Vitalik's 42 Days in Chiang Mai

TechFlow Selected TechFlow Selected

Vitalik's 42 Days in Chiang Mai

Frequent visits and conversations undoubtedly brought him many new ideas, and some new systematic thinking began to take shape in his mind.

Written by: Zhou Zhou, Foresight News

Chiang Mai—a highly internationalized big village. Vitalik recently stayed here for about 42 days. For someone who flies an average of 55 times a year and essentially "moves" nearly every week, staying in one city this long is rare.

Over these 42 days, a bottom-up, decentralized social experiment gradually unfolded, eventually drawing over 1,000 blockchain practitioners from around the world to Chiang Mai. They spontaneously formed eight or nine pop-up cities and villages (Pop-Up City), aiming to build a six-week-long "Web3 City."

Vitalik says this is Zuzalu 2.0. Ever since he initiated the first "flash mob city experiment," Zuzalu, in Montenegro in 2023, he has been searching for ways to sustain this kind of social experiment. "Watching Zuzalu 2.0 develop feels like watching my own son grow up step by step," Vitalik told me.

The crypto industry often wears two distinct faces: one marked by high-risk financial transactions and activities; the other sustained by idealists striving to use blockchain's decentralization and incentive mechanisms to build a new "utopia."

"During these six weeks, there were 1,606 events—meditation, hiking, Muay Thai, sound healing, Web3 lectures, geek boot camps... The largest village, Edge City, had nearly 500 people," said Jiang, co-founder of Social Layer. Here, builders used Social Layer to organize events instead of more standardized, commercialized tools like Luma. Beyond Edge City, other "villages" emerged—Invisible Garden, centered on global ZK developers, and Shanhaiwu, focused on Chinese-speaking Web3 professionals—each surpassing 100 residents. This continuity gives experiments like Zuzalu a sense of legacy.

The dramatic increase in density and breadth of Web3 talent made Chiang Mai a temporary "playground" for Vitalik’s ideas. Vitalik visited two or three Web3 villages almost daily, engaging with residents. As he spoke, I realized he could recall each village’s location and characteristics in detail—even their precise distances and directions from one another.

This intense round of visits and conversations undoubtedly sparked many new thoughts, shaping fresh systemic reflections in his mind. In this conversation, Vitalik extensively shared his views on Ethereum ecosystem applications, emphasizing that technology has matured enough—it’s time to focus on applications. He introduced several cutting-edge Web3 applications he encountered in Chiang Mai. He also discussed his observations on Solana, Binance, Tencent AI Labs, the book Three-Body Problem, and other Chinese elements, ending with personal insights into his lifestyle, habits, and hobbies.

For this reason, Foresight News invited Vitalik for an in-person interview at one of Chiang Mai’s "villages"—Shanhaiwu—to share his observations and reflections during this period. Below is the full transcript.

42 Days in Chiang Mai

Joe: Hello everyone, I’m Zhou Zhou from Foresight News. It’s a pleasure to have Vitalik Buterin, founder of Ethereum, for this interview. Vitalik, would you like to introduce yourself?

Vitalik: Hi everyone, I’m Vitalik Buterin, a well-known Dogecoin holder.

Joe: Quite a signature introduction. You’ve stayed in Chiang Mai for quite some time—over 30 days. What attracted you here?

Vitalik: I’m constantly moving from place to place—I average about 55 flights a year, not counting layovers. But here in Chiang Mai, I haven’t moved in six weeks. It felt like a good opportunity to both work and rest. Of course, I found myself attending many events every day.

Last year in Montenegro, I ran the Zuzalu experiment. People said it was successful as an experiment, but we didn’t know what would come next. Between Singapore Token2049 and Bangkok Devcon—about seven weeks—some people started organizing pop-up events in Chiang Mai. At first just a few, then more and more. Eventually, it evolved into Zuzalu 2.0, supported by the same fund (the Zuzalu Fund). As the founder of Zuzalu 1.0, watching Zuzalu 2.0 unfold feels like watching my son grow up.

There are truly many interesting things and communities here—seven or eight major pop-ups, each with its own unique character. Right now we’re in Shanhaiwu, where many interesting events happen—technical ones, non-technical ones, various meditation sessions.

