Long Read: A 15-Year Evolution of Crypto Venture Capital

TechFlow Selected TechFlow Selected

Long Read: A 15-Year Evolution of Crypto Venture Capital

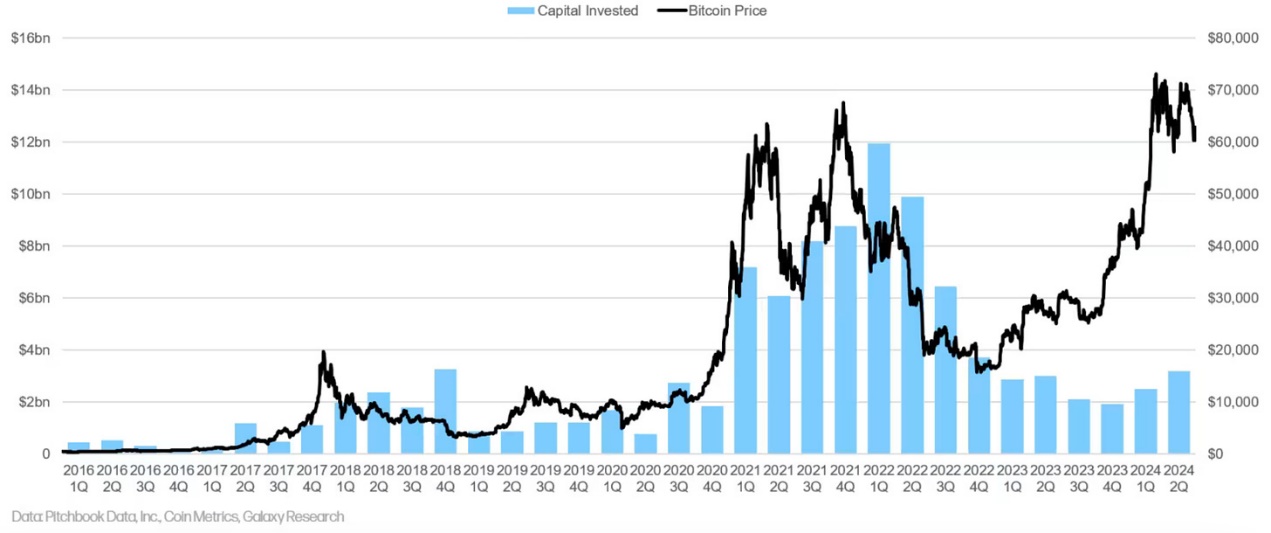

The long-term correlation between Bitcoin's price and funding rates did not disappear until 2023.

Written by: insights4.vc

Translation: Felix, PANews

This article explores the evolution of venture capital (VC) dynamics in blockchain-related entities over the past 15 years, with a focus on the shift some firms have made toward liquidity investments—where VCs acquire tokens with vesting schedules instead of equity. It also highlights notable VC institutions such as a16z and their first forays into crypto, including a16z's April 2013 investment in OpenCoin (later Ripple Labs).

In the early days of Bitcoin, from 2009 to 2012, venture capital showed little interest in the cryptocurrency space. Therefore, this analysis begins in 2012. It is also worth noting that the long-term correlation between Bitcoin prices and funding amounts did not break down until 2023.

