Perhaps the most valuable application of cryptocurrency is creating new speculative markets.

TechFlow Selected TechFlow Selected

Perhaps the most valuable application of cryptocurrency is creating new speculative markets.

This article discusses the development prospects of the presale field, as well as the diversity and challenges of market products.

Author: 2lambro

Translation: Baicai Blockchain

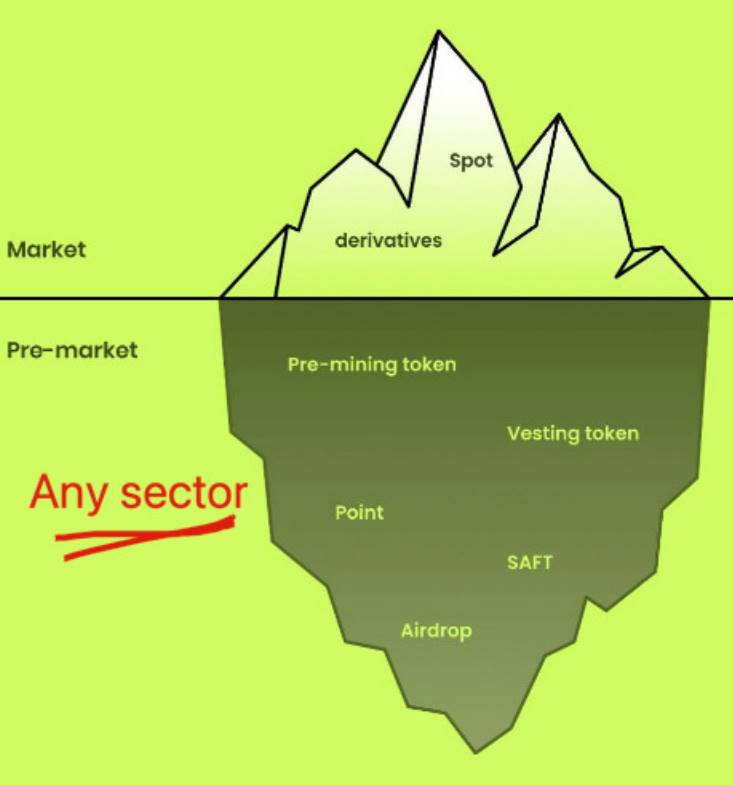

In the cryptocurrency space, presales and tokenization applications have not yet received significant attention. This article will explore recent developments in the presale domain, analyze the pros and cons of various project offerings, and make predictions about future trends.

1. Thoughts and Predictions on Presale Applications

Uniswap enabled speculation on tokens, Pendle.fi facilitated yield and points speculation, and OpenSea drove digital art speculation. So what about presale tokens, airdrops, SAFTs, and points? Below are my thoughts and predictions on presale application platforms:

Launching price discovery and trading for assets on your platform reveals limited functionality—this constraint itself becomes a strong moat and business model.

pumpdotfun is a uniquely structured memecoin launcher designed for memecoin price discovery, currently holding a total value of 543k SOL ($85 million).

FjordFoundry has earned $20 million in fees from its LBP platform through a 2% swap fee.