Invisible Garden is 900 meters away—they focus on ZK and Ethereum-related topics. Three kilometers east is MegaZu, a project researching Ethereum L2 tech with a strong developer culture, running application development bootcamps. One kilometer further east is Web3 Village, a Vietnamese community hosting interesting talks and events. Another kilometer east is Edge City—the largest, currently housing about 300 people, with different themes weekly. Last week it was stablecoins; this week it’s Dapps.

Every time you visit a pop-up, the people, activities, and discussions are different—that’s what makes it so fascinating.

Joe: You attended events almost daily in Chiang Mai. How did this experience shift your understanding of crypto?

Vitalik: In Shanhaiwu, I noticed Ethereum community members often discuss two questions: why they care about Ethereum, and what challenges Ethereum faces.

Online, many people express strange opinions—like Ethereum having no values, or crypto being just gambling. But within the Ethereum community, including many Chinese participants, people engage because we deeply value certain ideals—we want an open world, a decentralized blockchain and platform, sustainable applications, and socially beneficial projects. That’s how our community talks.

But we haven’t achieved this for a long time. Why? Because until recently, our technology wasn’t good enough. In 2021, we only had L1, no L2. Ethereum L1 transaction fees could be $1, $5, or even higher. Last year we had many L2s, but they weren’t secure enough, and wallet UX was poor.

Now things have changed. First, Optimism and Arbitrum on L2 have reached Stage 1. According to a framework I proposed a few years ago, if you're not Stage 1, you're just a multisig wallet without real security links to Ethereum. But Optimism and Arbitrum have achieved it—security improved, and fees dropped dramatically. In February this year, average L2 transaction fees were $0.40; now sometimes they’re $0.004.

Over the past twenty-plus years, tech industries have seen an interesting trend: exciting ideas emerge early, but remain unrealized for years—then suddenly, after a decade or two, technology matures and they become viable.

