Interpreting the Dilemma and Future of BTCFi from pSTAKE

TechFlow Selected TechFlow Selected

Interpreting the Dilemma and Future of BTCFi from pSTAKE

pSTAKE Partners with Babylon: Can They Unlock a New Era of BTC Liquidity?

Author: Shisijun

1. Background

Thanks to the introduction of the Ordinals protocol and the BRC-20 standard, Bitcoin today has not only revolutionized payment methods and value storage but also transformed the traditional financial system.

The exploration of its ecosystem is becoming increasingly diverse, especially in Bitcoin staking. While BitVM remains far from realization, projects like Babylon and PStake are already advancing POS chain operations by leveraging Bitcoin’s security without altering its core protocol.

With the initial breakthrough in this staking connectivity layer, traditional staking has enabled security borrowing. Now, PStake further evolves into liquid staking, allowing BTC to maintain liquidity while being staked—suggesting that BTCFi may be closer than we think.

2. BTCFi

2.1 What is BTCFi?

Bitcoin has long been viewed as an inactive asset, with its multi-trillion-dollar market cap largely sitting idle. Within the BTC ecosystem, emphasis on "security" far outweighs that in other ecosystems, making any attempt to expand BTC particularly cautious.

BTCFi refers to decentralized finance (DeFi) built on the Bitcoin blockchain—bringing DeFi functionality into the Bitcoin ecosystem so that Bitcoin can serve not just as a store of value but also play active roles in financial applications.

In essence, BTC and ETH users come from different backgrounds. Retail users care more about equal profit opportunities, decentralized culture, and equitable power, showing less sensitivity to gas fees and often favoring deeper asset potential. In contrast, institutions and large holders deeply rooted in BTC infrastructure and stable finance tend to pursue long-term, conservative yield strategies, prioritizing safety and stability.

BTCFi can meet the needs of institutional users and regular users less driven by FOMO, transforming Bitcoin from a passive asset into an active one.

I previously discussed various DeFi infrastructures on Ethereum. Most stablecoin lending protocols still rely on over-collateralization models, as algorithmic stablecoins have lost consensus.

For further reading, see A Deep Dive: AAVE's Latest Stablecoin Proposal GHO, the King of DeFi.

After all, most models are based on over-collateralization—the difference lies only in whether the operating platform has native enforceability via smart contracts. So do Bitcoin holders have opportunities to participate in staking, lending, and market-making to unlock new revenue streams? Currently, BTCFi's total value locked (TVL) accounts for only 0.09%, an extremely low ratio compared to other blockchains. Consider that DeFi makes up 14% of Ethereum’s ecosystem, 6% on Solana, and 3% on Ton.

3. The Dilemma of Bitcoin Scaling Solutions

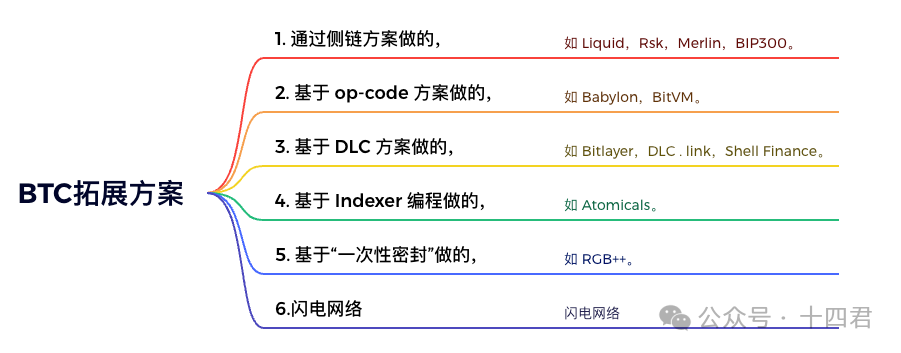

BTCFi typically relies on various Bitcoin scaling solutions. Current attempts at expanding Bitcoin include:

Many of these projects are already well known. Despite appearing diverse, they share common roots stemming from the cautious evolution of Bitcoin’s native protocol.

