The meme era is not over, but keep the profits and don't play with fire.

TechFlow Selected TechFlow Selected

The meme era is not over, but keep the profits and don't play with fire.

Play with fire like a trader.

Author: Lavina

Compiled by: TechFlow

Memes have been the dominant theme of this cycle. WIF and PEPE enjoyed a glorious run, consistently setting new records and reaching new highs. However, as DeFi and other fundamental narratives regain prominence, is the meme era over? Let's explore this through several key indicators.

Memes in the Spotlight

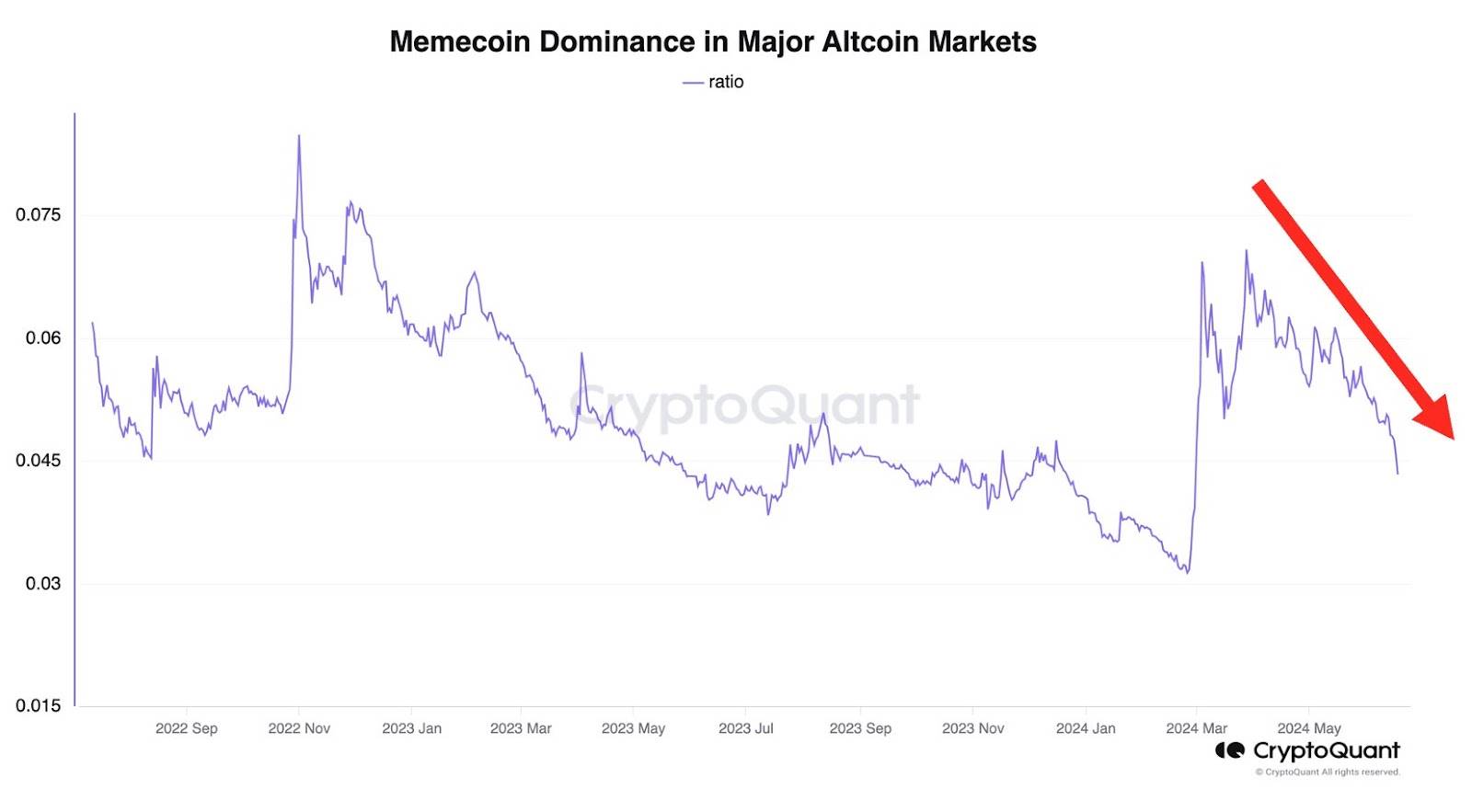

In the current cryptocurrency cycle, memes have undoubtedly been one of the focal points. Although their dominance in the broader altcoin market has recently declined, this doesn't mean the meme game is over. From multiple perspectives, the meme market still demonstrates unique vitality and potential.

Ki Young Ju of CryptoQuant said: "Pack it up, guys, it’s over."

(Source: Twitter)

What Does Duck Think?

