ETH ETF Flow Analysis: Expected net outflows to decrease within two weeks, ETH price to see more upside momentum

TechFlow Selected TechFlow Selected

ETH ETF Flow Analysis: Expected net outflows to decrease within two weeks, ETH price to see more upside momentum

Overall, it feels like a good time to set buy orders for $ETH, as it's expected to gradually strengthen over the next two weeks.

Author: Defi_Maestro

Compiled by: TechFlow

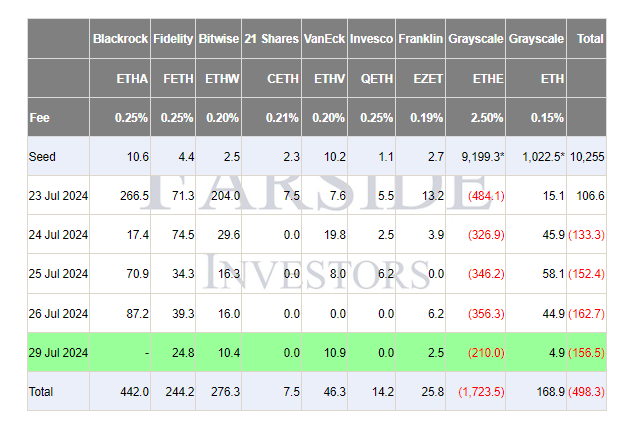

$ETH ETF inflows look quite solid, with the latest net outflow at $97.9 million ($58.6 million inflow into ETHA not yet updated in the table).

TechFlow Note:

-

The top row lists various investment firms or products, including Blackrock, Fidelity, Bitwise, 21Shares, VanEck, Invesco, Franklin, and two Grayscale products.

-

The second row shows each product's ticker symbol, such as ETHA, FETH, ETHW, etc.

-

The third row indicates management fees for each product, ranging from 0.15% to 2.50%.

-

The fourth row represents initial or seed capital, with values ranging from 1.1 to 10,255.

-

Following that are daily figures from July 23 to July 29, likely indicating daily fund inflows or outflows.

-

Notably, Grayscale’s ETHE product appears to be experiencing substantial outflows, showing negative values almost every day, totaling -1,723.5.

-

In contrast, other products like Blackrock’s ETHA and Fidelity’s FETH show positive inflows during this period.

-

July 29 (the last row) is highlighted in green, possibly indicating it is the most recent data or a day requiring special attention.

-

Overall, although some products saw inflows, there was a net outflow during this period, totaling -498.3.

Outflows from $ETHE have begun to slow, with a net outflow of $210 million.

From an initial AUM of $9.2 billion, total outflows amount to 19.8%.

Current asset holdings in $ETHE should be close to $7.4 billion.

Since the launch of $ETH ETFs, we’ve seen a 5% decline from the initial price of $3,490, with a total net outflow of $440 million.

The ETH-to-BTC chart appears to have bottomed out, with $ETH recovering from its recent dip following Trump’s remarks about BTC.

Personal Thoughts

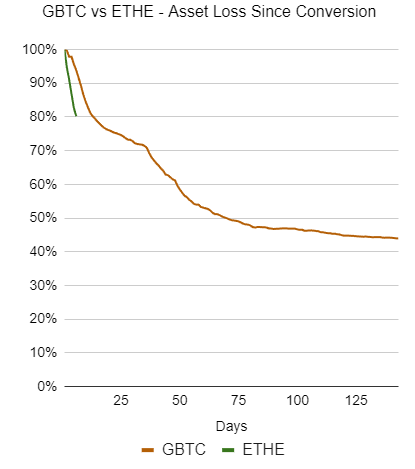

Given that $ETHE’s initial outflows were faster than those of $GBTC, we expect outflows to begin slowing over the next two weeks.

We anticipate that $ETHE outflows will stabilize around 40–50% of its initial $9.2 billion AUM, approximately $4.5 billion to $5.0 billion.

As investors notice the slowing outflows from $ETHE, we can expect inflows to start increasing.

We expect overall ETH liquidity to see some positive inflows, aligning with the slowing outflows from $ETHE.

Overall, now feels like a good time to place $ETH buy orders, as we expect gradual strength over the coming two weeks.

Again, this is not financial advice.

Personally, I will be adding more $ETH long positions and closely monitoring ETF liquidity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News