The Elephant in the Room: Exploring TON's Ecosystem Development and Future Potential

TechFlow Selected TechFlow Selected

The Elephant in the Room: Exploring TON's Ecosystem Development and Future Potential

The integration of TON with Telegram has the potential to create an interface bridging Web2 and Web3, reshaping the landscape of the Web3 world.

Author: Trustless Labs

Since 2024, the TON chain ecosystem has shown explosive growth. From May 25 to June 17, Toncoin surged by a maximum of 79.7%, Notcoin by up to 700%, and Fishcoin by as much as 400%. The TON ecosystem has demonstrated strong wealth-generating effects, attracting massive capital inflows. So how can we participate in this grand feast? This article reviews TON's history, core logic, and ecosystem development.

1. Project Background

Basic Information

Name: TON (The Open Network)

Founders: Pavel Durov, Nikolai Durov

Operating Team: TON Foundation

Official Website: TON: The Open Network for Everyone

Social Media: TON-Twitter

TON (The Open Network) is a decentralized Layer-1 blockchain designed for billions of users, featuring scalability and sharding capabilities aimed at solving issues such as high transaction fees, slow transaction speeds, cross-chain communication, and scalability in traditional blockchains. Currently, TON is primarily operated by the TON Foundation, a non-profit organization whose goal is to enable 500 million users to own their digital identities, data, and assets by 2028. Backed by Telegram, the TON chain serves as a key vehicle toward achieving this vision. While TON’s current development is thriving, its journey has been full of twists and turns.

Figure 1 Definition of TON

A Rocky Development Journey

-

2017: Project Launch — Telegram founders Pavel Durov and Nikolai Durov began developing a blockchain project called Telegram Open Network (TON), planning to launch its native cryptocurrency Gram.

-

2018: Initial Coin Offering (ICO) — Telegram raised approximately $1.7 billion through an ICO, one of the largest token sales at the time, involving multiple major venture capital firms and individual investors. This attracted attention from the U.S. Securities and Exchange Commission (SEC).

-

2019: Development Progress — TON blockchain introduced sharding technology to enhance scalability and processing speed, launching a testnet simultaneously for developer testing.

-

2020: Regulatory Challenges and Pivot — Telegram announced withdrawal from the TON project, transferring development to an independent open-source developer community. The project was renamed "The Open Network," with the token renamed Toncoin. Funds raised during the ICO were returned.

-

2021: Community Takeover and Growth — The TON Foundation, founded by Anatoliy Makosov and Kirill Emelianenko, took over the project, continuing TON’s development and promotion.

-

2023: Return to Telegram — Telegram officially announced that the TON blockchain would be its preferred Web3 infrastructure, planning integration into the Telegram app interface; Telegram also revealed IPO plans.

-

2024: Ecosystem Expansion — The application ecosystem on the TON blockchain continues expanding across finance, storage, payments, domains, and other areas. Projects like PunkCity, PUNK, and HyperGPT within the TON ecosystem have begun receiving significant market attention. In February of the same year, Telegram announced it would exclusively use the TON blockchain and Toncoin for all transactions and payment activities with channel owners.

Figure 2 TON Logo

From inception to current popularity, TON has come full circle yet steadily progressed—from initial narrative to real-world project deployment—demonstrating strong vitality.

Core Narrative Focused on Users

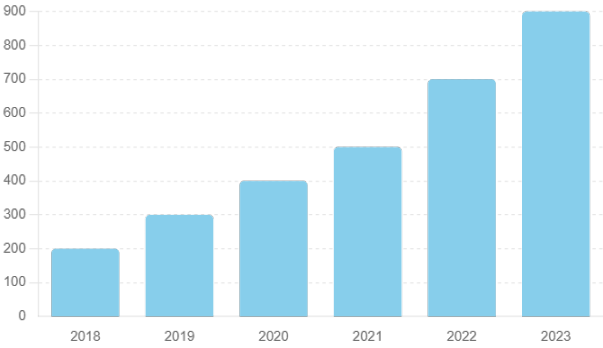

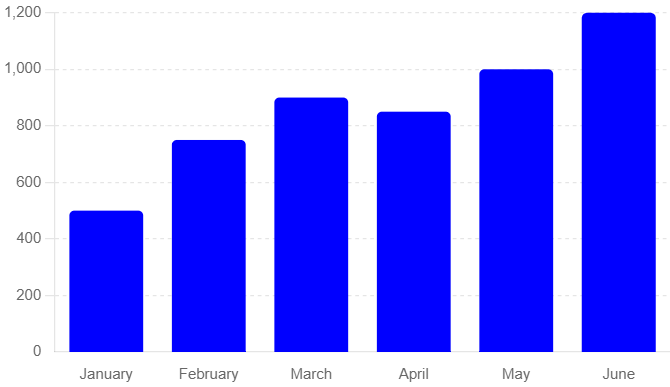

Throughout TON’s development, Telegram’s influence has never been far removed. While most public chains promote technological innovation, TON leverages Telegram’s 900 million monthly active users to emphasize user needs and convenience.

Moreover, Telegram no longer aims merely to be a social messaging platform. By continuously enriching its product line, integrating payments and lifestyle services, and offering powerful bots, Telegram is transforming into a comprehensive platform. This strategic shift not only reflects Telegram’s ambition but also signals vast potential for the future of the TON public chain.

