Grayscale's Q4 Outlook for Crypto Markets: Bitcoin Leads, Ethereum Steady, New Assets Enter the Rankings

TechFlow Selected TechFlow Selected

Grayscale's Q4 Outlook for Crypto Markets: Bitcoin Leads, Ethereum Steady, New Assets Enter the Rankings

Despite underperforming Bitcoin this year, Ethereum still outperforms the smart contract platform crypto industry index.

Author: Grayscale

Translation: TechFlow

-

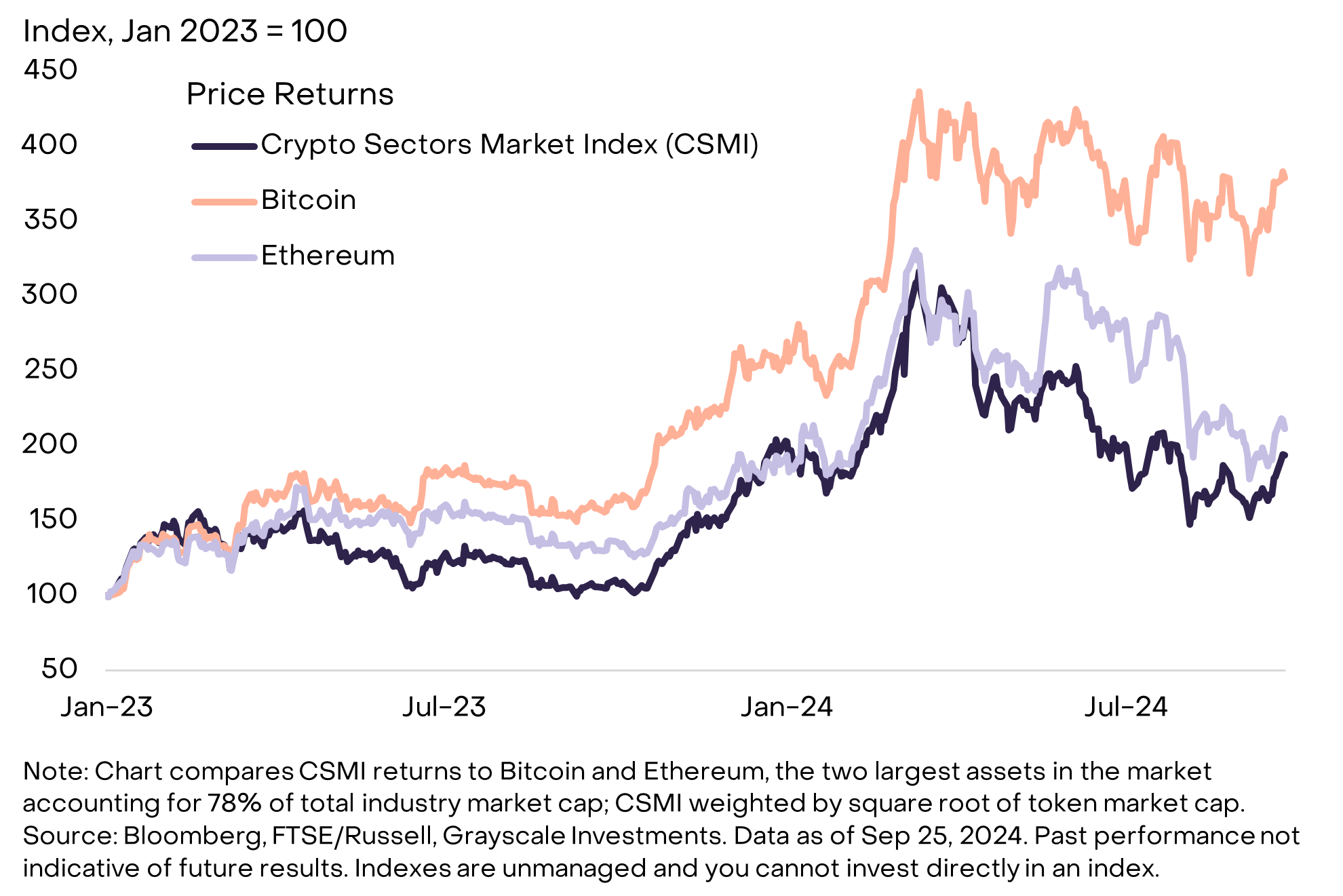

In the third quarter of 2024, the crypto market remained flat, as assessed by the FTSE/Grayscale Cryptocurrency Industry Index Series.

-

Changes to the FTSE/Grayscale index series this year highlight emerging trends in the digital asset industry, including the rise of decentralized artificial intelligence (AI) platforms, tokenization efforts for traditional assets, and the popularity of memecoins.