Venture Capital and Bitcoin Price

2009–2018: Bitcoin’s First Decade and the Rise of VC Investment in Blockchain

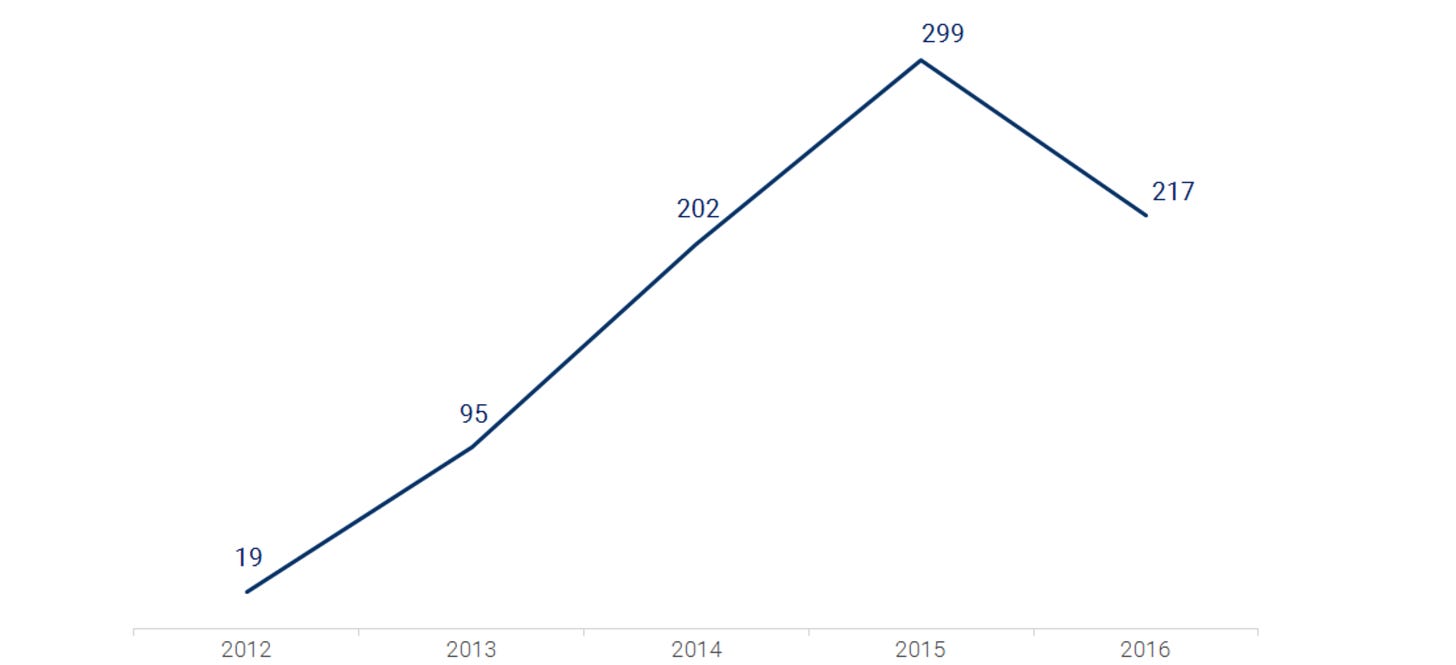

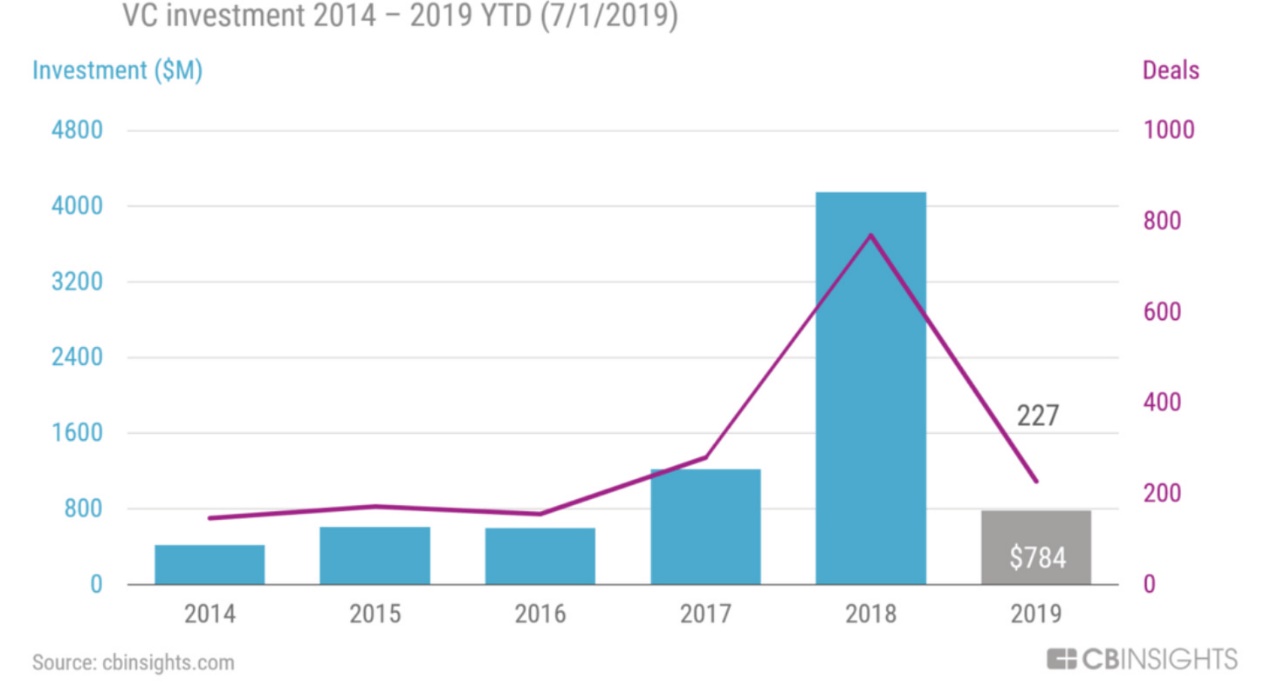

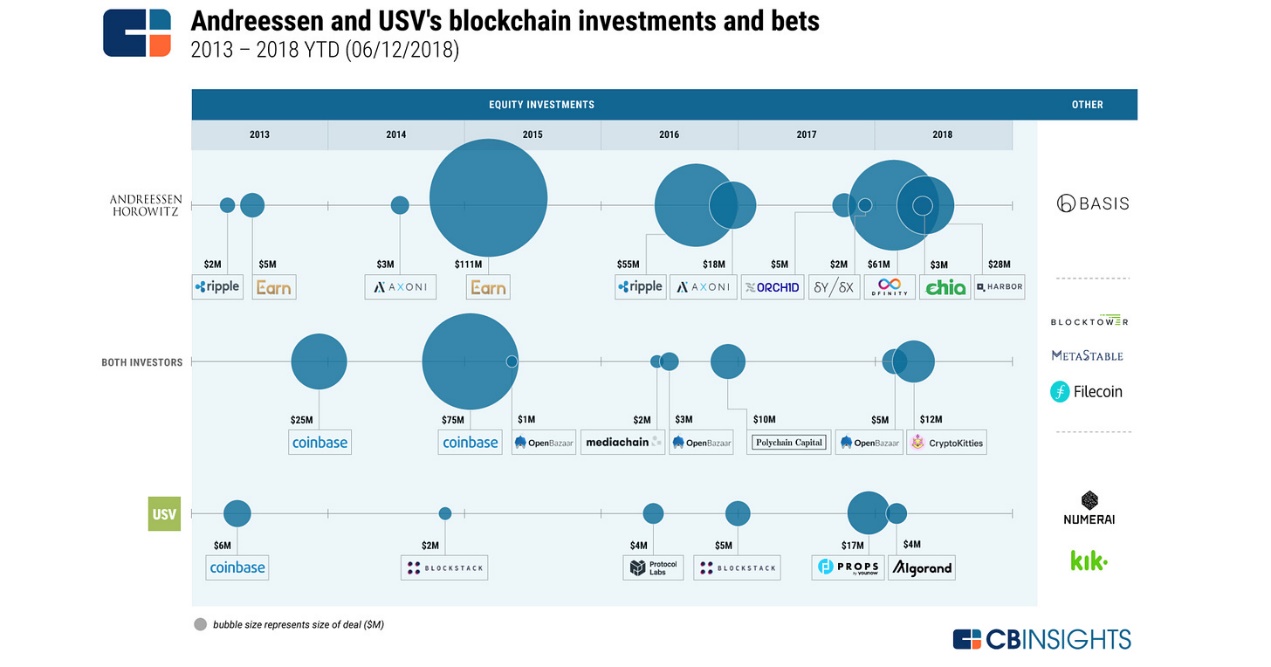

Bitcoin and Blockchain Independent Investors (CBINSIGHTS)

The venture capital landscape for Bitcoin and crypto projects began taking shape in the early 2010s. Union Square Ventures (USV), led by Fred Wilson, and Andreessen Horowitz (a16z) were among the first firms to invest in blockchain startups, both backing Coinbase in 2013.

Ribbit Capital, founded by Meyer "Micky" Malka in 2012 and focused on disruptive fintech, was an early investor in Bitcoin-related companies like Coinbase. Boost VC, established by Adam Draper in 2012, started as an accelerator and VC fund for emerging technologies, including Bitcoin and blockchain startups. Lightspeed Venture Partners invested in Blockchain.info (now Blockchain.com) in 2013.

Other notable early funds include Barry Silbert’s Bitcoin Opportunity Corp, founded in 2013, and Pantera Capital, which shifted its focus to Bitcoin and blockchain in 2013. Blockchain Capital, founded in 2013 by Bart Stephens, Brad Stephens, and Brock Pierce, was one of the first firms dedicated exclusively to blockchain and cryptocurrency investments.

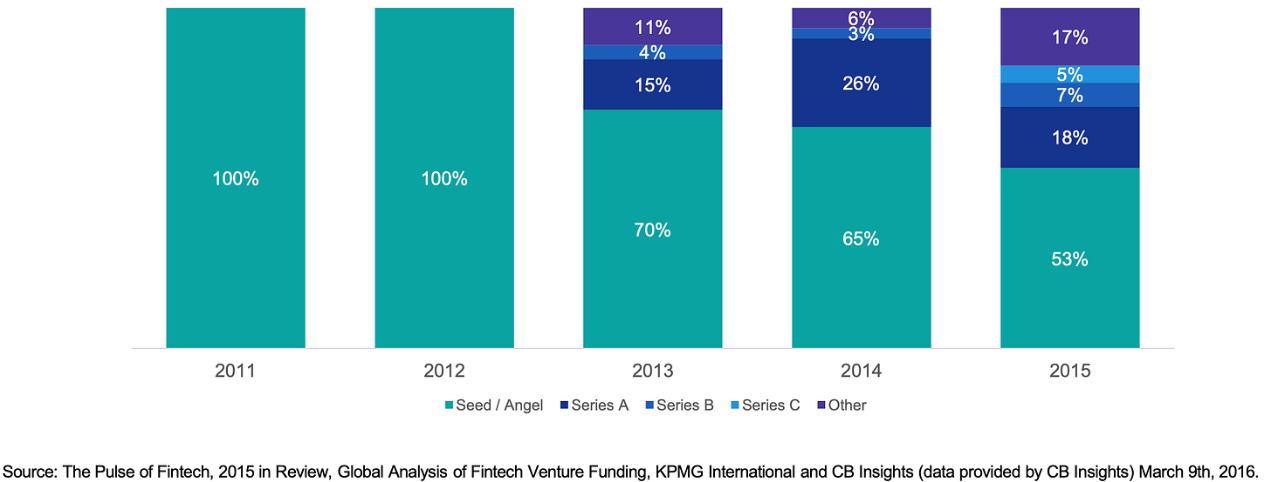

Annual Share of Blockchain and Bitcoin Deals (2011–2015)

2012

Bitcoin startups raised only $2.1 million in investments.

2013

Key milestones included:

-

Coinbase: Raised the largest single round, backed by Andreessen Horowitz, Union Square Ventures, and Ribbit Capital. Coinbase is now a publicly traded company and a key player in the Bitcoin ecosystem.

-

Bitcoin China: The largest and earliest Bitcoin exchange in China, raised $5 million from Lightspeed China. Although this investment ultimately failed, it remains a significant part of China’s early crypto history.

-

Circle Internet Financial: Circle, originally a Bitcoin application company, raised $9 million from Breyer Capital and Accel Capital. Jeremy Allaire aimed to popularize Bitcoin usage similarly to Skype or email. Circle later gained fame for launching USDC in 2018.

Investments and major breakthroughs:

Total VC funding in 2013: $88 million, a significant increase from the previous year.

Major breakthroughs in 2013:

-

In November, Bitcoin price surpassed $1,000 for the first time.

-

The world’s first Bitcoin ATM launched at Waves Coffee House in Vancouver.

-

Bitcoin mining hash rate surged from 20 Th/s to 9,000 Th/s.

Notable VC firms and projects:

-

Union Square Ventures: Invested in major projects such as Protocol Labs, Dapper Labs, Arweave, Polygon, zkSync, Polychain, and Multicoin Capital.

-

Ribbit Capital: Active in early-stage industry investments, supporting projects like Ethereum, AAVE, and Arbitrum.

