Playing with coins is all about playing with attention—cryptocurrency products are gradually converging toward SocialFi.

TechFlow Selected TechFlow Selected

Playing with coins is all about playing with attention—cryptocurrency products are gradually converging toward SocialFi.

SocialFi platforms transform users from passive consumers into active participants, becoming the new attention merchants.

Author: MASON NYSTROM

Translation: TechFlow

The internet is a marketplace of attention, and competition for attention is intensifying rapidly. Cryptocurrency has introduced a new chapter to the attention economy by enabling more efficient valuation of attention through ownable attention assets—such as content, social graphs, memes, algorithms, and platform engagement.

However, cryptocurrency not only changes how attention is valued—it also has the potential to redefine who captures its value.

In 2016, Tim Wu coined the term “attention merchants” to describe how publishers and platforms profit from users’ attention. Cryptocurrency opens a new path for users to become their own attention merchants, reclaiming the value of their attention by owning attention-based assets.

This shift is most evident in SocialFi (Social Finance), where users can own attention flows tied to memecoins, influencer access keys, content, and more. By allowing users direct participation in attention-driven assets, SocialFi platforms challenge traditional power structures in the attention economy, transforming users from passive consumers into active participants—and new attention merchants.

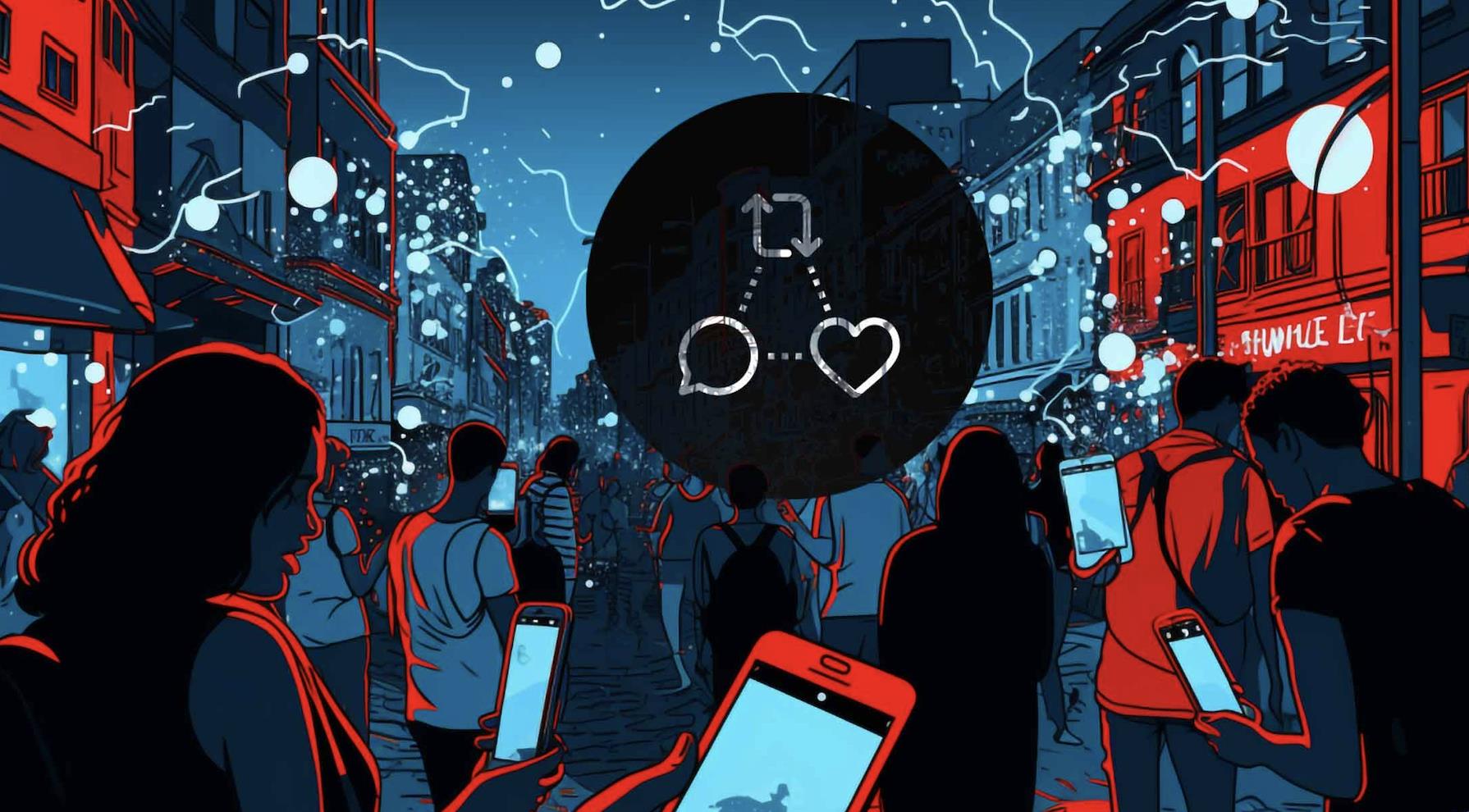

Frontiers of SocialFi

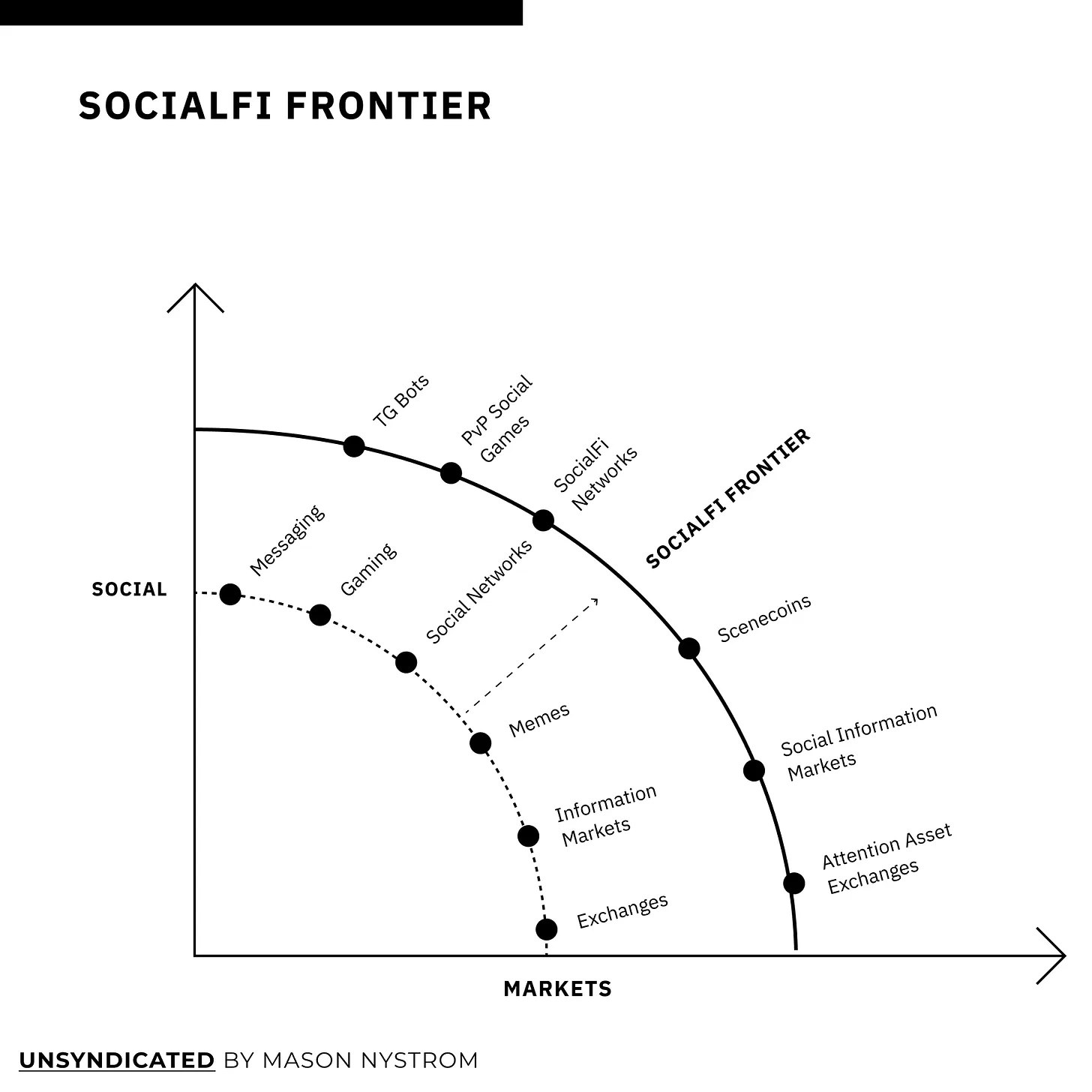

