The Long-Neglected Memecoin Perspective: Community

TechFlow Selected TechFlow Selected

The Long-Neglected Memecoin Perspective: Community

Actually, if you're a bit more patient, making money isn't that hard.

Author: Ryanqyz

Meme coins are undoubtedly the hottest sector across the entire market. Buying meme coins seems the easiest and highest-odds play, yet very few achieve large profits with significant positions, while countless people lose everything. Of course, there are many reasons—infrastructure draining, small-scale manipulators, conspiracy groups, KOL setups, etc. But today I want to share a perspective that most people overlook, one that I believe is the crown jewel of the crypto world: community.

Many say this cycle has no memes—that everyone is fighting against conspiracy groups, trying to uncover the real masterminds behind each coin. "A coin without a whale is like loose sand, scattered by the wind." I agree. Identifying the whale is indeed one of the most crucial factors for success in crypto, after all, “the highest spender holds God’s perspective.”

But if we switch perspectives and stand on the other side of the table—what would you, as a whale, be thinking?

If I were the project team—the primary holder of tokens—I’d need as many people as possible to buy in. To offload my holdings successfully, I must drive the price up to gain attention and liquidity. I’d also want buyers to hold rather than sell, so I can dump at higher prices.

If I were a major whale (a rogue player) holding cash but no tokens, what should I do? I'd look for a coin where I could sleep soundly knowing it will rise; where pumping attracts followers; where opposing sellers are few, diamond hands plentiful, and other whales share my vision. Ideally, the team itself has long-term ambition and won’t dump early.

We realize that the interests of sustainable teams and large whales actually overlap significantly: the price should rise, attract momentum buyers, gain visibility, maximize diamond hands, minimize weak holders, align holder behavior and mindset—and both sides benefit from a project lasting longer for greater returns.

So how do we identify whether a project can endure? Who will buy in? How many diamond hands exist? What drives holders’ thoughts and actions? Ultimately, it comes down to observing holder behavior. The collective of holders is called a community. Communities exist on Twitter, Telegram, Discord, WeChat, TikTok—anywhere.

A high-quality community must achieve the following:

Increase token exposure;

Increase buying pressure;

Reduce selling pressure;

Align collective interests, behaviors, and mindsets;

Grow exponentially—in size and buying power (as market cap rises, more energy is required).

How does a strong community achieve these goals?

It has a clear, well-defined value anchor;

It develops a consistent, evolving language used by all members:

Examples: *It's funnier if u don't sell*, *Stop Trading and Believe in Something*;

During rallies, members amplify the message across platforms;

During dips, members shame or ignore sellers, sometimes even encouraging them to sell for life improvements while welcoming their return—and urging others not to follow suit;

Early members profit through giveaways and event-driven incentives within the community.

You might think: Who are you? Why should I help promote your coin? Why be loyal? Why jump through hoops? And isn't building such communities nearly impossible—shouting, never selling—who can pull that off? I just watch charts and follow KOLs—what does any of this have to do with me?

But none of that matters when making investment decisions. As an investor, my job is simply to observe. If I can recognize such communities, hold their tokens, join them, co-create funny content, let them work for my gains, and embrace the absurdity alongside them—I win. And it’s actually a lot of fun.

High-quality communities generally exhibit these traits:

Resemble a cult, speaking in cryptic phrases;

Early holders made big gains but refuse to sell—some even accumulate more;

Potential and narrative anchor for explosive market cap growth;

A powerful central leader combined with widespread ownership mentality among members;

Abundant organic, user-generated memes and videos—crude but highly entertaining;

Tools enabling easy meme creation, like laser goggles filters or branded tags;

An NFT collection used for social recognition, signaling commitment, and reinforcing positive feedback loops with price;

Unique Handle suffixes;

Ties to real-world subcultures, yet accessible enough for broad appeal;

Twitter mentions spark genuine engagement from real users (not bots);

They inspire, bring joy, and offer emotional relief;

Holders are micro-influencers or KOLs within their own circles, eager to influence others.

