With fervent communities and innovative technologies, which "cult tech" cryptocurrencies are worth watching?

TechFlow Selected TechFlow Selected

With fervent communities and innovative technologies, which "cult tech" cryptocurrencies are worth watching?

Overall, this is an extremely enthusiastic community with no competitors, and the market is definitely not saturated.

Author: Zoomer Oracle

Translation: TechFlow

Tech Cult Coins

The word "cults" is probably one of the most commonly used terms on CT to describe the memecoin craze. During the 2023 bear market, I posted what became my most popular tweet, titled "The Art of Cults."

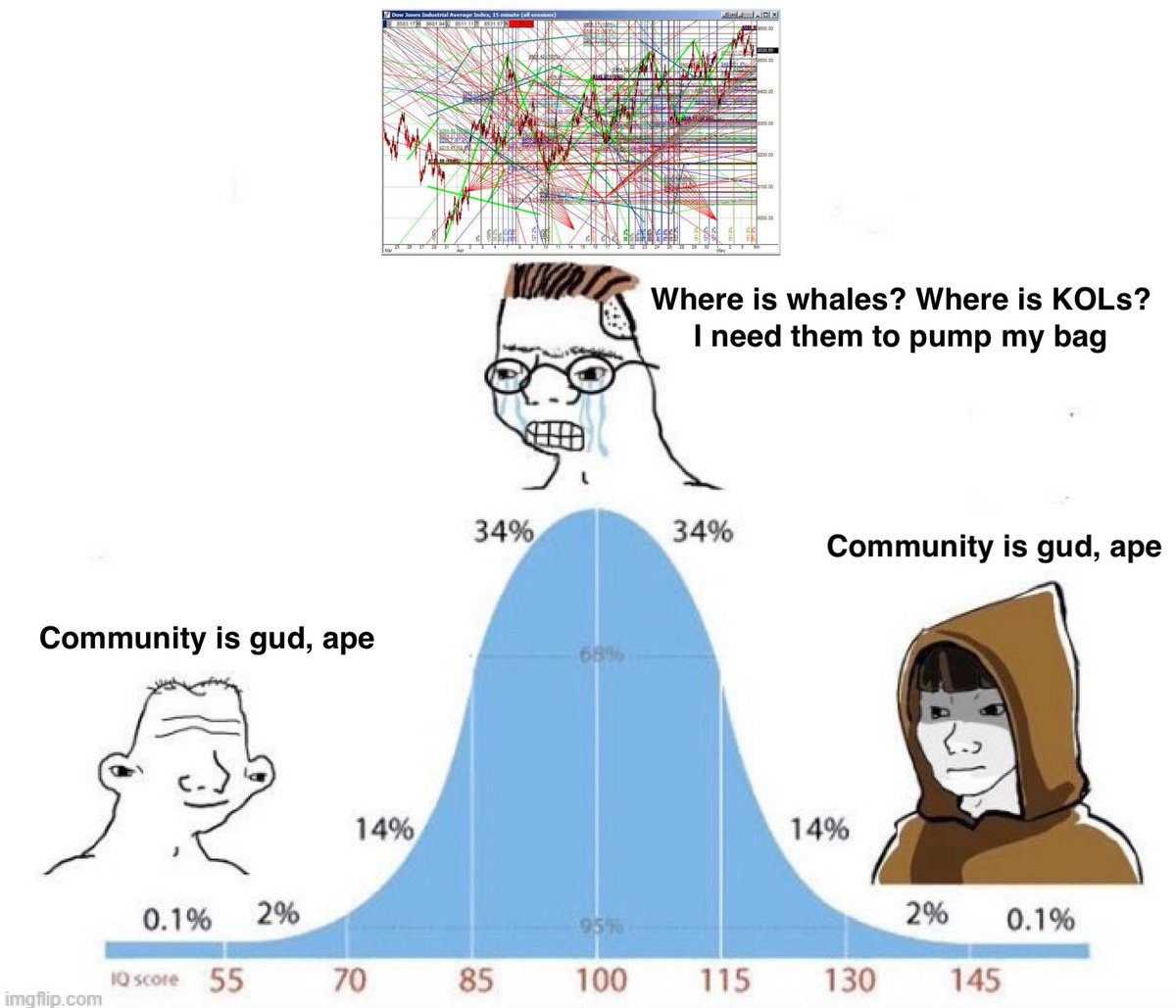

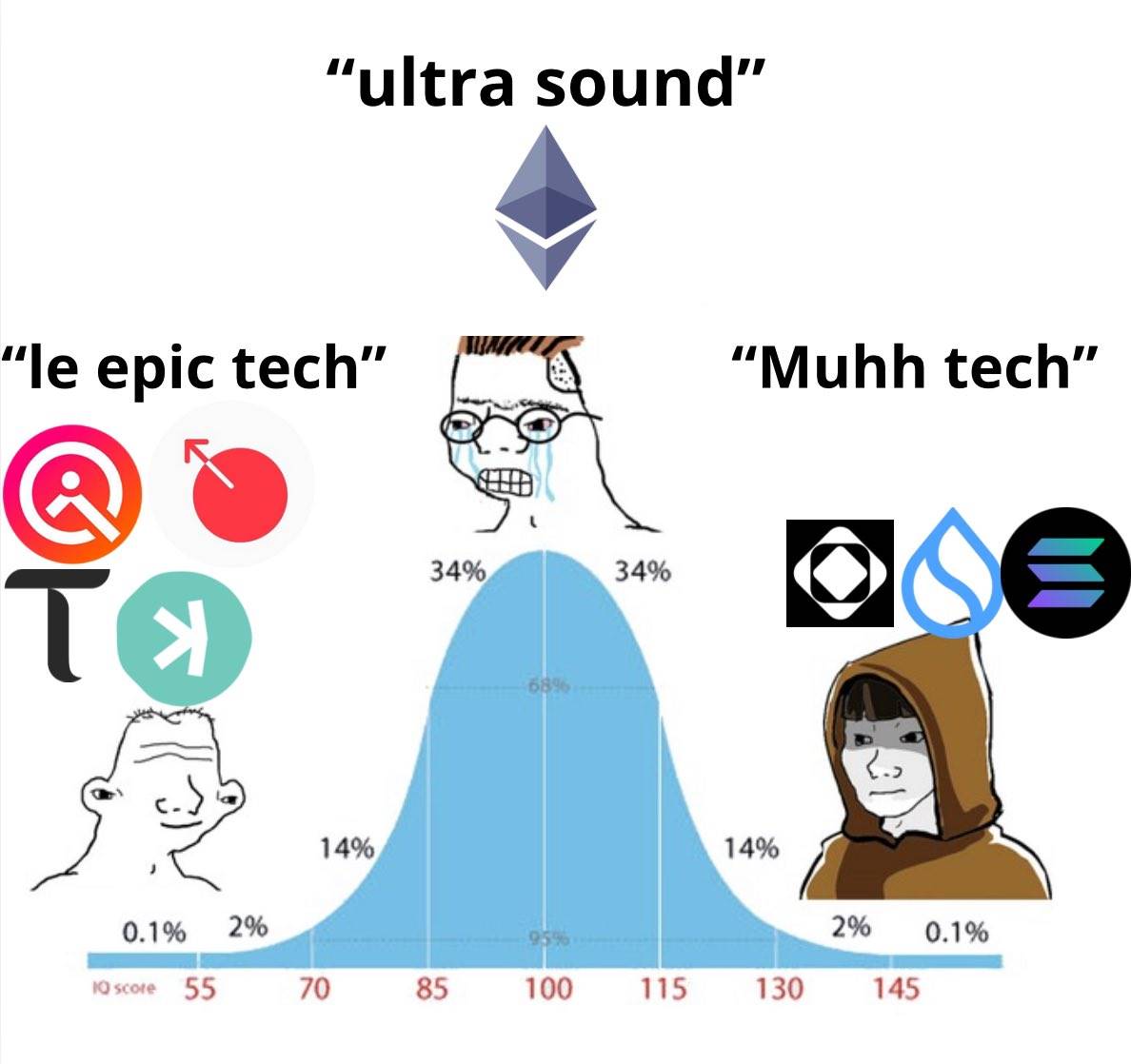

I explored the difference between the desire for cults and the nature of tech coins. Now, the market is catching up with this trend—every memecoin with a large following is rapidly appreciating. It's great to see that this theory has essentially held true. However, within these "cult coins," there’s another category that’s barely mentioned. When we think of "cult coins," we usually think of memecoins.

Yet, there are also technology-focused coins (without venture capital backing) that have amassed massive followings. The reason lies in their origins—these projects started with little to no VC funding, attracting an initial base of devoted supporters. Often, these early adopters are miners who remain fiercely loyal to their belief that the project will change the world.

