Crypto Winter Returns? Understanding the Market Crash and an Investor's Survival Guide

TechFlow Selected TechFlow Selected

Crypto Winter Returns? Understanding the Market Crash and an Investor's Survival Guide

Don't sell at the bottom, even if you're anxious about cryptocurrency.

Author: ardizor

Compiled by: TechFlow

This historic crash will be remembered:

-

$BTC -25%

-

$ETH -35%

-

$SOL -30%

Here's what happened in the past 48 hours, the events that triggered this crash, and how you should protect your crypto assets now.

Today is definitely not a "good morning" day.

Mr. Market has once again shown us how fast things can change.

As investors or traders, you should never feel too comfortable.

The market can strike at any moment and nearly wipe you out.

The Fear & Greed Index may drop further tomorrow.

While I'm writing this, the market is correcting, but in the long run, this is good for us.

At times like this, the timeless words of our wise old grandfather Buffett still apply:

"Buy when there's blood on the streets, even if it's your own."

So let's understand where we stand.

What has happened in the past 48 hours, and what to do if you're feeling lost.

Current situation:

① S&P 500 dropped 4% today, wiping out $2.1 trillion in market cap at open:

This is the first time since 2020.

In other words, the S&P 500 erased twice the market value of $NVDA within just 14 days.

Staggering numbers.

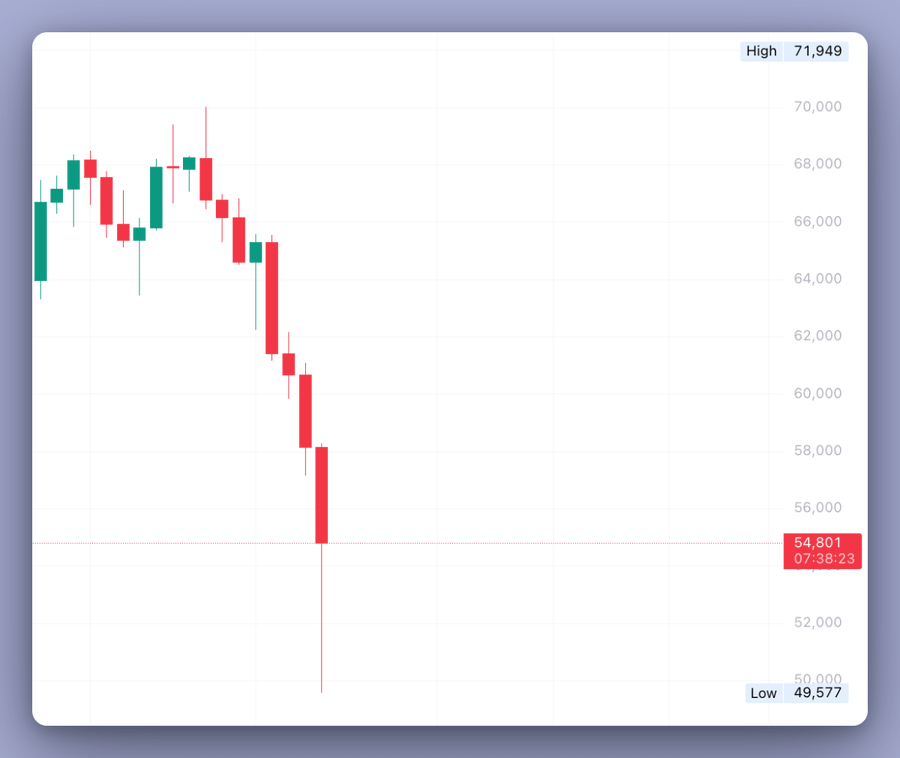

② Just looking at crypto prices, you'll feel inner numbness:

· BTC low of $49,577 on Binance

· ETH low of $2,116 on Binance

Within the past 24 hours, we've witnessed one of the largest drops since last year.

