Why Lumoz Is the Ultimate Winner Amid the Crowded Launch Schedule?

TechFlow Selected TechFlow Selected

Why Lumoz Is the Ultimate Winner Amid the Crowded Launch Schedule?

Lumoz is a decentralized ZK-RaaS platform that enables any user to generate customized zkEVM appchains without coding.

Over the past two weeks, Lumoz, a modular compute layer and ZK-RaaS platform, has been conducting a node sale.

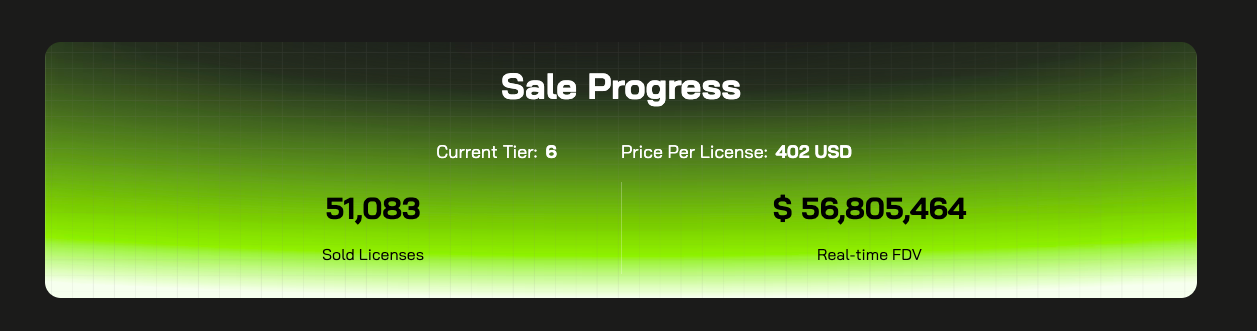

The launch was met with immediate market frenzy, with community users even "offering large sums of money to beg for a Lumoz presale invitation code." In the presale phase, the first four tiers of nodes sold out in an extremely short time. The current round is now in the second wave of whitelist-based node sales, with over 51,000 nodes sold (out of a total 100,000), and a real-time FDV exceeding $56 million.

Lumoz isn't the first project to launch a node sale—other high-quality projects like Aethir, CARV, and ALIENX have also adopted this model—but Lumoz has emerged as the hottest and most anticipated one.

Backed by strong narratives around its "modular compute layer" and "ZK-RaaS enabling one-click chain deployment," Lumoz has attracted top-tier investors including IDG Blockchain, OKX Ventures, and HashKey Capital. It has raised over $20 million in funding at a $300 million valuation. Community members are highly optimistic about the project’s potential listing on major platforms.

So here's the question: amid persistent high BTC prices and uncertain market outlooks, is participating in a node sale truly a good investment? Among numerous node sale projects, why is Lumoz emerging as the ultimate winner?

1. Node Sales: Funding and Loyal Users for Projects

Over the past few months, many projects have launched node sales. Why are teams so drawn to this model?

A key reason is that node sales can generate substantial funding for a project. Especially for seed or strategic round projects that have only raised a few million dollars, building a public blockchain often requires far more capital. Node sales offer a way to secure significant funds quickly. A prime example is Aethir: before its node sale in 2023, it had raised just $9 million; the node sale brought in over $100 million, enabling the project to reach listing.

Of course, this approach carries risk—if a project fails to use the proceeds effectively, early buyers could end up losing everything alongside the team. Therefore, participants must carefully evaluate a project’s fundamentals. Projects with minimal funding or obscure backers may be red flags. From this perspective, Lumoz stands out as one of the best-funded node sale projects recently.

According to public data, Lumoz raised $4 million in a seed round in April 2023; followed by a $6 million Pre-A round at a $120 million valuation in April 2024; and then secured over $10 million in a strategic round at a $300 million valuation in May 2024. Investors include IDG Blockchain, OKX Ventures, HashKey Capital, Polygon, NGC Ventures, KuCoin Ventures, Gate Ventures, G Ventures, MH Ventures, Summer Ventures, and Aegis Ventures.

