Opinion: The product-market fit of crypto primarily comes from speculation; otherwise, it can only serve a small number of users.

TechFlow Selected TechFlow Selected

Opinion: The product-market fit of crypto primarily comes from speculation; otherwise, it can only serve a small number of users.

Is market growth ultimately driven solely by speculation? Mostly, yes.

Author: 100y

Compiled by: TechFlow

Current reality: Either speculate or target niche markets.

We are now in the middle (perhaps nearing the end) of the fourth major market cycle. The crypto market has grown significantly, with BTC ranking ninth among global assets ($1.26 trillion), and ETH at 25th ($409 billion).

This naturally raises a question: Has such a large market truly achieved product-market fit (PMF)? In 2020–2021, most would have said no. However, given market maturity and the emergence of various protocols, many today might say yes.

My answer is mixed. Indeed, some protocols generate substantial revenue even after accounting for token incentive spending, which inclines me to say yes. Yet, I must point out that the PMF of most of these protocols heavily relies on speculation. In contrast, protocols unrelated to speculation often struggle to achieve broad PMF and serve only limited user bases.

(Source: Vitalik Buterin)

Recently, many people, including Vitalik Buterin, have expressed similar views on social media. Even protocols that appear to have found PMF—especially infrastructure protocols—often derive their PMF primarily from speculation. During the third bull cycle, there were numerous blueprints leveraging blockchain to solve real-world problems. Buzzwords like metaverse, P2E, and decentralized social networks captured attention. Yet, despite market growth, blockchain’s vision appears to be narrowing, leaving only a few enthusiasts behind, without solving real-world issues.

1. Is It All About Speculation?

Speculation emerging in nascent industries is natural. While speculation may create many victims, it also helps markets and industries scale. In other words, for speculation to be justified, the industry must eventually find genuine PMF.

Throughout this bull cycle, efforts to find PMF seem to have regressed. Despite significant advances in regulation, technology, and infrastructure driven by an influx of talent and capital, there remains no widespread PMF for blockchain products. Even with Bitcoin and Ethereum ETF approvals, discussions around decentralization and the metaverse have declined since the 2021 bull run, and the market appears to be targeting increasingly niche segments.

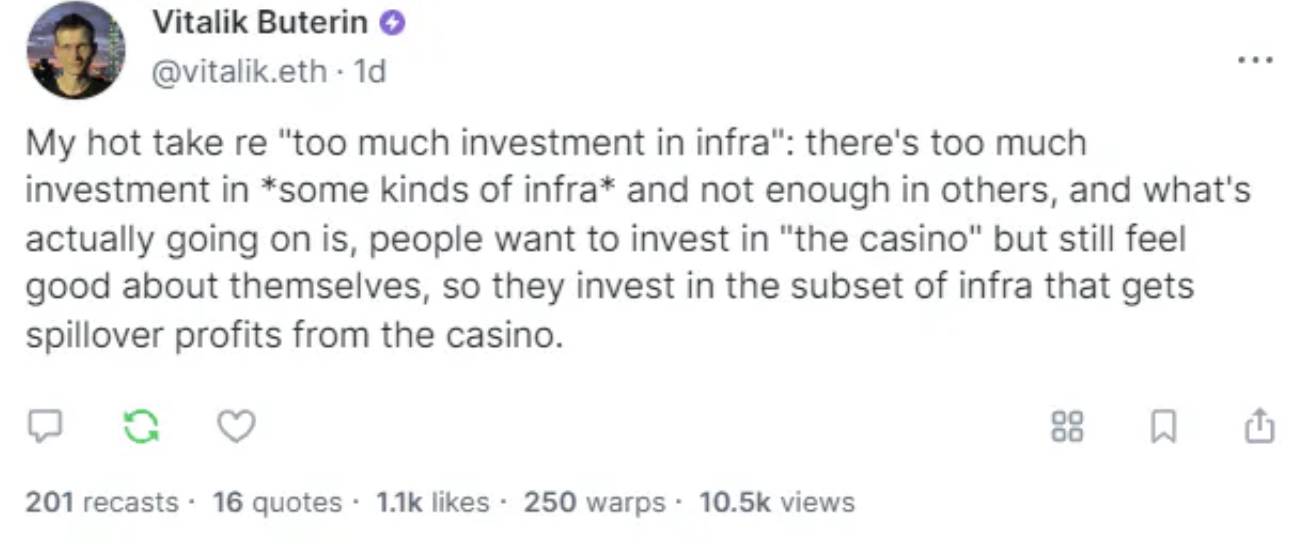

Is market growth ultimately driven purely by speculation? To answer this, I divide the market into three phases.