-

Although Ethereum has underperformed Bitcoin year-to-date, it still outperformed the Smart Contract Platform Cryptocurrency Sector Index. Grayscale Research believes that despite intense competition within the smart contract space, Ethereum retains multiple competitive advantages.

-

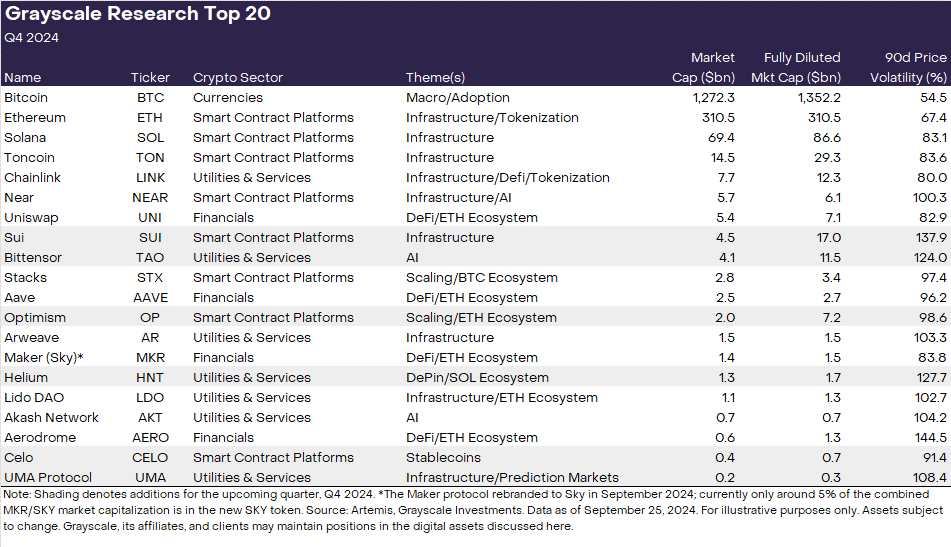

We have updated Grayscale Research’s Top 20. The Top 20 represents a diversified set of assets across the cryptocurrency industry with high potential over the next quarter. New additions this quarter include SUI, TAO, OP, HNT, CELO, and UMA.

-

All assets on our Top 20 list are highly volatile and considered high-risk; U.S. elections also represent a significant risk factor for the crypto market.

Grayscale Crypto Sectors provides a comprehensive framework for understanding investable digital asset domains and their relationship to underlying technologies. Based on this framework and in collaboration with FTSE Russell, we developed the FTSE Grayscale Cryptocurrency Industry Index Series to measure and track cryptocurrency asset classes (Figure 1). Grayscale Research incorporates these sector indices into its ongoing analysis of the digital asset market.

Figure 1: Cryptocurrency sector indices measuring performance across asset categories

The Cryptocurrency Sector Framework is designed to evolve alongside changing digital asset market dynamics and is rebalanced at the end of each quarter. The latest quarterly rebalancing was completed on September 20. Since the beginning of the year, index rebalancings have led to significant changes in index composition, reflecting new exchange listings, shifts in asset liquidity, and market performance. Updates to the cryptocurrency indices this year reflect emerging themes in the digital asset industry, including the rise of decentralized AI platforms (e.g., TAO), tokenization initiatives for traditional assets (e.g., ONDO, OM, and GFI), and the growing popularity of memecoins (e.g., PEPE, WIF, FLOKI, and BONK).

