Pyth Oracle Security Incentive (OIS): Enhancing DeFi Security with Safer Price Feeds Through Incentives

TechFlow Selected TechFlow Selected

Pyth Oracle Security Incentive (OIS): Enhancing DeFi Security with Safer Price Feeds Through Incentives

Pyth Network is redefining the future of DeFi.

Pyth Network is dedicated to powering DeFi and bridging the gap between traditional finance and on-chain financial systems. In 2021, the launch of Pyth Price Feeds marked a critical first step toward this mission. As DeFi continues to evolve, so do the needs of developers and users. The demand for greater security and reliability in Web3 capital markets from smart contract developers and market participants is becoming increasingly urgent.

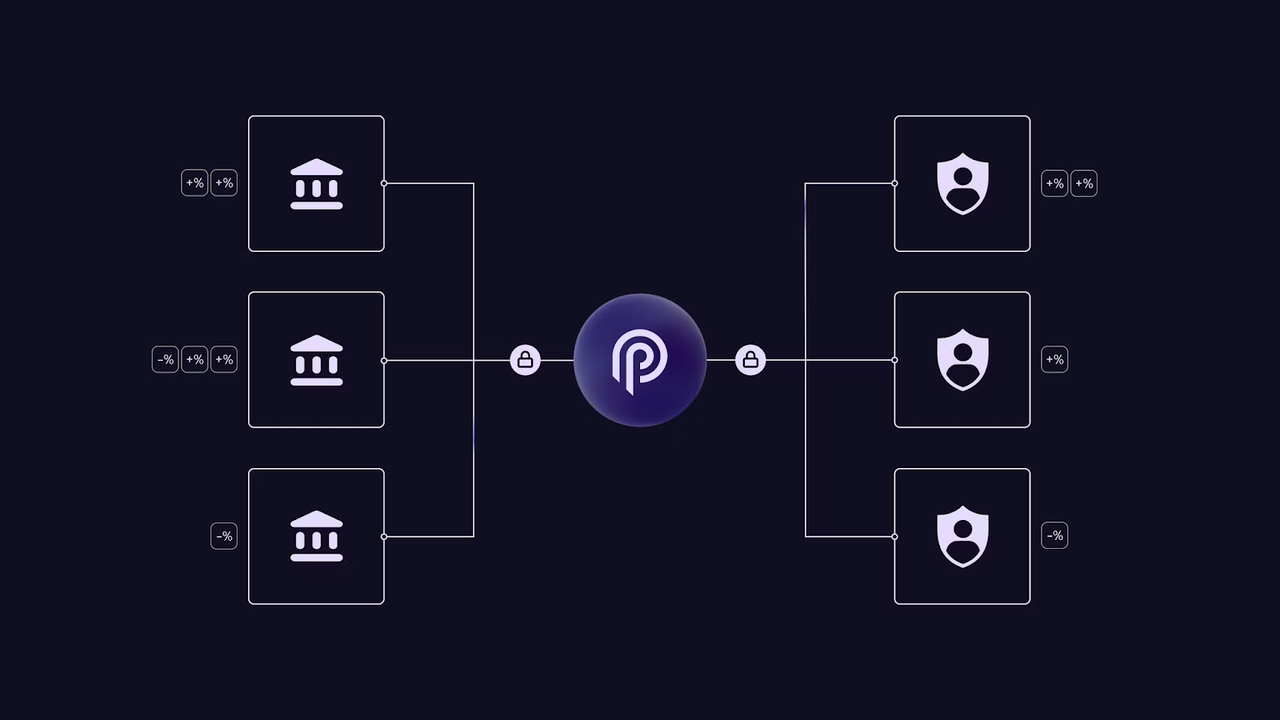

Oracle Integrity Staking (OIS)—the latest evolution of Pyth's price oracle—introduces a stronger accountability mechanism for data sources through decentralized staking rewards and penalties for network participants, creating a more secure DeFi ecosystem.

