Mid-Year Review: Performance Analysis of Emerging Layer2 Projects in ZK and OP Ecosystems

TechFlow Selected TechFlow Selected

Mid-Year Review: Performance Analysis of Emerging Layer2 Projects in ZK and OP Ecosystems

Overall, both OP Rollup and ZK Rollup projects have underperformed in terms of token price, failing to follow Ethereum's own upward trend.

Author: BitMart Research

Key Takeaways

-

Shift in Narrative Cycle: In the first half of the year, the Ethereum ecosystem was in a macro narrative and capital-driven cycle. Despite the launch of Layer 2 tokens represented by ZK and OP, these new L2s experienced continuous price declines due to initial market sell pressure and weak investor confidence. This prevented them from supporting the broader market, ultimately causing their price movements to decouple from Ethereum itself. While ETH prices continued to rise, newly launched L2 tokens kept falling.

-

Rise of Base: Base emerged as a dark horse this year, achieving strong growth in both ecosystem development and user activity, establishing itself as the second-largest leader among Layer 2 solutions.

-

OP Rollup vs. ZK Rollup: In the first half of 2024, OP rollups have dominated the Layer 2 market—four of the top five projects by total Layer 2 TVL are OP rollups. However, overall token performance for both OP and ZK rollups has been disappointing, failing to follow Ethereum’s upward price trend.

Secondary Market Performance of L2 Tokens

Over the past six months, Ethereum's price declined initially before recovering and ultimately gaining 35.01%. Despite ETH’s strong performance, newly launched L2-related tokens such as MNT, BLAST, ZK, MANTA, and STRK experienced significantly larger drawdowns. Market participants appear to favor holding Ethereum itself over investing in technical infrastructure projects like L2s. Below is the price performance of ETH and selected L2 tokens between January 1, 2024, and July 1, 2024:

-

ETH: +35.01%

-

MNT: +9.27%

-

BLAST: +1.36%

-

ZK: -26.46%

-

MANTA: -59.44%

-

STRK: -76.89%

This phenomenon indicates that in the first half of 2024, Ethereum remained in a macro-narrative and capital-driven phase. The market widely believes that the approval of ETH ETFs will bring more institutional investment and liquidity to Ethereum, rather than to innovation-focused L2 projects. This divergence stems from two main factors: First, numerous high-valuation institutional-grade projects entered the market this year, leading to sustained price declines post-launch and weakening investor confidence. Second, most of these Ethereum L2 tokens were launched recently, resulting in relatively low initial market adoption and liquidity, making their prices highly volatile. As a result, while ETH rebounded after a correction, its associated L2 tokens failed to recover in tandem and instead suffered steeper losses.

Figure 1: The price trends of the L2 tokens analyzed here all diverged from ETH’s price movement.