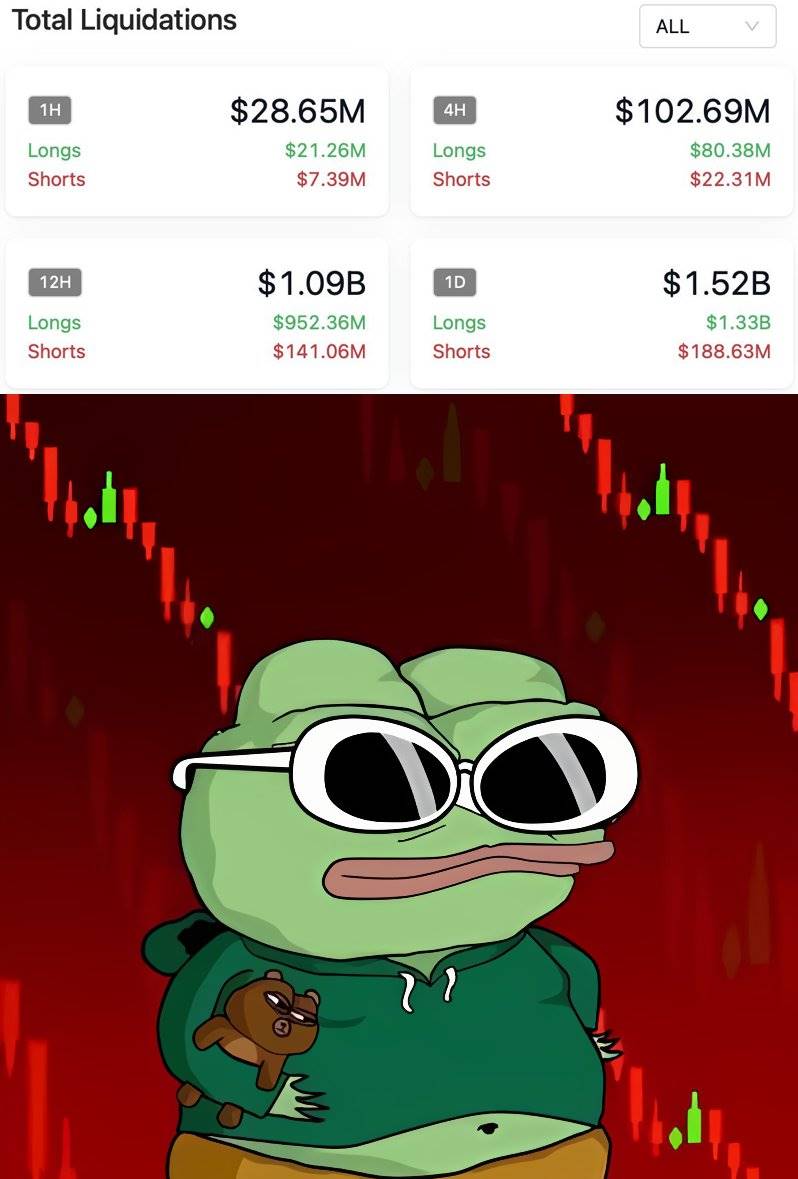

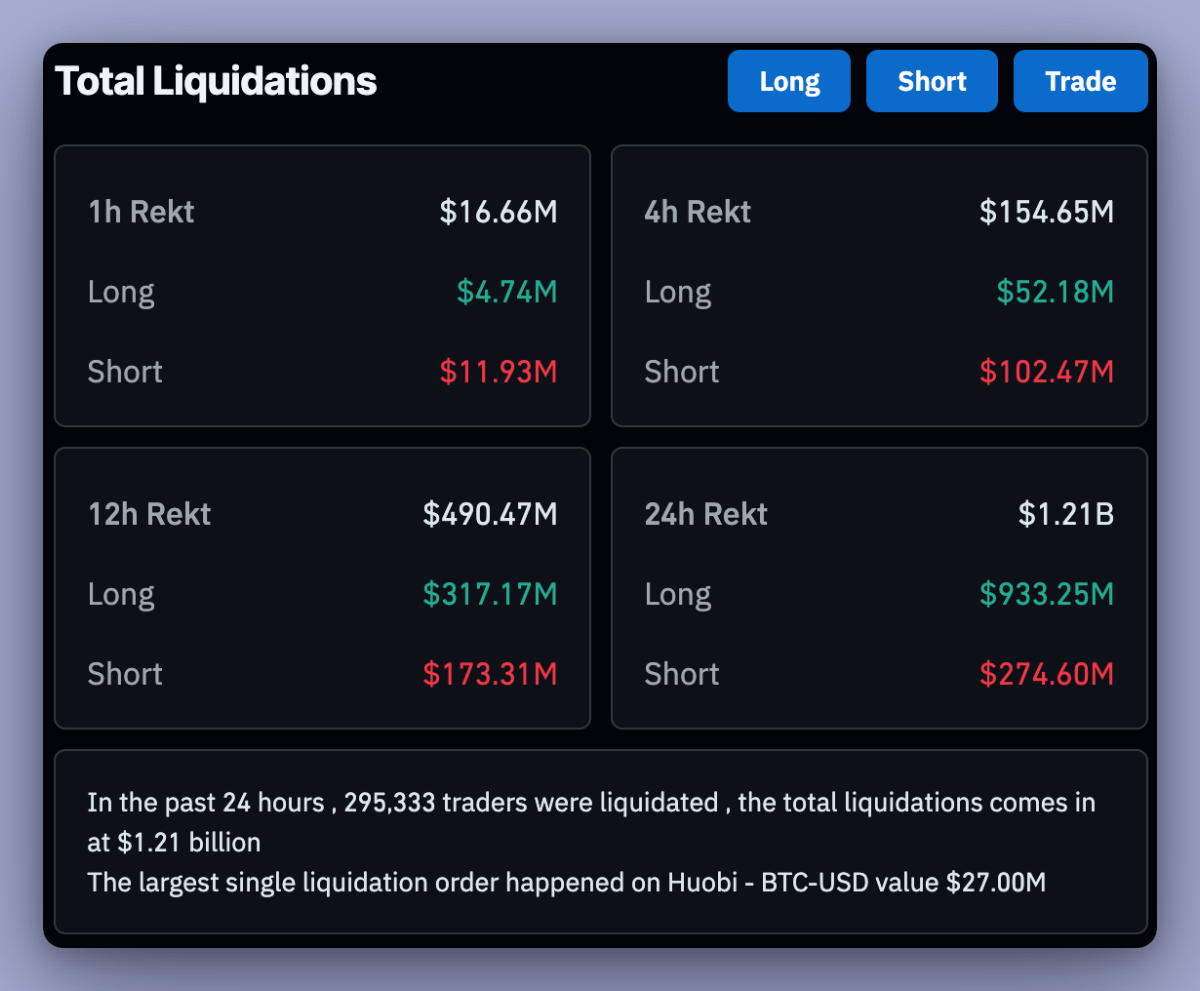

③ Liquidation levels resemble those during the COVID and FTX era:

Few long positions left, shorts dominate the market—clear from liquidation data.

However, note this metric can shift rapidly.

