The bull market won't disappear until you stop believing it's a bull market.

TechFlow Selected TechFlow Selected

The bull market won't disappear until you stop believing it's a bull market.

"Reality is, it doesn't go away just because you stop believing in it." - P. Dick

Author: Crypto, Distilled

Compiled by: TechFlow

Crypto – Has the top already formed?

This is a taboo question within the crypto community (CT).

Yet ignoring it can be costly (which is why most people go through full boom-and-bust cycles).

"The reality is that it doesn't disappear just because you stop believing in it." – P. Dick

Here’s why the top may already be in — and how to still thrive regardless.

Breakdown in Market Structure

The first major concern is $BTC's recent loss of its 4-month range.

While the long-term trend remains intact, the medium-term trend has turned bearish.

Andrew Kang sees parallels with May 2021 price action.

(Credit: @Rewkang)

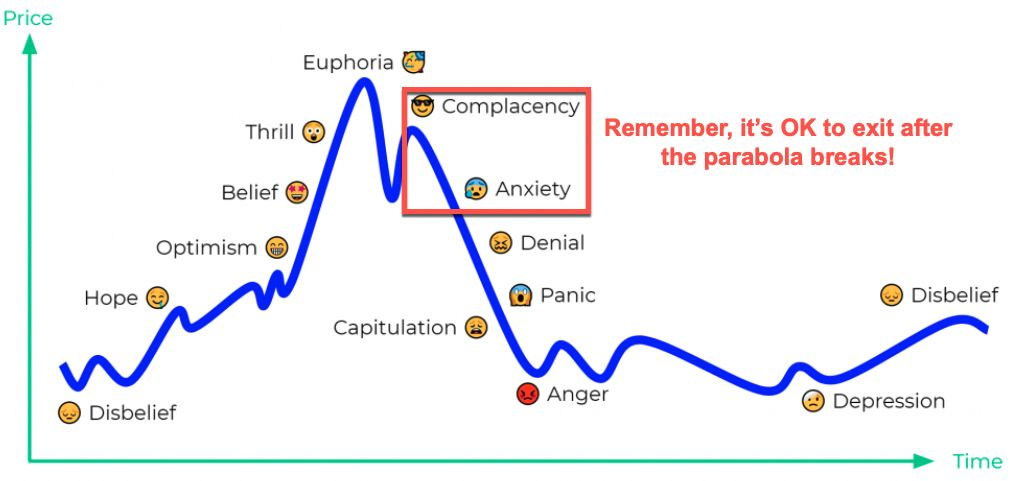

Potential Double Top?

With key support broken, the double-top formation on the weekly chart is hard to ignore.

While I'm no technical analyst, this resembles a classic Complacency Shoulder pattern.

“Spot markets feel comfortable, crypto is safe because liquidity will return” = Consensus narrative

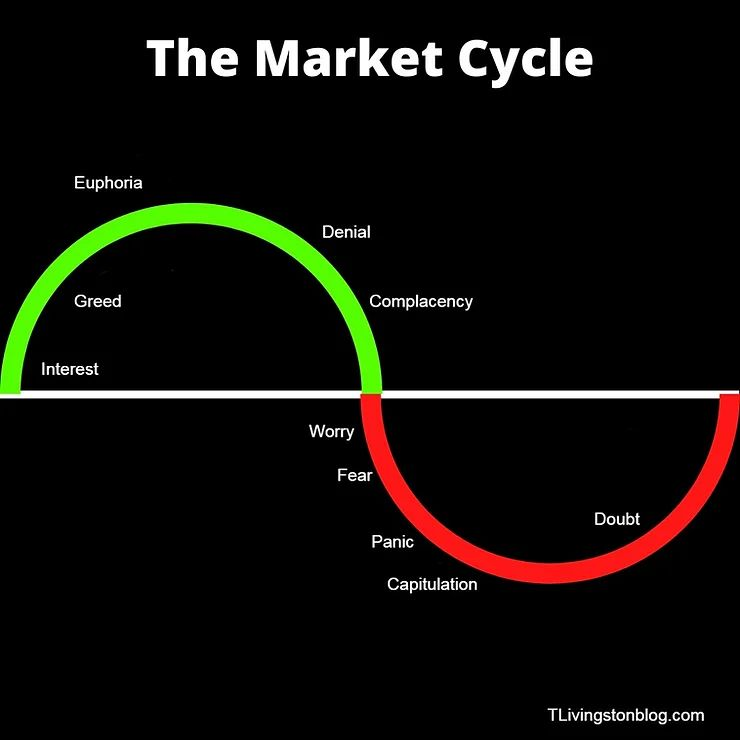

From Wall of Worry to River of Hope

Bull markets climb a “Wall of Worry”; bear markets slide down a “River of Hope.”

