Deep Dive into Maker, the World's First Fair Global Financial System

TechFlow Selected TechFlow Selected

Deep Dive into Maker, the World's First Fair Global Financial System

Maker is a decentralized stablecoin protocol founded by Rune Christensen. As real-world assets become tokenized and institutionalized, Maker has emerged as a giant in the Ethereum DeFi space—complex yet robust and resilient, with substantial revenue streams.

Authored by: 0xkyle, Jimmy Zheng, Alex

Translated by: Baicai Blockchain

1. Introduction

Founded in 2014 by Danish entrepreneur Rune Christensen and officially launched on the Ethereum network in 2017, Maker is a credit protocol featuring DAI, a decentralized stablecoin. This simple concept has evolved over ten years into the world's largest decentralized stablecoin. With over $10 billion in total value locked (TVL), Maker is currently one of the giants in Ethereum DeFi.

We believe that as a foundational asset, Maker stands to benefit significantly from the growing institutionalization of the digital world. Its core idea is straightforward: with the launch of Bitcoin and Ethereum ETFs, and the tokenization of real-world assets, Maker sits at the intersection of institutional adoption and DeFi.

However, as a protocol, Maker is notoriously complex, and most analyses focus only on high-level overviews. At Artemis, we believe the world is moving toward increasingly first-principles-driven understanding. Therefore, this article aims to build a thesis grounded in fundamentals—first truly understanding Maker’s mechanisms, then building an investment case around them.

*Note: In this article, "Maker" refers to the general protocol, while "MakerDAO" refers to the decentralized autonomous organization (DAO) that governs the Maker protocol.

2. Understanding Maker

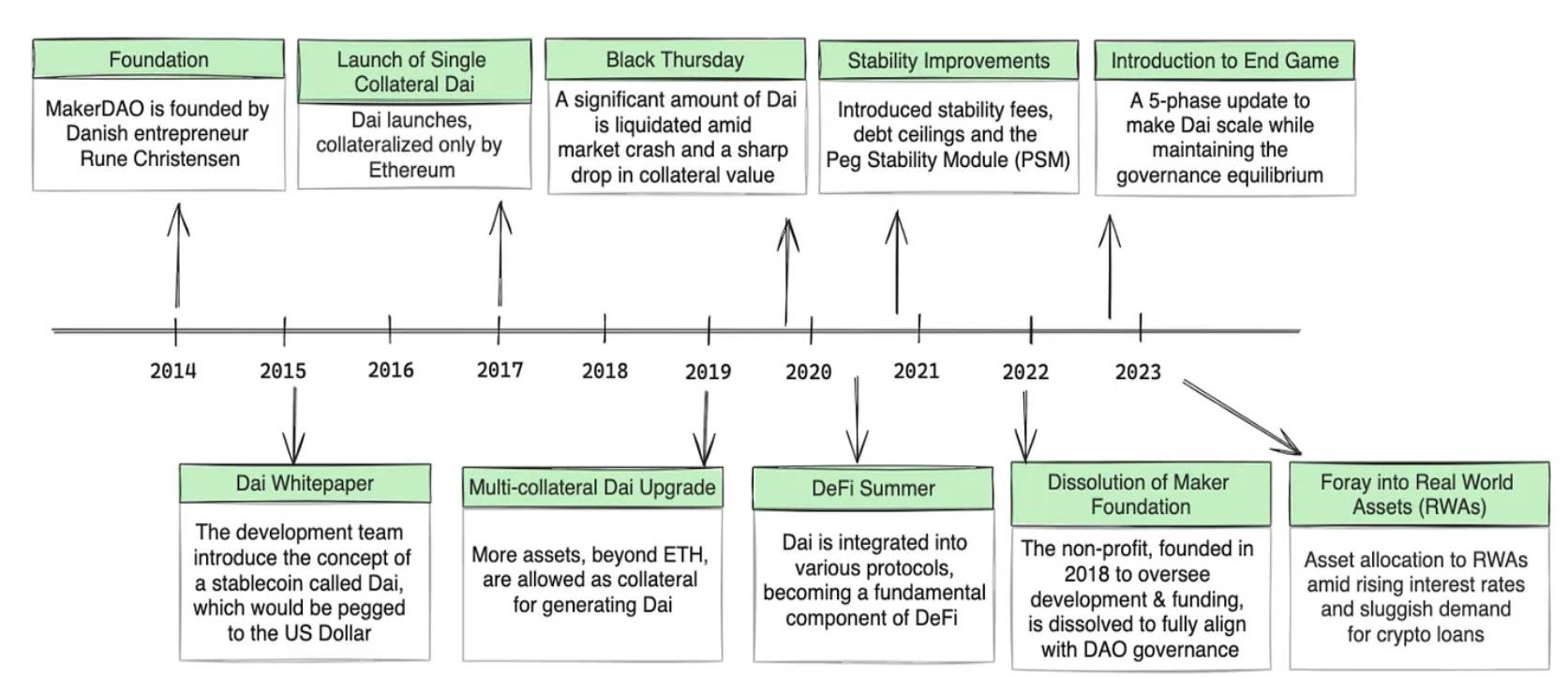

1) Maker’s History

Before diving in, it’s worth exploring Maker’s background. MakerDAO was founded in 2014 as Rune Christensen’s vision for a more transparent and accessible financial system. After losing his funds in the Mt. Gox collapse, he set out to create a more stable alternative to volatile cryptocurrencies—thus founding Maker.

In 2017, DAI was officially launched—a USD-pegged, DAO-managed decentralized stablecoin. In its first year, despite Ethereum’s price dropping over 80%, DAI successfully maintained its peg. Over the next seven years, Maker demonstrated resilience through full market crashes, such as Black Thursday in 2020, when the entire crypto market lost a third of its value.

Christensen’s leadership has been undeniably central to Maker’s antifragility: his ability to navigate challenges and guide the protocol has been crucial to its success. Even today, he continues to contribute to MakerDAO’s strategic direction, proposing Maker’s “Endgame” plan. He remains steadfast in his belief in a decentralized future, saying he looks forward to “the day I’m no longer needed.”

Maker’s history – Source: Steakhouse Finance

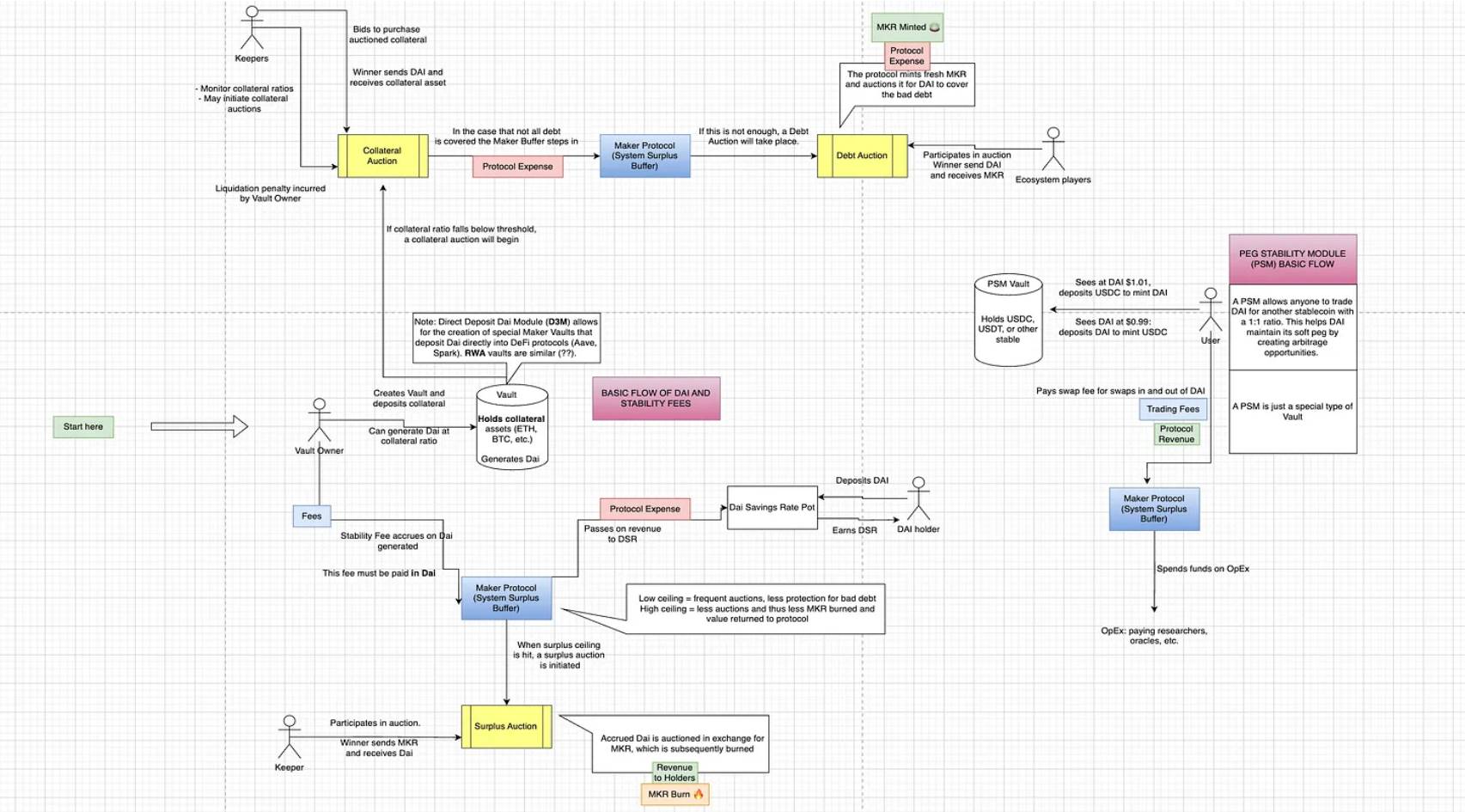

2) A Detailed Look at How Maker Works

Diagram illustrating how Maker works

From Maker’s history, it’s clear it has undergone many changes over the past decade—from accepting more collateral types to introducing stability mechanisms. Each upgrade has added complexity. What began as a simple lending protocol has evolved into something far more intricate. But at Artemis, we believe in building knowledge from first principles—so let’s dive deep into how it operates.