Top 5 Largest Fundraising Rounds for Blockchain Startups in 2013

2014

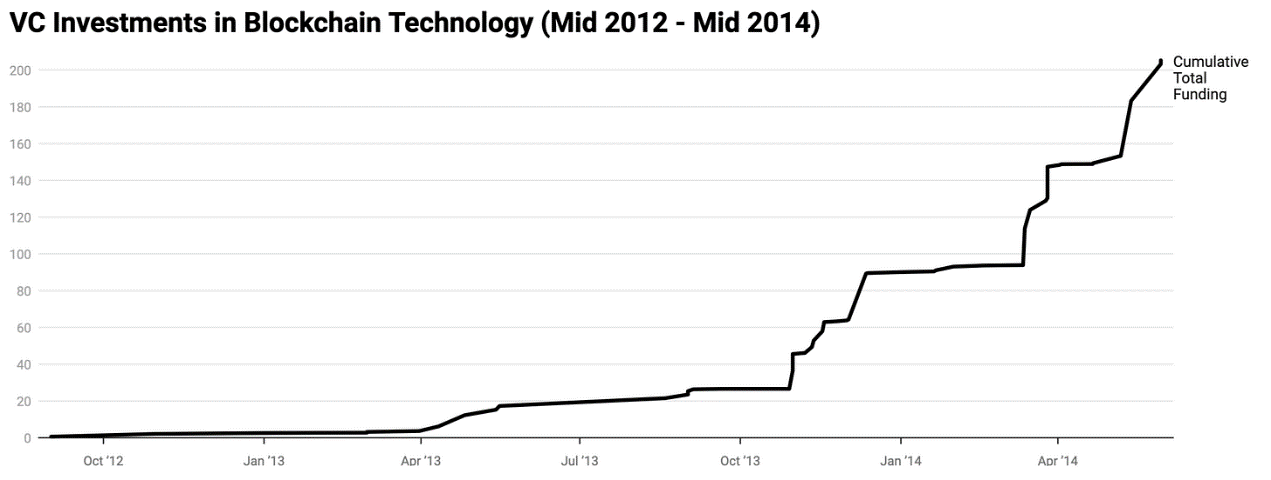

By June 2014, blockchain industry funding had already exceeded the total amount raised in all of 2013, reaching $314 million—a 3.3x increase from $93.8 million in 2013.

500 Startups became the most active investor, alongside Boost VC, Plug and Play Technology Center, and CrossCoin Ventures, supporting Bitcoin application companies. Initially focused on the crypto sector, 500 Startups later shifted toward early-stage investments.

Major investments in Bitcoin applications included:

-

Blockchain: $30.5 million

-

BitPay: $30 million

-

Blockstream: $21 million

-

Bitfury: $20 million

Bitcoin payment platform BitPay raised $30 million, led by Index Ventures, with participation from AME Cloud Ventures, Horizons Ventures, and Felicis Ventures.

Blockstream focused on the Lightning Network, a major innovation in Bitcoin payments, and developed the c-lightning client and the Liquid Bitcoin sidechain.

OKcoin (now OKX) raised $10 million from investors including Ceyuan Ventures, Mandra Capital, and venturelab. Notably, Feng Bo, co-founder of Ceyuan, went on to establish Dragonfly Capital in 2018, which launched numerous crypto funds in subsequent years.

Overall, 2014 saw steady growth in crypto venture capital.

2015

Despite Bitcoin’s price decline from its 2013 peak, blockchain technology attracted growing capital and entrepreneurial interest. Total funding for Bitcoin startups reached $380 million.

Major fundraising rounds included:

-

Coinbase: $75 million Series C round

-

Circle: $50 million Series C round

-

BitFury: $20 million Series B round

-

Chain: $30 million Series B round, including strategic investors such as Visa and Nasdaq

Ripple Labs (formerly OpenCoin) raised $28 million in its Series A, while 21 Inc. secured $116 million from a16z, Qualcomm, Cisco, and PayPal.

OMERS Ventures from Canada announced plans to invest in blockchain, signaling increasing institutional interest. Notable active VC firms included a16z, Union Square Ventures, Ribbit Capital, Boost VC, and DCG.

2015 demonstrated continued market participation despite bearish conditions.

2016

As fintech investment declined, venture capital in the crypto market decreased. According to CB Insights, fundraising activity for Bitcoin and blockchain startups dropped 27% compared to 2015, returning to 2014 levels.

Despite reduced activity, total funding reached $550 million, primarily directed toward more mature companies. Major rounds included:

-

Circle: $60 million Series D

-

Digital Asset Holdings: $60 million Series A

-

Ripple: $55 million Series B

-

Blockstream: $55 million Series A

Circle transitioned from Bitcoin trading services to remittance and payment services, paving the way for its stablecoin. Polychain Capital, founded by former Coinbase employee Carlson-Wee, raised $750 million for its third venture fund with support from a16z, Union Square Ventures, and Sequoia Capital.