SocialFi is emerging as a significant category within Web3. Crypto-native social networks like Farcaster are growing rapidly, with daily active users exceeding 75,000. Telegram bots that combine group messaging with trading have facilitated billions of dollars in trading volume. Meanwhile, prediction markets are evolving toward financialized social graphs (e.g., Twitter’s Trends.market, Fantasy.top, and Farcaster’s Swaye, Perl, Arrina).

While not every social platform will include financial incentives, SocialFi represents an evolution—from indirectly measuring social capital to more efficiently valuing social and attention-based assets. As a socio-technical system, crypto enables social apps to add financialized features (like asset trading) or integrate financial primitives natively at the application layer (such as Friendtech’s bonding curves). This trend is driven by strong consumer demand to own and trade attention assets. Users increasingly spend time on applications where they can monetize their attention or enhance social entertainment through financial gamification.

For example, Fantasy is a fantasy sports trading card game and information market built atop X’s (formerly Twitter) social graph. Fantasy allows creators to earn from their social presence while enabling players to be rewarded based on their intuition and knowledge about specific accounts. Elsewhere, new social networks like Friendtech, Unlonely, and Sanko allow creators to directly monetize interactions via chat access passes. This benefits early buyers who allocate attention to under-the-radar creators and communities, rewarding them for discovering rising talent.

The core benefit of these new information markets and social networks is that both creators and users are now attention merchants—they own the attention assets within these apps and monetize attention simply by using them.

Many applications are already responding to users' desire to embed commerce and finance into social experiences:

-

Messaging → Trading within messages

-

Gaming → Ownable assets and real-money in-game economies