Interestingly, several exchange-affiliated VCs are backing Lumoz, such as OKX Ventures, which has supported the project from the start. As a result, the community widely believes there’s over a 90% chance Lumoz will debut on OKX, possibly even launching an IEO across multiple exchanges simultaneously.

Beyond fundraising, node sales help projects build a loyal user base and gain critical validation support. In their early stages, projects struggle to attract users for node validation due to low visibility. Yet achieving decentralization requires third-party validators. Node sales effectively incentivize early participation, and most projects allocate a portion of tokens as rewards for node operators.

Among comparable projects, ALIENX allocates the highest percentage—40%—but these tokens unlock over five years, introducing long-term uncertainty. Aethir reserves only 15%, unlocking over four years. Lumoz strikes a balanced approach, allocating 25% of tokens with a three-year linear unlock—the most favorable structure among current node sale projects.

2. Return Analysis: Is Participating in a Node Sale a Good Deal?

Node sales clearly benefit project teams, but for ordinary users, they also represent a unique opportunity for outsized returns.

In today’s crypto market, Bitcoin hovers above $60,000, yet most altcoins are failing to rally and continue declining. Some investors describe this bull run as “VC dumping,” calling VC-backed projects “high FDV, low liquidity.” While this view may be overly harsh, it reflects investor frustration: promising projects often see their early allocations monopolized by VCs, leaving retail investors holding the bag.

Participating in node sales may offer retail investors a powerful alternative. It allows them to invest at earlier valuations than public offerings, potentially yielding much higher returns.

(1) Early Access via Node Sales

Many mistakenly equate node sales with public sales, but this is incorrect. Public sales typically occur at valuations far higher than a project’s last VC round—essentially asking retail to buy what VCs are selling. Node sales operate differently; they’re closer to participating in a private or pre-public offering.

(Lumoz node sale details)

Take Lumoz’s current node sale: 100,000 nodes across 10 Tiers. Purchasing a Tier 1 node costs just $200, implying a project valuation of $6.4 million—far below the $300 million valuation in its latest Pre-A round. This means Tier 1 buyers enter at a cost comparable to early seed-round VCs, avoiding the typical “buying VC bags” scenario. Even at Tier 10, the final valuation caps at under $290 million—nearly identical to institutional entry prices. Currently, whitelist sales are only at Tier 6, with a project valuation of just $100 million. Earlier participation means lower valuations and higher potential returns.

Notably, Lumoz originally planned 200,000 nodes across 50 Tiers. This revised structure keeps valuations reasonable, prevents inflation, and preserves healthy profit margins for participants, enhancing their risk resilience.

In contrast, Aethir’s node sale was less sustainable—raising $100 million pushed its valuation above $3 billion. On launch day, FDV peaked at $3.2 billion with little upside, leaving many node buyers stuck. For instance, an Aethir Tier 1 node currently yields 31.44 ATH per day. At a token price of $0.07, it would take 7.5 months to break even.

By comparison, Lumoz offers vastly superior returns. Even assuming a post-launch FDV of $300 million, a Tier 1 node buyer could break even in just one month, with over 20x net return within six months. A Tier 5 buyer would break even in four months, earning nearly 2.5x returns in half a year. If Lumoz’s valuation surges post-launch, payback periods shorten dramatically.

(2) Lumoz Node Benefits and Costs

Beyond token economics, Lumoz offers additional incentives not seen in other node sales. For example, node holders receive 40 million积分 (points) rewards—1 million points daily distributed from June 25 to August 4 (40 days). After TGE, these points can be exchanged for Lumoz mainnet tokens.

More importantly, node holders gain eligibility for potential airdrops from new chains within the Lumoz ecosystem. With a community exceeding one million users and aggregate ecosystem TVL surpassing $4 billion, Lumoz’s RaaS service already supports over 20 L2 chains including Merlin Chain, HashKey Chain, ZKFair, Ultiverse, and Matr1x. Buying a Lumoz node is effectively purchasing tickets to dozens of upcoming public chain airdrops.