Figure 3 Telegram User Growth

Telegram currently has over 1.3 billion registered users and 900 million monthly active users. Freedom of speech and privacy protection were foundational missions when Telegram launched—and these very principles made Telegram a natural hub for cryptocurrencies. Almost every Web3 project maintains a Telegram community for announcements, updates, and engagement with their user base. This fertile Web3 ground on Telegram provides immense support to the TON ecosystem, offering a ready-made community foundation for projects from incubation to ICO.

Growing Market Recognition

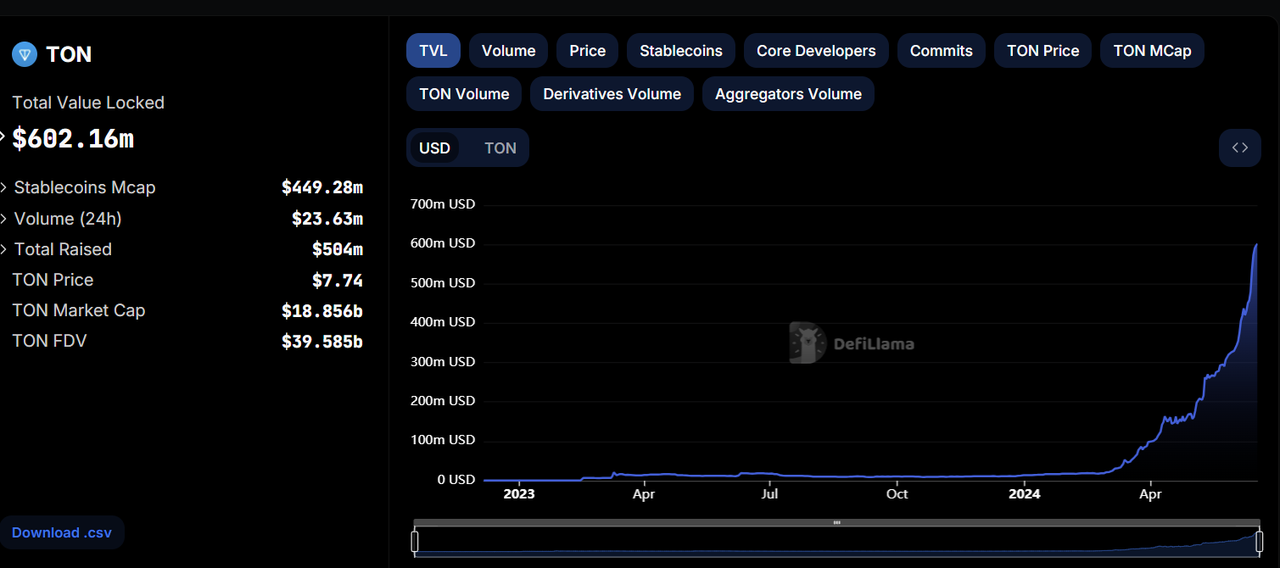

As of writing, TON’s market cap reached $18.759 billion, making it the ninth-largest cryptocurrency. Additionally, TON’s TVL (Total Value Locked) has grown rapidly since April, now reaching $605.72 million USDT, ranking 15th among public chains. Clearly, while TON’s TVL growth is fast, it hasn’t kept pace with its market cap, indicating substantial room for improvement.

Figure 4 TON Chain TVL

Figure 4 TON Chain TVL

Figure 5 Public Chain TVL Rankings

2. Funding Information

-

2018: First ICO raised $1.7 billion; partially refunded due to SEC legal action.

-

April 2022: Huobi Incubator, KuCoin Ventures, and MEXC Pioneer Fund jointly invested $250 million to establish the TON Foundation, focusing on supporting DEX and NFT projects on the TON chain.

-

October 2023: MEXC Ventures provided tens of millions of dollars in investment to promote the adoption of the Web3 ecosystem within Telegram.

-

November 2023: Animoca Brands invested funds, research, and analytics platforms to support third-party mini-programs and gaming projects within the TON ecosystem, becoming its largest validator.

In its early days, Telegram prioritized user privacy and lacked clear revenue channels, relying on bond issuances to raise hundreds of millions of dollars for operations. Starting in 2022, Telegram began exploring monetization models and recently announced it is nearing profitability. In 2023, Telegram founder Pavel Durov proposed plans for an initial public offering (IPO) within the next two years. The company is currently valued at over $30 billion and may choose to list in the United States.

Figure 6 Telegram Cartoon Icon

Both TON and Telegram are currently experiencing vigorous growth. Investing in the TON ecosystem equates to betting on Telegram’s transformation from a Web2 social platform into a comprehensive Web3 platform—a transition with enormous potential.