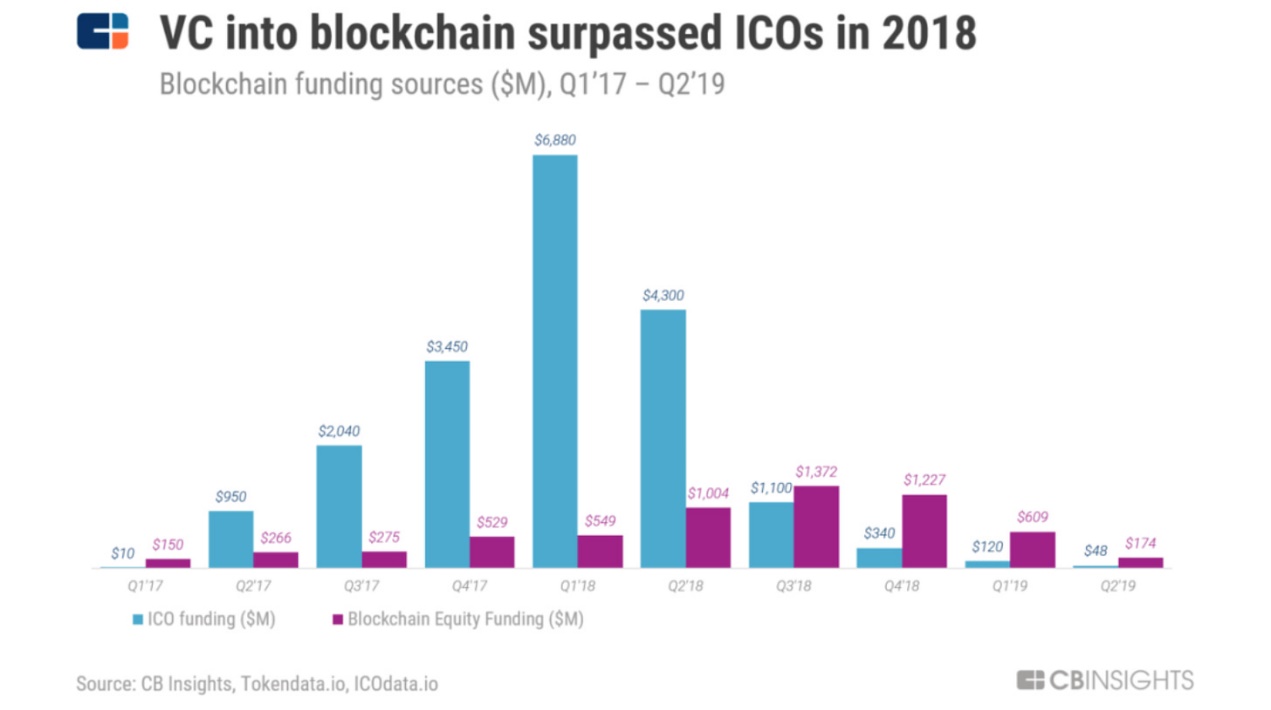

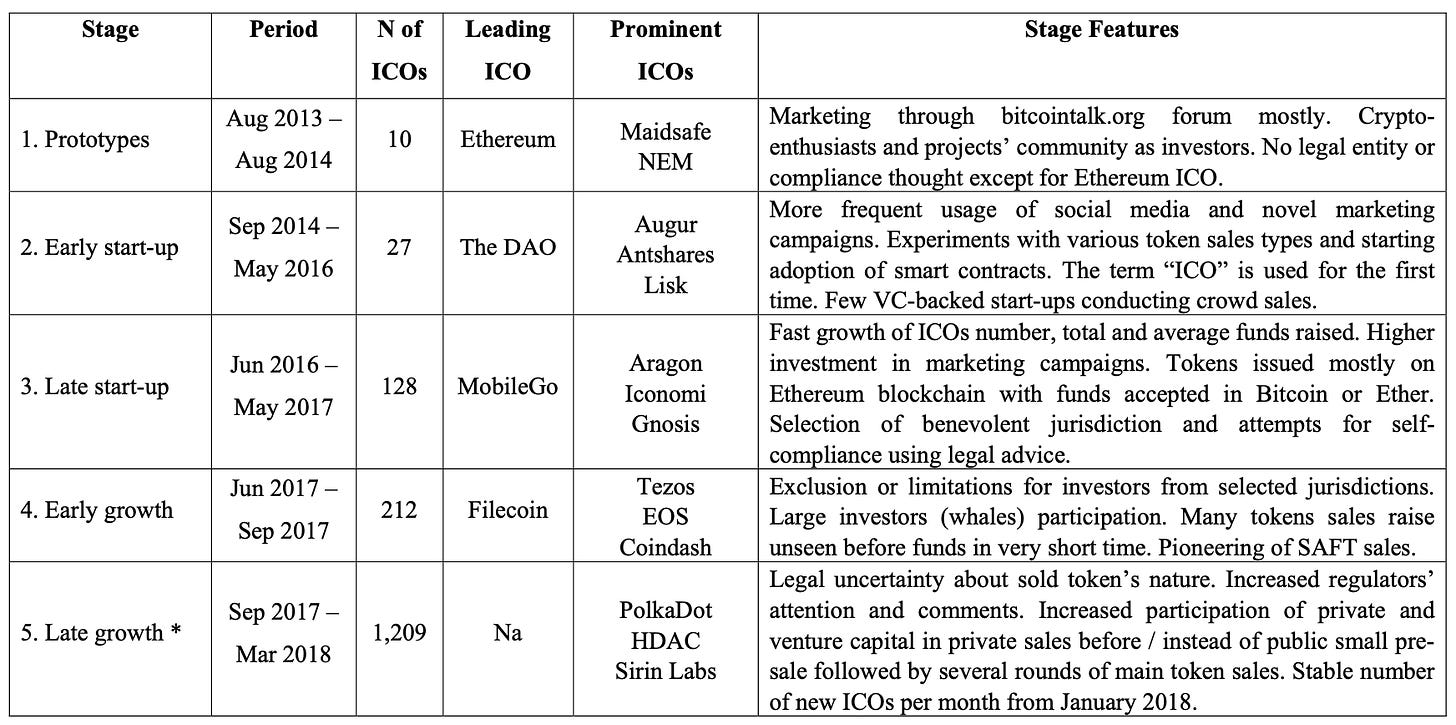

In 2016, project financing via ICOs began to grow, with The DAO raising $150 million, marking the beginning of the ICO boom.

2017

Liquidity Investments

Around 2017–2018, driven by the ICO boom and rising interest in tokenized assets, the landscape of liquidity-focused VC investing began to take shape. Pioneer funds such as Polychain Capital, founded by Olaf Carlson-Wee in 2016, and MetaStable Capital, co-founded by Naval Ravikant, focused on tokens rather than equity. Pantera Capital launched an ICO fund in 2017 targeting ICOs and token projects, while Blockchain Capital introduced the BCAP token, a security token representing shares in its fund. Multicoin Capital, founded in 2017 by Kyle Samani and Tushar Jain, and 1confirmation, led by former Coinbase employee Nick Tomaino, also emphasized token investments. Amentum Investment Management joined in 2017, focusing on long-term capital appreciation through blockchain and token economics. These funds recognized the potential of tokenized assets and shifted from traditional equity models to liquid token strategies.

2017 was a year of frenzy and regulation in the blockchain industry. Ethereum’s ERC-20 standard triggered an ICO boom, but regulatory crackdowns led the crypto industry into a prolonged bear market.

ICO vs. VC Performance:

-

Q1 2017: 19 ICOs raised $21 million.

-

Q4 2017: Over 500 ICOs raised nearly $3 billion.

-

Full-year 2017: ICOs raised $5 billion across nearly 800 projects—five times the $1 billion invested by VCs in 215 deals.

Notable ICO Projects:

-

Filecoin: $257 million

-

Tezos: $232 million

-

Bancor: $152.3 million

-

Polkadot: $140 million

-

Quoine: $105 million

Institutions like Union Square Ventures and Blockchain Capital, drawn by rapid returns, also participated in ICOs.

Geographic Distribution:

-

EU: Accounted for 40% of ICOs, raising $1.76 billion.

-

North America: Raised $1.076 billion.

-

After regulatory policies emerged, Chinese VCs relocated to regions like Hong Kong and Singapore. Due to regulatory pressure and unsustainable business models, the ICO bubble burst.

2018

ICO activity continued into 2018, with over 400 projects raising $3.3 billion in Q1 alone. CoinSchedule reported 1,253 global ICOs in 2018, raising $7.8 billion.

Largest ICO Projects:

-

EOS: Raised over $4 billion.

-

Telegram: Raised $1.7 billion across two rounds, though the project was later abandoned.

-

Petro: Venezuela’s government raised $740 million, but the project ultimately failed.

-

Basis: Raised $130 million, though the project later encountered difficulties.

VC Equity Financing:

-

Bitmain: Raised $400 million in Series B (backed by Sequoia Capital) and $1 billion in pre-IPO funding (supported by Tencent, SoftBank, and CICC).

-

Total VC funding: $4.26 billion.

Key developments:

-

Coinbase launched Coinbase Ventures.

-

Paradigm was founded by Coinbase co-founder Fred Ehrsam and Matt Huang.

-

a16z raised a $300 million crypto fund, investing in projects like CryptoKitties and Dfinity.

-

Fidelity launched its institutional crypto platform.

2018 saw the emergence of various “blockchain+” applications, many still in conceptual stages, laying the foundation for future innovation.

Evolution of ICOs from 2013 to 2018

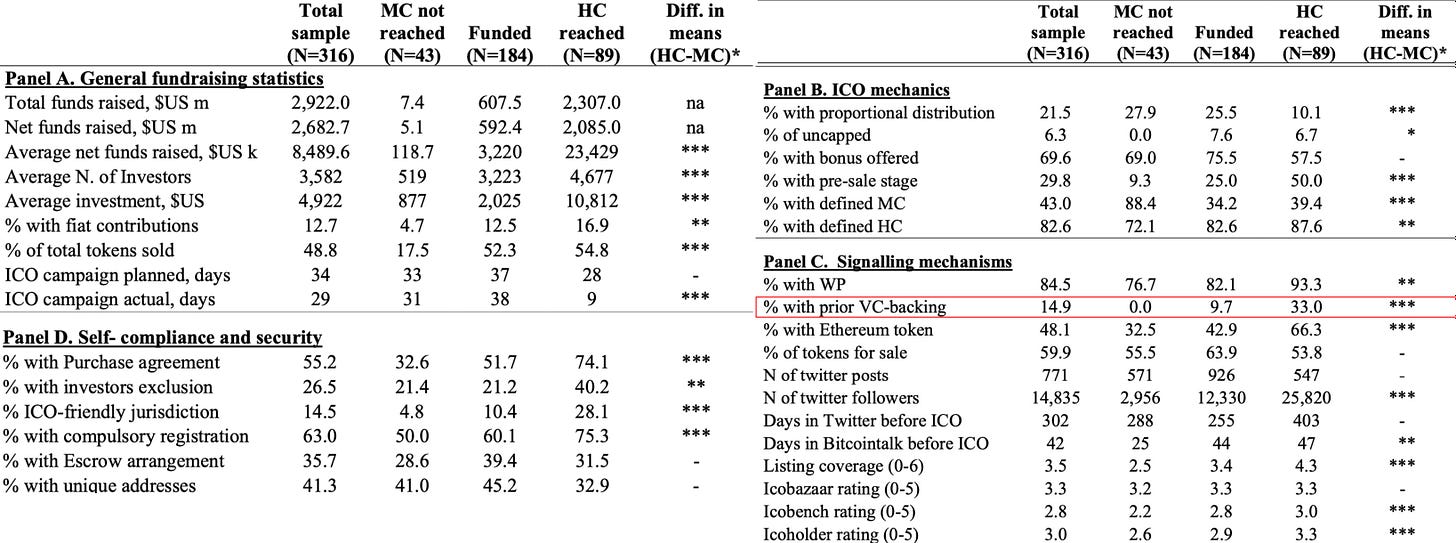

Empirical Analysis: To ICO or Not to ICO

-

Total Sample (N=316): 14.9% — Among the 316 analyzed ICOs, 14.9% received VC backing before launch, meaning roughly one in seven ICOs had VC support prior to token sale.

-

Underfunded (failed to meet minimum funding target) (N=43): 0.0% — None of the underfunded ICOs had received VC support, suggesting a possible link between lack of VC backing and failure to reach minimum funding goals.

-

Well-funded (met minimum funding target) (N=89): 9.7% — Among well-funded ICOs, 9.7% had received VC backing, indicating nearly one in ten successful ICOs had VC support.

-

Mean Difference (average funding goal – minimum funding goal): 9.7% — The proportion of VC-backed well-funded ICOs is significantly higher than underfunded ones, highlighting the positive impact of VC support on fundraising success.

