Web3 Land Rent and Seigniorage

TechFlow Selected TechFlow Selected

Web3 Land Rent and Seigniorage

Ethereum is a land-rent economy, and ETH is a form of seigniorage.

Author: Zuoye Waise Mountain

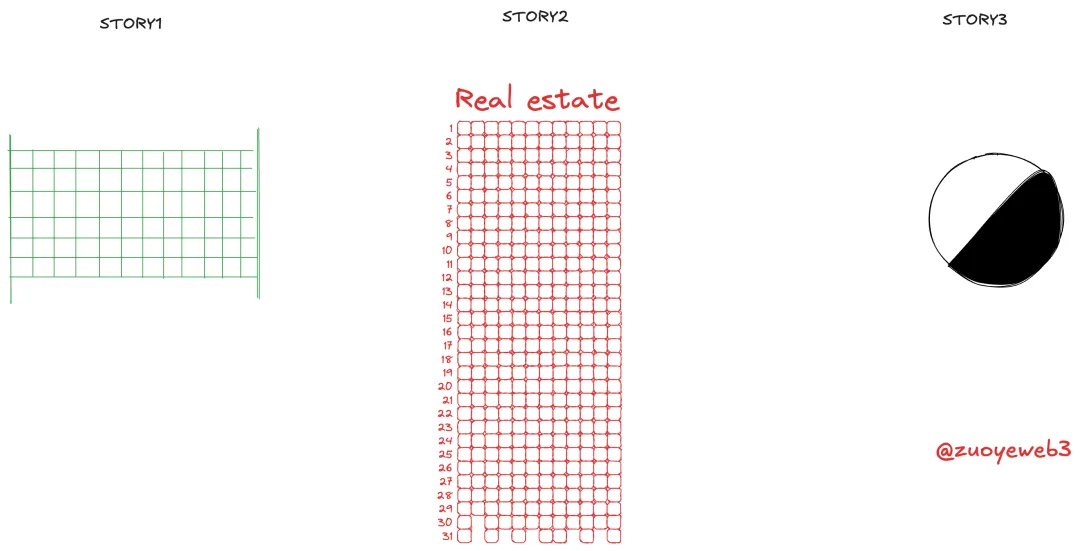

It is now a crisis moment for Earth facing the Trisolarans, and you are Yun Tianming, who has lived among the Trisolarans for many years. Now you need to send some information back to Earth, so you craft three parables:

Story One:

You are a young man from a small town, free to wander around the township. When you reach adulthood and wish to support yourself, two options are available in the market:

-

Lord Liu is kind-hearted and willing to sell you a piece of land—hand over money, get the deed immediately. But here's the problem: you lack sufficient funds. So Lord Liu grows even more generous—he offers to lease the land to you, asking only that you hand over a portion of your harvest afterward;

-

The county magistrate hears of your situation and, also feeling charitable, says you may contract a plot of public land from the county, as long as you deliver part of your harvest once the wheat ripens.

After careful consideration, you choose Lord Liu’s land, hoping through hard work you can save enough to eventually buy it outright. However, under natural disasters and human misfortunes, your grain yield is never enough—not only to feed yourself, but sometimes not even sufficient to cover the rent. So Lord Liu kindly extends credit so you can sow seeds and eat. Truly a benevolent man.

You also hear that the county magistrate still cannot find laborers to farm his land and is now considering selling it to Lord Liu. That might be good—perhaps then you could still lease it, and eventually save up to buy it.

Story Two:

You are a young person on Earth, free to move anywhere globally. By middle age, you want to settle down and buy property. In the market, two choices exist:

-

You can pay in full upfront—cash for deed—and afterward only pay utility fees and property management charges. But after checking housing prices against your bank account, you hesitate. Then the bank steps in with kindness, offering a mortgage loan. You sign the loan contract; developers use the funds to pay migrant workers, and local governments collect revenue for civil servant salaries and pensions;

-

A Chinese-speaking real estate agent across the ocean hears your plight and, out of compassion, suggests you buy a home in installments. With interest rates falling, your mortgage will become cheaper each year. After paying off the loan, you’ll own permanent title and only need to pay a small annual property tax.

After weighing both options carefully, you decide to take on the mortgage—at least the house belongs to you now, and later you won’t owe taxes. Yet after three or five years, government services dwindle, neighborhood security deteriorates, and home prices slowly decline. Your monthly payment drops slightly, but remains high relative to current market value.

At this point, you begin envying those in another paradise who only pay property tax—a tax that funds community safety, education, and collective action. Hayek’s invisible hand builds heaven on earth.