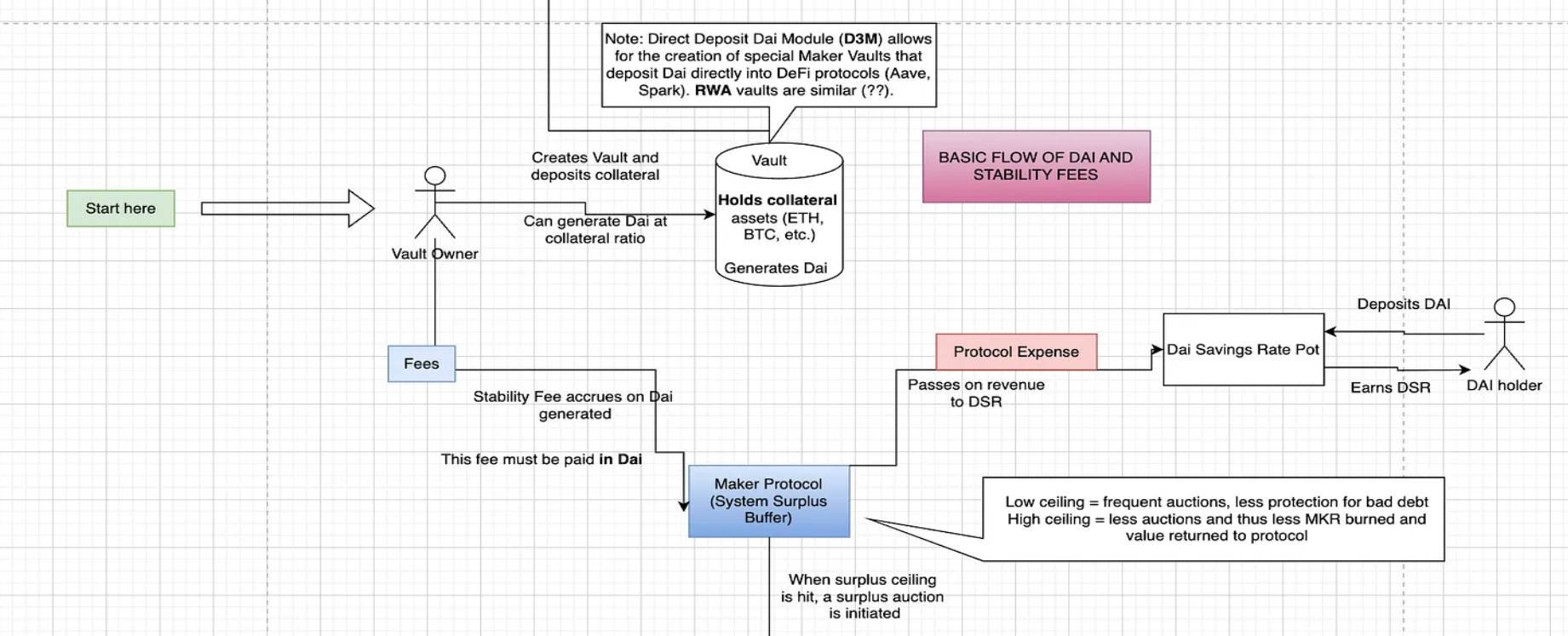

a). Borrowing and Repaying Debt

Borrowing and repaying debt

Let’s start with an overview. Bitcoin is priced at $60,000, and Billy owns 1 BTC. He needs liquidity but doesn’t want to sell his Bitcoin during a bull market. He goes to Maker to take out a loan: by locking up his Bitcoin as collateral, he can borrow against it.

Some time passes, and Billy wants to repay his loan. He must repay the principal debt plus the accrued stability fee (interest), both denominated in DAI. Part of this interest flows into Maker’s system surplus buffer, while the remainder is paid to Dai Savings Rate (DSR) holders—those who deposit DAI into Maker.

However, the buffer has a cap. Sometimes, surplus revenue cannot be absorbed due to this limit—in such cases, a surplus auction is triggered, where DAI is “sold” for MKR and then burned.

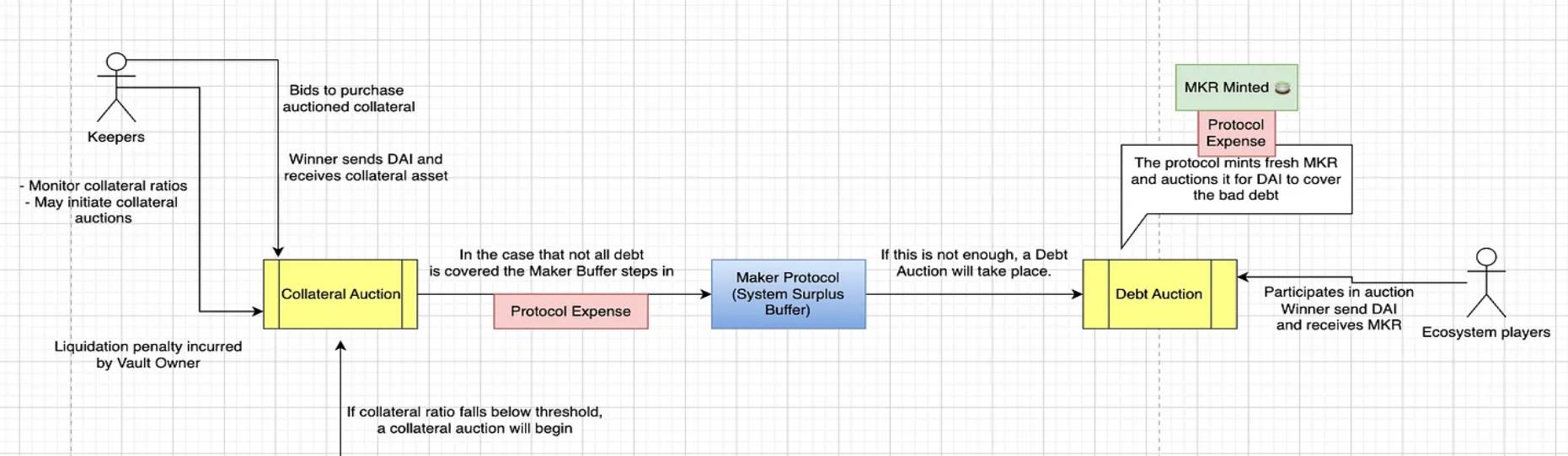

b). Liquidation Auctions

Guide to liquidation auctions

But what if Billy can’t repay his debt? Suppose Billy took out a $30,000 loan when Bitcoin was $60,000, with a Loan-to-Value (LTV) ratio of 0.5. The next day, Bitcoin drops to $40,000, pushing his LTV to 0.75—assumed to be the maximum allowable LTV before liquidation. Billy must now pay interest on his loan, plus a liquidation penalty if liquidated.

In a liquidation scenario, the borrower must repay not only the principal but also interest and a liquidation penalty. Here’s the breakdown:

-

Maker holds 1 BTC (worth $40,000)

-

Billy owes $30,000 (debt)

-

Billy owes $3,000 (stability fee)

-

Billy owes $2,000 (liquidation penalty)

The protocol handles this in several steps:

Collateral Auction: The protocol first sells the collateral (in this case, 1 BTC) to anyone willing to buy it at a slight discount. Ideally, someone buys it for $35,000, capturing a small arbitrage—the proceeds directly cover the shortfall.

If the collateral auction doesn’t raise enough, Maker taps into its system surplus buffer.

If the buffer is insufficient, a last resort is triggered—the Debt Auction, where Maker mints new MKR and auctions it off to raise DAI to cover bad debt.

Notably, debt auctions are only truly activated when the system runs a deficit—that is, when the total value of collateral backing DAI loans falls below required levels, resulting in under-collateralized debt. This means debt auctions occur only in extreme situations—and have happened just once: during the 2020 COVID black swan event that caused a global market crash.

