Do We Still Need Binance: From Regulatory Crackdowns to User FUD, What's the Real Problem?

TechFlow Selected TechFlow Selected

Do We Still Need Binance: From Regulatory Crackdowns to User FUD, What's the Real Problem?

Historically, no company has gone bankrupt simply because of too many rumors. Most have declined because the rumors were proven true, ultimately succumbing to arrogance.

Author: Icefrog

Binance, as the industry's top-tier and pinnacle player, has recently faced increasingly intense market FUD. Simon, labeled as CEO of MoonrockCapital on platform X, claimed that Binance demands 15%-20% of a token’s total supply as a listing condition—sparking widespread debate. The market reaction surged rapidly, with both support and opposition emerging. Some emotionally charged voices even labeled Binance as possibly the biggest cancer in the industry, while others argued it wasn't Binance's fault but rather an issue with projects themselves or the industry's developmental model.

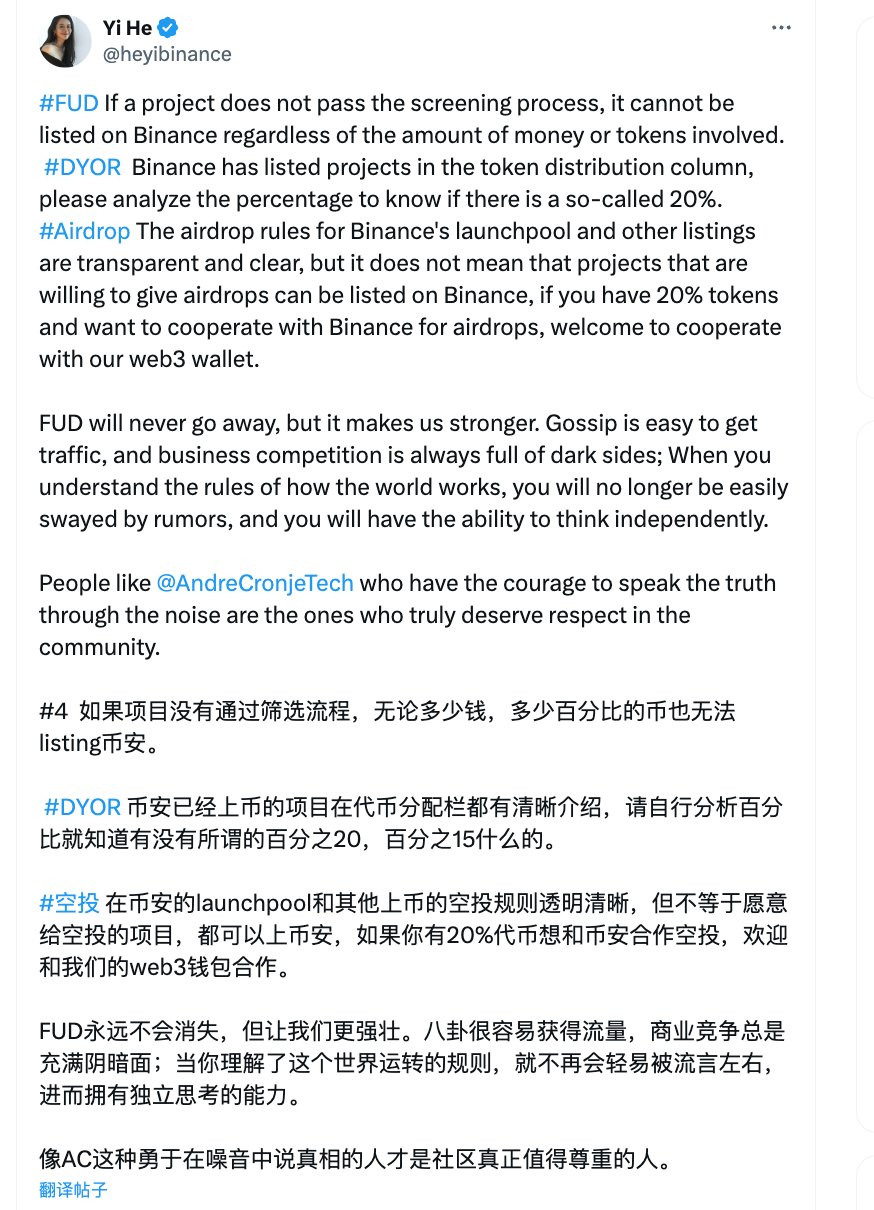

Eventually, Binance’s number one executive publicly responded on social media: “If a project doesn’t pass Binance’s screening process, no amount of money or listing fee can get it listed. Token allocations are public; Binance could never take such a high proportion.”

Regardless of whether either side is telling the truth behind this verbal clash—or if it’s merely another act of business competition—at least from this executive’s response, we see her leveraging her personal reputation to defend Binance’s credibility. By proactively and promptly addressing such criticism, she continues to earn community respect for her honesty and directness—a trait she has consistently demonstrated in the past and present.

