From Grace to Disgrace: The Rise and Fall of Friend.Tech

TechFlow Selected TechFlow Selected

From Grace to Disgrace: The Rise and Fall of Friend.Tech

In today's "What are you playing with?" daily question, who would still bring up the name Friend.Tech?

Markets rise and fall, and some altcoin prices never return.

Likewise gone for good might be certain products and businesses.

In the daily question of "what's hot today," who still mentions Friend.Tech?

Yet a year ago, you weren't saying that at all: Friend.Tech was the new trend in SocialFi, the darling of Paradigm investments, the hot topic covered eagerly in research reports, the wealth god liberating KOL fan economies...

So how did it become an abandoned project nobody even bothers with?

Attention isn't eternal. Once-popular crypto products quietly fall from grace before we realize it.

But the crypto market has memory. Let's take a brief look back and see how Friend.Tech squandered such a strong starting position.

At its peak, deafeningly loud; after collapse, eerily silent

Let me tell you a ghost story.

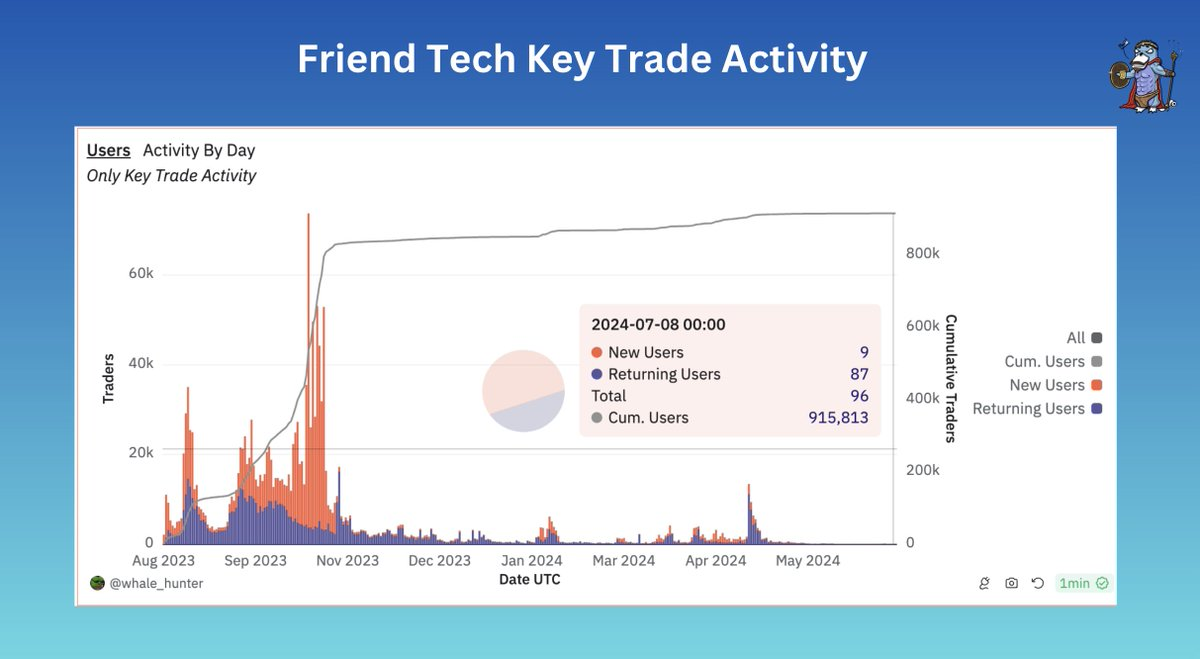

Data shows that today, Friend.Tech has fewer than 100 daily active users.

During its last frenzy, daily active users once exceeded 77,000—a decline of 99.9%.

But about a year ago, Friend.Tech surged unexpectedly.

