9 Big Data Insights into Market Trends: Bear Market Not Here Yet, Bottom-Fishing Capital Quietly Positioning

TechFlow Selected TechFlow Selected

9 Big Data Insights into Market Trends: Bear Market Not Here Yet, Bottom-Fishing Capital Quietly Positioning

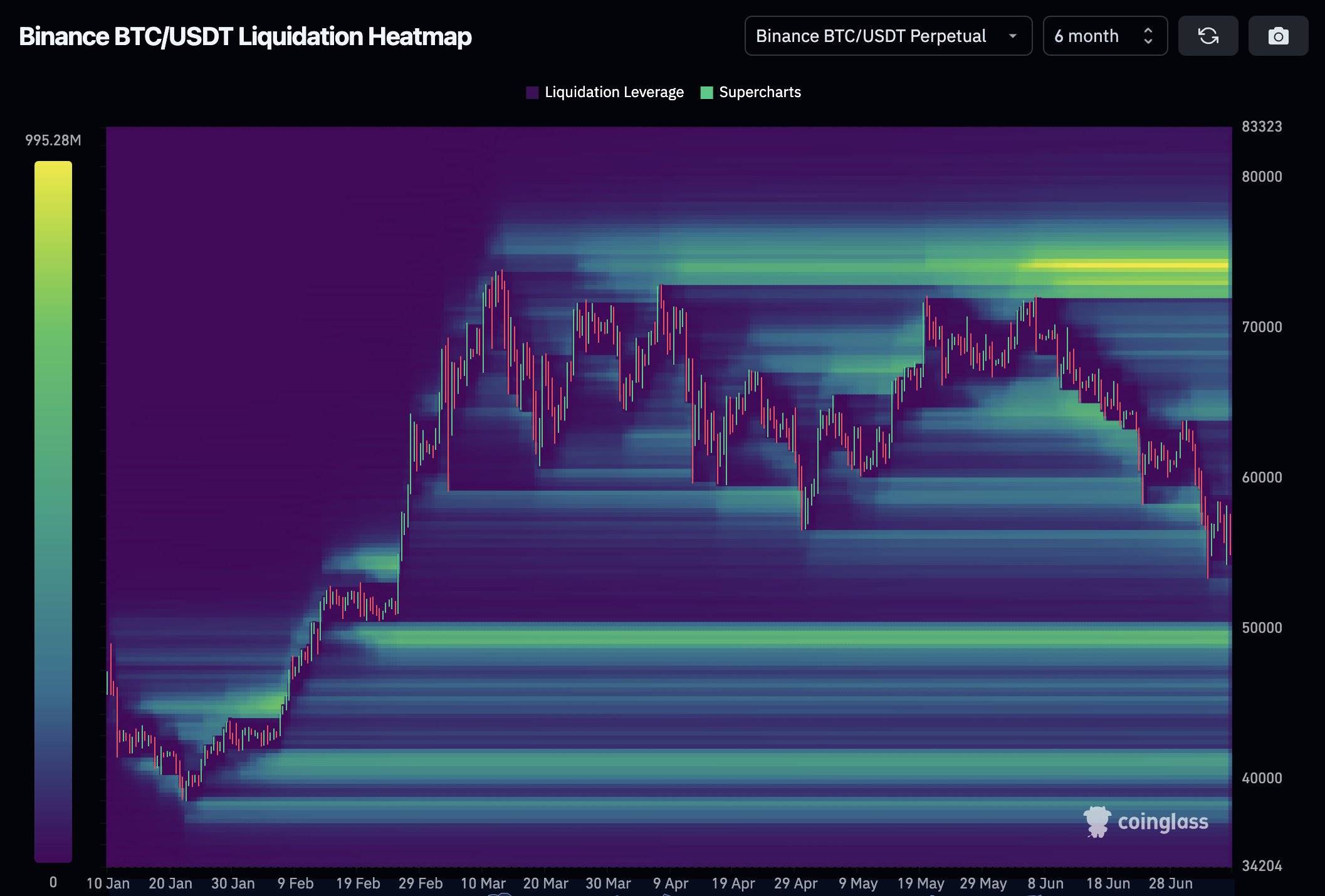

To push BTC price higher, all shorts need to be cleared up to $77,000, but there's also a significant cluster of liquidation levels around $47,000, which would be the next stop if the market turns bearish.

