Interpreting Binance's RWA Research Report: Traditional Institutions Actively Joining, Asset Yields May Decline Amid Rate Cut Expectations

TechFlow Selected TechFlow Selected

Interpreting Binance's RWA Research Report: Traditional Institutions Actively Joining, Asset Yields May Decline Amid Rate Cut Expectations

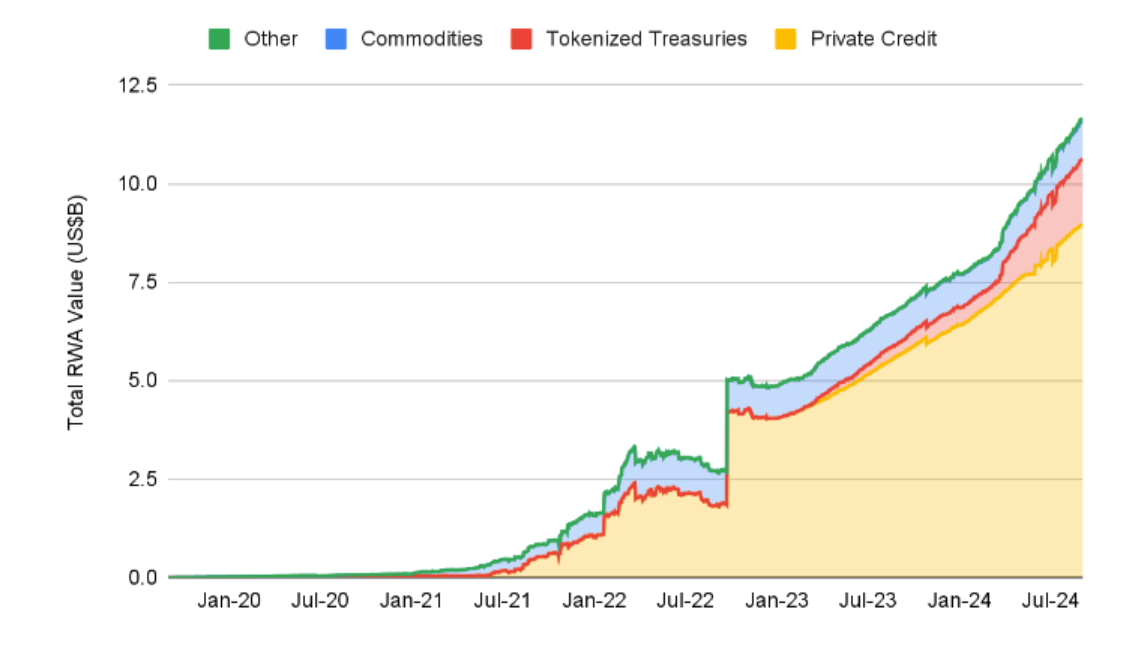

The total value of on-chain RWA has reached $12 billion, not including the $175 billion stablecoin market.

