Crossing the Crypto "Fast Money Trap": From Speculation to Rationality, Refocusing on Fundamentals

TechFlow Selected TechFlow Selected

Crossing the Crypto "Fast Money Trap": From Speculation to Rationality, Refocusing on Fundamentals

Consider holding projects with strong fundamentals and meme appeal.

Author: Ryan Watkins

Translation: TechFlow

"In their deep reflections, the subtle sounds of omens reached their ears; they listened reverently, while people on the streets outside remained unaware." — C. P. Cavafy

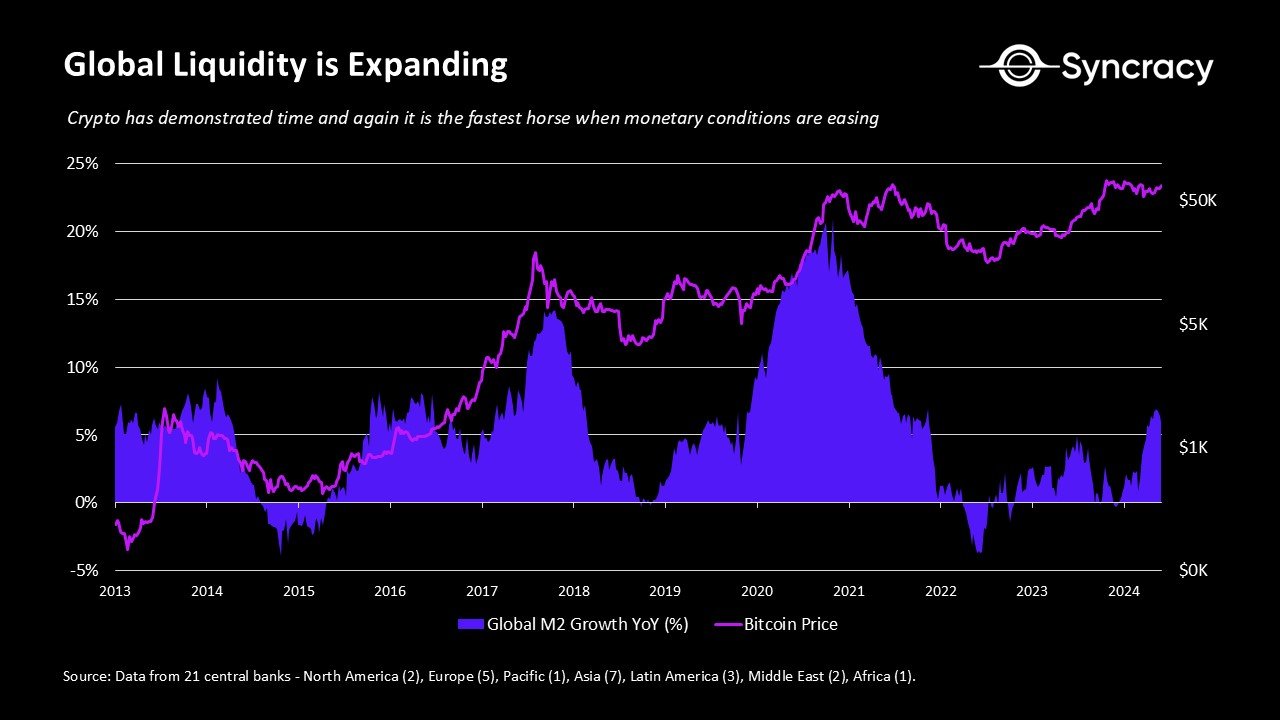

Crypto markets have repeatedly proven to be the fastest investment vehicle when monetary policy turns accommodative. Syncracy believes this cycle will be no exception—especially with growing institutional adoption and regulatory clarity. However, a key difference today compared to past cycles is that returns are unlikely to be driven by a single dominant theme, but rather will likely be more fragmented.