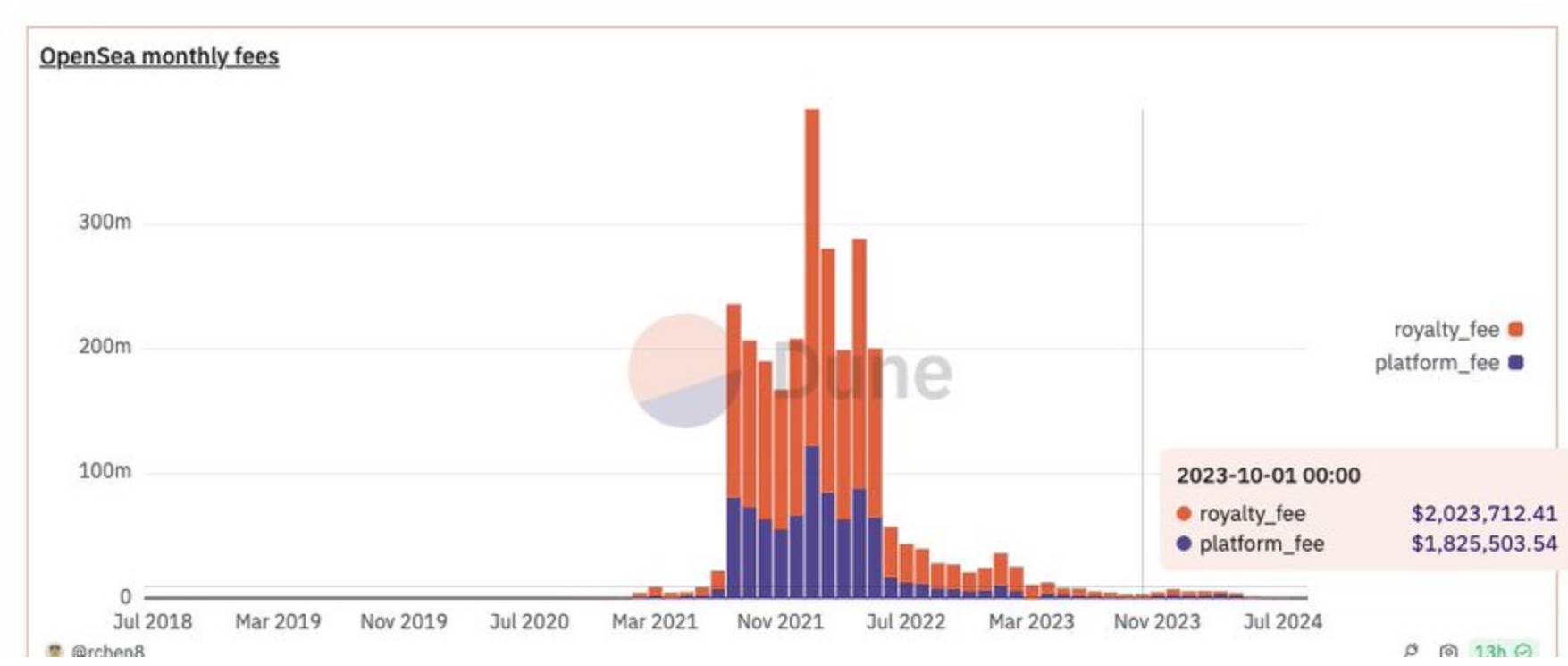

While I've always believed most crypto revenues aren't sustainable—since these fees often rely on speculative activity that may be temporary—for example, OpenSea's revenue is now 100x lower than its NFT bull market peak (due to fading NFT enthusiasm and increased competition from other marketplaces):

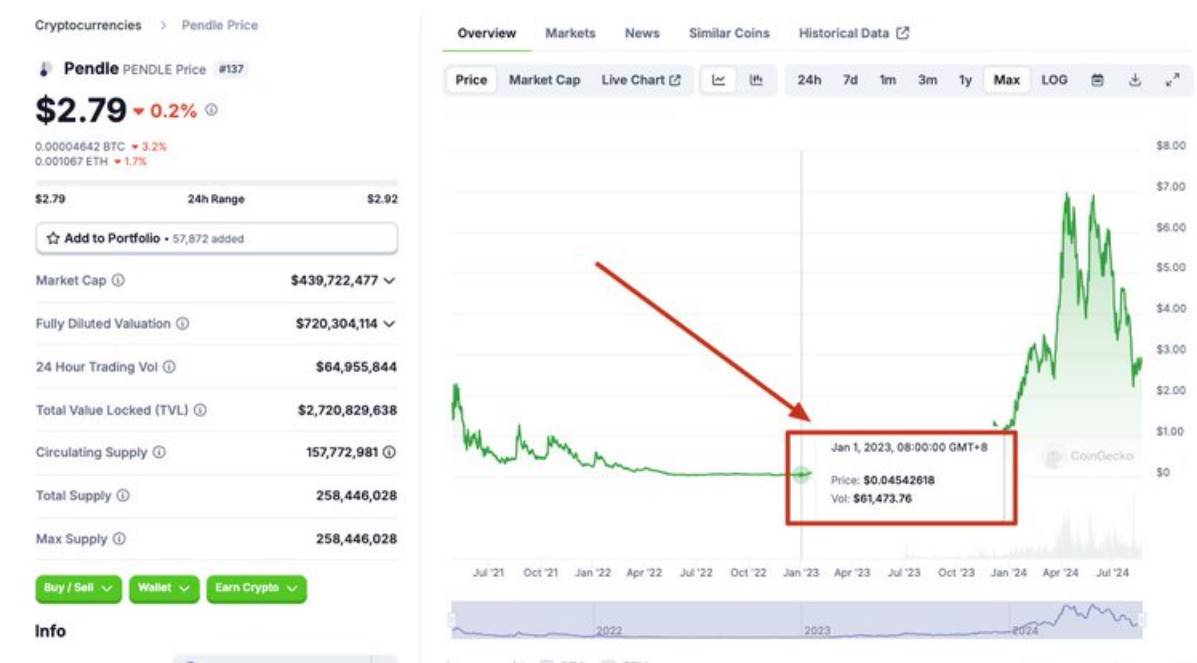

However, given Pendle’s success in finding product-market fit within the yield market (and clearly adapting to the points market as well), I’ve decided to dive deeper into the presale space for several reasons:

1) The presale market is domain-agnostic for illiquid or pre-token assets, encompassing markets such as LRT tokens, DeFi, social finance, and more.

2) It has strong retail appeal and high user engagement. Once product-market fit is achieved (see Pendle), it becomes easier to sequentially launch multiple products and conduct effective marketing.