Author: TechFlow

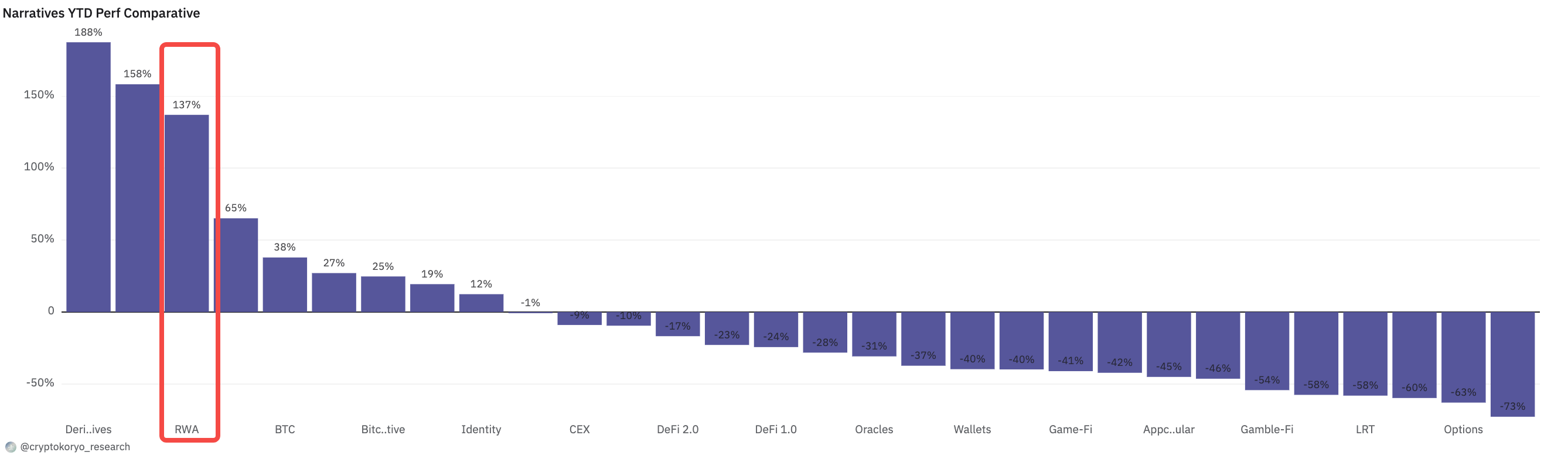

RWA sector has been quietly thriving during this atypical bull market.

While market sentiment is easily swayed by memes, a closer look at the data reveals that tokens in the RWA sector have delivered stronger year-to-date returns than most other crypto sectors.

As U.S. Treasuries become the largest RWA, the sector’s performance will increasingly reflect macroeconomic trends.

Recently, Binance Research released a comprehensive report titled "RWA: A Safe Haven for On-Chain Yields?", providing detailed analysis on the RWA landscape, key projects, and yield performance.

TechFlow summarizes and interprets the key findings from the report below.

Key Takeaways

-

Total on-chain RWA value has reached $12 billion, excluding the $175 billion stablecoin market.

-

Main RWA categories include tokenized U.S. Treasuries, private credit, commodities, equities, real estate, and non-U.S. bonds. Emerging categories include aviation rights, carbon credits, and fine art.

-

Institutional and traditional finance ("TradFi") involvement in RWA is growing. BlackRock’s BUIDL tokenized Treasury product leads the category (market cap > $500 million); Franklin Templeton’s FOBXX is the second-largest tokenized Treasury product.

-

Six spotlighted projects: Ondo (structured finance), OpenEden (tokenized Treasuries), Maple (tokenized and structured credit aggregation), Parcl (synthetic real estate), Toucan (tokenized carbon credits), and Jiritsu (zero-knowledge tokenization).

-

Non-negligible technical risks: centralization, third-party dependencies (especially asset custody), oracle robustness, and whether system complexity justifies the yield earned.

