Knowledge科普 on Perpetual Contracts DEX: From Application Models, Ecosystem Overview to Future Prospects

TechFlow Selected TechFlow Selected

Knowledge科普 on Perpetual Contracts DEX: From Application Models, Ecosystem Overview to Future Prospects

Perpetual contract DEXs are not limited to trading scenarios—they are expanding the application scope of blockchain and paving the way for Web3 mass adoption.

Author: Gaurav Gandhi

Translation: Bai Ding, Geek Web3

Summary: In today's crypto market, perpetual DEXs are rapidly advancing, showing significant improvements in efficiency, speed, and scalability. This article explains how perpetual DEXs are expanding beyond mere trading to broaden blockchain’s application scope and pave the way for web3 mass adoption.

Main Content: Exchanges are central to the crypto market, enabling market operations through user trading activities. The primary goal of any exchange is to achieve efficient (low-cost, low-slippage), fast, and secure trade matching. Building on this goal, DEXs have introduced innovations over CEXs—eliminating trust assumptions, avoiding intermediaries and centralized control, allowing users to retain custody of funds, and enabling community participation in product development and governance.

However, reviewing DeFi history reveals that while DEXs offer advantages, they often come with higher latency and lower liquidity due to blockchain throughput and delay limitations.

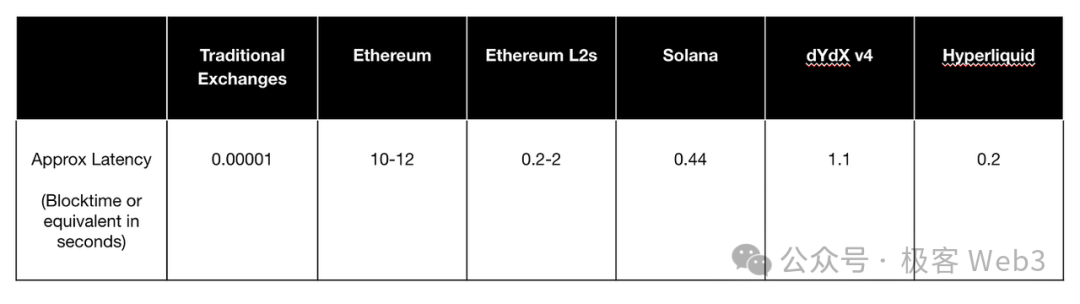

Transaction latency across major public blockchains

According to Chainspect and various blockchain explorers, DEX spot trading now accounts for 15%-20% of total crypto trading volume, whereas perpetual contracts account for only about 5%.

Developing perpetual products on DEXs is challenging because CEX perpetual trading holds several key advantages:

-

Better product experience

-

Efficient market maker controls enable tighter spreads

-

Superior liquidity (especially for major assets; most new projects aim to list on large CEXs)

-

All-in-one functionality (spot, derivatives, OTC, etc., seamlessly integrated)

Centralization and monopolization by CEXs have become unavoidable issues for users. The collapse of FTX further intensified this trend, leaving the current CEX landscape dominated by a few giants. This concentration introduces systemic risks to the crypto ecosystem. Increasing DEX usage and market share can effectively mitigate these risks and promote sustainable growth of the entire crypto ecosystem.

