Has crypto winter ended? Global liquidity and Fed data suggest a reversal may be coming

TechFlow Selected TechFlow Selected

Has crypto winter ended? Global liquidity and Fed data suggest a reversal may be coming

Global liquidity and Federal Reserve reserves are key to crypto growth.

Author: Finish

Compiled by: TechFlow

Some experts say the altseason is still far off. Others claim it's about to begin.

But what’s the actual truth? I spent 30 hours analyzing all available data—and my findings will surprise you.

First, let’s talk about public sentiment. Most people are bearish, harshly criticizing 60% of projects, with some even believing that crypto is about to lose all retail interest. But what if we look at the $BTC chart?

Since February, $BTC has been on a steady rise, leading many to believe a massive bull run was imminent. Now that $BTC is declining, everyone says crypto is nonsense.

However, the chart shows we’re in a 15-week consolidation phase—a typical market correction. So people won’t lose interest in crypto. But what about altcoins?

Altcoins are performing terribly, causing holders to lose up to 80%. But why? $BTC hit new all-time highs—why are altcoins doing so poorly?

Let me walk you through expert insights.

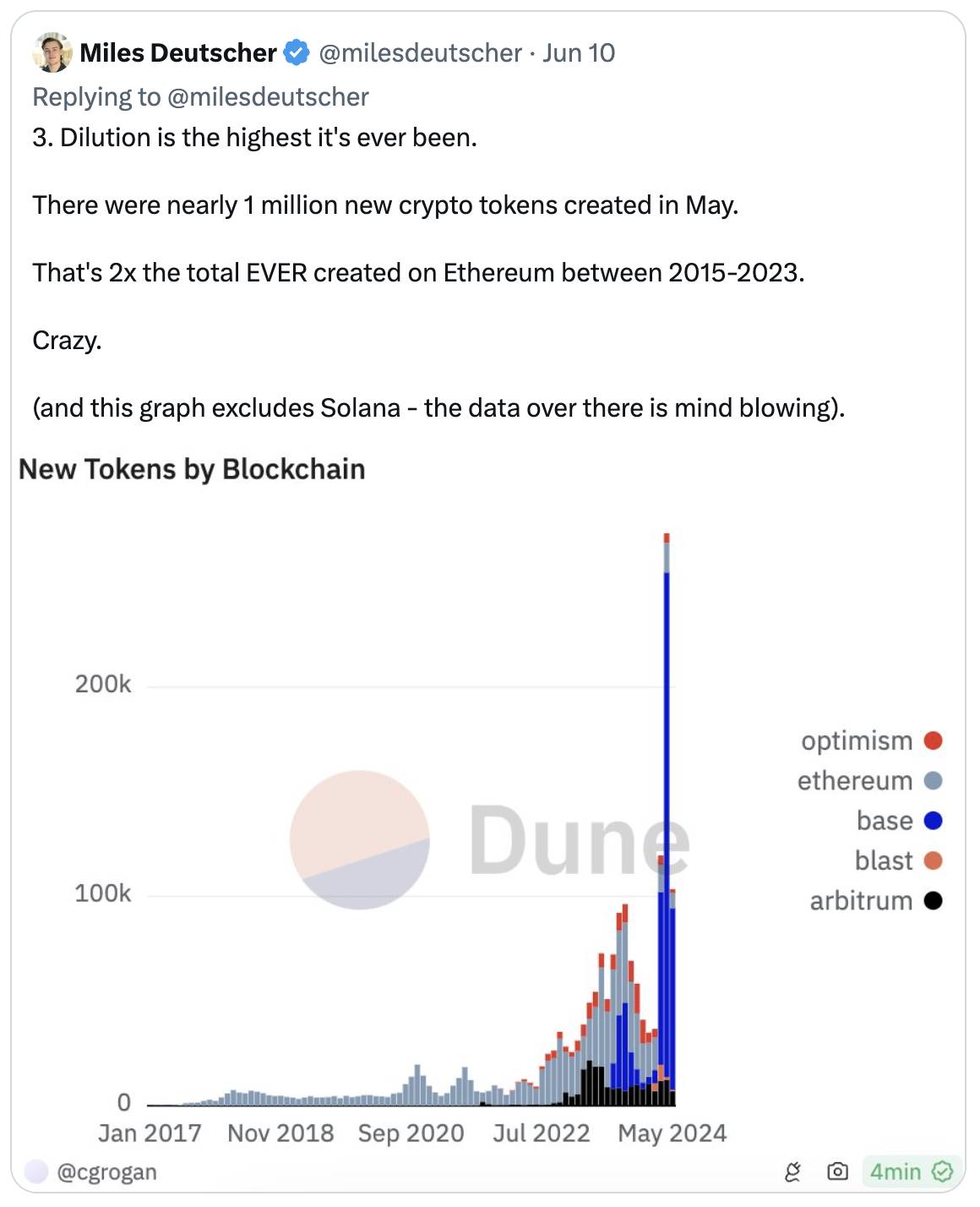

