Strategy Test 05 | OKX and AICoin Research Institute: Time-Weighted and Iceberg Order Strategies

TechFlow Selected TechFlow Selected

Strategy Test 05 | OKX and AICoin Research Institute: Time-Weighted and Iceberg Order Strategies

Explaining classic strategies in the simplest way.

OKX, in collaboration with the premium data platform AICoin, has launched a series of classic strategy research initiatives aimed at helping users better understand and learn various trading strategies through core dimensions such as data-driven testing and strategy characteristics, minimizing blind usage.

Time-Weighted Average Price (TWAP) and Iceberg Order strategies are two common large-order splitting trading strategies, particularly suitable for block trades and algorithmic trading.

The TWAP strategy is a method that splits large orders and executes them incrementally over time. Its goal is to evenly distribute a large order across a specified period to minimize market price impact. The basic principle involves breaking a large order into multiple smaller ones and executing them sequentially at preset time intervals, allowing the average execution price to closely match the market’s average price during that period. This strategy effectively avoids market impact caused by placing a single large order all at once, reducing slippage risk. It is typically used by traders or institutional investors who wish to avoid significant price fluctuations due to their trades.

The Iceberg Order strategy is a large-order splitting method that places partial visible limit orders gradually into the market. Its purpose is to conceal the actual trade size, preventing other market participants from detecting large trading intentions and triggering sharp price movements. The fundamental mechanism involves dividing a large order into several smaller sub-orders, only revealing part of it to the market. Once a visible portion is fully executed, the system automatically generates the next sub-order until the entire large order is completed. This way, only the “tip of the iceberg” is visible, hiding the true scale of the order. It is commonly used by institutional traders or high-volume traders seeking to conceal their market presence.

In practice, these two distinct strategies can be selected based on different use cases to better manage the execution of large orders. By using the TWAP strategy to spread out timing impact and the Iceberg strategy to hide trade volume, traders can effectively control market impact and slippage risks while protecting their trading intent. These strategies are widely applied in high-frequency trading, institutional trading, and large-order execution, especially beneficial in markets with lower liquidity or higher volatility.

Advantages and Disadvantages Comparison

Overall, the TWAP strategy offers multiple advantages in practical applications. First, minimal market impact: by splitting a large order into smaller chunks executed over time, it reduces pressure on market prices. Second, price smoothing: spreading executions over time helps avoid sharp price swings caused by large trades, resulting in more favorable average execution prices. Third, simplicity: the logic is straightforward and easy to understand, with simple operation—on OKX, it can be deployed with one click. Fourth, high controllability: users can customize parameters such as price, time interval, and quantity, enhancing execution flexibility.

However, its drawbacks are also apparent. For example, execution risk: since orders are placed at fixed intervals, sudden market volatility may prevent optimal pricing. AICoin's TWAP strategy introduces randomized time intervals and trade sizes during execution, making the strategy harder to detect and front-run.

The Iceberg Order strategy also brings several practical benefits. First, concealment of true intent: by splitting a large order into small visible portions released gradually, it effectively hides the real order size, reducing the risk of being detected and exploited by others. Second, gradual execution: incremental order placement minimizes market impact and leads to better average prices. Third, flexibility: users can adjust displayed order size and frequency according to market conditions, offering strong adaptability.

Nonetheless, the Iceberg strategy has limitations too. For instance, liquidity risk: since only a fraction of the order is exposed, if market liquidity drops suddenly, parts of the order may fail to execute promptly. AICoin’s Iceberg strategy counters this by randomizing order placement position, timing, and size, increasing stealth and resistance to detection.

Theoretical Analysis – Performance of the Two Strategies in Bull and Bear Markets

First, theoretical analysis of the TWAP strategy’s performance in bull and bear markets.

1) Performance in Bull Markets

In bull markets, the TWAP strategy avoids large buy orders impacting cryptocurrency prices by placing orders in batches, thereby lowering average purchase costs. This approach can generate relatively strong excess returns during upward trends.

