Analysis and Reflection on Cryptocurrency Business Models

TechFlow Selected TechFlow Selected

Analysis and Reflection on Cryptocurrency Business Models

This market has been thoroughly educated by DeFi; relying solely on tokenomics innovation no longer works or can only last for a very short time.

Author: YettaS

I've roughly compiled my thoughts on various types of Fi—ranging from DeFi to CeDeFi to PayFi—and the central role of Stablecoins throughout. Welcome everyone to join the discussion.

I categorize current business models into four types:

1. Focus on on-chain yield, with revenue derived from fee sharing. This was essentially the keyword of the previous cycle—for example, the DeFi "trifecta" earned returns by providing financial venues. The biggest innovation in this cycle appeared in Pendle. I believe opportunities in this category are becoming increasingly scarce unless there's delivery-centric-level innovation.

2. Focus on arbitrage between on-chain and off-chain yields, with revenue coming from product fees. This model dominates the current cycle: Ondo Finance brings RWA yields on-chain; Ethena Labs brings DN yield strategies on-chain; BounceBit brings various BTC CeDeFi strategies on-chain—all following the same logic. This sector is now highly homogenized and exhausting.

3. Focus on on-chain liquidity, with revenue from settlement fees. A classic case here is Justin Sun’s TRC20-USDT. Back then, people hadn’t yet recognized the massive potential of stablecoins on-chain. ETH transfers in USDT were expensive and slow, while Tron was cheap and fast. Justin Sun immediately launched large-scale subsidies to capture market share, spending hundreds of millions (naturally funded by Tron node revenues) to subsidize TRC20-USDT deposits and withdrawals on exchanges—users at the time could enjoy 16%-30% returns on nearly every deposit or withdrawal, leading to what we see today: Tron generating nearly $1.5B in annual revenue. I think there are still opportunities here, but one must identify where on-chain liquidity is fragmented. For instance, Noble is an asset issuance chain that currently helps deploy USDC across various appchains.

Recommended reading: The Rise of TRON's TRC20-USDT: What's Behind It?

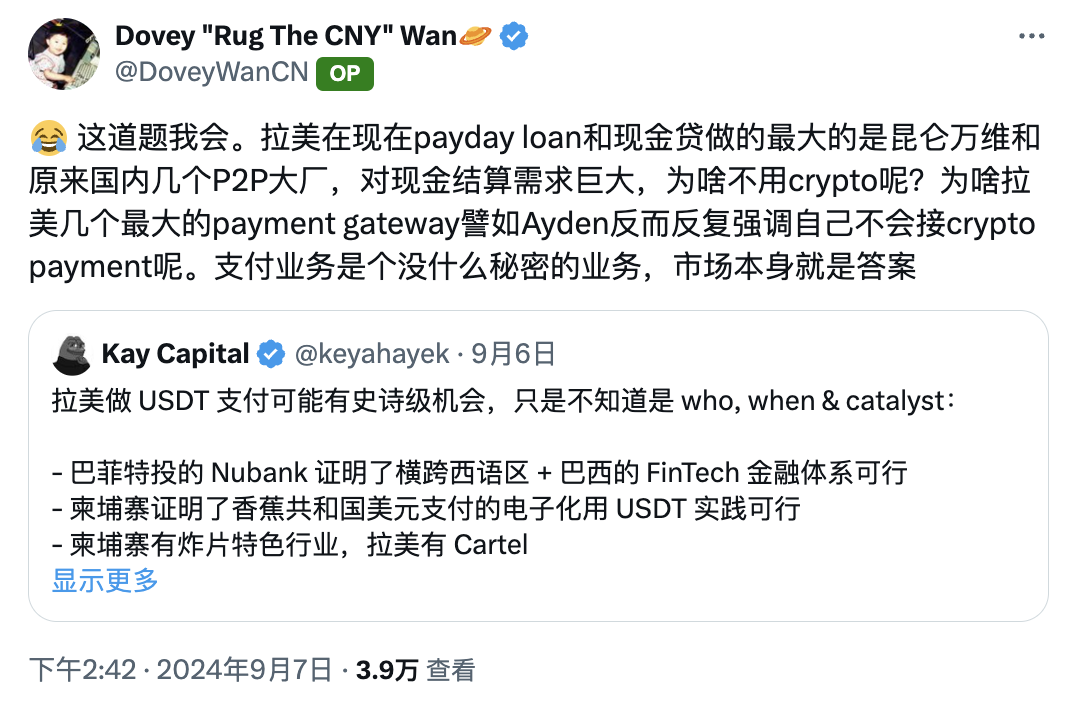

4. Focus on integrating on-chain/off-chain liquidity with financial functionality. This category is very broad, encompassing on- and off-ramps like USDT/USDC, as well as Solana’s Lily Liu’s concept of PayFi. The core idea is merging payments with credit facilities, leveraging on-chain efficiency to accelerate off-chain capital velocity and reduce funding costs. This requires connecting and integrating vast amounts of real-world off-chain demand, which is why DoveyWanCN says you need experience having “fought battles in internet or fintech companies, or cross-border e-commerce/drop shipping—any hands-on global cash flow operation.” The required Web2 know-how here goes far beyond what past crypto natives can deliver.

My observations:

1. These four models increase progressively in difficulty and narrative strength. The market has now entered the stage of competing in categories three and four, where differentiation is possible and moats can be high;

2. The market has been thoroughly educated by DeFi. Innovations based purely on tokenomics no longer work—or only work for a very short time;

3. The market always rewards the first mover with the highest premium. Aim to become the market leader like Ondo or Ethena—don’t get stuck in homogeneous competition;

4. Clearly understand what kind of arbitrage you're actually exploiting: demand, technology, or regulation? Why couldn't this happen before? For example, Latin American payment systems not adopting crypto isn't a technological limitation;

5. Each model demands completely different founder skill sets and resources. Founder-product fit is paramount for investors.

Laid out this way, there are actually abundant opportunities. I hope founders broaden their vision and build something truly different.

Those interested in various Fi topics during 2049 are welcome to reach out!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News