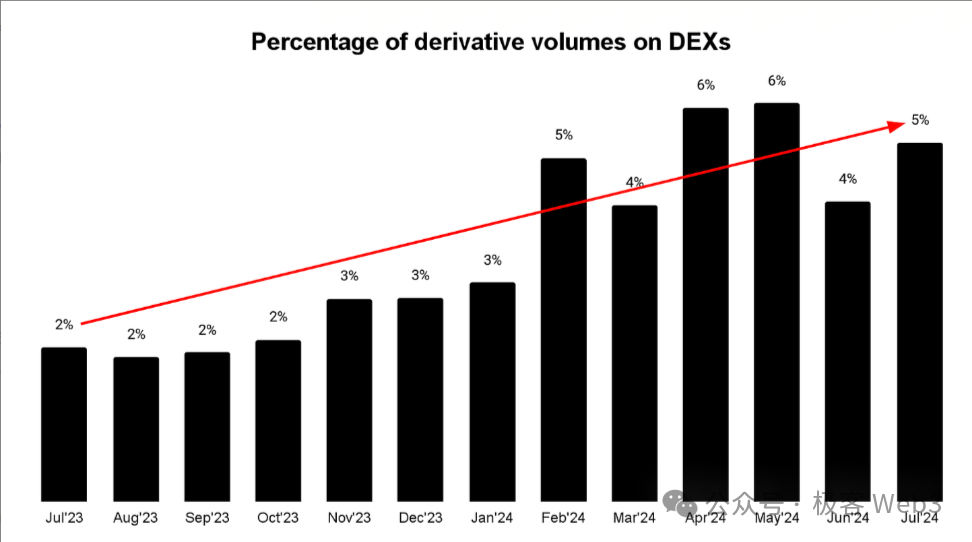

Derivatives trading volume share on DEXs

The rise of Ethereum Layer2 and multi-chain ecosystems has brought innovation in liquidity sourcing and user experience (UX), creating ideal conditions for DEX growth. Now is an excellent time for perpetual DEXs to thrive. This article provides an in-depth analysis of the current state of perpetual DEXs and explores their design philosophies.

Product-Market Fit of Perpetual Contracts in Crypto: A Key Tool for Speculation and Hedging

Perpetual contracts allow traders to hold positions indefinitely, resembling off-exchange futures trading in traditional finance (TradFi). However, by introducing funding rates, perpetuals democratize access to what was once an instrument reserved for accredited investors in TradFi, enabling broader retail participation. They also create a “damped oscillation effect,” helping prevent excessive imbalance between long and short positions.

(Funding rate mechanisms prevent contract prices from deviating too far from spot prices. Rates are typically determined by the balance of long vs. short positions in the market. When longs dominate, perpetual prices rise slightly above spot, resulting in positive funding rates—longs pay shorts—moderating bullish sentiment and preventing runaway price increases.)

Monthly trading volume in the perpetual market now exceeds $120 billion. This scale stems from strong user experience offered by exchanges, order book efficiency, and vertically integrated clearing systems that enable fast and secure liquidations.

(A vertically integrated clearing system refers to full control and management of the clearing process by a single entity or platform, without relying on external clearinghouses or third-party services. In contrast, a segregated model separates exchanges and clearing houses. Vertical integration offers higher efficiency; segregation emphasizes transparency and regulatory oversight.)

Moreover, projects like Ethena use perpetuals as a foundational mechanism, expanding their utility beyond speculation. In general, perpetual contracts offer four key advantages over traditional futures:

1. Eliminates rollover costs and related fees at contract expiration

In traditional futures, traders who wish to maintain a position must close their expiring contract and open a new one—a process known as "rollover." This incurs transaction fees, bid-ask spreads, and other costs. Perpetuals, having no expiry date, eliminate the need for rollover and thus avoid these extra expenses.

2. Avoids making forward contracts more expensive

In traditional futures markets, longer-dated contracts usually trade at a premium to shorter-dated ones—a phenomenon called "contango." During rollover, investors often buy higher-priced contracts, increasing holding costs. Perpetuals circumvent this via funding rate mechanisms.

For example, if a commodity’s March futures price is $100 and June futures are $105, rolling from March to June requires buying at $105, adding $5 to holding cost. With perpetuals, traders can hold the same position indefinitely without paying higher prices.