Author: Willy Woo

Translation: 1912212.eth, Foresight News

Let's talk about the recent supply and demand dynamics of Bitcoin and current market conditions. Below is an analysis covering miners, the German government, ETFs, and futures.

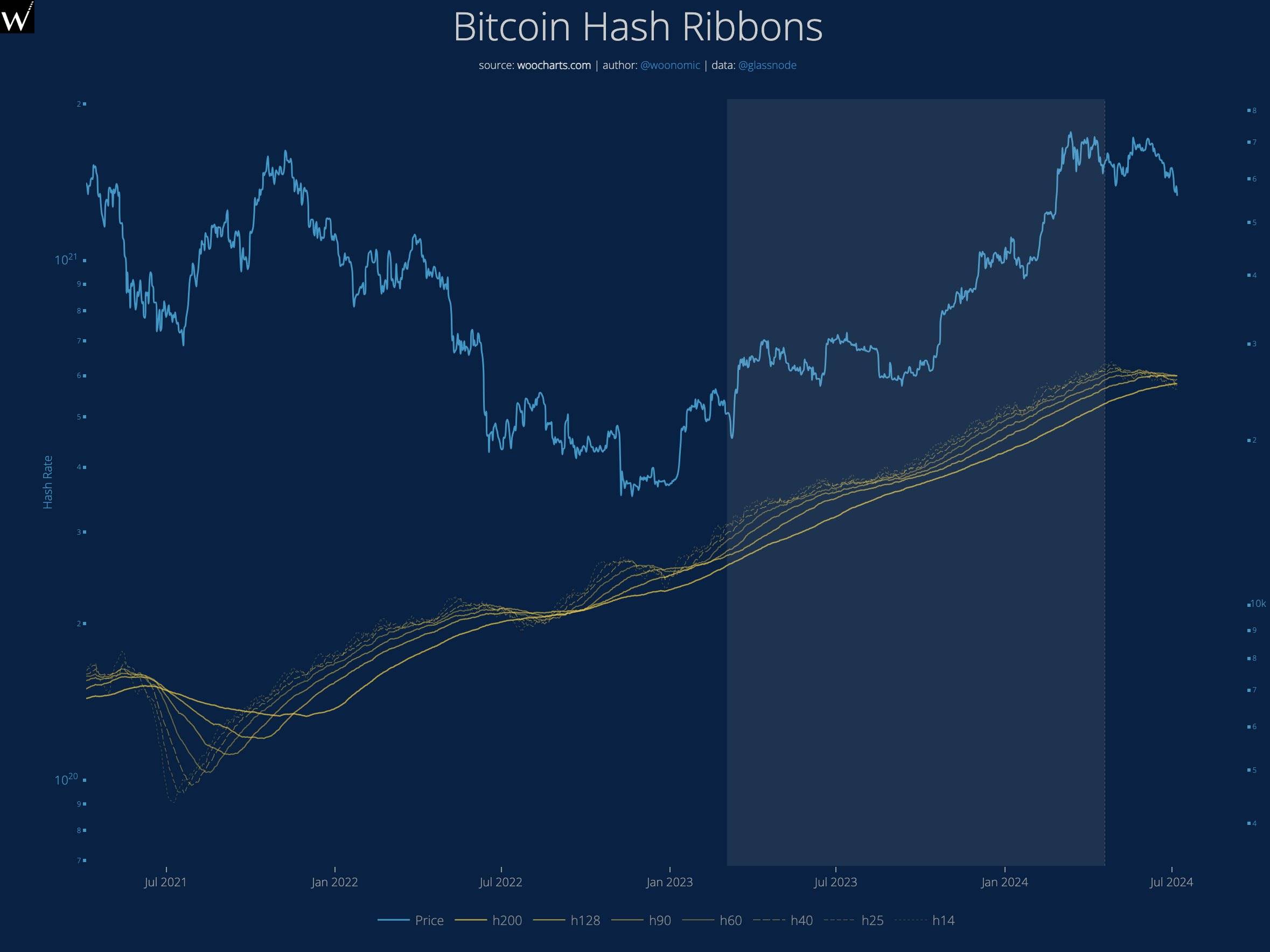

Miners have capitulated—does that mean we're in a bear market now? The answer is no.

The market was bearish before hash rate rose (the thin yellow line in the chart). Miners were selling off, which happens after every halving event. Each time the yellow line resumes its upward trend, it has historically presented a solid buying opportunity.