Data source: Trading View

On-Chain Data Analysis of Layer 2

-

Ecosystem & TVL Analysis

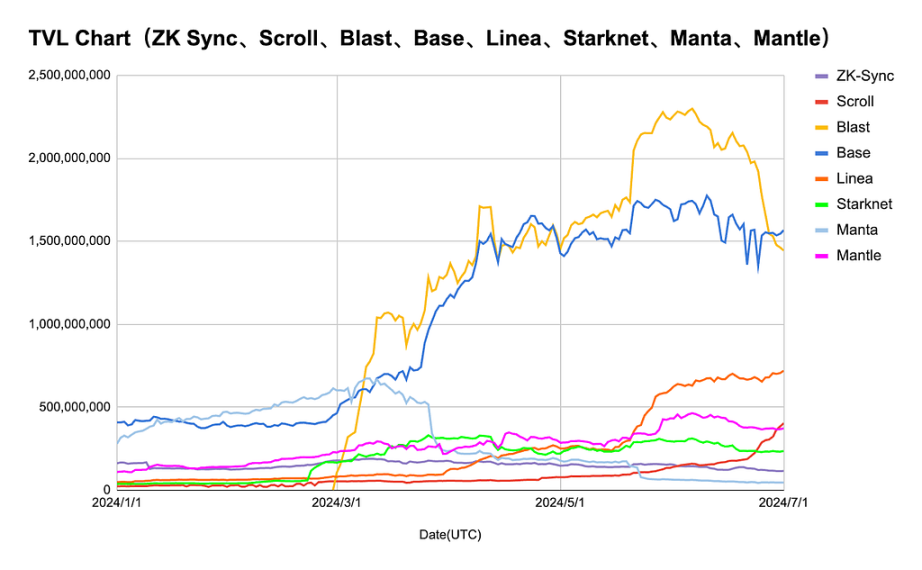

Although most L2 tokens underperformed in the first half of the year, some projects showed promising on-chain metrics. Base and Blast saw significant TVL growth during this period, far exceeding other L2s—Base reached a peak TVL of around $1.8 billion, while Blast peaked at approximately $2.3 billion. Additionally, Base, Blast, and Linea surpassed Optimism in total market share of Layer 2 TVL, securing positions within the top four. Base’s TVL growth was primarily driven by its diverse ecosystem. According to Coingecko data, the Base ecosystem supports 656 tokens with a daily trading volume of about $664 million. In contrast, despite higher average TVL, Blast’s ecosystem remains less developed, currently supporting only 74 tokens with an average daily trading volume of $65 million.

Linea’s TVL surged notably in mid-May, likely due to its re-staking project Zerolend announcing an airdrop and token launch, combined with Linea’s official staking points campaign launched in May, which attracted substantial deposits. Currently, the Linea ecosystem supports 57 tokens, with a daily trading volume averaging $37 million. Starknet, ZK Sync, Scroll, and Mantle maintained relatively stable TVL throughout the observation period, showing gradual upward trends. Meanwhile, Manta’s TVL began declining significantly from April and continued its downward trajectory through July 1.

Overall, based on ecosystem size, activity, and TVL, Base currently leads by a wide margin. Its diversified ecosystem has brought greater on-chain activity and higher TVL.

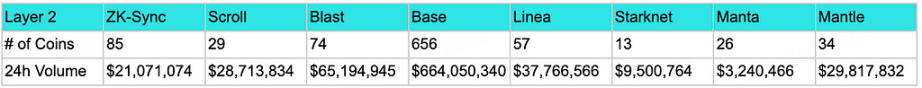

Figure 2: As of July 1, number of tokens supported and 24H trading volume across various Layer 2s

Data source: Coingecko

Figure 3: In the first half of the year, Blast and Base had significantly higher TVL than other observed Layer 2 projects.

Data source: Defillama, Coingecko

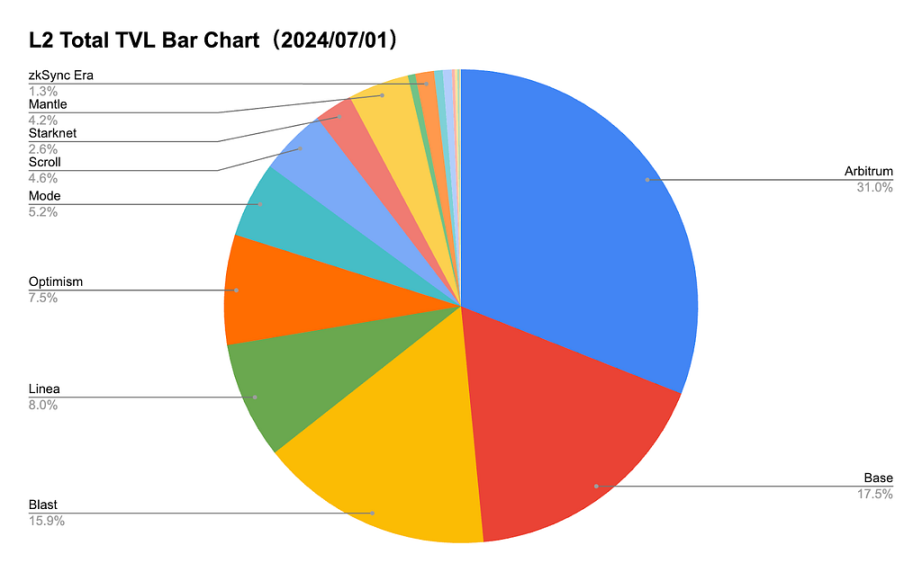

Figure 4: As of July 1, Arbitrum still holds the largest share (31%) of total platform Layer 2 TVL. Base, Blast, and Linea surpass Optimism and rank in the top four.

