Metrics Ventures Market Insight: New momentum will emerge amid volatility

TechFlow Selected TechFlow Selected

Metrics Ventures Market Insight: New momentum will emerge amid volatility

Momentum accumulation still needs to occur through oscillation and subsequent convergence; maintaining patience is the better strategy.

By Metrics Ventures

Market Overview and Trend Analysis

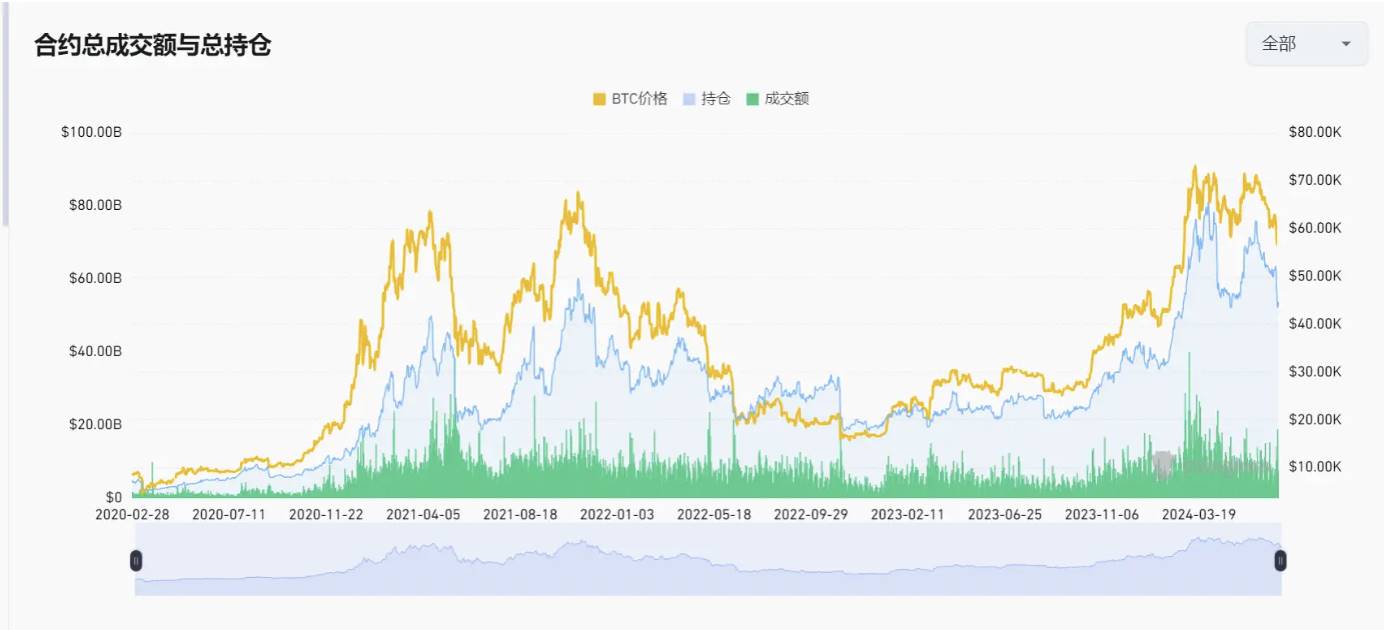

The past month has been painful for most holders, as repeated volatility compression converged with declining asset prices, culminating in a sharp downward breakout at the beginning of July under external selling pressure. At its worst, the daily decline in futures positions approached the level seen during the FTX collapse. As this report is being written, markets have stabilized following Friday's macro data release and saw an inertial rebound on Saturday. Several key phenomena emerged during this deleveraging cycle:

① A large number of altcoins showed their first volume-backed stabilization after severe overselling;

② Bitcoin found support near the midpoint of its previous uptrend channel, coinciding with miner cost levels;

③ SOL demonstrated relatively strong technical structure, while ETH gave up all gains previously driven by ETF speculation;

To date, Bitcoin has formed an expanding consolidation pattern but has not broken below its overall uptrend. Consistent with our June analysis, such expansion facilitates healthy redistribution of chips and bodes well for long-term trends. Given our continued belief that rate cuts within the year remain inevitable, we view around $50,000 as a favorable zone for medium- to long-term accumulation. For most altcoins, we believe increased short-term volatility does not signal a trend reversal, though some MM-strong coins may outperform—further observation is required.

In summary, the market is healthier compared to last month, but momentum buildup will require further consolidation and range contraction—patience remains the optimal strategy.

Sectoral Ecosystem Update

ETH Ecosystem & DeFi: The DeFi sector remains weak, and the entire ETH ecosystem showed lackluster rebound momentum.

Capital continues to flow into SOL and TON ecosystems, with minimal buying interest in ETH. Additionally, persistently low Ethereum gas fees—remaining below 10 gwei for extended periods—have placed ETH in a net issuance state, creating potential selling pressure twice that of BTC.

BTC ETFs have attracted approximately $50 billion in net inflows, absorbing $15 billion in GBTC outflows over six months. Grayscale’s ETH fund is roughly one-third the size of its BTC counterpart, meaning ETH ETFs would need to capture one-third of BTC ETF demand to achieve similar impact. However, it is unlikely that ETH ETF inflows will exceed one-third of BTC’s.

Overall, ETF flows will likely remain dominated by BTC, with ETH playing a secondary role. We expect significantly weaker net capital inflows for ETH compared to BTC, resulting in less robust price performance. Moreover, ongoing net issuance cannot be offset by ETF demand, which may erode confidence among ETH ETF holders. Therefore, we remain bearish on the ETH/BTC pair over the medium term.

LayerZero: $ZRO exhibits a solid chip distribution, with almost no supply in retail hands. There may still be room for upside, but we will not add new positions at current levels.

TON: As one of the two major alpha-generating ecosystems this cycle, TON remains worth watching. Currently, $NOT remains the only tradable asset in the TON ecosystem. Market makers are accumulating at lows—worth monitoring going forward.

SOL: Solana remains our preferred ecosystem this cycle. The strong support zone between $120–$130 for SOL continues to hold. Multicoin Capital will donate $1M worth of SOL to the Sentinel Action Fund (supporting pro-crypto candidates running for the U.S. Senate).

Promising alpha plays within the SOL ecosystem include $JUP and $JTO.

Several notable memecoins in the SOL ecosystem are also worth tracking: $Billy / $Aura / $Retardio.

AI: The AI sector largely followed broader market movements this month, delivering mediocre performance. However, as a central narrative of this market cycle, we continue to closely monitor developments in the AI space. Leading projects in the sector include TAO and RNDR.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News