From Airdrop Diamond Hands to Nothing: 70% of Airdrop Tokens Already Numb from Declines by TGE

TechFlow Selected TechFlow Selected

From Airdrop Diamond Hands to Nothing: 70% of Airdrop Tokens Already Numb from Declines by TGE

Airdrops are not the only reason for the decline in these projects' tokens.

Author: Aylo

Compiled by: TechFlow

Airdrops have played a significant role in this cycle.

I was curious how many tokens launched via airdrop continued trading above their initial distribution price after the first day of listing.

This could help answer whether one should hold an airdrop (i.e., whether holding leads to profit).

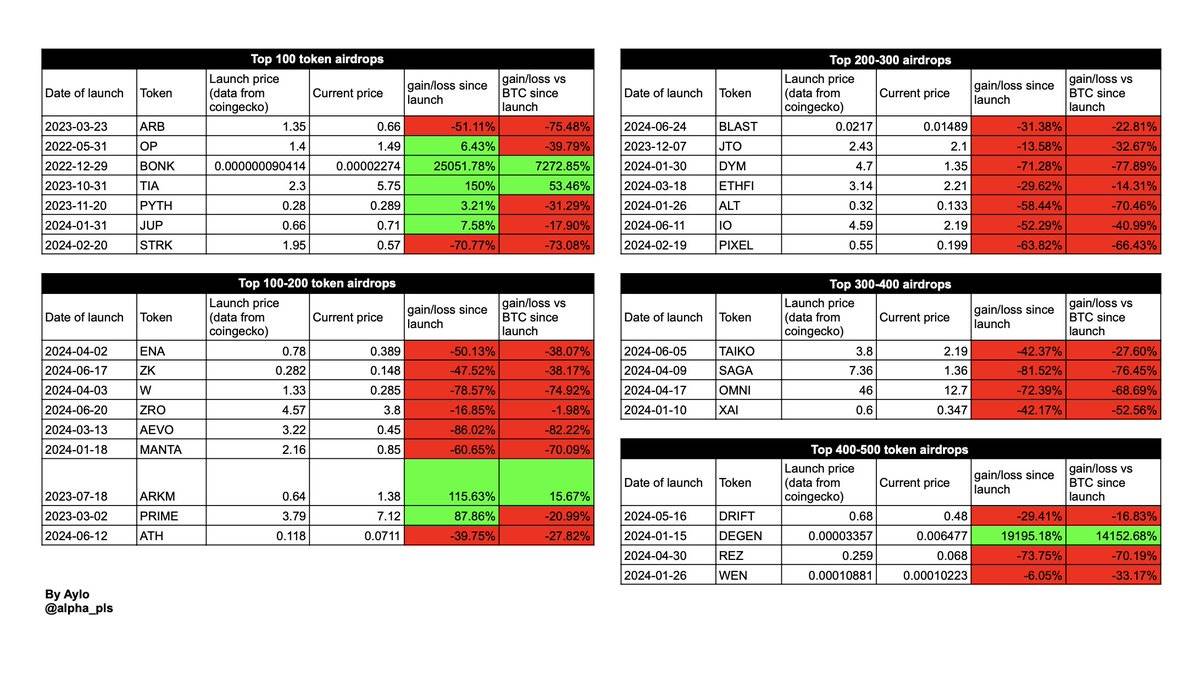

I compiled the data, focusing only on the top 500 tokens. While the prices used are from this morning and may be slightly delayed, they should still reflect the overall trend.

Here are the key findings:

-

Of the 31 tokens, 23 have declined in price since their initial release, some significantly

-

Only 4 out of the 31 tokens have outperformed BTC since launch

-

Only 1 token launched in 2024 has outperformed BTC

-

Two meme-related airdrops were highly successful—BONK and DEGEN. TIA also trades far above its issuance price and has outperformed BTC, despite current controversies

Selling airdropped tokens for USD or BTC on the listing day is almost always the right choice. You might get lucky (some call it skill) selling during early post-launch pumps, but overall, the longer you hold, the worse your performance tends to be.

There will always be exceptions, but the odds of holding the right airdropped token are very low—especially relative to BTC. If you truly believe in a project’s long-term potential, you can almost always buy back in at a lower price after launch. The next bear market may make these tokens better investments. There are indeed some solid projects on this list.

Airdrops aren’t the sole reason these project tokens decline. Often, teams and market makers set valuations too high from the start. Users dumping their airdropped tokens quickly reveal that these valuations were completely unjustified.

Many have learned in this cycle that FDV actually matters. Holding an airdrop means believing there will be sufficient demand to push the price higher, even as large unlocks occur and investors hedge or short-sell.

Farmers will sell regardless of price because they’re just extracting yield and moving on. In theory, tokens should recover from such "mercenary" exits, but data shows most don’t. Of course, some of these tokens still have time. This is just a random snapshot—things can change quickly.

People often complain that many airdrops are poorly designed, but based on this data, it seems difficult to execute an airdrop that doesn’t negatively impact the token in the short and medium term (long term remains to be seen).

The two surprise meme airdrops (no points programs) delivered the best returns to holders, thanks to very low initial valuations. Both were designed to support different ecosystems (Solana and Farcaster).

We’ve also seen many meme airdrops go to zero instantly in the past, so you certainly can’t assume meme airdrops will perform better. A better conclusion might be: surprise + low valuation.

I actually think points programs will continue to exist, as they are a common feature in Web2 and can enhance user experience with more fun, incentives, and stickiness. But I don’t expect airdrops to persist in the form we’ve seen over the past few years.

Based on this data, project teams should be extremely cautious about whether and how to conduct an airdrop.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News