In the crypto space, you can't be a bystander—you should be a participant.

TechFlow Selected TechFlow Selected

In the crypto space, you can't be a bystander—you should be a participant.

Alignment between a cryptocurrency founder and its culture is not a nice-to-have—it's essential.

Author: Marco Manoppo

Translation: TechFlow

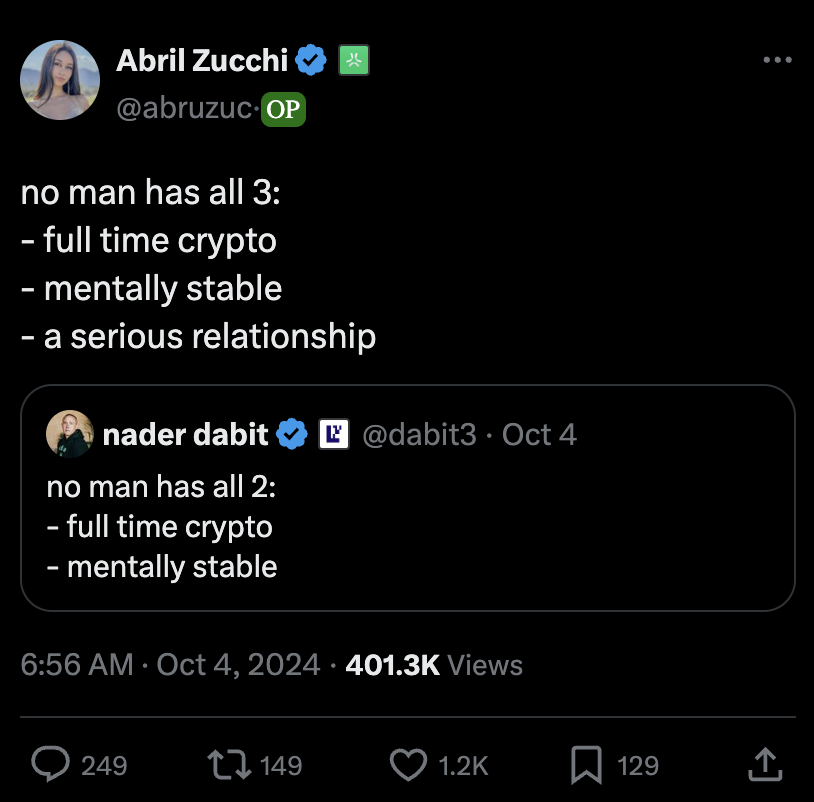

No one can have all three:

-

Work full-time in crypto

-

Maintain emotional stability

-

Be seriously committed in a relationship

If my girlfriend is reading this, I swear I possess all three.

The crypto space moves fast. In every cycle, it feels like there are five new things to keep up with, and now industry trends shift from months to weeks. That’s why we all feel the pressure—Abril is right.

Anyway, I digress. Let’s get back on track.

In the past, founders could simply launch a token on a DeFi pool2 to achieve the desired trading volume and user metrics for a Tier-1 CEX listing. Those days are long gone. In each new cycle, founders must adapt to new challenges. And one of the most critical yet often overlooked challenges isn’t technical, financial, or operational—it’s cultural.

So what does crypto culture actually mean?

The term “crypto native” gets thrown around as frequently as an MBA from an unknown school—everyone claims it, but it doesn’t mean much.

It was supposed to signify a deep, unique understanding of how crypto works, but few truly embody it. Being a crypto native isn’t just about reading a few whitepapers or making a couple of meme trades. It requires a level of project leadership that goes beyond tech, finance, or operations. It’s the ability to sense subtle yet significant dynamics—shifting community sentiment, power plays within ecosystems, even global regulatory changes.

If you’re leading a crypto project, cultural fluency is no longer optional—it’s a core competency.

What Makes Crypto Unique

Crypto isn’t just technology, nor is it just finance. It’s a distinct multidisciplinary field that blends tech, finance, game theory, and even global politics.

-

You can’t focus solely on tech and product while ignoring capital markets until you go public like a traditional Web2 company.

-

You can’t focus only on token financial engineering while neglecting product development.