-

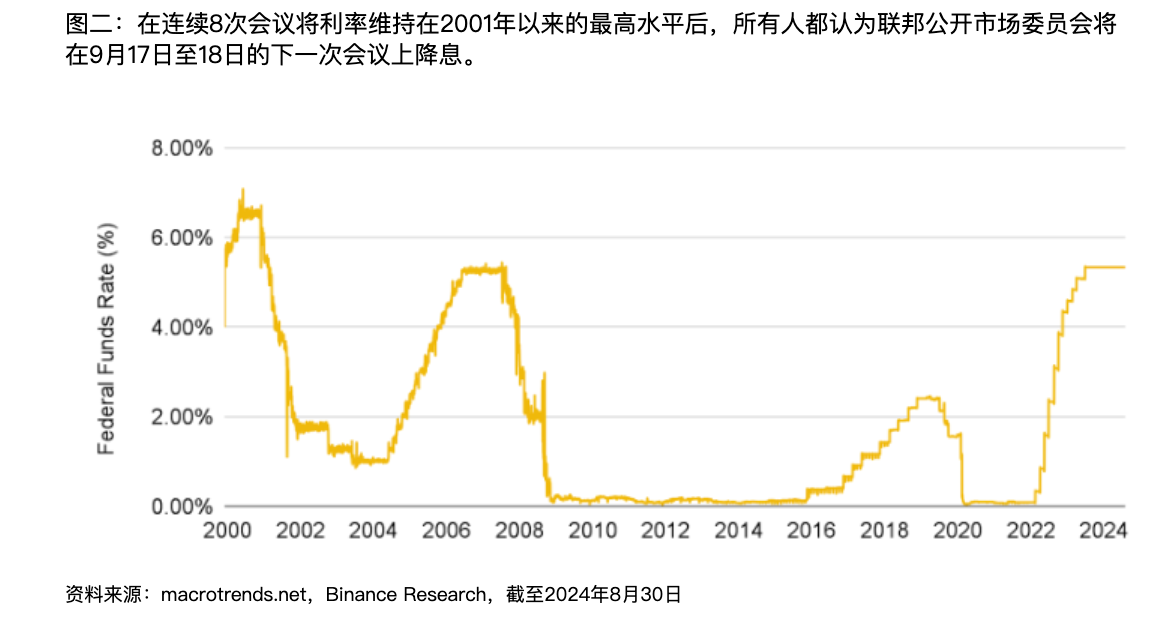

From a macro perspective, the U.S. is entering a historic rate-cutting cycle, which may impact many RWA protocols—particularly those focused on tokenized U.S. Treasuries.

Data Fundamentals of RWA

Consolidated RWA definition: on-chain tokenized versions of tangible and intangible non-blockchain assets such as currencies, real estate, bonds, and commodities. Broader categories include stablecoins, government debt (dominated by U.S. Treasuries), equities, and commodities.

Total on-chain RWA value has hit an all-time high of over $12 billion (excluding the $175+ billion stablecoin market)

Key Category 1: Tokenized U.S. Treasuries

-

Experienced explosive growth in 2024, rising from $769 million at the start of the year to $2.2 billion by September.

-

Growth likely driven by U.S. interest rates at a 23-year high; since July 2023, the federal funds target rate has remained steady at 5.25–5.5%, making U.S. Treasury yields attractive to investors.

-

Government backing — U.S. Treasuries are widely considered one of the safest yield-bearing assets in the market, often labeled “risk-free.”

-

The Fed is expected to begin its rate-cutting cycle at the September FOMC meeting. Monitoring how RWA yields evolve as they begin to decline will be crucial.

