10 Key Signals and Tips to Help You Become a Pro at Timing the Market Peak

TechFlow Selected TechFlow Selected

10 Key Signals and Tips to Help You Become a Pro at Timing the Market Peak

In the final stage of a bull market, it's just a race to take profits.

Author: CRYPTO, DISTILLED

Compiled by: TechFlow

1. Introduction:

As cryptocurrency gradually enters the mainstream, "easy money" opportunities are diminishing.

Unfortunately, not everyone can successfully seize these opportunities.

Here are 10 signals and tips to help you exit at the peak of the market cycle.

2. Balloon > Bubble:

The term "bubble" is often misused. Instead, think of the market as a balloon.

While a bubble implies fragility, a balloon can overinflate, deflate, and stabilize again.

The key is to gradually exit as the balloon approaches its maximum volume.

3. Understanding Balloon Dynamics:

The balloon analogy helps explain why market tops are hard to identify.

No one knows the balloon's limit.

It’s not as simple as waiting for euphoric Twitter sentiment or your neighbor buying BTC.

4. Need for New Top Signals:

Crypto has many precursors that blur the line between adoption and old top signals.

As the industry evolves, so do the signals.

In the last cycle, tracking crypto trading apps via Apple Store rankings was popular.

However, with the rise of BTC ETFs, this method may no longer be effective.

5. Stakes Are Higher Than Ever:

2017 was tulip mania. 2021 gave us a glimpse of dreams. 202X could be real.

Will it end with a bang or a whimper?

While the outcome remains uncertain, this cycle is very different.

6. Signal 1 - Excessive Leverage:

Excessive leverage often leads to forced liquidations and crashes.

New, unforeseen risk factors and Ponzi schemes can trigger chain reactions.

Let’s dive into each:

(i) Rapid De-risking (and Black Swan Events):

Rapid de-risking occurs when new, unforeseen risks are quickly priced in.

This triggers broad portfolio de-risking, catching over-leveraged investors off guard.

Example: The LUNA collapse in 2022.

Source: CoinGape

(ii) Ponzi Schemes:

Chasing short-term gains while ignoring fundamentals creates instability.

Overreliance on price momentum requires a constant influx of "dumb money."

Studying the tulip mania offers further insights.

7. Signal 2 - Corporate Treasury Assets:

Many companies holding BTC as a treasury asset could be a signal.

While bullish, it may indicate we're further along the adoption curve than many realize.

Even Trump is talking about it now.

Source: Forbes

8. Signal 3 - Sovereign Wealth Funds (SWFs):

Further ahead, sovereign wealth funds might FOMO into BTC due to fear of missing out, marking ultimate exit liquidity.

Insiders at BlackRock have indicated interest from sovereign wealth funds.

Examples: Norway ($1.4 trillion fund) or Saudi Arabia ($1 trillion fund).

9. Signal 4 - Gold Flippening:

In the 2021 cycle, the "flippening" narrative (ETH > BTC) was strong.

Now, the BTC vs. gold flippening might define this cycle.

As BTC is hailed as digital gold, private and public capitulation could mark the final bull stage.

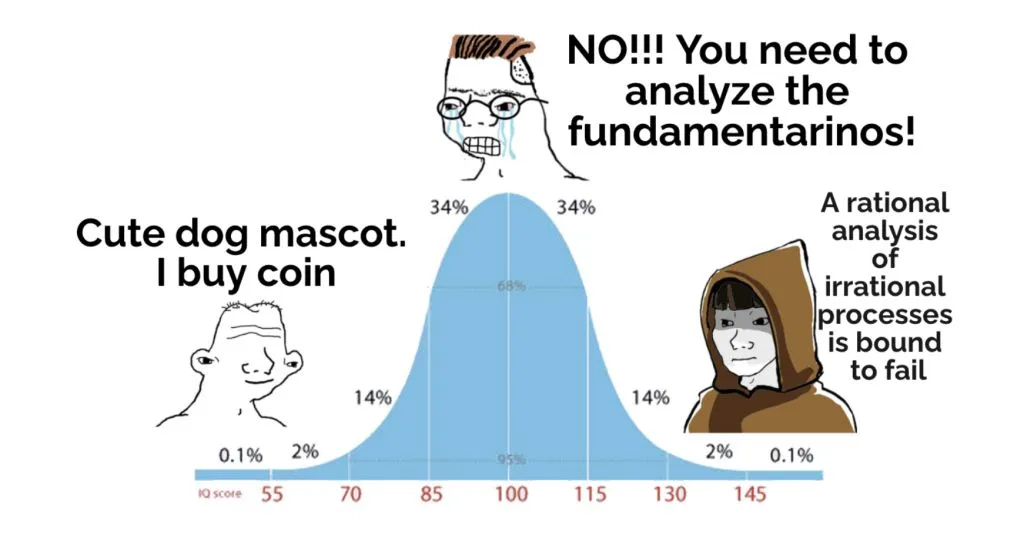

10. Signal 5 - Liquidity Drought:

Tightening liquidity is a potential market top signal.