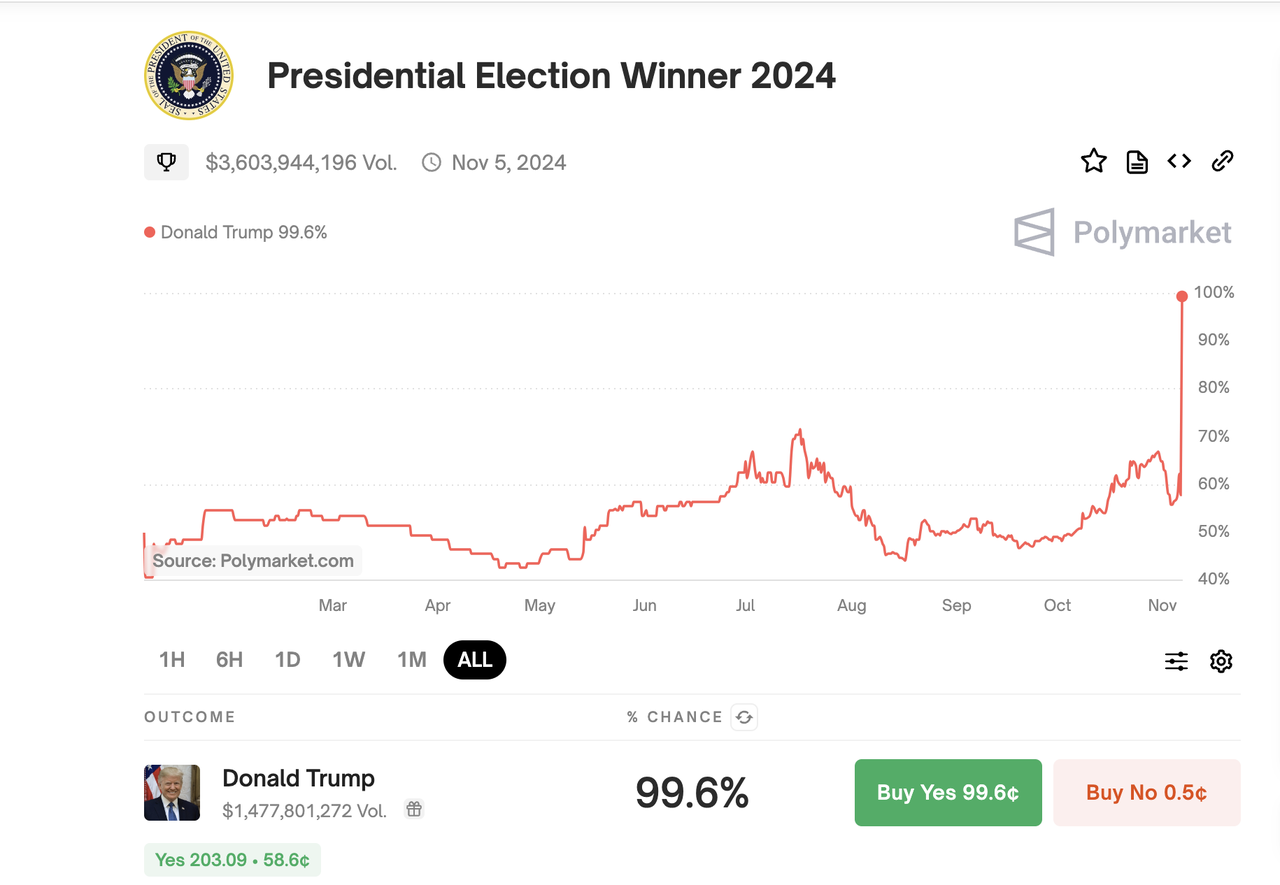

I’ve been interested in prediction markets since 2014. I participated in Augur (a prediction market platform founded in 2014) in 2020, but users were few and UX terrible. In early 2021, I wrote an article titled “Prediction Markets: Tales from the Election,” earning $58,000—but paid $1,000 in fees. Now Polymarket, built on Polygon, is nearly free.

Prediction markets existed back in 2014. Over the past decade, entrepreneurs kept trying. But only in 2024 did Polymarket suddenly explode in popularity. Why are such applications finally viable? Two key reasons: lower transaction fees and faster confirmation times.

Blockchain isn’t a standalone technology—it needs complementary tech to mature before applications can thrive. Imagine you're building a blockchain app: in scenario one, users pay $5 per transaction; in two, $0.50; in three, $0.005. In the first case, only high-value, high-risk financial products can succeed.

Farcaster is another fascinating example. They use a hybrid on-chain/off-chain architecture: critical data like account registration is on-chain, while user messages are off-chain. They’ve developed an interesting decentralized off-chain storage method. Registering an account or updating key info requires a transaction—and thus a fee. If that fee is $5 or $15, the app simply can't succeed. But at $0.001 or $0.05, it becomes feasible.

Our industry has entered a new phase. Many idealistic blockchain enthusiasts want to build non-financial apps, solve identity issues, create decentralized governance—but until now, only high-risk finance succeeded. Because when fees were $5, high-risk finance was the only option. When fees drop to $0.005, countless previously impossible applications become viable.

So I believe we’re seeing a new trend: many once-impossible blockchain applications are now becoming possible.

Joe: Besides Polymarket and Farcaster—applications you often mention—what other interesting apps did you see in Chiang Mai?

Vitalik: I found MegaZu working on some really fun applications.

In 2018, I saw an intriguing idea—an encrypted event platform. Often, 200 people might sign up for an event, but organizers and attendees don’t know whether 100, 50, or only 20 will actually show up.

Their solution was a “trustless commitment” model: if you commit to attend, you send 0.01 or 0.02 ETH. If you don’t show up, you lose your ETH. If you do attend, you receive part of the ETH forfeited by no-shows. This ensures most registrants actually attend.

I thought this idea was brilliant—it solves real-life problems. The app was built in 2018, but then disappeared. I suspect it failed due to poor blockchain transaction costs and user experience at the time. Now, MegaZu has many developers building exactly this kind of application—and I find that exciting.

“Many Web3 Applications Are Now Becoming Possible”

Joe: How do you and the Ethereum Foundation view the current criticism that infrastructure is overbuilt while applications lag behind?

Vitalik: Some critics say Ethereum philosophers love talking about tech but avoid discussing applications.

Why? Initially, we couldn’t build good applications because the tech wasn’t ready. Now that tech has matured, we can finally focus on application development. So we need an application-building community. We need both—tech and applications. That’s the strength of Ethereum’s diversity.

The best approach isn’t telling L1 builders to switch to apps—they should focus on L1. Instead, we need to give newcomers more opportunities and space in the community. First, freedom. Second, support.

Joe: Any concrete measures planned?

Vitalik: First, community support. If someone is building important applications, they should feel welcome to talk about it publicly.

Second, many people excel at creating user-friendly products but struggle with blockchain integration—L1/L2 connections, wallet interfaces. We need more connecting organizations: community groups, hackathons.