DonAlt, an analyst known for accurately predicting market bottoms and tops in the past, takes a contrarian stance and isn't truly fond of memes. Despite holding an extreme opposing view, he maintains his position. Regarding WIF, he recently said: "It looks terrible. No matter how much you accuse me of bias, a drop is still a drop."

(Source: X)

He indeed profited from shorting when the coin began its sharp decline. However, he has since exited the market, claiming he doesn’t want to “kill” the coin. Better safe than sorry, and there’s no harm in avoiding becoming a target for “moon boys,” right?

Despite DonAlt’s extremely bearish stance, he hasn’t ruled out the possibility of memes rallying again. If Bitcoin ultimately reverses its trend upward, memes will likely follow.

However, if a bear market returns, meme holders will need to buckle up. In DonAlt’s words: "I don’t oppose that—if Bitcoin breaks out upwards, your meme might do well, but in tail-risk scenarios, it’ll be brutal."

Enter Solana

Most memes launched during this cycle have been built on Solana. In fact, the number of tokens created on this chain has surpassed those on other chains like BNB, Ethereum, and Polygon.

By comparison, it’s fair to say that Solana’s meme dominance has replaced Ethereum’s NFT dominance from the previous cycle. Indeed, for retail investors and meme traders, it has become the go-to chain of this cycle.

A recent report from Pantera Capital noted: "By May 2024, Solana accounted for 85% of all new tokens appearing on DEXs, up from 50% a year earlier. The growth of Solana-based tokens reflects its advantage in retail adoption, driven largely by memecoin activity."

(Source: Pantera Capital)

As the meme frenzy gradually fades, will Solana be affected? To some extent, yes. However, Solana does have fundamentals to fall back on.

Several consumer-facing applications, DePIN projects, content distribution platforms, CLOB-based DEXs, and gaming apps are being built on this blockchain. So even if memes take a temporary break, Solana won’t be sidelined.

According to Pantera Capital, Solana’s future is undoubtedly secure. Solana’s monolithic architecture follows a product roadmap focused on optimizing each component of its own blockchain—similar to Apple’s approach to its vertically integrated hardware and software stack in macOS.

Now Is the Season of "Debate"

By the end of this month, political finance memes are expected to reclaim the spotlight. The debate between U.S. President Joe Biden and presidential candidate Donald Trump will air on June 27.

Podium positions and closing statement order have already been determined by a coin toss. As the debate approaches, volatility in the basket of political finance memes—including Jeo Boden [BODEN], Doland Tremp [TREMP], Super Trump [STRUMP], MAGA [TRUMP]—is expected to increase.

Analysts at Bitfinex suggest that general capital gains tax discussions—and particularly crypto tax policies—could significantly impact the market. They said: "During and after the debate, 'political finance' tokens could experience notable market volatility based on their performance, as these tokens themselves have become speculative assets tied to election outcomes."

Therefore, the meme season isn’t over yet. Ahead of November, we can expect a surge in market volatility.