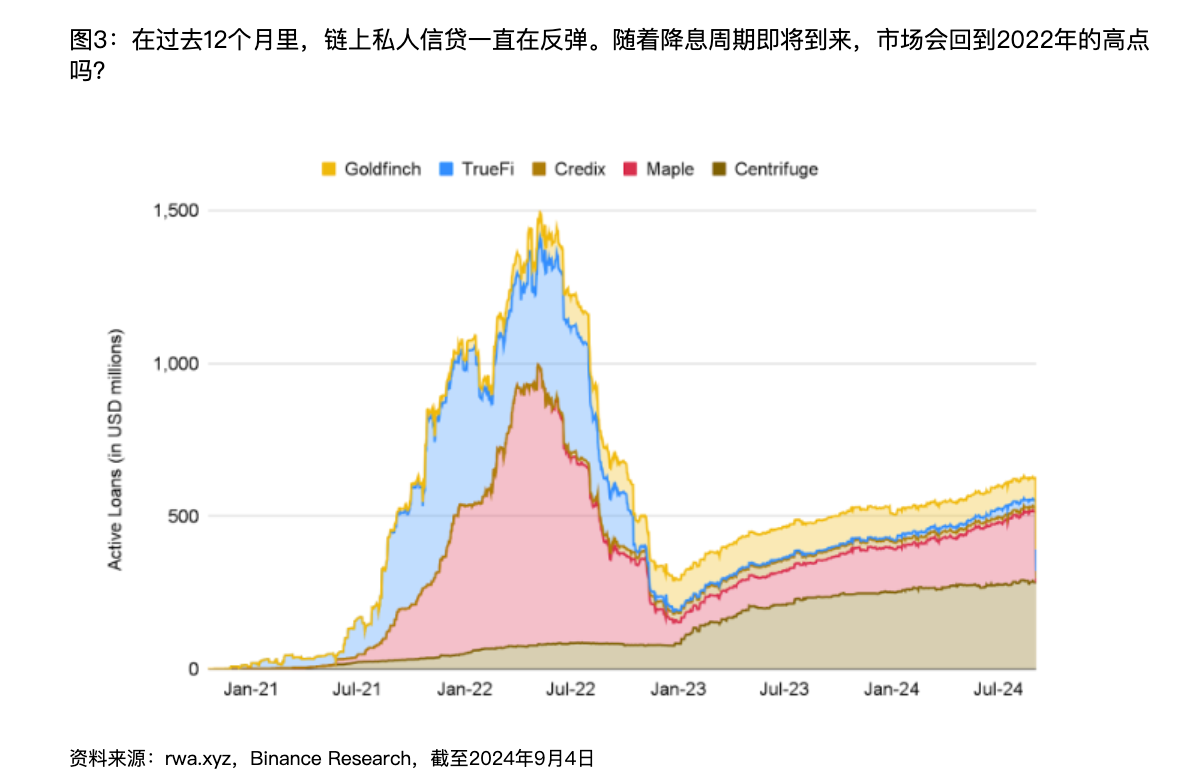

Key Category 2: On-Chain Private Credit

-

Definition: Debt financing provided by non-bank financial institutions, typically to small and medium-sized enterprises.

-

IMF estimates place the size of this market at over $2.1 trillion in 2023, with on-chain activity accounting for only ~0.4%, or about $9 billion.

-

On-chain private credit has grown rapidly, with active loans increasing by approximately 56% over the past year.

-

Most growth comes from Figure, a platform offering home equity line of credit (HELOC) products.

-

Other major players in on-chain private credit include Maple, Goldfinch, and Centrifuge.

-

Despite recent growth, total outstanding loan volume remains ~57% lower than the same period last year. This aligns with the Fed's aggressive rate hikes—higher interest payments (especially under floating-rate agreements) have pressured borrowers, leading to reduced loan activity.

Key Category 3: Commodities (Gold)

-

The two leading tokenized gold products, Paxos Gold ($PAXG) and Tether Gold ($XAUT), hold ~98% of the ~$970 million market.

-

However, gold ETFs remain far more dominant, with over $110 billion in market capitalization. Investors remain reluctant to move their gold holdings on-chain.

Key Category 4: Bonds and Equities

-

A relatively small market, with a total market cap of around $80 million.

-

Popular tokenized stocks include Coinbase, NVIDIA, and S&P 500 trackers (all issued by Backed).

Key Category 5: Real Estate, Clean Air Rights, etc.

-

Though not yet at mass adoption, these categories still exist.

-

ReFi (Regenerative Finance) concepts align closely, aiming to link financial incentives with eco-friendly and sustainable outcomes—such as tokenizing carbon emission allowances.

Core Components of RWA

Smart Contracts:

-

Utilize token standards like ERC-20, ERC-721, or ERC-1155 to create digital representations of off-chain assets.

-

A key feature is the automatic yield accrual mechanism, which distributes off-chain income on-chain via rebasing tokens (e.g., stETH) or non-rebasing tokens (e.g., wstETH).