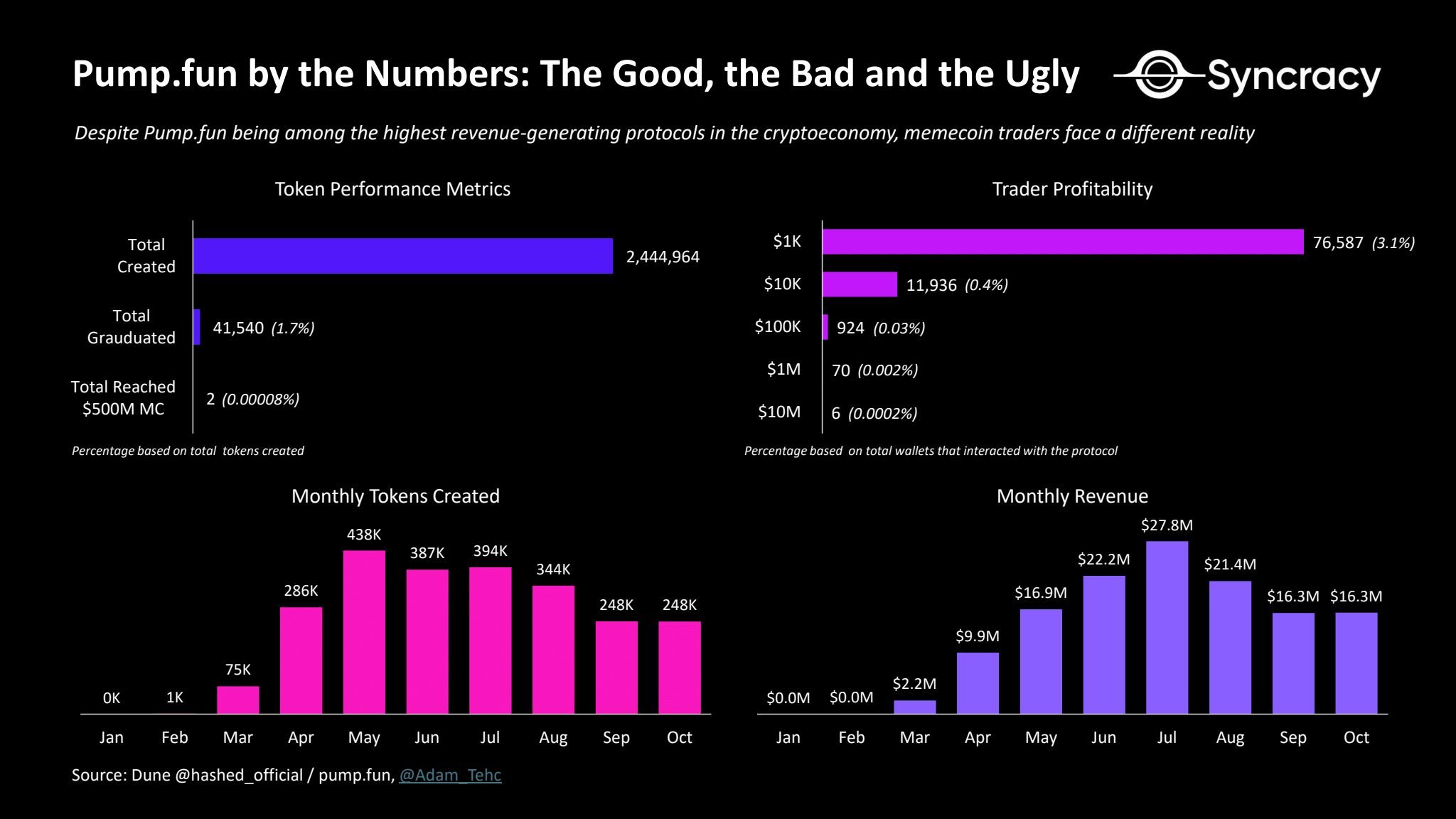

Unlike previous cycles, this market rebound has not been fueled by innovation, but by Bitcoin ETFs and promises of institutionalization. This has led to speculative capital flows lacking clear direction. Unlike 2021, there are no exciting new DeFi or NFT narratives capturing attention—only a general sense that macroeconomic conditions are improving and infrastructure is maturing. Meanwhile, the number of assets in crypto has increased ten- to one-hundredfold, making it difficult for the entire industry—or even the asset class as a whole—to rise in unison. As a result, speculative flows lack clear direction, and many ironically refer to the only guiding logic as "financial nihilism"—perhaps the only notable technical advancement this cycle being the launch of more efficient infrastructure for launching and trading tokens.