3. Funding rate mechanism enables continuous real-time P&L, simplifying back-end processing for holders and clearing systems

Perpetuals use funding rates to balance long and short positions, with settlement intervals typically every 8 hours (the industry standard followed by Binance, Bybit, etc.). After each period, funds are automatically deducted from or credited to holders’ accounts, providing real-time profit-and-loss updates. This frequent settlement reflects traders’ performance more accurately. Compared to daily mark-to-market settlements in traditional futures, perpetuals offer greater efficiency and streamline capital management and back-office operations.

4. Perpetuals enable smoother price discovery, avoiding sharp volatility caused by coarse pricing granularity

Price discovery is the process by which market participants determine asset prices. As mentioned, funding rates reflect supply-demand dynamics and continuously adjust contract prices to track spot closely, ensuring stable and continuous price movements. Combined with short settlement cycles, this results in smoother price discovery compared to daily or monthly settlements in traditional futures, reducing volatility spikes during rollover or delivery events.

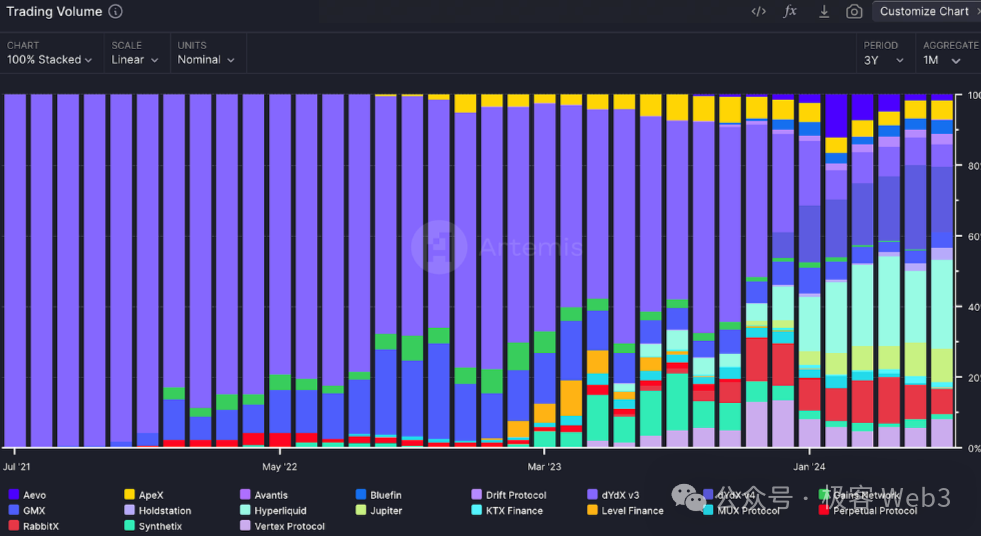

Market share of perpetual DEXs

Since BitMEX first introduced perpetual contracts in 2016, perpetual DEXs have grown rapidly. Today, over 100 DEXs support perpetual trading. Early perpetual DEXs were small in scale. dYdX launched on Ethereum in 2017 and dominated the space for years, concentrating decentralized perpetual trading on Ethereum with very low volumes. Now, active perpetual DEXs exist across multiple chains, and perpetual trading has become an essential part of the crypto ecosystem.

Studies show that as perpetual trading grows, it has begun to drive price discovery even when spot markets are inactive. Trading volume on perpetual DEXs has surged from $1 billion in July 2021 to $120 billion in July 2024, representing a compound annual growth rate of approximately 393%.

However, perpetual DEXs face bottlenecks due to blockchain performance constraints. To advance further, they must solve two core issues: low on-chain liquidity and high latency. High liquidity reduces slippage, smooths trades, and minimizes user losses. Low latency allows market makers to quote tighter spreads and execute trades faster, improving overall market fluidity.

Pricing Models in Perpetual DEXs

In perpetual DEXs, pricing mechanisms are crucial for ensuring market prices accurately reflect supply and demand dynamics. Different platforms adopt various models to balance liquidity and reduce volatility. Below we explain several major approaches:

Oracle-Based Model

The oracle-based model involves perpetual DEXs sourcing price data from high-volume centralized exchanges. While vulnerable to price manipulation, this method reduces pricing costs. For example, GMX, a decentralized perpetual exchange.