The main source of recent market panic has been the continuous selling of seized Bitcoin by the German government.

The individuals behind movie2k (criminal suspects) have held BTC since 2013, whose value has increased over 100x, now worth approximately $3 billion.

The German government now controls these assets and plans to sell them immediately.

I came across what might be the best comment: "This is bullish—when was the last time Germany made a good decision?"

Anyway, back on track.

They've already sold over 10,000 BTC (editor’s note: tweet published on July 9), and the sales appear to have been executed as market orders, further depressing Bitcoin prices—and simultaneously devaluing their own remaining holdings.

Rumors suggest they've now shifted to OTC desks, letting professionals handle the process.

This will reduce the severity of price impact, though not eliminate it entirely. OTC desks work to bridge the gap between buyers and sellers in the open market.

Let’s revisit the Mt. Gox situation.

Recently, around 2,700 BTC seem to have been distributed to users, with 139,000 still remaining. That’s a significant amount. I’ll be watching closely how many of these recipients decide to sell their long-lost Bitcoin.

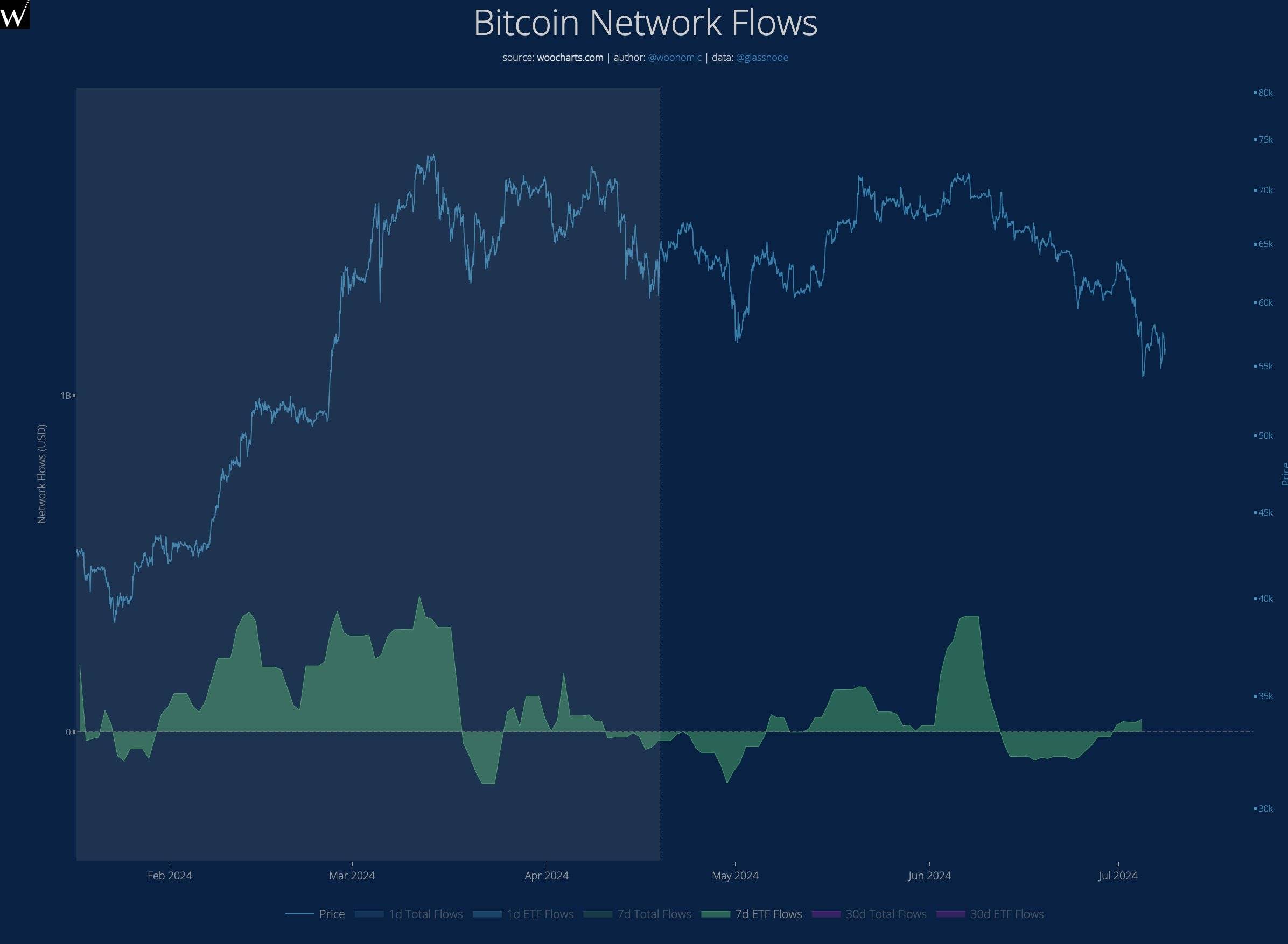

What about players trading Bitcoin ETFs?