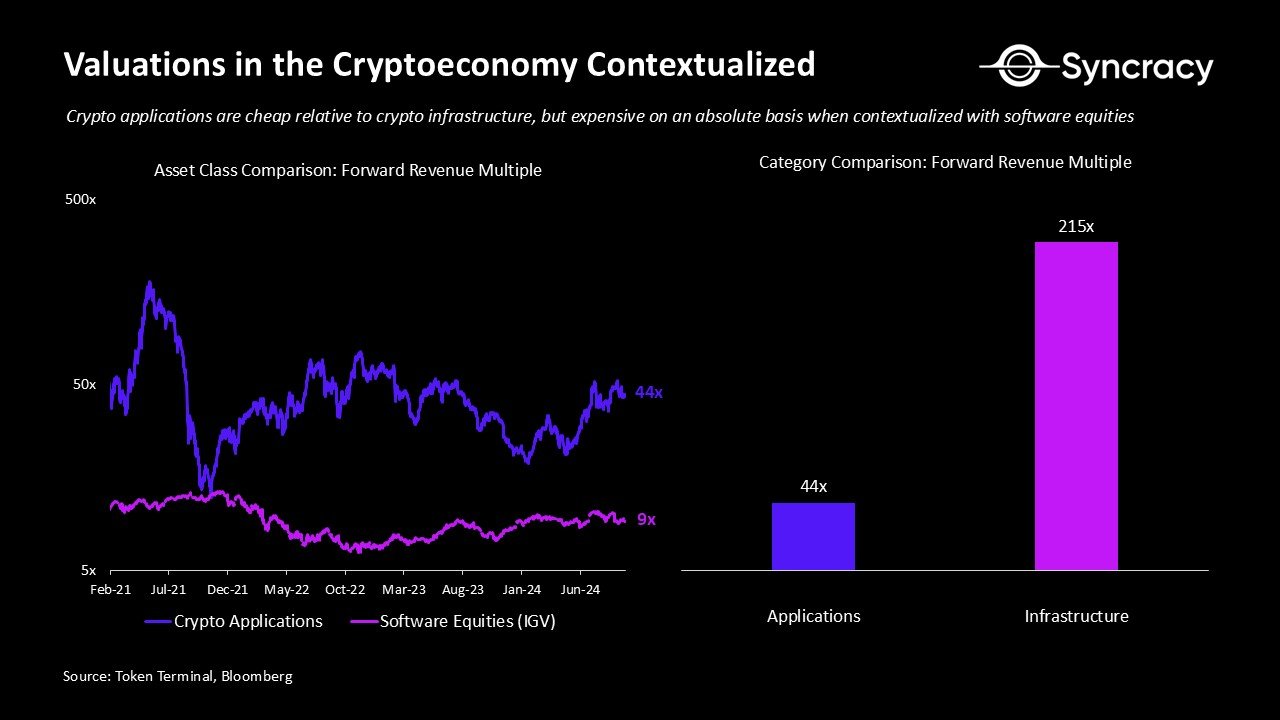

Currently, a challenge facing this asset class is that valuations for many “real” projects are not cheap. While they've only just begun to show signs of overcoming cyclical headwinds and transitioning into sustainable long-term growth, the average application trades at a price-to-earnings ratio as high as 44x. Although some projects stand out with reasonable valuations relative to traditional equities, overall, these applications still need to grow into their valuations. While there's a case to be made that such applications are undervalued in the long run—especially compared to non-monetary blockchain infrastructure, which trades at roughly 200x higher multiples—it remains unclear whether there’s any urgency to make long-term investments on an absolute basis.