These coins have significantly outperformed VC-backed tech coins, achieving returns nearly comparable to those of memecoins. Here are some representative examples:

Legacy tech cult coins:

HEX

Cardano (ADA)

Raiblocks (NANO)

If you’ve followed these coins since 2017, you’ll notice they attracted passionate communities early on. Many believed these would become the next Bitcoin. Yet, most people didn’t take these tech cult coins seriously, dismissing them as “bubbles” and claiming only “fools” would buy these “useless coins.”

In reality, these coins often outperformed so-called “legitimate” coins precisely because of their strong cult-like community traits. They occupy a unique space in crypto, as most people in your Telegram groups or crypto Twitter circles don’t hold significant positions in them.

Of course, coins like Cardano, Hex, and Nano suffered during market corrections, and their once-enthusiastic followers gradually quieted down.

But new coins are emerging in exactly the same way. A new market cycle brings new coins—and with it, the rise of a new generation of tech cult coins.

Over the past 1–2 years, we've seen the emergence of a new wave of “tech cult coins.” Here are a few notable examples:

Bittensor (TAO) – $4.7B market cap, $13B fully diluted valuation

Kaspa (KAS) – $3.4B fully diluted valuation

Both coins have developed large, dedicated followings. People began mining early and strongly believe these projects can change the world. Whether you agree or not, if you're focused on maximizing profits, you should learn from history. Consider the data:

TAO once traded below $35 and now trades at $642—a return of 18x.

Kaspa once traded below $0.0004 and now trades at $0.1358—a return of 339x.

Despite differing returns, one thing is clear: most crypto Twitter users don’t hold these assets, yet both have vastly outperformed newly launched VC-backed tech coins on major centralized exchanges. At this point, the only conclusion I can draw is that this represents a distinct category—one that receives little discussion. Most label these coins as “this cycle’s Cardano,” but in reality, they belong to their own unique class, meaning more such opportunities likely exist.

On my current watchlist, two coins may fit into this category:

Many early investors in Bittensor were also early in QUIL. Check the QUIL hashtag—you'll find numerous users who include both TAO and QUIL in their bios. The communities promoting QUIL and Bittensor are strikingly similar. Cyberpunk culture and grassroots spirit are deeply embedded in both projects.

One focuses on decentralized AI, the other on decentralized internet infrastructure.

Of course, AI itself is a hot narrative, so many bought TAO simply due to the AI + crypto crossover. I believe the conversation around decentralized internet infrastructure will eventually gain traction—especially when projects like Nillon launch in Q4—sparking debates between QUIL (community-led) and Nillon (VC-backed). I won’t argue which tech is better, but this attention alone could fuel upward momentum.

Be aware: QUIL has a large token unlock happening today or this week. I don’t want miners dumping on you at the top, so I recommend waiting until the market stabilizes before deciding. Keep that in mind. I’m invested in QUIL (also bought higher) and plan to add more when miners are done selling.

In this category, I’m also bullish on META DAO. META has an exceptionally smart community that genuinely believes it can revolutionize how DAOs operate in crypto.

Overall, I consider DAOs one of the most boring parts of crypto. But META’s experiment might be one of the most interesting ongoing in the space right now. Their core idea:

Humans aren’t always good at making decisions. For example, prediction market participants often outperform professional pollsters at forecasting outcomes. Google even explored using internal prediction markets to improve organizational decision-making. I recommend reading the founder’s thread to fully grasp the concept.

You might wonder: why does this matter? But prediction markets have already proven strong product-market fit in crypto (e.g., Polymarket and Drift). This presents a massive opportunity. Introducing prediction markets into DAO proposals could make them exciting again. We’re moving toward an era of “futures governance”—not one where governance is controlled simply by whoever holds the most tokens, but driven by predictive intelligence.

Currently, “futures governance” is adopted by less than 5% of Solana projects. Since this is a brand-new concept, I suspect seasoned players are watching closely before committing further. The rising price chart suggests early observers are already buying in, believing the idea might actually work. I’ve already seen discussions on social media calling it the “enterprise version of Polymarket.”

Overall, this is an extremely passionate community, with no real competitors and an absolutely untapped market. All supply is circulating. It’s not widely discussed on crypto Twitter yet, and the chart looks very promising. At the time of writing, its fully diluted valuation is $70 million. Note: liquidity is poor, so proceed with caution if you decide to invest.

I’ll wrap this up—it’s gotten too long. I enjoy documenting my thoughts because it sparks discussions on angles I hadn’t previously considered.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News