This shift happens gradually and tops are often only confirmed in hindsight.

To assess this transition, examine:

-

Price reaction to positive/negative news

-

Psychology of dry powder

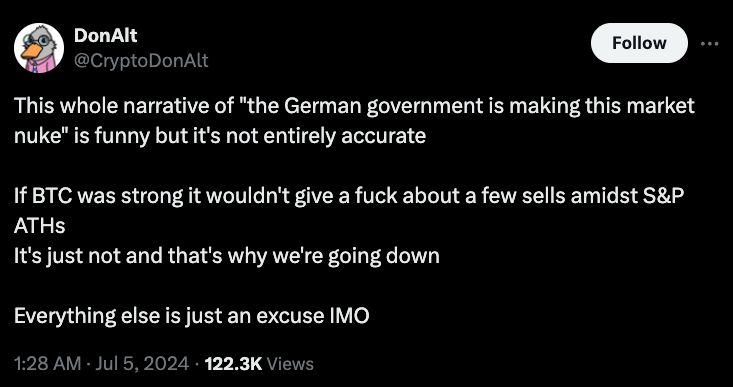

Market Reaction to News

In weak markets, good news is ignored while bad news triggers massive fear.

Recent examples:

-

Good news: Trump discussing Bitcoin ($BTC) as corporate treasury + Ethereum ($ETH) ETF approval.

-

Bad news: Mt. Gox / German government BTC sell-offs

(Credit: @CryptoDonAlt)

Dry Powder & Catching Falling Knives

Retail blindly catching falling knives without clear catalysts is concerning.

As complacency and denial turn into panic, markets slide further down the river of hope.

(Credit: T. Livingston)

Technical Bounce of 2022

Markets saw multiple technical bounces in 2022 — but no trend reversal.

Ideally, you want to see major catalysts ahead AND dry powder hesitant to deploy.

The opposite signals danger — as recently seen in $ETH ETF price action.

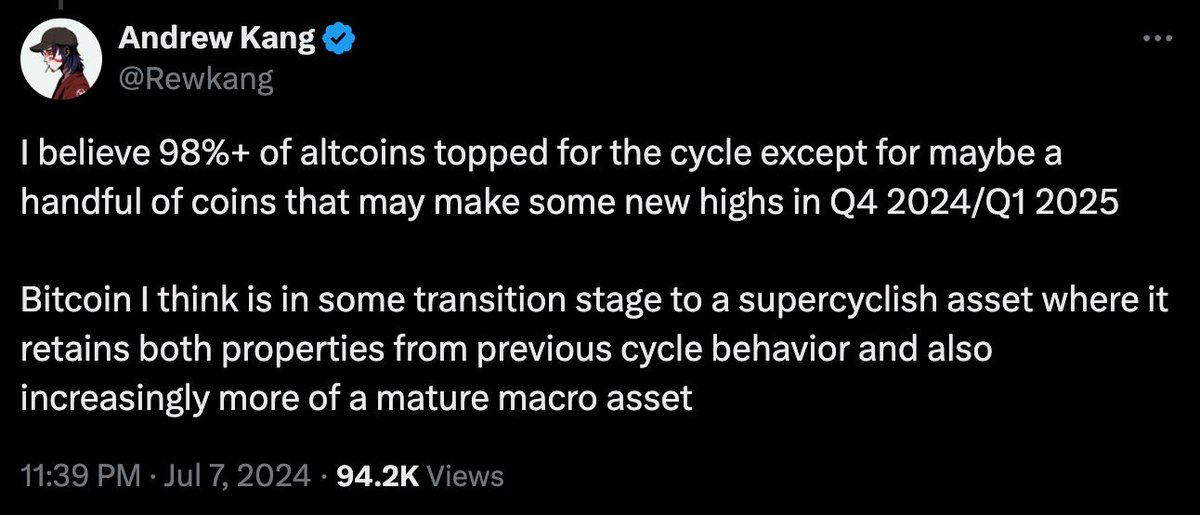

Bitcoin Super Cycle Narrative

Many altcoins may have topped, but Bitcoin ($BTC) could enter a super cycle.

Despite potential global liquidity surge, this challenges the assumption that alts are the fastest horses.

A paradigm shift may be underway, with effects lagging.

