Crypto Market Faces "Black Monday" — Where Is ETH Headed?

TechFlow Selected TechFlow Selected

Crypto Market Faces "Black Monday" — Where Is ETH Headed?

The crypto market plunged, triggering massive liquidations.

Author: Ebunker

Crypto Market Plummets, Triggering Mass Liquidations

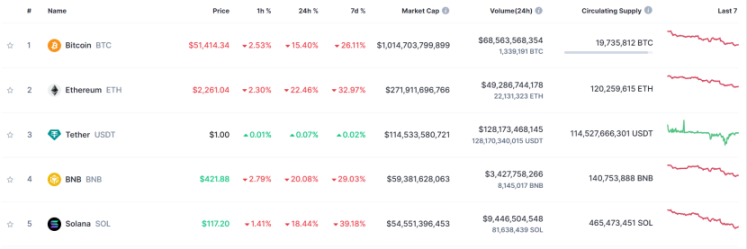

Since August 2, the cryptocurrency market has been underperforming due to multiple factors including geopolitical tensions, Japan's interest rate hike triggering a major sell-off in Japanese equities, weak U.S. employment data and recession fears, as well as weaker-than-expected earnings reports from leading tech and retail giants that sparked broad tech stock selloffs.

On August 5, as traditional financial markets such as Japan experienced sharp declines, the crypto market also entered a steep downturn, with $1 billion in liquidations across all exchanges within 24 hours—$350 million in BTC and $342 million in ETH.

According to a report by on-chain analyst @EmberCN (Yujin), the sharp drop in ETH price triggered a wave of leveraged liquidations among large ETH holders (whales), exacerbating the decline. Several whale addresses were forced to sell their ETH holdings to repay loans, including:

-

An address starting with "0x1111" liquidated 6,559 ETH to repay a loan of 277.9 WBTC.

-

An address starting with "0x4196" liquidated 2,965 ETH to repay a $7.2 million USDT loan.

-

An address starting with "0x790c" liquidated 2,771 ETH to repay a $6.06 million USDC loan.

-

An address starting with "0x5de6" liquidated 2,358 ETH to repay a $5.17 million USDC loan.

Data from CoinGecko shows that over the past week, ETH plunged from around $3,300 to below $2,200—a drop exceeding 30%. Additional factors contributing to ETH’s fall include rising leverage liquidation pressure and news of significant ETH selling by Jump Trading.

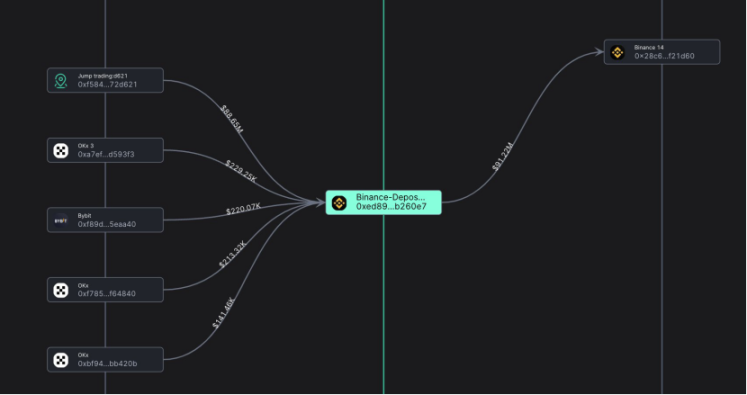

Note: According to blockchain analytics site Spot On Chain, on August 5, Chicago-based trading firm Jump Trading transferred 17,576 ETH worth over $46 million to centralized exchanges from its crypto wallet. Fortune magazine reported on June 20 that the U.S. Commodity Futures Trading Commission (CFTC) is investigating Jump Trading’s cryptocurrency investment activities. Since July 25, this wallet has moved nearly 90,000 ETH to exchanges. After the market crash, it still holds 37,600 wstETH from the Lido protocol and 11,500 stETH.

Julian Hosp, CEO and co-founder of decentralized platform Cake Group, believes, “The sharp drop in ETH is linked to Jump Trading, possibly because the firm faced margin calls in traditional markets and needed liquidity over the weekend, or chose to exit crypto operations for regulatory reasons.”