3) Drives ecosystem development

4) I'm tired of infrastructure and fork projects raising funds at high valuations

5) I still believe in trying and exploring everything new—this approach has paid off handsomely for me in the past

2. Current Product Landscape

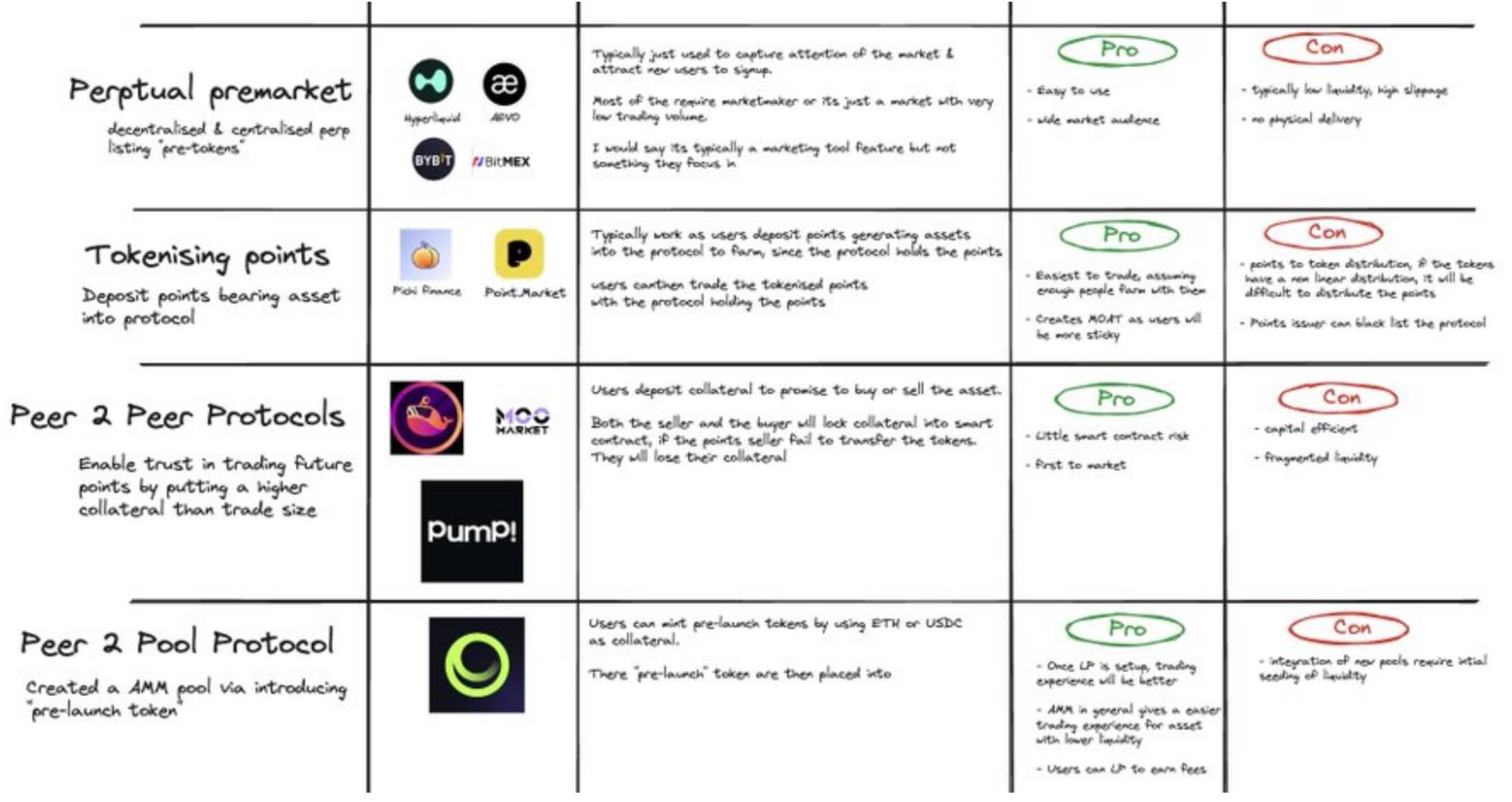

The current offerings in the market include:

1) Perpetual DEX presales

HyperliquidX

aevoxyz

Bybit_Official

BitMEX

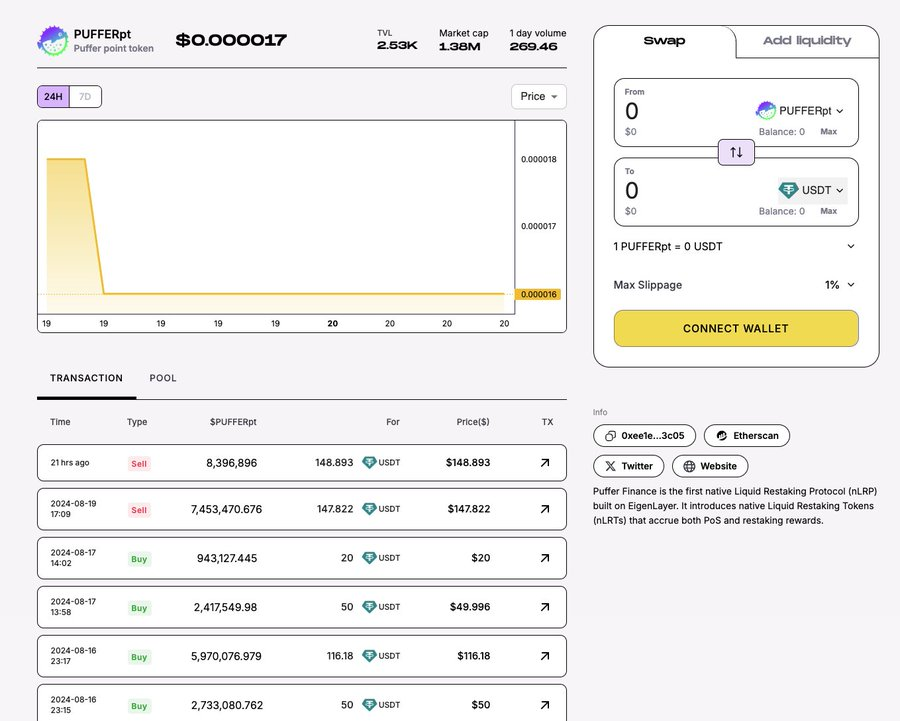

2) Tokenized Points

PichiFinance

PointMarket_NOW

3) Peer-to-Peer Protocols

WhalesMarket

MooMarketplace

pumpmarkets

4) Pool-Based Protocols

BubblyFinance

5) Perpetual DEX Presales

Most orderbook-based perpetual DEXs can technically list any presale token, but actual trading experience depends heavily on market makers and order book depth.

Currently, this is often just a gimmick to attract new users or allow small investors to "hedge airdrops."

As you can see:

24-hour volume is only around $7K, with open interest at just $350K—you could easily move prices with just a few thousand dollars.

From a user perspective, this isn't very practical because you must continuously pay funding rates to maintain risky positions.

Volumes typically spike within 24–48 hours after the official token launch.