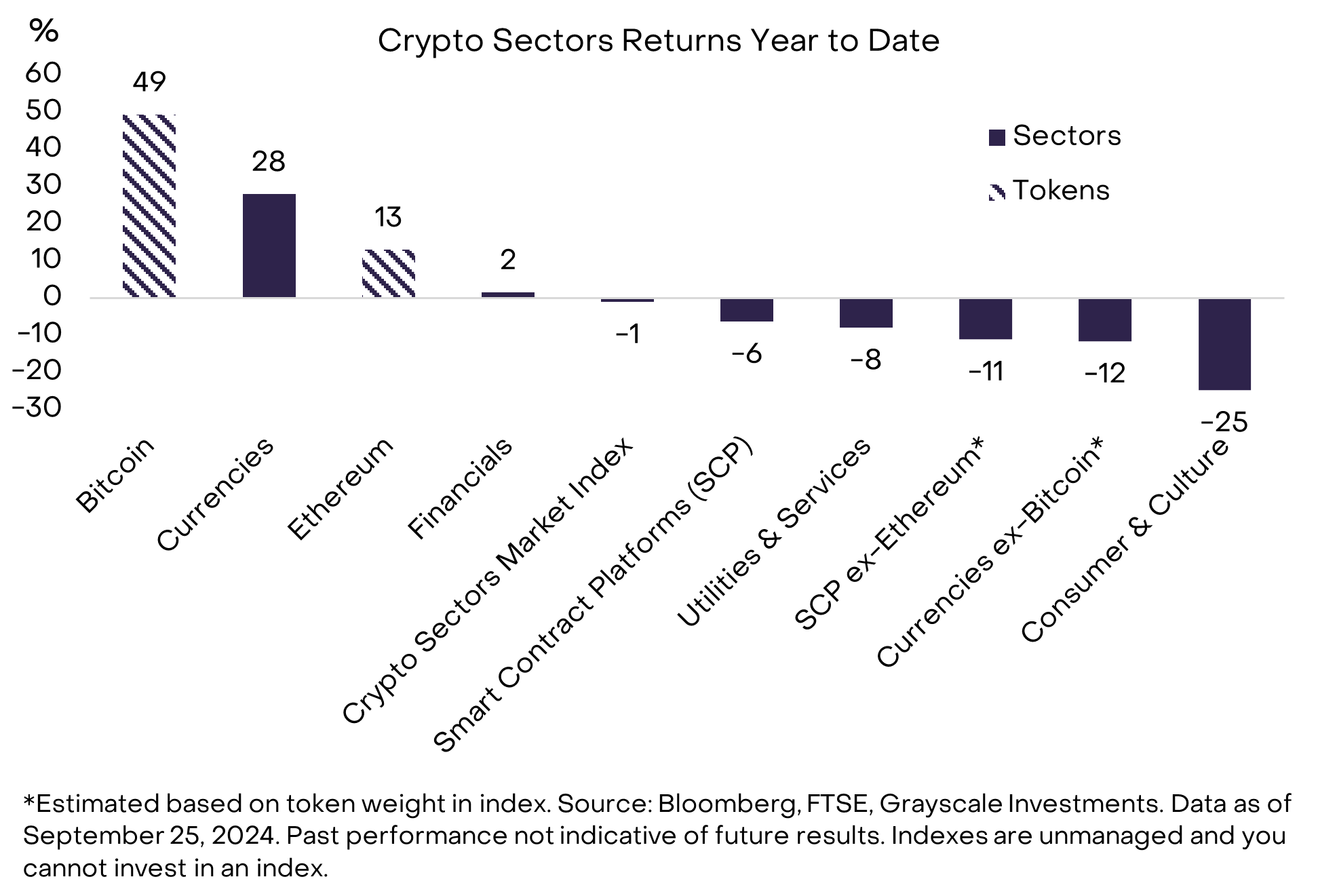

From a returns perspective, Bitcoin and the Currencies Cryptocurrency Sector outperformed other market segments in 2024 (Figure 2), likely reflecting the successful launch of spot Bitcoin exchange-traded products (ETPs) in the U.S. market and favorable macroeconomic conditions (for more details, see our previous quarterly report, "Grayscale Research Insights: Cryptocurrency Sectors in Q3 2024").

Figure 2: Bitcoin has outperformed other assets this year, but Ethereum remains strong

Ethereum has underperformed Bitcoin this year, rising 13%, yet still performed well relative to most other crypto assets. For example, our Cryptocurrency Sector Market Index (CSMI)—which measures returns across the entire asset class—declined by approximately 1% year-to-date. In fact, excluding Ethereum, the Smart Contract Platform Cryptocurrency Sector Index fell by about 11%, meaning Ethereum significantly outperformed its peers within its market segment. Among all assets in our Cryptocurrency Sector Framework, Ethereum’s year-to-date return ranks roughly in the 70th–75th percentile. Therefore, although Ethereum’s gains lag behind Bitcoin’s, its performance remains solid compared to both its sector and the broader CSMI.