-

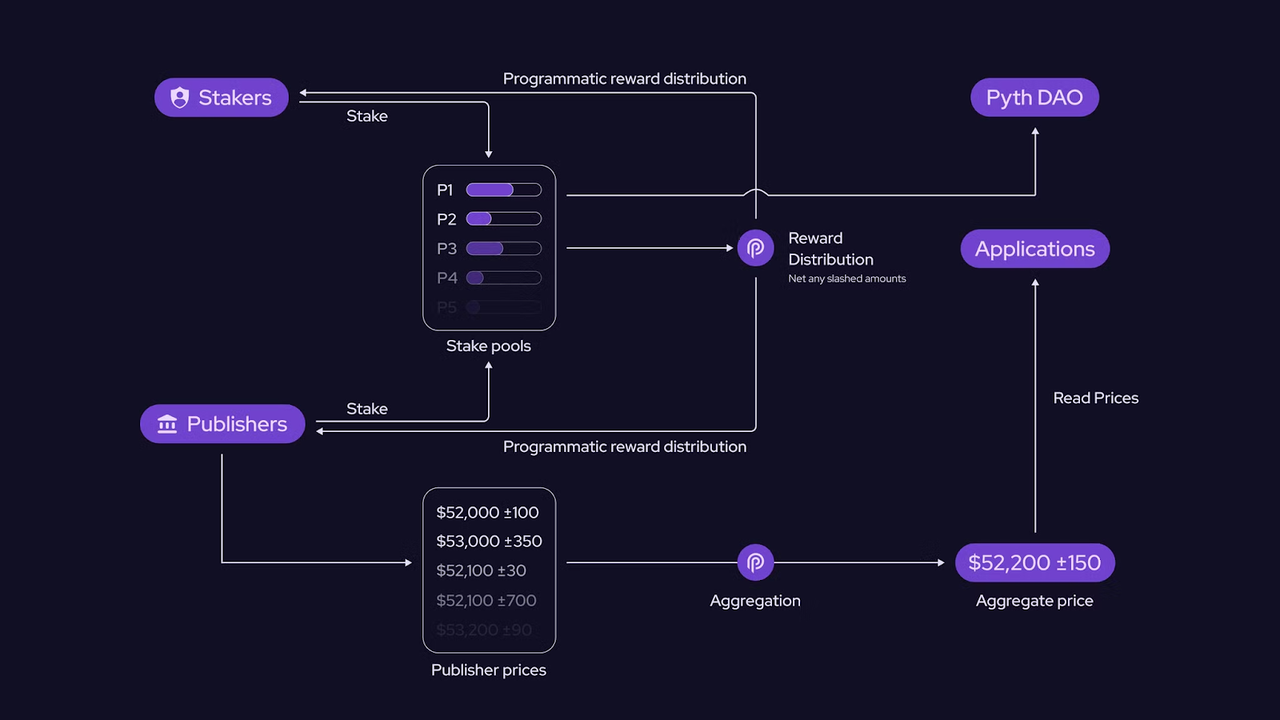

Pyth Data Publishers (data providers) will now be systematically rewarded by the Pyth protocol for ensuring the quality of price data. If their inaccurate data negatively impacts the protocol, their stake will be slashed. Pyth DAO can vote on how to use these slashed funds—for example, distributing them to affected users or allocating them to other uses.

-

PYTH stakers can delegate their staked tokens to PYTH data publishers to increase the potential rewards publishers receive for delivering high-quality data. This strengthens the resilience and security of Pyth price feeds; in return, PYTH stakers are automatically rewarded for helping protect the oracle network and the broader DeFi ecosystem.

Oracle Integrity Staking (OIS) covers all 500+ Pyth price feeds, setting a higher standard for oracle technology and market participants integrating into the DeFi ecosystem. This release marks a significant milestone in Pyth Network’s mission to deliver reliable, accurate price data across all blockchains, while also meeting growing demands for decentralization and sustainability.

This article explores in depth how Oracle Integrity Staking (OIS) enables developers to build applications with confidence by enhancing data accountability and oracle security.

How Oracle Integrity Staking (OIS) Transforms the Developer Experience

The most pressing challenge in today’s oracle landscape is delivering high-quality, reliable price data for all assets that developers need—across all blockchains—in a trustless manner.

Currently, the data infrastructure available to developers lacks comprehensive accountability measures to ensure data quality. Existing oracles rely only on simple on-chain incentive mechanisms to guarantee quality for a limited number of relatively safe markets.