c). Maintaining DAI’s Peg

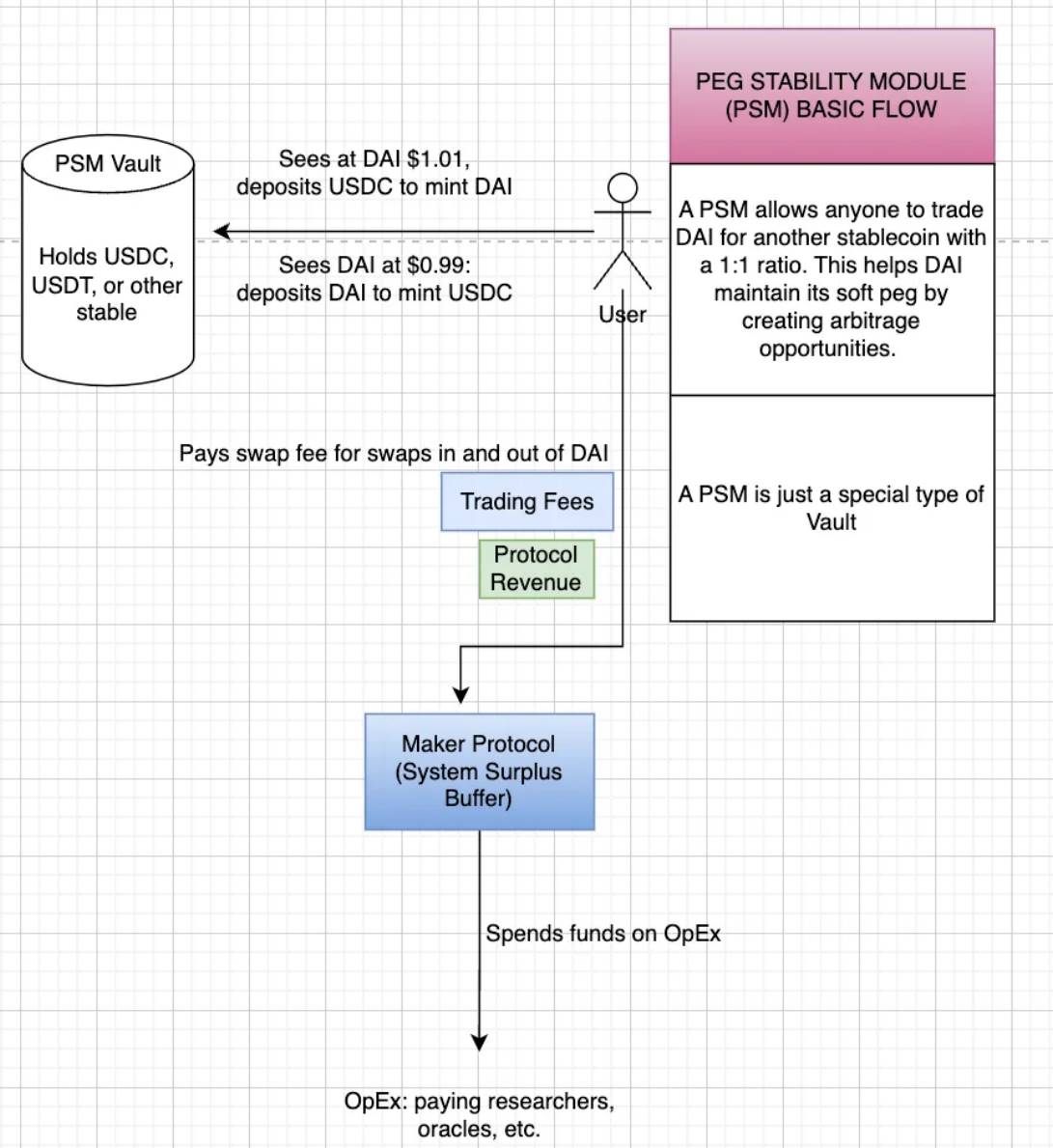

PSM (Peg Stabilization Module) vault guide

Now suppose Billy isn’t interested in collateralized debt but wants to perform arbitrage—since DAI is a decentralized stablecoin, he profits whenever it depegs. How does Maker incentivize this behavior?

This is where the Peg Stability Module (PSM) comes in—a special vault allowing users to exchange DAI 1:1 with another fiat-backed stablecoin.

-

If DAI trades at $1.01, you can deposit 1 USDC to mint 1 DAI and profit $0.01.

-

If DAI trades at $0.99, you can deposit 1 DAI to mint 1 USDC and again profit $0.01.

Thus, PSM enables arbitrageurs to maintain DAI’s peg—and charges no fees on these exchanges.

d). How Ordinary Users Can Leverage Maker

In the final scenario, Billy doesn’t want complexity—he just wants yield. Through the Dai Savings Rate (DSR) pool, Billy can deposit DAI and earn competitive returns. This yield primarily comes from stability fees paid by borrowers on their collateral.

This concludes our operational guide to how Maker works. Now that we understand its core mechanics, let’s explore its deeper complexities.

3) Maker’s Mechanisms

a. Collateral Deposit

Maker allows borrowing via two main pathways:

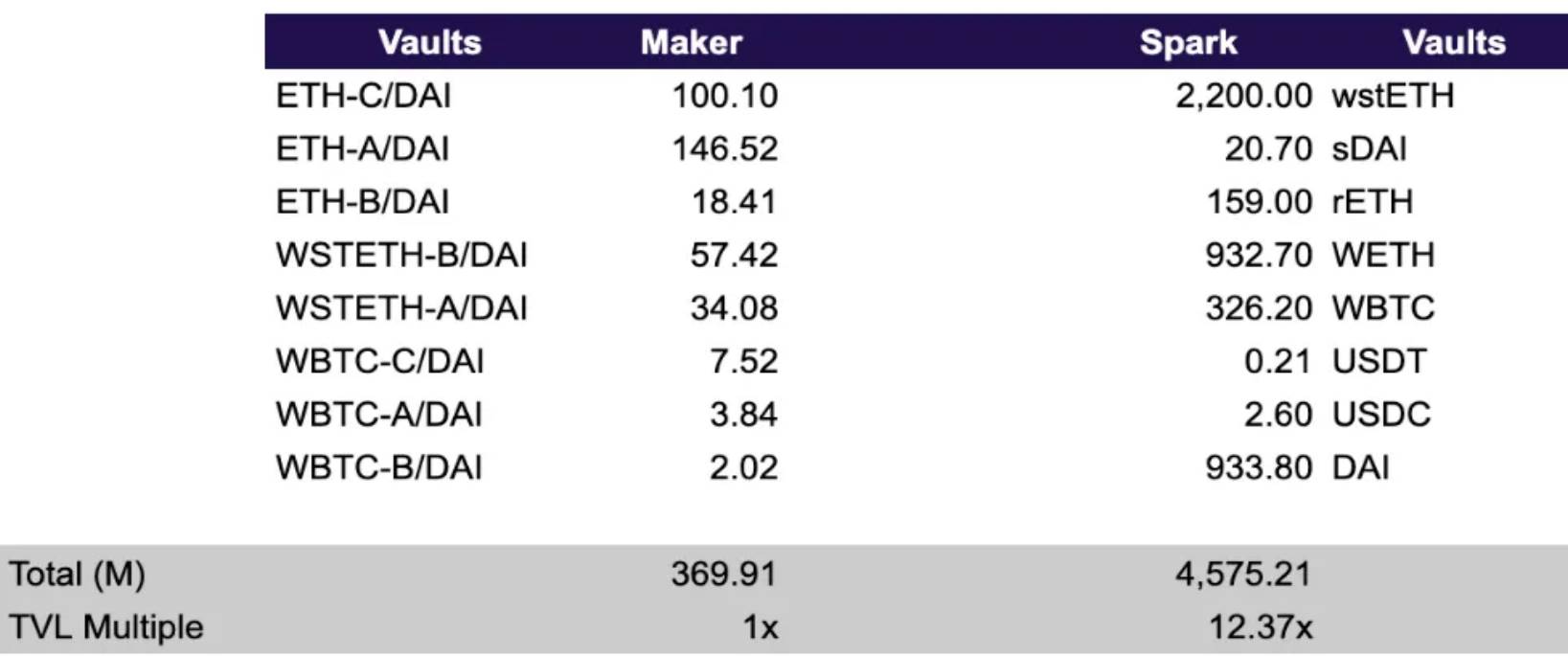

-

Spark: Maker redirects users to Spark.fi, a sub-DAO of Maker. Spark differs from MakerDAO vaults in offering loans against a broader range of assets. MakerDAO vaults are standalone, each with different liquidation ratios and debt ceilings.

-

sDAI: Spark also offers sDAI, a yield-bearing version of DAI, with advanced risk management features like efficiency mode and isolation mode.

-

D3M: Spark connects to Maker via D3M—a direct liquidity line enabling interaction between the Maker ecosystem and third-party lending protocols.

MakerDAO Vaults—accessible via Summer.fi—allow users to deposit collateral assets to mint new DAI. Thus, MakerDAO vaults are more customized: for the same asset, different vaults exist depending on how much you wish to borrow.

TVL comparison across vaults – Source: Artemis

You can see that TVL in Maker’s vaults is far lower than in Spark. For Maker vaults, differences between A/B/C lie in their stability fees, liquidation ratios, and debt caps. A key reason for this TVL disparity may be that Maker hasn’t actively promoted these vaults—indeed, Maker’s main website directs users straight to Spark, which hosts its vaults on Summer.fi.

b. Maker Auctions

Maker operates three primary auctions: Surplus Auction, Collateral Auction, and Debt Auction. Market participants involved in these auctions are called “keepers,” each serving distinct purposes detailed below:

Surplus Auction

When the system functions normally, interest payments from borrowers generate stability fees. These fees, paid in DAI, fund Maker’s System Surplus Buffer—a reserve used to cover operational costs like oracles and researchers. This buffer size is adjustable via MakerDAO governance; in a 2021 proposal, it was raised from $30 million to $60 million.

The system prioritizes using revenue to fill the buffer. Once the buffer reaches capacity, excess DAI is auctioned externally for MKR. In this auction, bidders compete by offering higher amounts of MKR. Upon completion, the DAI is sent to the winning bidder, and the MKR they provided is burned.

Hence, this mechanism is known as the Surplus Auction.

Collateral Auction

Collateral auctions are the first line of defense during liquidations. They recover debt from defaulted vaults. While risk parameters vary per collateral type, the general process is:

When a vault becomes undercollateralized, a user can trigger liquidation by sending a “bite” transaction identifying the vault. This initiates a collateral auction.

If the collateral amount in the “bitten” vault is less than the batch size, all collateral is auctioned at once.

If the collateral exceeds the batch size, an auction for one batch is initiated. The vault can be “bitten” again to start another auction until all collateral is sold.

A key aspect: auction expiry and bid expiry times depend on collateral type—more liquid assets have shorter durations.

At auction end, the winner purchases the vault’s collateral using DAI. The collected DAI repays the vault’s outstanding debt.

Debt Auction

Finally, debt auctions activate only when the system has Dai debt exceeding the designated ceiling and the surplus buffer lacks sufficient funds to cover it.

Debt auctions recapitalize the system by auctioning MKR for a fixed amount of Dai. It’s a reverse auction: keepers bid how little MKR they’re willing to accept for a fixed Dai amount.