6) Tokenized Points

PichiFinance

PointMarket_NOW

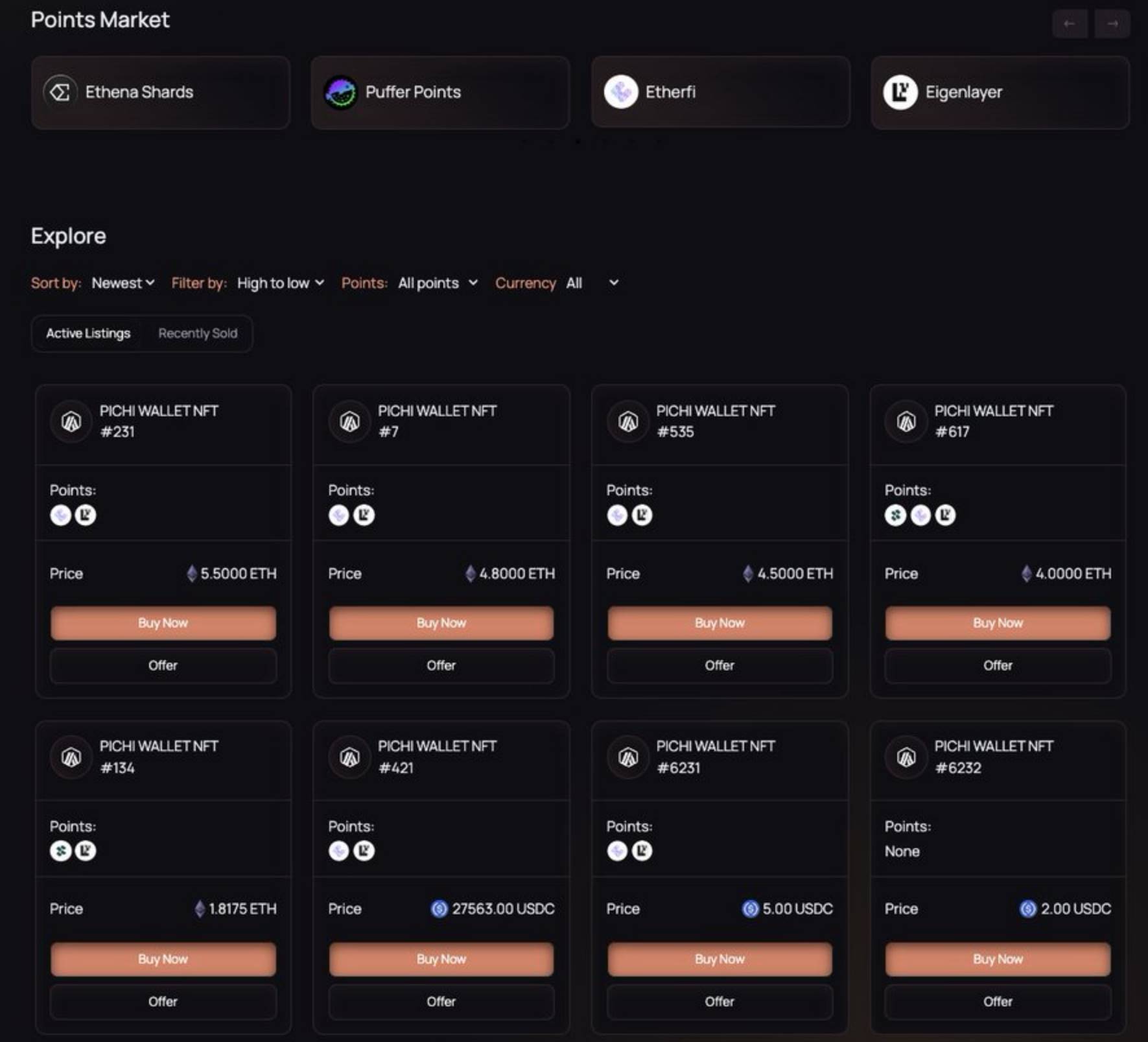

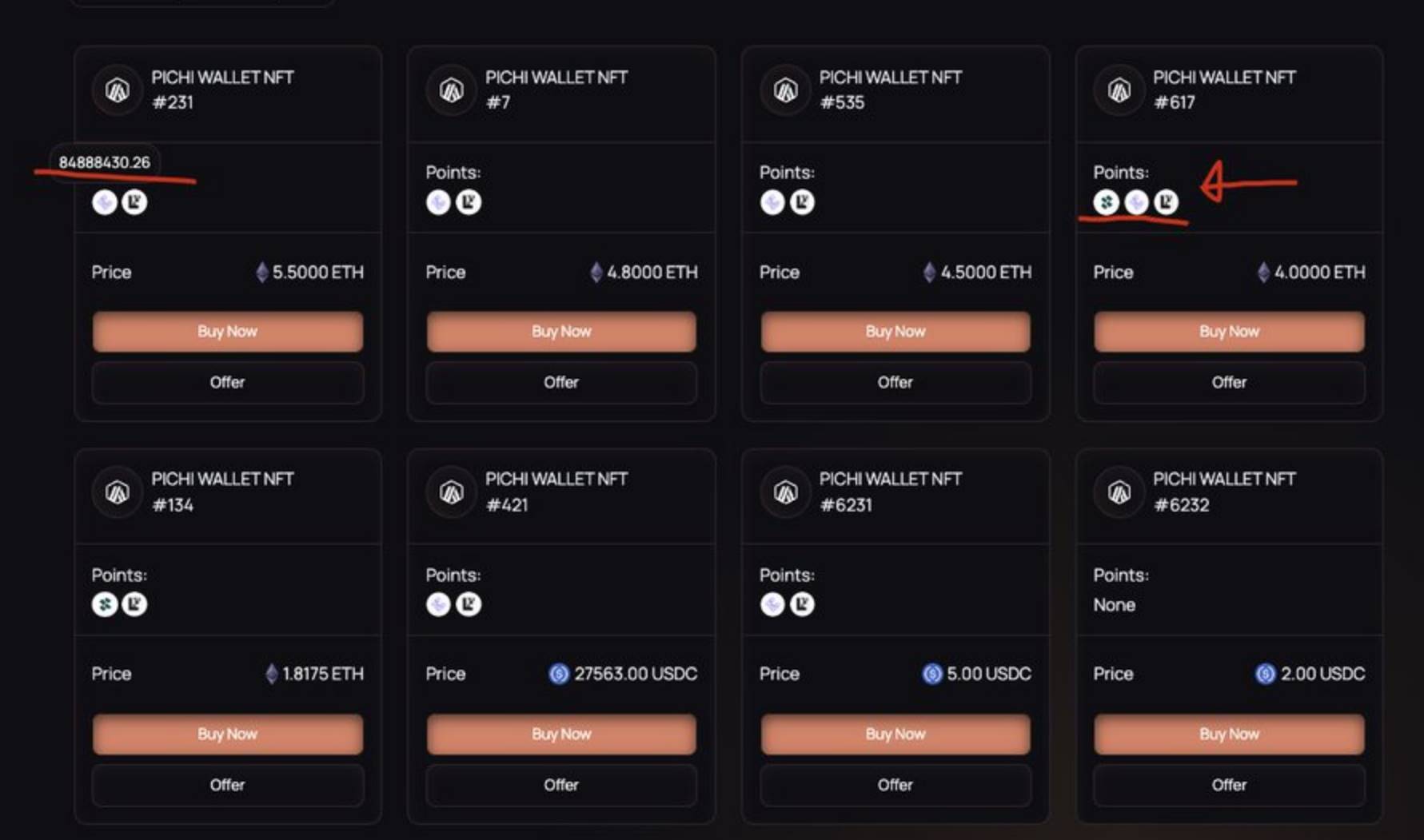

In simple terms, these usually work by having users deposit their "farming" assets into the protocol. The protocol performs yield farming on their behalf and, since it holds the points, allows users to trade them.

For PichiFinance, users can deposit point-generating assets (like ETH) into their protocol and farm points.

Each position is an NFT that can be traded.

A key advantage of this design is avoiding disputes upon settlement if the airdrop is non-linear.

For example, 10 points get 10 tokens, but 100 points get 50 tokens.

However, similar to NFT trading, the user experience may not be smooth, as users need to select NFTs with varying point balances and prices—they're essentially buying entire "wallet" NFTs.

