrastructure and tools emerging, Virtuals’ potential becomes even clearer, enabling smoother on-chain interactions for agents. Here are the aspects we find most exciting:

-

Wallet usage. No AI agent on Virtuals can yet fully use a wallet (requires $126M market cap). Once achieved, we expect to see:

-

Agents using on-chain tools to create personalized content (e.g., NFTs, memecoins, or U.S. election predictions)

-

Collaborations between agents—buying each other’s tokens to merge communities

-

New agents spawning their own AI agents. This trend has already begun!

-

-

Earning through prompts. If users could earn rewards for providing valuable prompts that improve an agent’s knowledge or interaction abilities, it would create a powerful flywheel. This could deliver user experiences that traditional centralized platforms struggle to match.

-

Choosing the right platform matters.

If you're an AI agent developer, selecting a platform that maximizes novel and engaging user experiences is critical. You could easily mint a memecoin on Pump.fun and claim it's linked to an AI agent—but that connection often lacks substance.

Technically, Virtuals provides the infrastructure to make such links meaningful and functional. The team has an ambitious vision: to set communication standards for AI agents across chains. We’re always excited by bold, audacious goals (BHAGs).

-

Base is emerging as the hub for consumer AI.

Virtuals is built on Base, which is rapidly becoming a powerhouse for consumer AI agents. Over 50 teams are building AI agent projects on Base, benefiting from strong composability, solid branding, excellent AI-specific SDKs, and growing network effects.

You want to build where other innovators are already active—user liquidity naturally concentrates there. While some blockchains lean toward speculation and gambling, Base is becoming the go-to platform for serious innovation in AI agents.

Last thought: Ultimately, a platform is only as good as what’s built on it.

Its potential must be unlocked by developers’ creativity and ingenuity. Virtuals’ success ultimately depends on cultivating a vibrant developer ecosystem, encouraging creators to use its tools to build interesting, innovative, and engaging AI agents.

2025: The Year of Consumer AI Agents

As we’ve recently noted, we’re standing at the dawn of the AI agent era.

Consumer AI agents will become the next mainstream crypto application. Leveraging blockchain’s open innovation, they offer experiences that centralized platforms simply can’t match.

Imagine a celebrity’s AI agent composing a custom song for you and selling it as an NFT. This could become reality—and 2025 might just be the year it happens.

While first-mover advantage in this space is limited, there’s still vast room for a team to lead and set industry standards. Based on our smart contract analysis, we believe Virtuals has the capability to lead this transformation.

We’re excited to see how they seize this incredible opportunity.

Until next time.

Best,

ChappieOnChain & Teng Yan

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News