Jump Trading transfers ETH to Binance exchange

According to a research report from 0xScope, since August 3, the top five market makers have collectively sold 130,000 ETH. Wintermute sold over 47,000 ETH, followed by Jump Trading with over 36,000 ETH sold, Flow Traders ranked third with 3,620 ETH sold. GSR Markets sold 292 ETH, while Amber Group sold 65 ETH. Although Wintermute sold the largest volume of ETH, Jump Trading began selling ETH earlier last weekend, ahead of other major market makers.

The chain reaction from these events led to up to $100 million in ETH liquidations within one hour and over $445 million in total liquidations within 24 hours. According to Parsec data, DeFi platform loan liquidations exceeded $320 million on August 5—the highest level this year. Of that, $216 million was from ETH collateral, $97 million from wstETH, and $35 million from wBTC.

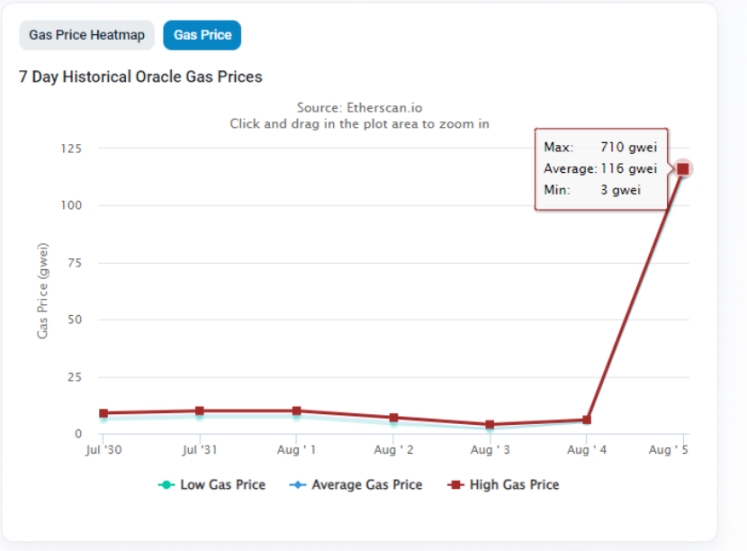

As ETH dropped as low as $2,100, Ethereum’s peak gas fee reached 710 gwei. Notably, if ETH continues to fall to $1,950, $92.2 million worth of crypto assets in DeFi protocols will be liquidated; should ETH drop to $1,790, $271 million in DeFi assets would face liquidation.

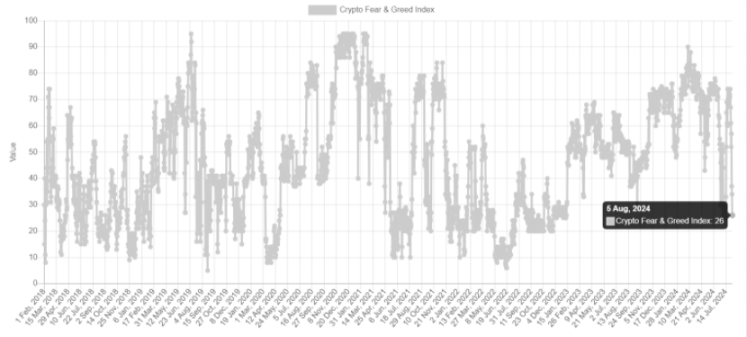

Following this plunge, long leverage positions in the crypto market were largely wiped out, many short-term spot holders exited, and market fundamentals were shaken but not destroyed. The Crypto Fear & Greed Index dropped to 26 (indicating "fear"), reaching one of the lowest levels since 2023, suggesting limited downside risk in the near term.

What’s Next for ETH Spot ETFs?

