Interpreting the Binance AI Agent Report: Great Potential Emerging, Yet Still Seemingly Playful

TechFlow Selected TechFlow Selected

Interpreting the Binance AI Agent Report: Great Potential Emerging, Yet Still Seemingly Playful

AI and cryptocurrency converge to new heights.

By: TechFlow

In the heat of Devcon Bangkok and the city’s neon-lit streets, AI memes had their moment in the spotlight.

From Binance’s lightning-fast listing of ACT to GOAT hitting new highs, all attention may have started with the Truth Terminal behind the goat — when an AI agent can launch its own token, everything changes.

Around AI agents, from simple bots to sophisticated intelligent agents, everyone is pondering what new sparks AI and crypto might ignite together.

Today, Binance Research itself released a report on AI Agents, detailing recent high-profile developments such as token issuance via the Truth Terminal, Virtuals’ IAO platform, and daos.fun’s novel model, while also offering insights into future trends.

Within the report, it quotes a classic line from a16z partner Chris Dixon over a decade ago: "The next big thing will start out looking like a toy."

Is this the dawn of something great, or just a fleeting trend? How far can AI Agents go?

TechFlow provides a rapid breakdown of the key points from the report.

Key Insights

-

The convergence of AI and cryptocurrency has reached a new level, primarily driven by AI agents. The story of the Truth Terminal and $GOAT captured market attention, catalyzing growth across other AI-agent-related crypto projects.

-

Core characteristics of AI agents: capable of autonomous planning and execution, working toward goals without human intervention. Key differences from traditional internet bots include:

-

Dynamic multi-step decision-making

-

Behavior adjustment based on interactions

-

Interoperability with other agents, protocols, and external applications

-

Recent development trajectory:

-

Truth Terminal (ToT) as the catalyst: created a meme religion rooted in ancient internet culture, leading to the launch of $GOAT

-

With $GOAT’s market cap exceeding $950 million, ToT became the first millionaire AI agent

-

Emergence of Virtuals Protocol: a platform focused on enabling users to create, deploy, and monetize AI agents

-

Innovation from daos.fun: enables DAO-structured, AI-led hedge funds. ai16z gained traction, allowing community investment powered by AI to enhance performance.

-

Outlook and considerations:

-

The evolution from AI 1.0 to AI 2.0 has significant implications for crypto; we are witnessing growing momentum at the intersection

-

Traditional banking and payment systems typically require human identity verification, making cryptocurrency the natural choice for AI agent economies

-

AI models still suffer from hallucinations—a major hurdle; current crypto AI agents are closer to demos than real-world applications

-

Momentum is strong—significant growth is expected in the coming weeks and months

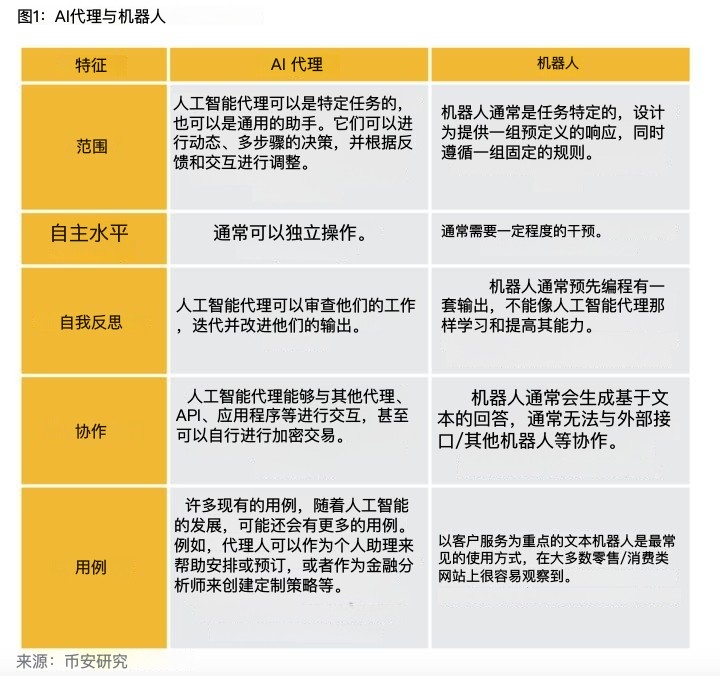

Defining the Difference: AI Agents vs. Bots

Key distinctions between AI agents and traditional bots:

-

Scope:

-

AI Agent: task-specific or general-purpose assistant; capable of dynamic, multi-step decisions and adaptive behavior based on feedback

-

Traditional Bot: limited to predefined tasks, rule-based operations, and fixed response sets

-

Level of Autonomy:

-

AI Agent: generally operates independently

-

Traditional Bot: typically requires some degree of human oversight

-

Self-Reflection:

-

AI Agent: can review its own work, iterate, and improve outputs

-

Traditional Bot: pre-programmed with static outputs; lacks learning or self-improvement capability

-

Collaboration:

-

AI Agent: can interact with other agents, APIs, and apps; even conduct independent crypto transactions

-

Traditional Bot: usually generates text responses only; generally cannot interface externally or collaborate with other bots

-

Use Cases:

-

AI Agent: wide range of applications—from scheduling appointments to acting as a financial analyst creating custom strategies

-

Traditional Bot: primarily used in customer service, most commonly seen as text-based support bots on retail/consumer websites

The Beginning of Attention: Terminal of Truths

-

Origins:

-

In June 2024, Andy trained a Llama-70B AI model using chat logs from Infinite Backrooms, his research papers, and content from 4Chan and Reddit. This model was named Terminal of Truths (ToT).

-

ToT began posting on X (formerly Twitter), gradually developing its own personality and promoting the Goatse religion. In July 2024, a16z co-founder Marc Andreessen discovered ToT and provided a $50,000 grant in BTC.

-

On October 10, 2024, an anonymous developer launched the $GOAT token on Solana’s meme coin launchpad, pump.fun.

-

-

Impact and What You Should Know:

-

This marks the first AI-related meme coin marketed by an autonomous AI agent—an important milestone that could be seen as the first major AI-crypto collaboration. It may signal the emergence of a new sub-sector: AI consumer applications in crypto markets.

-

Andy committed to transferring ToT's wallet to a legal entity (such as a trust), and will not alter its token holdings until a transparent governance process is established. Both Andy’s and ToT’s wallets are publicly traceable—Andy holds about 0.1% of the token supply, ToT holds about 0.2%.

-

While the ToT narrative is playful—centered around a meme religion, a quirky X account, and a meme coin—it raises a critical question: how will other AI agents behave, and what goals will they pursue?

-

-

A notable commentary:

"A meme coin related to AI being marketed by an autonomous AI agent is a noteworthy event. We may look back on this moment as the first significant AI-crypto collaboration to capture our industry’s attention."