Due to its rarity, this has occurred only once in MakerDAO history—during the 2020 COVID crisis. Then, 40 batches of 50,000 DAI each were released, with bidders competing to accept fewer MKR tokens for their 50,000 DAI bids.

After auction completion, the Dai paid by bidders reduces the system’s debt, while newly minted MKR increases the circulating supply.

c. Peg Stability Module (PSM)

Next is the Peg Stability Module (PSM)—a critical mechanism in MakerDAO designed to maintain DAI’s dollar peg. Due to its decentralized nature, DAI requires safeguards to maintain its peg, and PSM provides mechanisms to achieve this:

Direct 1:1 Exchange: PSM allows users to swap fiat-backed stablecoins (e.g., USDC, USDP) for DAI at a 1:1 rate, paying only a small fee, and vice versa. This creates arbitrage opportunities to maintain the peg, subject to any protocol-set fees.

-

If DAI > $1, arbitrageurs deposit 1 USDC into PSM to mint 1 DAI and sell it for profit.

-

If DAI < $1, arbitrageurs buy DAI on the open market, deposit it into PSM, and receive 1 USDC, profiting while burning DAI (reducing supply) and pushing the price back to $1.

Collateral Backing: Users may choose to deposit USDC into PSM without swapping—receiving an equal amount of DAI backed 1:1 by the deposited USDC.

Beyond this, Maker has two additional features—not core to peg maintenance but still helpful in stabilizing DAI’s price:

MakerDAO can adjust the stability fee via governance votes to maintain DAI’s peg.

-

If DAI > $1, increasing the stability fee makes borrowing DAI more expensive, suppressing DAI creation and reducing supply.

-

If DAI < $1, lowering the stability fee stimulates demand by reducing issuance cost, increasing supply and pushing DAI toward $1.

The Dai Savings Rate (DSR) is essentially the interest rate DAI holders earn by locking their DAI. While it incentivizes holding DAI, it also helps stabilize the peg—MKR token holders can adjust DSR to guide DAI toward the peg (though opposite to the stability fee).

DSR income sources include stability fees, protocol revenues, surplus, and general market dynamics. The DSR rate is set by MakerDAO governance as a tool to balance DAI supply and demand. When higher DAI demand is needed, DSR may be increased—requiring more funds to support the rate. DSR is not funded by external or traditional investment sources. As of July 2024, DSR stands at 8% APY.

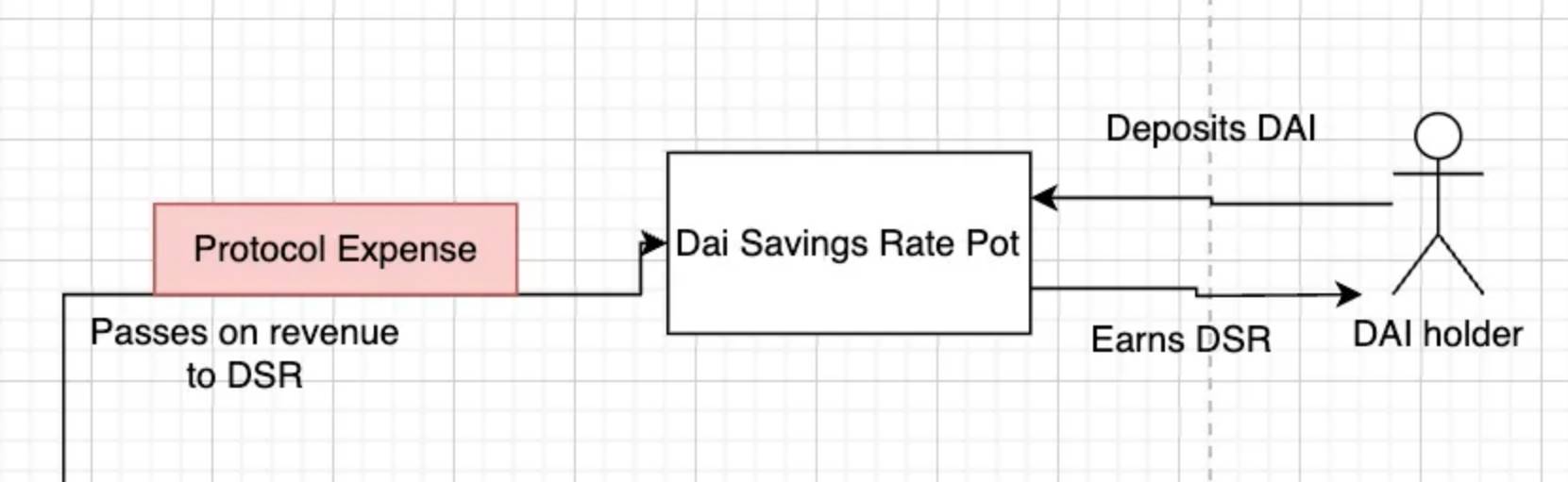

d. Dai Savings Rate (DSR)

As noted, the Dai Savings Rate (DSR) is a special module where DAI holders deposit to earn yield. DAI holders can lock and unlock their DAI into the DSR contract at any time. Once locked, their DAI balance grows continuously based on a global system variable called the DSR.

Essentially, DSR depositors receive a share of Maker’s generated revenue. DSR income comes from profits generated by MakerDAO—including stability fees paid by borrowers, liquidation penalties, and yields from T-bills held in Maker vaults, among other protocol revenues.

Currently, over $2 billion in DAI is held in DSR, yielding an annual rate of 7%.

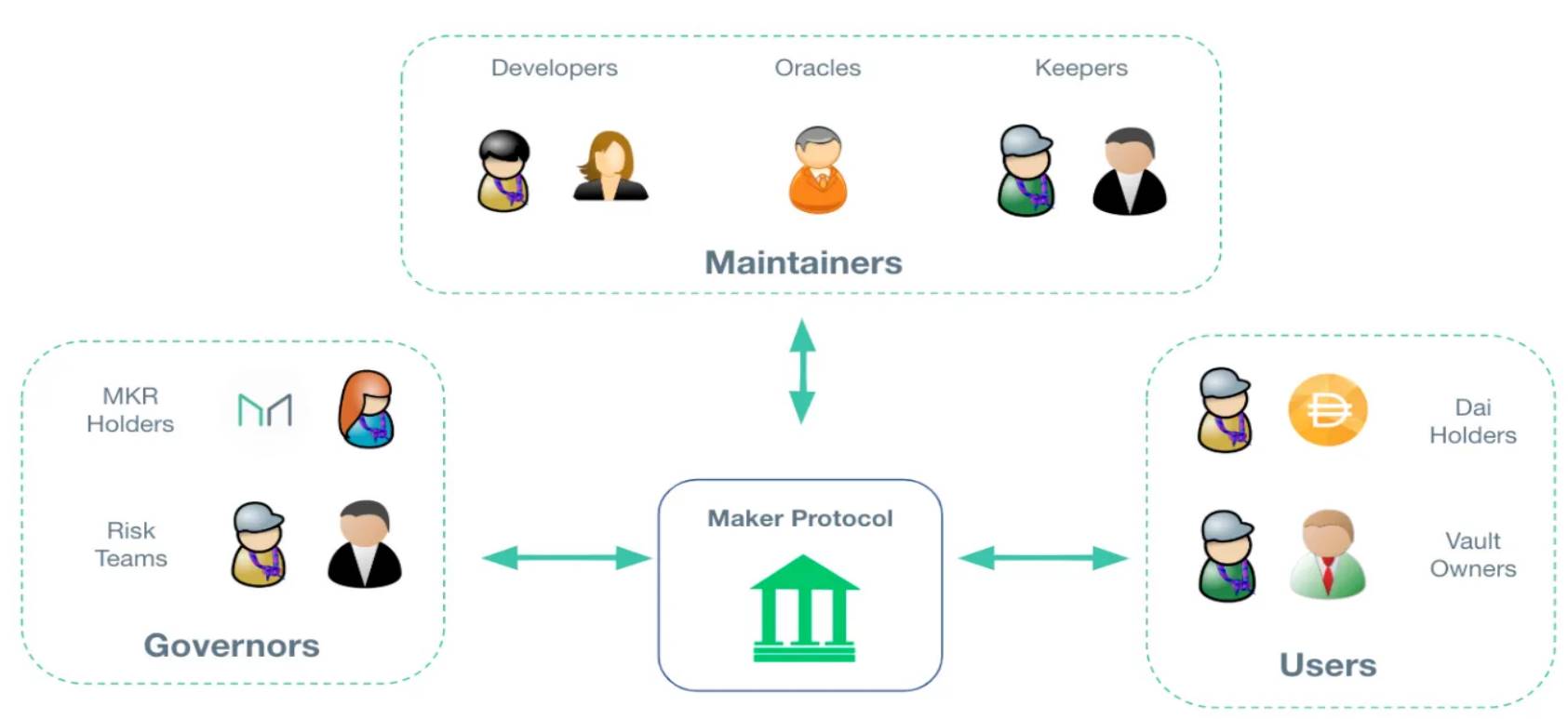

e. MKR Token

Finally, Maker is governed by its token, MKR. MKR holders vote on key system parameters. MakerDAO’s governance is community-driven, with decisions made by MKR holders through a scientific governance system. This includes executive and governance votes, enabling MKR holders to manage the protocol and ensure DAI’s stability, transparency, and efficiency.

By leveraging all the mechanisms described above, Maker provides a secure, decentralized, and stable financial system that allows users to generate and use DAI without relying on traditional financial intermediaries. This approach embodies core principles of crypto philosophy, offering a decentralized alternative to traditional finance and enabling permissionless access to various financial services.