(Credit: @Rewkang)

BTC vs. S&P 500 Divergence

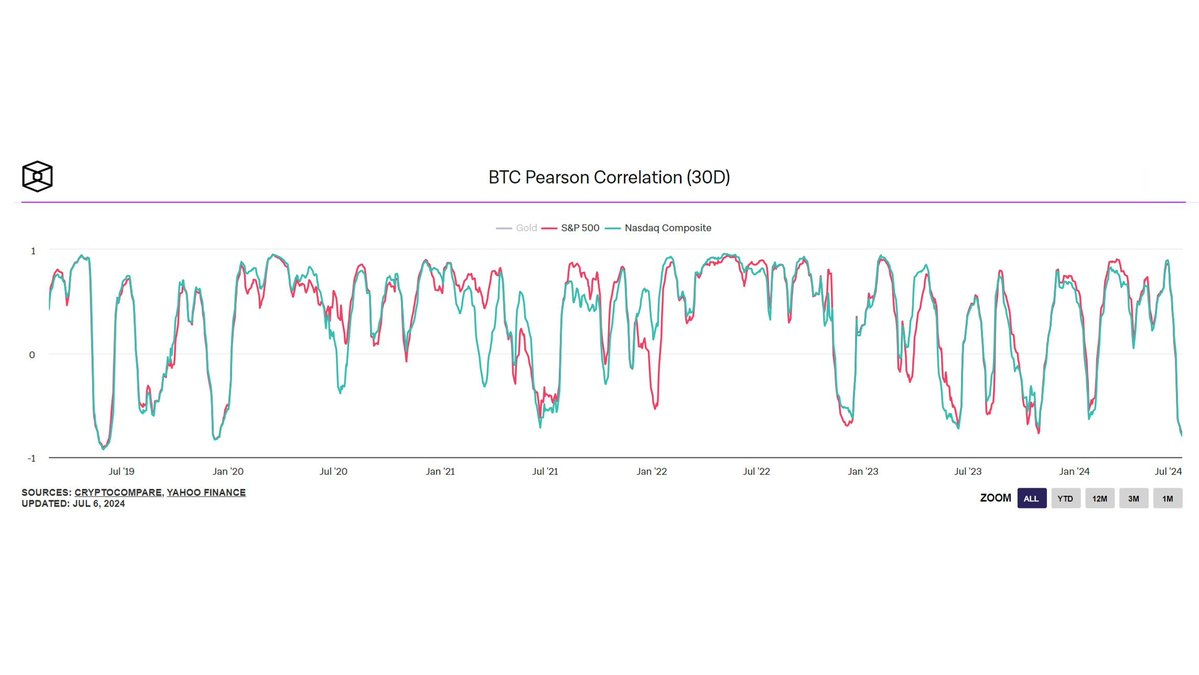

Declining correlation between Bitcoin ($BTC) and equities (lowest in 4.5 years) is concerning.

Massive supply overhangs (Germany, USA, etc.) may push this decoupling to extremes.

(Credit: @WClementeIII)

Similar to 2019

BTC vs. S&P 500 divergence mirrors 2019, when BTC peaked in June.

It took over 12 months to make new highs.

(Credit: @intocryptoverse)