Data source: Defillama

-

PE Ratio Analysis (TVL/MC)

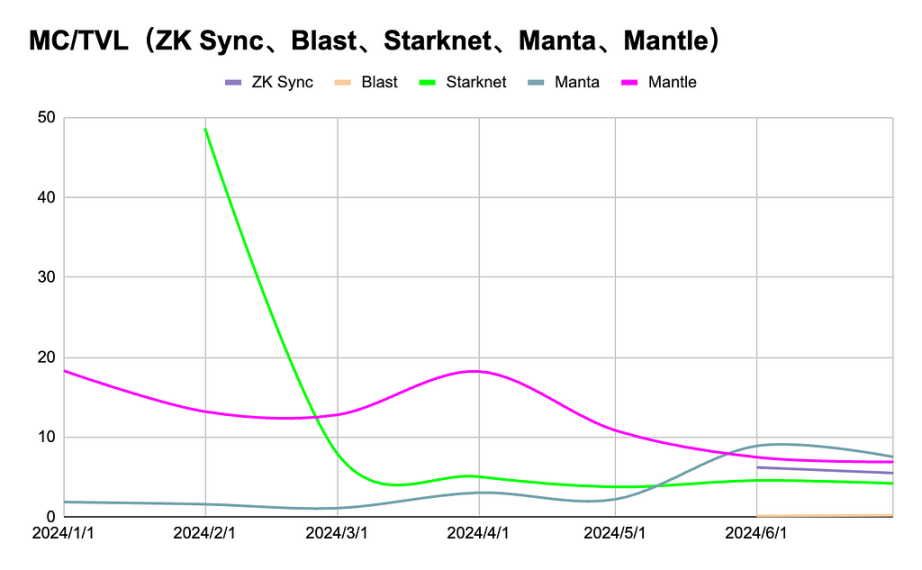

Starknet and Mantle: Both projects started with high PE ratios, which quickly dropped and stabilized. The market remains cautious about their future growth potential, with the initially high PE ratios likely caused by excessive valuations. CMC and Defillama data show that STRK had a circulating market cap of nearly $1.9 billion when it launched in February, while its TVL was only about $40.47 million, indicating severe overvaluation. Although TVL grew nearly sixfold a month later, significantly lowering the PE ratio, investor confidence remained weak. Heavy early selling pressure made STRK the worst-performing L2 token observed in the first half of the year (-76.89%).

ZK Sync and Linea: Showed strong growth momentum in the first half but experienced TVL pullbacks after peaking. This suggests they attracted significant short-term attention and capital but remain vulnerable to market volatility.

Scroll, Blast, Base, and Manta: Exhibited minimal changes, with small fluctuations in TVL and PE ratios, indicating relatively stable market positions without attracting major attention. This may reflect steady but unspectacular holder confidence and growth expectations.

Overall, the market performance of Ethereum Layer 2 solutions shows significant divergence, reflecting varying levels of market confidence and expectations. The rapid rise and subsequent decline of ZK Sync and Linea suggest speculative interest in emerging projects, whereas Starknet and Mantle demonstrate more stable market acceptance. The relatively steady performance of Scroll, Blast, Base, and Manta indicates they hold stable but not outstanding positions in the market.

Figure 5: As the first launched ZK rollup, Starknet’s token was severely overvalued in the early stages

Data source: Defillama, CMC

-

Layer 2 Revenue in First Half of 2024

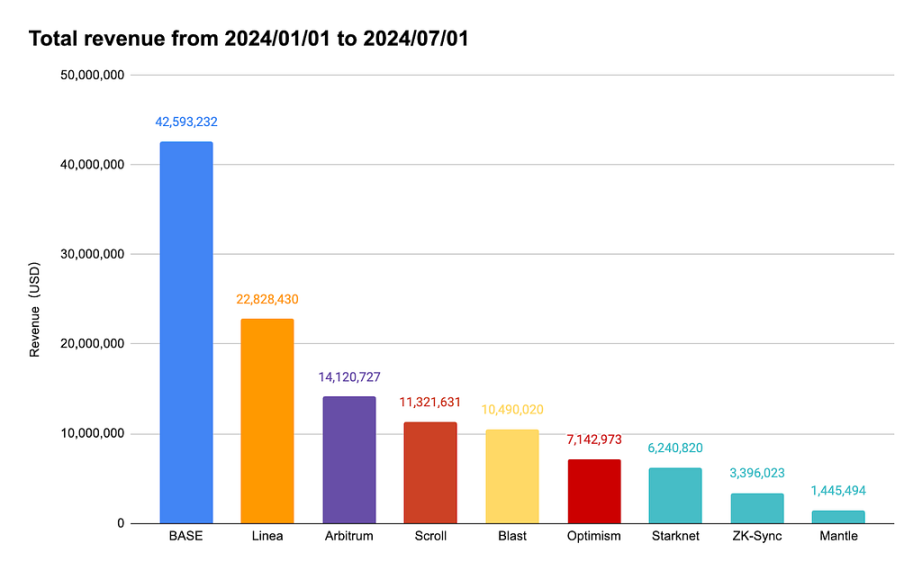

In the first half of the year, Base generated revenue of $42.59 million, surpassing Layer 2 leaders Arbitrum and Optimism. As mentioned earlier, Base’s high revenue is largely due to its diversified ecosystem, cementing its status as a rising star among Layer 2s. Linea followed with $22.82 million in revenue, ranking second and also outperforming Arbitrum and Optimism.