Third, the Foundation recently expanded a team focused on deepening relationships with wallets—MetaMask, OKX, Rabbit, etc.—because wallets have direct user access.

Joe: What are the top three products you'd most like to see built on Ethereum?

Vitalik: I’ve mentioned Polymarket and Farcaster frequently this past year—not just because I like them, but because both represent highly promising categories. Polymarket blends finance and new media. Twenty years ago we had traditional media; ten years ago, social media. Now, many distrust both.

Everyone talks about building better Web3 social media, but merely adding crypto payments to existing platforms doesn’t work. How did successful social media emerge? Twitter didn’t aim to be the next Facebook. TikTok didn’t aim to be the next Twitter. We need to invent entirely new categories—not just tweak existing ones.

I categorize Polymarket as media. When I want to know what’s happening in the world, I now habitually check Polymarket. Or when traditional media reports something, I go to Polymarket to assess its significance. Sometimes I just browse Polymarket to discover emerging events. If I see massive betting volume on an event, I wonder—what’s going on?

Image source: Polymarket (2024 U.S. election: $3.6 billion wagered globally)

Having traditional, social, and Web3 media coexist is fascinating. Polymarket offers two participation modes: one where you bet money, and another where you simply observe market outcomes. I believe this blend of market and non-market interaction holds tremendous potential. I don’t yet know all the opportunities, but I’m confident they exist. That’s point one.

Regarding Farcaster, I believe social products must incorporate crypto elements. Crypto entrepreneurs today face two extremes: either building profitable but unsustainable, meaningless apps; or building user-focused apps with no revenue.

The first problem: founders don’t earn. The second: unless users are idealists, they won’t participate. A successful Web3 app must merge these two aspects.

SocialFi also has pre-blockchain history. In 2012, Diaspora aimed to build a decentralized Facebook—but failed. Today, platforms like Bluesky and Threads face two problems: they can’t generate revenue, so lack resources for quality development; and unless users are idealists, they have no incentive to leave Twitter. If we can bridge this gap, it would be perfect. But no one has fully cracked it yet. Merging idealism with profitability is crucial.

Joe: Do you follow applications on ecosystems like Solana or TON?

Vitalik: I occasionally chat with Solana folks about what excites them. Some are turning DePIN into internet infrastructure or next-gen networks.

Exchanges like Binance are expanding rapidly in developing countries. In 2021, we visited Argentina and found widespread crypto usage. But I noticed many were crypto users—not blockchain users.

Once on Christmas, I walked into a café—the owner immediately recognized me and showed me his Binance account. I asked if I could buy coffee with Ethereum. He said yes. But the payment took about five minutes—transaction confirmation was very slow. That issue has since been resolved. Now I care about enabling exchanges to accept Ethereum transactions within 12 seconds.

Joe: You mentioned many are crypto users but not blockchain users. Could this relate to most on-chain activity happening on desktop rather than mobile?

Vitalik: Some wallets are encouraging change. Daimo on Base is a great example—its goal is a decentralized wallet.

Ethereum’s “Crisis”

Joe: What do you see as Ethereum’s biggest crisis today? And what has hindered Web3 progress over the past two years?

Vitalik: I think 2022 and 2023 were the most dangerous periods. Now, we’re doing better.

In 2022, AI exploded. Many began seeing AI as the future, while crypto seemed useless—just gambling. Idealists wanting positive global impact left crypto, disappointed by the technical limitations I mentioned earlier. I remember visiting Silicon Valley in April 2022, talking to prominent AI figures who told me crypto was pointless—this was before FTX collapsed, which made things worse.

Now, crypto has made significant technical progress, and applications are achieving greater success—so the situation has improved.

Still, risks remain. Our community has become extremely diverse: some focus on finance, others on cyberpunk, culture, art, philosophy. Their visions differ. A worst-case scenario is mutual disrespect—profit-driven builders ignoring everything else, and mission-driven builders lacking funds. I hope these two sides can integrate.

Joe: Solana is growing stronger—many see it as Ethereum’s top competitor. What’s your take?

Vitalik: I find Solana significantly more centralized than Ethereum.

First, running Solana nodes is much harder than Ethereum nodes. Second, Solana’s PoS is more centralized. Third, more initiatives are directly funded by the Solana Foundation.