Focus on Smart Contract Platforms

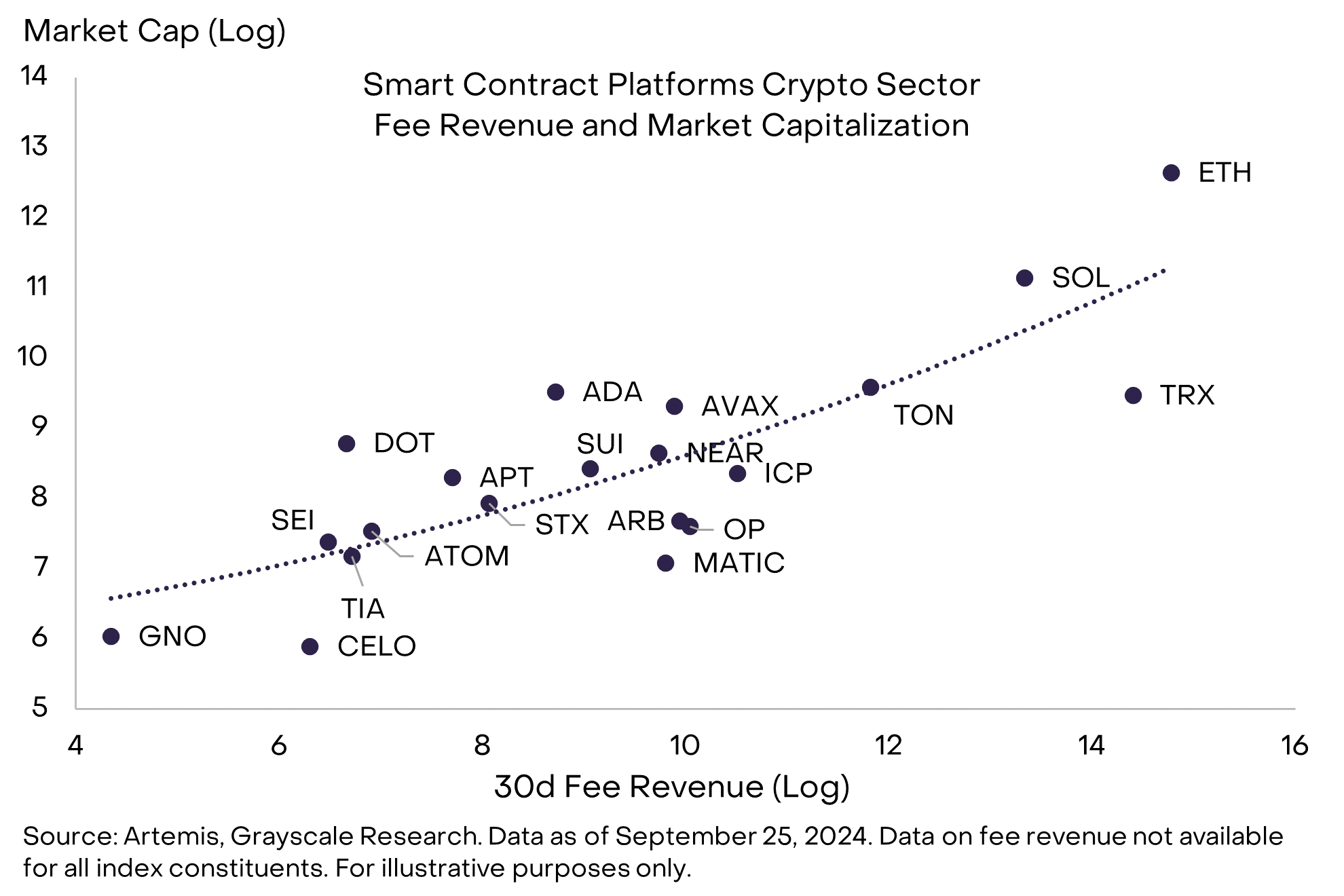

Unlike Bitcoin, which dominates the Currencies sector, Ethereum faces intense competition within the Smart Contract Platforms category. This year, several alternative smart contract platforms have gained significant attention, including Solana, Toncoin, Tron, Near, and the emerging Sui. These assets are all competing for fee revenue, and superior user experiences offered by some alternatives could erode Ethereum Layer 1’s market share.

At the same time, Ethereum holds several competitive advantages within the Smart Contract Platform sector that reinforce its leading position (Figure 3). Most importantly, it remains the category leader in terms of the number of applications, developer activity, highest 30-day fee revenue, and total value locked in smart contracts. When including major Ethereum Layer 2 networks, its daily active users rank second only to Solana.

Figure 3: Ethereum leads the smart contract platform sector in fee revenue

As public blockchain technology continues to advance, Grayscale Research expects the overall Smart Contract Platform sector to grow in users, transactions, and fees, which may benefit all assets in the category to some extent. Given Ethereum’s leadership position, it is difficult to envision a period of sustained growth in this sector that does not also benefit Ethereum, partly due to its existing network effects. For this reason, despite facing notable competition, we believe Ethereum remains a compelling asset within the Smart Contract Platform sector.