Figure 6: Base became the highest-revenue-generating Layer 2, far exceeding Arbitrum and Optimism

Data source: Artemis

-

Transaction Volume

According to data from each Layer 2’s official block explorer, there were large differences in daily transaction volumes over the past six months. Base saw a sharp increase in April and has since maintained a clear lead, with daily transactions fluctuating between 2 million and 4 million. Linea experienced an unusual spike in April, briefly reaching nearly 5 million daily transactions—the reason remains unclear. Other Layer 2s generally maintained daily volumes below 2 million with modest increases. Overall, Layer 2 activity remained healthy, with no significant drop in average daily transactions.

Figure 7: Among the Layer 2s analyzed, Base leads by a wide margin in daily transaction volume

Data source: Each L2Scan

-

New Addresses

-

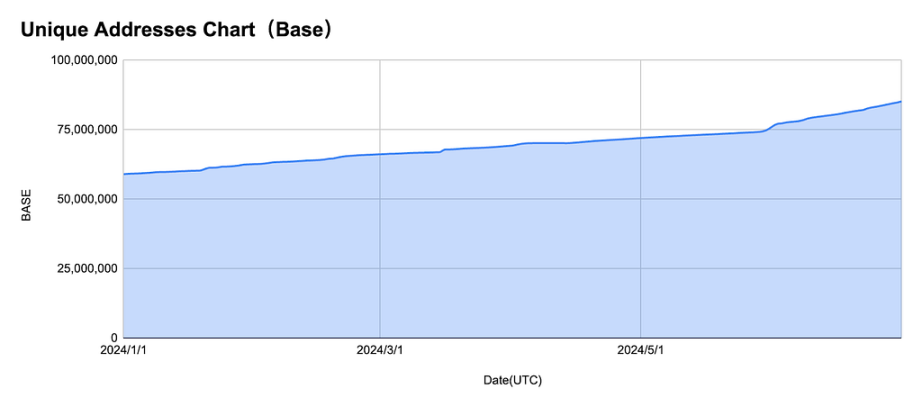

Base: Unique address count increased from approximately 60 million at the start of 2024 to nearly 85 million by early July, more than seven times that of second-place ZK Sync. This reflects expanding user adoption and growing network usage.

-

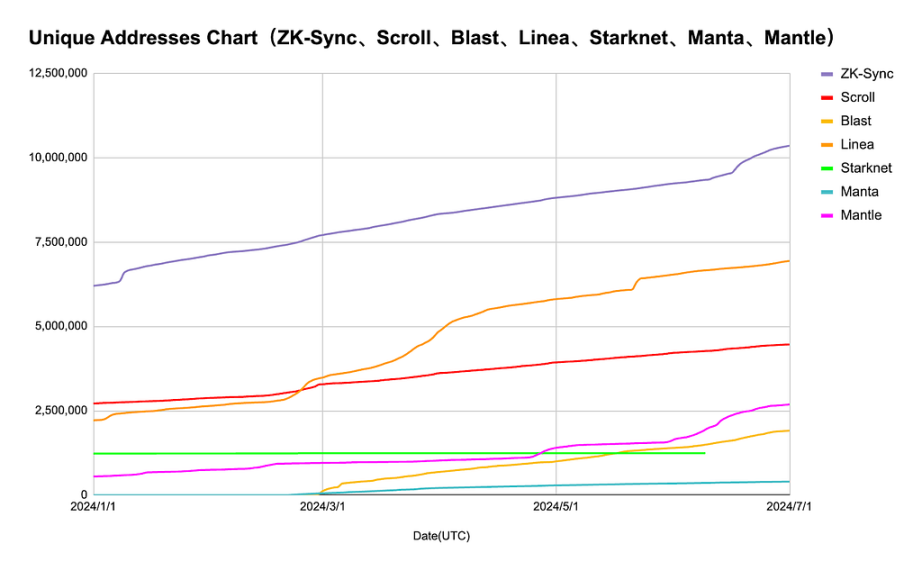

ZK Sync: Unique addresses grew from around 6 million to nearly 10 million during the same period, showing notable momentum and increasing market recognition.

