Throwing Money ≠ Growth: What Did Arbitrum's $85 Million Ecosystem Incentive Program Bring?

TechFlow Selected TechFlow Selected

Throwing Money ≠ Growth: What Did Arbitrum's $85 Million Ecosystem Incentive Program Bring?

Supply-side incentives are equivalent to burning money.

Author: Kerman Kohli

Translation: TechFlow

Imagine you're a business launching a promotion offering $3 in value for every $1 spent—and anyone can claim it, no conditions attached. Whether it's your grandmother, a homeless person on the street, a high-earning executive, or an average middle-class individual, everyone qualifies.

What do you think would happen? Well, those who need money most—often the least likely to become repeat customers—would flood in and quickly drain your funds or inventory until you could no longer sustain the offer.

The good news is that in the real world, free markets swiftly eliminate such unsustainable businesses.

The bad news is that in crypto, this actually happens—and free markets keep pouring capital into it.

Introduction

The scenario above is essentially what Arbitrum did, involving $85 million in funding and ultimately resulting in a $60 million loss. Let’s dive into what this program was, how it was structured, and what lessons we can draw from it.

The Arbitrum DAO somehow designed this scheme to distribute ARB tokens to specific sectors and their respective applications as incentives for users to engage on their platforms. The ultimate goal was to increase usage of these platforms, thereby generating more fees for the Arbitrum network and benefiting the underlying protocols. It turns out one side won, while the other did not (and I suspect you already know who lost).

This analysis is quite high quality, with appropriate methodological rigor. Credit to the Blockwork team for clearly explaining their rationale, approach, and execution.

You can view the results here.

Methodology

From a high-level perspective, the initiative can be broken down into two main components:

1. Establishing a baseline to measure what percentage of observed activity can be attributed to the incentives versus normal behavior. They refer to this as the "synthetic control" method, which involves some sophisticated mathematics. This isn't crucial to grasp in detail because regardless of our final numbers, we must downward-adjust them—after all, not all outcomes can be solely attributed to this single effort. You can read more about this in the original forum post.

2. Incentivizing end-users of various applications across different domains on Arbitrum by distributing ARB tokens to boost key metrics. Three domains were selected: perpetual contracts, decentralized exchanges (DEXs), and liquidity aggregators. Each application received guidance on how best to utilize these incentives.

I found several interesting excerpts worth sharing here for your own judgment:

-

"Many protocols missed multiple biweekly reports, or didn’t publish any at all. Approximately 35% of STIP recipients failed to submit final reports."

-

"When applying for STIP, protocols rarely provided rigorous justification for why they should receive a certain amount of incentives. Instead, final allocations often resulted from iterative discussions between the protocol and the community, leading to decisions that resembled 'We feel this request is too large/small'."