Surprisingly, capital continues to flow in steadily. ETF data indicates investors are buying the dip. It's too early to draw definitive conclusions, but this suggests the market may be entering a "bottom-fishing" phase.

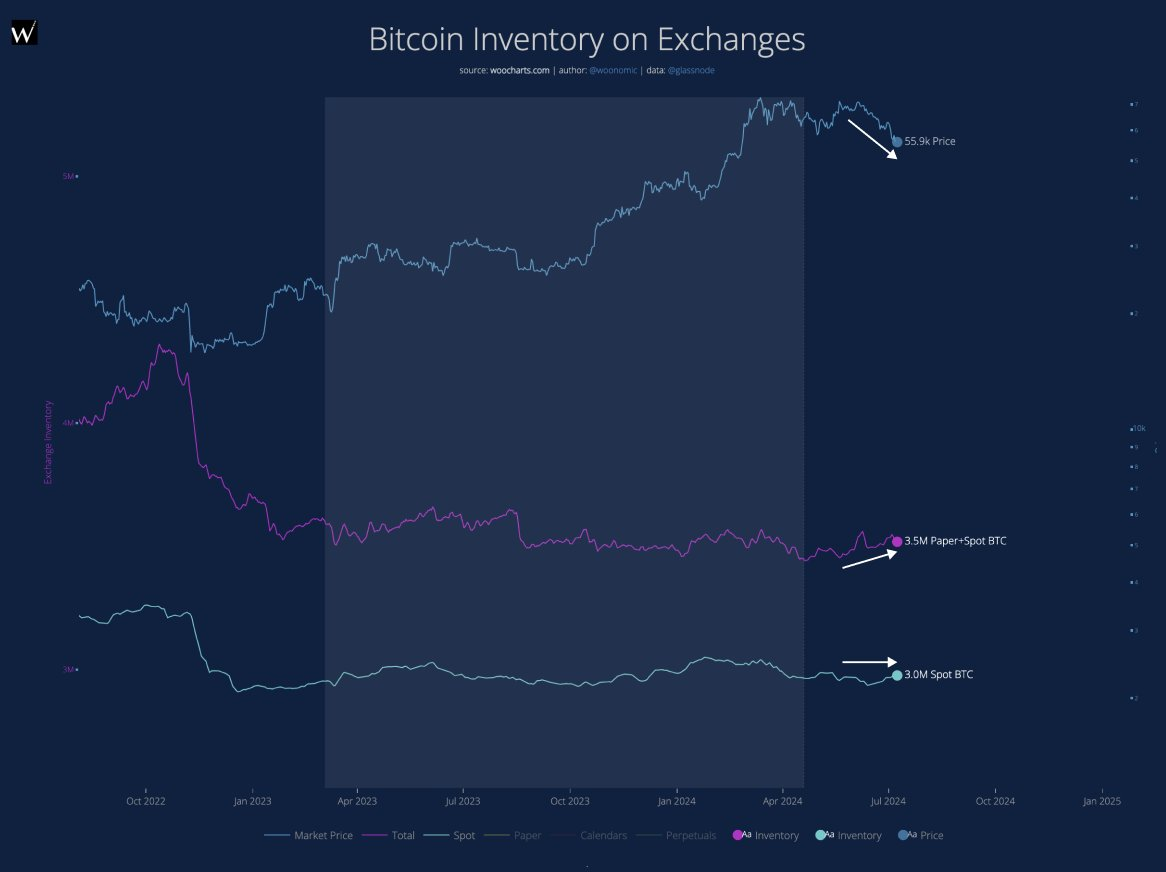

Notice how BTC price is consolidating within a low-volatility range while BTC is leaving exchanges—that's accumulation happening.