-

Scroll, Blast, Linea, Mantle: These four Layer 2s maintained steady growth in unique addresses over the past six months.

-

Starknet and Manta: Unique address counts remained nearly flat over the past six months, suggesting little new user acquisition.

Overall, there are significant differences in user growth among these Layer 2s. Base, ZK Sync, and Linea demonstrated strong expansion, indicating substantial new user inflows. In contrast, Starknet and Manta saw almost no growth in unique addresses.

Figure 8: Among the Layer 2s analyzed, Base leads by a wide margin in daily new address additions

Data source: Each L2Scan

Data source: Each L2Scan

-

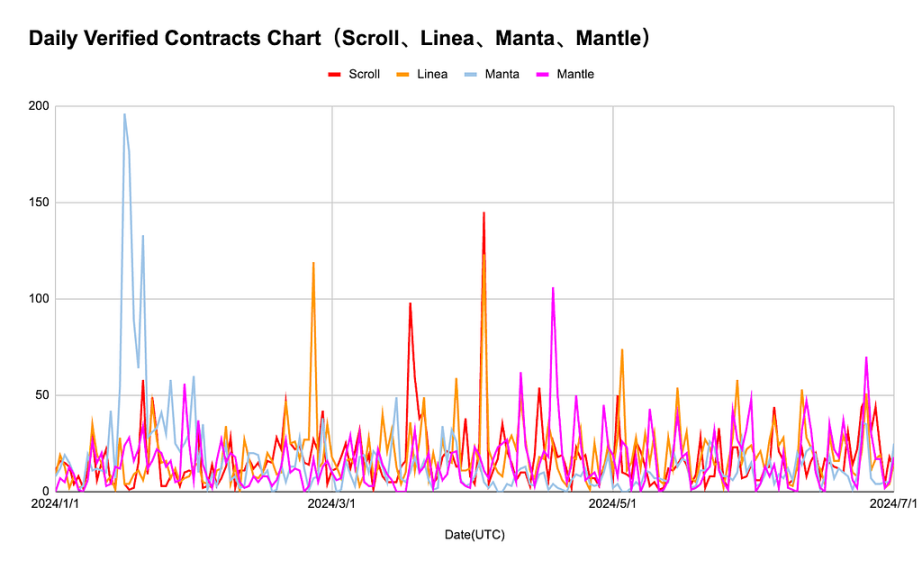

New Verified Contract Deployments

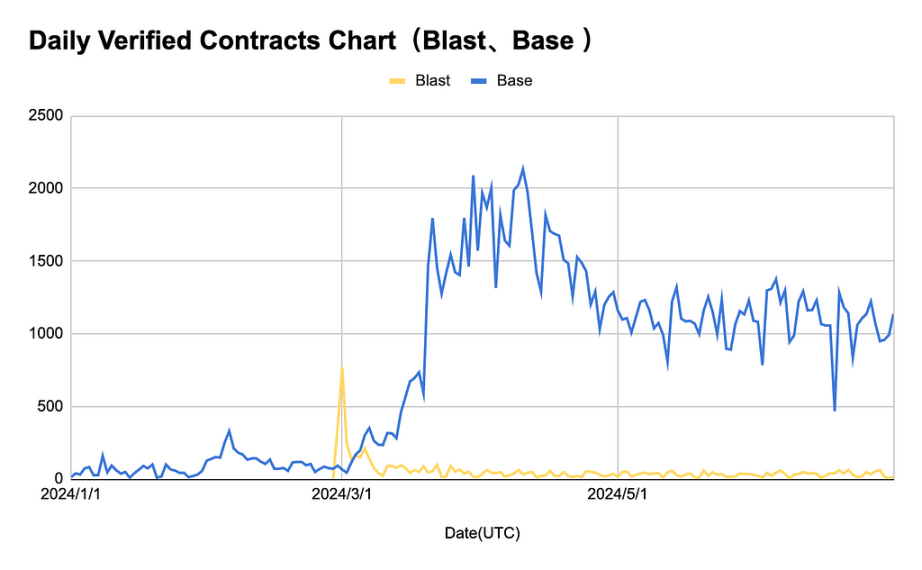

As shown in the chart below, Base’s daily verified contract deployment trend differs significantly from other Layer 2s. Daily new contract deployments peaked in March 2024, approaching 2,000 contracts per day, then declined slightly but remained at relatively high levels. This surge is mainly driven by the ongoing development of meme coins on Base. According to Coingecko, the total market cap of meme coins is currently around $562 billion, with Base-based meme coins accounting for approximately 3.2%, ranking third behind Solana meme coins at 16.6%. The proliferation of meme coins on Base continues to drive up contract deployment numbers. Other Layer 2s showed minimal fluctuations, generally adding fewer than 200 new contracts per day. Blast and Manta exhibited brief initial spikes, possibly due to specific projects, followed by rapid declines and stabilization, indicating high initial popularity but poor sustainability.

Overall, Base stands out among all platforms, demonstrating strong growth momentum and high user engagement. In contrast, Blast, Scroll, Linea, Manta, and Mantle have lower and more volatile new contract counts, reflecting weaker and less stable market influence and user activity.

Figure 9: Among the Layer 2s analyzed, Base leads by a wide margin in daily new verified contract deployments

Data source: Each L2Scan

Data source: Each L2Scan

Comparison of OP and ZK Rollup Market Performance

OP Rollup (Base, Blast, Mantle, Manta)

-

Base: Base made significant progress in the first half of the year. Despite launching its mainnet only about a year ago, its TVL reached $1.5 billion, surpassing the OP mainnet and becoming the second most popular Ethereum Layer 2 after Arbitrum. Additionally, Base became the highest-earning L2 chain, generating $42.6 million in revenue during the first half of 2024—nearly double that of second-place Linea.

-

Blast: After launching its mainnet on February 29, Blast attracted massive user participation in its dApp ecosystem through airdrops and point campaigns, driving its TVL above $2 billion at one point. However, following the token launch, heavy sell pressure from airdrop recipients and user attrition led to continuous declines in both token price and TVL. Blast now ranks third in Layer 2 TVL (around $1.4 billion). Whether Blast can maintain its TVL and activity post-airdrop will reflect the stickiness of its initial user base.