2. Answer: Mostly Yes

2.1 Internet Money

(Source: siliconANGLE)

After Bitcoin and blockchain concepts first emerged in 2008, Bitcoin was primarily used as a payment method for online transactions due to its censorship resistance and ease of cross-border payments.

A notable example is Bitcoin's use in trading items within MMORPG games with active economies, such as World of Warcraft. Additionally, Bitcoin was used for illegal transactions on darknet markets like Silk Road, involving drugs, weapons, and pornography.

Although Bitcoin saw significant use in illicit transactions, even when not widely known, it found PMF among specific user groups.

2.2 Speculation

During this phase, cryptocurrencies were primarily viewed as speculative assets. Although projects like Steemit, Livepeer, Filecoin, and Brave Browser aimed to solve real problems, the market remained dominated by speculation.

At the end of 2013, Bitcoin’s price surged from $100 to $1,100, reinforcing its image as a speculative asset. This led to Ponzi schemes like OneCoin, causing many victims.

The first bull market in 2013 failed to attract widespread attention, but the second one in 2017 drew global focus. BTC and ETH reached significant market caps, especially in South Korea, where speculative trading was highly active. During this period, projects like EOS, ADA, TRX, and BNB raised substantial funds through ICOs, although many ICOs were outright scams.

Since the market was built on speculation, the subsequent crash led to a prolonged crypto winter. However, projects established during this time, combined with post-COVID quantitative easing, helped the market recover by 2021. DeFi protocols like Uniswap and Compound flourished on-chain, and speculative activity thrived both on and off-chain.

This era saw high interest in blockchain technology itself, with many idealistic projects attempting to solve problems through decentralization. While grand visions like metaverse, P2E, and decentralized social largely failed to materialize, they inspired many.

2.3 Speculative Infrastructure

After the third bull market in 2021, the crypto industry attracted massive attention, driving efforts to integrate blockchain technology into traditional Web2 industries to find PMF. In Web3 scenarios, venture capital increased, and more teams began building projects to solve real problems—not just for speculation. These teams focused on scalability, interoperability, and user experience (UI/UX) to enable mass adoption of blockchain technology.

These efforts addressed critical challenges. Notable progress includes bridges (e.g., Across, Wormhole, LayerZero) solving liquidity fragmentation, and Layer 2 solutions (e.g., Optimism, Arbitrum, Polygon) effectively addressing base-layer scalability.

Some protocols generate fee revenue exceeding their token incentive costs. A representative example is Base. The L2 business model relies on providing highly scalable blockspace secured by Ethereum. They pay gas fees to publish data on Ethereum and charge users transaction fees. Without governance token incentives, Base achieved $35 million in gross profit over the past 180 days.

Moreover, numerous projects in the on-chain ecosystem offer utility, and the following protocols have achieved a degree of PMF:

-

L1: Ethereum, Solana, Tron

-

L2: Arbitrum, Base, Optimism

-

Bridges: LayerZero, Wormhole

-

Staking: Lido, Rocket Pool, Jito

-

Restaking, LRT: EigenLayer, etherfi, Symbiotic

-

DeFi: Aave, Maker, Uniswap, Pendle, Ethena

-

NFT: OpenSea, Zora

-

Prediction Markets: Polymarket, Azuro

-

Social: Farcaster, ENS

-

Infrastructure: Chainlink, The Graph

-

Meme: Pump Fun, Moonshot

Here’s My Take

While the above protocols do provide significant utility and have achieved product-market fit (PMF), I believe much of this PMF still revolves primarily around speculation. Conversely, services unrelated to speculation, while achieving PMF, serve very limited audiences.

-

The core of smart contract L1s lies in computation within decentralized environments, offering benefits like censorship resistance and uptime. However, few real-world use cases align with this core principle; most users treat L1s as platforms for speculation.