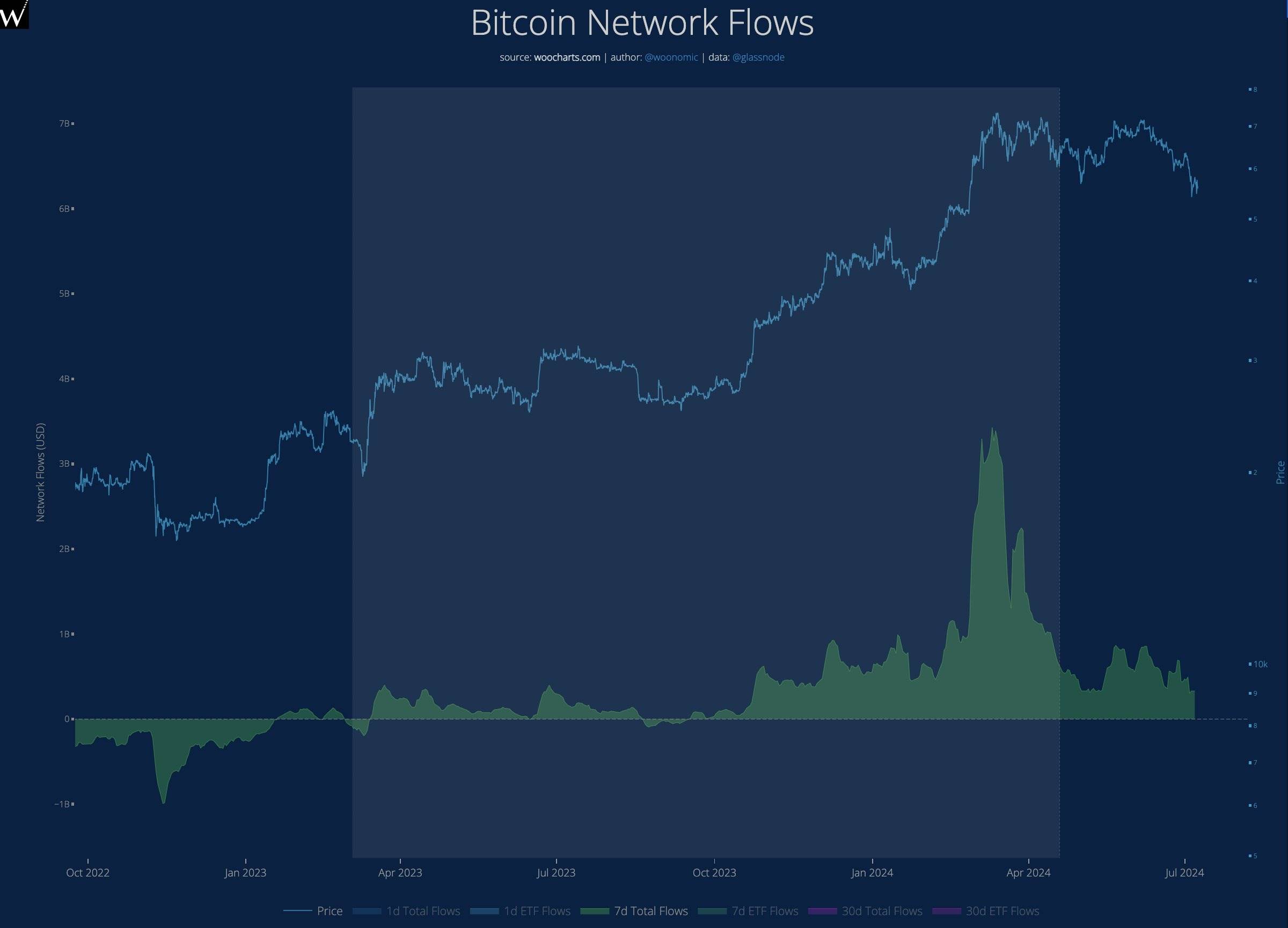

What about total capital inflows into Bitcoin?

It has dropped into a common reversal zone.

How about the futures market?

The heatmap below shows where leveraged positions are getting liquidated. To climb higher, the price needs to clear out all short positions up to $77,000—but there are also massive liquidation clusters at $47,000, which would mark the next stage of a bearish turn.

The question is, which direction will dominate?