Meanwhile, investor fatigue is growing toward venture-backed projects that launched at high valuations without fundamental support. As long-term winners begin to emerge within crypto, oversupply of infrastructure within the ecosystem is becoming increasingly apparent. Venture investors who overfunded such infrastructure may face losses due to capital misallocation. Retail investors have already recognized this trend and now refuse to blindly buy newly launched tokens whose upside potential was already fully—or even excessively—priced in during private sales.

In this context, as speculative interest in the asset class rises while compelling investment opportunities remain limited, investors are increasingly turning to “meme” assets. These assets lack clear valuation frameworks, making them highly reflexive and prone to bubbles. For example, primary-layer assets continue to trade based on relative valuations against BTC and ETH, which themselves are viewed as non-sovereign monies that cannot be intrinsically valued. Similarly, AI tokens also rely on relative valuation, though this is because AI is an emerging field with immense potential yet difficult to quantify. Meme coins, meanwhile, completely abandon any pretense of value and are priced purely on market attention.

The appeal of meme assets is further amplified in crypto markets due to rising short-term speculation, a phenomenon best described as the “fast money trap.” In an investment environment increasingly influenced by social media and gamified trading, herd behavior and instant gratification are distorting investor psychology, with retail speculators chasing short-term gains at ever-faster speeds. This isn’t surprising—it reflects broader global economic trends toward instant goods and services. Just as consumers expect food delivered instantly to their doorstep, retail investors now demand immediate returns through mobile trading apps like Robinhood. Growing evidence suggests these trends are reducing market efficiency in equities. Syncracy notes that similar distortions are occurring in crypto—few market participants can see beyond two weeks, let alone two months or two years. For many, trading has quietly become a form of gambling.

So how should a fundamentals-driven investor respond? Taking all this together, we recommend holding projects that combine strong fundamentals with meme appeal. Purely fundamental assets may generate returns, but they tend to have valuation floors and ceilings and offer less appeal to retail investors unless they’re small caps. Pure meme assets benefit from market reflexivity but suffer from oversupply, intense gaming, and extreme volatility, limiting their attractiveness to institutional investors. Assets like SOL combine both traits, offering dual advantages—solid real-world foundations with active on-chain activity, while also attracting speculative capital from both retail and institutional investors who often price it relative to ETH and BTC. Non-large-cap assets such as TAO also fit this mold, with accelerating economic growth and concentrated speculation around the potential of decentralized AI—TAO has been dubbed “the AI currency.”