Equity Investments by Union Square Ventures and Andreessen Horowitz from 2013 to 2018

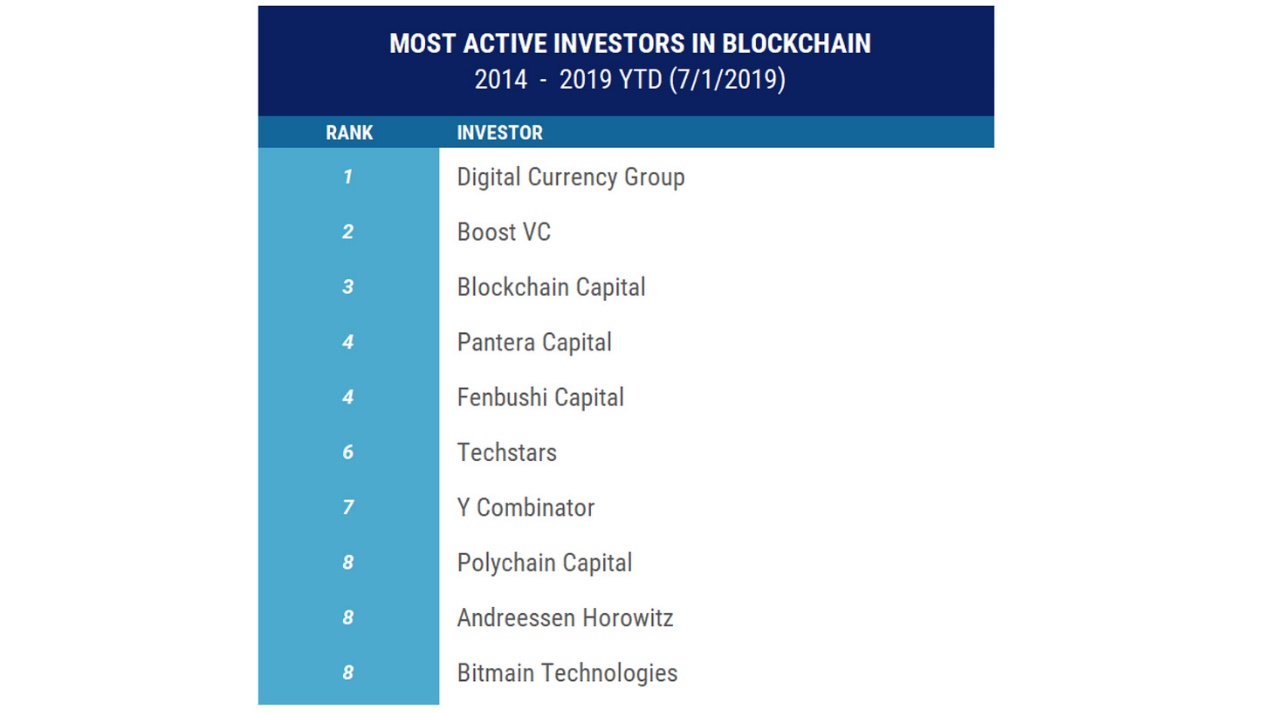

List of Most Active Investors from 2014 to 2019

2019: The Post-ICO Boom Era

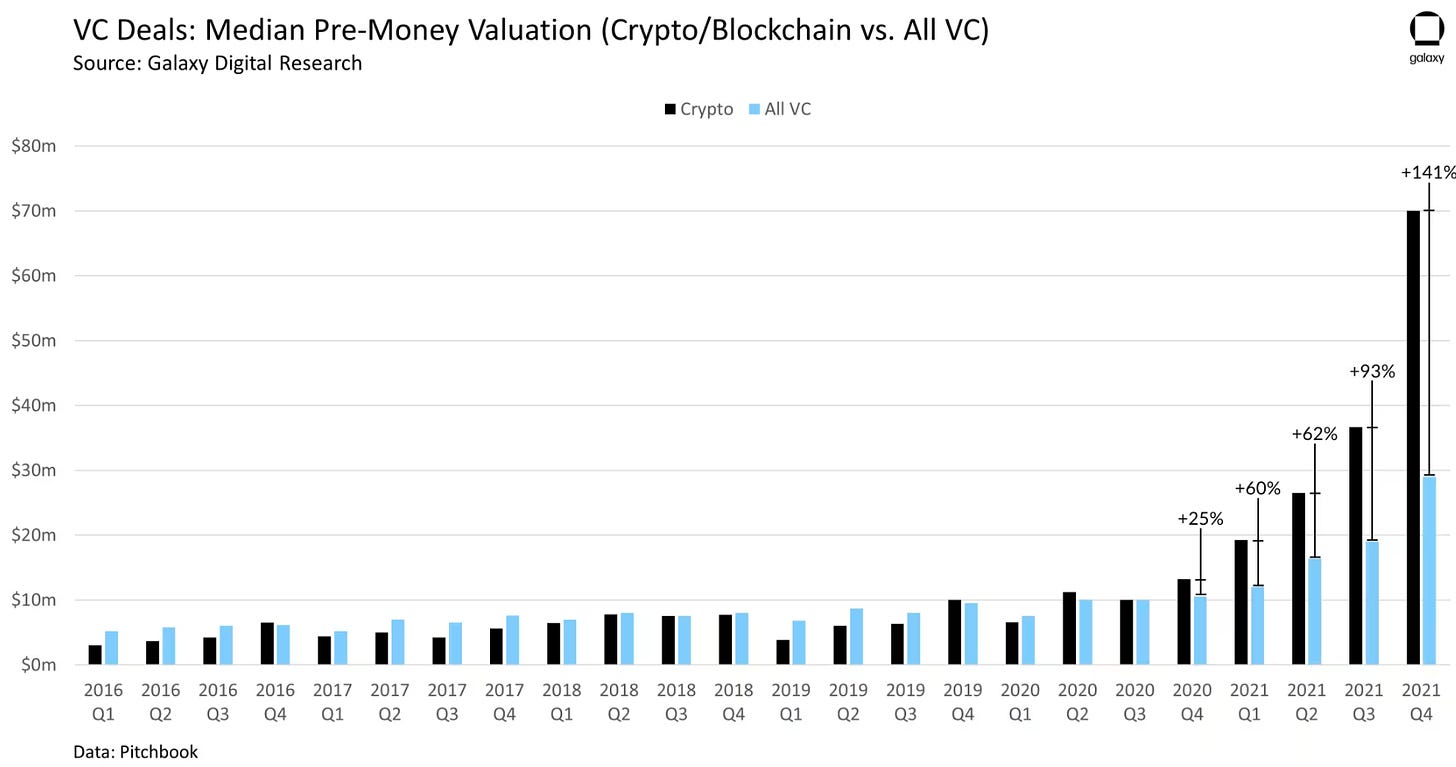

In 2019, the blockchain deal environment stabilized after the surge in 2018, recording 622 deals totaling $2.75 billion—up from 322 deals worth $1.28 billion in 2017. Blockchain’s share of VC deals rose from 1.5% in 2017 to 2.8%, while seed and early-stage blockchain deals increased from 1.8% to 3.6%. The median early valuation for blockchain deals was $12.5 million, 22% lower than the $16 million median across all investments.

The focus of blockchain investments shifted: in 2019, 68% of investments were classified as fintech, down from 76% in 2017, indicating broader applications beyond just “crypto.” North America accounted for 45.3% of blockchain deals, Asia 26.8%, reflecting a more global distribution.

In 2019, blockchain represented 2.8% of global venture capital deals and 1.1% of total capital, down from 3.6% and 2.7% respectively in 2018. The median deal valuation dropped from $16.6 million in 2018 to $13 million in 2019. Notable non-crypto blockchain companies included Securitize, Figure, PeerNova, and Spring Labs.

CB Insights reported 806 global blockchain investment deals in 2019, down from 822 in 2018, with investment volume dropping 27.9% to $4.26 billion. Zeroone Finance identified Digital Currency Group as the most active blockchain investor in 2019, making 14 investments, followed by Collins Capital, Coinbase Ventures, and Fenbushi Capital.

In 2019, investors focused on cryptocurrency exchanges, gaming, digital wallets, digital asset management, smart contracts, and DeFi. Animoca Brands, a Hong Kong-based mobile game developer listed on the Australian Securities Exchange, emerged as a major player in blockchain gaming. FTX was founded with strong support from Alameda Research.

In 2019, global enthusiasm for blockchain investment declined sharply, and traditional institutions became more cautious. Investor behavior during the bear market reflected a disciplined approach.