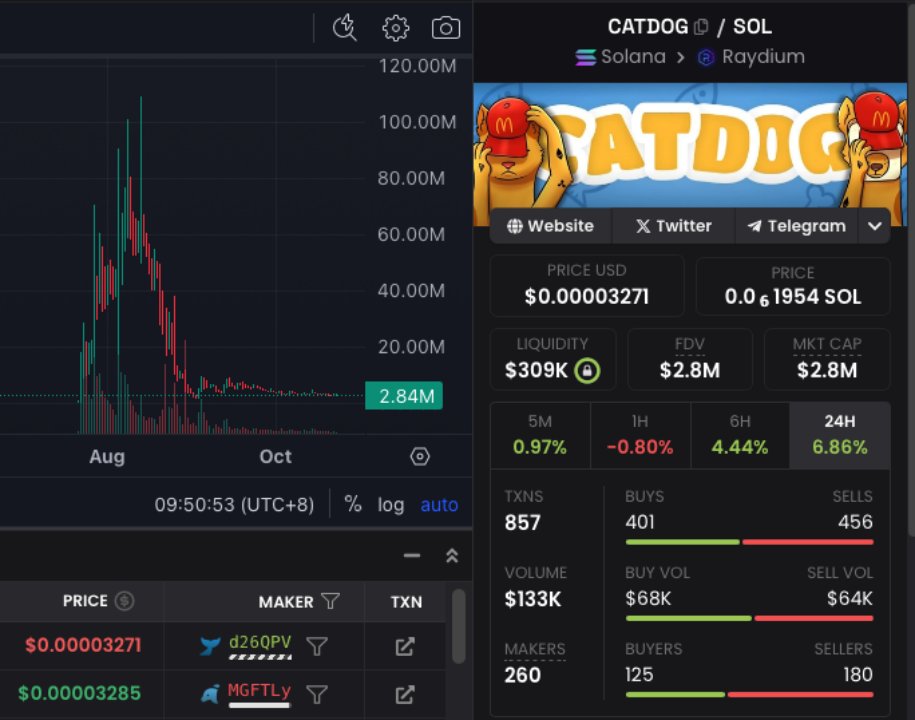

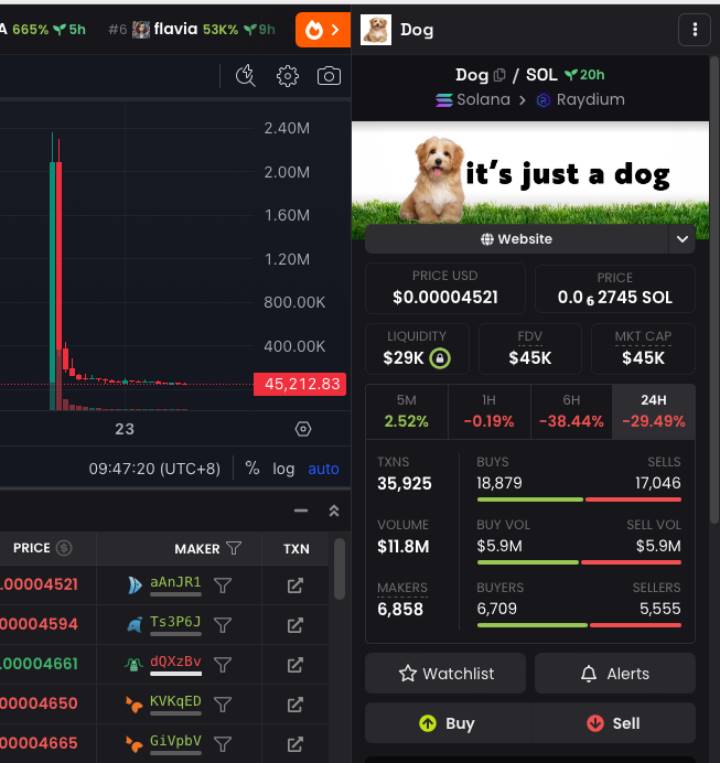

Clearly, most generic cat, dog, hippo, or AI-themed coins don’t qualify. They lack community dimensions entirely—just price charts and IP蹭hots. These, I truly call scams. Is creating a Telegram group a community? Is filming a poorly dubbed video in Henan accent English a community? Without strong PVP, address analysis, or whale-tracking skills, participating in these projects—unless you entered extremely early—means your long-term mathematical expectation is less than zero.