3. Technical Features

Programming Languages

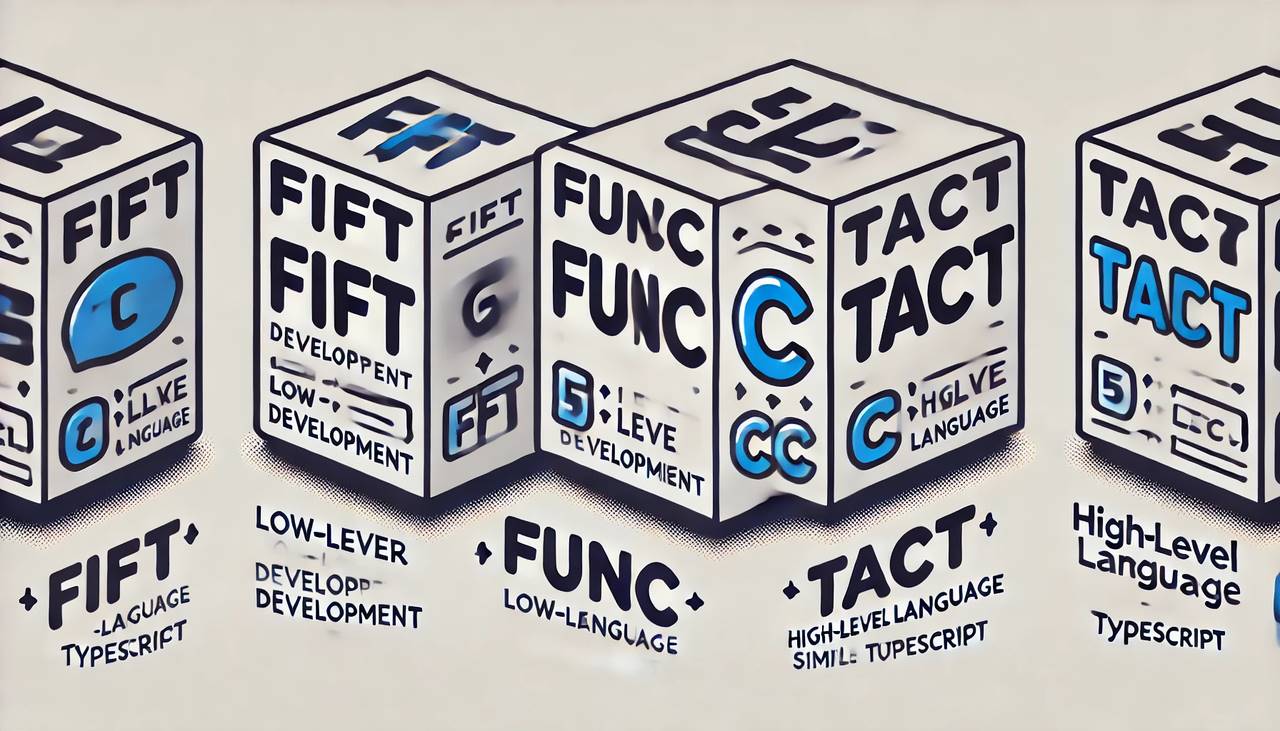

Smart contract development on the TON chain does not rely on popular languages like Solidity, Rust, or Vyper. Instead, it uses three programming languages: Fift, FunC, and Tact. Fift focuses on low-level development with high runtime efficiency but presents steep learning curves. Tact is a new high-level language introduced by TON, syntax similar to TypeScript, designed to lower development barriers. FunC resembles the C language and is currently the preferred choice for developers. Given Tact’s efficiency, mainstream developers may increasingly adopt it in the future.

Figure 7 TON Chain Development Languages

Cutting-Edge Technologies

-

Asynchronous Smart Contract Calls: Unlike Ethereum and other chains, TON employs asynchronous smart contract calls. This design enhances system scalability. When one smart contract invokes another function, execution isn't immediate and doesn't need to complete within a single block. However, this asynchronous mechanism increases complexity in application development and maintenance, posing higher technical hurdles for developers building on TON.

