How to Learn "News Arbitrage" That Made $3.4 Million in 2 Seconds

TechFlow Selected TechFlow Selected

How to Learn "News Arbitrage" That Made $3.4 Million in 2 Seconds

Is the bull market here? New token surges 10x in 10 minutes, hits $1 billion market cap in 10 days.

Author: Viee, Core Contributor at Biteye

Editor: Crush, Core Contributor at Biteye

On November 11, Binance listed two low-market-cap tokens, $ACT and $PNUT. Both performed remarkably—$ACT surged tenfold within 10 minutes, and this afternoon $PNUT surpassed a $1 billion market cap, less than two weeks after launch.

According to blockchain data monitoring platform Lookonchain, just two seconds after Binance announced the listing of $ACT, an address quickly bought 10.9 million ACT tokens using $320,000. As ACT rapidly appreciated, the profit from this investment soared to $3.4 million (approximately 24 million RMB).

Can retail investors without technical backgrounds profit from news arbitrage? The answer is yes.

Today we’ll dive into arbitrage strategies around Binance listing announcements 🤔—suitable for both beginners and experienced traders! 👇

01 Get Timely Information—Follow News Channels

Recently, Binance has accelerated its listing pace, with significantly different criteria compared to before. In short: low market cap, strong community momentum, compelling narratives, and prior circulation on tier-two or tier-three exchanges.

How can you capture such information in time? We recommend following the Telegram channels of Bwenews https://t.me/bwenews or Layergg https://t.me/layergg, pinning them, and enabling notifications.

02 Know the Ecosystems and Use Tools Effectively

Most recent Binance listings are Solana-based meme coins, though there are exceptions like $cow on Ethereum and $cetus on Sui.

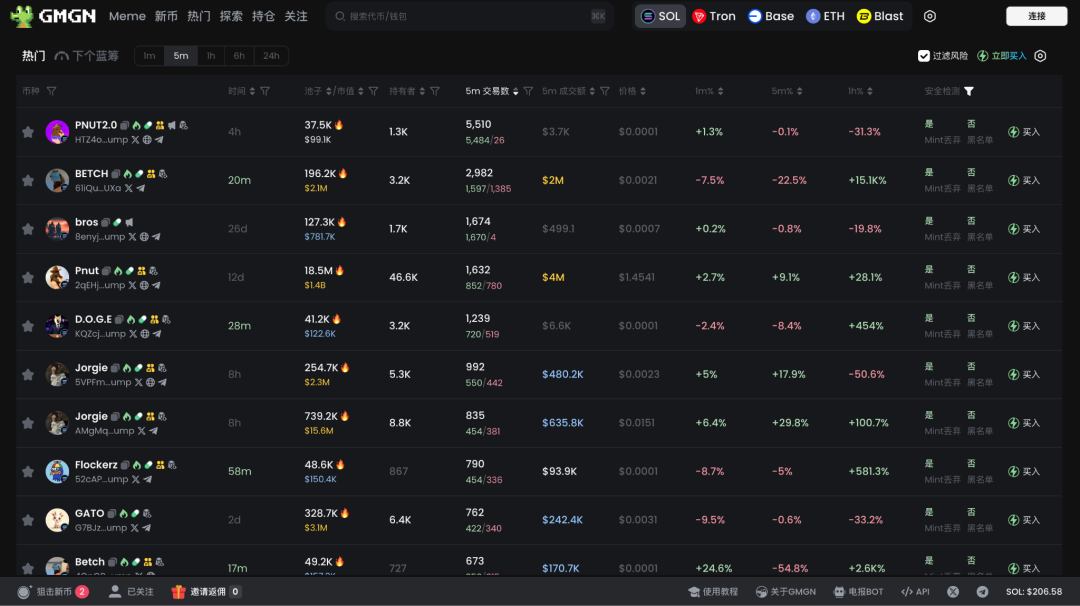

1. You're likely already familiar with the Solana ecosystem. For Solana-based listings, speed is crucial—tools make all the difference. We recommend using Telegram bots @gmgnai and @PepeBoost888. Avoid trading via Jupiter or Raydium in these cases; they’re too slow.

Using GMGN website to trade hot tokens and snipe new launches

2. For non-Solana tokens, you usually have slightly more time to act. Take $cow and $cetus as examples—both were listed simultaneously. $cow operates on both Ethereum and Gnosis Chain, while $cetus is built on Sui.

Upon hearing listing news, check @CoinMarketCap first to see if the token exists across multiple chains and whether price discrepancies exist between exchanges and on-chain markets.

Next, use @dexscreener to monitor price charts. If the token is multi-chain, enable the multichart feature to track prices across chains simultaneously.

3. These arbitrage opportunities must be executed very quickly—typically within 3–5 minutes. When price differences emerge between chains or between exchange and on-chain prices, you can buy low and sell high to capture profits.

03 Practical Examples

First example: $cow

1. After spotting the listing news, check @CoinMarketCap for price disparities. You may find little difference between Ethereum and exchange prices, but note that it's deployed across multiple chains.

2. Then open @dexscreener and observe that the price on Gnosis Chain is lower than on Ethereum. Buy cheaper on Gnosis Chain and bridge to sell higher elsewhere. Use the official bridge—the cross-chain transfer takes about 3 minutes, which is feasible given the time window.

Second example: $cetus

The key feature of $cetus is the significant price gap between exchange listings and on-chain prices. If you already hold funds on-chain, simply buy and sell immediately on the exchange. If not, withdraw directly to the chain—Sui transactions are fast, often confirmed within 2 minutes, still leaving room for profitable action.

Third example: Recently popular $Pnut and $ACT

$Pnut and $ACT offer massive returns if bought immediately upon listing, but profits diminish sharply with delay. On Solana and Ethereum, execution windows are extremely short due to competition from automated bots that front-run trades. Skilled users might run scripts to gain an edge, though this is complex and beyond the scope here. Most retail traders cannot outpace bots—so avoid chasing high prices cautiously.

Tokens on other chains typically allow 3–5 minutes of arbitrage window—enough time to analyze and act swiftly.

04 Summary

All tools mentioned above are included in Biteye’s recently compiled mind map of meme coin tools, featuring nearly 40 additional tools covering on-chain monitoring and trading—from discovering meme coins, tracking smart money, dashboards, trading utilities, to security tools. Feel free to explore:

How to Spot 100x Opportunities? The Ultimate Guide to Meme Coin Tools!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News