GMX uses Chainlink oracles to ensure price accuracy and integrity, creating a favorable environment for price takers (small institutions and individuals) while offering generous rewards to price setters (large institutions and market makers). However, such oracle-dependent exchanges face a key limitation: they rely heavily on top-tier exchange data and act solely as price takers, unable to lead price discovery.

Virtual Automated Market Maker (vAMM)

Inspired by Uniswap’s AMM model, vAMM differs in that while AMMs provide liquidity and pricing through real asset pools, vAMMs use virtual pools—mathematical simulations without actual deposited assets—to mimic trading behavior and determine prices.

vAMMs support perpetual trading without requiring large capital commitments or linking to spot markets. Currently, platforms like Perpetual Protocol and Drift Protocol have adopted the vAMM model. Despite challenges like high slippage and impermanent loss, vAMMs remain a strong on-chain pricing solution due to their transparency and decentralization.

Classification of perpetual DEX product models

Off-Chain Order Book with On-Chain Settlement

To overcome performance limits of on-chain order matching, some DEXs adopt a hybrid model combining off-chain order books with on-chain settlement. In this setup, trade matching occurs off-chain, while settlement and asset custody remain on-chain. This ensures users retain self-custody of assets. Off-chain matching also significantly reduces MEV risks. This design preserves DeFi’s security and transparency while mitigating MEV, offering users a safer trading environment.

Notable projects such as dYdX v3, Aevo, and Paradex use this hybrid approach. It improves efficiency without sacrificing security, aligning conceptually with Rollup architectures.

Full On-Chain Order Book

A full on-chain order book places all trading-related data and operations entirely on-chain, representing the most robust solution for transaction integrity. While arguably the safest model, it faces clear drawbacks due to blockchain latency and throughput constraints.

Additionally, full on-chain order books are vulnerable to front-running and market manipulation. Front-running occurs when users (often MEV searchers) monitor pending transactions and execute trades ahead of target orders to capture profits. This is common in fully on-chain models since all order data is publicly visible, enabling anyone to devise MEV strategies. Moreover, transparent order books may be exploited—e.g., through large orders—to manipulate prices for unfair gains.

Despite these issues, full on-chain order books remain compelling narratives in decentralization and security. Public chains like Solana and Monad are upgrading infrastructure to support them. Projects such as Hyperliquid, dYdX v4, Zeta Markets, LogX, and Kuru Labs are expanding the scope of full on-chain order books, either innovating on existing chains or building dedicated app-chains for high-performance systems.

Liquidity Sourcing and UX Improvements in DEXs

Liquidity is fundamental to any exchange, but acquiring initial liquidity remains a challenge. In DeFi history, emerging DEXs typically attract liquidity through incentives and arbitrage opportunities. Incentives often take the form of liquidity mining, while market-driven forces involve cross-market arbitrage. However, as DEX numbers grow, individual market shares shrink, making it harder to attract enough traders to reach liquidity’s “critical mass.”

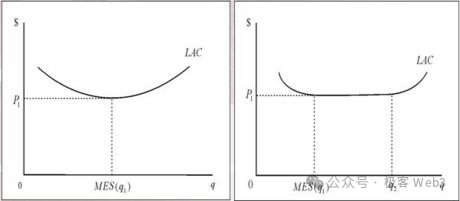

Here, “critical mass” refers to the threshold where a product reaches sufficient scale to surpass minimum viability and achieve long-term profitability. Without reaching critical mass, maximum profitability cannot be sustained; successful products must operate above this threshold. As shown below, the x-axis represents product scale, and the y-axis represents total cost.