-

You can’t understand how markets operate in one region without grasping the different power players and political interests in another. And all of this revolves around the ideals of financial populism and individual sovereignty at Bitcoin’s core—which is why we say, “community is everything” in crypto. Community power determines whether a project succeeds or fails. Building a great product isn’t enough; success hinges on understanding community dynamics. Founders must go beyond tech and finance to grasp and embrace crypto’s cultural foundations.

In my work at Primitive Ventures, we dive deep into both Eastern and Western crypto market movements, regularly guiding our portfolio founders to understand these dynamics. From tracking the latest consensus research published by professors in Silicon Valley to evaluating new initiatives launched by offshore Tier-1 CEXs, our work centers on helping founders navigate the global crypto landscape.

Founders who assume crypto operates the same everywhere often run into trouble. There’s no one-size-fits-all approach in crypto—mastering the factors above is essential to stand out.

Diving Deeper

Among the crypto founders we’ve encountered—both newcomers and veterans who’ve lived through multiple cycles—many lack a genuine understanding of today’s crypto culture. Newcomers often treat crypto as an extension of their prior industry expertise, while veterans may remain stuck in the “good old days” of crypto, failing to adapt to evolving conditions.

People tend to rely on past knowledge, but problems arise when they force outdated perspectives onto current realities. How often have you heard ex-traditional finance professionals turned founders rattle off buzzwords about tokenization? Or mid-level managers from big tech pitching consumer apps while completely ignoring tokenomics? Far too often.

These approaches aren’t inherently wrong, but ultimately, your success as a founder comes down to your understanding of crypto culture.

Some founders think they can outsource this—just hire a Chief Marketing Officer or Head of Growth who “gets crypto.” But that’s only a temporary fix. Founders must personally immerse themselves in the community, actively participate in discussions, and understand the nuances of their niche. You don’t need to become a full-time influencer or spend four hours a day on Twitter, but you do need to develop your own voice in crypto conversations.

If you’re an experienced founder, yes, you can draw attention based on credentials or past achievements. But wouldn’t it be better if you combined those with authentic capability and deeper integration into crypto culture?

Focus and Act Directly

If you’re not genuinely interested in what’s happening in crypto, you’re not a real crypto founder—you’re just a hobbyist. In this space, you can’t be a passive observer. Top biotech founders know every new drug approval, every regulatory change, and every rumor from Big Pharma. That’s their lifeline, their oxygen. Crypto founders need the same level of immersion. If you’re not deeply engaged with the latest protocol updates, regulatory decisions, and community disputes, there’s a deeper issue at play.