Historically, crypto correlates strongly with global money supply.

Market concern arises when liquidity surges and tightening looms.

Liquidity typically leads crypto prices by at least six months.

Source: RaoulPal

(i) Running on Empty:

Without central bank intervention, market frenzy may continue until funds dry up.

Asset prices accelerate as fuel runs out, but liquidity has already dried up.

11. Psychological Top Signals:

Sentiment is a major driver of human behavior, especially in crypto markets.

Let’s explore two common psychological top signals:

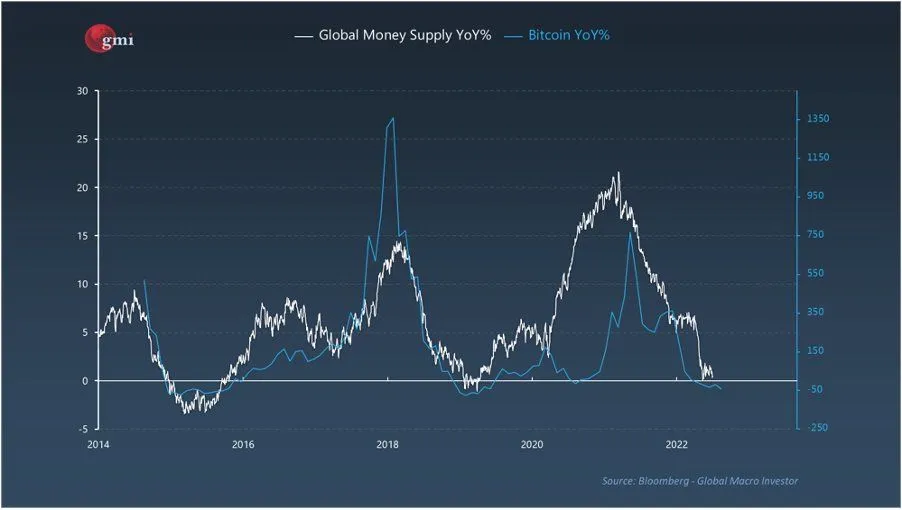

12. Signal 6 - Fear & Greed Index:

Prolonged periods of extreme greed may foreshadow trouble.

They often coincide with excessive leverage and rising Ponzi schemes.

A common strategy is to gradually sell during periods of extreme greed.

Source: Alternative.me

13. Relying on the "Average Person":

Many people time their exits based on when their "most clueless" friend enters the market.

However, this can be misleading.

For our final signal, let’s have some fun and expand on this common strategy:

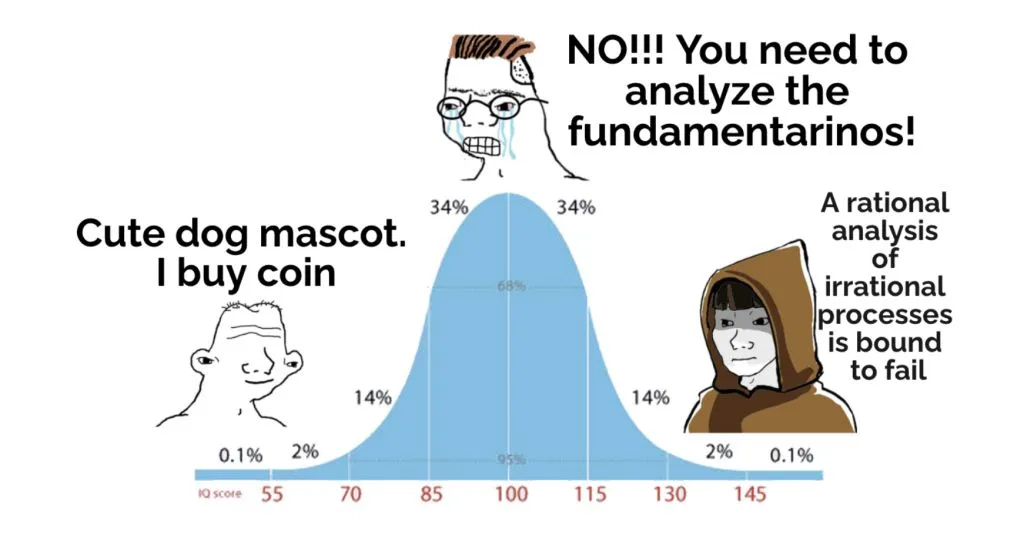

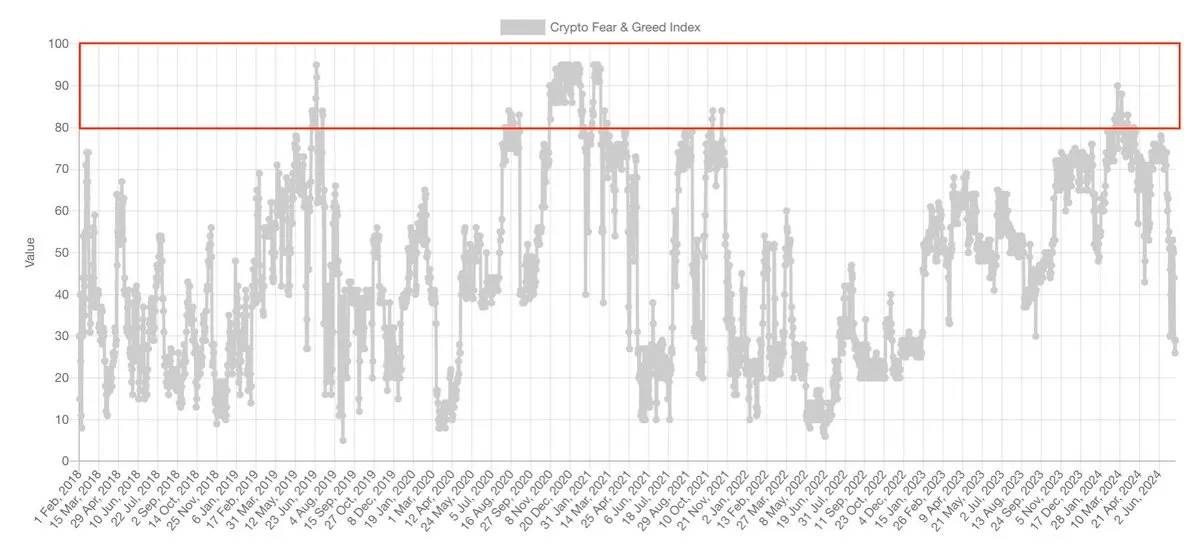

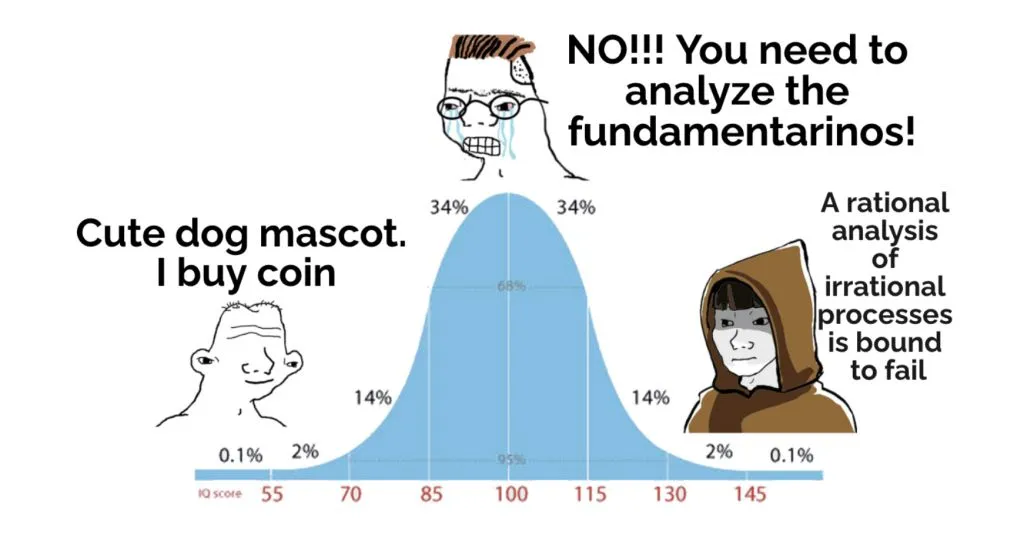

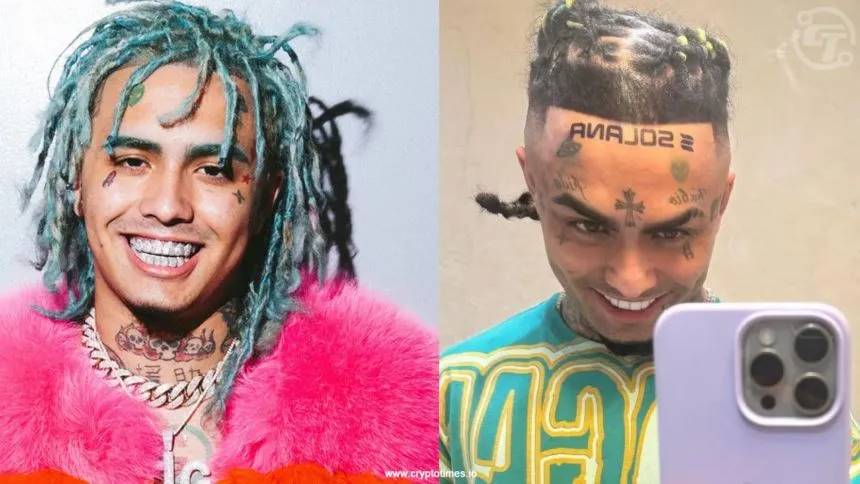

14. Signal 7 - Left Curve:

During euphoria, your average friend might outperform you. Why?

Because "left curve" assets deliver far higher returns during manias.

Ordinary people can beat you again by buying your fundamentally sound coins, while you miss out buying theirs due to FOMO.

15. Mental Preparation:

You may not perfectly time the top, but by mastering sentiment and training market intuition, you can improve your odds.

Here’s how to best prepare yourself:

16. Signs of Adoption vs. Bubble:

Adoption and bubbles can look similar.

If this cycle is truly different, past patterns may be useless.

Trust your intuition and long-term thesis, staying open to paradigm shifts.

17. Emotional Regulation:

Preemptively consider potential losses, assuming you might be wrong about your thesis.

For example, what would you do if the market has already topped?

This proactive approach minimizes future pain and financial traps.