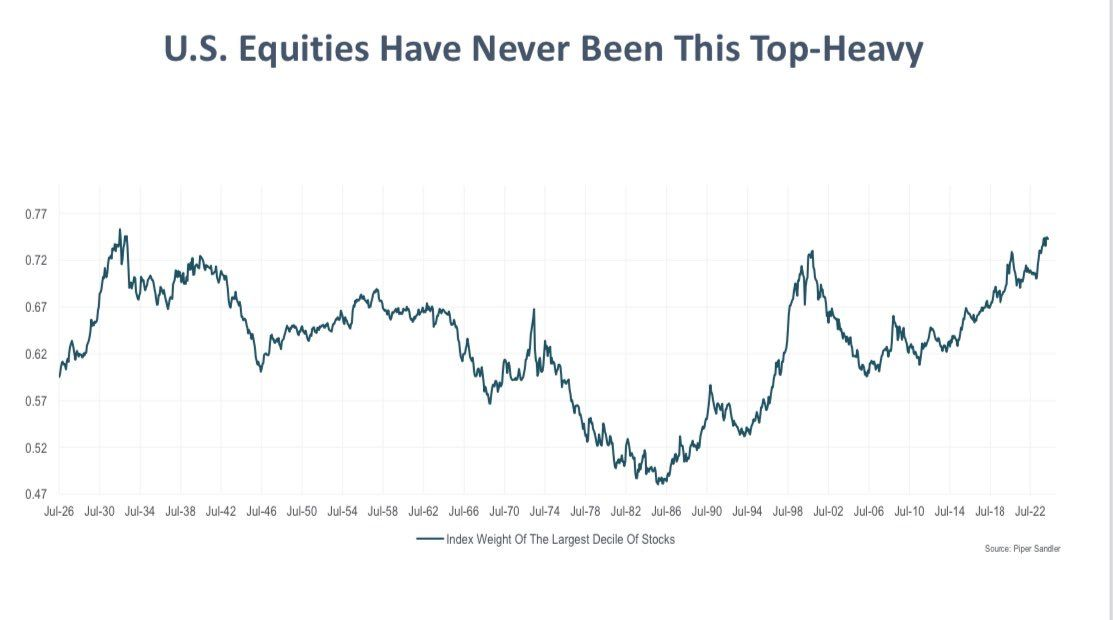

Big AI Companies Overshadow Crypto

Perhaps the market topped not because crypto is bad — but because AI is better.

We’re seeing the thinnest stock rally in history — driven by big AI companies.

Despite unprecedented access to Bitcoin ($BTC), retail demand growth is slow. Why?

(Credit: @TXMCtrades)

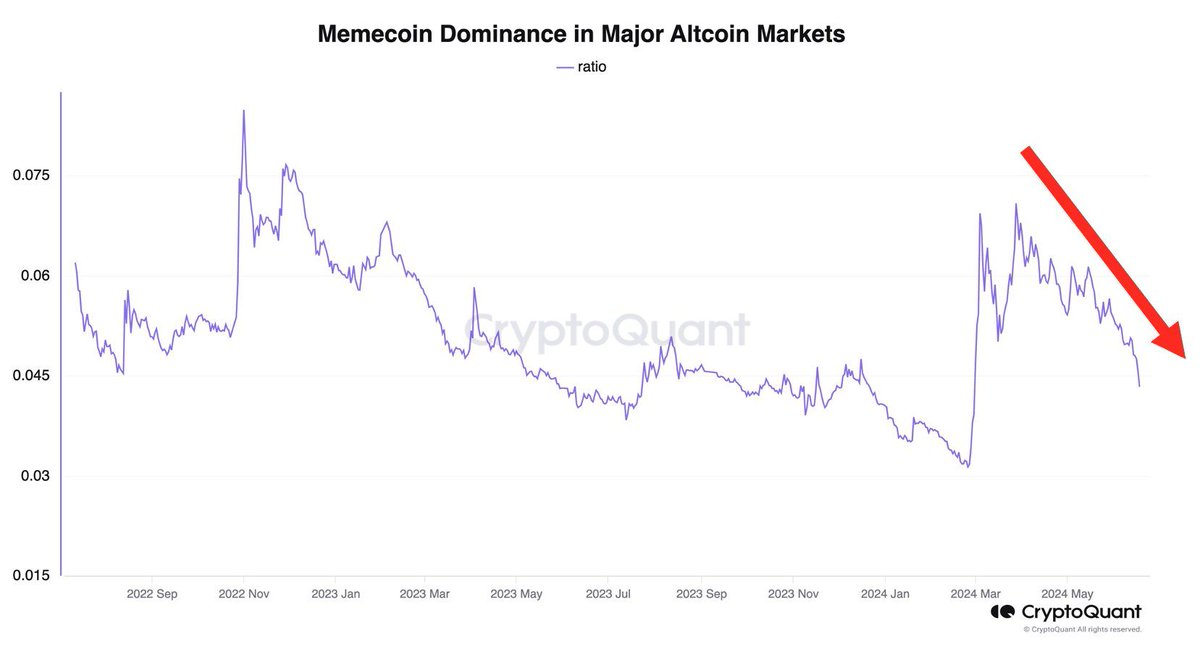

Has Peak Mania Passed?

Peak mania may have passed. This cycle might be just a flash in the pan.

Evidence: Memecoins peaked in Q1 2024 and have been declining since.

Did Bitcoin ($BTC) also peak in Q1 2024? (Coincidence?)

(Credit: @ki_young_ju)

Memecoin Super Cycle = Top Signal

The idea of a “memecoin super cycle” may be the ultimate top signal.

A similar top signal emerged in 2021, when predictions of a BTC super cycle ($250k+ BTC) circulated.

Due to less disillusionment this cycle, perhaps we entered memecoin mania faster.