2020–2021: Resurgence and Surge in Funding

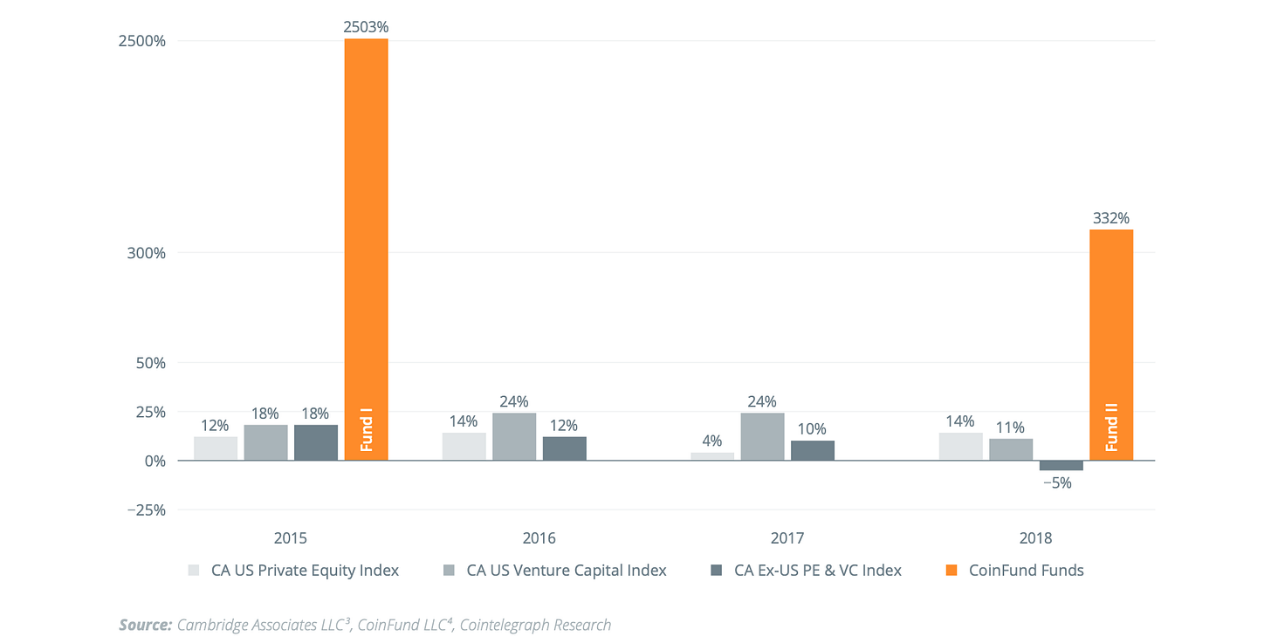

In 2020, driven by high return potential, blockchain venture capital became a significant component of the global private equity market. Since 2012, 942 venture capitalists have participated in over 2,700 deals involving blockchain startups. Top blockchain VC funds consistently outperformed traditional VC funds and the broader tech industry.

Blockchain Private Equity Outperformance vs. Traditional PE (Since 2013–2020 IRR Fund Inception)

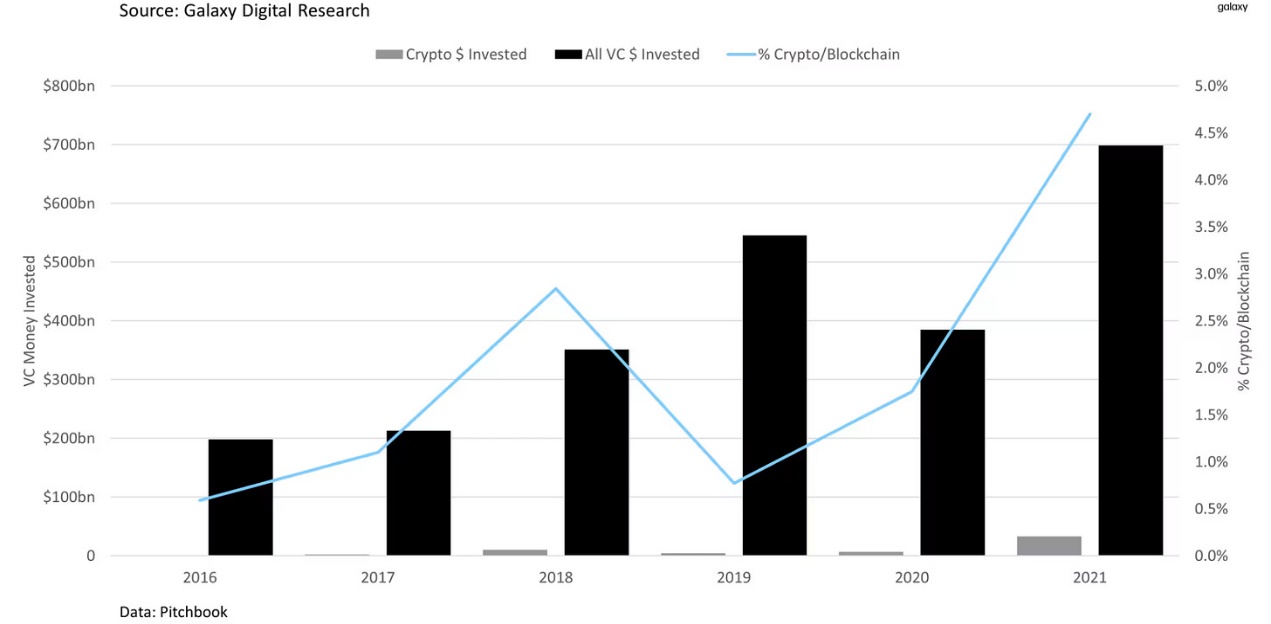

Despite its importance, blockchain private equity accounts for less than 1% of the global venture capital market, peaking at around 2% during the 2017 crypto bull run.

Overall, blockchain venture capital has shown resilience, performing well even during market downturns. Its high return potential and diversification benefits make it an attractive option for investors.

In 2020, DeFi began gaining significant attention. According to PAData under PANews, total investment and fundraising in the crypto industry amounted to approximately $3.566 billion, similar to 2019 levels. DeFi projects raised $278 million, accounting for 7.8% of the total. While relatively small in dollar terms, DeFi had the highest number of funding events—over a quarter of the 407 disclosed projects were DeFi-related—indicating growing interest in this new crypto-native sector.

Prominent DeFi applications attracted substantial investments in 2020. Uniswap completed an $11 million Series A, 1inch secured $2.8 million in seed funding, and lending platform AAVE raised $25 million in its Series A. Throughout the year, DeFi’s total value locked grew nearly 2,100%, and the number of unique addresses increased tenfold. Though modest compared to later figures, the “DeFi Summer” marked a pivotal turning point.

Notably, native blockchain VC firms showed a preference for industry application projects, especially DeFi, adopting more aggressive and higher-risk approaches. Investment strategies varied across institutions. PAData reported that over 700 institutions and individuals invested in blockchain projects in 2020, with NGC Ventures being the most active, followed by Coinbase Ventures and Alameda Research.

2021

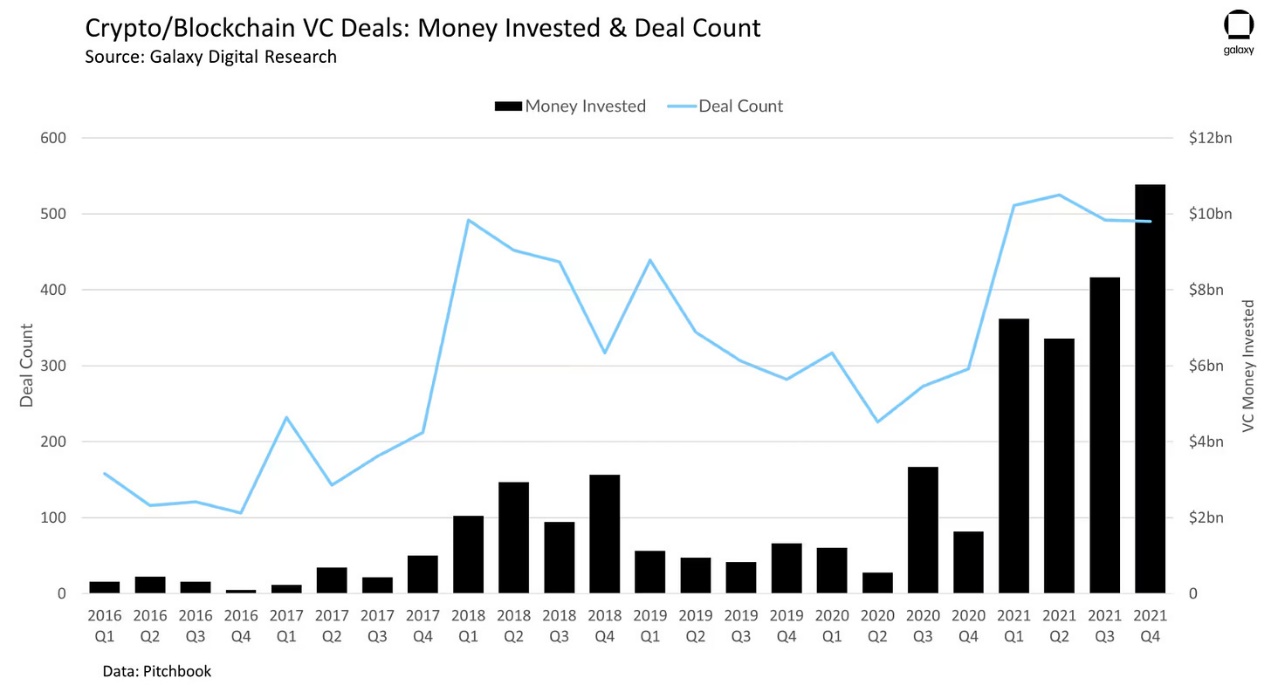

As blockchain technology advanced, global VC firms increasingly recognized its significance, especially with the rise of concepts like Metaverse and Web3. In 2021, blockchain startups raised approximately $33 billion in funding—the highest annual total on record. According to PwC, the average fundraising amount per crypto project in 2021 reached $26.3 million.