3.1 Understanding Community Dynamics Through BIP-300

Let me briefly explain through the evolution of BIP-300. BIP-300, commonly known as Drivechain, was first introduced in 2017. It proposed a sidechain concept called "Drivechain" operating atop the Bitcoin blockchain, using BTC as its native token and enabling trustless, two-way pegged (2WP) transfers between the mainnet and Drivechains. Technically speaking, there isn't much challenge here—since Drivechain operates under a BIP proposal, implementing it would essentially mean a soft fork modifying Bitcoin’s source code, unlike the aforementioned approaches that avoid soft forks entirely.

However, BIP-300 quickly became mired in endless debate and failed to progress. Its advantages were obvious, yet opponents argued it strayed from Bitcoin’s role as digital gold, potentially opening doors to network scams and attracting greater regulatory scrutiny. Additionally, the two-way peg might fundamentally disrupt Bitcoin’s economic assumptions. Some even raised concerns about miner incentives, suggesting merged mining could allow miners to earn “free money” simply by continuing their current work.

Ultimately, the discussion devolved into the classic ideological battle within the Bitcoin community, halting further advancement. Reflecting on this journey, I believe the core community is essentially protecting this principle: Bitcoin should be complemented by another system rather than competing with alternatives created to replace it.

Thus, gaining consensus among BTC Core developers is harder than achieving the ZK holy grail (laughs). This explains why many subsequent innovations no longer depend on directly modifying Bitcoin itself, instead focusing on novel application-layer designs.

3.2 Limitations of Native Programmability

Despite differing directions, most explorations face similar challenges:

-

Lack of native smart contract functionality: Bitcoin does not support complex smart contracts, limited to basic scripts like time locks or multi-signature locks (BTCscript).

-

Limited interoperability: Interoperability between Bitcoin and other blockchains is constrained, with most solutions relying on centralized entities.

Due to limitations 1 and 2, liquidity fragmentation occurs. Since users generally perceive Bitcoin primarily as a store of value on-chain, off-chain liquidity concentrates in centralized exchanges or wrapped tokens like WBTC on Ethereum, restricting users’ ability to efficiently trade or provide liquidity in decentralized financial ecosystems.

Although Bitcoin’s original design is relatively simple, two recent major upgrades have opened new possibilities.

SegWit (Segregated Witness)

Activated in August 2017, SegWit separates transaction signatures (Witness Data) from transaction data, reducing transaction size, lowering fees, and increasing network capacity. It effectively increased Bitcoin’s block size limit from 1MB to 4MB.

Taproot Upgrade

Similar to SegWit, Taproot is also a soft fork upgrade aimed at enabling smart contract deployment and expanding use cases. While Bitcoin lacks native smart contract capabilities, Taproot allows multiple parties to sign a single transaction via Merkle trees. By introducing a new script type called "Tapscript," it supports conditional payments and multi-party consensus features.

Indeed, development based on Bitcoin’s native technologies tends to be slow—for example, RGB took over four years, Lightning Network has been in development for many years, and Babylon spent several years building its "timestamp protocol." Perhaps profitability is the best driver; if a secure solution enables most participants to earn during engagement, it will naturally attract widespread adoption. After all, relying solely on technical idealism to motivate already financially independent geeks is incredibly difficult.

You might complain about how long these upgrades take—even Taproot, arguably the fastest consensus-driven upgrade in Bitcoin history (proposed in 2018, launched in 2020), still took over two years to deploy.

Yet despite this, the ecosystem's infrastructure remains incomplete, with current interest focused on exploring possibilities around BitVM, BitVM2, and RGB++.

Now, setting aside familiar topics like BTC Layer 2 and typical multi-sig wallet-based wrapped BTC staking, and leaving future prospects like BitVM aside, let's focus on what’s currently feasible—where existing approaches clearly show significant shortcomings.

3.3 Limitations of Other Models

Overlay protocols like Inscriptions

While the popularity of BRC-20 brought traffic and attention to the Bitcoin ecosystem, subsequent standards such as ARC-20, Trac, SRC-20, ORC-20, Taproot Assets, and Runes aim to solve BRC-20 issues from different angles. However, the fundamental problem remains: decentralization of indexing, which risks inconsistencies across indexers or irreparable damage if an indexer is attacked.

The biggest issue with the Lightning Network is its narrow applicability—it only supports transactions, lacking broader use cases.

As for other scaling protocols, RGB, DLCs, and sidechains like Rootstock and Stacks, they remain in early stages, offering weak scalability and smart contract functionality—or rely heavily on multi-sig wallets for security.