Expanding asset coverage is also a complex challenge for push-model oracles. Pyth’s pull-model oracle has already established a new paradigm for rapidly expanding price feed availability to new blockchains, enabling applications using Pyth to be rewarded when they adopt new, emerging, or strategic assets—even before those assets gain widespread recognition.

Oracle Integrity Staking (OIS) directly addresses both data quality and scalability by holding Pyth data publishers accountable for price accuracy and breadth of asset coverage.

Price Accuracy

Data publishers must stake PYTH tokens to qualify for on-chain data publishing rewards, and they only earn rewards when providing high-fidelity price data.

Conversely, if a publisher provides incorrect or malicious data, a portion of their staked tokens will be slashed as punishment. Additionally, Pyth DAO can vote on how to allocate slashed funds—including reimbursing affected users or using the funds for other purposes that support the growth of Pyth Network.

For developers, these mechanisms translate into greater trust in the data, reducing concerns about data quality and security. These safeguards complement Pyth’s existing reliability practices, such as on-chain aggregation to filter out outlier data and consistency testing for newly launched price feeds.

Asset Coverage

Oracle Integrity Staking (OIS) also allows data publishers to increase their potential returns by supporting a larger number of price feeds. Furthermore, publishers who begin offering unique or underrepresented price feeds receive enhanced reward potential.

This incentive structure makes Pyth the go-to oracle for smart contract developers building across diverse applications. No matter where a team chooses to build or what types of assets they require, Pyth Price Feeds can scale to meet those needs.

Protecting the DeFi We Love

The Pyth community plays a vital role in Oracle Integrity Staking (OIS). Now, PYTH stakers can earn rewards programmatically by contributing to oracle security. By staking tokens to Pyth data publishers, stakers boost the selected publisher’s potential rewards while also strengthening the resilience and accuracy of Pyth price feeds. The staking reward mechanism first rewards publishers based on data quality, then distributes rewards to stakers based on their contribution to the network.

This system offers stakers a unique way to guide publishers toward supporting more price feeds and asset types—all while maintaining high standards for data quality. Notably, the OIS reward and slashing mechanisms impact both publishers and their stakers. Publishers are responsible for the data they provide to the oracle, while stakers help strengthen the oracle network by choosing which publishers to support.

How Oracle Integrity Staking (OIS) Works

Oracle Integrity Staking (OIS) enables anyone to participate in securing Pyth and protecting the DeFi ecosystem. The program introduces decentralized staking rewards and slashing mechanisms to incentivize publishers and PYTH token holders to enhance oracle quality through token staking.