Crypto OG Miles Deutscher shared an interesting insight: In May alone, 1 million new crypto tokens were created (excluding Solana), twice the total number created between 2015 and 2023.

But why can't the market push all these tokens upward?

(See tweet)

Since the last bull run, the market has become smarter.

Why should people buy copy-paste Layer 2 solutions like $ZK, $STRK, and $ZRO—developed for $5 million instead of $260 million?

So, what will happen to altcoins in this supercycle?

Here, remember two core rules of crypto:

-

New cycle, new altcoins

-

There’s no need to invest in boring L2s—focus on predicting the next narrative and carefully backing potential leaders

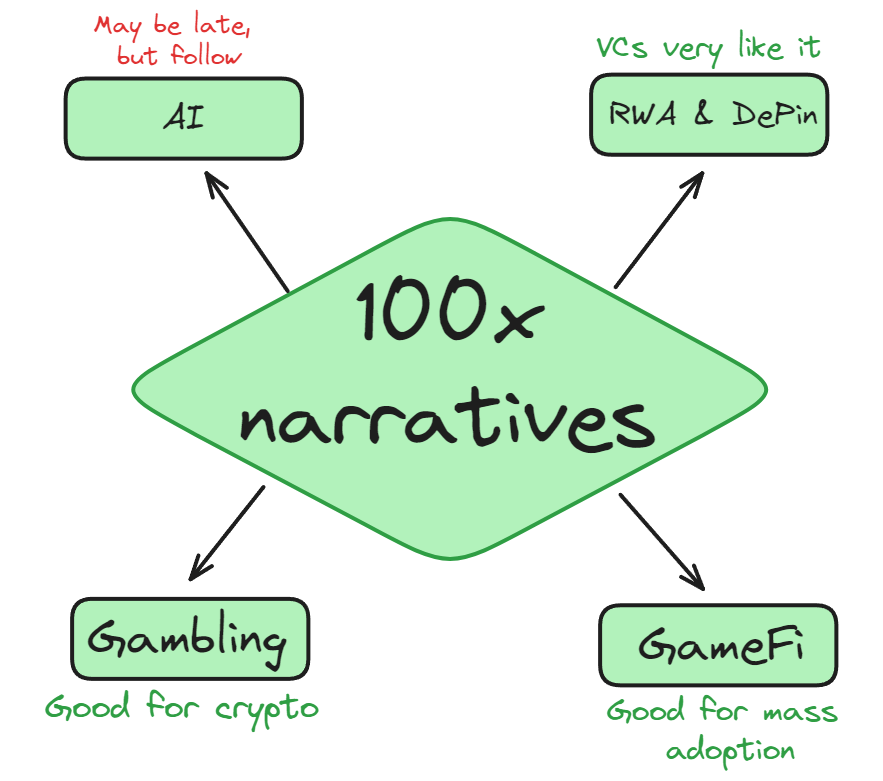

Now, let me share my view on future narratives

RWA (Real-World Assets) and DePin (Decentralized Physical Infrastructure Networks):

These sectors received the most funding this year and last—obvious areas to watch.

GameFi:

There are some great games, but they lack sufficient players. I expect explosive growth in this space within a year.

Gambling:

Crypto is perfect for gambling, but aside from memecoins, nothing has attracted Web2 users yet.

Artificial Intelligence (AI):

It may seem late, but who knows what OpenAI will create in a year? Following this narrative remains crucial.

Now, let’s explore when the next surge might occur.