Illustration of critical mass

In DEXs, critical mass refers to thresholds in trading volume and liquidity. Only upon reaching these levels can a stable trading environment be provided to attract more users. In perpetual DEXs, liquidity is provided spontaneously by LPs, so a common path to critical mass is establishing LP pools with economic incentives. In this model, LPs deposit assets into a pool and receive rewards for supporting trading activity on the DEX.

To attract LPs, many traditional DEXs offer high annual percentage yields (APY) or airdrops. However, this approach has a flaw: to sustain high APYs and airdrop rewards, DEXs must allocate a large portion of their tokens to liquidity mining. Such economic models are unsustainable and risk triggering a vicious cycle of “farm, dump, sell,” potentially leading to rapid collapse and failure to operate long-term.

To address the challenge of initial liquidity acquisition, two new approaches have recently emerged: community-supported active liquidity vaults and cross-chain liquidity sourcing.

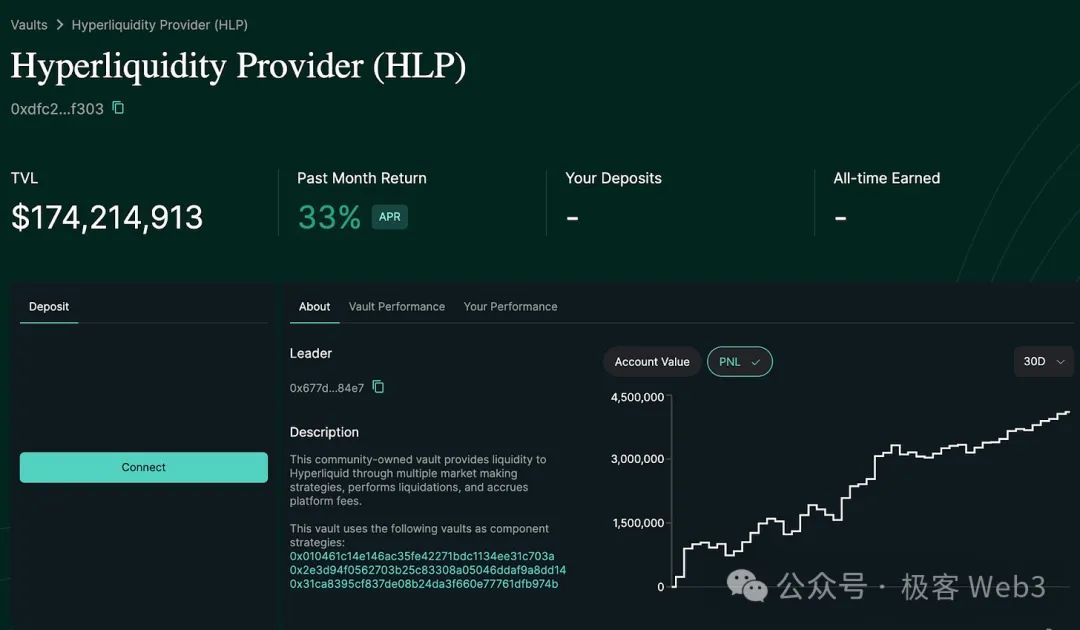

Arbitrum-based perpetual DEX Hyperliquid exemplifies the community-supported active liquidity vault model. The HLP Vault is one of Hyperliquid’s core products, using community-contributed funds to provide platform liquidity. The HLP Vault calculates fair prices by aggregating data from Hyperliquid and other exchanges, executing profitable liquidity strategies across multiple assets. Profits and losses (P&L) generated from these operations are distributed among community participants based on their share in the vault.

Hyperliquid product interface

Cross-chain liquidity provisioning is championed by Orderly Network and LogX Network. These projects enable perpetual trading frontends on any chain and leverage liquidity across all markets. “Cross-market liquidity leverage” refers to integrating and utilizing liquidity resources across multiple markets or blockchains, allowing platforms to source liquidity from diverse chains.