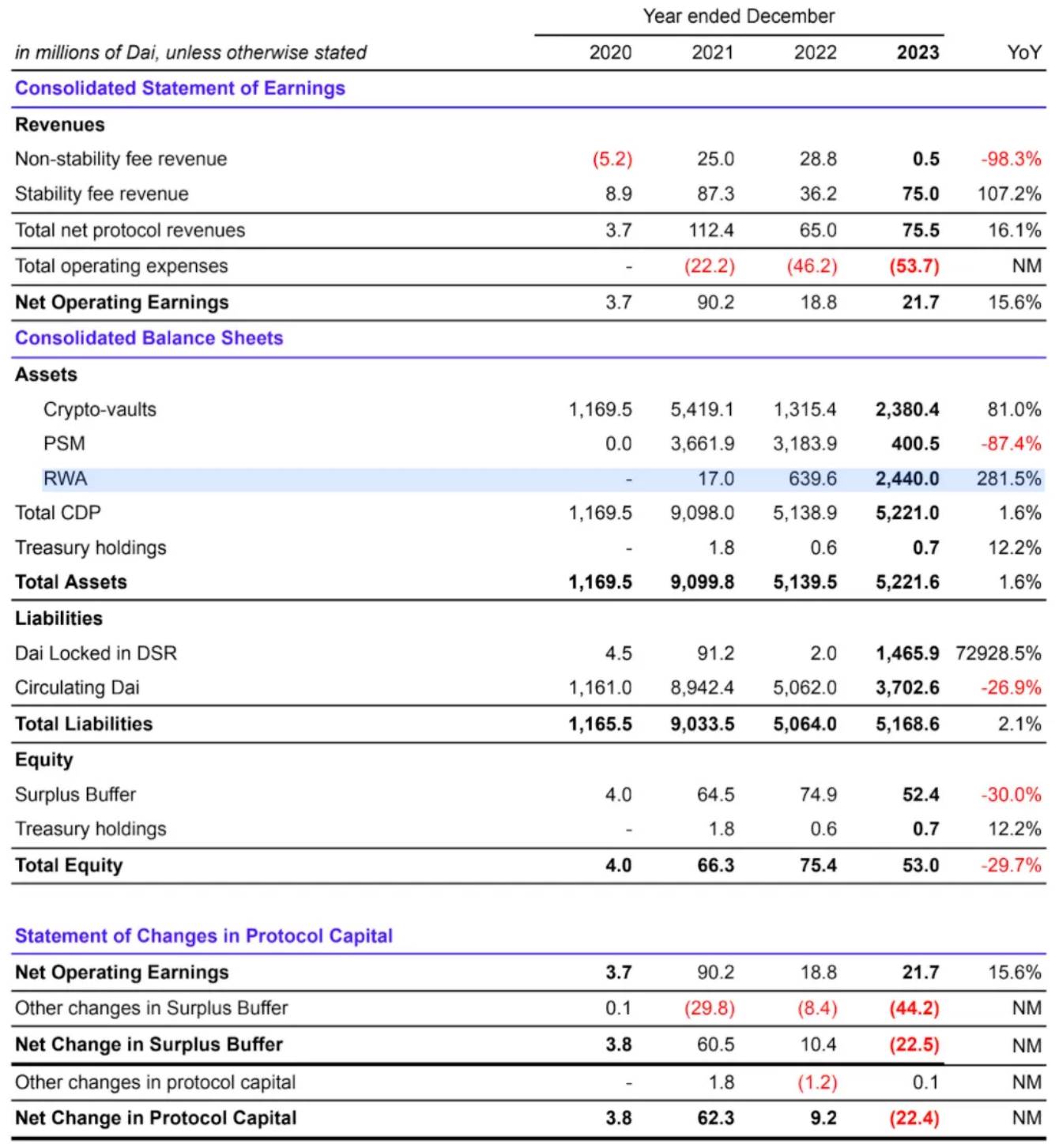

f. Maker’s Revenue Streams

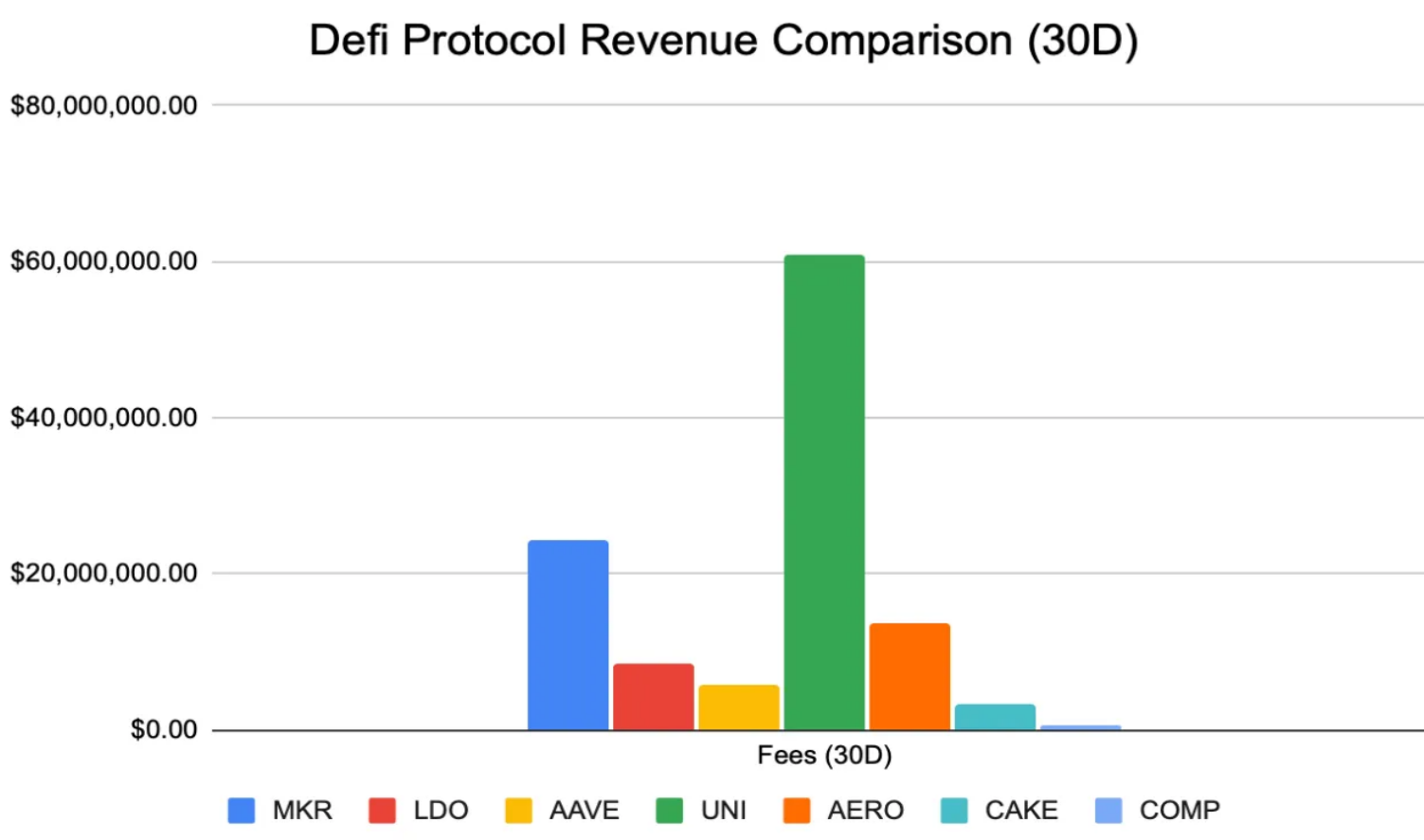

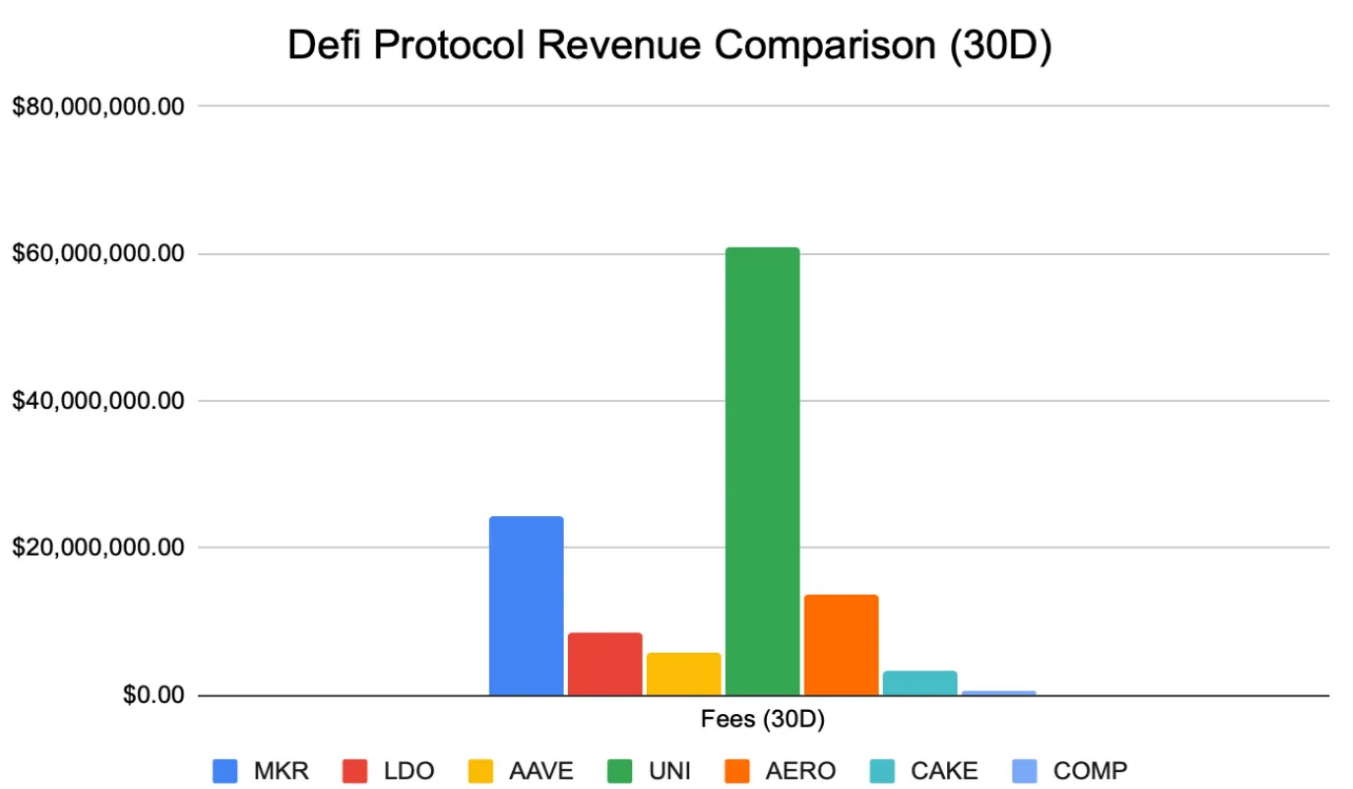

Now that we’ve covered Maker’s mechanisms, we can examine how it generates revenue. Among all DeFi protocols, Maker generates the highest annual revenue. The chart below compares DeFi protocol revenues to better understand their daily performance.