They emphasize applications—especially DePIN—often partnering with large companies to sell hardware, collaborating with telecom firms to build new internet infrastructure. These applications inherently demand less decentralization than Ethereum’s vision. Their market goals are fundamentally different.

If you need a 100 TPS blockchain, Ethereum L1 will never meet that. You have two choices: switch to a high-performance chain, or build on Ethereum L2s—Arbitrum, Base, MegaETH, etc.

What can Ethereum do that faster chains cannot? I guarantee it will remain a long-term, decentralized, neutral, and secure blockchain. Compare Ethereum’s PoS validator pools with Bitcoin’s mining pools—you’ll find Ethereum is more decentralized than Bitcoin.

We have a proven track record of solving centralization issues. For example, client diversity: three years ago, the Ethereum network relied heavily on Geth and Prysm. Now, no single client exceeds 52%.

Another example: the Tornado Cash crisis two years ago. Some began censoring transactions, raising fears about Ethereum’s neutrality. A year later, look at how many blocks censor those transactions. Two years ago, it was over 80%; now it’s consistently around 20–50%. In one or two years, we’ll see the results of our solutions.

Ethereum L1 isn’t ideal for high-performance apps. If you’re building a game, L1 isn’t the best choice—hence the need for L2s. Ethereum’s architecture reflects this: L1 prioritizes decentralization, neutrality, and security—unique among blockchains, second only to Bitcoin. L2s focus on efficiency and speed, delivering great blockchain experiences to mainstream users.

Joe: Does this mean Ethereum’s endgame is to become an invisible layer beneath all L2s?

Vitalik: Somewhat. The exception is Ethereum as an asset—if no one knows it exists, it can’t succeed. So Ethereum can’t become entirely background.

Ethereum must remain known. It won’t vanish like Google Cloud into complete invisibility. Ethereum’s advantage over Google Cloud is that it’s normally invisible—but visible when absolutely necessary. That distinction matters.

Until that critical moment arrives, we must keep affirming Ethereum L1’s existence and highlighting its strengths.

Joe: You mentioned AI earlier—how often do you use AI tools? Do you frequently use ChatGPT?

Vitalik: Yes, I sometimes use ChatGPT. I even bought a powerful GPU for my computer so I can run local models. Some illustrations in my articles are generated by local AI tools.

Joe: Have you seen any novel intersections between AI and Ethereum recently?

Vitalik: AI and crypto have already formed a significant connection in the past decade—AI participating in decentralized exchanges. This is a fascinating example, representing a broad and promising category.

What is this category? Crypto uses smart contracts to define game rules and ensure secure execution—AI can then participate in these games. Examples include decentralized exchanges (first), prediction markets (second). More examples may emerge in the future.

Joe: Some claim Ethereum is becoming technically more centralized. How do you respond?

Vitalik: I find this strange—I feel Ethereum is becoming more decentralized. Our challenge now is managing the consequences of decentralization.

Take L1 client development: five years ago, we mostly had Geth. Now we have Geth, Nethermind, Besu, and others.

You can visit ClientDiversity.org to see client distribution across the Ethereum network—Geth at 52%, others lower. No client exceeds 66%.

What if Geth fails? First, Ethereum can’t finalize—finality requires 66% agreement. A fork occurs, but it won’t finalize. Client developers investigate—once they identify Geth as the issue, other clients stay unchanged while Geth patches itself.

In 2016, a similar incident occurred—Geth controlled 85% of the network. Within 12 hours, everything normalized. Today, if finality halts, high-security applications would pause confirmations. Twelve hours later, Geth releases a fix—problem solved. Client decentralization is progressing well.

Look at funding sources behind client teams. In 2021, though theoretically independent, all were funded by the Ethereum Foundation—so decentralization was weak. Why? We wanted diverse client teams to emerge and grow. Now, many don’t rely on Foundation grants—we’ve reduced funding significantly.

Protocol research has also diversified. Five years ago, I was nearly the sole researcher. Now we have a team of at least 20—some in the Foundation, others outside, like Paradigm researchers publishing protocol ideas, plus many more teams.

Ethereum’s ecosystem organizations have diversified too. Five years ago, the Foundation dominated—Consensus was second, nothing else. Now we have client companies, independent groups like ETH Global, diverse wallets—MetaMask, Rainbow, Trust Wallet, Rabbit—whereas three years ago, only MetaMask existed.