-

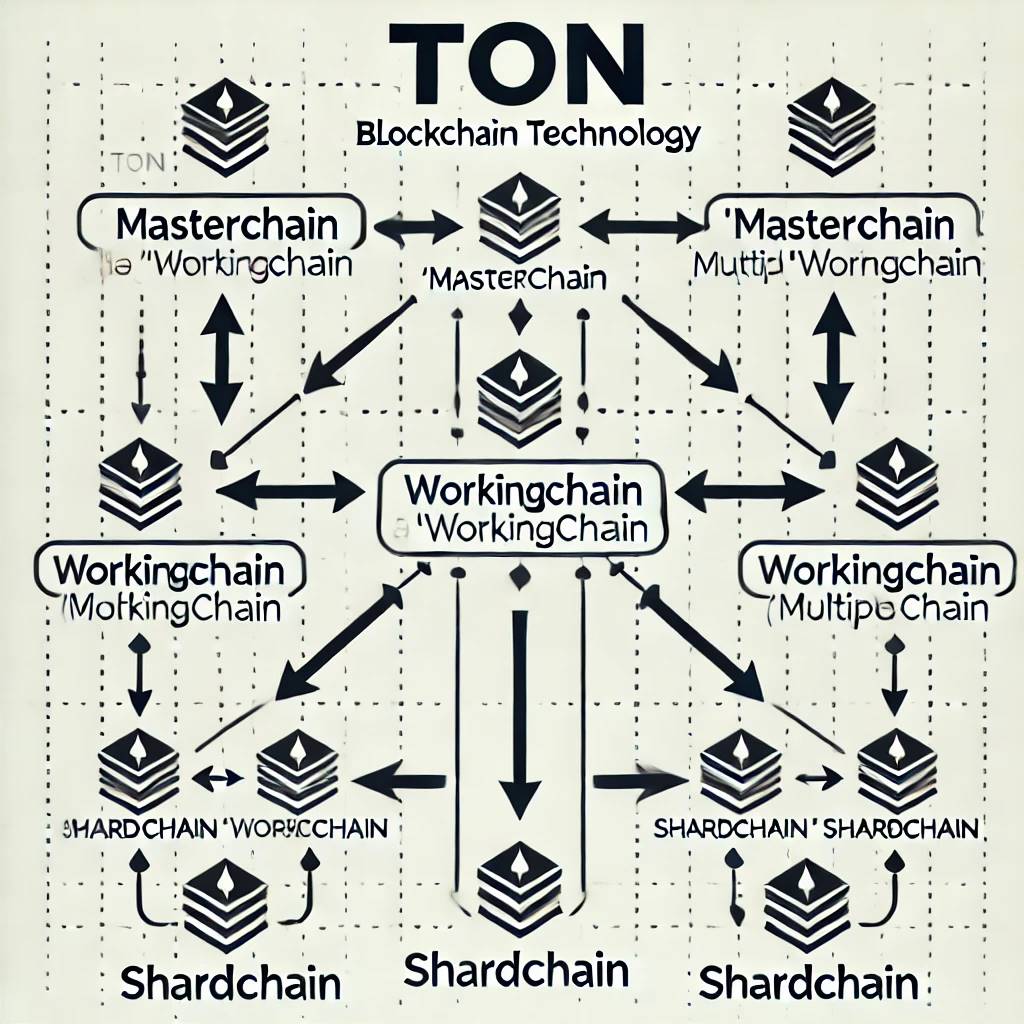

Infinite Sharding: The TON blockchain is architecturally divided into three types of chains: Masterchain, Workchains, and Shardchains.

Figure 8 Sharding Technology

The Masterchain serves as the core of the entire network, storing global metadata and consensus mechanisms. It records the state of all workchains and shardchains, ensuring network-wide consistency and security. Workchains are independent blockchains responsible for handling specific types of transactions and smart contracts, each capable of having unique rules and features tailored to different application needs. Shardchains are sub-chains of workchains, further splitting workload to improve processing capacity and scalability. Each workchain can contain multiple shardchains, which independently process subsets of transactions, enabling efficient parallel processing.

Privacy Protection: TON leverages TON Proxy to hide the IP addresses of TON nodes, creating a decentralized VPN service. Combined with TON DNS and TON P2P networks, it protects user privacy.

Figure 9 TON Privacy Protection

Relative Advantages

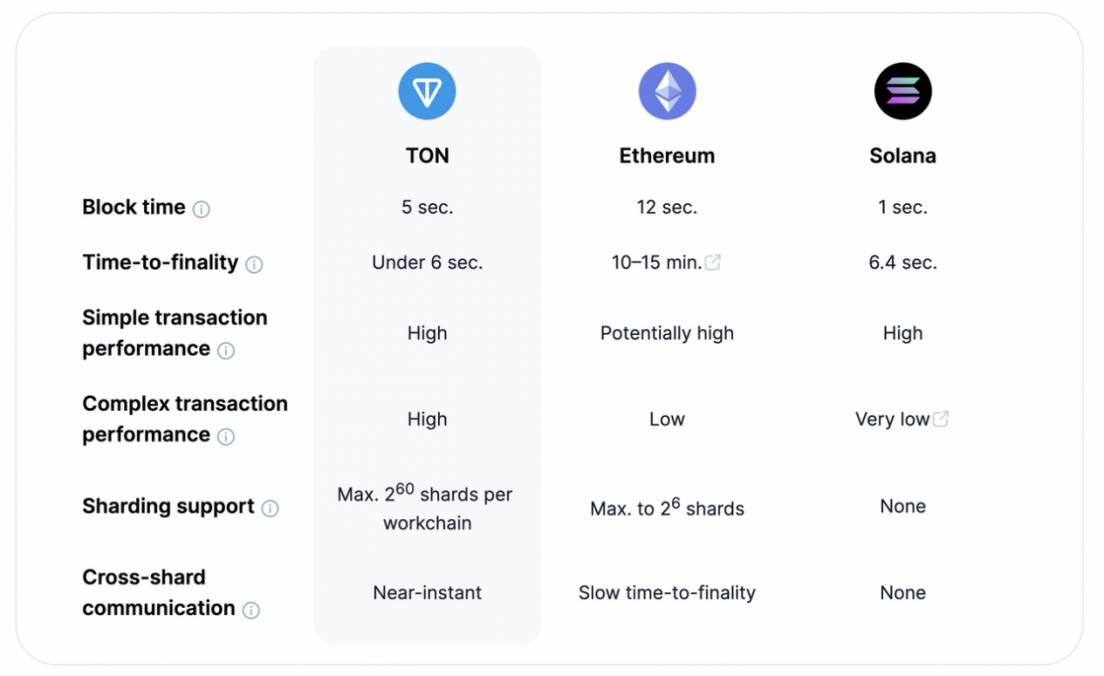

While asynchronous contract calls and sharding technologies are used in projects like Ethereum 2.0, Polkadot, and NEAR Protocol, TON integrates multiple technologies and outperforms Ethereum and Solana across several metrics, including transaction finality time.