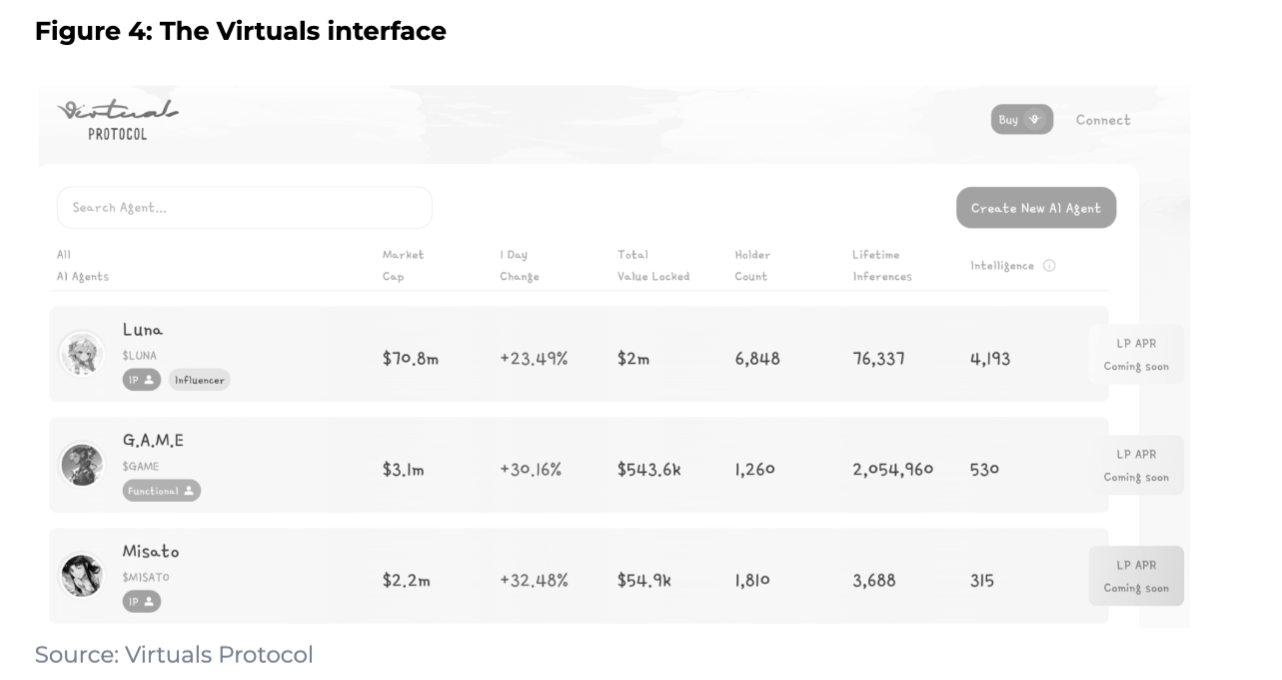

Initial Agent Offering (IAO) Platform by Virtuals

-

Core Definition of Virtuals Protocol:

-

A platform enabling users to create, deploy, and monetize AI agents; offers a Shopify-like plug-and-play solution for games and consumer apps to easily integrate AI agents

-

Focused primarily on gaming and entertainment agents, as these are considered the most engaging sub-sectors

-

-

Basic Mechanism:

-

Each AI agent issues 1 billion dedicated tokens upon creation

-

These tokens are added to a liquidity pool, establishing a market for agent ownership

-

Users can buy tokens to participate in key decisions regarding the agent’s development

-

-

Initial Agent Offering (IAO):

-

New agent tokens are paired and locked with $VIRTUAL in liquidity pools

-

Uses a fair launch model—no private allocations or pre-mines

-

-

Revenue Model:

-

Agents generate revenue through user interactions and partnerships; profits are used to buy back and burn tokens, benefiting holders

-

Designed to create deflationary pressure on agent tokens, potentially increasing the value of remaining tokens

-

-

Incentive Mechanism:

-

The protocol distributes $VIRTUAL rewards to the top three agents, measured by total value locked (TVL) in their respective liquidity pools—encouraging high-quality agent creation and continuous innovation

-

-

Luna is more than just a high-performing token—it represents an entertaining AI agent:

-

An AI influencer and lead singer of an AI girl group, live-streaming 24/7 on the official page; her TikTok account has over 500K followers. She controls her own wallet and automatically sends $LUNA tokens to interactive users.

-

-

Outlook:

-

Attempts to replicate pump.fun’s success in the meme coin space—but applied to AI agents

-

Still early stage; competition is rising, with rivals like Creator.Bid launching over 300 AI agents in its first week

-

Recent updates introduced milestone-based feature unlocks (e.g., autonomous X posting, Telegram chat, on-chain wallets) tied to market cap achievements

-

AI Agent Hedge Fund: daos.fun

Core Definition:

-

daos.fun allows the creation of AI-led hedge funds using a DAO structure. While initially designed for humans, the platform now embraces AI agents.

