The market is declining, but fat apps are continuously capturing value from order flow.

TechFlow Selected TechFlow Selected

The market is declining, but fat apps are continuously capturing value from order flow.

"Fat apps" are inevitable, and the crypto world will re-evaluate the value of applications.

Author: Mason Nystrom

Translation: TechFlow

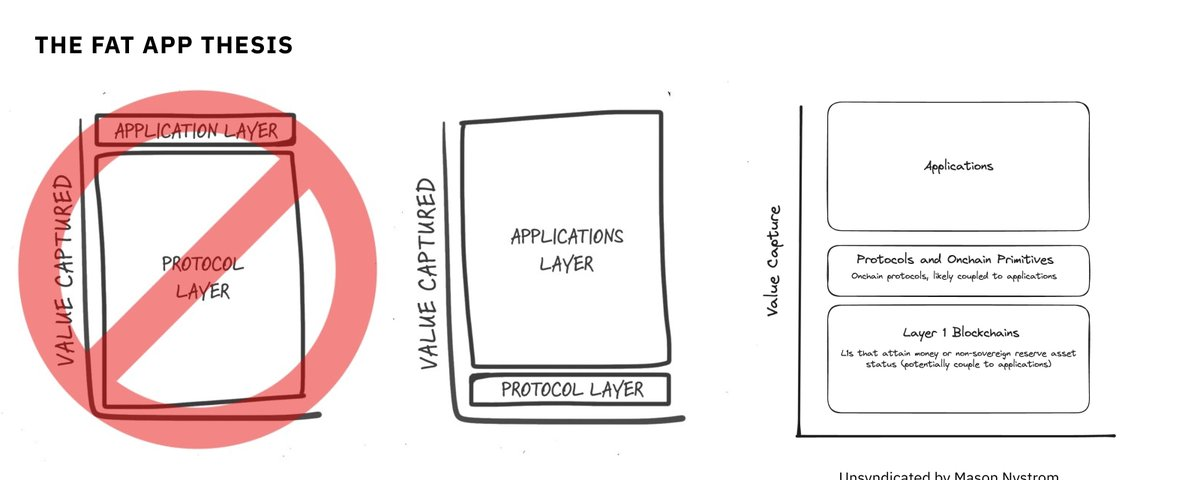

Over the past 30 days, Ethereum’s order flow has exceeded $25 billion, with nearly half originating from proprietary applications.

As the value of blockspace commodities rises, private order flow will increase—paving the way for "fat apps." (Translator's note: "Fat apps" refers to dominant applications in the blockchain ecosystem that not only control significant user traffic and transactions but also vertically integrate key components, enhancing their value and competitive edge.)

Source: Orderflow.art

But how did we get here—and where are we headed?