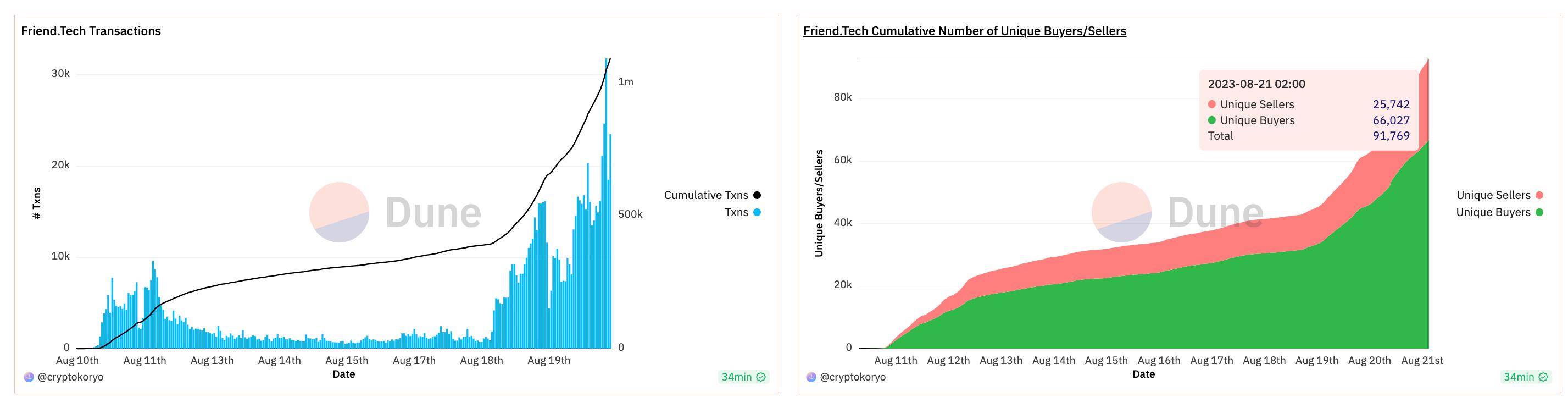

Back in mid-August last year, friend.tech began gaining traction. Trading volume for shares (Keys) surpassed $1 million, with over 66,000 unique buyers and 25,000 unique sellers—making it nearly another mass-participation crypto product following StepN.

Just two weeks after launching its V1 version, the platform attracted over 100,000 users and generated approximately $25 million in revenue—an important milestone in user adoption and financial performance.

At the time, FT’s financials looked healthy, even generating so-called real income distributions, sharing around $6 million with users.