2) Performance in Bear Markets

In bear markets, the TWAP strategy demonstrates strong defensive capabilities. By setting aggressive take-limit prices, it avoids buying at high levels, thus reducing loss risk. Meanwhile, staggered order placement allows better capture of market lows, increasing profit opportunities.

Overall, the TWAP strategy shows clear advantages in dynamic environments. If a user’s primary objective is to reduce market impact from large orders and execute gradually over time, TWAP is an excellent choice—though market volatility risks should still be carefully considered.

Next, theoretical analysis of the Iceberg strategy’s performance in bull and bear markets.

1) Performance in Bull Markets

In bull markets, sentiment is generally bullish, buyer demand is strong, trading activity is high, and liquidity is abundant. The Iceberg strategy effectively conceals the actual size of large buy orders, preventing the market from pushing prices higher prematurely, enabling gradual purchases at relatively low prices. However, if prices rise rapidly, the small visible portions may not get fully filled, causing missed entry opportunities.

2) Performance in Bear Markets

In bear markets, sentiment is bearish, seller dominance prevails, trading activity slows down, and liquidity decreases. The Iceberg strategy conceals large sell orders effectively, avoiding panic selling triggered by visible large-volume selling, allowing gradual exits at relatively higher prices. But due to reduced liquidity, even the small visible portions may struggle to fill quickly, increasing unfilled order risk and potentially preventing timely exit.

Overall, if the goal is to hide the true size of large orders and prevent adverse market reactions, the Iceberg Order strategy is highly suitable—especially effective in high-frequency trading scenarios.

Accessing the Two Strategies on OKX

Currently, OKX Strategy Trading offers convenient and diverse strategy options.

OKX's Iceberg strategy employs a more dynamic and flexible order placement method, going beyond simple fixed-price gaps or proportional settings. This advanced approach significantly reduces slippage while better concealing trading intent. Additionally, OKX provides three modes for Iceberg orders: "Faster Execution," "Balanced Speed," and "Better Price," allowing users to select based on preference and needs. Overall, OKX’s Iceberg strategy delivers key advantages including large-order splitting, hidden trading activity, reduced slippage, and customizable order preferences.

The key features of OKX’s TWAP strategy include large-order splitting, time-based order placement, and slippage reduction. This strategy breaks large trades into many smaller ones executed at timed intervals, avoiding market shocks from single large orders. When prices meet predefined conditions, small taker orders are placed for quick execution. These orders operate under IOC (Immediate or Cancel) mode—any portion not immediately filled is canceled. For example, if an order for 2 units fills only 1.6, the remaining 0.4 is instantly canceled, minimizing slippage. The TWAP strategy applies not only to spot trading but also to perpetual contracts, delivery contracts, and margin trading, making it highly versatile.

For example, how does OKX’s TWAP work when buying?

Take a buy order: when the market price is above the take-limit price, order placement pauses; when the market price falls below the take-limit price, the strategy resumes, calculating the order price based on the current best bid and your configured price offset, then placing small taker orders. As long as the price remains below the limit, orders are placed periodically until the total target quantity is filled.