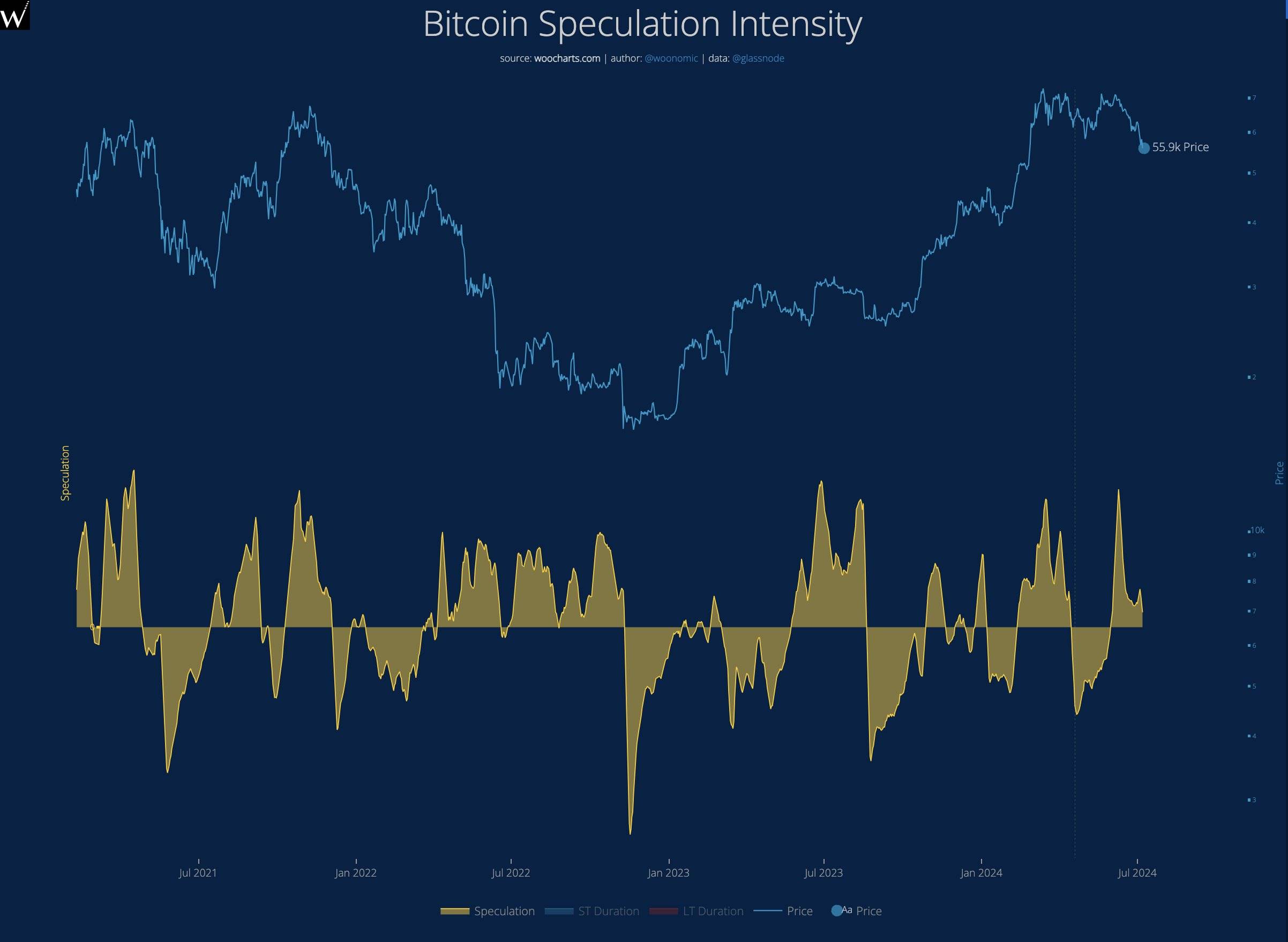

Here's another view of the futures market—there’s still too much speculative leverage. Under such conditions, it’s hard for prices to sustainably rise.

Too many “paper BTC” bets are outstanding. We’re not in a “to the moon” moment yet.

Another chart makes this clearer.

Paper BTC bets continue to rise, creating an additional 140,000 BTC out of thin air, while spot supply remains unchanged. Now compare this to Germany’s sale of over 10,000 BTC—you can see what’s truly driving the market downturn.

