1kx analyst: Overview of new players and trends in prediction markets

TechFlow Selected TechFlow Selected

1kx analyst: Overview of new players and trends in prediction markets

AI agents represent the next major opportunity for prediction markets.

Author: mikey, 1kx Analyst

Translation: Luffy, Foresight News

There has been a surge of new builders entering prediction markets, making it necessary to provide a comprehensive overview of this vertical. This article will briefly summarize the prediction market category, go-to-market (GTM) strategies, product updates, mechanisms, and current development trends.

GTM

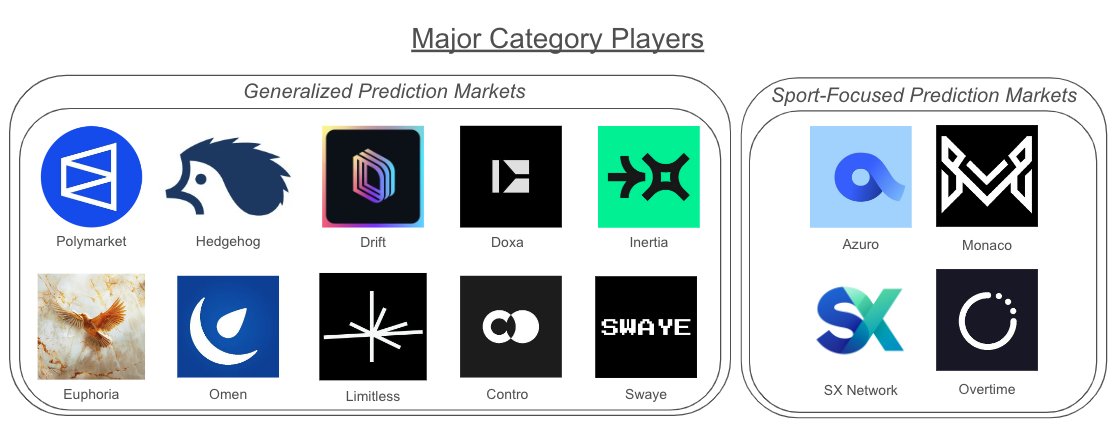

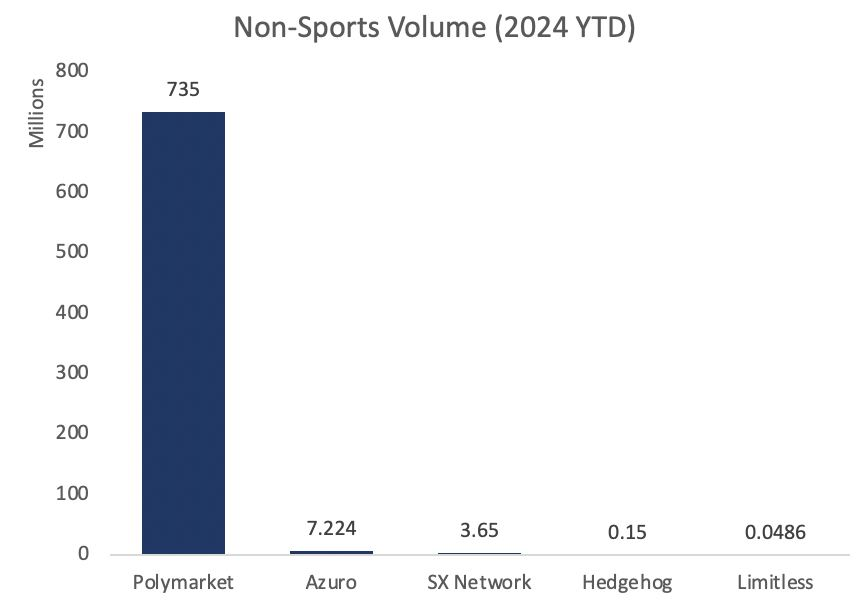

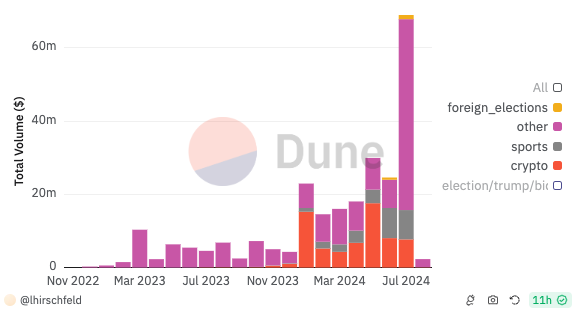