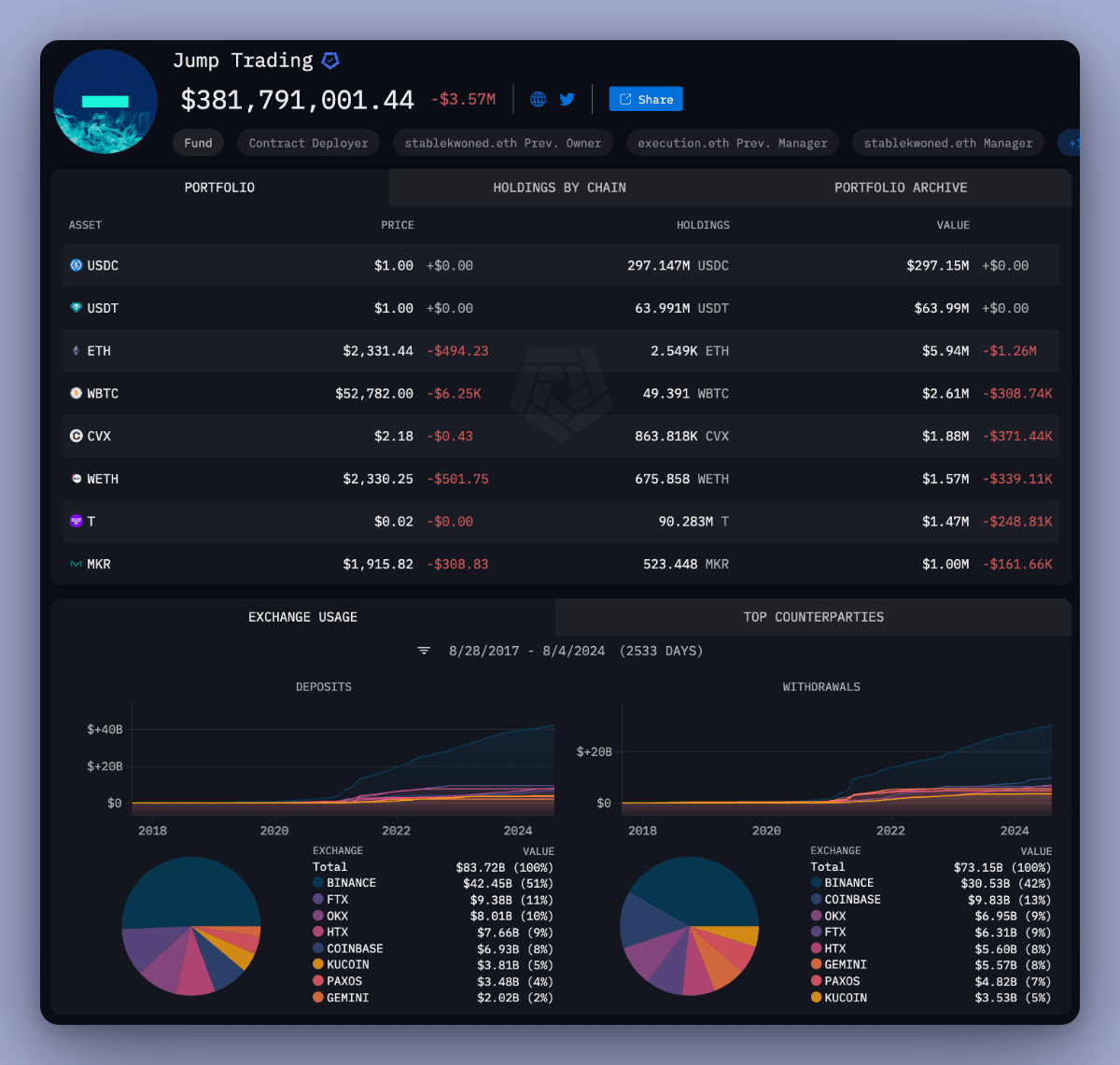

④ @jump_ is dumping their holdings:

You can view the sell-offs here.

They started selling with minimal market liquidity, offloading over $310 million worth of ETH.

⑤ Escalating geopolitical tensions between Israel and Iran:

It's reasonable to speculate the situation won't end easily. Iran's response could coincide with significant dates in Israel, such as Tisha B'Av, August 12–13. The Jerusalem Post, one of Israel's largest media outlets, has reported on this.

Why can't people just live in peace?

⑥ Japan's stock market facing historic losses:

The Nikkei 225, similar to the S&P 500, dropped 13% in a single day.

It has already fallen over 25% from its peak.

Meanwhile, the yen remains strong, which is unfavorable for markets.

⑦ Robinhood halts trading, Charles Schwab's platform experiences issues:

⑧ The U.S. Federal Reserve may hold an emergency meeting:

They could implement an immediate 50-basis-point rate cut after the meeting.

Markets price in a 60% chance of an emergency rate cut, but I still consider it unlikely.