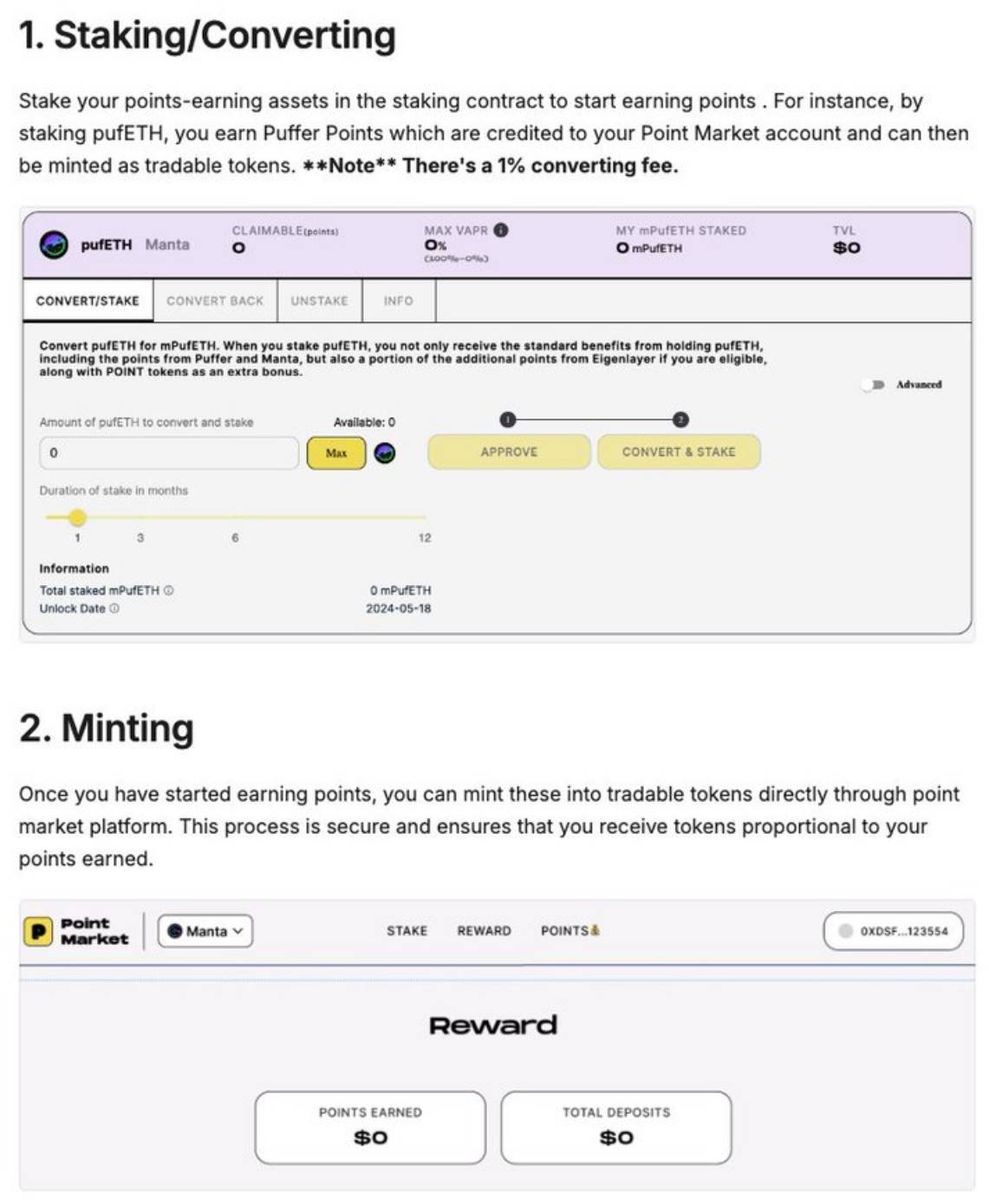

For PointMarket_NOW, users deposit assets, and the mined points are minted into tokens.

Once points are converted into tokens, they can be swapped or used to provide liquidity. However, I’m unsure how they’ll handle non-linear airdrops.

7) Peer-to-Peer Protocols

WhalesMarket

MooMarketplace

pumpmarkets

Simply put, users deposit collateral to commit to buying or selling assets. Both buyers and sellers lock collateral into smart contracts.

If a points seller fails to deliver tokens at contract expiry, they lose their collateral.

Whales Market was the first to launch this design; the other two protocols have very similar structures.

Mechanically, this design carries almost no smart contract risk, but capital efficiency is extremely low, as users must lock up more collateral than the value of their position.

Some airdrop trading platforms have simply "canceled" OTC deals, significantly damaging user trust.

Additionally, prices were distorted, and many airdrops faced delays, causing severe losses.

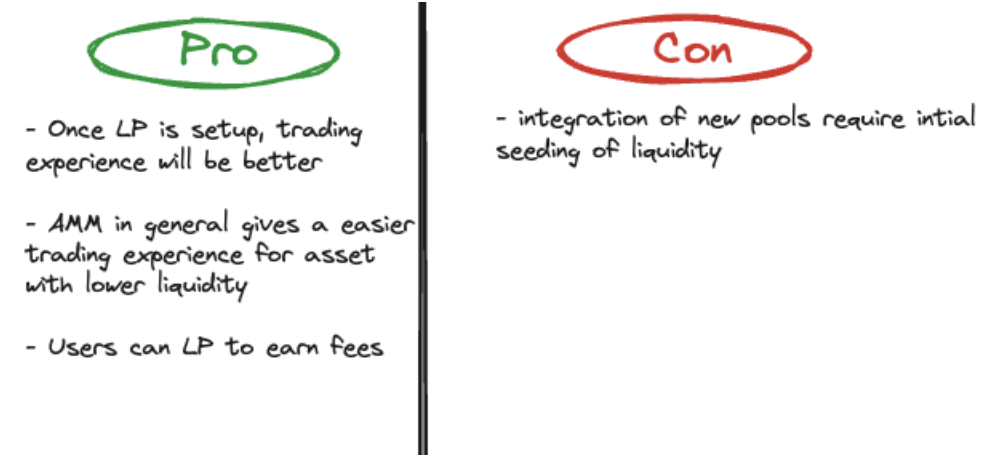

8) Pool-Based Protocol: BubblyFinance (Not Yet Launched)

In short, it allows users to mint "pre-issue tokens" using USDC or ETH, which can then be swapped or used to provide liquidity in pools.