-

L2s aim to provide fast scalability while relying on base-layer security. Though L2s have achieved PMF, most demand stems from users wanting faster, cheaper on-chain speculation. If L1s are high-risk, expensive casinos, L2s are low-risk, more affordable ones.

-

Bridges facilitate capital and information flow across networks, making them essential infrastructure in today’s multi-chain environment. Without bridges, many users and businesses would face major inconveniences. Yet, like L2s, bridges are often used by users to chase speculative opportunities across networks—akin to moving money between casinos.

-

Staking and restaking are crucial for protocol security and have seen massive success in total value locked (TVL). While seeking incentives is normal and not wrong, many investors participate expecting unsustainable high returns (e.g., airdrops, yields).

-

DeFi enables anyone to conduct financial activities on-chain. Despite growing integration with real-world assets (RWA), the market remains small, and many DeFi protocols are tied to speculation. For example, Pendle and Ethena grew rapidly by finding suitable PMF, but this growth was driven by user speculation. Both protocols attracted massive users and TVL by leveraging airdrop expectations.

-

NFT markets vividly illustrate speculation’s impact. NFT marketplaces are neutral platforms for trading NFTs, but examples like OpenSea and Blur show that once NFT speculation fades or token incentives end, trading volume plummets.

-

Web3 social aims to address issues with centralized social media. While users may have some speculative expectations, this is one of the few areas where development intent aligns with actual PMF. Still, it remains a niche market, as few currently worry about centralization in Web2 social.

-

On-chain infrastructure like oracles and query services is vital for secure and efficient ecosystem operations, but they are still primarily used for speculation-related services.

-

Prediction markets and meme-related protocols are inherently designed to facilitate speculation.