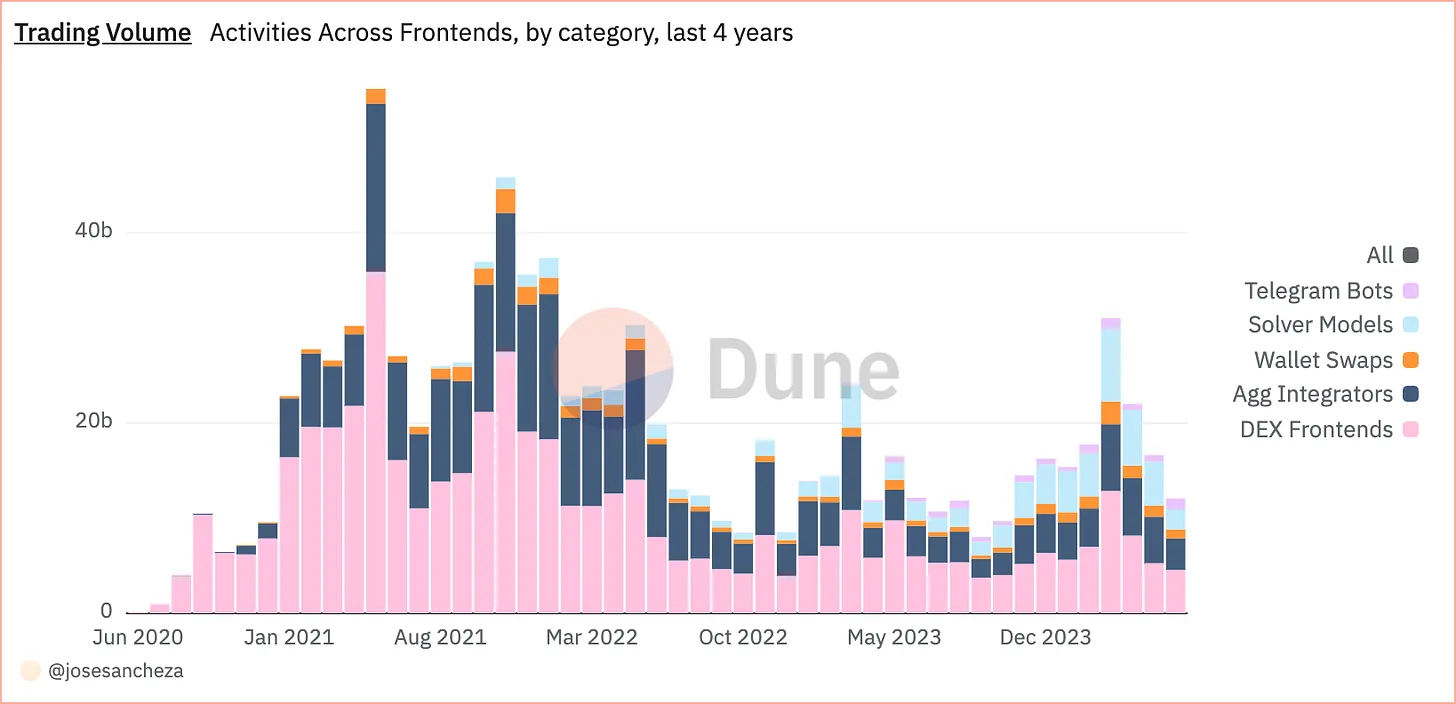

The short answer: foodcoins. A slightly longer explanation: DeFi summer generated massive consumer and retail trading activity, leading to the emergence of aggregators like 1inch, which improved price execution through private order routing. Wallets such as MetaMask quickly followed, realizing they could monetize user convenience by embedding swap functionality—proving that any app controlling user attention and order flow possesses a highly valuable business model.

Over the past two years, two new categories of players have entered the private order flow space—Telegram bots and solver networks. Telegram bots operate similarly to MetaMask’s “convenience fee” model, offering users an easy way to trade long-tail assets directly within group chats. As of June, Telegram bots accounted for approximately 21% of volume and 11% of transaction value, mostly executed via private mempools.

Source: Dune

On the other end of the spectrum, solver networks like Cowswap and UniswapX have become core venues for large liquidity trades (e.g., stablecoins and ETH/BTC pairs). These networks transform market structure by outsourcing optimal route discovery to competitive solvers (market makers).

As a result, trading venues have begun to differentiate. Convenient front-ends (such as TG bots, wallet swaps, and Uniswap’s interface) primarily handle long-tail, lower-value trades (under $100K), while aggregators and solver networks serve as preferred platforms for high-value trades involving major assets like stablecoins and ETH/BTC.

