Opinion: Why Won't L2s Make Ethereum Deflationary?

TechFlow Selected TechFlow Selected

Opinion: Why Won't L2s Make Ethereum Deflationary?

L2s will only make ETH deflationary when both the blob and regular fee markets are saturated.

Author: BREAD, Crypto KOL

Translation: Felix, PANews

There's a popular notion circulating in the crypto community: L2s will make Ethereum deflationary again. This statement is incorrect—and there are already examples proving it.

This article is a report on L2s, blobs, and why the Ultrasound Money meme will die without mainnet users.

(Note: A meme related to Ethereum emphasizing its potential to become deflationary over time. The core idea is that if gold or Bitcoin have capped supplies and are considered "Sound Money," then Ethereum, whose supply is decreasing, should be seen as "Ultrasound Money.")

Key Points:

-

L2s will only make ETH deflationary if both the blob and regular fee markets are saturated

-

L2s are largely unconstrained by L1-specific batch publishing rhythms

-

The combination of these factors means L2s will continuously coordinate with each other to avoid creating high-fee environments for themselves

Background

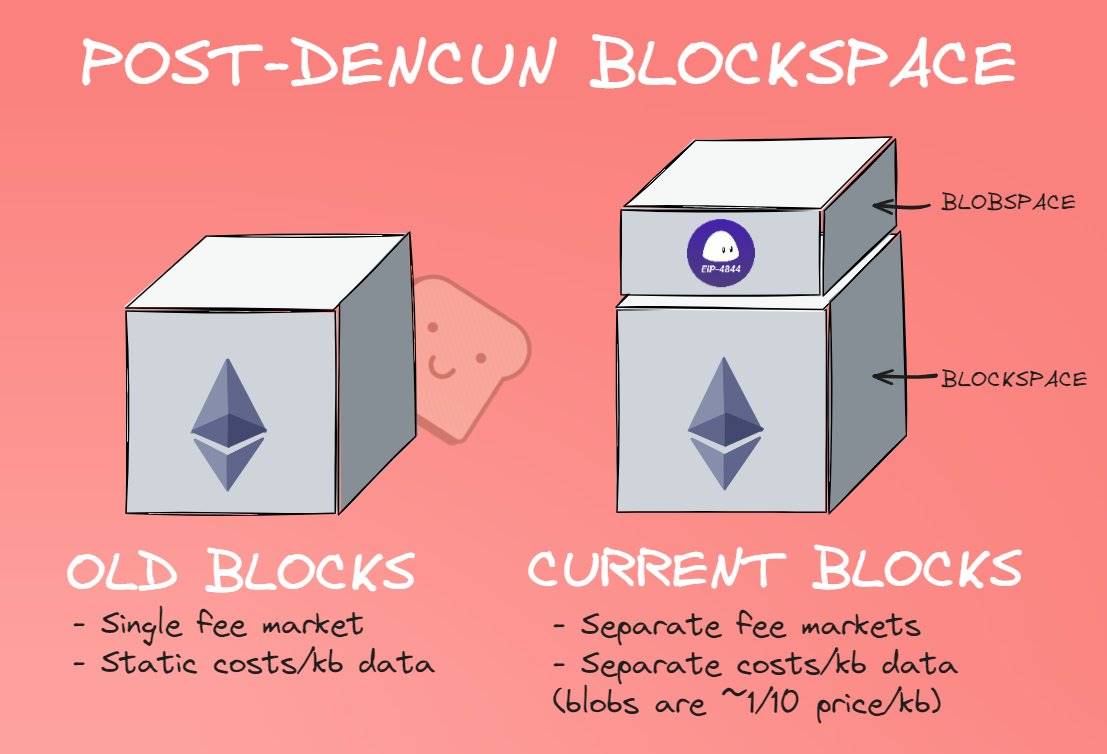

First, a quick recap of Ethereum’s state post-Dencun (the March upgrade that made L2s about 10x cheaper for users).

Dencun introduced the concept of blob space—an extension of block space on Ethereum specifically designed for L2s to publish their batch data.

This new area has several notable characteristics:

-

"Blobspace" is currently limited to a maximum of 6 individual blobs per block

-

It operates as a separate fee market from regular block space, but uses a similar mechanism

Blockspace: If current block utilization >50%, base fee increases for the next block

Blobspace: If there are 4 or more blobs (i.e., >50%) in the current block, the base fee for the next block increases by approximately 12%

Note: L2s can choose independently whether to use Blockspace or Blobspace.

Given the above, we can anticipate certain behaviors from these L2s that will impact ETH burning:

-

L2s will first saturate blobspace until it is no longer idle (3 blobs/block)

-

Once this level is reached, they will begin calculating cost vs. reputation trade-offs and choose between two paths:

-

a.) Use calldata

-

b.) Reduce publishing frequency / distribute / coordinate to cool down the fee market

In other words, even though top-tier L2s already earn millions per month in profit (with margins close to 100%), they will continually adjust their behavior to avoid creating high-fee environments for themselves.