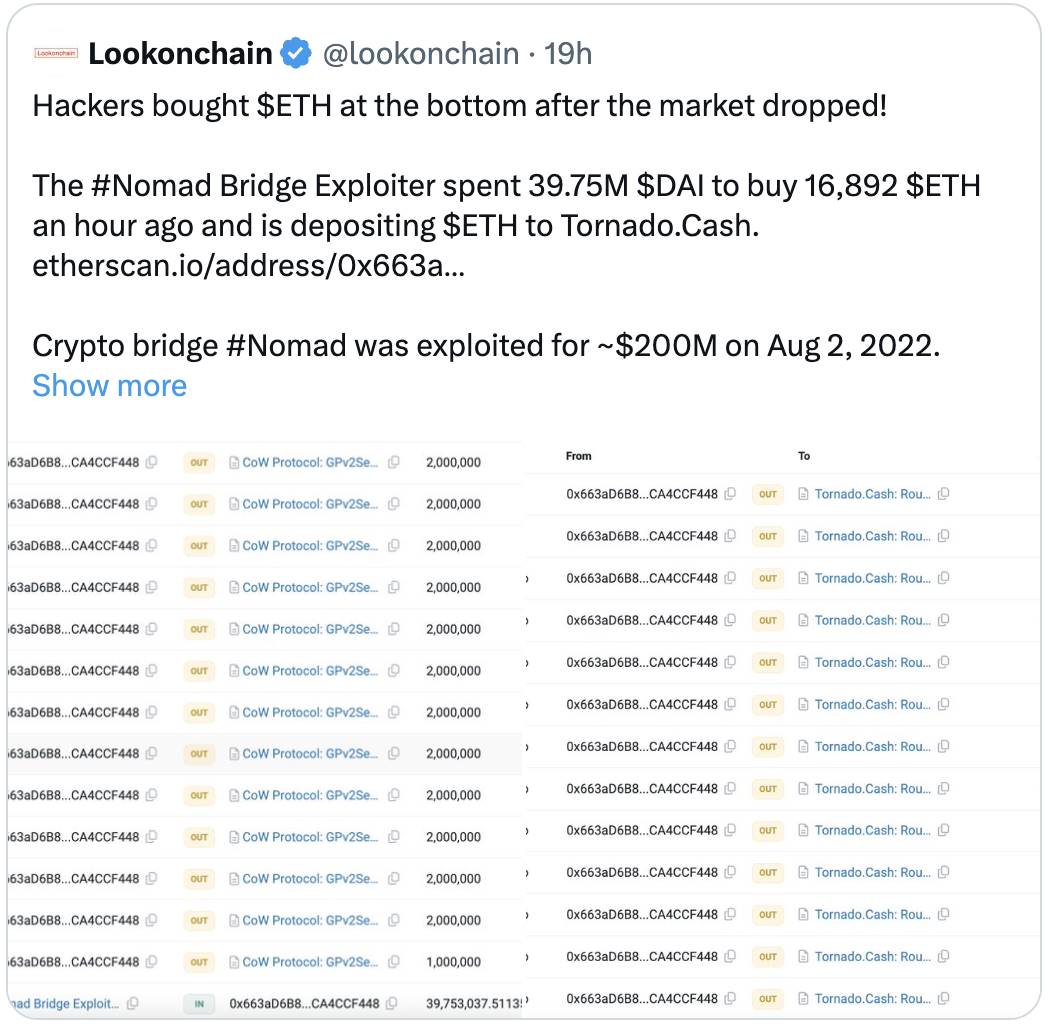

⑨ Nomad hacker used stolen $DAI to buy $ETH:

See tweet for details.

Now, let's move to the most important part.

What you can do in this situation, and how to protect your assets and mental health:

-

Don't sell at the bottom, even if you're anxious about crypto.

-

Wait for market consolidation or a shift in sentiment. Focus first on $BTC, then $ETH. Other altcoins can wait.

-

Avoid margin, leverage, futures, loans, or credit. Stick to spot trading for survival.

-

Don't rush to recover losses. Crypto is a long-term game.

-

Get enough sleep, exercise regularly, spend time with family.

Pick strong altcoins, stay calm, and a month from now you’ll have forgotten all about this.

We should all stand together.

Storms always come, but dark clouds eventually clear. After the rain comes the rainbow.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News