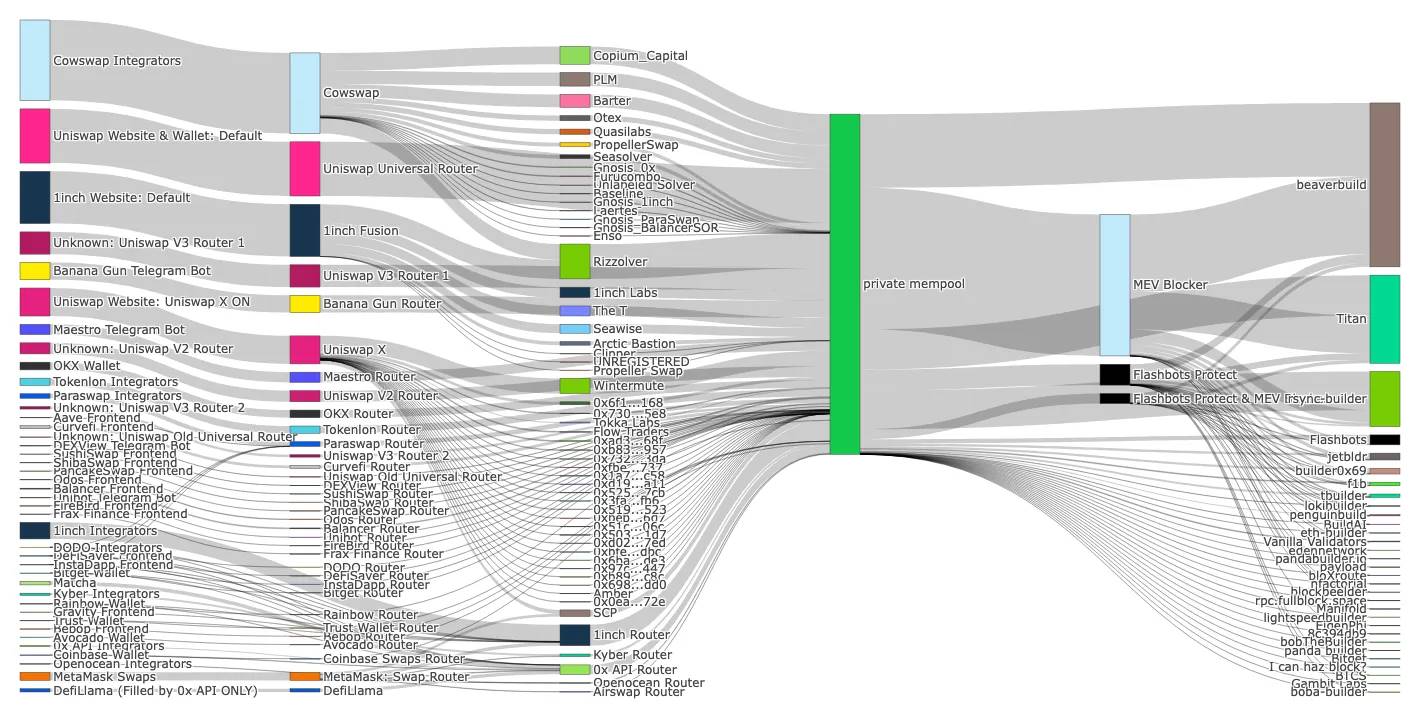

With closer inspection, you’ll find most private order flow originates from front-ends (TG bots, wallets, and interfaces).