-

Mantle: Mantle’s on-chain performance in the first half was unremarkable, showing no standout performance in TVL, revenue, or on-chain activity.

-

Manta: Manta had high on-chain activity at the beginning of the year, but as its token price fell and its ecosystem lacked innovation, its TVL and on-chain metrics gradually declined. It now ranks near the bottom among Layer 2s.

ZK Rollup (ZK Sync, Starknet, Linea, Scroll)

-

ZK Sync: As an established ZK rollup, ZK Sync launched its token ZK in the first half of the year, distributing it via airdrop to early users. The token had an initial circulating market cap of $800 million and a fully diluted valuation of $4.5 billion. Since launch, the token has traded steadily between $0.15 and $0.18, with a current circulating market cap of around $670 million, slightly below its competitor Starknet’s $STRK, which has a circulating market cap of nearly $900 million.

-

Linea: Linea currently leads ZK rollups in TVL and ranks fourth across all Layer 2s. Launched in August 2023, Linea achieved rapid growth in TVL and on-chain activity, primarily due to its points program launched in May. Notably, Linea has not yet launched a token. If a future token launch brings significant sell pressure from points participants, and if users remain active post-airdrop, will be key challenges going forward.

-

Starknet: Starknet airdropped its $STRK token on February 20, 2024, becoming the first ZK rollup to issue a token. However, as the first ZK-native token launch, it was severely overvalued initially—STRK opened with a circulating market cap of nearly $1.9 billion, while its TVL was only about $40.47 million. Heavy early sell-offs made STRK the worst-performing L2 token in the first half (-76.89%). Starknet focused heavily on GameFi in the first half, but persistent bearishness in altcoins limited growth in on-chain activity and TVL.

-

Scroll: Like Linea, Scroll launched a Layer 2 points program in May. Following the campaign, Scroll’s TVL surged from $100 million to around $400 million. This high level of on-chain activity makes Scroll one of the most anticipated upcoming airdrops in the second half of the year.

Overall, in the first half of 2024, OP rollups have taken a dominant position in the Layer 2 market—all four of the top Layer 2 projects by TVL are OP rollups. In particular, Base emerged as a dark horse, achieving strong growth in ecosystem development and user activity, solidifying its status as the second-largest Layer 2. However, overall token performance for both OP and ZK rollups has been disappointing, failing to follow Ethereum’s upward price trend. This reflects that the market is currently not in an innovation-driven cycle—investor capital remains more aligned with macro narratives.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News