This year, interoperability has become a major concern. With many L2s and wallets, integration issues arise. In a centralized system, these wouldn’t exist.

Our biggest challenge now is maintaining a decentralized ecosystem while enabling coordination where needed—improving key standards without sacrificing decentralization.

Joe: You mentioned decentralization brings challenges. I’ve heard concerns about L2s operating in silos, fragmenting Ethereum’s strength—do you think multiple ecosystems dilute Ethereum’s resources?

Vitalik: I remember this discussion peaked in August—debates over L2 fragmentation and Ethereum event competition, feeling somewhat adversarial. But after people voiced concerns, L2s, wallets, and event organizers became eager to solve it.

Just two days ago in Chiang Mai, we held an L2-wallet interoperability event. At Devcon, there will be a larger one. All agree we need more standards, cross-L2 interoperability, and are committed to advancing it. Outsiders attacking Ethereum might claim L2s are warring—but listen to L2 teams themselves: they don’t want war. They want cooperation.

Thirty: Established, Yet Still Going

Joe: Let’s end with more personal questions. Confucius said “at thirty, one stands firm.” You’re turning 30 this year. Ten years ago, you wrote the Ethereum whitepaper. Have you fulfilled your original dreams? What will you do in the next decade?

Vitalik: Partially fulfilled—and my understanding of what we need to do has changed significantly.

A major shift is in my thinking. Ten years ago, I focused on theory—using economics and math to invent new mechanisms. But that era is over. Most mechanisms we can invent have already been invented. Now, the focus isn’t on creating entirely new mechanisms, but optimizing existing ones. Optimization can’t rely solely on theory—sometimes it works, like in cryptography or zero-knowledge proofs. But in many areas, the only way is experimentation: try, observe success and failure, iterate.

Take a concrete example: ten years ago, I dreamed of inventing a mathematically provable, optimal, and guaranteed governance model. In many cases, you can prove correctness mathematically—but real-world participants vary, making stable governance impossible to guarantee.

In The Three-Body Problem, scientists run experiments only to discover physics no longer exists—so they commit suicide. I feel the same about economics. To achieve more, our only path is experimentation. If we want to optimize public goods funding, we must run experiments, adjust mechanisms, run again, adjust again. That’s likely how I’ll spend my time now and in the next decade.

Joe: What non-crypto hobbies do you have?

Vitalik: Walking, running, reading books or browsing the internet, traveling to learn new languages.

Joe: What kinds of books do you enjoy?

Vitalik: Mostly non-fiction—economics, history, society. Online, some people write extremely long articles—essentially books.

Joe: Where do you draw energy from? How do you start your mornings to get into peak state?

Vitalik: The most interesting thing about my life is having two types of work. One is introverted—writing code, writing articles, discussing technical topics with developers. The other is extroverted—attending events.

I’ve found an interesting balance: each type serves as rest for the other. When you’re tired of one, switching to the other recharges you.

Joe: Who are your favorite writers, musicians, and philosophers?

Vitalik: This is hard to answer—truly difficult to say one is better than others.

Joe: If you hadn’t entered crypto, what would you be doing?

Vitalik: Before crypto, I worked in online education—a topic I still consider important.

My current goal is bridging crypto with other key technological fields. Without crypto, I might work on DApps related to healthcare or DCI (Data Center Interconnect). If crypto-related, I’d focus on Community Notes.

Joe: Will you retire? Or disappear like Satoshi?

Vitalik: If I stopped doing this work, I think I’d feel lonely.

Joe: What aspects of Chinese culture do you appreciate most?

Vitalik: I’ve always found the Chinese community friendly, full of interesting ideas, deeply caring about building strong communities and upholding Ethereum and blockchain values. And simpler things—Chinese food is delicious.

Joe: What Chinese dishes do you like?

Vitalik: Greens, steamed fish.

Joe: Alright, we’ve reached the end. Thank you, Vitalik, for joining Foresight News’ interview. Special thanks to the Chinese-speaking Web3 community members who contributed questions—Yisi (co-founder, Mask Network), Jiang (co-founder, Social Layer), Forest (co-founder, Foresight Ventures), Yuanjie (co-founder, Conflux), Sandy (co-founder, Scroll), KOL Jason—your questions reflect the community’s voice. Also, heartfelt thanks to Audrey from Shanhaiwu for her support, and photographer Shaka. Thank you all.

Vitalik: Thank you.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News