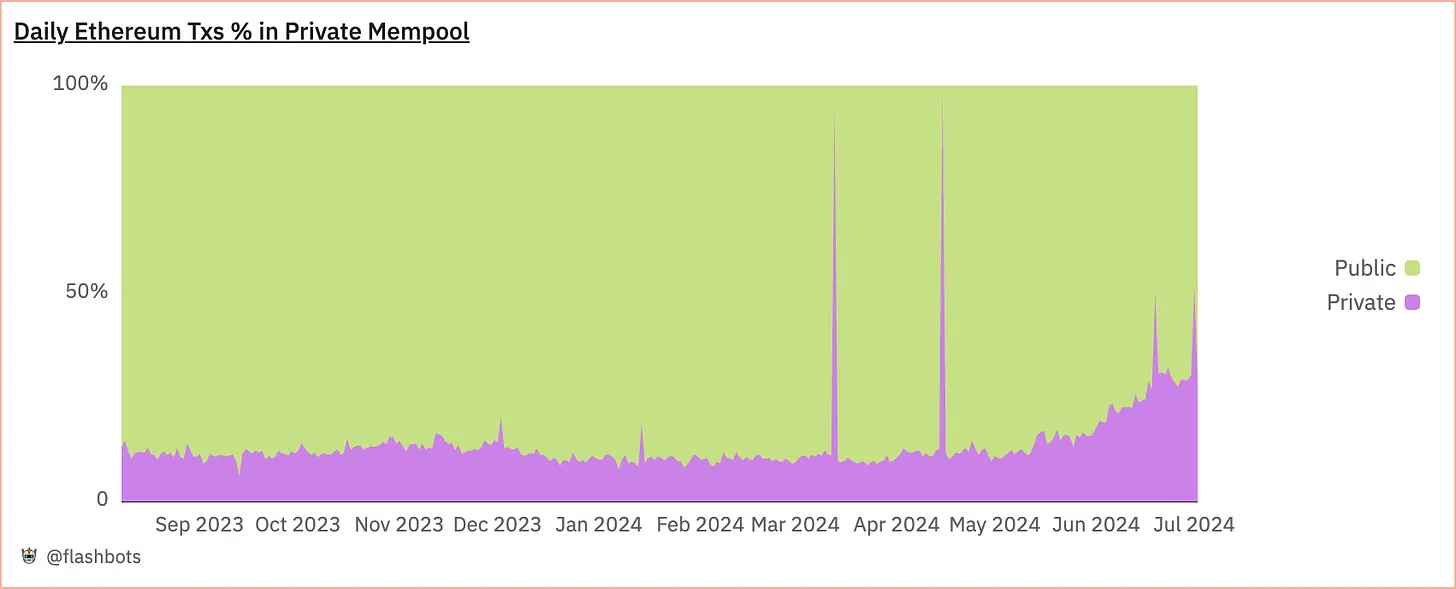

Considering only 15–30% of Ethereum transactions go through private mempools, the concentration of private order flow is even more pronounced—meaning a small number of traders contribute disproportionately to private volume.

Source: Dune

In other words, valuable order flow matters more than sheer volume. The power law distribution of users and order flow suggests applications will capture the largest share of overall value. Put simply, the case for "fat apps" remains strong and well-supported.

Approaching the "Fat App"

Uniswap’s protocol is undoubtedly valuable, but the more compelling story unfolds at the application layer. Uniswap is actively evolving into a consumer-facing app by vertically integrating key components across its stack—expanding capabilities in its interface, mobile wallet, and aggregation layer. For example, Uniswap Labs’ suite—including Uniswap’s frontend, wallet, and aggregator UniswapX—generated roughly 25% of the $13 billion in private order flow and nearly 40% of total order flow (private + public) over the past 30 days, according to data.

Elsewhere in crypto, apps like Worldcoin account for nearly 50% of Optimism’s mainnet activity, prompting them to launch their own appchain—further validating the "fat app" thesis and the strategic importance of controlling demand (users and transactions).

Even top-tier NFT projects with strong brands, such as Pudgy Penguins, are building their own chains. Luca, CEO of Pengu, explained that controlling blockspace built atop their distribution is beneficial for accumulating value in the Pudgy brand and IP.

Looking ahead, applications should focus on creating new types of order flow—whether by launching novel assets (e.g., Pump and memecoins), building apps that deliver new utility to users (e.g., Worldcoin and ENS), or delivering superior consumer experiences that are vertically integrated and support valuable transactions, such as Farcaster and frames, Solana Blinks, Telegram and TG apps, or on-chain gaming.