You can think of it as Whales Market but with an automated market maker (AMM) layer.

Like more established tokens, AMMs offer better trading experiences for traders but require initial liquidity bootstrapping.

However, because it trades pre-issue tokens rather than points, it avoids non-linearity issues altogether.

3. Pros and Cons of Current Products

Finally, let’s summarize the different designs and their strengths and weaknesses:

1) Perpetual DEX Presales

Pros: Easy to use, supports leveraged trading

Cons: Requires market makers; thin order books lead to poor trading experience

2) Tokenized Points

Pros:

-

Strong network effects once adopted—they effectively hold users’ total value locked (TVL), creating a moat;

-

Higher capital efficiency—no collateral required;

-

No losses due to non-linear airdrops since users buy entire wallets.

Cons: Fragmented liquidity and poor trading UX—for instance, there might only be a wallet worth 1000 points, but you only want 800 points;

User acquisition is difficult since users must deposit into your smart contract to farm.

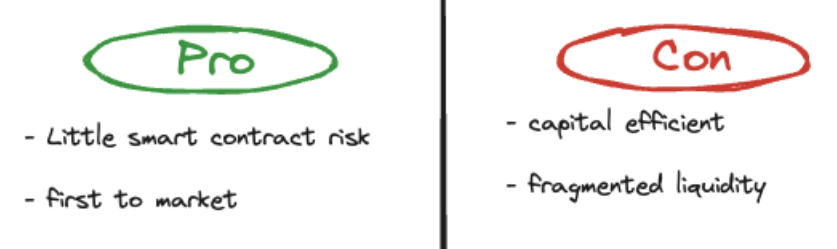

3) Peer-to-Peer Protocols

Pros: First-mover advantage, users are already familiar

Cons:

-

Low capital efficiency;

-

Liquidity fragmentation leads to poor trading experience

4) Pool-Based Protocols

Pros:

-

Improved trading experience for users;

-

Users can speculate on future token prices without needing to farm points;

-

Better capital efficiency compared to peer-to-peer models

Cons: Requires initial liquidity injection to bootstrap the system

From a pure user perspective: If I were a yield farmer, I’d prefer using Pichi Finance to farm and then sell my position.

Assuming active secondary market trading, farming directly here gives me more flexibility as a farmer.

If I wanted to hedge my airdrop exposure, I might use perpetuals—but I’d worry about getting liquidated due to massive price spikes during initial token distribution.

If I’m bullish on a token, I’d buy it from Bubbly (assuming sufficient liquidity at launch), since I can easily check liquidity depth and avoid funding rate costs.