Illustration: TWAP Buy Order Execution

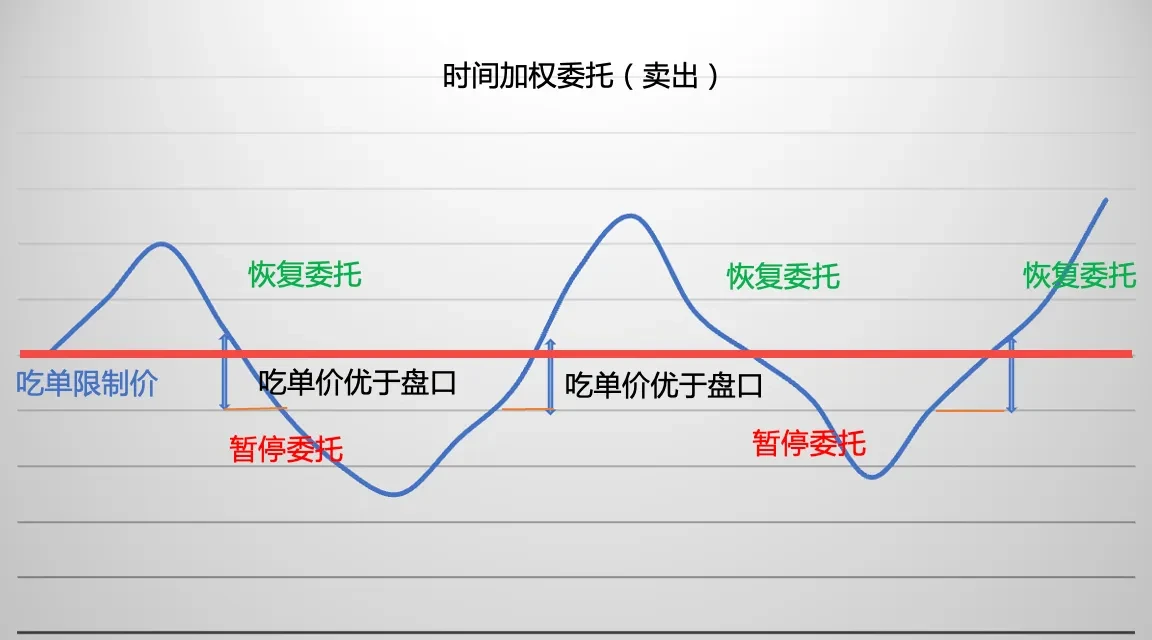

For a sell order: when the market price is below the take-limit price, order placement pauses; when the market price rises above the take-limit price, the strategy resumes, calculating the order price based on the current best ask and your configured price offset, then placing small taker orders. As long as the price stays above the limit, orders are placed periodically until the full quantity is executed.

Illustration: TWAP Sell Order Execution

How to access OKX Strategy Trading? Users can enter via the OKX app or official website, navigate to the “Trade” section, switch to “Strategy Trading” mode, then click “Strategy Plaza” or “Create Strategy” to begin. Besides creating custom strategies, the Strategy Plaza currently offers “Premium Strategies” and “Top Signal Providers’ Strategies,” which users can copy or follow directly.

OKX Strategy Trading offers multiple core advantages: ease of use, low fees, and robust security. In terms of usability, OKX provides intelligent parameter suggestions to help users set trading parameters scientifically, along with step-by-step图文 and video tutorials for fast onboarding. Regarding fees, OKX has upgraded its fee structure, significantly reducing trading costs. On security, OKX’s team of global top-tier experts ensures bank-grade protection for user assets.

How to Access AICoin Strategies?

How to access AICoin’s strategy trading? Users can go to the AICoin homepage, enter the “Market” section, find and click “Trade” on the right side, then select “Smart Order Splitting” to get started. Beyond smart order-splitting strategies, the “Community Indicators” section offers many “Premium Indicators” that users can search for and add to “My Indicators.”

AICoin provides intelligent parameter guidance for scientific configuration and offers图文 and video tutorials for quick learning. Its Smart Order Splitting feature boasts flexible order placement, intervals as short as 0.3 seconds, and highly concealed split counts that make monitoring by competitors extremely difficult.

Disclaimer

This article is for informational purposes only and reflects the author's views, not those of OKX. It does not constitute (i) trading advice or recommendations; (ii) an offer or solicitation to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. We do not guarantee the accuracy, completeness, or usefulness of the information provided. Holding digital assets (including stablecoins and NFTs) involves high risk and may experience significant price volatility. You should carefully consider whether trading or holding digital assets is appropriate for you based on your financial situation. Please consult your legal/tax/trading professional regarding your specific circumstances. You are solely responsible for understanding and complying with applicable local laws and regulations.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News