On cost and accessibility: unlike io.net’s 2024 node mining requiring high-end hardware and extensive KYC, Lumoz has relatively low hardware requirements—CPU 4-core or higher, 8GB RAM, and 16 Mbit/s bandwidth. Users can either run nodes directly after binding a license or delegate their NFTs to other operators for mining.

Additionally, given the macroeconomic uncertainty—especially possible Fed rate cuts in the second half of 2024—Lumoz has implemented a thoughtful "regret mechanism." Six months after TGE, a refund window opens: dissatisfied users can apply for a refund, receiving 80% of their initial payment back plus all earned tokens and NFTs. In other words, if token prices rise, users keep mining profits; if prices crash, they can exit with only a 20% loss—effectively a safety net.

3. High-Potential Niche: Modular Compute Layer for ZK Rollups

Even with elite backers, a project with unclear prospects is unlikely to succeed—and node participants could lose everything.

Today, chain creation is the go-to move for many Web3 founders. Projects like dYdX, Magic, and FXS have all launched their own chains, since standalone app valuations pale in comparison to owning a blockchain. However, teams without deep technical expertise face steep barriers. Lumoz serves exactly these teams—providing the "picks and shovels" for chain deployment.

Lumoz is a modular compute layer and ZK-RaaS platform that solves both the high computational cost and centralization issues in ZKP generation and verification. It enables one-click chain launches—via its no-code ZK-Rollup Launchbase, anyone can create a customized zkEVM appchain without writing code. Meanwhile, Lumoz provides underlying compute power for general-purpose ZKP calculations through its Decentralized Prover Network. Beyond provers, it opens the verification layer to regular users via zkVerifier, aiming for decentralized validation and reduced L2 gas fees.

“Lumoz combines ZK-RaaS and DePIN to deliver low-cost, accessible ZK-Rollup deployment. OKX Ventures recognizes its progress in ZK-RaaS and prover technology, and this investment will accelerate Lumoz’s development of its modular compute layer and platform innovation,” said Dora, founder of OKX Ventures.

Indeed, ZK-Rollup’s potential has already been proven. Ethereum has long struggled with scalability, and Rollups are the dominant Layer 2 scaling solution—batching transactions off-chain and posting data on-chain to simplify validity checks. As early as 2020, Vitalik Buterin updated Ethereum’s roadmap emphasizing a “Rollup-centric” future. Rollups typically consist of settlement, execution, consensus, and data availability layers. But ZK-Rollups require an additional core component: the Prover Layer. Today, Lumoz is one of the few providers offering a modular Prover Network in the modular Rollup space.

Key pain points in the ZK Rollup space include high ZKP computation costs and the current reliance on centralized provers. The complexity of zero-knowledge tech also makes building EVM-compatible ZK-Rollups difficult. To tackle cost and centralization, Lumoz introduced the ZK-PoW algorithm, drastically reducing ZKP computation costs. Since launch, the ZK-PoW mechanism has attracted over 145 global miners and more than 20,000 testnet validation nodes. Additionally, to ensure security, accuracy, and decentralization in data processing, Lumoz employs a node verification system where zkVerifiers validate ZKPs generated by zkProvers.

Overall, Lumoz’s modular compute layer eliminates the need for projects to build and operate ZKP systems, significantly lowering the barrier to launching ZK-Rollups. Users can customize their Layer 2 stack within LaunchBase—selecting SDKs, settlement layers, data availability solutions, sequencers, etc.—entirely without code. This empowers teams to focus on non-technical aspects like ecosystem growth instead of complex infrastructure.

Conclusion

Behind cutting-edge technology lies a founding team with deep technical expertise. Lumoz CEO NanFeng, a Tsinghua University graduate, leads a core team that has spent nearly five years developing ZK technologies—this dedication is what made Lumoz possible.

Currently, Lumoz’s node sale is in the whitelist phase, selling Tier 6 nodes at $402 each. After the whitelist concludes, the public sale will begin on July 3 at 3:00 PM (UTC+8). Interested users can participate via the official website: https://node.lumoz.org/whitelist-sale.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News