There are roughly two GTM approaches in prediction markets: non-sports and sports. The former is a relatively underdeveloped area, covering several target domains: cryptocurrency, politics, and cultural events. Polymarket is clearly the leader in the non-sports space, with its GTM primarily focused on political events.

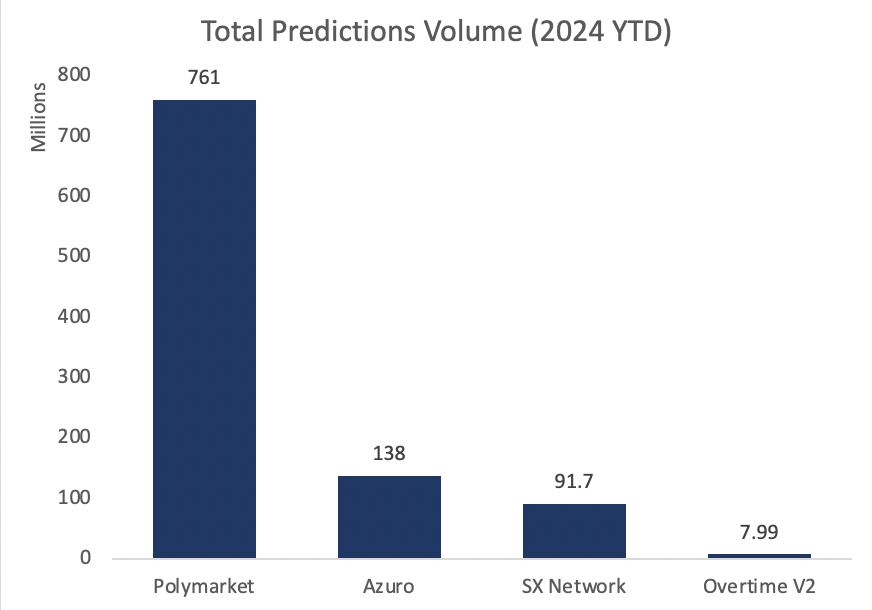

If you compare the trading volume of sports-focused prediction markets this year, you’ll see that Azuro and SX Network have fallen further behind Polymarket.

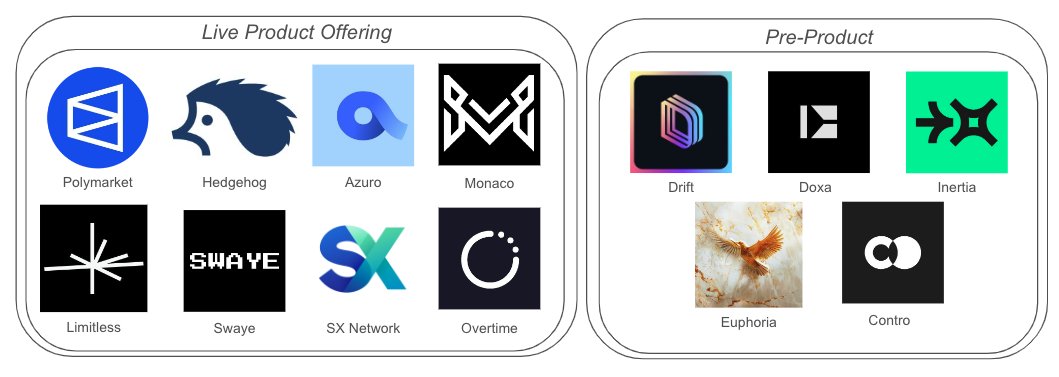

New entrants include Limitless on EVM (with some markets supporting ETH trading) and Hedgehog on Solana. Other competitors have yet to launch products, including Drift Exchange, xMarkets, Inertia Social, Doxa, and Contro.