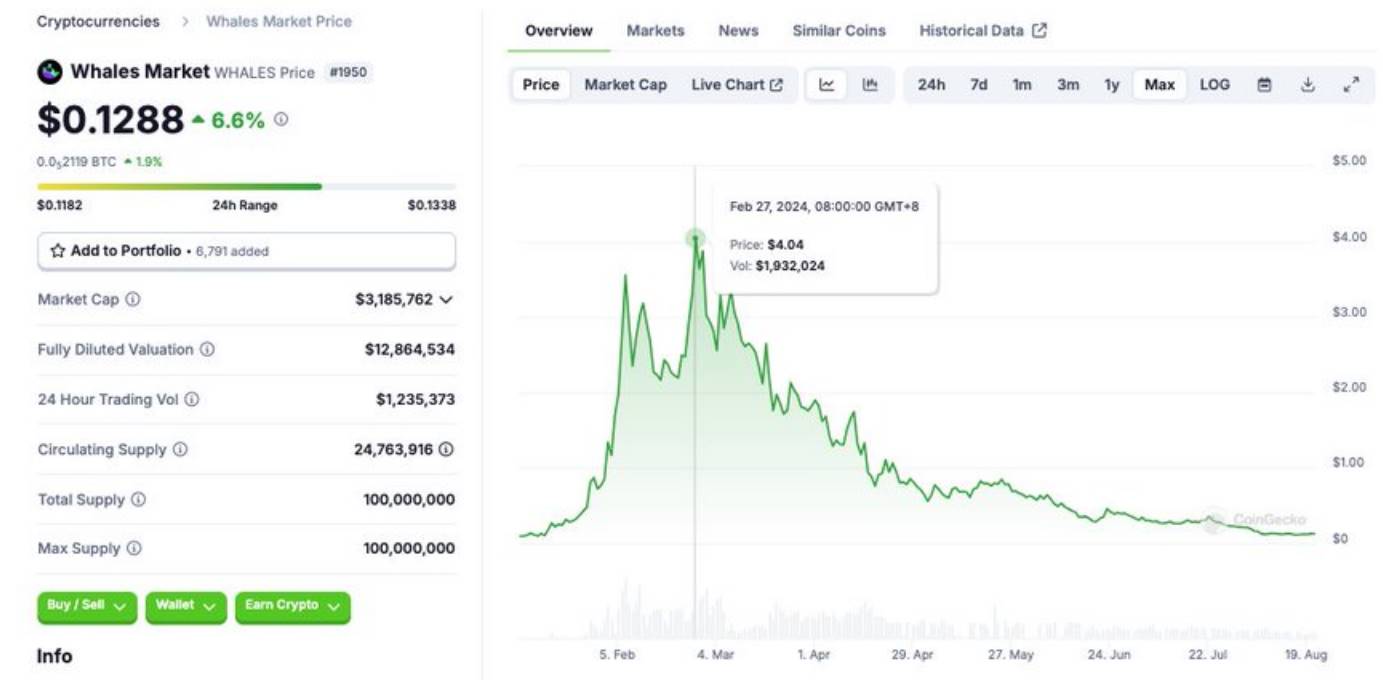

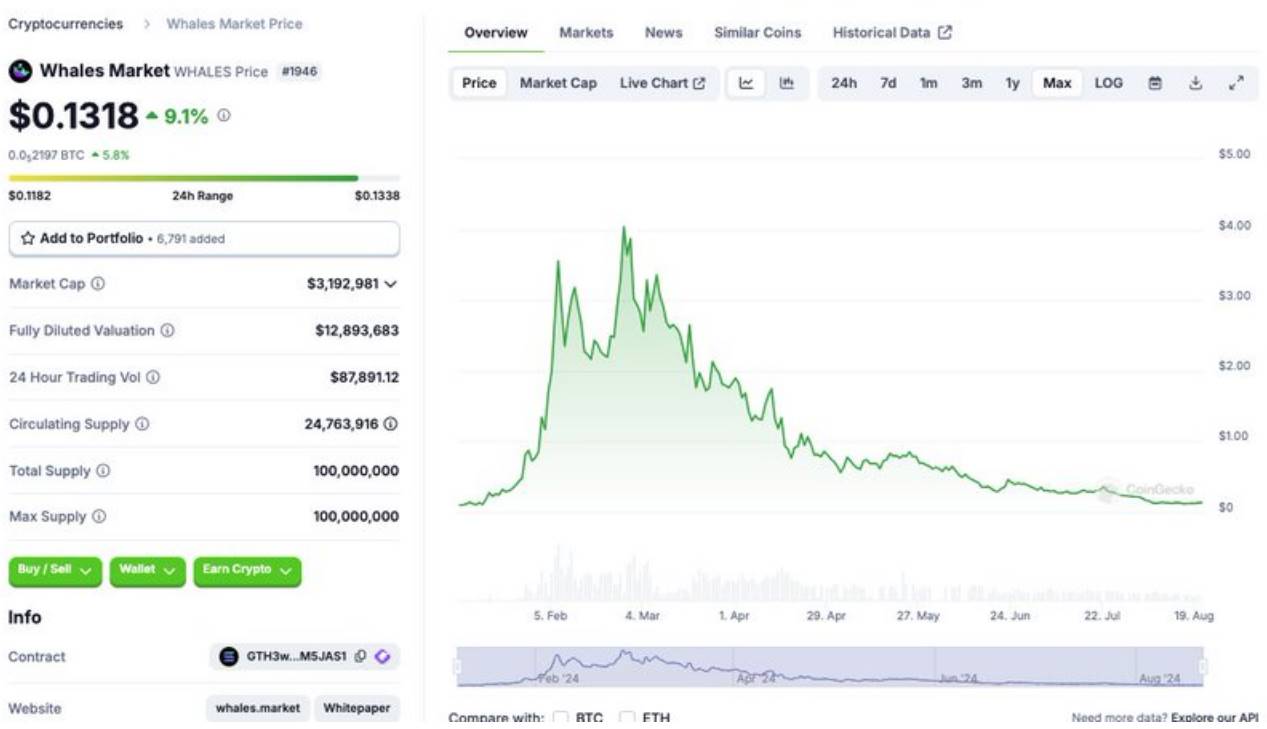

5) Valuation of Tokens

Overall, valuations are primarily driven by Whales Market. This is a relatively small market, possibly too niche to warrant investment or attention.

Yet, I firmly believe that enabling price discovery and trading for a limited set of assets on a platform creates a powerful moat and viable business model.

Who would have thought a memecoin launcher could earn so much? Or that FjordFoundry could charge such high fees?

This is still a very young space, but don’t forget—many people dismissed yield trading markets in 2023. Haha.

In such niche sectors, I’ll be watching closely for:

-

Team execution capability

-

Consistent updates and communication

-

Ability to adapt strategies or even anticipate market shifts

This is a lesson I learned from observing Pendle’s growth over the past two years.

Overall, I don’t think it’s wise to jump into micro-cap coins right now, but we should keep an eye on emerging niches that could gain traction.

There are already too many top-tier projects that have issued points but haven’t launched—or are about to launch—their tokens. When the micro-cap season arrives, perhaps in 3 to 6 months,

Can pre-issue tokens capture market momentum?

Even if not, points won’t disappear, nor will airdrops. There will only be more tokens and more illiquid assets available for trading.

In any case, sharing some thoughts on under-discussed areas.

Full transparency: I’m an early investor in Pichi and Bubbly Finance. I plan to dive deeper into more obscure niches—if you have any ideas, tag me or DM me!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News