-

Social → Ownable social graphs, channels, content, and platforms

-

Memetics → Scene coins and derivative meme assets

-

Information Markets → New markets for social entertainment, influencers, and social capital

-

Exchanges → Launching protocols for social and attention-based assets

Over the past year, the SocialFi ecosystem has expanded rapidly, with a surge in attention asset exchanges (e.g., memecoin protocols), PvP (player-versus-player) social games, new forms of information markets, and financialized social networking startups. This growth is fueled by maturing crypto infrastructure in terms of scalability and usability, enabling new consumer experiences (e.g., mobile PWAs), cheaper transactions (e.g., L2s), and faster app iteration cycles thanks to improved developer tools like account abstraction and wallet-as-a-service solutions.

Social Networks

Social networks can broadly be divided into two categories with distinct creator monetization models: one-way and two-way.

-

One-way networks are platforms where relationships between creators and fans are unilateral. This one-sided dynamic typically comes with direct monetization methods such as subscriptions (e.g., Substack, OnlyFans, Patreon) or revenue-sharing from ads (e.g., YouTube, TikTok).

-

Two-way networks are platforms where interaction between creators and followers is mutual (e.g., Twitter, Reddit, Facebook, Snapchat). Two-way networks enable monetization through content propagation rather than restriction—such as token-gated access (e.g., influencer-locked chats). Historically, Web2 two-way platforms like Twitter and LinkedIn have made it harder for creators to directly monetize influence. Instead, creators had to rely on affiliate programs, redirecting audiences to other monetized platforms (e.g., Twitter → Substack), or running promotional campaigns.