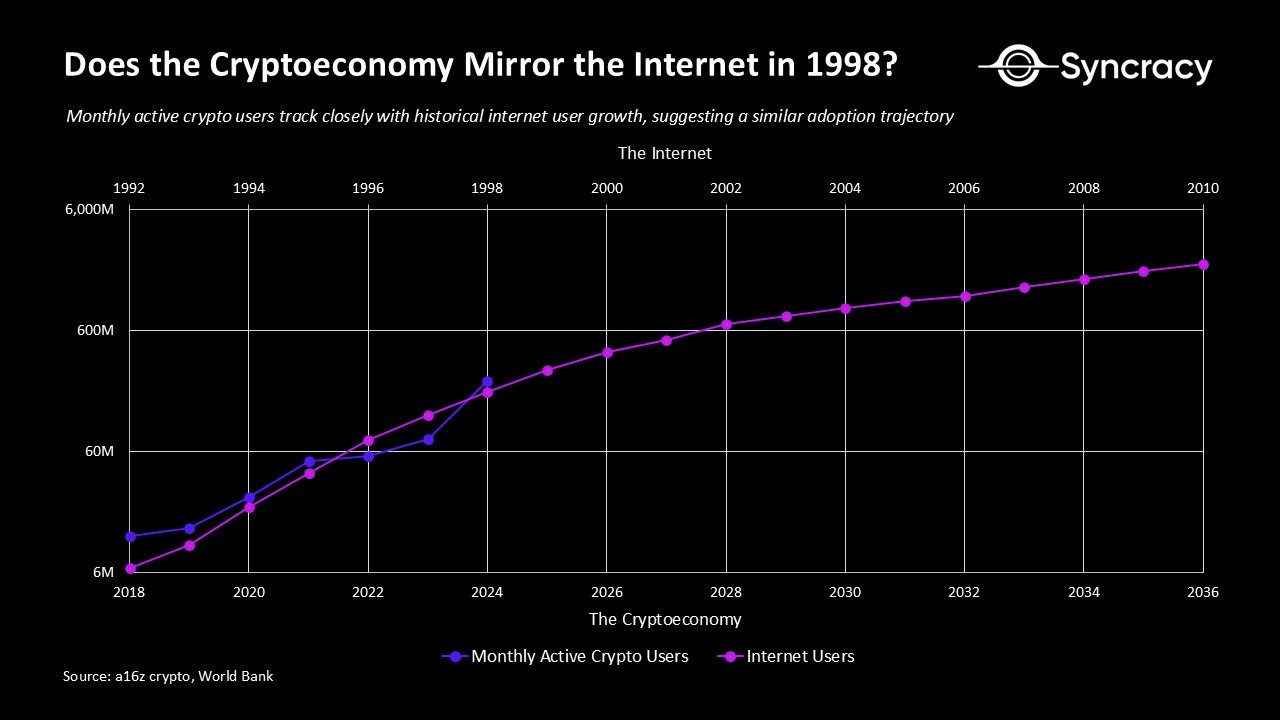

Overall, Syncracy believes this asset class is beginning to bifurcate between Bitcoin and stablecoins. Bitcoin and stablecoins appear to have entered a phase of productive stability, while other assets remain at most in the early stages of enlightenment. By many measures, crypto resembles the internet during the late 1990s dot-com bubble—a period when the revolutionary potential of the internet was evident, valuations were sky-high, and no solid framework existed for evaluating internet companies. As previously noted, Bitcoin may have moved beyond that uncertain phase and is now on a path toward global adoption as “digital gold.” Yet, other asset categories are once again showing signs of speculative fervor reminiscent of the late 1990s.

"We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten." — Bill Gates.

While many view this speculation negatively, we see signs of progress. It’s encouraging that genuine projects are increasingly trading more like equities—based on fundamentals—and are being forced to return value to token holders. This is a positive development, indicating that public market investors are becoming more sophisticated, pushing new projects to launch at more reasonable valuations. Optimistically, this could compress venture capital returns and drive capital into public markets, allowing better allocation toward emerging long-term winners. The crypto economy needs time to digest these shifts before taking its next step forward as an asset class.

In the meantime, one thing is clear: we must go with the flow, not against it. The major structural changes we’re witnessing—from the decline of venture capital dominance to the rising influence of institutional players—will take time to fully unfold. The allure of this speculative chaos lies in the fact that the market offers a rare opportunity to own foundational digital platforms that function as commodity money, offering highly attractive asymmetric growth potential with institutional-grade liquidity. Such opportunities don’t last forever, but for now, the market’s game is capital, memes, and speculation.

Special thanks to Chris Burniske, Sean Lippel, Qiao Wang, and Ansem for feedback and discussion.

Important Legal Disclaimer

This article represents the views of Syncracy Fund Management LLC (“Syncracy”) and should not be construed as financial or investment advice.

The content herein is not intended as an offer to sell, a solicitation of an offer to buy, or a recommendation of any security, including any interests in private investment funds managed by Syncracy. Any such offering will only be made through a formal confidential private placement memorandum, available upon request to qualified prospective investors, containing important information and risk factors related to such investment. Additionally, this article does not constitute investment or tax advice. Recipients should consult their legal, tax, and other professional advisors before making any investment decisions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News