Final Thoughts on "Fat Apps"

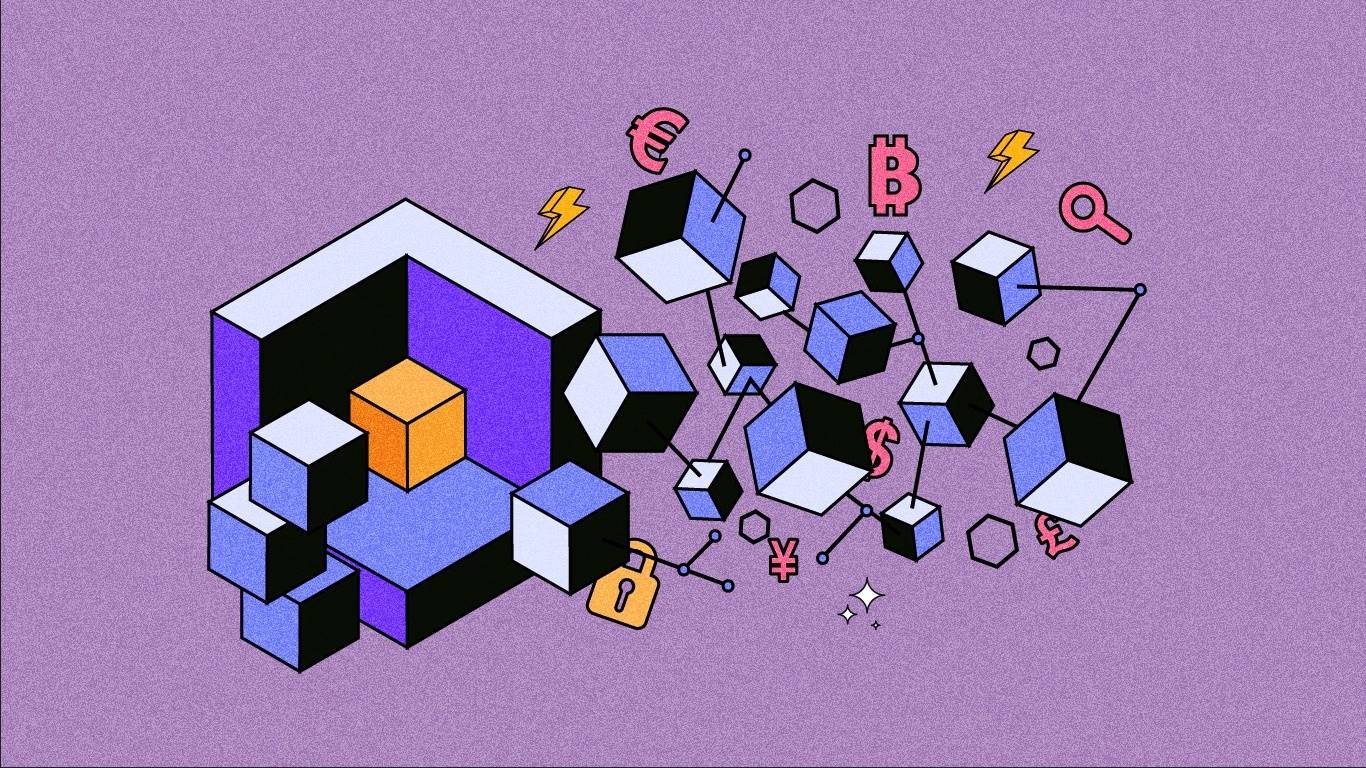

It's worth noting that since the last cycle ended, the "fat app" argument has been a central focus for many in crypto, as the case for appchains has become widely accepted.