Figure 10 Comparative Analysis of TON Chain

For more detailed technical specifications, please visit the official TON website.

4. Market Analysis

Tokenomics

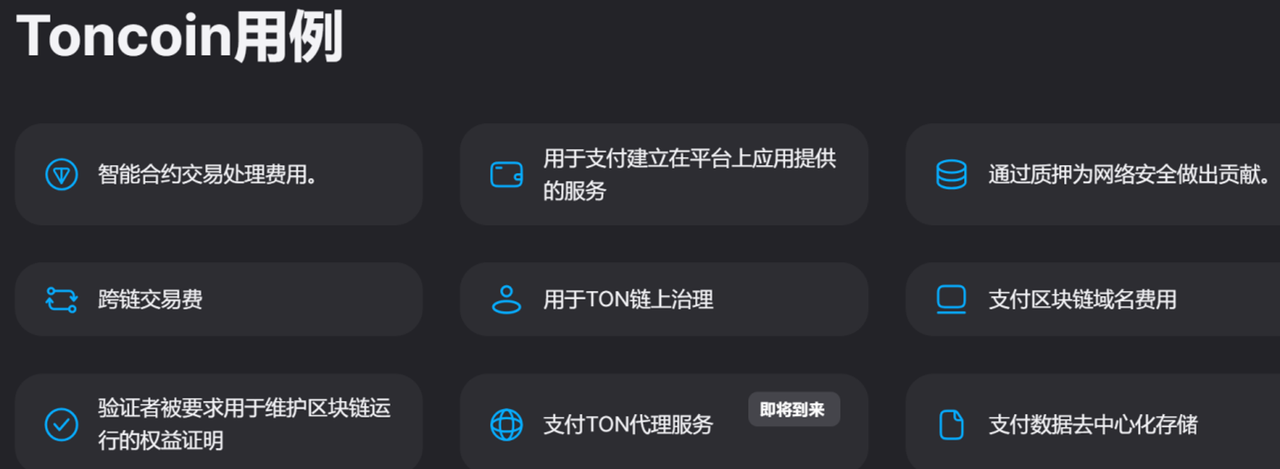

Token Utility: $Toncoin functions similarly to a native token on Telegram, allowing users to pay for Telegram Premium memberships and other virtual goods at discounted rates. On the TON chain, $Toncoin is used for transaction fees, staking, cross-chain transactions, decentralized data storage, proxy services, and more.

Figure 11 TON Token Utilities

Token Supply: The maximum supply of $Toncoin is 5 billion. As of June 28, 2022, all $Toncoin had been mined, marking TON’s complete transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS). An annual inflation rate of 0.6% (approximately 3 million tokens) will reward validators securing the network.

Token Distribution: Initially, 1.45% of the 5 billion $Toncoin tokens were allocated to the team, with miners receiving 98.55%. In February 2023, the TON community proposed freezing 1.08 billion $Toncoin (about 21% of total supply) held in 171 inactive early wallets for 48 months—an action reflecting strong community confidence in TON’s long-term development.

Secondary Market Analysis

Market Cap: As of June 3, 2024, $Toncoin’s market cap stood at $18.759 billion, ranking No.9, with a fully diluted valuation of $39.382 billion, a circulating supply of 2.432 billion, and a total supply of 5.107 billion.

Holder Distribution: As of June 3, 2024, analysis based on CoinMarketCap data shows 85.45% of holders possess 0–$1k worth of $Toncoin, 14.16% hold $1k–$100k, and 0.38% hold over $100k.

Figure 12 TON Holder Address Ranking by Balance

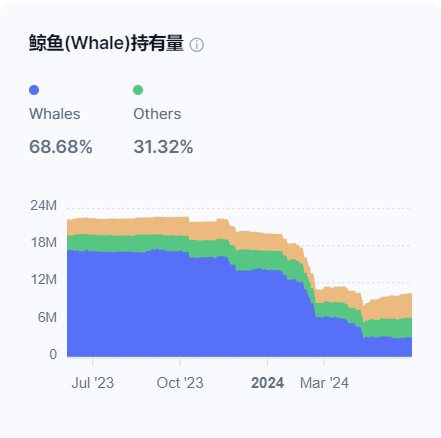

Whale holdings analysis indicates whales hold 68.68% of $TON, while retail investors hold 31.32%.

Figure 13 Whale Holdings

Holding duration analysis reveals 29.20% of holders have kept $Toncoin for over a year, while 16.7% of traders hold it for less than one month—indicating strong diamond-handed sentiment and broad optimism about TON’s prospects.

Figure 14 TON Holder Address Ranking by Holding Duration

According to Etherscan data, the top 10 addresses collectively hold 29.99% of $Toncoin, suggesting relatively dispersed distribution and healthy market conditions.

