How can an ordinary media editor discover $GOAT and achieve 250x profit?

TechFlow Selected TechFlow Selected

How can an ordinary media editor discover $GOAT and achieve 250x profit?

You need to have the kind of savvy sensitivity that comes with experience.

Author: TechFlow

"Back then, standing at a crossroads with winds shifting and sails rising all around, the day you made your choice felt utterly dull and ordinary in your diary—just another seemingly mundane day in life."

--- From "The Girl Who Kills Quails"

Fourteen days ago, one of our regular editors, while casually browsing the internet for writing material, stumbled upon the ramblings of Terminal of Truth and noticed its issued token $GOAT.

At the time, the editor invested 1 SOL. Today, with Binance announcing the listing of GOAT's contract, that initial 1 SOL investment has yielded a return of 250 times, based on current prices at the time of writing.

Back when GOAT first launched, there was almost no coverage explaining how it all began.

After some research, our editorial team found the narrative of an AI bot launching a meme coin particularly intriguing, so we published an article titled "Are AIs Now Launching Meme Coins? A Look at a16z-Backed Bot’s Self-Issued Meme Coin GOAT."

If you compare publication timelines carefully, you'll find this was among the earliest articles in Chinese media to introduce GOAT. Precisely because we spotted it early, the final returns far exceeded expectations.

Compared to professional dog-hunting bloggers, on-chain analysts, or industry veterans, this profit—both in multiples and absolute value—may seem trivial, perhaps even laughable.

Yet we believe this story holds greater relevance for ordinary readers:

How does someone relatively average, not professionally trading, manage through interpreting public information, using free tools, and maintaining a healthy mindset, to achieve an unexpected windfall?

Below is his true story, shared with all of you.

Laughing Before the Pump, Prophet After

This industry has always been ruthlessly results-driven—success justifies everything.

In hindsight, once GOAT reached today’s level, people might see you as a visionary who caught the hottest coin. But going back 14 days, I was just another PVP韭菜 (clueless retail trader) among many.

Besides my daily grind as a media editor, I frequently lose money in Solana’s “shitcoin arena.”

But due to my job, I’m constantly exposed to new trends and narratives, which I then turn into articles when I find them interesting. This comes from work demands, not active speculation.

Creating engaging, informative content is my real job.

So when I first saw GOAT, I was mostly amused—“laughing,” not making serious investment decisions. I simply found the theme fascinating.

Naturally, the outcome turned out well—an unexpected bonus.

Looking back, on the afternoon of October 11, I wrote an article introducing a16z’s investment in the Terminal of Truth bot and how the bot itself issued a token. Almost at the same moment I started drafting that piece, I casually bought 1 SOL worth of GOAT, when the price was 0.0019.

Figure: Screenshot taken shortly after GOAT launched on October 11; green point B marks entry price

Today, GOAT trades around 0.75—nearly 370 times the original purchase price in theoretical returns.

However, I cashed out my principal early. When FUD emerged over Terminal of Truth misspelling an English word, raising suspicions that a human was behind it and causing the price to crash, I added another 1 SOL.

If we only calculate the return from that initial 1 SOL after withdrawing the principal, the gain is roughly 250x.

Figure: Screenshot before publishing on October 25; due to intermediate buy/sell activity, calculated returns differ slightly from text

Clearly, from a profit-maximization standpoint, I made at least two mistakes:

-

Should’ve invested more than 1 SOL initially—starting capital too small;

-

When FUD hit, I should’ve doubled down more than 1 SOL—the pullback was a major re-entry opportunity yielding only minor gains;

But I’m neither a professional trader nor analyst, let alone a winning guru pumping signals, nor do I seek access to exclusive Alpha groups.

For an ordinary crypto worker with limited time, bargaining power, or informational edge, these imperfect moves are acceptable.

Also, precisely because my total cost was only 1 SOL, I could hold with ease, remaining emotionally unfazed even during busy workdays—after all, it was just 1 SOL.

You know, among the 2.5 million tokens launched on Pump.fun, fewer than five have market caps exceeding $100 million. For every success story, countless others die.

So betting big or doubling down recklessly often leads to ruin.

Given my conservative nature, when uncertain but intrigued, a 1 SOL tactical move makes sense.

There’s no prophecy here—no overnight genius. Just laughter amid volatility.

If someone had confidently dumped $1,000 into GOAT at launch and held calmly till now, they probably wouldn’t be working or writing stories today. Such legends stay hidden.

While such windfalls can’t be replicated, one thing worth sharing is how I discovered GOAT and Terminal of Truth early.

"Getting Early" Is About Integrating Information and Tools

If you’re deeply involved in Solana’s shitcoin PVP scene, you’ll realize every new token launch is ultimately a game of attention.