Moreover, Ethereum benefits from certain unique characteristics that may help defend against competitors over time, including high network reliability (limited downtime), strong economic security, high decentralization, and a relatively clearer regulatory standing in the U.S. Encouraging adoption trends are also emerging within the Ethereum ecosystem, including tokenization, prediction markets, and development activities by companies such as Sony. For these reasons, Grayscale Research continues to view Ethereum as having a very compelling investment thesis.

Grayscale Research Top 20 Assets

Each quarter, the Grayscale Research team analyzes hundreds of digital assets to inform the rebalancing process of the FTSE/Grayscale Cryptocurrency Industry Index Series. As part of this process, Grayscale Research publishes a Top 20 list of assets within the Cryptocurrency Sectors framework. The Top 20 represents a diversified group of assets that we believe hold high potential (Figure 4). Our methodology considers various factors, including network growth/adoption, upcoming catalysts, fundamental sustainability, token valuation, supply inflation, and potential tail risks.

This quarter, we added six new assets to the Top 20:

-

Sui: A high-performance first-layer smart contract blockchain offering innovative applications (for more details, see Building Block: Sui).

-

Bittensor: A platform fostering the development of open, global AI systems (for more details, see Building Block: Bittensor).

-

Optimism: An Ethereum scaling solution based on optimistic rollups (a layer-2 scaling approach).

-

Helium: A decentralized wireless network operating on Solana and a leading project in the decentralized physical infrastructure (DePin) space.

-

Celo: A mobile-first blockchain project transitioning to an Ethereum Layer 2, focused on stablecoins and payments.

-

UMA Protocol: An optimistic oracle serving Polymarket, a leading blockchain-based prediction market, and other protocols.

Figure 4: High-potential cryptocurrency sector assets for Q4 2024

The newly included assets reflect several key themes emphasized by Grayscale Research in the crypto market. Sui and Optimism are both examples of high-performance infrastructure. Sui is a third-generation blockchain developed by former Meta engineers. Two months ago, Sui completed a network upgrade that boosted transaction speeds by 80%, surpassing Solana and driving recent increases in network adoption. Optimism is an Ethereum Layer 2 helping scale the Ethereum network and is developing a framework called the “Superchain” for building scalable solutions—used by Coinbase’s Layer 2 BASE and Worldcoin’s Layer 2 developed by Sam Altman.

Celo and UMA both benefit from unique adoption trends: stablecoin usage and prediction markets. Celo is a blockchain focused on stablecoins and payments in emerging markets and has gained traction in Africa through Opera browser’s MiniPay app. Recently, Celo surpassed Tron to become the blockchain with the highest daily address volume for stablecoin usage. It is currently migrating from a standalone blockchain to an Ethereum Layer 2 using Optimism’s Superchain framework. UMA is the oracle network powering Polymarket, a breakout application in the crypto election year. UMA records the outcome of every Polymarket event contract on-chain and facilitates voting on disputed results, ensuring resolution without centralized, arbitrary, or biased intervention.

Helium’s inclusion reflects our preference for industry leaders and projects with sustainable revenue models. Helium is a leader in the DePIN (Decentralized Physical Infrastructure Networks) category, leveraging a decentralized model to efficiently distribute wireless coverage and connectivity resources while rewarding participants who maintain the infrastructure. Helium has expanded to over 1 million hotspots and 100,000 mobile users, generating over $2 million in network revenue to date.

Finally, although we’ve been tracking the decentralized AI theme for some time, Bittensor is now being incorporated into our Cryptocurrency Sector framework due to improvements in market structure—specifically, more available pricing sources and higher liquidity. Bittensor has emerged as a key player at the intersection of crypto and AI, aiming to use economic incentives to create a global, decentralized AI innovation platform, earning increasing recognition.

This quarter, we removed the following projects from the Top 20: Render, Mantle, ThorChain, Pendle, Illuvium, and Raydium. Grayscale Research continues to recognize the value of these projects, which remain important components of the crypto ecosystem. However, we believe the revised Top 20 list may offer more attractive risk-adjusted returns in the coming quarter.

Investing in the cryptocurrency asset class involves risks, some of which are unique, including smart contract vulnerabilities and regulatory uncertainty. Furthermore, all assets on our Top 20 list are highly volatile and may be considered high-risk, making them unsuitable for all investors. Finally, broader macroeconomic and financial market developments may impact valuations of digital assets, and the U.S. election in November is viewed as a major risk event for the crypto market. Former President Trump has explicitly supported the digital asset industry, while Vice President Harris recently stated her administration would “encourage innovative technologies like AI and digital assets while protecting our consumers and investors.” Given the risks facing this asset class, any investment in digital assets should be evaluated within the context of an investor’s portfolio and financial objectives.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News