Figure 15 Top 10 Addresses’ Token Holdings

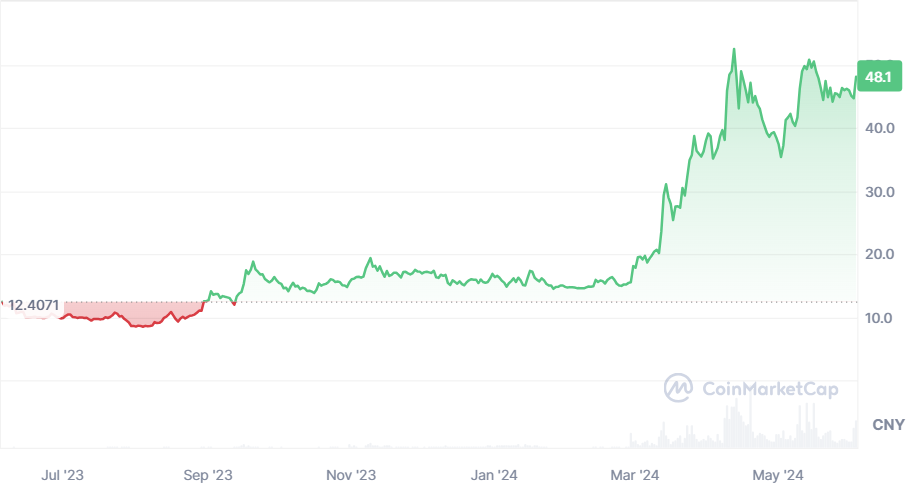

Price Trend: Over the past year, $Toncoin rose from ¥12.4071 to ¥56.54, an increase exceeding 400%, reflecting strong market expectations and wealth-generation effects associated with the TON chain.

Figure 16 One-Year Price Chart of TON Token

5. Ecosystem Development

Currently, the TON ecosystem hosts over 500 DApps and numerous Telegram bots, covering nearly every popular sector including infrastructure, development tools, DeFi, GameFi, NFTs, SocialFi, and inscriptions. Vertical segments include launchpads, wallets, cross-chain bridges, staking/lending, DEXs, various blockchain games, collectibles, and more.

Ecosystem Assistant: Telegram Bots

Telegram bots are automated robots running within Telegram, significantly enhancing efficiency in community building, asset management, information aggregation, and project promotion.

-

For regular users, official and third-party Telegram bots deliver timely crypto news and market updates.

-

For general Web3 communities, bots provide automated Q&A, FAQs, manage events, contests, and airdrops, fostering interaction among members.

-

For DAOs, bots notify members of governance proposals and discussions, enabling voting and participation via bot interfaces—greatly simplifying governance processes.

-

For typical projects, bots boost information flow efficiency within communities, and engaging bots can attract user involvement in project development.

-

For TON-based projects, leveraging Telegram apps and bots is essential—they allow frictionless participation in airdrops for 900 million users, greatly aiding project visibility and growth.

Telegram bots are not only versatile but also easy to develop. Telegram offers mature documentation and API support. Once functional requirements are defined, developers can implement them using Python, Node.js, etc., deploy on cloud servers, and quickly set up their own bots. Moreover, many Telegram bots are already open-sourced on GitHub, enabling even non-coders to utilize them effectively.

DeFi Leader: STON.fi

STON.fi is currently the largest DEX on the TON chain, supporting over 280 trading pairs. Using a combination of Automated Market Maker (AMM), Request-for-Quote (RFQ), and Hashed Time-Lock Contracts (HTLC), it inherits Uniswap’s low-slippage advantages while enhancing trade reliability and security.

Figure 17 STON.fi Logo

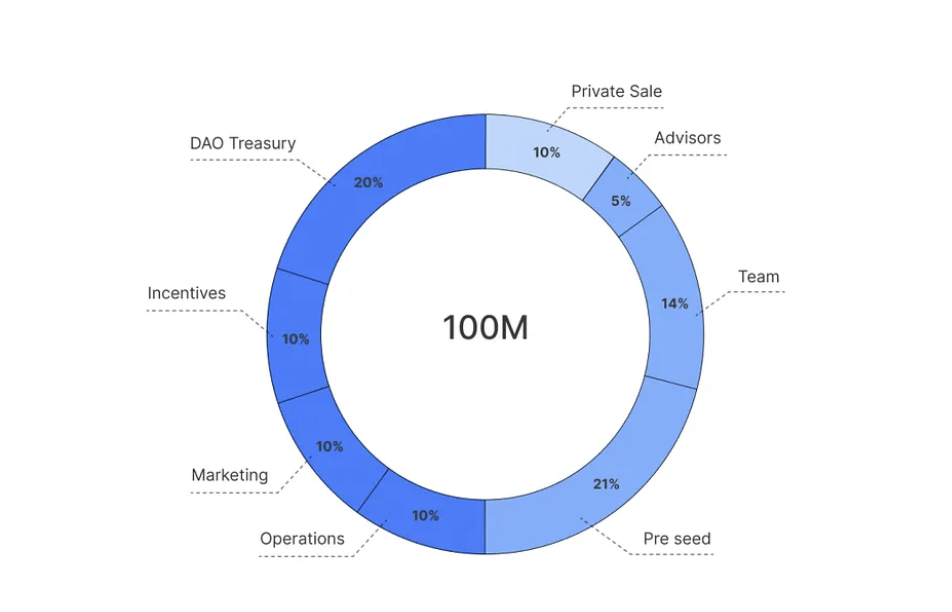

$STON is the native token of STON.fi, with a total supply of 100,000,000 $STON. Its token allocation strategy is as follows:

Figure 18 STON.fi Token Allocation

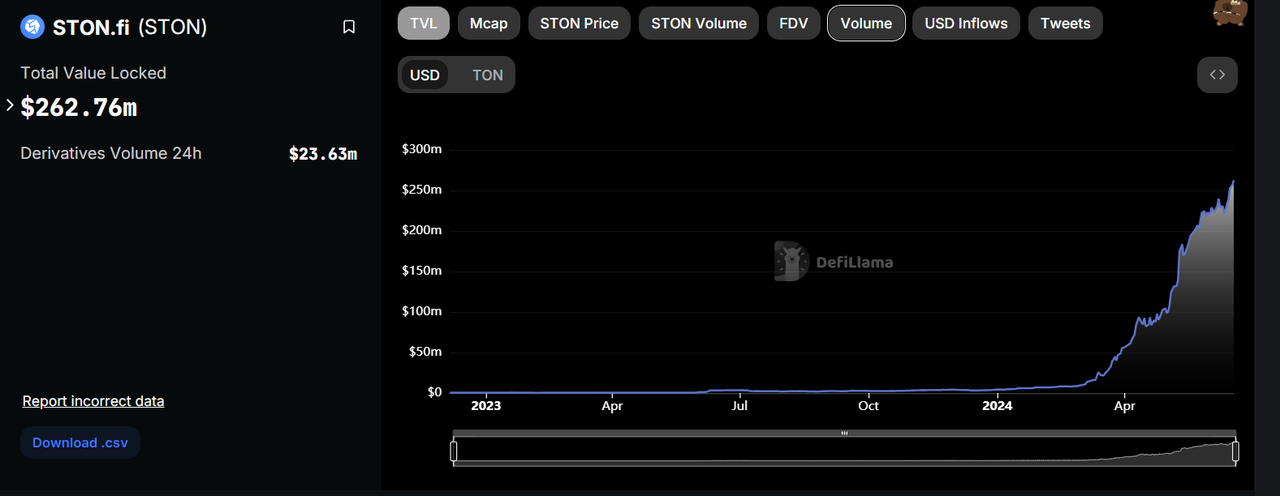

With the explosive growth of the TON ecosystem, STON.fi’s TVL has seen rapid expansion since February, currently reaching $262.2 million USDT, ranking third within the TON ecosystem.

Figure 19 STON.fi TVL Growth

Figure 20 TON Ecosystem TVL Rankings

Overall, STON.fi is undoubtedly the premier DEX on the TON chain—and one of the leading projects in the entire TON ecosystem—deserving continuous attention.

Launchpad Leader: TonUP

TonUP is a star asset issuance platform built on the TON blockchain, aiming to help projects successfully conduct token fundraising.

Figure 21 TonUP Logo

-

August 2023: TonUP was established and completed its first IDO (Initial DEX Offering) for Tap Fantasy, raising 80,000 $Toncoin within 32 minutes.

-

October 2023: TonUP launched the TONversation column to deliver premium content. The team also publicly announced completion of a seed round led by TONCoin Fund, with participation from Foresight X, Waterdrip Capital, BitFund DAO, and several angel investors.

-

December 12, 2023: TonUP 2.0 launched. On December 20, it initiated the IDO for its native token $UP, followed by an IEO on Bitget Launchpad on December 22, marking a new phase of growth.

As a breakout launchpad on TON, TonUP has secured investments from top-tier funds including TONCoin Fund, Foresight X, Waterdrip Capital, and BitFund.DAO. Unlike other launchpads, TonUP demonstrates strong crisis management. During the $MC token launch via TonUP and subsequent promotional activities, Tap Fantasy faced technical delays pushing back game release, causing severe price drops. TonUP responded by using all commission income from the IDO to repurchase and burn tokens—earning community trust. Most importantly, TonUP is still far from its peak: 99.66% of its tokens remain concentrated in project-controlled addresses, indicating solid cash reserves for ongoing development without needing retail funding. As the TON chain evolves, TonUP’s token price could rise substantially—making it a powerhouse within the TON ecosystem.

Telegram Wallet & Tonkeeper

Compared to any other platform, Telegram Wallet holds the greatest potential to become the future bridge between Web2 and Web3 financial flows. Operating natively within Telegram, it offers exceptional ease of use for mainstream audiences. Through integrated Neocrypto, Telegram Wallet enables users in over 100 countries to buy cryptocurrencies using Visa and Mastercard. Partnering with MoonPay, Onramp.money, AlchemyPay, and others, it has built efficient P2P market on/off-ramps. Additionally, Telegram partnered with Tether to create USDT-TON swap terms. Before USDT integration, TON network TVL exceeded $100 million; just two weeks after the announcement, it doubled.