Yet these kinds of criticisms are neither new nor will they be the last. They indirectly highlight Binance’s ongoing challenges: externally facing regulatory crackdowns and competitive pressure, internally grappling with community skepticism. True crises rarely lie in surface-level confrontations—just as the entity that ultimately defeats Binance won’t be another exchange mimicking its model.

I. Is FUD Just Rumor? "Victim Mentality" and "Who Is the Real Enemy"

Let’s assume the executive’s statement is truthful—that the FUD stems purely from underhanded tactics in business competition. Unfortunately, the general public rarely exercises independent thinking; otherwise, they wouldn’t be the masses. History shows clearly: rumors aren’t dispelled by mass self-awareness, but by irrefutable facts. Influencer narratives may temporarily distort perception, but they don’t eliminate doubt—they might even fuel stronger FUD next time.

When all FUD is attributed solely to competitors’ sabotage, the underlying victim mentality does little to resolve controversy. Perhaps rivals are indeed fanning the flames, but likely not entirely. When a platform possesses truly compelling evidence, few would resort to such ineffective attacks against an industry leader. Only when you have flaws do such tactics become effective. This is basic business logic.

Facing FUD, the first step should be introspection—not immediately suspecting competitors. That’s the posture a great company should adopt. The real enemy has always been arrogance, not external forces. Treating FUD merely as a tactical move risks overlooking deeper, hidden crises.

II. Where Does the Crisis Come From: Shifts in Pricing Power and Liquidity

1. Liquidity Determines Pricing Power—but Users Are the Source of Liquidity

Binance remains, at least for now, the largest liquidity hub in the industry. Whoever controls liquidity holds pricing power—an immutable truth in finance. But viewed long-term, while institutions or exchanges often dictate short-term prices, ultimate pricing power always returns to users. Abuse of pricing power accelerates this shift.

A clear sign of such abuse is tolerating projects with extremely unbalanced token distributions and poor reputations. On Binance, low-circulating-supply, high-market-cap projects abound—often compounded by Binance itself taking significant token allocations. This results in VCs, teams, exchanges, and market makers controlling most tokens, leaving retail investors to passively absorb sell pressure. Take Scroll recently as an example.

Initial circulation accounted for only 19% of total supply, plus another 5.5% allocated to Binance Earn. The rest came with various vesting schedules. Simple math: who absorbs such massive, sustained sell pressure? Even if a project has strong fundamentals and revenue generation, some sell-off can be offset, smoothing price curves. In reality, data dropped nearly 50% shortly after airdrop and TGE. Worse, this fundamental collapse was 100% foreseeable before listing on Binance.

So questions arise:

1) Knowing full well this project had guaranteed weak fundamentals, highly skewed token distribution, terrible reputation, and prone to centralized control and dumping—why did Binance list it?

2) Whose interests does Binance’s screening mechanism actually serve?

Together, these two points lead to an obvious conclusion: at least from利益/user sentiment perspectives, Binance appears not aligned with users—or at best, not primarily aligned with user interests.

If Binance truly stood with users, no competitor could tarnish its image—because sustainable wealth creation in crypto is the ultimate truth.

A striking contrast highlighting users' role as final arbiters of value is the Grass project. Its fundraising was less than 1/10th of Scroll’s, yet currently boasts a market cap over $1 billion compared to Scroll’s $500 million.

Despite similar early unlock pressures, Grass achieved fair and sustainable airdrops, earning strong community goodwill. The result? Continuous user buying, increased incentives, and positive feedback loops.

Same macro environment, vastly different outcomes. It clearly reveals: no matter how advanced the tech, impressive the funding, or prestigious the exchange backing—if users refuse to buy in, the pump-and-dump cycle collapses faster each time. Each collapse erodes Binance’s foundation, accelerating the transfer of pricing power.

2. Liquidity Migration: Human Greed Chases Fairness First—Dex on Chain Has Unmatched Advantages

Whether crypto is a giant casino remains debatable, but it certainly follows core gambling principles: operators don’t fear you winning—they fear you leaving. Contrary to popular belief, legitimate casinos like those in Macau invest heavily in fairness, transparency, and openness to ease gamblers’ concerns. They profit not through cheating, but via statistical edges amplified over time.

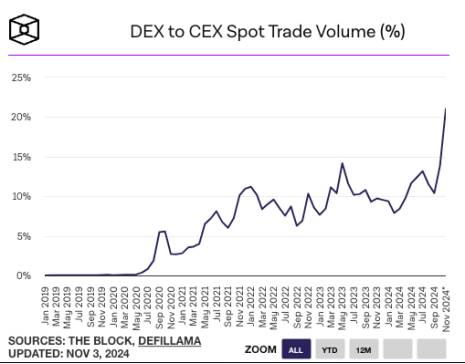

In terms of fairness, transparency, and impartiality, decentralization inherently outperforms centralization. While Dex growth is limited by UX friction, the allure of wealth effects minimizes this impact. Data confirms this trend: according to The Block & DefiLlama, by October, Dex spot trading volume relative to Cex reached a record high of 13.84%, and this ratio continues to grow steadily.