New players generally focus on two common themes:

-

Permissionless markets: Open market creation and incentive layers

-

Solutions: Relying on artificial intelligence for market settlement or building more efficient systems

This is exactly what Polymarket users have long been hoping for.

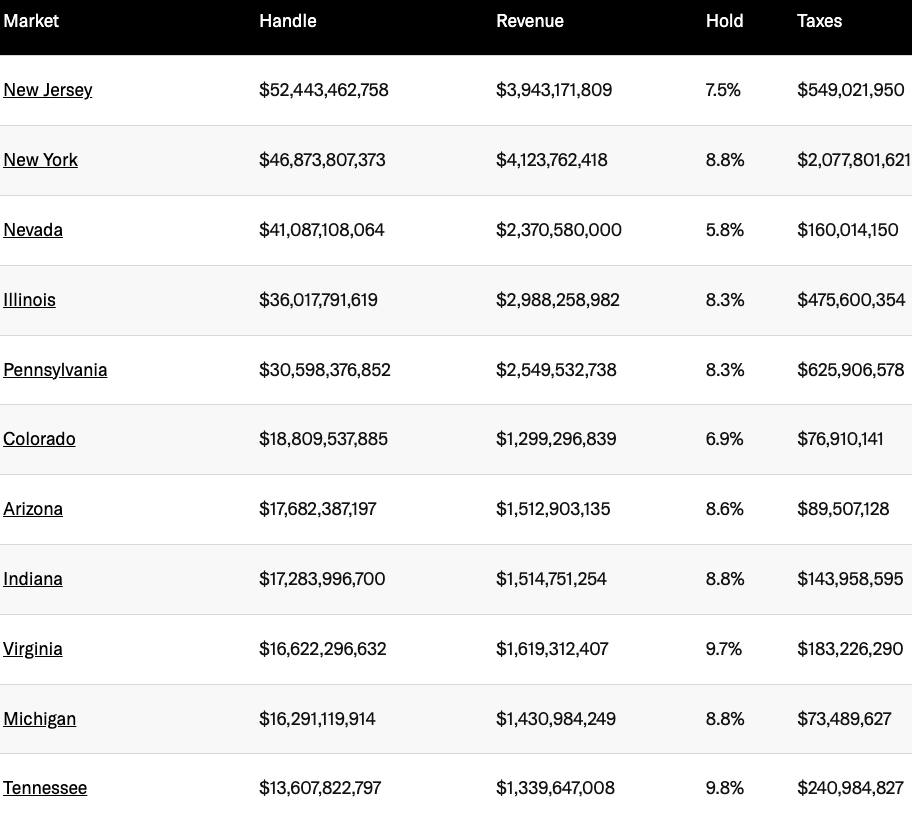

Given the popularity and regularity of sports events, sports-based prediction markets have clear appeal in Web2. It’s difficult to migrate users to Web3, as most prioritize brand and user experience. Additionally, Web2 sports betting platforms hold a funding advantage in marketing—over five sports betting companies spend at least $100 million annually.

The amount Americans bet on a single Super Bowl game (approximately $23 billion) is ten times the total betting volume across crypto prediction markets (around $2 billion). Even individual states exceed $2 billion in betting volume.

More on-chain capital means more on-chain sports betting, just as internet betting companies were overtaken by mobile devices. One constraint for prediction markets is lack of capital. On the non-sports side, LogX will support perpetual TRUMP products, similar to FTX in 2020. Doxa is also exploring leverage. Both projects use liquidity pools as counterparties. Liquidation and bad debt are potential issues.

I hope Polymarket explores parlay-style betting more deeply. Technically, a "Trump and Biden win nomination" market is a leveraged bet since it requires predicting two separate events.

I’d love to see markets like “Will a, b, c, and d happen?” I don’t think initial liquidity would be an issue—LPs won’t miss such opportunities.

In sports prediction markets, multiple protocols already allow leveraged bets via parlays, where payouts occur only if users correctly predict multiple unrelated events. SX Bet, Azuro, and Overtime already support this functionality.