By redefining users as new attention merchants, SocialFi introduces multiple novel monetization paths for both types of networks. One-way networks empower creators to further monetize top-tier audiences via tokenized content, influencer access, time-limited rewards, or social status. Platforms like Drakula and Friendtech tokenize content and creators respectively, enabling top creators to earn from trading volume. Sofamon demonstrates a token model where users gradually purchase parts of an aesthetic item (e.g., avatar clothing) until they own the full item and can wear it.

Web3 social networks unlock new monetization opportunities. For instance, monetizing usernames and namespaces can generate revenue from valuable digital identities scalable to millions of users. Additionally, two-way networks can better leverage in-app transactions—manifested as internal marketplaces, channel storefronts, or embedded mini-games.

A key distinction between Web3 two-way networks and their Web2 counterparts lies in the emergence of new attention merchants—users and creators—who can now capture greater value from their activities. Imagine if Reddit moderators could own their subreddits, earn ad revenue, or receive a cut of transaction fees generated through their community channels.

PvP Social Games

With the maturation of consumer-facing crypto infrastructure, PvP (player-versus-player) social games are gaining renewed momentum. Notably, a wave of “Survivor-style” competitive games—such as Crypto The Game and Blessed Burgers—has emerged, offering users novel, digitally native, and highly social gameplay experiences with monetary rewards. Other apps like Rug.fun or PvPWorld offer game-theoretic strategy games where users collaborate to win prizes. In contrast, most Web2 mobile games monetize attention through traditional ads or charge users to skip cooldown periods. Now, game developers have access to new business models: social games are becoming more like content, where developers launch multiple short-lived apps featuring compressed play cycles, allowing users to earn meaningful rewards during brief engagements before moving to the next game.

New social games should optimize around several key principles: multiple winners to boost engagement; easy-to-learn mechanics so casual users feel they have a high chance of winning; and strong social interactivity to amplify virality. These game dynamics create stronger incentive alignment compared to many Web3 games, which have historically leaned toward pay-to-win mechanics or prioritized farming over fun.

New Markets and Exchanges

Cryptocurrency’s primary use cases revolve around market creation—particularly issuing new asset classes, bringing existing assets on-chain, or expanding access to digital-native assets.

-

Prediction Markets—Platforms like Polymarket have the potential to build more efficient political markets and enable new event-based markets grounded in real-world events, culture, and business.

-

Attention Exchanges—Launch platforms like Pump and Ape.store let users create new assets based on attention (e.g., memecoins). Elsewhere, Sofaman tokenizes status and culture by letting users create Telegram-based avatars and sell branded apparel on bonding curves.

-

Telegram Bots—Telegram bots bring markets and social finance games into messaging experiences, offering users seamless access.

-

Points and Pre-Tokens—Points have long been an effective incentive strategy for teams testing user behavior and experimenting with dynamic rewards. Points markets like Michi and WhalesMarket, along with pre-token markets like Aevo, help build more efficient token ecosystems.

Several sub-trends are driving the rise of new markets and exchanges. First, the verticalization of social and financial platforms is increasing, prompting apps to issue new asset types. Second, growing ownership of on-chain activity—through earning points, tips, and tokens—expands the range of assets users can interact with, encouraging the creation of new trading venues. Finally, users now engage with assets like memecoins with a stronger sense of autonomy. Much like real-world cultural assets such as sneakers or music, users feel greater control over the popularity and potential appreciation of these digital cultural assets, since their value foundation—their attention—is controlled by end consumers.

Built for the Next Generation of Attention Merchants

The social landscape is undergoing a paradigm shift—the relationship between users, creators, and attention is being redefined. At the heart of these trends is a transformation: users and creators are no longer just suppliers and consumers in the attention economy, but can now become merchants of their own attention.

Designing new financial or social infrastructure is challenging enough; combining both into a unified experience is even harder. Yet, early social finance tools, toys, and games that move quickly to experiment, test new consumer behaviors, and capture emerging user preferences will lead the next generation of SocialFi networks and applications.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News