Oracles:

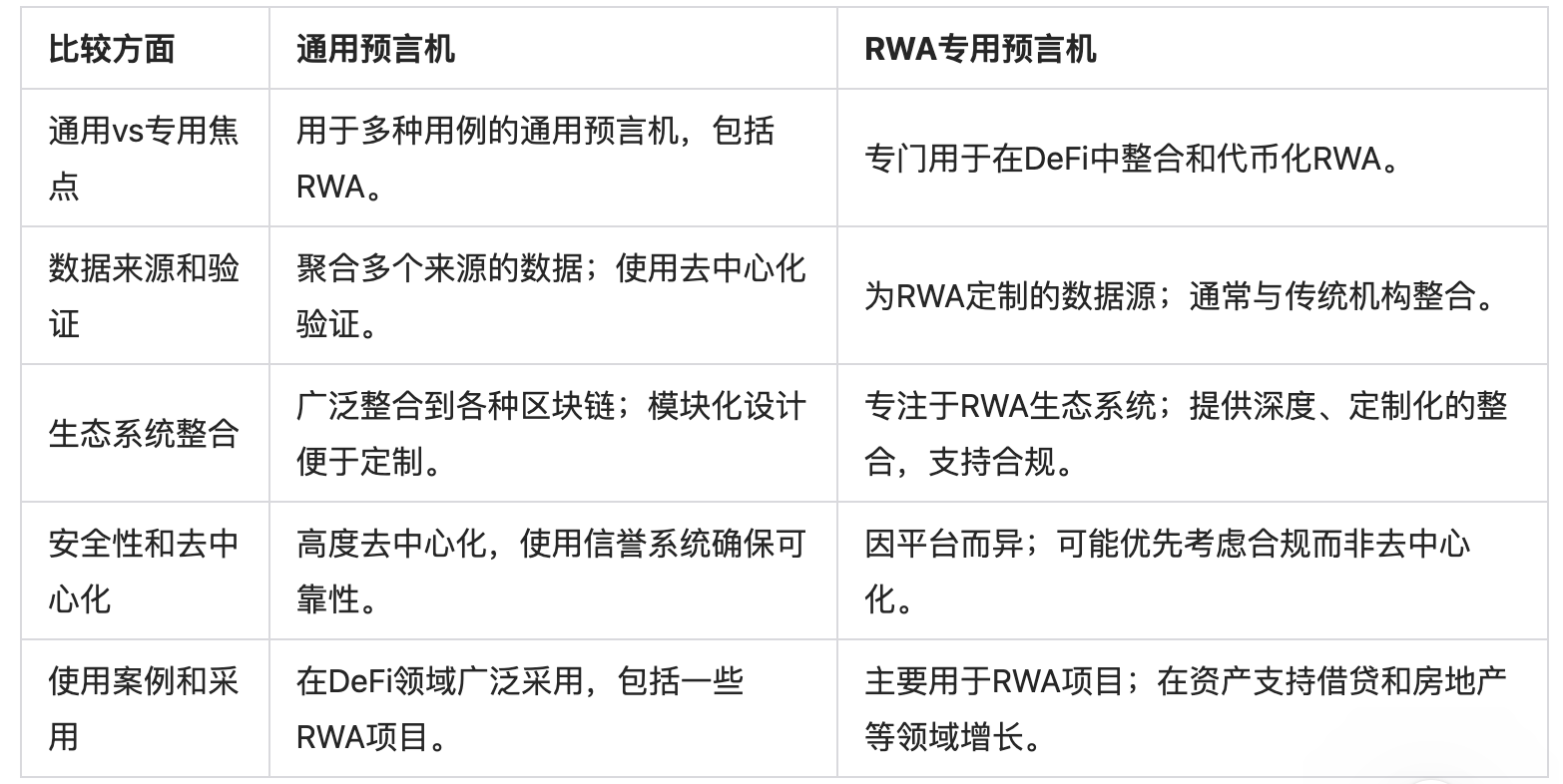

-

Key trend: Dedicated RWA oracles. General-purpose oracles may not fully address compliance, accurate valuation, and regulatory oversight needs.

-

For example, in private credit, lenders may issue RWA-backed loans on-chain. Without high-quality oracles to verify fund usage, borrowers might violate loan terms, take excessive risk, or default.

(Image source: Original report, compiled and translated by TechFlow)

-

Projects building dedicated oracles: Chronicle Protocol, Chainlink, DIA, and Tellor.