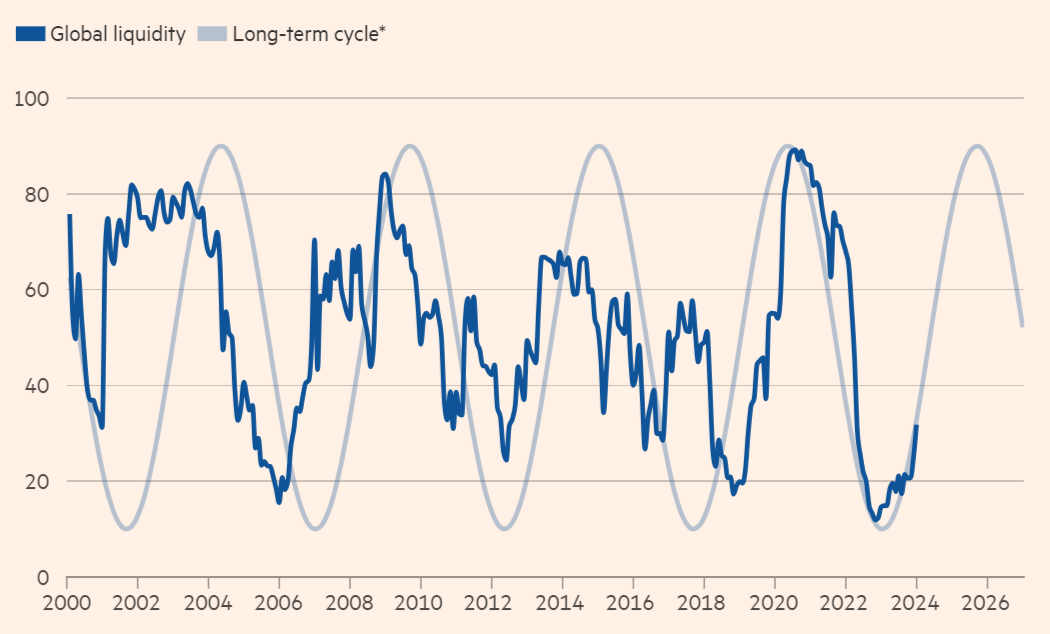

One indicator is the Global Liquidity Index.

Comparing the chart below with crypto price movements reveals similar trends.

According to the data, a major market reversal is expected within 6–18 months.