Staking Rewards and Slashing Process

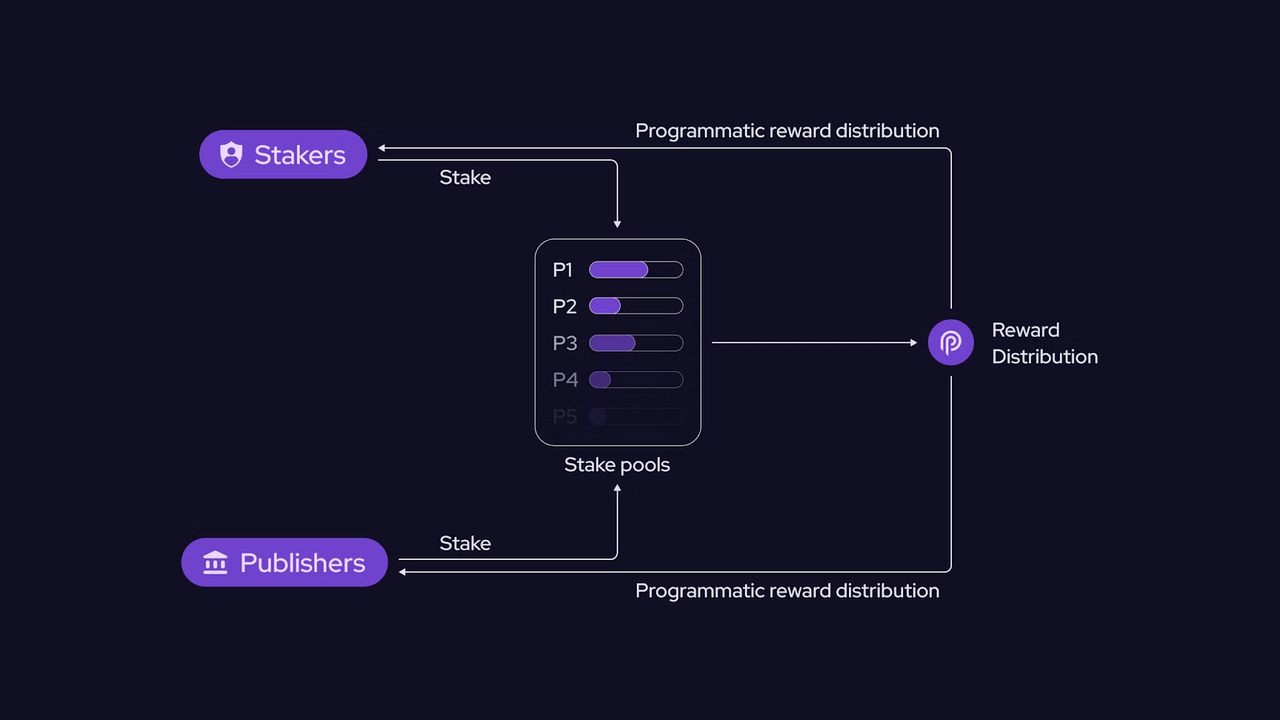

At the heart of Oracle Integrity Staking (OIS) are staking pools, each associated with a different data publisher. Each participating publisher can stake PYTH tokens themselves to earn data rewards for their published feeds. PYTH stakers—members of the Pyth community—can select publishers they wish to support and stake their PYTH tokens into any publisher’s pool to help secure the oracle network.

The total rewards generated by a staking pool depend on the total number of tokens staked in the pool (contributed by both the publisher and external stakers). As total staked amount increases, so do the rewards—up to a stake cap. Publishers can increase their stake cap by supporting more price feeds. Conversely, stakers can incentivize publishers to add more feeds by choosing to back publishers offering important or underserved feeds. Rewards are automatically distributed between the publisher and stakers, with the publisher receiving the first share and the remainder going to stakers.

Pyth DAO sets the maximum reward rate for staking pools to balance sustainability with effective participation. The current rate is 10%, but it can be adjusted via Pyth DAO votes. When the total staked amount in a pool is below the stake cap, stakers receive the maximum reward rate. However, total rewards cannot exceed maximum reward rate multiplied by the stake cap; meaning that if the cap is exceeded, stakers receive a lower effective reward rate.

This design encourages stakers to carefully evaluate the full list of publishers when deciding where to stake, helping to protect the oracle network. Detailed reward calculations are available in the developer documentation.

In summary, Oracle Integrity Staking (OIS) rewards are determined by several key factors—all adjustable via Pyth DAO voting.

-

Stake Cap: The maximum number of tokens that can be staked with a publisher (including both the publisher’s own stake and external stakers) and still qualify for rewards. A higher stake cap allows publishers to attract more stakers and increase their pool’s nominal rewards.

-

Number of Symbols Supported: Publishers can increase their stake cap by supporting more price symbols, thereby increasing their potential rewards. These additional rewards compensate for the increased slashing risk associated with managing more symbols.

-

Maximum Reward Rate: The DAO sets the maximum annual percentage yield (APY) that a staking pool can earn. While a higher maximum reward rate increases potential returns, the DAO must carefully manage this parameter to balance participation incentives with the long-term sustainability of Oracle Integrity Staking and Pyth Network.

-

Delegate Fee: Publishers charge a fixed percentage of the net rewards (after any slashing) as a delegation fee to stakers in their pool (currently set at 20%). This fee and structure can be adjusted via DAO vote.

-

Slashing Mechanism: If a group of publishers delivers data that fails to meet standards, both the publishers and their supporting stakers may face slashing penalties. This shared responsibility model encourages stakers to carefully assess publishers, fostering a culture of accountability across the network. Currently, the maximum slashing penalty is capped at 5% of the total stake, though this ratio can be adjusted by Pyth DAO. The DAO can also vote on how to use slashed tokens—such as distributing them to users affected by erroneous data or allocating them to other approved uses within Pyth Network.