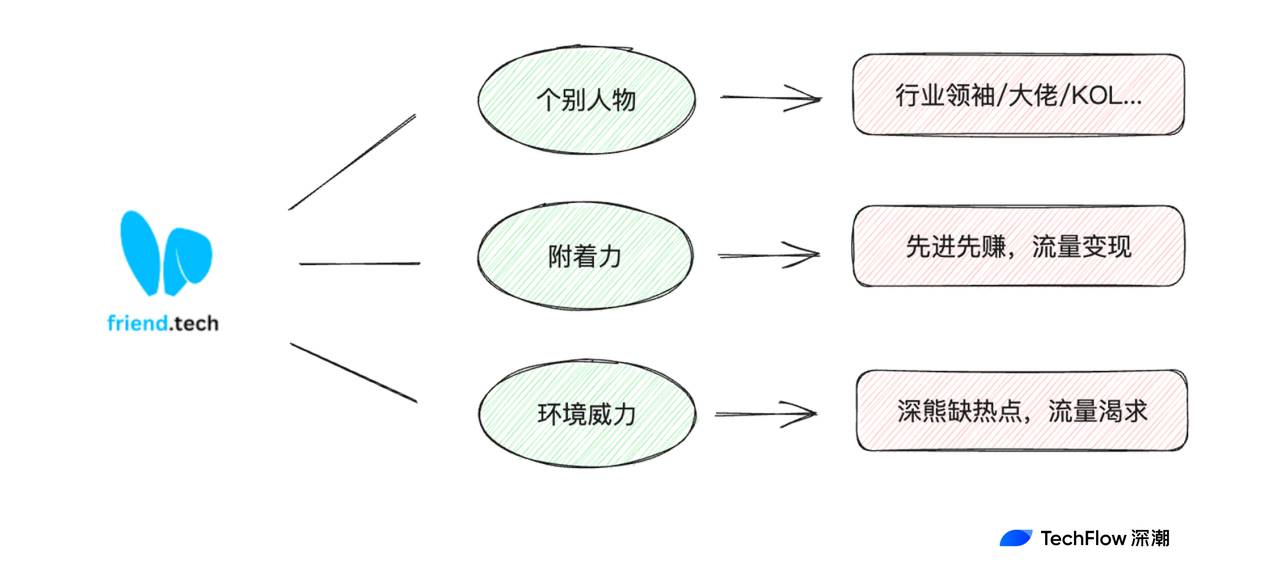

Initially, the logic behind FOMO-ing into this product was simple: get in early, buy keys early, make money. Securing spots in popular KOLs’ fan zones became a wealth formula. FT also had a points system based on activity levels, creating expectations for potential airdrops.

After a long bear market slump, it indeed brought a rare feast of liquidity and excitement.

Crypto world data is public and transparent. This heating trend naturally caught the industry's institutional players' attention. That same month, FT announced it secured seed funding from top-tier VC Paradigm. With boosted airdrop expectations and fresh capital, FOMO sentiment reached fever pitch.

New product model, solid user metrics, backing from a top VC... At that point in the cycle, when people hadn’t yet debated high FDV vs low liquidity or vilified VCs, possessing these elements meant Friend.Tech truly held a winning hand.

But as you and I know, FT’s key-selling model had inherent flaws and monotony. Without constant influx of new users, its structural weaknesses would inevitably drain popularity quickly.

Everyone could see this—especially the FT team. Holding a strong hand, their priority should have been excellent product development, operations, and economic expectation management to extend FT’s lifespan and vitality.

Instead, they played that strong hand terribly.

Aggressive moves, but a dumb product

If we rewind time, we can see clues to FT’s decline scattered across different moments.

One extreme phrase sums it up: aggressive moves, but a dumb product.

Don’t misunderstand—this isn’t to say FT had no merits. On the contrary, it possessed traffic and liquidity attraction capabilities unmatched by earlier products. It’s just that compared to overly aggressive operational moves and directional choices, the product itself seemed stagnant.