Hence, growing voices in the community argue against merely copying Ethereum-style applications onto the Bitcoin network.

Instead, a more practical approach emerges: native-chain liquid staking. This refers to implementing staking mechanisms directly on the Bitcoin network—without relying on external smart contracts or sidechains—while introducing liquidity to generate yield.

In my view, this model cleverly leverages Bitcoin’s strongest security while achieving a relative balance between speed and returns.

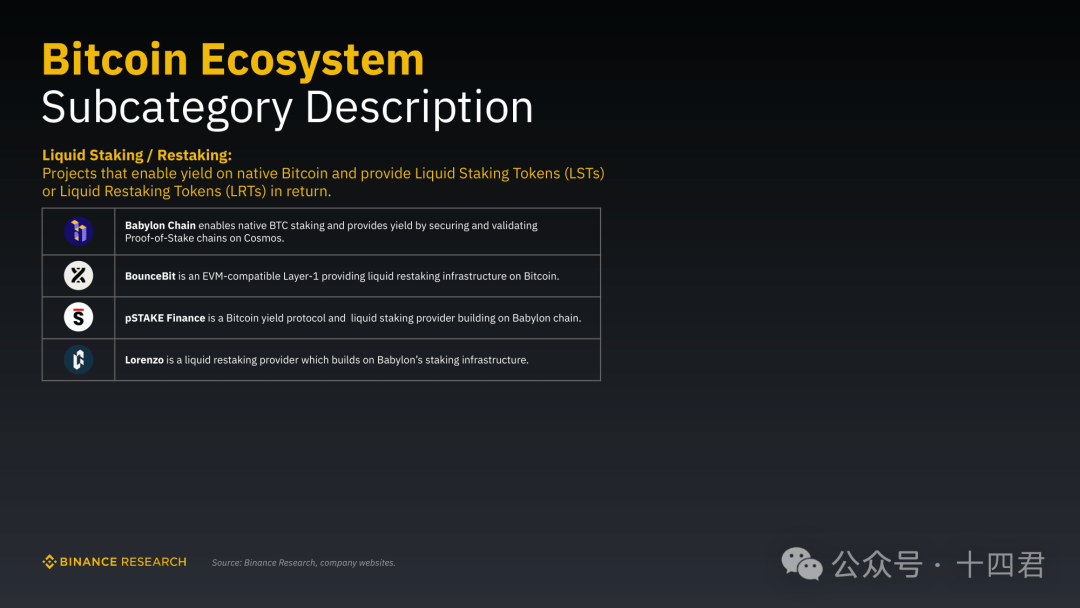

Recently, Binance Research highlighted four heavyweight BTCFi protocols: Babylon, Bouncebit, PSTAKE Finance, and Lorenzo.

4. pSTAKE Finance on Bitcoin

Since 2021, pSTAKE has offered staking and yield services across multiple chains. On Bitcoin, pSTAKE is built atop Babylon—a system not rejected by Bitcoin’s core community (unlike inscriptions, which faced strong opposition and even calls for a soft fork to eliminate them). This native-chain liquid staking model does not transfer BTC to other chains. Instead, it uses Babylon’s remote staking mechanism—staking BTC on the Bitcoin chain while transmitting its security benefits to other chains—to unlock greater value from BTC assets.

Through this bidirectional security-sharing agreement, PoS chains gain enhanced validation security, while BTC holders participating in staking earn rewards.

But how exactly does Babylon achieve this, and what is pSTAKE built upon it?

4.1 Babylon’s Traditional Staking Protocol: Foundation of pSTAKE’s Liquidity Yield

Babylon isn’t overly complex. It’s a Bitcoin security-sharing protocol composed of three core modules: BTC staking contract, Extractable One-Time Signatures (EOTS), and the BTC timestamping protocol.

First, the staking contract is a BTC script utilizing two opcodes:

-

OP_CHECKSEQUENCEVERIFY: Enables relative time-locking, meaning transaction outputs can only be spent after a certain time has passed.

-

OP_CHECKTEMPLATEVERIFY: Sets conditions on spending transaction outputs, such as enforcing specific recipients or rebinding inputs.

Together, users have only two paths post-participation: normal staking (unlock upon maturity) or violation (penalty and asset slashing).