Note: For Uniswap, the numbers shown represent fees collected—since generated revenue goes entirely to liquidity providers, Uniswap itself earns no net income. For comparison purposes, we use fees as a proxy for revenue.

Source: Artemis

Among all DeFi protocols, Maker leads with a staggering 9.48x FDMC/fee ratio. Compared to other money markets like Aave and Compound, Maker’s lead is substantial—Maker has the highest fee-based revenue among all DeFi protocols except DEXs.

In terms of financials, Maker generates a jaw-dropping $274 million annually, clearly making it one of the top-performing DeFi protocols. So, where does Maker’s revenue come from?

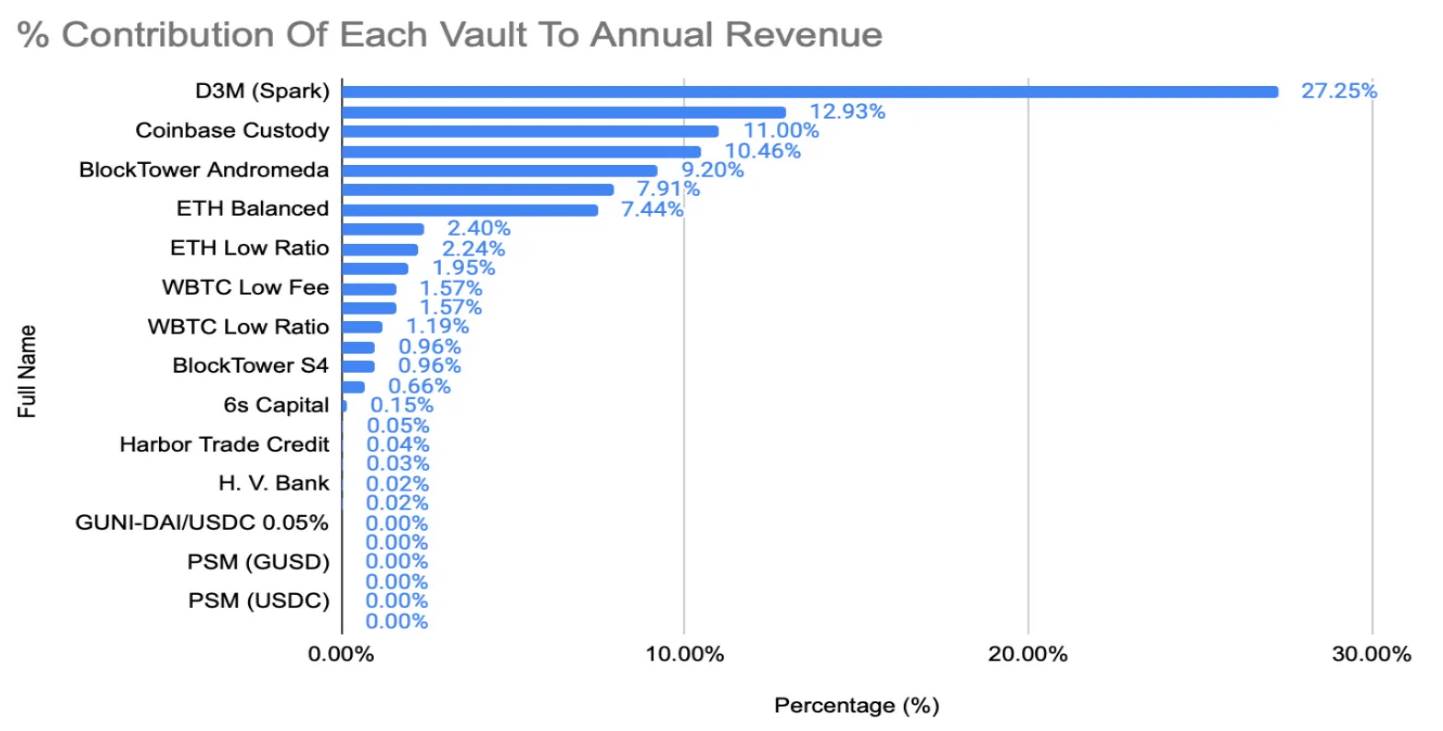

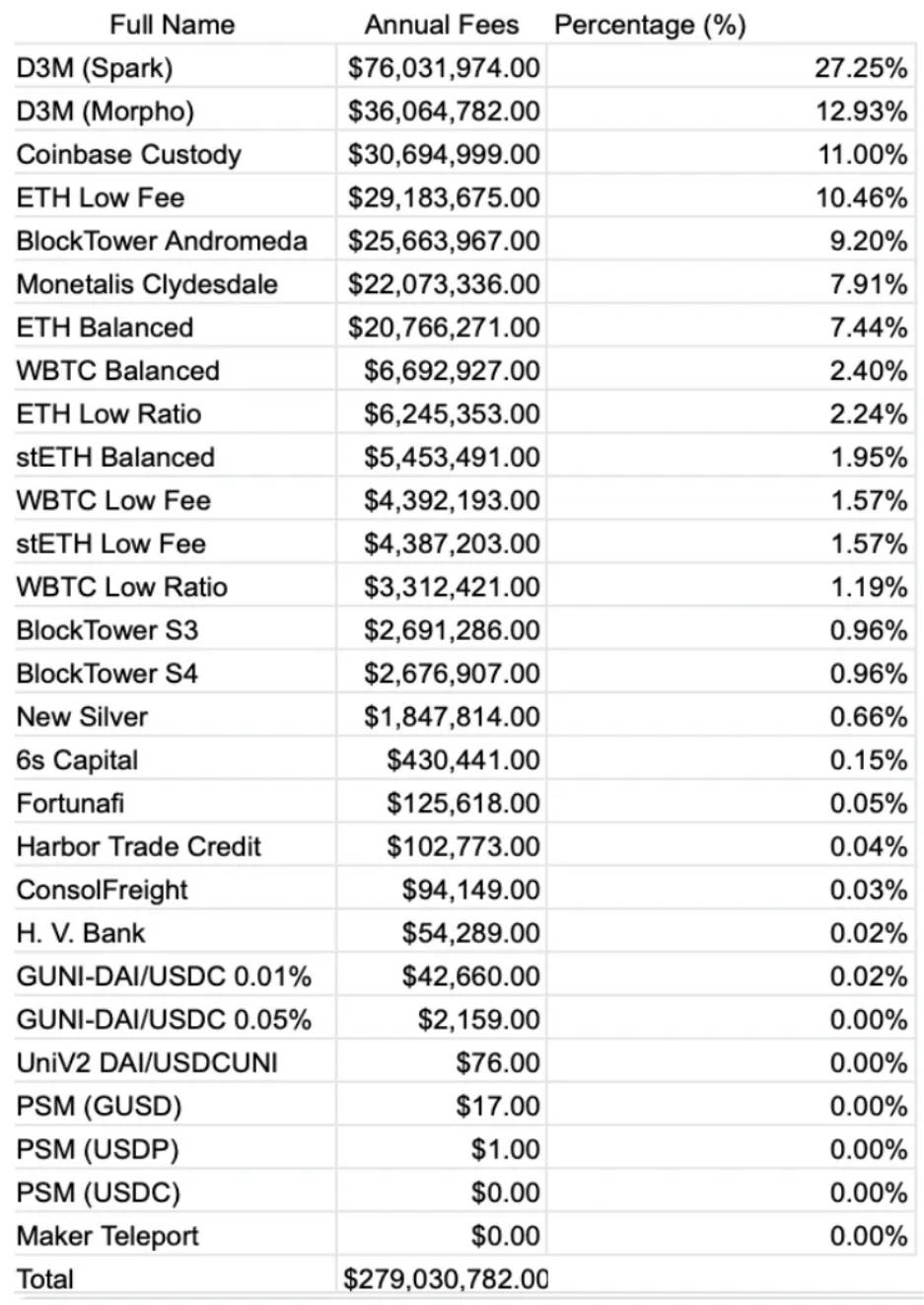

3. Maker’s Revenue Sources

1) Maker Has Three Primary Revenue Streams

Stability Fees (Interest Payments): This is Maker’s main revenue source. Users pay these fees when borrowing DAI against collateral. For example, the D3M (Spark) vault generates over $84 million in annual revenue.

Real-World Assets (RWA): This has become a major revenue driver for Maker. Maker holds public credit vaults like Monetalis Clydesdale—a vault backed by U.S. short-term Treasuries, valued at 1.11 billion DAI.