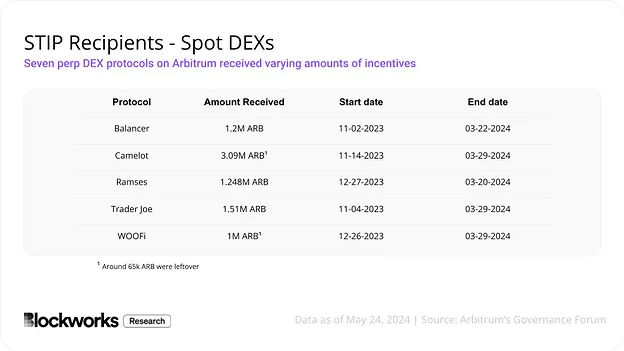

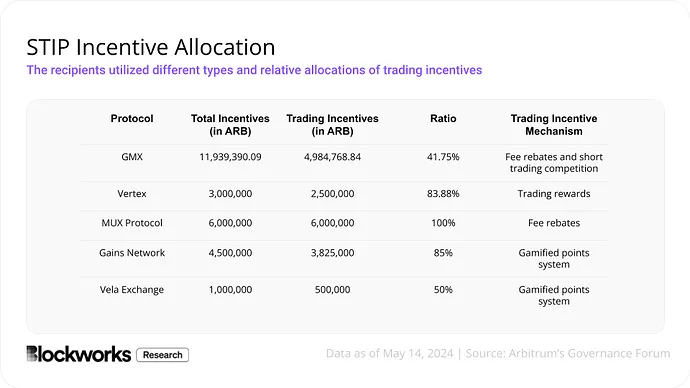

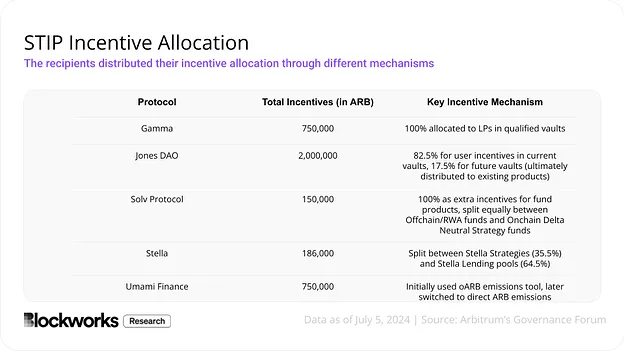

In summary, below are screenshots categorizing spending amounts and mechanisms (no methodology screenshot for DEXs, but essentially they just incentivized liquidity). Keep in mind that 1 ARB is roughly equivalent to $1. So yes, millions of dollars were distributed here.

Results

I'll divide the results into two parts, since the experiment aimed to evaluate two aspects:

1. The impact of these incentives on application-level metrics

2. The impact on sequencer revenue

We’ll start with the first, as it presents a slightly more positive story. If we go back to first principles: if someone gives you free money to run promotions for your business, what do you expect to happen? Typically, business improves—at least temporarily. And that’s exactly what we observe overall in this experiment.

Starting with spot DEXs, surface-level results appear quite strong:

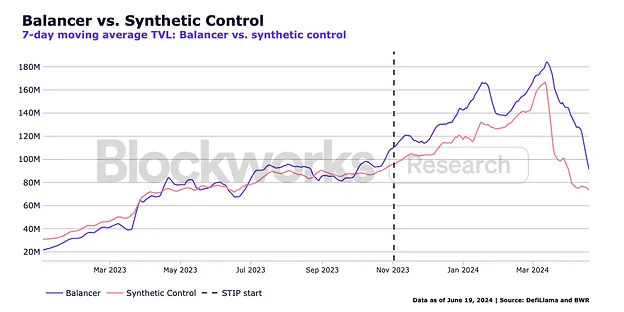

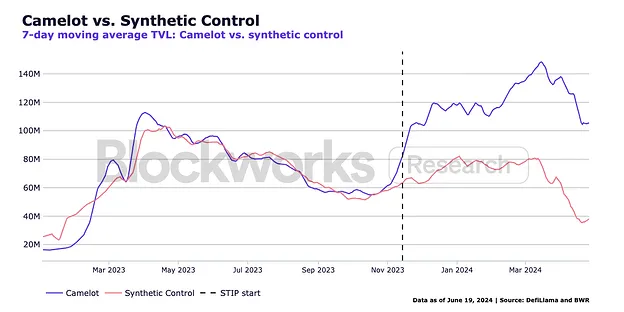

Essentially, we see that for every dollar spent, TVL (total value locked) increased between $2 and $24, which sounds impressive. However, we must ask a critical question—how much of this was retained? This is where things get tricky. Balancer’s TVL dropped back down after incentives ended, clearly visible in this chart:

Camelot, however, successfully retained its TVL! I'm not sure why there’s such a difference in retention between these two protocols, but if I had to guess, it likely relates to how each ran its incentive program and the type of users they attracted. This is something I’ve flagged for deeper analysis in future articles.

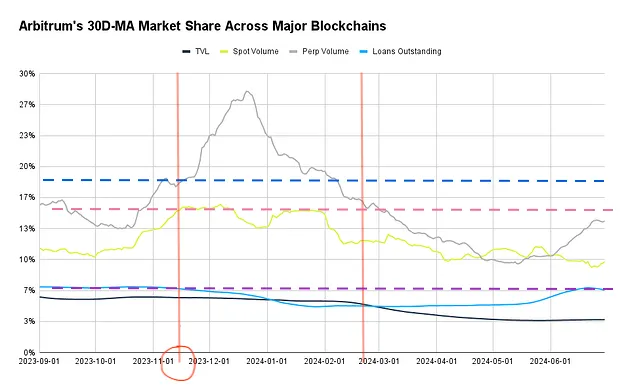

Now that you've seen some micro details, let’s zoom out to understand the broader effectiveness across applications, focusing on three top-level metrics: spot trading volume, perpetual trading volume, and loans. Here's the key chart—with annotations I’ve added to help guide your understanding. Follow along.