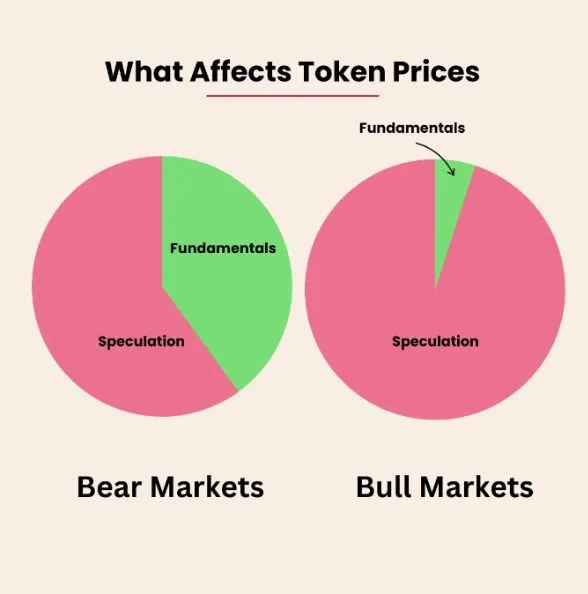

18. Speculation Over Fundamentals:

In high-risk markets, speculation trumps fundamentals.

Conversely, in low-risk markets, fundamentals dominate.

Yet, as the industry matures, fundamentals grow increasingly important.

Source: The DeFi Edge

19. We’re All Retail:

While new users may join later, it’s crucial to accept that 99% of CT users are "retail."

Many end up losing by buying junk coins and selling them to "dumb retail money."

In the final bull phase, it’s just a race to take profits.

20. Leave Some Gains Behind:

Fight your greed by leaving some profits for others.

For example, aim to fully exit in the top third of the cycle (not at the exact peak).

Respect the game to avoid being disrespected by the market.

21. Thread Summary:

-

Monitor institutional greed (corporates + sovereign wealth funds)

-

Watch for new/potential black swan events

-

Beware of excessive leverage / Ponzi schemes

-

Study liquidity (altcoins follow)

-

Leave some profits for others

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News