PMFs aren't genuinely real

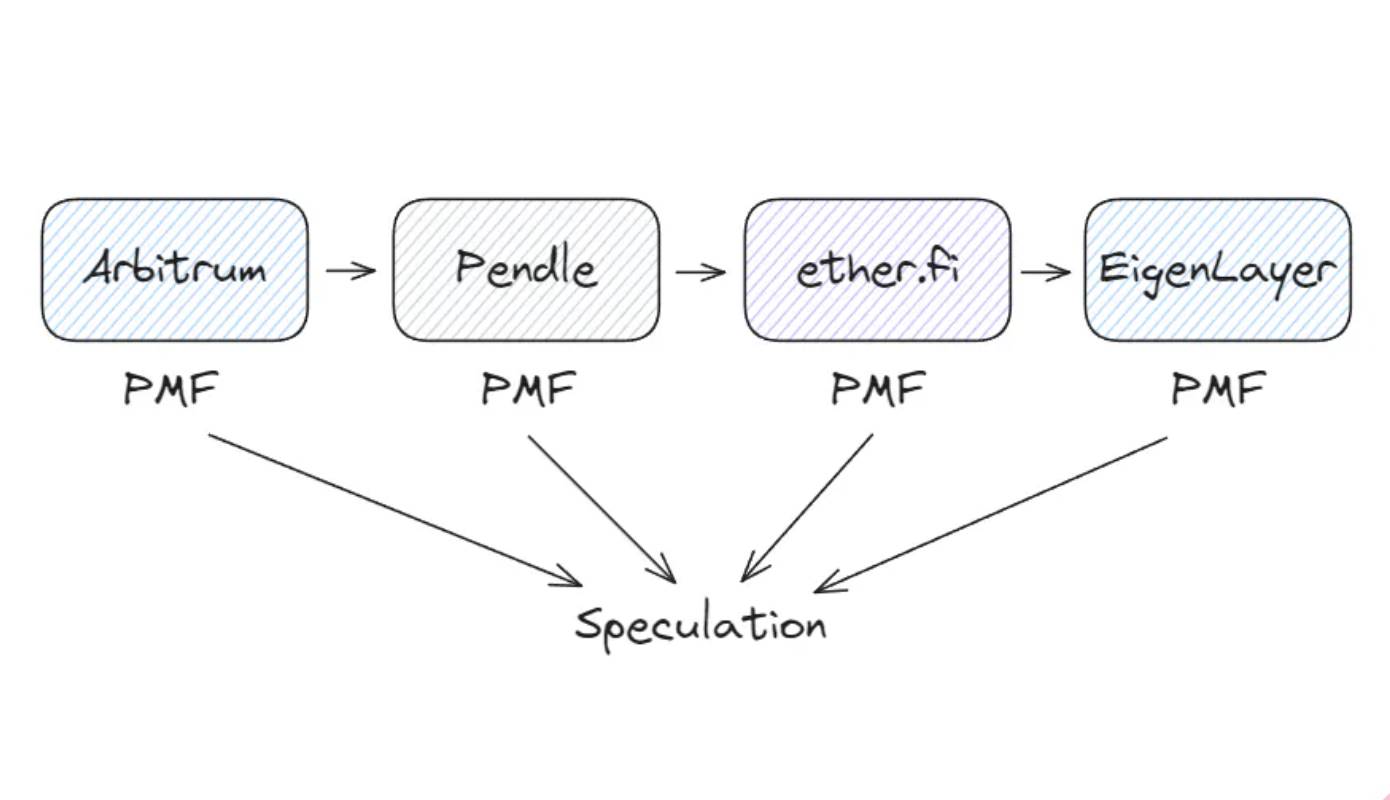

For instance, imagine you buy YT-eETH on Arbitrum via Pendle. Arbitrum, an L2 solution, reduces your cost and time. Pendle allows you to separate eETH’s yield and principal, offering various strategies. Etherfi stakes on your behalf and mints liquid ETH, while EigenLayer lets you stake ETH across multiple protocols simultaneously. While these services are useful, their activity is driven by speculation around AVS rewards and potential airdrops.

Note: Some blockchain-related services are indeed widely used in real life, but they typically follow Web2 paradigms, with blockchain serving as just one feature. Examples include Reddit’s avatar NFTs and Sweatcoin.

Don’t get me wrong.

In free markets, products don’t need to be used as intended. Even if demand and revenue come via speculation, a product is still valuable. However, if PMF diverges from blockchain’s core essence, then blockchain may not be necessary—traditional Web2 technologies are often sufficient.

Given the market size, why haven’t we seen widespread PMF for blockchain products? Because modern society doesn’t yet truly need blockchain.

3. From Speculation to Credible Neutrality

As Josh Stark explains in Atoms, Institutions, Blockchains, blockchain’s value in the digital realm lies in credible neutrality—similar to how physical laws and social norms function in physical and social domains. Physical laws define space, time, and matter; social norms (like governments and laws) govern human interactions. In contrast, modern society still relies on trust in centralized entities for digital interactions, so blockchain isn’t yet needed.

Yet, exceptions exist. In countries where government corruption or poor infrastructure undermines social norms, Bitcoin and stablecoins play key economic roles. This is especially evident in Latin America and Africa. Unlike people in developed nations who view crypto as investment, residents here use it for survival. Here, blockchain’s credible neutrality gives Bitcoin and stablecoins properties of assets and money, achieving genuine PMF beyond speculation.

To find broader PMF based on credible neutrality, we must wait for more centralized systems to fail. While not directly related to blockchain, Trump’s Truth Social emerged to avoid big tech censorship. Though such failures may not hurt developed nations immediately, they could eventually push people toward blockchain systems. Essentially, when centralized flaws become undeniable, blockchain will offer true utility beyond speculation.

However, issues like social media censorship, data breaches, and cloud outages aren’t yet catalysts. While real, the benefits of centralized services still outweigh these issues, so most continue using existing systems. As I noted in a previous article, the biggest catalysts for blockchain to achieve PMF via credible neutrality will be 1) the failure of the U.S. dollar and 2) rapid AI advancement. Recently, support for Bitcoin from prominent figures like Trump, Larry Fink, and Jamie Dimon reflects similar trends.

4. Final Thoughts

Over the past three years, blockchain technology and the entire industry have advanced rapidly. This growth has been largely driven by investor speculation. While speculation is often criticized, we should also recognize its role in driving industry progress. Unfortunately, however, PMF in today’s blockchain market remains predominantly speculative, and we struggle to find fundamental PMF rooted in credible neutrality.

Nonetheless, I remain highly optimistic about the blockchain industry. As Balaji pointed out, the world undergoes continuous cycles of bundling and unbundling. As our social systems grow increasingly centralized, they will inevitably encounter problems, increasing demand for unbundling. I hope that in the future, blockchain will play a crucial role in protecting human sovereignty.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News