The majority are playing a near-impossible game. Unless you're the whale, a top KOL with insider knowledge, or possess comprehensive address intelligence, you have no real edge in predicting price movement. Getting it right is luck; getting it wrong is skill.

Coins lacking community—relying only on IP, or even lacking IP altogether—only attract buyers via price action/charts and KOL hype. Do metrics like trading volume, pool size, transaction count, or new whale wallets really matter? Do you truly believe such projects will last? Can you really sleep soundly holding them? A strong whale may push 4-hour candles green, but when they exit, you might be left holding the bag. For meme coins, beyond whales, the most important product is an emotionally connected community. Community = fundamentals. (For non-meme examples, past projects like Link Marine, Temple DAO, Magic, and current ones like Solana share similar dynamics.)

Back to quality communities: their members prioritize emotional experience over material gain. Spreading and shaping culture feels deeply meaningful. They care little about short-term price fluctuations. Bonds between members run deep, mutual beliefs are strong, and friendships often extend into real life.

As prices rise, connections strengthen. Members grab megaphones on Twitter, sparking viral interactions. More people join, wanting NFTs—not just for profit, but because they look cool and signal success. It’s like wanting to hang out with the cool kids. At ATH, retail FOMO floods in to take the bags.

Of course, during downturns, community noise fades. Some paper hands leave, sell NFTs, or turn hostile. Yet this is when true leaders and diamond hands emerge—buying aggressively, refusing to sell, voicing conviction publicly, rallying the faithful. Social volume drops, but core believers shine brighter. Their emotional bonds deepen, like soldiers in a trench without bread, waiting for dawn.

This is also when smart money (long-term capital) begins loading up heavily. Often, these are KOLs—or existing community members doubling down. This process transforms weak hands into diamond hands, shifting ownership from psychologically fragile individuals to resilient ones who can withstand noise.

Thus, community-building and price manipulation go hand in hand, reinforcing each other. Skilled developers effectively purge paper hands, retain diamonds, and create event-driven catalysts to boost cohesion. In many ways, price and community may essentially be one and the same.

Finally, regarding buying pressure: when a coin’s core community becomes solid and consists almost entirely of diamond hands, resourceful members begin bringing in whales. Trusting whales aren’t disappointed—the token rises smoothly, few sell, and momentum buyers vastly outnumber sellers—until some members decide to take profits or macro conditions worsen. Then the coin enters its next market cap phase, followed by another cycle of trough and peak. Strong communities accumulate more diamond hands, supporters, and capable, creative holders with every wave—this is why the strong grow stronger, and the weak inevitably go to zero.

In my view, only three coins this cycle have built genuine communities—or cults—are:

$MOG;

$SPX;

Their core messages are respectively:

BITCOIN: Why so serious? It's funnier if u don't sell

This speaks to the lack of humor in modern life—don’t take things too seriously;

$MOG: Moggers gonna Mog

Reflects desire for carefree, relaxed, trendy lifestyles;

$SPX: Stop Trading and Believe in Something

A continuation of anti-elitism and the WallStreetBets/GME narrative in crypto.

To readers:

Reduce PVP frequency; be extremely selective in coin picking;

Sleep more, stay清醒, find meme coins that work for your position even while you sleep;

Buy your favorite coins during dips—especially sharp crashes—never chase rallies; train contrarian instincts and muscle memory;

Enjoy the selling process; selling too early is fine—as long as you don’t sell everything. Ideally, keep selling prematurely but always retain some;

Reduce reliance on KOLs; immerse yourself in communities, analyze on-chain data yourself, trust your own judgment;

Identify valuable content creators (<1% still do this), engage with them actively.

That’s my understanding of community—what it truly means for a project, and how to evaluate projects through the lens of community. Truthfully, if you’re patient, making money isn’t that hard. I know most of us lack patience—I often do too. So best of luck, and enjoy the ride.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News