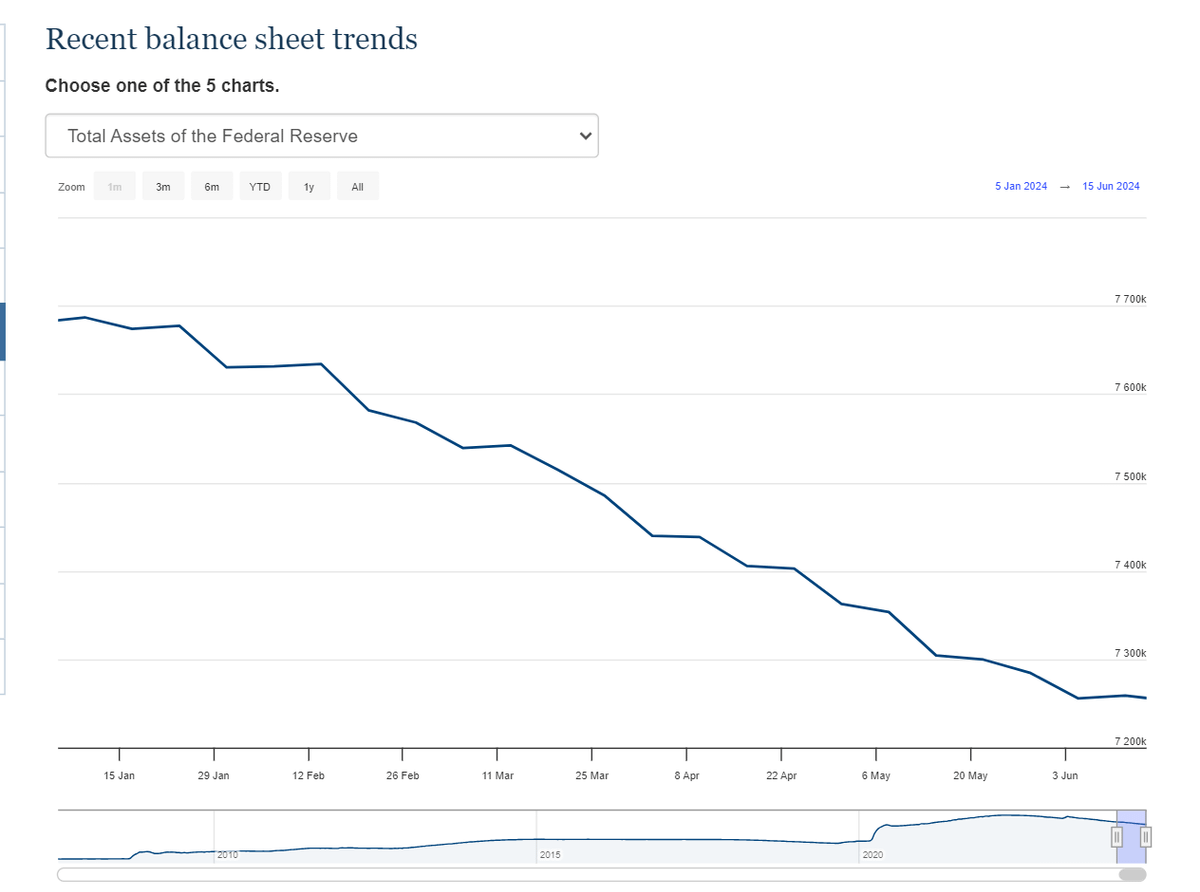

Another way to predict altseason: simply track the Federal Reserve’s total balance sheet.

When the Fed starts buying assets again, massive liquidity will flood the markets—including crypto.

Currently, the Fed is selling assets—but a reversal is coming.

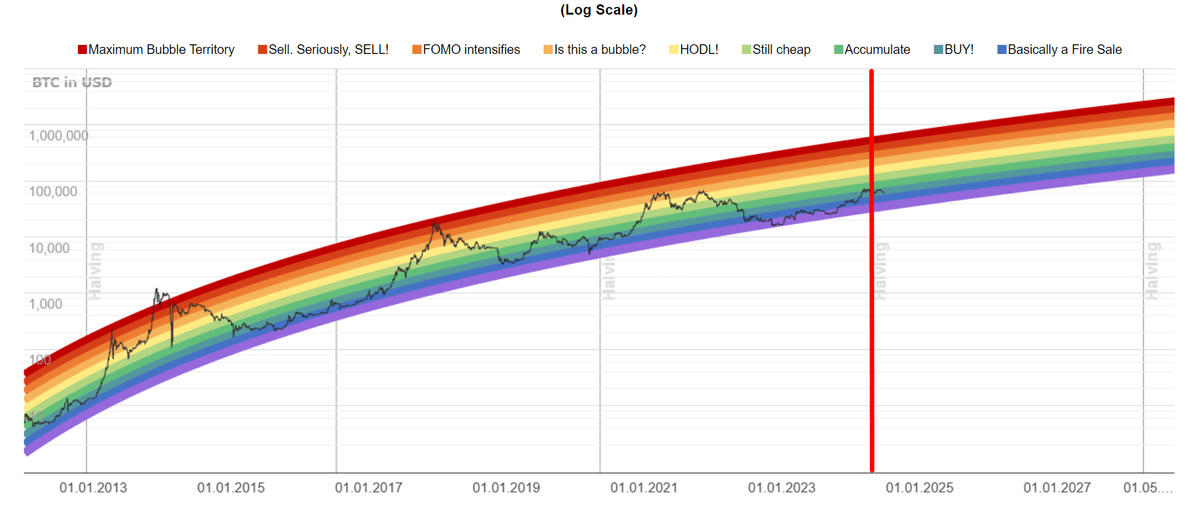

After reviewing the first two charts, use the Bitcoin Rainbow Chart for clearer context.

As shown, we're in the "fire sale zone," meaning now is a good time to look for entry points.

But don’t invest everything—only allocate 10–15% of your portfolio. If prices drop further, buy more.

Still skeptical about crypto? Here’s final proof: The U.S. government is preparing to support crypto growth.

After the U.S. presidential endorsement of crypto, are you still holding a bearish view?

(See tweet)

Summary

-

Retail investors won’t lose interest in crypto.

-

The market is tired of copy-paste projects and awaits new altcoins.

-

Investors have lost interest in repetitive L2s and are looking for fresh, high-potential altcoins.

-

GameFi, gambling, RWA, DePin, and AI are worth watching.

-

Global liquidity and the Fed’s balance sheet are key drivers of crypto growth.

Join the official TechFlow community

Telegram subscription group:

Official Twitter account:

English Twitter account:

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News