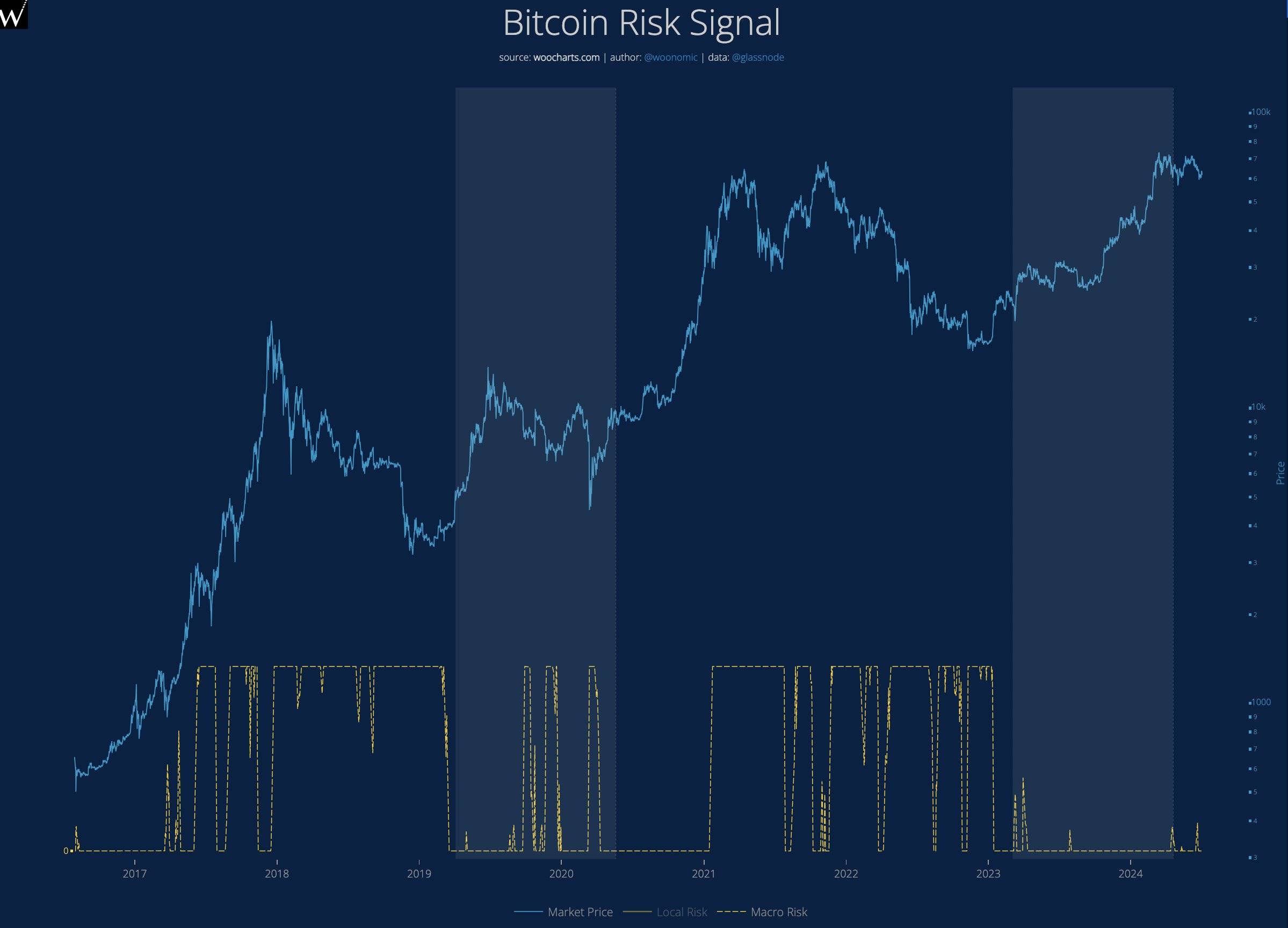

The risk signal shown in the chart below indicates the market hasn’t entered a bear phase. Additionally, U.S. equities have hit new highs, and traditional financial markets still favor a bullish outlook.

For investors accumulating Bitcoin, this consolidation period could present a valuable opportunity.

Markets in deep consolidation aim to scare traders, pushing liquidation pain to the extreme.

A breakdown below the $47,000 level could still crush long positions, but currently, signs of bottom-fishing have already begun.

Let’s wait and see. If you’re using leverage, I’d wait for hash rate to rebound.

Remember: Use spot market margin, not futures.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News