Identity & Compliance

-

Emerging technologies like Soulbound Tokens (“SBTs”) for identity verification; zero-knowledge SBTs (“zkSBTs”) offer a promising way to verify identity while protecting sensitive user data.

Asset Custody

-

Managed through a hybrid of on-chain and off-chain solutions:

-

On-chain: Secure multisig wallets or Multi-Party Computation (“MPC”) wallets manage digital assets. Off-chain: Traditional custodians hold physical assets, integrated legally to ensure proper ownership and transfer mechanisms.

Traditional Financial Institutions Entering RWA

BlackRock (AUM: $10.5 Trillion)

-

The USD Institutional Digital Liquidity Fund (“BUIDL”) is the market leader, with over $510 million in assets.

-

Launched only in late March, it quickly became the largest product in the space.

-

Securitize is a key partner for BlackRock on BUIDL, serving as transfer agent, tokenization platform, and distribution agent.

-

BlackRock is also the issuer of the largest spot Bitcoin and spot Ethereum ETFs.

Franklin Templeton (AUM: $1.5 Trillion)

-

Their on-chain U.S. Government Money Market Fund (“FOBXX”) is currently the second-largest tokenized Treasury product, with a market cap exceeding $440 million.

-

While BlackRock’s BUIDL operates on Ethereum, FOBXX is active across Stellar, Polygon, and Arbitrum.

-

Blockchain integration investment platform Benji adds functionality for FOBXX, enabling users to browse tokenized securities and invest in FOBXX directly.

WisdomTree Investments (AUM: $110 Billion)

-

Originally a global ETF giant and asset manager, WisdomTree has expanded into multiple “digital funds.” The combined AUM of all its RWA products exceeds $23 million.

Project Analysis

-

The report highlights six key projects: Ondo (structured finance), OpenEden (tokenized Treasuries), Maple (tokenized and structured credit aggregation), Parcl (synthetic real estate), Toucan (tokenized carbon credits), and Jiritsu (zero-knowledge tokenization).

-

Detailed descriptions of each project’s business model and technical implementation are included in the original report but omitted here due to space constraints.

-

Below is a comparative overview and key characteristics of the projects:

(Image source: Original report, compiled and translated by TechFlow)

Overall Findings and Outlook

-

RWAs can generate yield, but whether the technical risks justify the returns depends on individual judgment. Key risks include:

Centralization: Higher degrees of centralization in smart contracts or overall architecture—often unavoidable due to regulatory requirements.

Third-party dependency: Heavy reliance on off-chain intermediaries, especially for asset custody.

-

Emerging tech trends:

The emergence of RWA-specific oracle protocols. Established players like Chainlink are also increasingly focusing on tokenized assets.

Zero-knowledge technology is emerging as a potential solution to balance regulatory compliance with user privacy and autonomy.

-

Do RWAs need their own blockchain?

Pros: Easier to launch new protocols without building separate KYC frameworks or navigating regulatory hurdles, fostering broader RWA protocol growth. Traditional institutions or Web2 companies adopting certain blockchain features can ensure all users meet KYC and regulatory requirements.

Cons: Faces “cold-start” challenges; difficult to bootstrap liquidity and ensure sufficient economic security. Higher entry barriers—users may need to set up new wallets, learn new workflows, and adapt to unfamiliar products.

-

Outlook amid rate cut expectations

The market anticipates the Fed will begin cutting rates at its September 18 meeting. What does this mean for RWA projects that thrived in a high-interest environment?

While some RWA yields may decline, they continue to offer unique advantages—diversification, transparency, and accessibility—that could maintain their appeal even in a low-rate environment.

-

Legal and regulatory concerns

Many protocols remain significantly centralized. There is ample room for improvement across various technologies, including zk-based systems.

Decentralization while maintaining regulatory compliance may require rethinking traditional compliance frameworks to recognize new forms of verification.

Most RWA protocols still have a long way to go before truly serving professional investors while enabling permissionless access.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News