Mechanisms

Prediction markets operate under two broad models: Web2.5 and Web3. The Web2.5 model typically uses crypto as a payment rail—for example, Stake/Rollbit. Users can place bets using crypto, but the counterparty is the team behind the app, and the product interacts off-chain.

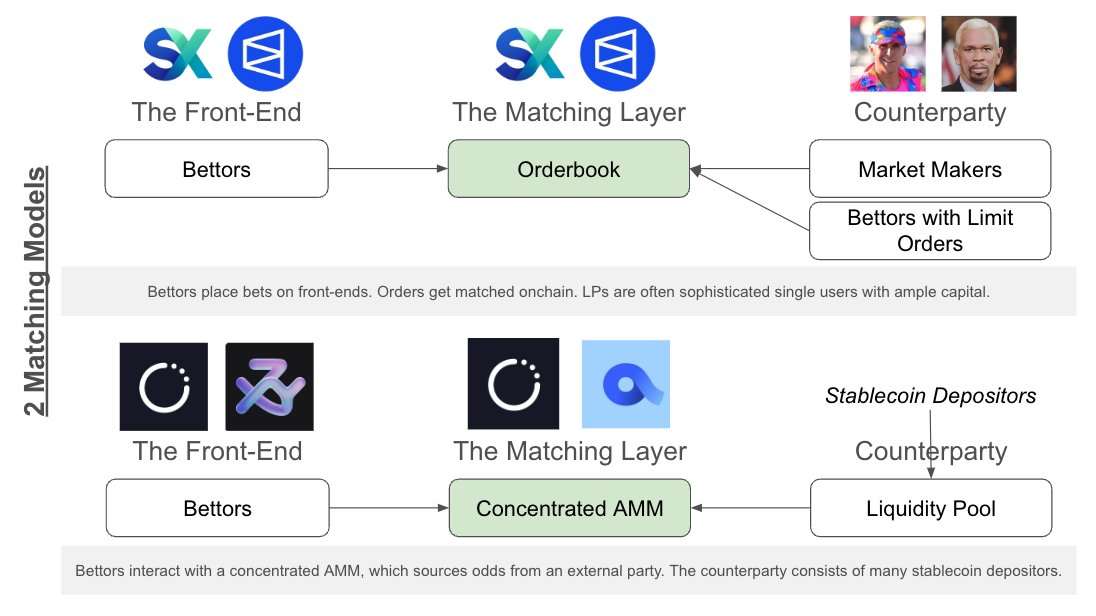

In the Web3 model, parts of the product logic are placed on-chain, whether through NFT positions or wagers executed via smart contracts. There are generally two ways to match on-chain bets: either using AMMs relying on passive LPs, or order-book models where the platform acts as an exchange.

In Web3, memecoins themselves have become prediction markets. $TRUMP and $BODEN are classic examples—holders profit in two ways: 1) being directionally correct; 2) attracting attention. Memecoins let you speculate on others’ speculative behavior, regardless of your own correctness.

A new protocol called Swaye attempts to combine the strengths of prediction markets and memecoins. Early adopters not only bet on specific outcomes but also have incentives to attract attention, as betting activity on either side increases PnL.

Revenue Models

How do prediction market protocols generate revenue? Several methods exist:

-

Trading fees

-

A share of trader profits (the path followed by Web2 models)

-

Counterparty PnL (Web2 prefers serving losing customers)

Most protocols adopt either method 1 or 3. Polymarket currently charges no fees.

Next Steps

What’s next? AI agents represent the next big opportunity for prediction markets, as they can react rapidly to news. They can manage orders and place bets, calculate expected values of outcomes, and take on calculated risks. Several teams are actively working in this space.

In the coming years, at least one protocol will directly compete with Polymarket in trading volume. Given Polymarket’s current level of market incentives, competitors may need to heavily utilize points, tokens, or USDC incentives.

Everyone is asking whether trading volume can be sustained after the U.S. election. So far, non-election-related trading volume on Polymarket has remained stable since the beginning of the year.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News