Figure 22 2024 TVL Growth

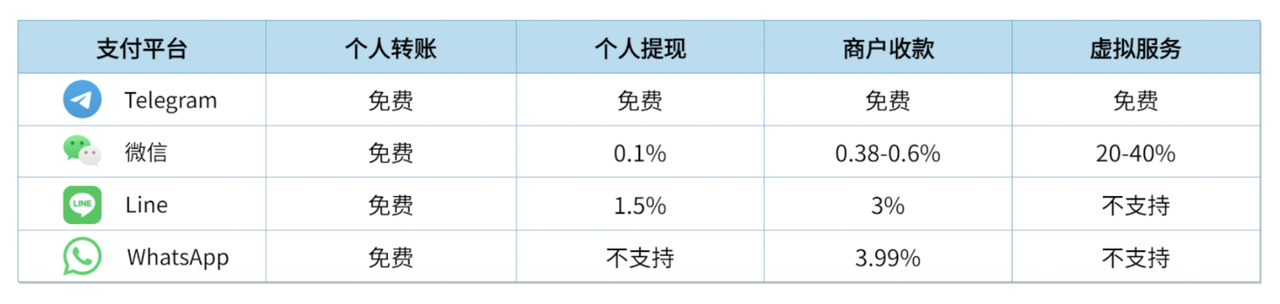

Additionally, Telegram’s transfers, withdrawals, merchant fees, and virtual transactions incur zero fees—further attracting large-capital users.

Figure 23 Comparison of Platform Fees

Tonkeeper is the simplest way to store, send, and receive Toncoin on the Open Network—a powerful new blockchain offering unprecedented transaction speed and throughput, along with a robust programming environment for smart contract applications. Compared to other wallets, Tonkeeper offers several advantages:

-

End-to-end security. Unlike Wallet, which operates within the Telegram app, Tonkeeper stores encryption keys locally on the user’s device, requiring no files, personal info, contact details, or KYC—maximizing privacy protection.

-

Built-in exchange functionality. Users can directly purchase Toncoin within the Tonkeeper app and swap it on decentralized markets.

For those holding significant crypto assets on the TON chain, Tonkeeper is an excellent choice.

Notcoin & Catizen

Notcoin is a free and easy-to-use Telegram game that went viral after its January 1, 2024 launch, amassing over 30 million participants and averaging 5 million daily active users.

Notcoin features a simple yet engaging gameplay model:

-

Users earn tokens easily through tapping the interface, with energy mechanics timed to maintain sustained engagement.

-

NFT vouchers allow players to pre-trade earned Notcoins, amplifying FOMO sentiment.

-

A guild alliance system encourages organic player-led promotions, creating a positive feedback loop.

Figure 24 Notcoin Viral Popularity

Thanks to viral spread, Notcoin built a massive community, laying the groundwork for its successful ICO listings on major exchanges like Binance, OKX, and Bybit. After listing, Notcoin maintained strong momentum, aligning with the meme coin boom and surging over 400% in seven days.

Catizen is a cat-themed game built on the TON ecosystem, combining metaverse, GameFi, and AI elements. It introduced a revolutionary “play-to-airdrop” model where players earn future airdrops while playing. Backed by official TON support, Catizen was featured as a showcase project at Token2049. As of May 30, 2024, mining for Catizen’s $wCATI token has ended, yet community interest remains high, and development plans extend well beyond this stage.

-

Catizen’s seed round received investment from TON, Web3 Ventures, Mask Network, Y2Z, SecondLive, EMURGO Ventures, Moon Capital, and Initiate Capital.

-

The Catizen team has signed contracts with 18 popular WeChat mini-games, gradually launching them on the Catizen platform. Each new game release could reignite excitement around the Catizen community, serving as a major driver for future growth.

-

Catizen will become the first app in the TON ecosystem to support NOT-based top-ups. In the future, Catizen and Notcoin are poised to form a deep, mutually reinforcing ecosystem partnership.

Hamster Kombat: The Rise of the Hamster

Hamster Kombat is a Telegram mini-game where players assume the role of an exchange CEO, earning coins by tapping a hamster image. The game also includes a card-mining mechanism, allowing players to strategically increase passive income.

Figure 25 Hamster Kombat Gameplay

Despite its simplicity, Hamster Kombat has captured the Telegram gaming space faster than Notcoin. Since its Q1 launch, its Twitter following soared to 5.1 million in just three months, Telegram group members reached 25 million, and its YouTube channel surpassed 10 million subscribers in only seven days. In June, Hamster Kombat officially announced over 100 million users, with 32 million daily active users and an average of 6.5 million concurrent online players. Clearly, Hamster Kombat has emerged as the new leader among TON-based meme coins. But it won’t stop at being just a game—it aims to turn the hamster into a major brand icon in the Web3 world.

Figure 26 The Hamster Mascot

Whether Notcoin, Catizen, or the currently hottest Hamster Kombat, they all share three critical success factors: innovative and simple gameplay, fair mining principles, and backing from top-tier institutions. These elements break away from common problems seen on chains like Ethereum—such as insider allocations and rug pulls—drawing massive user bases and enabling viral community growth. Moreover, going viral via memes appears to be a key strategy for TON ecosystem projects to reach broader audiences. The immense wealth effect generated by Notcoin is likely to spill over to later-stage TON ecosystem projects like EVAA, STON.fi, and Tonstakers, fueling F

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News