The number of blockchain venture capital deals also hit an all-time high in 2021, exceeding 2,000 deals—double that of 2020. Increased frequency of late-stage funding led to 65 startups achieving unicorn status (valuation ≥$1 billion), reflecting the crypto market’s shift from niche to mainstream.

VC Investment in Crypto/Blockchain vs. Total Investment

Galaxy reports that in 2021, nearly 500 global blockchain VC firms operated, with both fund count and size reaching historic highs. Major institutions such as Morgan Stanley, Tiger Global, Sequoia Capital, Samsung, and Goldman Sachs entered the blockchain market through late-stage equity investments, bringing abundant capital.

In 2021, the crypto space saw a massive influx of new users and capital:

According to Gemini data, nearly half of users in major crypto regions began investing in 2021.

New user share:

-

Latin America: 46%

-

Asia-Pacific: 45%

-

Europe: 40%

-

United States: 44%

This influx laid a solid user foundation for the growth and development of crypto applications.

Major investments:

In July 2021, FTX announced a $900 million Series B round at an $18 billion valuation—the largest private equity raise in crypto history. This round involved 60 investment firms, including SoftBank Group, Sequoia Capital, and Lightspeed Venture Capital.

Active investors:

Coinbase Ventures was the most active blockchain investment firm in 2021. After listing in the U.S. in April, it invested in 68 blockchain startups. Prior to listing, Coinbase had raised nearly $547 million across 13 funding rounds. Other notable investors included AU21 Capital (China-based), which invested in 51 companies, and a16z, which invested in 48.

Venture capital:

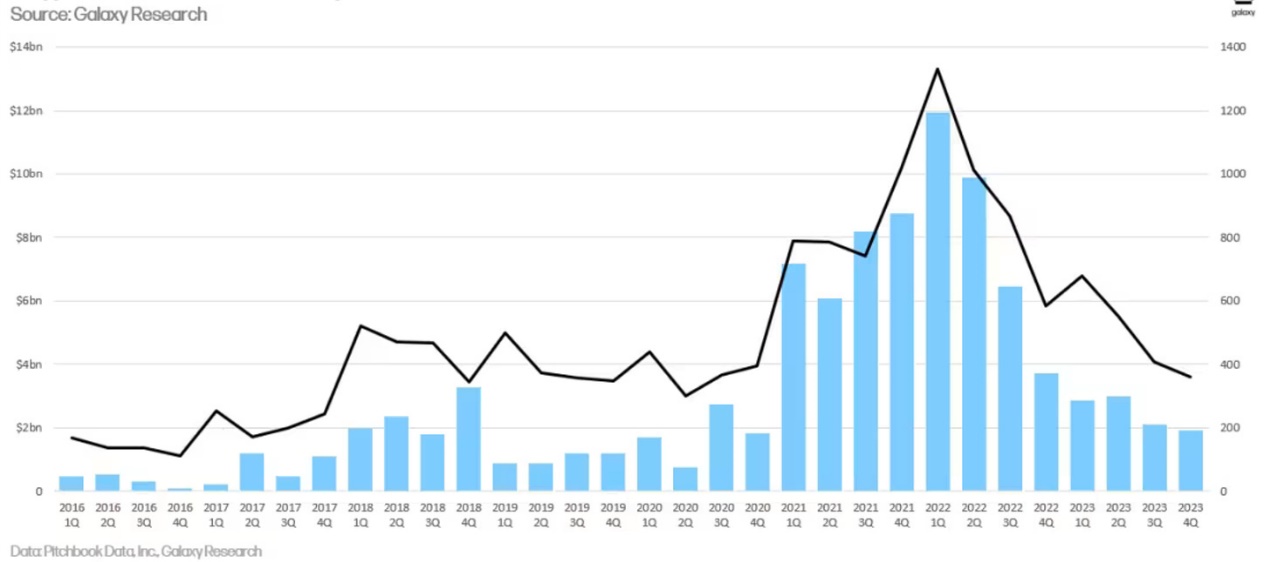

In Q4 2021 alone, investments exceeded $10.5 billion, bringing the total VC investment in crypto and blockchain to a record $33.8 billion—4.7% of total VC investment that year. 2021 also saw the highest number of deals, totaling 2,018—nearly double 2020 and surpassing the previous record of 1,698 set in 2019.

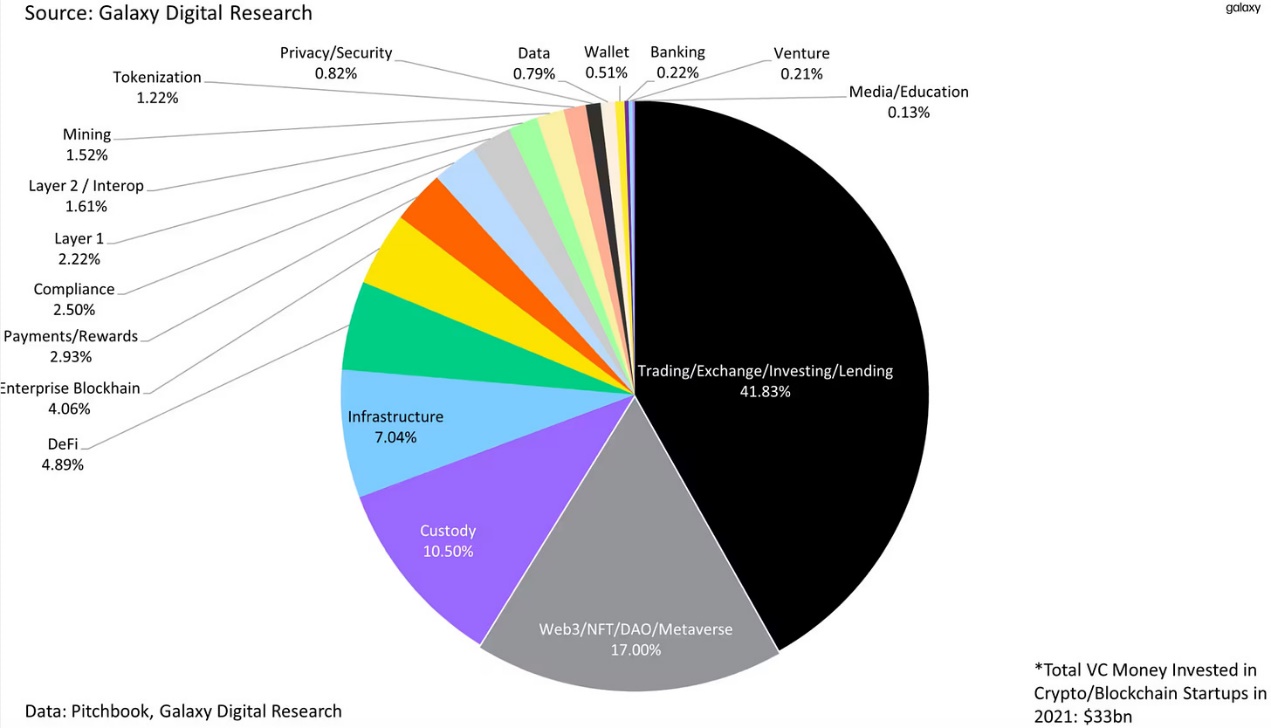

2021 VC Investment in Crypto/Blockchain by Category

Of the $33.8 billion invested by VCs into the crypto and blockchain startup ecosystem, the largest portion—over $13.8 billion (41.83%)—went to companies offering trading, investment, exchange, and lending services. Increasingly, VCs are investing in Web3 companies, including those developing NFTs, DAOs, metaverse tools, infrastructure, and games, which accounted for 17% of total investment.