In short, something (apparently) noteworthy launches a token—intentionally or accidentally.

This “something” could involve celebrities, culture, memes, drama, jokes, or anything unpredictable.

Essentially, you’re watching a foreign version of Weibo (X), needing a gossip mindset and placing bets via Pump.fun.

But with so much gossip out there, how do you spot the valuable ones earlier?

Social media can be staged, but money flow doesn’t lie.

Take my discovery of GOAT as an example:

Routine work has led me to collect, intentionally or not, numerous so-called “smart money” addresses from data-focused bloggers, researchers, and social media recommendations. I’ve also subscribed to several “smart money” alert bots.

I don’t expect them to be perfectly smart or honest—my goal is to identify trending topics for editing purposes.

But one thing I’m fairly confident about: if multiple monitored addresses and bots signal that XX bought XX token, it likely has short-term potential as a story topic.

In other words, whether by conspiracy or sharp instinct, these actors may have already filtered promising themes for you—something attention-grabbing, worth talking about.

Following this logic, I noticed on the 11th that a large number of addresses were buying GOAT, with high frequency and volume.

Acting on editorial instinct, I sensed a potential breakout story and searched GOAT’s contract address on X.

The results were flooded with shilling posts—but also buried treasure.

At the time, there was nearly zero coverage explaining GOAT or Terminal of Truth. The only meaningful result linked to this article:

To this day, that article has only around 5,000 views—not many, but the headline instantly grabbed me:

Mark Andreessen sent 50,000 USD in Bitcoin to an AI Bot.

Even if you don’t trade crypto, as someone in the industry, that headline alone would spark curiosity and a strong urge to learn more—which became my initial hook into GOAT.

Thus, the original logic behind discovering GOAT was:

Fund flow anomaly → Social media search → Finding valuable info → Curiosity → Interpretation.

With my mediocre English skills and GPT’s help, I quickly read through the report and located the AI bot account behind GOAT—“Terminal of Truth.” Then I rapidly skimmed all its past posts, from newest to oldest.

I still lacked solid evidence or knowledge to confirm it was truly an AI rather than a human pretending—but its chaotic rambling suggested炒作 potential:

Eccentric, half-intelligent, half-philosophical, announcing it would issue a token…

An (alleged) AI bot self-launching a meme coin—this was unprecedented.

Then I reviewed its conversation with Marc, confirming he indeed sent BTC. Combined with a16z founder’s soft endorsement, I sensed this could go viral.

I concluded it was a compelling story angle and quickly drafted the first article introducing GOAT.

(Are AIs Now Launching Meme Coins? A Look at a16z-Backed Bot’s Self-Issued Meme Coin GOAT)

Colleagues later told me parts of the Alpha groups shared this article, using it as an intelligence source. But my intent wasn’t speculation—it was spotting trends fast and writing.

Possibly this is an industry insider advantage, but only if you maintain a gossip-driven mindset and consistent workflow.

What followed unfolded naturally: a small bet based on understanding, entering with 1 SOL. Yet I never expected GOAT to surge into crypto’s top 100 by market cap.

In retrospect, getting early wasn’t pure luck—it was integrating information and tools.

If you rely solely on secondhand information, both fun and odds diminish.

Different industry players use different methods to gather intel. As editors, our approach best mirrors ordinary people—tools are public, searches are public, monitoring is free. You can replicate this your own way.

And remember, I still had to spend time writing. An average player could act immediately on the same information without writing a word.

Of course, they might also lose everything. That’s why I always stress: before any meme takes off, spend more time analyzing, less money betting. This stems from my job’s nature and pace.

You Need A Cynic’s Sensitivity

You might ask: I didn’t have the luck to catch GOAT early. What if I want to jump in now at higher prices?

In reality, from GOAT’s launch to now—about 15 days—there’s been a significant window. You don’t need to bet everything on GOAT. Plenty of other opportunities emerged during this period.

But you must possess a cynic’s sensitivity.

What’s a cynic? Let’s take pump.fun as an example.

When Coinbase CEO Brian posted about his wedding, sharing a sweet photo with his partner, pump.fun replied with oily precision:

“Congratulations! Nice dog in the photo—what’s its name? (Asking for research purposes)”

Clearly, pump.fun敏锐ly sensed launching a token around that dog might be profitable.

This is the kind of jaded, veteran sensitivity born from years in the space—irreverent yet razor-sharp, treating everything as potential assets for炒作.