Pause here—the third story will come later. Actually, these stories aren’t complicated. They respectively represent the land-rent/tax economic models of the agricultural era and the urban (industrial) era. In the agrarian model, people can only form economic ties through land. Being labeled a hired laborer or low-caste isn’t the worst fate—landless vagrants gain freedom, but often collapse by the roadside within days.

In the industrial era, land remains the most critical means of production, yet the economic value of grain rapidly declines. Factories built atop land generate far greater returns than landlords ever could. But production requires sales to realize value, and direct sales to individuals offer immediate monetization—thus commercial real estate booms. However, their weak risk resilience leads them to treat property as the sole store of value. Rent-based economics reasserts dominance, overshadowing productive activities. This "re-feudalization" allows Lord Liu’s family to monopolize wealth.

Only by curbing rent-seeking and maintaining productive activity can people escape the shackles of rent-based economies and allow broader participation in economic gains.

Ethereum is a rent economy, ETH is a seigniorage currency

Before proposing better economic policies, let us examine the “land” policy of another global commons—Ethereum.

Like the Trisolarans, there is no concept of private property here. Open-source and open-access are its foundational principles. Similar to Linux, a small number of developers have created a multi-trillion dollar economy. Ethereum’s innovation lies in using tokens to solve Linux’s historical inability to capture value—previously reliant only on donations and speculative capital. Its permissionless asset issuance enables private property and public value to grow together. As long as ETH is used, everything becomes meaningful.

If one truly grasps the profound significance of using ETH, then recent debates over Layer 2 Rollup scaling strategies become irrelevant—whether Vitalik no longer supports L2s, or only refers to Stage 1 Rollups.

The economic model of L2/Rollups leaves sufficient room for L1/Ethereum, competes aggressively with other L2s, and keeps whatever remains. Their issued tokens effectively use ETH as reserve assets. The more active an L2 economy, the stronger ETH’s value foundation.

Similar to the USD <> stablecoin relationship, the logic of ETH <> L2 tokens holds:

-

Stablecoin issuers must hold 1:1 USD reserves. Even if those dollars sit in banks, an equivalent amount circulates on-chain, fulfilling its purpose. If on-chain dollars collapse, people simply revert to relying more on bank-held USD;

-

The utility of L2 tokens lies in their role bridging L2 and L1. Since L2 transactions require L1 validation and confirmation—where blob space is priced in ETH—L2 tokens are fundamentally dependent on ETH. Conversely, ETH does not depend on the stability or utility breadth of any L2 token.

What changes this status quo isn’t L2s “rebelling”—such as introducing custom gas tokens—nor external DA solutions like Celestia, but rather Ethereum’s chosen path of rent extraction.

We must first acknowledge a fact: AppChains or RollApps haven't gained mainstream traction, nor is ETH Layer 3 a major threat. If L2 tokens cannot challenge ETH, then L3s certainly won’t either.

I previously wrote about restaking—Triangle Debt or Mild Inflation: An Alternative View on Restaking. To summarize briefly: restaking further strengthens ETH’s central position, as it monetizes Ethereum’s security, denominated in ETH.

This explains why Vitalik separates Rollups from L2s, and further breaks down Rollups into different stages. The stated goal is promoting decentralization, but the baseline for such decentralization is Ethereum’s ability to retain control during crises and ensure users can withdraw funds back to Ethereum.

The reason the L2 sector has fizzled wasn’t due to fragmented capital, but excessive centralization—such as centralized sequencers undermining L1’s governance authority.

In this sense, Ethereum embodies a clear rent economy. The activity level of dApps and their generated revenue matters less—what’s crucial is controlling the entire process of economic generation and distribution. For the Ethereum-ETH system, LRT/LSD protocols that rent out blockspace are far more favorable than disobedient L2/Rollups that intercept ETH revenue.

The wisdom of “letting water flow to nurture fish”

Finally, Yun Tianming prepares one last heartfelt parable for Cheng Xin:

You are a cosmic-level saintess, wandering through five-dimensional space. As Earth perishes, you prepare for cybernetic immortality. Two options lie before you:

-

Yun Tianming gifts you Universe No. 647—a tiny universe, yet fully self-contained, with its own ecosystem, sufficient for you to spend the rest of your days;

-

The Resetters broadcast across the cosmos, urging all civilizations to return the mass they’ve stolen, so the universe may restart. Only in the vast ocean can fish grow strong and become whales roaming the four seas.

If you were Cheng Xin, which choice would you make?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News