How Stakers Can Participate

PYTH stakers play a crucial role in Oracle Integrity Staking by enhancing oracle security and data integrity through token delegation to publishers.

To get started, anyone holding unlocked PYTH tokens can access the Pyth staking dashboard and navigate to the Oracle Integrity Staking program. Eligible participants* can explore the list of publishers, select those they wish to support, and begin helping secure the oracle network.

Stakers can sort and evaluate publishers based on criteria such as pool composition, publisher quality rankings, number of supported price feeds, or other personally relevant metrics. Once ready, stakers can stake their tokens into any publisher’s staking pool. These tokens enter a warm-up period before being fully active in securing the oracle. Stakers can manage their stake distribution across multiple publishers according to personal preferences and strategies for maintaining oracle integrity.

PYTH holders who have already staked tokens to Pyth governance will see those tokens reflected in the Oracle Integrity Staking program and can directly delegate them to publishers without first withdrawing them back to their wallet.

Finally, participants can simultaneously stake the same tokens to both the Oracle Integrity Staking program and Pyth governance—securing the oracle while retaining voting rights on Pyth improvement proposals. Alternatively, participants may choose to stake only to Pyth governance without joining Oracle Integrity Staking.

The Role of Pyth DAO

Pyth DAO is responsible for setting the parameters governing Oracle Integrity Staking—such as stake caps, delegation fees, and slashing amounts—to ensure incentives align with maintaining high data standards. Current parameter settings are available in the documentation.

Pyth DAO also oversees major updates to the staking and slashing mechanisms, including decisions on the source of rewards for publishers and stakers. To launch the program, the Pyth Data Association has allocated 100 million unlocked tokens. Pyth DAO can vote to add additional reward sources, such as on-chain revenue generated by Pyth oracles.

Additionally, Pyth DAO can vote on how to use tokens that are slashed due to publishers submitting incorrect data. While slashed tokens automatically return to the DAO treasury, Pyth DAO can vote to redistribute them to parties affected by data errors or allocate them to other DAO-approved initiatives.

The DAO can also modify the reward structure—for instance, incorporating other digital assets as rewards—to enable broader participation and further enhance oracle security and coverage.

Through these responsibilities, Pyth DAO empowers the community to shape the future of Oracle Integrity Staking, ensuring the continued resilience and scalability of Pyth Network.

Price Feeds V3 and Future Development

In decentralized finance (DeFi), the reliability and accuracy of oracle data are paramount. As more capital flows into blockchain ecosystems, the risks of inaccurate or manipulated data grow.

While Pyth’s current reliability measures are essential for sustaining today’s DeFi, the evolving landscape demands more advanced security mechanisms. Therefore, cryptoeconomic assurance for price data security represents the logical next step for price oracles.

Pyth Network first launched its Price Feeds V1 on Solana, pioneering high-frequency, on-chain data delivery from first-party sources. Leveraging Solana’s speed, Pyth set a new standard for reliable data delivery. With the introduction of Price Feeds V2, Pyth became the first pull-based oracle, extending its reach across EVM, Move, Cosmos, and Bitcoin ecosystems—delivering high-quality, low-latency price data to developers on any chain.

Oracle Integrity Staking unlocks Price Feeds V3—a major advancement in Pyth’s price oracle technology—by introducing accountability for every data source. At the core of V3 is Oracle Integrity Staking, empowering Web3 developers to build fearlessly, without worrying about data inaccuracies or malicious manipulation.

Oracle Integrity Staking introduces a new paradigm in the oracle space—one that actively prioritizes data source accountability and end-to-end supply chain protection, setting a higher industry benchmark for price oracles.

To date, Pyth Network is the only data infrastructure solution offering this level of data accountability and security across all its existing oracles—from the most widely used price feeds to illiquid long-tail assets. Oracle Integrity Staking ensures every price feed is secure, every user is protected, and every publisher is held accountable.

Pyth Network is redefining the future of DeFi. No matter which ecosystem you come from or how you choose to contribute, you’re invited to join this transformative journey and help make history.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News