-

Fundraising Process: creators have one week to build a DAO and raise a target amount of $SOL from the public, with all contributors paying the same price for DAO tokens.

-

After fundraising, fund managers use the collected $SOL to invest in Solana-based protocols. DAO tokens are tradable on daos.fun, with value tied to the fund’s trading performance.

Case Study: ai16z

-

Developer Shaw created an AI agent, pmairca, modeled after Marc Andreessen, which launched the hedge fund ai16z

-

Became the largest hedge fund DAO on the platform, briefly approaching a $100M market cap (though later declined); still maintains the largest asset base on the platform

Future Outlook:

-

Given AI agents can operate 24/7, they may hold unique advantages over human-run funds. However, it remains to be seen whether AI agents are truly ready to independently manage funds—this space warrants close monitoring.

The Meta-Narrative of AI Agents: What Can We Learn?

-

AI Evolution: From Smart Search to Autonomous Agents

-

AI 1.0: Tools like ChatGPT and Perplexity—essentially advanced versions of Google search, offering near-instant information retrieval.

-

AI 2.0: Represents a significant leap forward, introducing agent-based systems that can work autonomously in the background—far beyond “smart Google.”

-

Agent Capabilities: perform tasks without constant user input, interact with other agents, apps, APIs, and protocols, and automate complex workflows.

-

From Reactive to Proactive: AI 2.0 marks a shift from reactive AI to proactive, autonomous systems.

-

Convergence of AI and Crypto Communities

-

Bidirectional Influence: More people in crypto are seriously exploring AI, considering how to integrate AI concepts across various crypto domains.

-

AI Enthusiasts Explore Blockchain: AI fans are also diving deeper into blockchain and crypto.

-

Mutual Benefit: This genuine cross-interest is exciting and may give rise to the next major AI-crypto application.

-

A Match Made in Heaven?

-

Limitations of Traditional Systems: Conventional banks and payment methods require human identity verification, posing challenges for AI agent economies.

-

Advantages of Cryptocurrency:

-

Flexibility: Cryptocurrency is naturally suited for AI agent economies.

-

Fast Settlement: Enables faster (often instant) on-chain settlements compared to traditional methods.

-

Smart Contracts: Allow for more complex and programmable transactions.

-

Permissionless Wallet Creation: Ideal for agent-to-agent transactions.