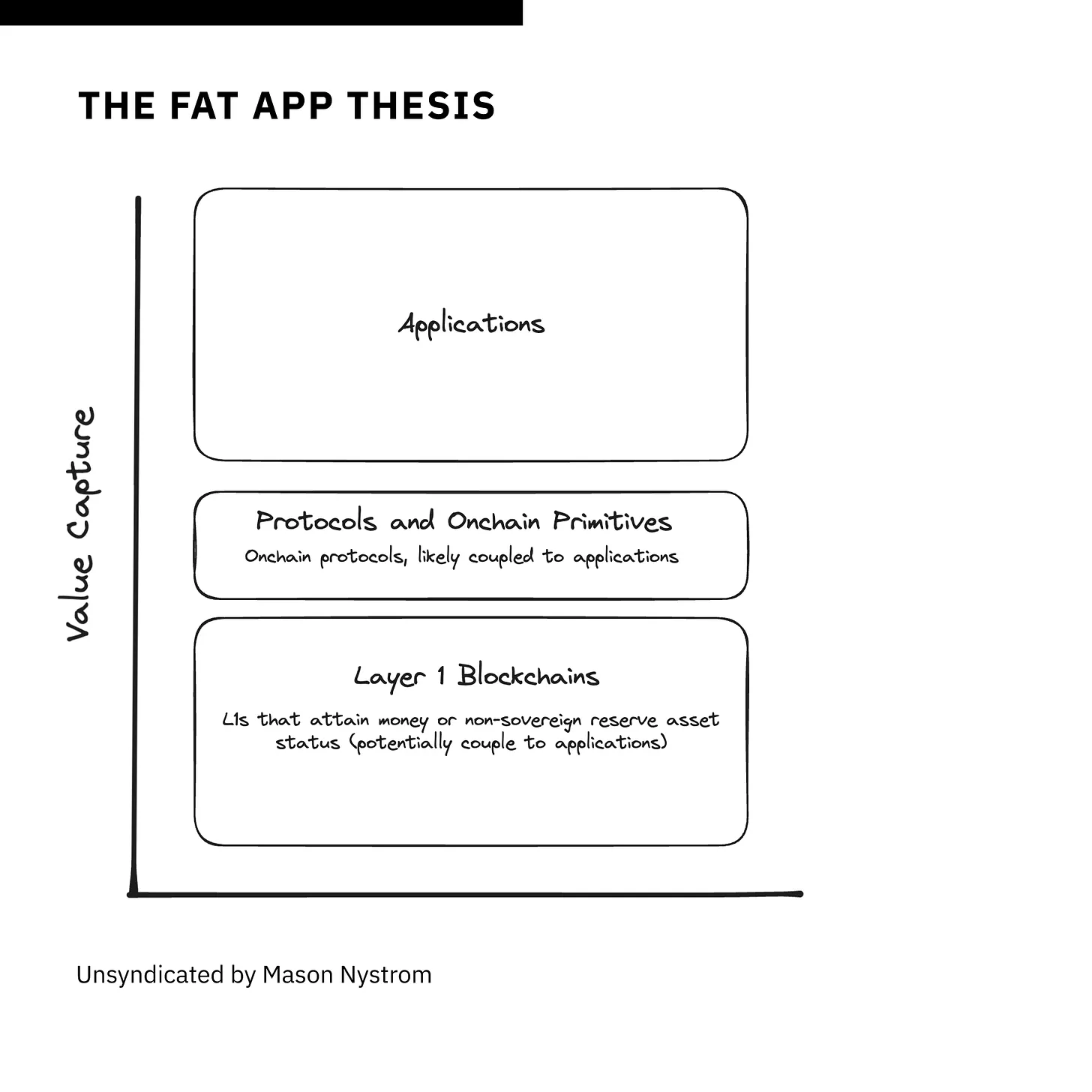

My current view on the "fat app" thesis is that most value will accumulate at the application layer of the stack, where control over users and order flow places apps in a privileged position. These apps may combine with on-chain protocols and primitives, much like today’s UniswapX and Uniswap protocol, Warpcast and Farcaster, or Worldcoin and Worldchain. Ultimately, these protocols—especially fully on-chain ones like MakerDAO—can still capture substantial value. However, apps are likely to capture even more due to their proximity to users and the defensibility provided by off-chain components.

Lastly, I still believe Layer 1 blockchains like Bitcoin, Ethereum, and Solana—as non-sovereign reserve assets—have the potential to capture significant value, with their base assets (like ETH) accruing immense worth. Over time, applications may attempt to build their own L1s just as they’ve built L2s. But launching a commoditized L2 is entirely different from launching an L1 and turning governance tokens into commodities and collateral assets—a discussion perhaps best left for the future.

The core takeaway is this: as more applications create and own valuable order flow, it becomes inevitable that "fat apps" are here to stay—and the crypto world will need to re-evaluate the true value of applications.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News