Not to mention the recent Meme boom, where platforms like Pump.fun have spawned multiple meme coins exceeding $1 billion in market cap, recording over 6.7 million daily transactions and averaging over $1 billion in daily volume.

These numbers reflect a gradual shift of liquidity toward on-chain Dex platforms and trending sectors like memes. Despite higher risks for newcomers, few question decentralized platforms because they offer a relatively fair playing field.

The key difference between Cex and Dex lies in their foundational premise: Cex exists because users delegate token selection authority to the platform. Either set no or low barriers uniformly, or establish high barriers backed by sustainable value. The worst scenario? Setting high barriers yet listing garbage projects.

Another misconception: some centralized exchanges fall into elitist proxy models. They don’t believe they’re listing junk—they’re staffed by individuals with impressive resumes and institutional pedigrees who over-trust capital’s ability to reshape reality, harbor unrealistic faith in so-called technology, and naturally favor institutions—or claim to foresee industry trends, calling it “the direction of progress.”

Take Scroll again: beyond seemingly cutting-edge tech and elite funding, what actual value does it deliver? Is it irreplaceable? If not, what justifies its listing? What meaning does a “strict” review process hold if it ignores team integrity and project reputation?

Binance listing signals project success—it’s power granted by users. If that power is misused, user skepticism becomes inevitable.

III. Some Reflections: Binance’s Crisis and the Industry’s Crisis

Nobel laureate and behavioral economics pioneer Richard Thaler proposed a famous theory: people weigh losses more heavily than gains when making decisions.

The rise of “anti-VC tokens” and “meme fever” vividly illustrates this principle. Clearly visible—and visible even through telescopes—the risk of investing in VC-backed tokens keeps rising. Factor in opportunity cost of being locked up and limited upside due to inflated valuations, and profit margins shrink to near zero. For ordinary users, buying VC tokens on Binance has become an event where harm outweighs benefit.

You might argue Binance is just a neutral venue—a third-party facilitator like a casino, where wins and losses are natural. But objective facts cannot replace factual objectivity. The real fact is: even casinos avoid launching games where players lose every single time. On the issue of VC tokens, retail investors almost never win—this consensus is currently undisputed.

Moreover, regarding project selection: a truly neutral exchange should operate transparent rules, akin to NYSE or Nasdaq. Currently, top-tier exchange listings remain black boxes—driven by speculation and inference, thus wielding absolute power. Some exchanges operate semi-transparently, offering near-zero thresholds (pay-to-list). Neither approach works: the former specialises power, breeding arrogance and closed-interest groups even without corruption; the latter monetizes access, charging excessive tolls that inflate project costs and stifle innovation.

On a broader scale, the industry’s crisis is evident. Without major new liquidity influx, BTC increasingly decouples from overall crypto markets, gradually falling under Wall Street’s control and pricing influence. Altcoins either stall like Ethereum, unable to break through, or fully pivot to memes. A sense of valueless nihilism pervades the space—especially as most “value tokens” repeatedly prove hollow. More users lose faith in actual building. When even the largest exchange chooses to trust project teams over users, confidence collapses faster. The rise of memes reflects lost faith in the entire industry’s development narrative.

As de facto industry gatekeeper, Binance should shoulder greater responsibility and meet heightened user expectations. Blaming competitors distracts from fixing internal systemic flaws. Users demand fairness—and yes, fucking fairness. Cases like Scroll, where Binance acquires large token stakes at minimal cost, make it hard to call the system fair—or beneficial to projects or industry progress.

From traffic and status alone, one might say everything’s fine. But remember where traffic comes from—and an old proverb: water carries the boat, but also capsizes it.

Do we still need Binance? Undoubtedly yes—no one denies its immense contributions. We still believe in professionals like CZ and He Yi as pillars of the industry. But as previously stated, this isn’t about individuals—it’s about systemic operation and ecosystem-wide issues. Solutions remain unclear, paths undefined. What we hope for is Binance genuinely siding with users, using its influence and vast resources to reverse current trends, restoring user confidence in “value tokens,” and reviving faith in the entire industry.

From Binance’s own perspective: Can users afford to live without Binance? Is its irreplaceability declining? These are questions worth deep reflection by Binance’s leadership—especially amid rising Dex volumes, surging on-chain meme activity, tightening regulations, and intensifying competition.

Remember: historically, no company has gone bankrupt simply due to too many rumors. Most collapsed because the rumors were proven true—and ultimately fell to arrogance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News