By combining native on-chain liquidity, cross-chain aggregated liquidity, and Discrete Asset Market Neutral (DAMN) AMM pools—which integrate independent assets into market-insensitive portfolios to hedge against volatility—LogX maintains liquidity even during periods of extreme market volatility. These pools use stable assets like USDT, USDC, and wUSDM and leverage oracles to facilitate perpetual trading. This infrastructure also opens possibilities for developing various applications.

LogX Network cross-chain liquidity allocation

In today’s DEX landscape, competition around user experience (UX) is intensifying. In the early days of DEXs, simple UI improvements could significantly enhance UX. As interfaces converge, DEXs now compete through features like gasless trading, session keys, and social logins.

In practice, CEXs often enjoy deeper ecosystem integration, serving not just as trading venues but also as user entry points and cross-chain bridges, while DEXs are typically confined within single ecosystems. Cross-chain DEXs are breaking this barrier—for instance, DEX aggregators consolidate liquidity and pricing data from multiple DEXs into a single interface, helping users find optimal trading pairs and lowest slippage. Think of them as transaction routers.

Many DEX aggregators, such as Vooi.io, are developing smart routing systems that integrate multiple DEXs and cross-chain bridges, delivering seamless and user-friendly trading experiences. These aggregators identify the most efficient trading paths across multiple chains, lowering costs and simplifying execution. Most importantly, users manage complex trading routes through a single, intuitive interface.

Furthermore, Telegram trading bots are increasingly optimizing UX. These bots offer real-time trade alerts, order execution, and portfolio management, all accessible directly within Telegram chats. This deep integration enhances convenience and engagement, helping traders access information and seize market opportunities more easily. However, Telegram bots carry significant risks—users must share private keys, exposing themselves to potential security breaches.

Innovative Financial Products in Perpetual DEXs

Many perpetual DEXs continue launching novel financial products or refining existing mechanisms to better meet evolving trader needs. Below is a brief overview of such innovations.

Variance Perpetuals

Variance is a statistical measure reflecting data dispersion. As the name suggests, variance perpetuals do not trade underlying asset prices but instead bet on the asset’s volatility.

For example, if you expect BTC to experience high volatility but are unsure of direction, you can buy a BTC variance perpetual to speculate on increased price fluctuations. You profit whether BTC surges, crashes, or ranges.

Moreover, variance perpetuals serve hedging purposes. In the above case, if BTC drops sharply, gains from your variance perpetual can offset some losses.

Decentralized perpetual exchange Opyn leverages existing market resources to develop innovative variance perpetual products. These contracts enable complex strategy replication, risk hedging, and improved capital efficiency.

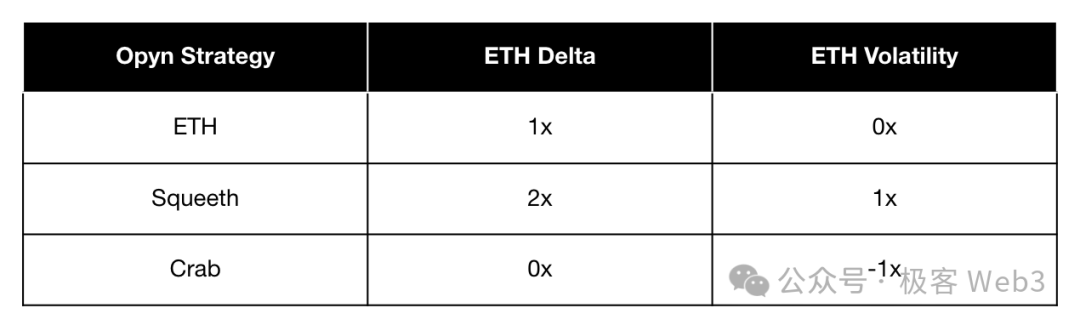

Opyn offers four types of perpetuals: Stable Perps (0-perps), Uniswap LP Perps (0.5-perps), Normal Perps (1-perps), and Squared Perps (2-perps, aka Squeeth). Each serves distinct purposes:

Stable Perps provide a solid foundation for trading strategies; Uniswap LP Perps mirror LP returns without direct liquidity provision; Normal Perps are standard contracts; Squared Perps amplify return potential through quadratic exposure.