As of 2023, nearly 80% of Maker’s fee revenue came from real-world assets over the past year. Over the past 12 months, this brought $13.5 million in revenue to the protocol treasury.

Operationally, users don’t directly deposit RWAs into Maker. Instead, vaults like Monetalis Clydesdale (discussed in MIP65) acquire USDC via the Peg-Stability Module and invest it in liquid bonds.

Liquidation Penalties: The third and final revenue stream comes from liquidation penalties charged when collateral is liquidated due to undercollateralization. However, due to the rarity of such events, revenue from liquidations is minimal—dropping from 28.8 million DAI in 2022 to just 4 million DAI in 2023.

Source: MakerBurn

2) Maker and Real-World Assets (RWA)

Now, let’s discuss why Maker became a hot topic in Q3 2024. The most notable thing about Maker isn’t just its numbers—it stems from a pivotal moment in Maker’s history in 2022, when it strategically decided to expand into real-world assets.

This move marked a significant shift in DeFi, being the first large-scale integration of real-world financial products by a DeFi protocol. Maker pursued this through initiatives such as:

-

Deploying $500 million in USDC into short-term bonds, ETFs, and Treasury bills (via Monetalis Clydesdale, Blocktower Andromeda)

-

Launching a $100 million vault to serve Huntingdon Valley Bank, a 151-year-old Pennsylvania financial institution

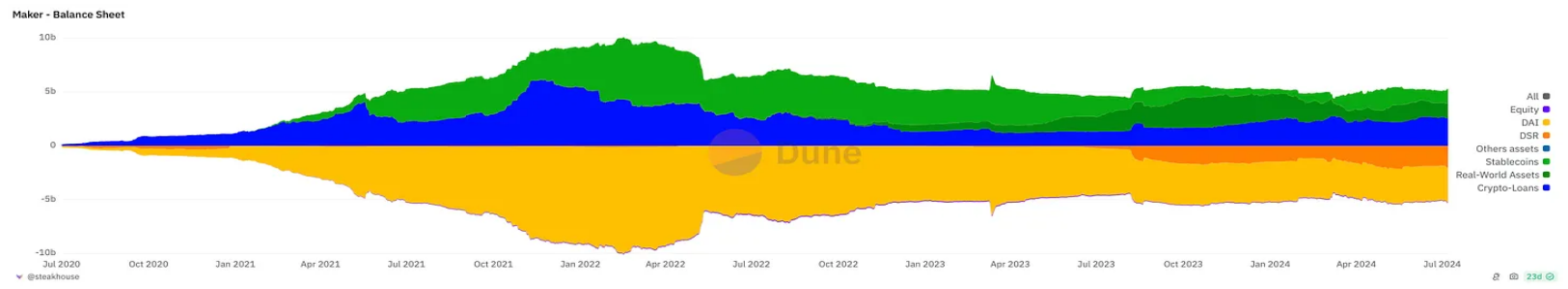

Source: Steakhouse Dune Dashboard

Today, real-world assets account for approximately 25% of Maker’s balance sheet and DAI backing. Maker’s successful RWA integration has not only boosted overall fees but also enabled it to tap into more stable and diversified revenue streams—crucial for maintaining its moat and solidifying its position as a leading DeFi protocol during tough market conditions.

This is an underappreciated point that deserves emphasis: crypto markets are notoriously cyclical and reflexive, both upward and downward. As markets mature, investors seek safer investments—Maker’s entry into RWA creates a more stable and consistent revenue stream, insulated from market volatility.

Maker now stands as a testament to the potential of merging DeFi with traditional finance, setting new standards for innovation and real-world applications. It represents a critical step in bridging decentralized finance with traditional financial products, positioning Maker at the forefront of DeFi innovation, perfectly aligned with the institutional demand wave for digital assets.

4. Bullish Case for Maker

1) The 2024 RWA Boom

Now that we’ve discussed Maker’s pivot to RWA, let’s explain why RWA matters. 2024 marks a year of maturation in the crypto asset market. With the launch of Bitcoin ETFs, we’ve seen over $14 billion in net inflows into Bitcoin. This surge in institutional participation extends beyond Bitcoin ETFs—major banks and institutions are increasingly embracing crypto assets:

-

Standard Chartered and Nomura leverage internal tech via Zodia Custody and Laser Digital to build digital asset custody solutions.

-

Citibank, JPMorgan Chase, and BNY Mellon partner with crypto firms like Metaco, NYDIG, and Fireblocks to offer cryptocurrency custody services.

-

Visa and Mastercard expand their crypto card programs, partnering with major exchanges to offer crypto-linked cards to retail and institutional clients.

Clearly, the biggest institutional players believe in digital assets—not just Bitcoin. Major asset managers have long talked about tokenization. BlackRock, the world’s largest asset manager, is now experimenting with tokenization:

-

BlackRock USD Institutional Digital Liquidity Fund: Launched in March 2024, this fund is represented by BUIDL tokens on Ethereum. Fully backed by cash, U.S. Treasuries, and repos, it pays daily yield to token holders via blockchain.

-

$100 Trillion Tokenization Vision: BlackRock is driving digital transformation in finance, aiming to tokenize various assets including bonds, equities, real estate, and cultural assets.

This has sparked a race among top financial institutions to tokenize all assets:

-

JPMorgan: Launched programmable payments via its Onyx blockchain platform, enabling real-time, programmable financial functions for institutional clients.

-

HSBC: Launched “Digital Vault,” a blockchain-based platform allowing custodied clients instant access to private assets (debt, equity, real estate).

Goldman Sachs invests in and supports Circle’s USDC stablecoin, enabling large-scale global transfers without volatility risk, and is exploring tokenization of physical assets as a new financial instrument.

Clearly, the next decade will be defined by institutional adoption and convergence—with Maker positioned at a pivotal moment in this evolving landscape. Maker has built strong presence in RWA tokenization and DeFi, while appealing to institutions. Just days ago, Maker announced a public competition to invest $1 billion in tokenized U.S. Treasury issuances—top issuers like BlackRock, Securitize, Ondo Finance, and Superstate are expected to apply.

At the end of 2023, real-world assets accounted for 46% of Maker’s total balance sheet. Source: Steakhouse Finance

We believe the proportion of real-world assets on Maker’s balance sheet will continue to grow. Therefore, as one of the largest DeFi protocols—and so far, the most extensively integrated with real-world assets—Maker is strategically positioned. Combined with the potential launch of an Ethereum ETF in Q3/Q4 2024, this further strengthens the long-term bullish case for Maker. As Ethereum continues to serve as the backbone of DeFi, Maker’s prominent role in this ecosystem further cements its function in facilitating institutional adoption.

2) Maker’s Stability and Resilience

As major financial institutions increasingly embrace crypto and blockchain technology, they are turning their attention to “mature” brands in the space. In an industry dominated by hacks and pump-and-dump schemes, protocols like Maker that have stood the test of time carry greater legitimacy and credibility in leading the coming wave of institutional interest.

Beyond that, Maker has demonstrated the ability to handle large-scale financial operations and shown remarkable stability and resilience during market downturns—proving capable of adapting to changing market conditions: diversifying its collateral pool to mitigate risks for decentralized stablecoins, building adaptive mechanisms like the Peg Stability Module, and implementing flexible governance that allows dynamic adjustments when needed.

This antifragility grants Maker the necessary legitimacy. Now, equipped with institutional-grade infrastructure and risk management protocols, Maker has become the dominant platform for institutional participation.

3) The Endgame

Maker is positioned as one of the leading decentralized banks, poised to become one of the world’s largest financial institutions. Given that DAI is the most widely used decentralized stablecoin, capable of providing cheaper credit structures than competitors, and given its strategic leadership in the space, Maker’s case is already strong.

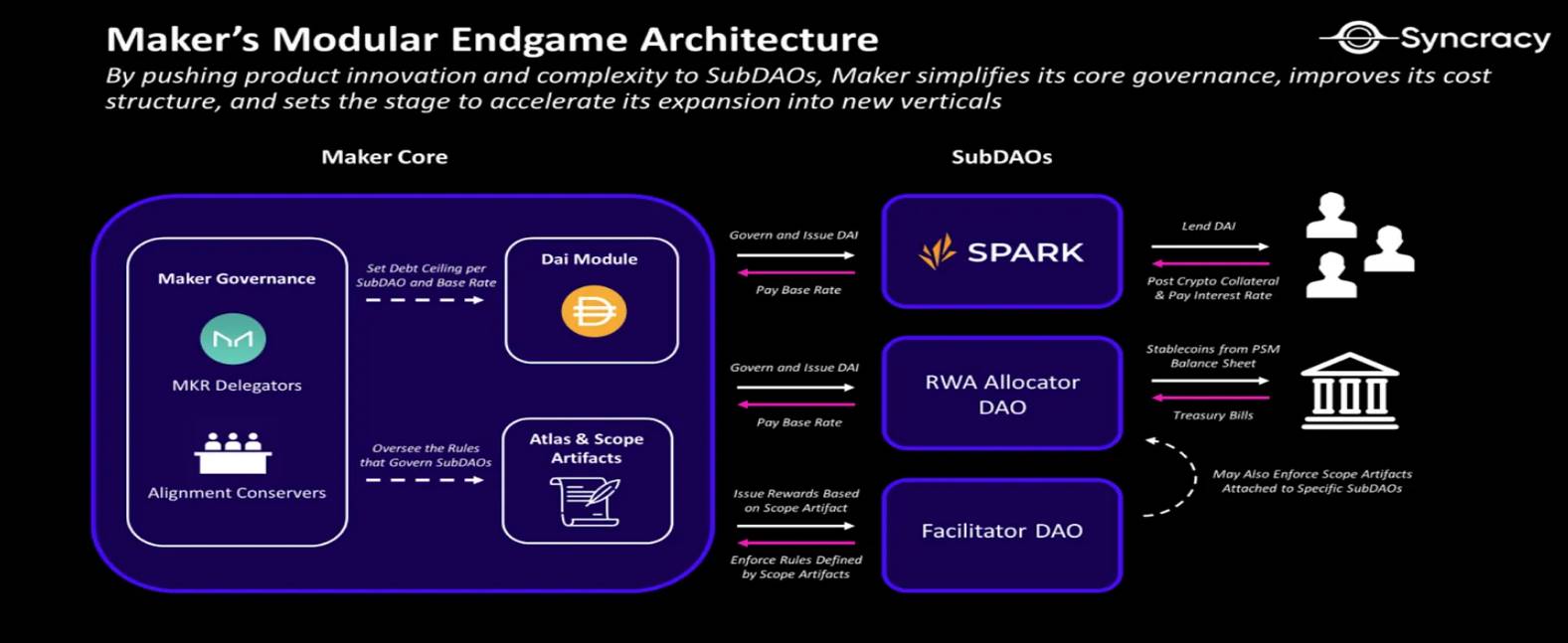

Yet perhaps the biggest catalyst remains unexplained—Maker’s ongoing “Endgame” rollout, transforming it into a scalable, modular protocol ecosystem, potentially making it one of the most important narratives in the upcoming crypto cycle. This upgrade is massive and divided into four main phases:

Phase One: Season of Launch – New Tokens and Infrastructure

-

New Tokens: Introduce “NewStable” and “NewGovToken” (placeholder names) as optional upgrades to DAI and MKR.

-

Lockstake Engine (LSE): A new feature allowing NewGovToken and MKR holders to earn yield on locked tokens.

-

NewBridge: A low-cost bridge connecting Maker ecosystem tokens from Ethereum to major Layer 2 networks.

-

Updated Tokenomics: Modifications to MKR burn mechanisms and new token distribution methods.

Phase Two: Horizon – Expanding Maker’s Ecosystem

-

Launch new SubDAOs: Create self-sustaining, specialized DAOs within the Maker ecosystem, starting with SparkDAO.

Phase Three: Launch a dedicated Layer 1 blockchain to host core tokenomics and governance mechanisms

Phase Four: Core governance aspects of Maker and SubDAO ecosystems become final and immutable

Through this plan, Maker aims to scale DAI from its current $4.5 billion market cap to “$100 billion or more.” For the most part, we won’t focus deeply on many of these initiatives—we believe the primary growth driver will be the addition of SubDAOs.

4) SubDAOs

The Endgame plan represents a comprehensive restructuring of the Maker ecosystem, transforming it into a network of interconnected modular protocols. At its core, this vision introduces SubDAOs. As the name suggests, these are projects operating outside Maker’s cost structure but ultimately governed by MakerDAO.

This new architectural approach aims to streamline MakerDAO operations and enhance scalability. SubDAOs will be able to rapidly develop and parallelly launch new products, while Maker’s core focuses on becoming an efficient DAI minting engine.

Expected outcomes of this restructuring include:

-

Accelerated ecosystem growth;

-

Enhanced process automation;

-

Greater decentralization;

-

Significant reduction in operating expenses.

Source: Syncracy Research

SubDAOs each have unique governance tokens, governance processes, and teams. They fall into three categories:

FacilitatorDAOs

These are administrative in nature, organizing internal mechanisms of MakerDAO, AllocatorDAOs, and MiniDAOs. FacilitatorDAOs help manage governance processes and execute decisions and rules.

AllocatorDAOs

AllocatorDAOs serve three main functions:

-

Generate Dai from Maker and allocate it to profitable opportunities within the DeFi ecosystem

-

Provide an entry point into the Maker ecosystem

-

Incubate MiniDAOs

MiniDAOs

MiniDAOs are experimental SubDAOs with no specific mission beyond advancing Maker’s protocol growth. Incubated by AllocatorDAOs, they serve to further decentralize, promote, or consolidate specific ideas or products. Essentially, they act as experimental spin-offs, possibly with shorter lifespans.

Thus, SubDAOs are revolutionary for MakerDAO and the broader DeFi ecosystem, representing a paradigm shift in how large-scale decentralized protocols evolve, innovate, and manage risk.

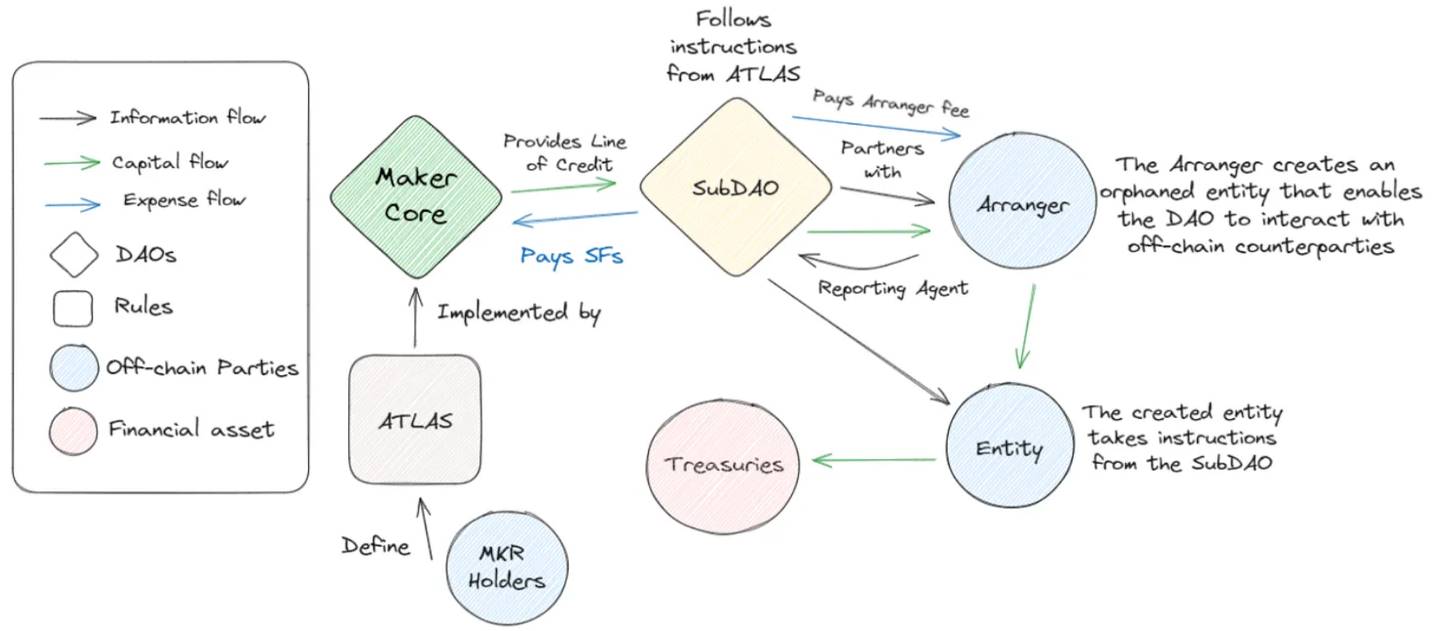

For example, the diagram below illustrates a simplified view of how MakerDAO might operate post-Endgame:

Source: Steakhouse Finance

By introducing a multi-layered governance structure, SubDAOs enable MakerDAO to rapidly experiment and grow in specialized domains while preserving core stability.

This approach addresses several key challenges faced by mature DeFi protocols, including governance fatigue, innovation stagnation, and risk concentration. SubDAOs decentralize decision-making, empowering small, focused teams to drive innovation in specific areas without jeopardizing the entire ecosystem.

This structure not only enhances the protocol’s adaptability to changing market conditions but also creates new avenues for community engagement and value creation. Moreover, the SubDAO model extends MakerDAO’s influence beyond traditional DeFi boundaries, potentially generating real-world economic impact through localized initiatives and targeted capital allocation.

Currently, beyond existing SubDAOs like Spark (Maker’s first SubDAO), a new bridge is planned to transfer DAI across Ethereum Layer 2 networks. While not revolutionary (its main product is a lending engine), it demonstrates SubDAO effectiveness. Spark will also gain the ability to deploy capital into real assets—again showcasing the incredible flexibility SubDAOs bring to what was once a single-purpose protocol.

By providing a more flexible and scalable governance framework, SubDAOs pave the way for MakerDAO to evolve from a single-purpose stablecoin issuer into a diverse, self-sustaining ecosystem of interconnected financial services and products. This revolutionary approach could set new standards for how decentralized organizations manage growth, innovation, and risk in the ever-evolving landscape of blockchain finance.

5. Final Thoughts

Maker stands at the forefront of bringing crypto into the traditional world, and it’s incredibly exciting to see this effort expanding its potential. With the rollout of Endgame, it sets a precedent for the entire crypto space—other DAOs are likely to follow, as many suffer from bureaucratic paralysis when voting deadlocks occur.

Moreover, Maker sits at the perfect intersection of RWA and Ethereum DeFi. With the tailwind of a potential Ethereum ETF, Maker is well-positioned to lead the Defi 1.0 asset recovery wave. Names like Aave and Uniswap remind us that some “legacy” protocols have proven resilient through multiple cycles, with some even achieving product-market fit and establishing sustainable revenue models.

Maker’s success will largely depend on its ability to execute Endgame while carefully navigating the growing political uncertainty surrounding crypto assets. Yet, with rising institutional interest in crypto and the launch of Bitcoin (and possibly Ethereum) ETFs this year, Maker’s future outlook is brighter than ever.

Maker’s Endgame plan represents a bold and ambitious vision for the protocol’s future. As the world moves toward a crypto-centric future, Maker stands at the industry’s cutting edge, poised to help bridge the gap between decentralized assets and the centralized world.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News