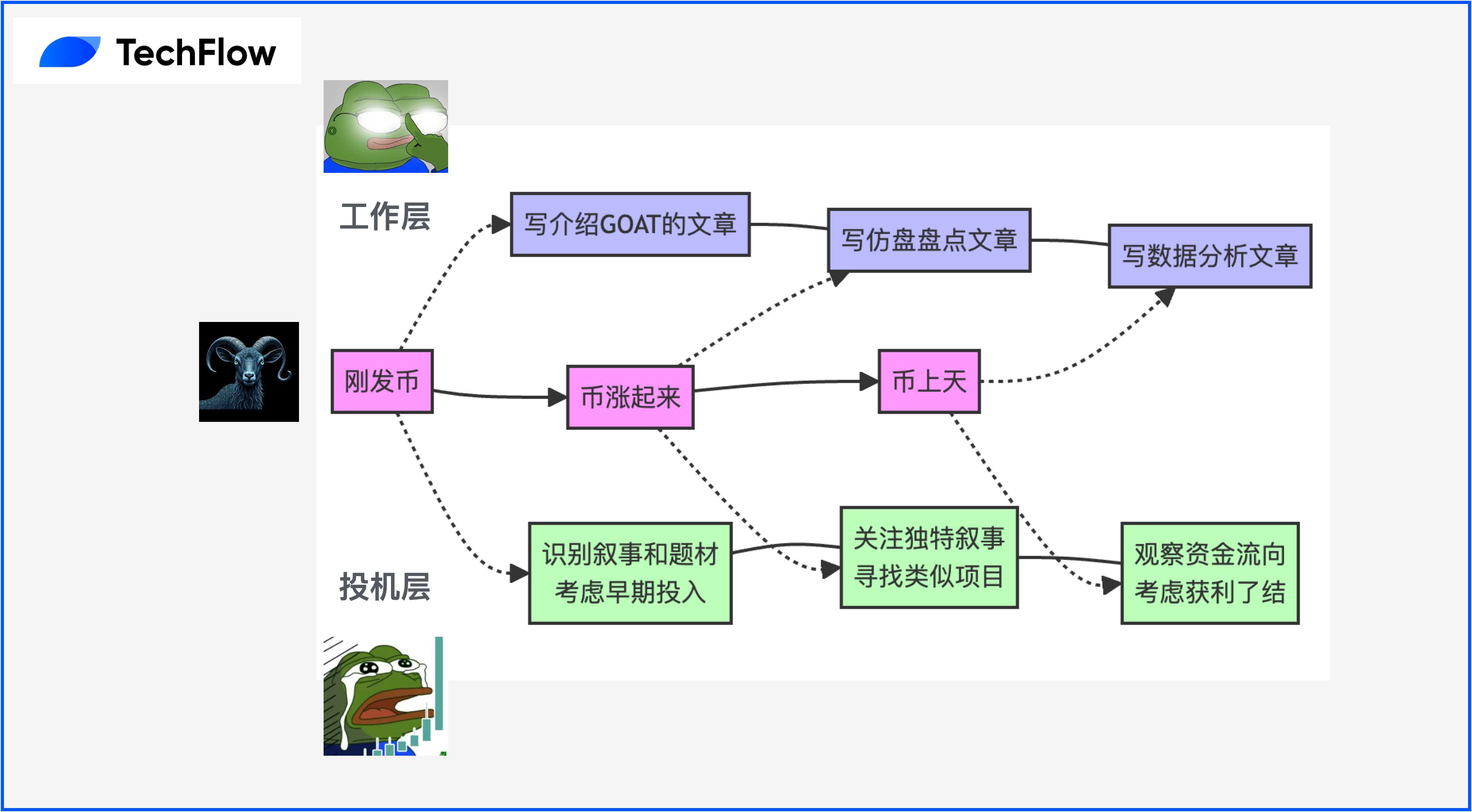

Regarding GOAT specifically, as an editor, I believe there were at least three sensitive moments tied to its event lifecycle:

-

At launch: Recognize whether the narrative/theme warrants attention, write an intro article on GOAT;

-

During the rise: Identify whether spin-offs or clones emerge with similar concepts but fresher narratives, write a roundup on imitators;

-

At peak: Monitor whether smart money or large holders are exiting, observe what successful players are moving into, write data analysis;

So GOAT is the main thread—multiple subplots exist beneath it. While momentum lasts, plenty of beta opportunities remain.

Since the entire crypto industry is a time-and-space-compressed “startup ecosystem,” your windows are narrow, yet dense with concurrent opportunities. To maximize gains during favorable conditions, you must continuously sharpen your sensitivity and increase your information density.

Finally, we hope this unexpected win with GOAT serves as a positive beginning, helping you grasp fresh industry changes and cutting-edge trends, identifying and uncovering more opportunities.

This is both our duty and a small moral stand against “doing evil” in this space.

*Risk Warning: MEMEs lack fundamental value, are highly sentiment-driven, and the vast majority (>99%) are PVP plays destined to go to zero. This article shares personal experience only and does not constitute any investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News