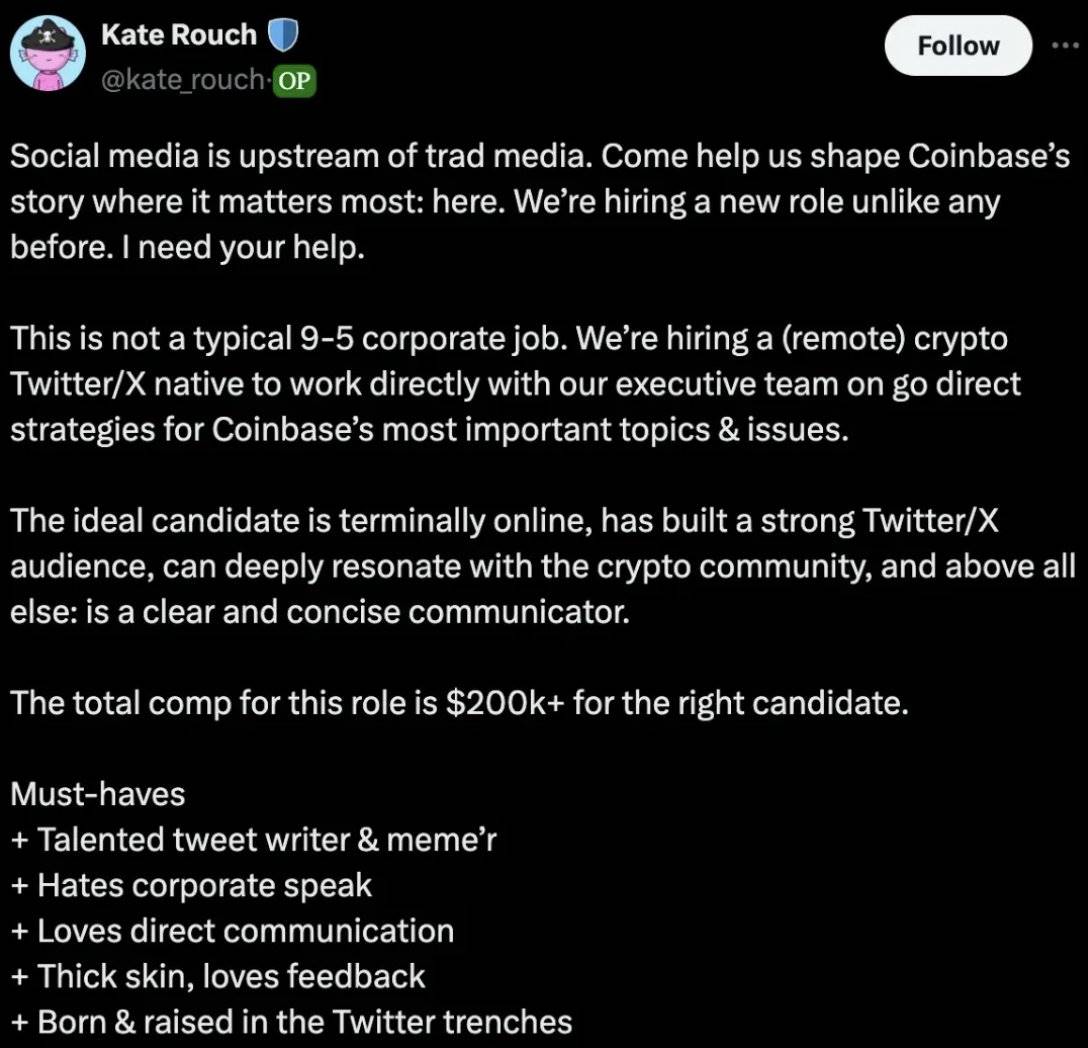

This intensity reflects a broader cross-industry trend. In 2024, everyone wants direct connection. Duolingo built a direct relationship with users via TikTok, turning a green bird into a celebrity. Now, Coinbase wants to hire a $200K/year Twitter expert to attract users. The era of hiring celebrities through ad agencies is over—remember Pepsi’s Kendall Jenner commercial?

Everyone now understands that winning the market means owning the relationship with users.

Social media is leading the way over traditional media. Come help us shape Coinbase’s story. We’re hiring for a brand-new role—one that’s never existed before. I need your help.

This isn’t a typical 9-to-5 corporate job. We’re looking for a (remote) crypto-savvy Twitter/X user to work directly with our executive team, shaping Coinbase’s direct communication strategy on key topics and issues.

Ideal candidates are heavy internet users with a large Twitter/X following, deeply in tune with the crypto community, and above all: capable of clear, concise communication.

Total compensation for the right candidate exceeds $200,000.

Requirements

-

Skilled at writing tweets and creating memes

-

Dislike bureaucratic corporate language

-

Prefer direct communication

-

Resilient and open to feedback

-

Grown up and active in the Twitter community

This is especially crucial in crypto because the community isn’t just part of your user base—it is your user base. It’s also your market, marketing engine, liquidity provider, governance body, and product advocate—all rolled into one. Ultimately, a founder’s ability to directly engage with the community and understand the users’ “DNA” is one of the most critical yet overlooked factors in becoming a great founder.

More Than Just a Nice-to-Have

Cultural fit for a crypto founder isn’t a bonus—it’s essential. If you’re not fully immersed in the space, don’t understand its culture, and haven’t found your voice within the community, you’re missing a fundamental ingredient for success. It’s not just about having a great product or strong tokenomics—you must show up, participate, and stay passionate about crypto’s ever-evolving environment.

In short: go all in, and do it yourself.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News