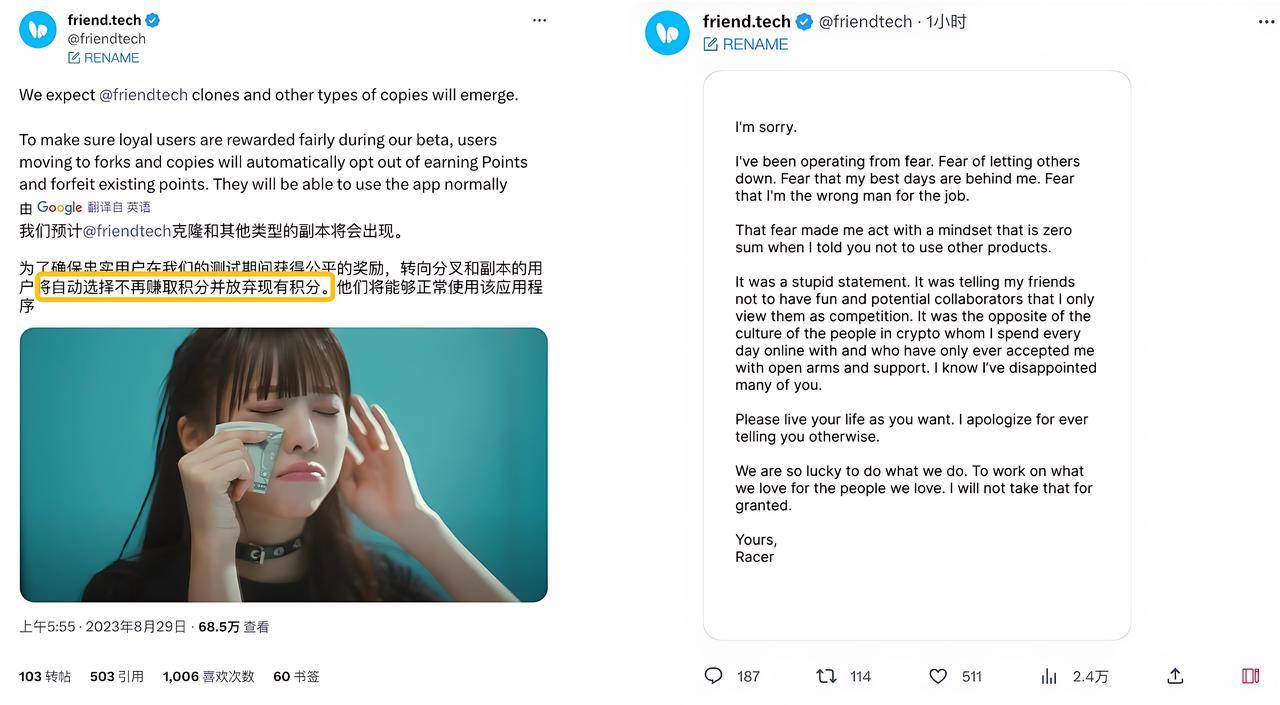

The earliest signs of this over-aggressiveness were mentioned last year in our article "Friend.tech Did a Complete U-turn and Agreed to Let You Play With Forks":

FT initially strongly discouraged users from playing on similar forked platforms, publicly stating that doing so would disqualify them from earning FT points. This authoritarian and narrow-minded move sparked community backlash. The founder then quickly issued a public apology fearing user loss—an abrupt reversal bordering on PR disaster.

Chances are, the FT team hadn’t figured out their operational strategy or how to handle competition. For a phenomenon-level product, going unprepared like this appears amateurish—and reveals deeper issues through small details.

Another over-the-top move came with the excessive PUA tactics around the V2 launch.

By late April this year, after a long silence, Friend.Tech promised to release the FRIEND token and a brand-new V2 version on the 29th, reigniting community enthusiasm.

The release was delayed until May 3rd—minor delays still within what speculators could tolerate. What truly turned people off was the airdrop claim process:

Users had to follow at least 10 people on FriendTech AND join one club to claim their airdropped tokens. Clearly, clubs were designed to push V2 engagement, promote activity, and give users something new to play with to sustain momentum.

But forcing users to join first before claiming tokens felt unpleasant. Worse, many reported technical difficulties claiming their tokens on launch day. Tokens failed to arrive promptly, while FRIEND’s liquidity pool was underfunded, causing sharp price drops in secondary markets. Many hadn’t even claimed their tokens yet, but the value had already halved.

My tokens are already losing value—why should I listen to your sales pitch now?

A netizen joked: “After eight months, the only update we got was ‘clubs,’ and everyone’s just using it to claim airdrops.”

Misalignment between incentives and actual product features started eroding confidence in FT.

Then came more self-inflicted wounds. Co-founder Racer publicly stated he wanted to migrate the product away from Base network, claiming FT was being marginalized and isolated within the Base ecosystem.

Openly distancing yourself from your host blockchain and complaining about it is clearly playing with fire. The market voted with their feet—FT suffered another dual drop in users and price.

More strikingly, in June, FT announced plans to launch its own dedicated chain, Friendchain—transforming overnight from application layer to infrastructure layer.

Will the market support such a shift?

Compared to aggressive operational maneuvers and strategic shifts, the FT product seemed largely unchanged from a year ago—simple, even crude interface, no standalone app, Ponzi game patterns...

A dumb product piled atop internal and external crises—no wonder a phenomenon-level product fell from grace.

In contrast, other social products like Farcaster spawned numerous meme coins—FRAME, FAR, POINTS—wave after wave of hype. Compared to them, FT has clearly fallen behind.

Is a Ponzi scheme the Ponzi player’s ticket?

Perhaps FT never deserved to sit on the pedestal.

Driving growth via a refined Ponzi model can make you fly higher—but the plane’s structural flaws remain undeniable.

A Ponzi scheme may be the Ponzi player’s ticket, but it doesn’t guarantee longevity. FT exploded last year due to a confluence of factors—inevitable within randomness—but that inevitability can’t be fully replicated.

Rush in for profit, flee when there’s none—the principle is simple, but FT stretched this cycle unusually long.

Ultimately, SocialFi products like FT failed to achieve true product-market fit. They resemble short-term speculative vehicles rather than solutions addressing real needs. Combined with operational blunders, their downfall was inevitable.

But if every viral crypto product is merely a historical phenomenon, then perhaps the greatest crypto product remains speculation itself.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News