Meme Liquidity

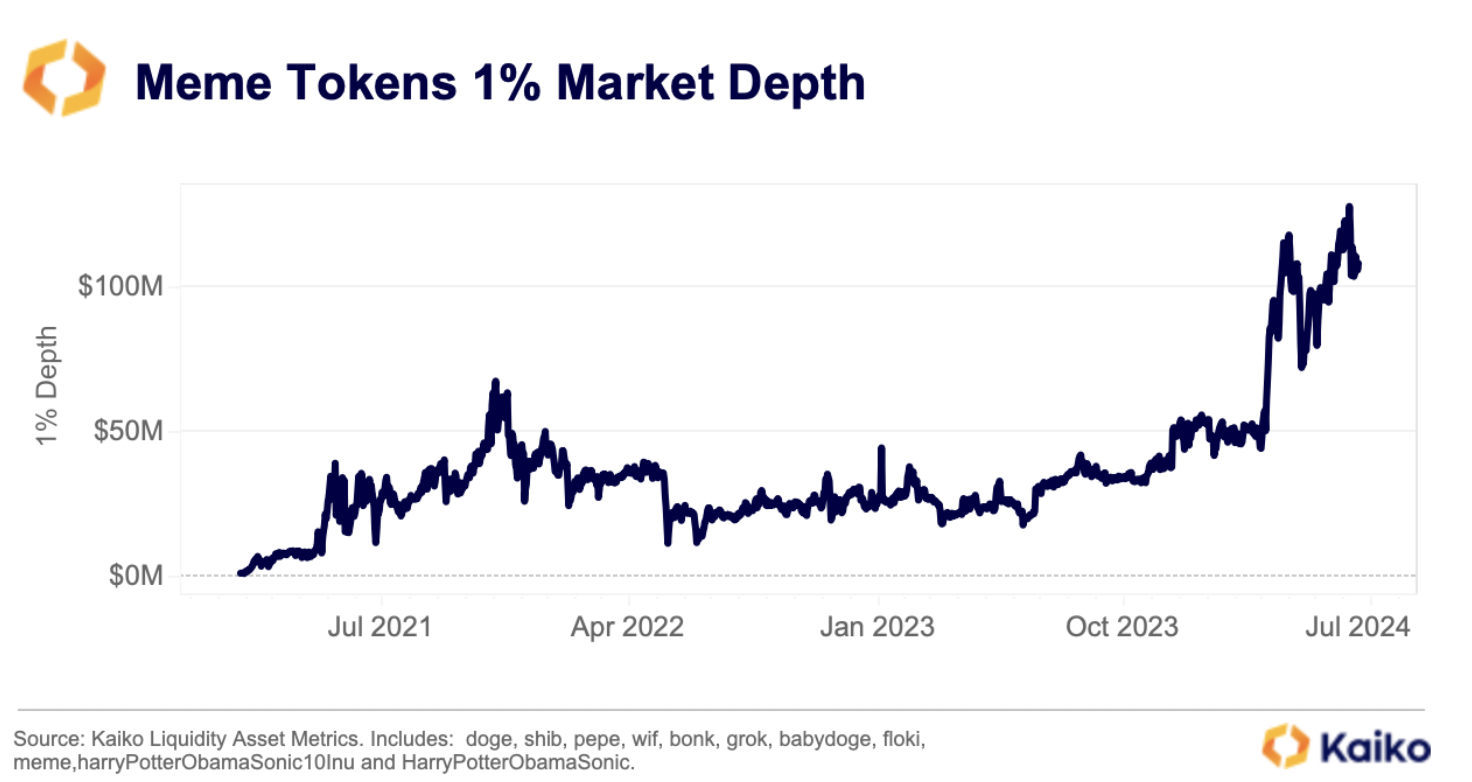

Although their dominance has waned, it’s worth noting that meme liquidity is currently at its peak. According to Kaiko data, the 1% market depth for DOGE, SHIB, PEPE, WIF, BONK, GROK, BABYDOGE, FLOKI, MEME, HarryPotterObamaSonic10Inu, and HarryPotterObamaSonic recently hit a record high of $128 million.

(Source: Kaiko)

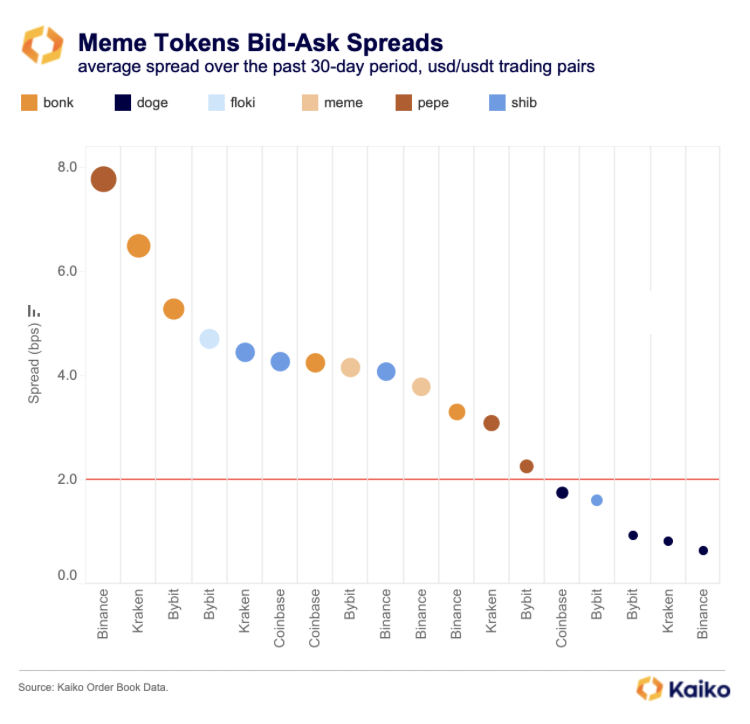

As a rule of thumb, higher liquidity means a healthier market, as large trades can be executed without significantly affecting prices. Historically, this tightens bid-ask spreads. However, meme trading costs remain high. On most exchanges, bid-ask spreads exceed two basis points, supporting the above narrative. Kaiko’s report notes: "While an increasing number of market makers are attempting to provide liquidity for these tokens, they are still considered high-risk due to their high volatility."

This isn’t a case of “smoke and mirrors.” Market participants haven’t completely stopped trading memes—they’re just proceeding with caution. Despite declining dominance, liquidity continues to flow in, indicating this group of tokens hasn’t been abandoned.

The rule is never to “marry” your memes; always remember they can crash overnight. Play with fire like a trader, but make sure you walk away with profits—not burnt fingers.

Join the official TechFlow community

Telegram subscription group:

Official Twitter account:

English Twitter account:

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News