The Double-Edged Sword of Token Launch: Premature Token Issuance Could Be a Mistake, Yet Generate Incentive Effects

TechFlow Selected TechFlow Selected

The Double-Edged Sword of Token Launch: Premature Token Issuance Could Be a Mistake, Yet Generate Incentive Effects

Markets and networks that launched with a token from the outset must achieve product-market fit within a shortened time window.

Author: MASON NYSTROM

Translation: TechFlow

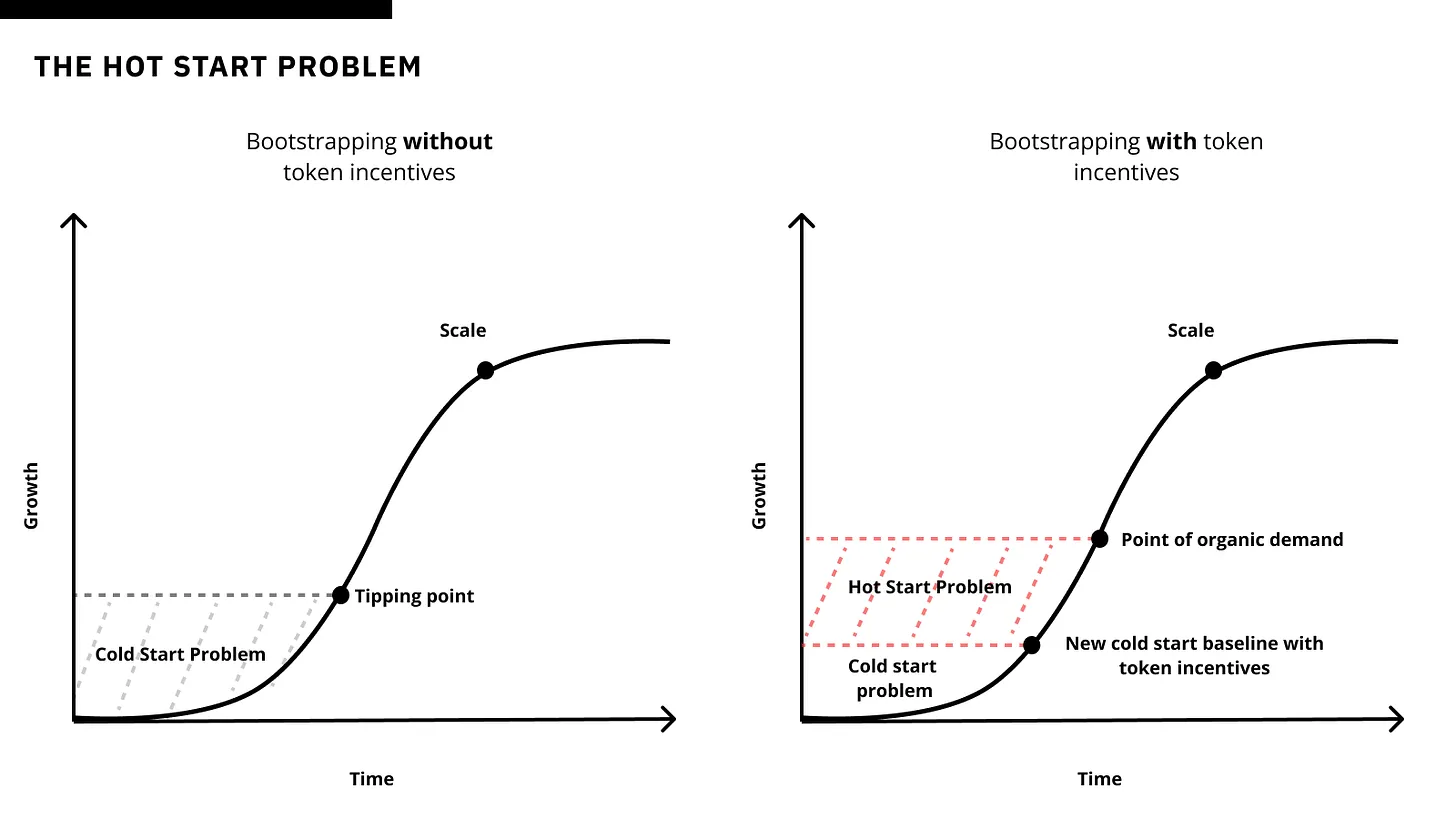

It turns out that combining tokens (or token promises) with innovative new products can effectively mitigate cold start problems. However, while speculation brings the benefit of network activity, it also introduces negative side effects such as short-term liquidity and unnatural user behavior.