These can be combined into advanced strategies. For example, the “Crab Strategy”: short 2-perps and long 1-perps to earn funding fees in stable markets while maintaining balanced directional exposure. Another example, the “Zen Bull Strategy”: short 2-perps, long 1-perps, and short 0-perps to maintain bullish exposure while earning funding income in sideways markets.

Decentralized perpetual exchange Opyn

Pre-Launch Contracts

Pre-launch perpetuals allow traders to speculate on token prices before official listing—an on-chain version of IPO OTC trading—enabling investors to build positions based on anticipated market value. Multiple perpetual DEXs—including Aevo, Helix, and Hyperliquid—have pioneered pre-launch markets. Their main advantage lies in offering exclusive assets unavailable elsewhere, attracting and retaining users.

RWA Asset Perpetuals

RWA asset perpetuals could become a primary pathway for real-world assets to go on-chain. Compared to direct RWA tokenization, launching RWAs as perpetuals is simpler—requiring only liquidity and price oracles. Even without an on-chain spot market, a liquid perpetual market can exist independently. Perpetual trading can thus serve as the first step toward RWA tokenization. Once sufficient attention and liquidity accumulate via perpetuals, spot tokenization can follow. Combining spot and perpetuals for RWAs unlocks new avenues for sentiment prediction, event-driven trading, and cross-asset arbitrage. Currently, companies like Ostium Labs and Sphinx Protocol are emerging leaders in RWA contracts.

ETP Perpetuals

ETPs track the performance of underlying assets or indices, with value derived from reference assets such as stocks, bonds, commodities, currencies, or baskets. Common ETPs include:

-

ETF: Tracks specific indices or sectors.

-

ETN: Bond-like instruments whose returns are linked to index or asset performance.

-

ETC: Focuses on commodities, tracking price movements.

Perpetuals can also underlie ETPs holding expiring futures, such as ETF—USO (WTI crude oil futures) or ETN—VXX (S&P 500 VIX futures). Without rollover needs, ETP perpetuals reduce trading costs and lower net asset value (NAV) decay risk. For firms needing long-term economic exposure without physical delivery, perpetuals significantly cut operational costs.

Additionally, for entities facing restrictions on foreign exchange speculation or hedging, 30-day or 90-day forwards are commonly used. These OTC instruments are non-standardized and risky. Perpetuals settled in USD can replace them, simplifying operations and reducing risk.

Prediction Markets

A prediction market is a financial sub-sector where participants trade and bet on future event outcomes, such as election results, sports outcomes, or economic indicators.

Perpetual DEXs can revolutionize prediction markets by offering flexible, continuous trading mechanisms—especially valuable for irregular events like elections or weather forecasts. Unlike traditional prediction markets dependent on real-world events or oracles, perpetuals allow markets to be built on continuously updated market data.

This brings clear benefits: continuous data updates enable the creation of multiple sub-markets within long-term predictions. For example, during elections, sub-markets could emerge around shifts in candidate support after specific debates. Sub-markets allow users to trade based on short-term fluctuations—such as news events or data releases—without waiting for final outcomes. This creates short-term trading opportunities and immediate user satisfaction.

Continuous real-time settlement ensures market stability, boosts liquidity, and increases participation. Furthermore, community-governed perpetual markets use reputation and token incentives to encourage involvement, laying the groundwork for decentralized prediction markets. This democratizes market creation and offers scalable solutions for diverse forecasting scenarios.