ETH vampire death loop:

-

Extend low-fee environment

-

Wait for Ethereum to scale, resetting the market

-

Extend low-fee environment

-

Wait for Ethereum to scale, resetting the market...

-

So when is Ethereum planning to scale?

The earliest would be the Pectra upgrade next year, which may increase blob capacity by roughly 2–3x.

But the market doesn't offer many such opportunities. However, there are two clear cases where L2s deliberately modified their behavior to save costs and avoid fees—just like any business or rational actor would.

Example 1: Blobscriptions Craze

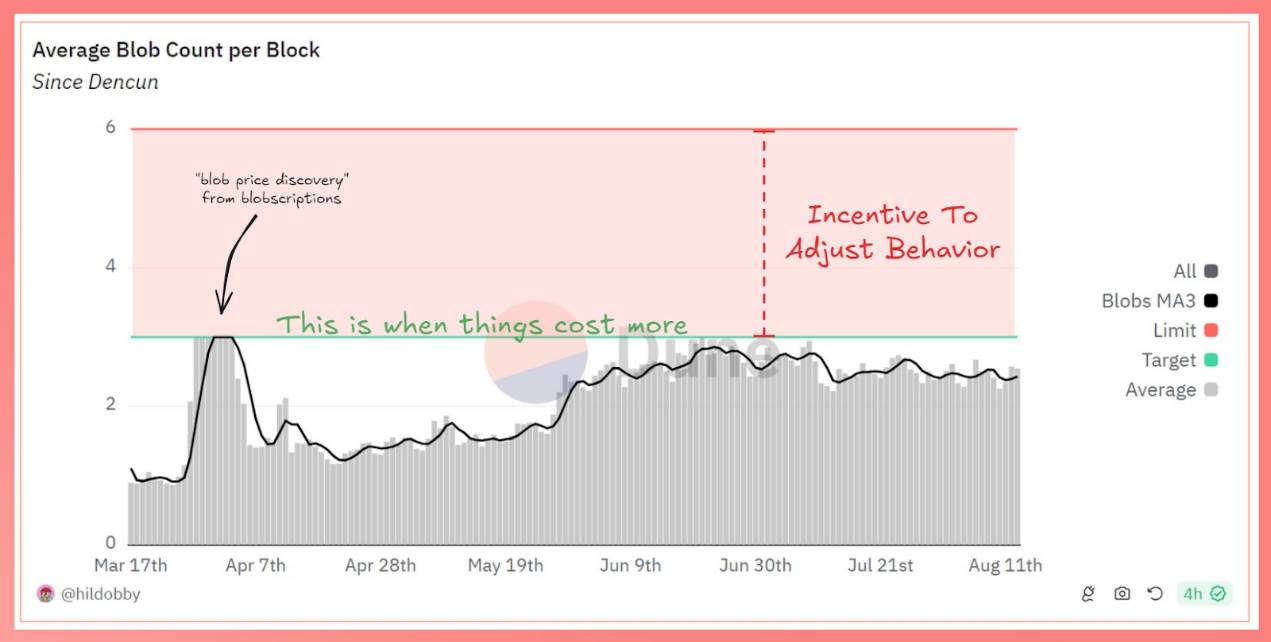

In late March, blobs underwent "price discovery" during the blobscription phase. Nevertheless, L2s and builders averaged their blob usage at 3 blobs/block—the non-price-increase threshold:

Data source: Dune

They had no obligation to exceed the fee growth threshold—so they didn’t.

Example 2: LayerZero Airdrop

On June 20, the ZRO airdrop caused a massive spike in transaction volume on Arbitrum, leading it to flood the blob market.

In short:

-

More blobs from ARB

-

Higher blob costs for all L2s

-

Due to lack of proper infrastructure to switch to regular block space, L2s burned around $800,000 worth of ETH

If you'd like to learn more, check out the author’s thread.

The biggest takeaway from this event was how different teams reacted to the high-fee environment:

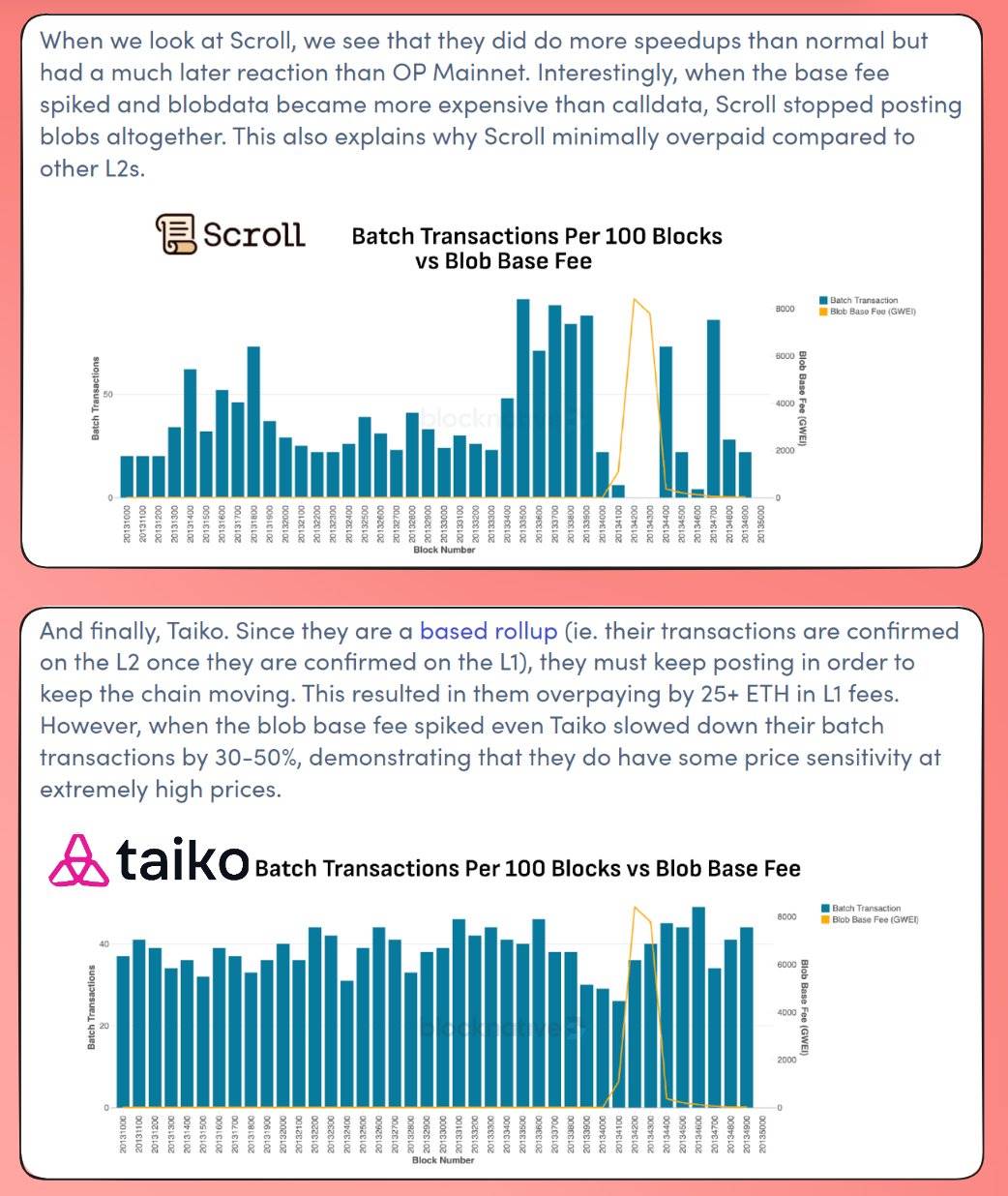

Scroll, a zk rollup with no publishing obligations, completely halted posting.

Looking at Scroll, they did speed up slightly compared to normal, but responded much later than OP Mainnet. Interestingly, when base fees spiked and blobdata became more expensive than calldata, Scroll stopped publishing blobs entirely. This also explains why Scroll incurred the lowest fees among all L2s.

Taiko, a rollup with strict timing requirements, slowed down its batching rate.

Since Taiko is a rollup (meaning transactions are confirmed on L2 once settled on L1), it must continuously publish data to keep the chain running. This led them to pay over 25+ ETH extra in L1 fees. Yet, even Taiko reduced its batch publishing speed by 30–50% when blob base fees surged—showing that they do exhibit price sensitivity under extreme conditions.

Both market participants took rational steps to reduce overhead costs.

In the future, they will surely adopt automated processes to avoid wasting hundreds of thousands of dollars before switching.

All L2s will.

What Can Be Done?

When the author began writing this report, the goal was simply to calculate “how many additional tier-1 L2s are needed to bring back ETH Ultrasound Money™,” but the deeper the investigation went, the clearer it became that this goal is unattainable.

L2s will continuously adapt their behavior to avoid high costs. They are businesses—they will naturally do so.

So given all this, what should be done? Make the mainnet “cool” again—bring back users and builders.

We must strike a balance between scaling via L2s and retaining sophisticated users on the mainnet, rather than indiscriminately pushing them into one of dozens of differently structured ecosystems that provide negligible economic return to Ethereum.

Progress can be made by adjusting messaging:

-

Fill capacity

-

Scale to comfortable levels

-

Tell users and apps “go away” (skip this step)

-

Scale via L2s

Measures like EIP-7623 could also be implemented to prevent L1 user block space from being used as a cost-saving fallback for L2s.

Isn't the idea to rely on L2s as participants and the mainnet purely as settlement? Not with current incentives.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News