Markets and networks that launch tokens early—or before establishing sufficient organic demand—must achieve product-market fit (PMF) within a compressed timeframe, or they will exhaust their valuable token resources.

My friend and investor Tina calls this the "hot start problem": the existence of a token restricts the time window for startups to find PMF and gain enough organic traction to retain users and liquidity once token incentives are reduced.

Applications launching with point systems also face the hot start problem, as users now implicitly expect a token.

I particularly like the term "hot start problem," because one of crypto’s key differentiators from Web2 is its ability to leverage tokens as financial incentives to bootstrap new networks.

This strategy has proven effective, especially in DeFi protocols like MakerDAO, DyDx, Lido, and GMX. Token launches have also worked for other crypto networks—from decentralized IoT networks (like Helium) to infrastructure (such as Layer 1 blockchains) and certain middleware (like oracles). Yet networks that opt for rapid scaling via tokens and face the hot start problem encounter several trade-offs: obscuring organic traction and PMF, depleting token reserves too soon, and increasing operational complexity due to DAO governance (e.g., fundraising, governance decisions).

When Does the Hot Start Problem Make Sense?

The hot start problem is preferable over the cold start problem in two scenarios:

-

Startups competing in crowded, red-ocean markets where demand is already known

-

Products and networks with passive supply-side participation

Red-Ocean Markets

The core drawback of the hot start problem is difficulty in measuring organic demand—but this is mitigated in categories with strong product-market fit (PMF). In such cases, latecomers can successfully challenge first movers by launching tokens early. The DeFi space offers many examples of later entrants overcoming the hot start problem through effective token use to launch new protocols. While Bitmex and Perpetual Protocol were the first centralized and decentralized exchanges offering perpetual contracts, later entrants GMX and dYdX used tokens to rapidly increase liquidity and became leaders in the perpetuals market. Newer DeFi protocols like Morpho and Spark have successfully launched with billions in total value locked (TVL), despite dominant incumbents like Compound and Aave (formerly ETHlend). Today, when demand for a new protocol is clear, tokens (and points) have become the default tool for liquidity bootstrapping. For example, liquid staking protocols actively use points and tokens to grow liquidity in competitive markets.

In consumer crypto, Blur demonstrated a red-ocean competition strategy—its well-defined point system and token launch helped it become the dominant Ethereum NFT marketplace by trading volume.

Passive vs. Active Supply Participation

The hot start problem is easier to overcome in passive supply networks than in active ones. A brief history of token economics shows that tokens are highly effective at bootstrapping networks when there are passive tasks to complete—such as staking, providing liquidity, listing assets (e.g., NFTs), or set-and-forget hardware (as in DePIN).

Conversely, while tokens have succeeded in launching active networks like Axie, Braintrust, Prime, YGG, and Stepn, premature token introduction often obscures true product-market fit. Therefore, the hot start problem is more challenging in active networks than in passive ones.

The lesson isn't that tokens are ineffective in active networks, but rather that apps and markets launching token rewards for active tasks—such as usage, gaming, gig work, or services—must take extra steps to ensure token rewards drive organic usage and key metrics like engagement and retention. For example, the data labeling network Sapien gamifies labeling tasks and requires users to stake points to earn more. Here, passive staking during certain actions may act as a loss-aversion mechanism, ensuring participants provide higher-quality data labels.

Speculation: Feature or Bug?

Speculation is a double-edged sword. If integrated too early in the product lifecycle, it can be a bug; but if executed strategically, it can also be a powerful feature and growth lever to attract user attention.

Rather than solving the cold start problem, startups that launch tokens before achieving organic traction choose the hot start problem. They accept the trade-off of using tokens as external incentives to capture user attention, betting instead on their ability to discover or create genuine product utility amid increased speculative noise.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News