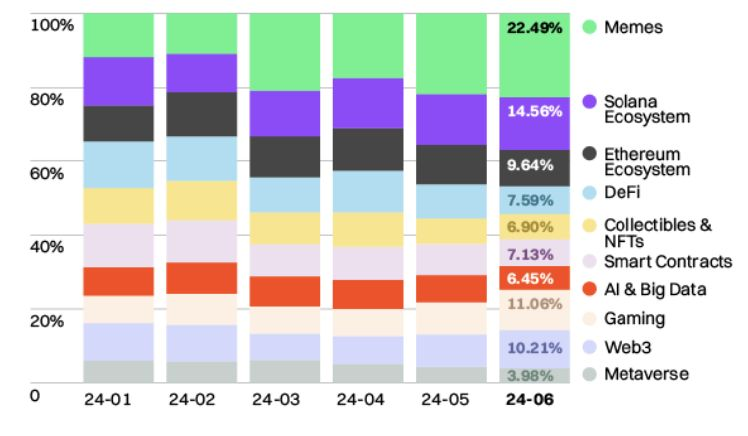

Dominance in the Memecoin Arena

For the first time, memecoins have become the most popular category on CoinMarketCap (CMC).

Without real utility driving organic demand, how long can altcoins run on speculation alone?

(Credit: @coinmarketcap)

Profit Through Hedging

Even if we’ve topped, it doesn’t mean all hope is lost.

Hedging strong alts with short positions in weak ones can be highly profitable.

This allows you to profit from declines while staying engaged in the market.

(Credit: @GiganticRebirth)

Rising Bitcoin Dominance

In risk-off markets, investors often sell alts for Bitcoin ($BTC), increasing BTC dominance.

Shorting weak ALT/BTC pairs could capture this trend profitably.

@intocryptoverse believes Bitcoin dominance ($BTC.D) could reach 60% by Q4 2024.

Profiting From VC Greed

Identify coins with large supply overhangs and significant unrealized profits held by VCs.

What If the 4-Year Cycle Breaks?

Imagine March 2024 was merely the peak for the next 6–12 months?

Would that still count as a cycle top?

Given limited upside so far, a milder downturn would be reasonable.

Due to shorter cycle + lower volatility.

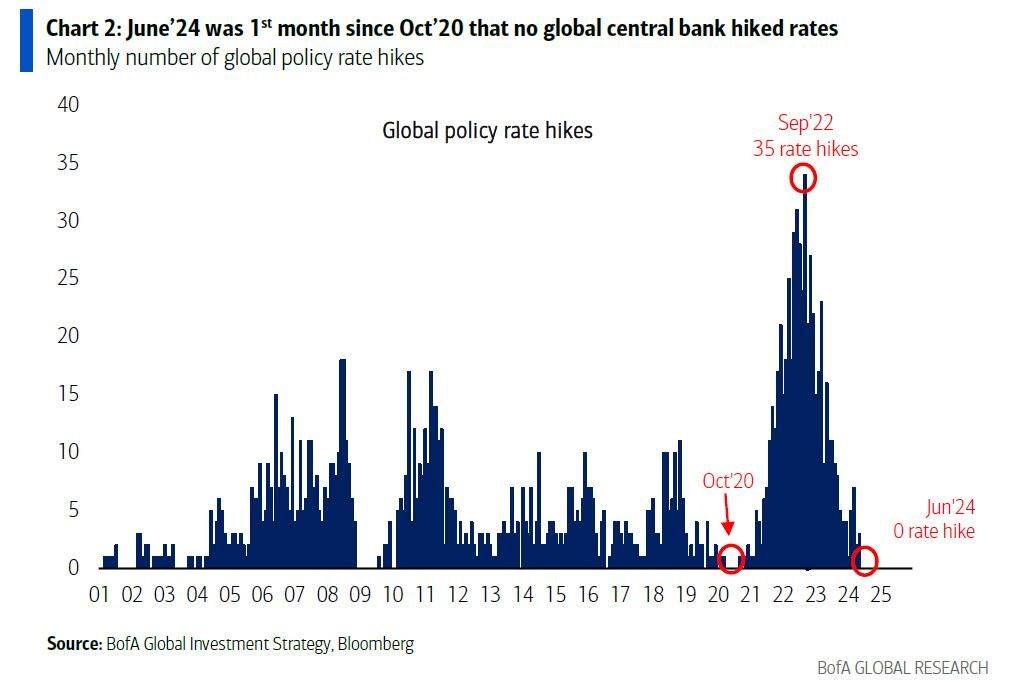

Macro Top Not Yet In?

Despite bearish signals, the macro top may not be here yet (personal view, for reference only).

Liquidity is key — and strong evidence suggests the peak may come in 2025.

Though current liquidity is low, we appear to be on the edge of a major shift.

(Credit: @zerohedge)

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News