The key lies in the slashing mechanism, which leverages Extractable One-Time Signatures (EOTS). In addition to participating in block production activities on the PoS chain’s consensus protocol, users must complete an EOTS signing round on Babylon.

Cryptographically, when a signer signs only one message, the private key remains secure. But if the same private key signs two different messages, Babylon can extract the private key via signature comparison. With the private key exposed, the user’s staked BTC assets (still held in the BTC contract) can be destroyed. At withdrawal time, the user competes with Babylon in transaction speed. Given Bitcoin’s 10-minute block time, detection is highly likely, and the entire stake is burned—effectively paid as miner fees and prioritized for inclusion in blocks.

“Oops, I did it again” – Security of One-Time Signatures under Two-Message Attacks

The BTC timestamping protocol is another clever design, mitigating longest-chain attacks in PoS systems. It publishes events from other blockchains onto Bitcoin, granting them Bitcoin’s timestamp security. Due to Bitcoin’s high security, timestamps follow strict rules—each new block’s timestamp must exceed the average of the previous six blocks.

These modular components of Babylon’s staking mechanism are reusable, creating a natural opportunity for collaboration with pSTAKE.

4.2 What is pSTAKE Bitcoin Liquid Staking?

pSTAKE is a liquid staking protocol operating similarly to Babylon, functioning within PoS (Proof-of-Stake) ecosystems. Its standout feature is allowing users to stake crypto assets while maintaining liquidity—an experience familiar to Lido’s sETH.

The key difference between liquid staking and traditional staking is clear: liquidity.

In traditional staking, when users deposit tokens into a PoS protocol to enhance economic security, they forfeit liquidity—locking up their tokens and preventing usage elsewhere. This describes Babylon’s current state, which prioritizes security.

Liquid staking solves this liquidity dilemma by allowing stakers to retain asset liquidity and continue using them elsewhere.

Practically, when users deposit BTC, the protocol mints a liquid staking token (LST) on the PoS chain. Users can freely trade or use this LST on other DeFi platforms, redeemable anytime for the underlying asset.

Where does the yield come from?

-

Users first stake BTC to pSTAKE, which then stakes those assets into Babylon to earn yield, distributing returns to users.

-

When users stake BTC, pSTAKE issues a liquid token (pToken), which they can use freely—just like sETH from Lido.

-

To redeem BTC, users simply burn their pTokens within the pSTAKE app, stopping rewards and swapping back BTC from the liquidity pool.

BTC staked to pSTAKE is custodied via MPC providers like Cobo on Bitcoin—similar to Merlin.

This results in a dual-token system: pTOKENs represent unstaked assets usable across DeFi, while stkTOKENs represent staked assets accumulating staking rewards.

4.3 Summary

pSTAKE brings years of asset management experience and multiple audited contracts, now collaborating with Babylon.

-

Enhanced liquidity: Partnering with Babylon—a platform focused on improving asset efficiency through advanced blockchain technology—can further optimize and expand liquidity.

-

Increased yield potential: Babylon’s expertise may unlock additional value for pSTAKE-staked assets. Through Babylon’s network, pSTAKE assets could access broader DeFi protocols and higher-yield strategies—including sophisticated trading algorithms or high-reward liquidity pools—offering diversified investment options and potentially boosting overall returns.

-

Improved security and compliance: Collaboration with Babylon adds extra layers of security and compliance. Combined with MPC service providers like Cobo, the system gains stronger safeguards, ensuring reliable yields.

In summary, through pSTAKE’s Bitcoin liquidity solution, BTC holders can stake their assets—earning yield via Babylon’s services—while receiving liquid tokens to maintain usability.

Currently, pSTAKE has not launched its mainnet version; all experiences remain on testnets. As such, many asset management and yield-expansion mechanisms have not been disclosed, and there is no TVL data available yet.

However, backed by Binance Labs, it has caught my attention—given Binance’s consistent investment in staking innovations and deep understanding of user demand for financial utility, the most realistic need in the blockchain industry.

After all, trillions of dollars worth of BTC sitting idle long-term is unsustainable.

Finally, returning to BTC’s paramount concern—security—MPC custodians like Cobo are now better understood and accepted through projects like Merlin. Rather than waiting years for BitVM and ZK-level trust models, it’s wiser to embrace optimistic execution via OP-based systems, leveraging deterministic base-layer yields to ensure asset management security.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News