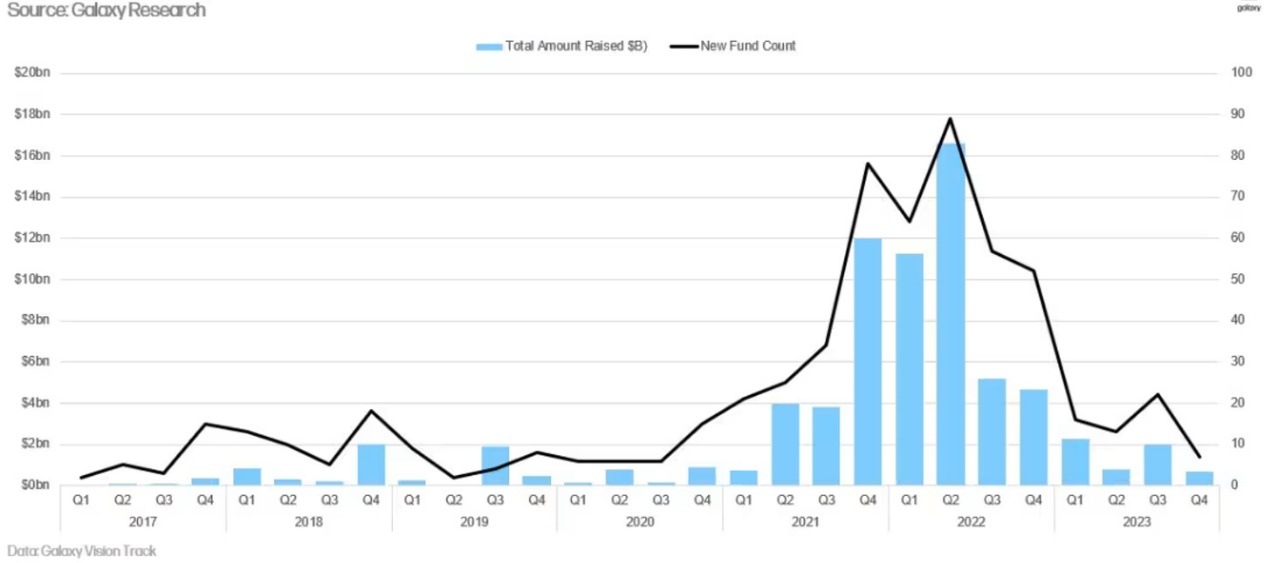

2022 and 2023: Sharp Decline in VC Investment

2022

Investment Overview:

-

VCs invested over $30 billion in crypto and blockchain startups in 2022, nearly matching 2021’s $31 billion.

-

Investments peaked in the first half, declining sharply in Q3 and Q4.

-

Q4 2022 saw the lowest transaction count and capital investment in two years.

-

Prominent VCs that invested in FTX faced major losses. Sequoia Capital wrote down its $200 million investment to zero, while Temasek’s $320 million stake in FTX became “worthless.”

Trends:

-

Later-stage companies captured a larger share of capital, while pre-seed investments continued to decline.

-

Web3 led in deal count, but trading and investment platforms raised the most capital.

-

Deal sizes and median valuations reached their lowest levels since Q1 2021.

VC Fundraising:

-

2022 was the highest year for crypto VC fundraising, exceeding $33 billion, although the amount raised in Q4 was the smallest since Q1 2021.

-

Average fund size increased, with over 200 funds raised, averaging over $160 million per fund.

2023

Investment Overview:

-

Crypto VC investment dropped sharply, amounting to only one-third of the previous two years’ levels.

-

Both deal count and capital investment continued to hit new lows each quarter.

Trends:

-

Early-stage companies dominated deal volume, though the share of pre-seed deals declined in the second half.

-

Valuations and deal sizes fell to their lowest levels since Q4 2020.

-

Trading firms raised the most capital, followed by Layer2 and interoperability, and Web3.

VC Fundraising:

Fundraising faced challenges due to macroeconomic conditions and crypto market volatility.

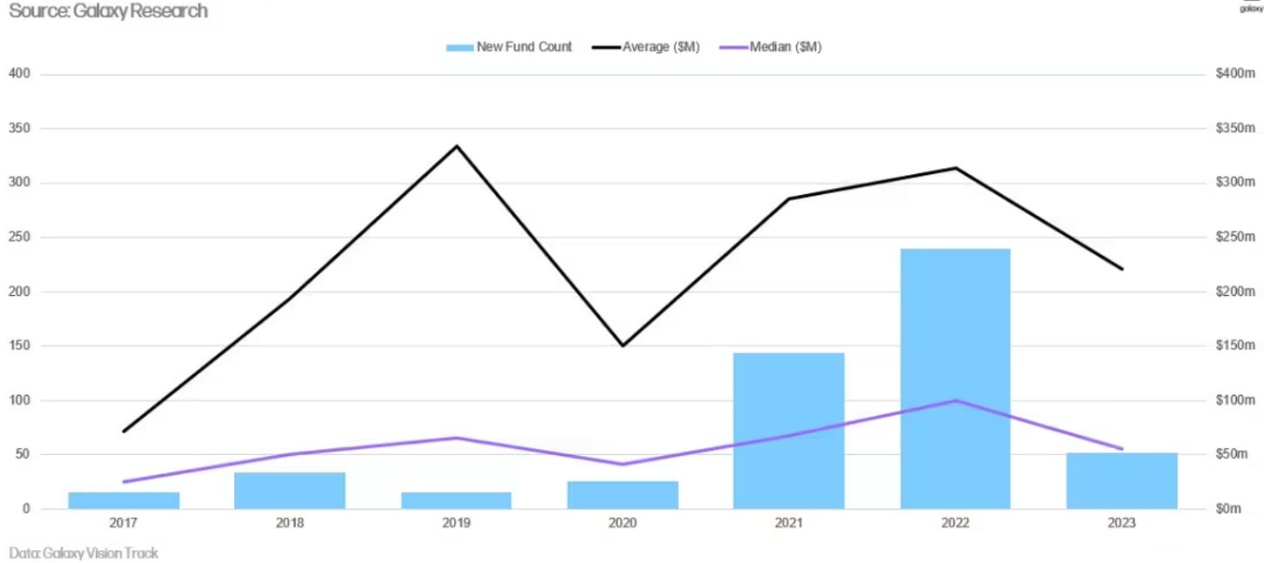

Crypto VC Fund Size

In 2023, the number of newly established crypto VC funds was the lowest since 2020, with average fund size down 30% and median fund size down 45%.

Interest and investment clearly declined in 2022 and 2023, with a particularly sharp drop in 2023. Nevertheless, Web3 remained dominant in deal count, while trading platforms led in fundraising. Despite regulatory challenges, the U.S. continues to lead the crypto startup ecosystem. Additionally, macroeconomic and market turbulence created a difficult environment for founders and investors, with fundraising facing significant headwinds.

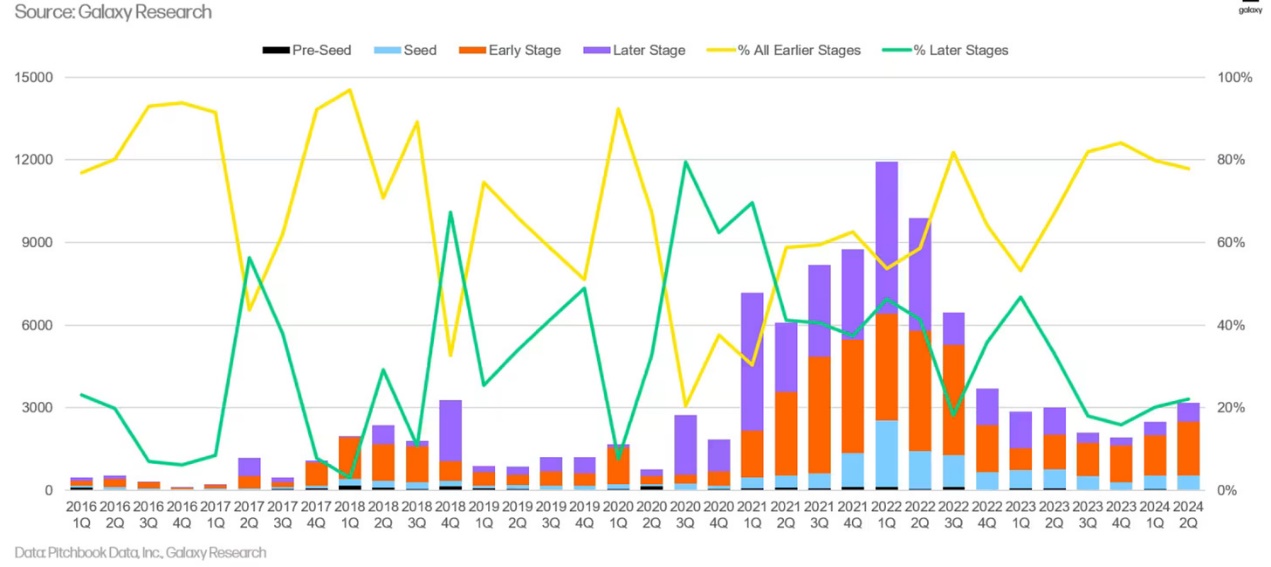

2024: Current State of VC

The venture capital landscape in Q1 and Q2 of 2024 has been detailed in prior articles. Here, we highlight only what is visible in the chart below—a continuation of the trend since the end of Q1 2021, where early-stage investments clearly exceed late-stage ones.

[Disclaimer] Markets involve risk; investment requires caution. This article does not constitute investment advice. Readers should consider whether any opinions, viewpoints, or conclusions herein are suitable for their specific circumstances. Investment decisions are at the reader’s own risk.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News