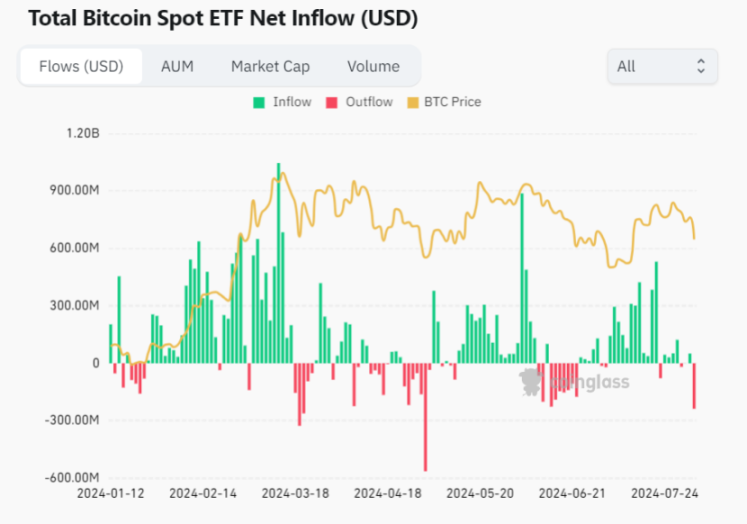

BTC spot ETF net inflow data chart

BTC spot ETF net inflow data chart

Looking at BTC spot ETF data, despite a period of net outflows (mainly driven by Grayscale’s GBTC sales), the cumulative net inflow remains around $17.5 billion, which explains why BTC prices have held relatively firm.

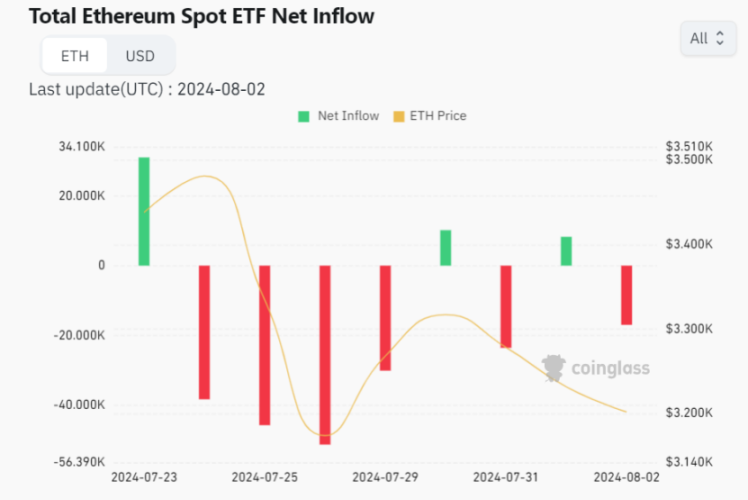

ETH spot ETF net inflow data chart

In contrast, ETH spot ETFs have recorded cumulative net outflows of -$511 million, launched during a period of macroeconomic turmoil and sharp declines in risk assets like U.S. stocks. Their total asset value is also significantly smaller than BTC ETFs. Grayscale’s ETHE accounts for most of the outflows—over $2.1 billion—while other ETF issuers remain in net inflow territory. Given that Grayscale’s ETHE still holds over $5.97 billion worth of ETH, further outflows are possible in the coming weeks.

Currently, ETH still lags far behind BTC in terms of recognition and adoption in traditional markets. Although ETH remains a secondary player compared to BTC spot ETFs, its approval marks a significant regulatory milestone for the crypto industry, carrying long-term importance. As traditional institutions deepen their understanding of ETH’s fundamentals, more institutional capital could flow into ETH in the future.

After the market crash, Circle CEO stated, “During global macro volatility, focus should be on technology, industry development, and adoption—not price. I remain bullish on the crypto industry.” Historical data shows that the cryptocurrency sector often underperforms in August and September, but tends to recover positively starting in October.

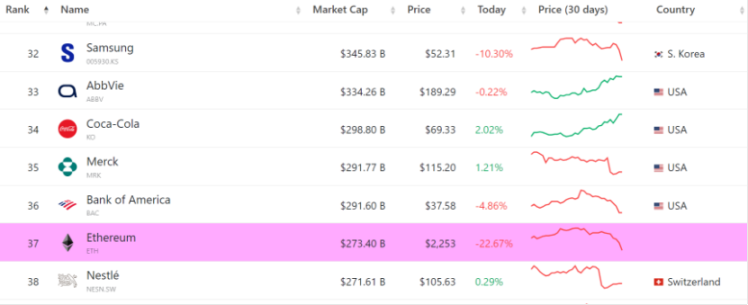

As of August 5, ETH’s market cap stood at $273.4 billion, ranking 37th globally among companies—lower than Coca-Cola and Bank of America, and even less than Berkshire Hathaway’s cash reserves ($276.9 billion) after Buffett reduced his Apple stake.

As the leading application-focused public blockchain in crypto, ETH holds immense potential in technological adoption and innovation. This dip in market cap presents better positioning opportunities for institutions. Moreover, markets expect the Federal Reserve may begin rate cuts in September. Such monetary easing could offset short-term yen-driven headwinds, and the resulting liquidity release might drive additional capital into ETH spot ETFs.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News