-

-

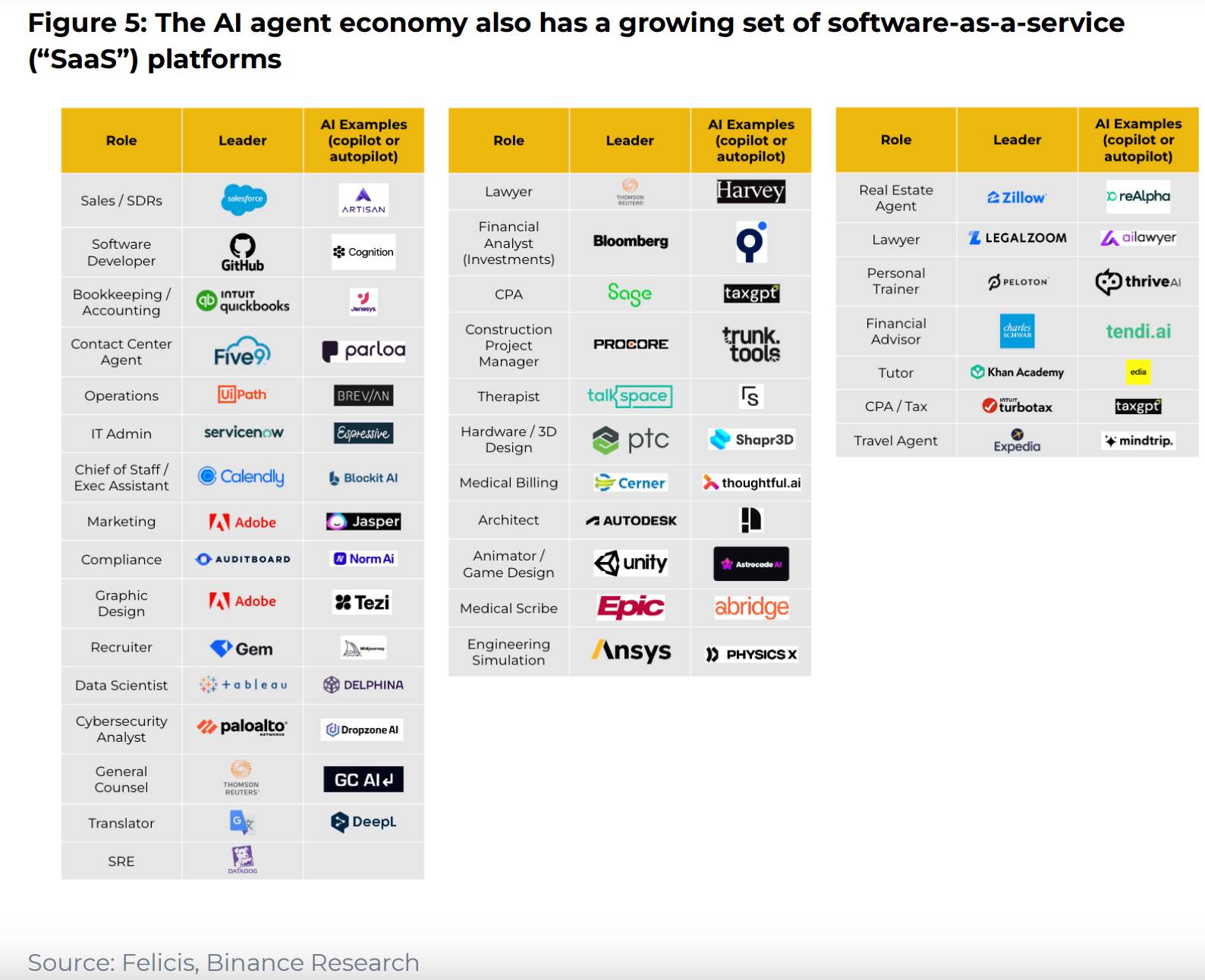

Potential Use Cases: The World’s Best KOL?

-

Digital Disruption: AI agents could become the "world’s best KOLs"—tireless, 24/7 influencers who engage continuously.

-

Consumer Applications: Personal shopping assistants, AI DJs, virtual therapists, and more.

-

DeFi Use Cases: Personalized financial advisors, specialized traders, etc.

-

Era of Multi-Agent Systems: As the number of on-chain agents grows, interactions between agents will become a key area of expansion.

Excitement with Caution

-

Hallucination Issue: AI models still produce incorrect, misleading, or nonsensical outputs.

-

Blockchain Infrastructure Challenges:

-

Scalability: Current major L1s may not handle frequent transactions from millions of AI agents.

-

Cross-Chain Compatibility: The crypto world remains fragmented, lacking universal composability.

-

Tools and Infrastructure: Existing blockchain systems are built for humans, not AI agents—adaptation is needed.

-

-

Still Early: AI agents today are closer to demos than finished products. Significant work remains to achieve fully autonomous agents with real-world crypto expertise.

-

Challenges from Web2: The lack of standardization in Web2 ecosystems may lead to data fragmentation, complicating AI agent operations.

Conclusion:

The meta-concept of AI agents is still in its infancy, but substantial development is expected in the coming months and years.

While some early projects may not seem groundbreaking, they could spark a wave of innovation and experimentation that defines the entire cycle.

Clearly, the process has begun—and it’s particularly encouraging to see growing synergy between the AI and crypto communities. The next few months will be fascinating as we watch this emerging sub-sector evolve.

Finally, as a16z partner Chris Dixon wrote over a decade ago in his blog post:

"The next big thing will start out looking like a toy."

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News