-

I’ve drawn two red vertical lines marking the start and end of the program, helping us contextualize the timeframe.

-

Then, I added several horizontal lines to track different metrics and visualize the program’s impact over time:

-

The first blue line shows a sharp spike in TVL (undoubtedly), but it then nearly collapses back to pre-program levels—indicating almost zero stickiness!

-

The second line represents spot trading volume. Pause here: unlike TVL (a supply-side metric), spot volume reflects demand. As we can see, demand was flat at best—and actually declined toward the end of the program!

-

The third line shows outstanding loans—a demand-driven metric as well—but it remained unchanged. While no lending protocols were directly incentivized, I consider this another strong indicator of user demand. In fact, it trended downward throughout the entire program!

-

So what can we conclude from all this? Essentially, Arbitrum spent $85 million subsidizing other businesses to boost their supply-side metrics (which clearly worked), but without corresponding demand to absorb the increased TVL and tighter liquidity, these efforts proved futile. In effect, you could say the money was wasted—funneled to yield farmers chasing short-term gains. At least some protocols saw higher TVL and token prices, making certain participants richer in the process.

Now, regarding demand-side metrics: surely these activities benefited the chain and led to increased transaction revenue, right?

Actually, no.

Reality looks nothing like that.

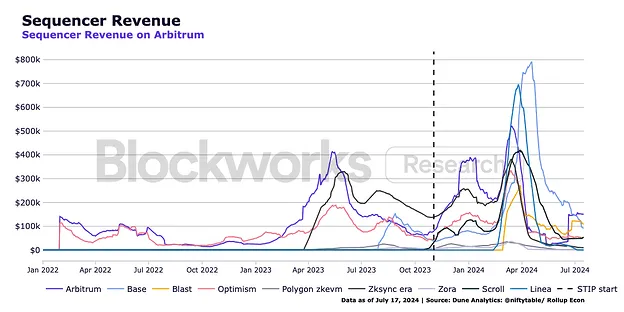

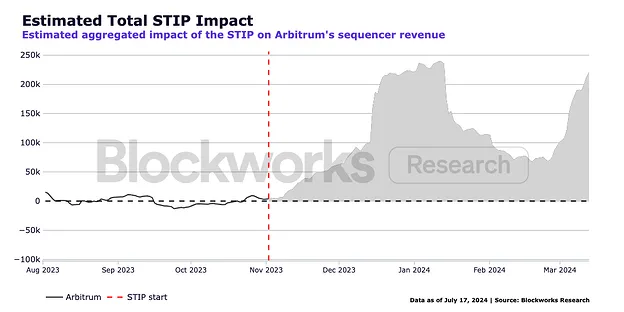

This is the sequencer revenue chart from January 2022 to July 2024. The large spike around April coincides with the beginning of a major crypto rally, and synthetic control helps adjust for that.

On the surface, we see revenue rising, peaking at $400,000 per day in certain months. Here’s a cleaner version isolating Arbitrum’s performance with synthetic control applied:

So what’s the area under the curve? $15.2 million. Without synthetic control, total sequencer revenue was $35.1 million. Given that $85 million was spent, we’re still far short of breaking even!

Key Takeaways

To summarize everything discussed:

-

Arbitrum decided to spend $85 million to incentivize network activity, aiming to grow market share and revenue.

-

This was done by distributing free tokens to apps and protocols, who passed them on to end-users.

-

Analysis revealed these free tokens primarily boosted supply-side metrics, with little to no change in demand-side activity.

-

A deeper look showed that the sequencer revenue generated from all this activity fell $60 million short of expenditures.

My takeaway: Supply-side incentives are equivalent to burning money—unless you have a genuine supply-side constraint, you should avoid them (and usually, the real bottleneck is on the demand side).

Secondly, recall the premise I introduced at the beginning: if you hand out funds indiscriminately to strangers without understanding who they are or why they’re participating, you’ll inevitably get poor outcomes. Protocols that keep distributing capital to users without knowing their identity or intent will end up exactly where this article describes.

Now imagine if this incentive program had used wallet-based, permissionless identity to determine eligibility, setting criteria such as:

-

Does this user genuinely use DEXs, or is this a brand-new wallet?

-

What is the wallet’s net worth? Is it a potentially valuable user?

-

How much has this wallet paid in fees? Do they consistently use the platforms they engage with?

-

Is this address interacting with every new token launch? They might be a bounty hunter.

Do you think the outcome would have been different?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News