Future Outlook for Perpetual DEXs

As the crypto financial system evolves, perpetual DEX designs continue to improve. The future focus may shift beyond merely replicating CEX features toward leveraging unique decentralized advantages—transparency, composability, and user empowerment—to build entirely new functionalities. Ideal perpetual DEX designs will strike a delicate balance between efficiency and security.

Moreover, perpetual DEXs are increasingly emphasizing community and developer engagement, using incentive mechanisms to foster user belonging and loyalty. Community-led initiatives—like using Hyperliquid bots for market making—enable broader, fairer participation in trading, truly realizing the inclusivity of decentralized trading.

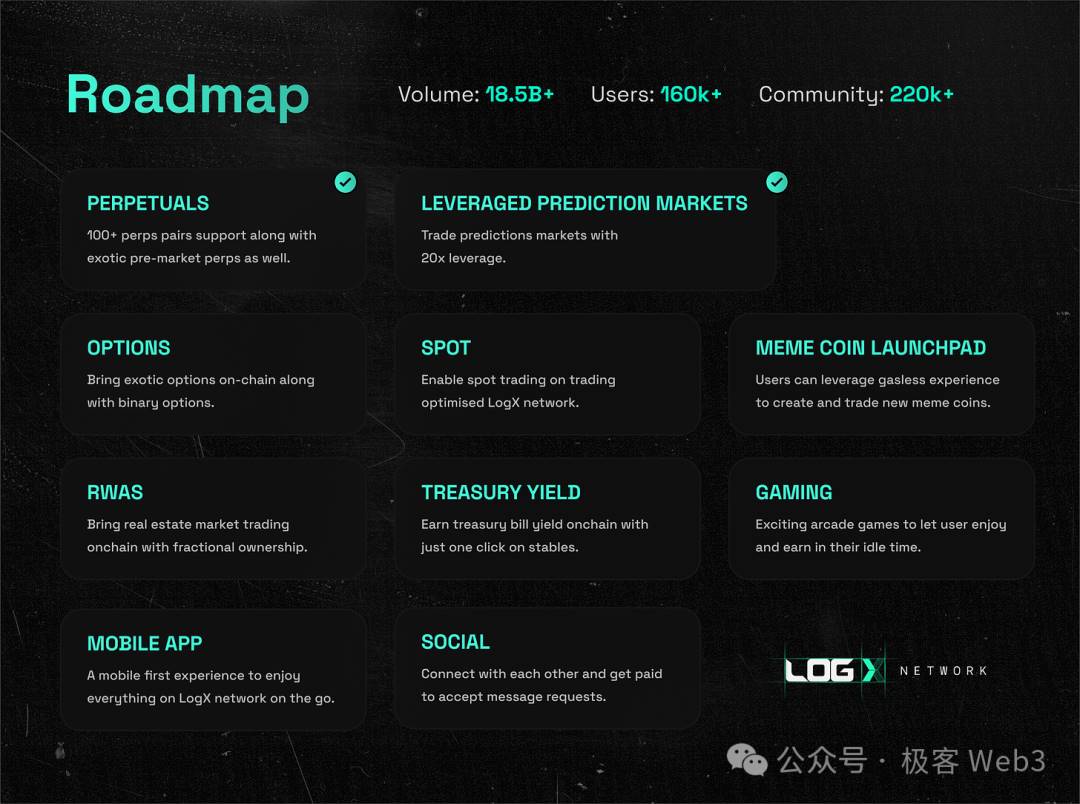

To drive crypto mass adoption, building integrated, iOS-like platforms with exceptional UX is crucial. This requires developing more intuitive interfaces and ensuring seamless user flows. Platforms like Hyperliquid, LogX, and dYdX are already expanding beyond finance into domains like elections and sports, offering new pathways for mainstream crypto participation.

Roadmap of LogX Network

Over the past decade, DeFi innovation has centered on DEXs, lending, and stablecoins. In the next decade, DeFi may converge with news, politics, sports, and other fields, evolving into widely used tools that accelerate crypto mass adoption.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News