Interest rate cut expectations slow down, spot Ethereum ETFs accelerate approval — when will the market turn around?

TechFlow Selected TechFlow Selected

Interest rate cut expectations slow down, spot Ethereum ETFs accelerate approval — when will the market turn around?

The cryptocurrency market is undergoing a phase of adjustment, and the best strategy in the short term is to wait patiently.

By: FMG Research

Crypto Market Summary

1. Since Bitcoin (BTC) prices broke their all-time high (ATH) in March, they have failed to sustain a clear upward momentum. Coupled with market pessimism around U.S. interest rate cuts and the absence of dominant narratives, the cryptocurrency market is undergoing a phase of adjustment. The best strategy in the short term is patience. In the long run, we believe a full bull market will emerge from late 2024 into 2025.

2. Spot Ethereum ETFs are expected to be approved as early as July 4, which would boost market sentiment and benefit the Ethereum ecosystem. The S-1 filing required for spot Ethereum ETF approval has received feedback from the SEC, with revisions requested by June 21 (this Friday).

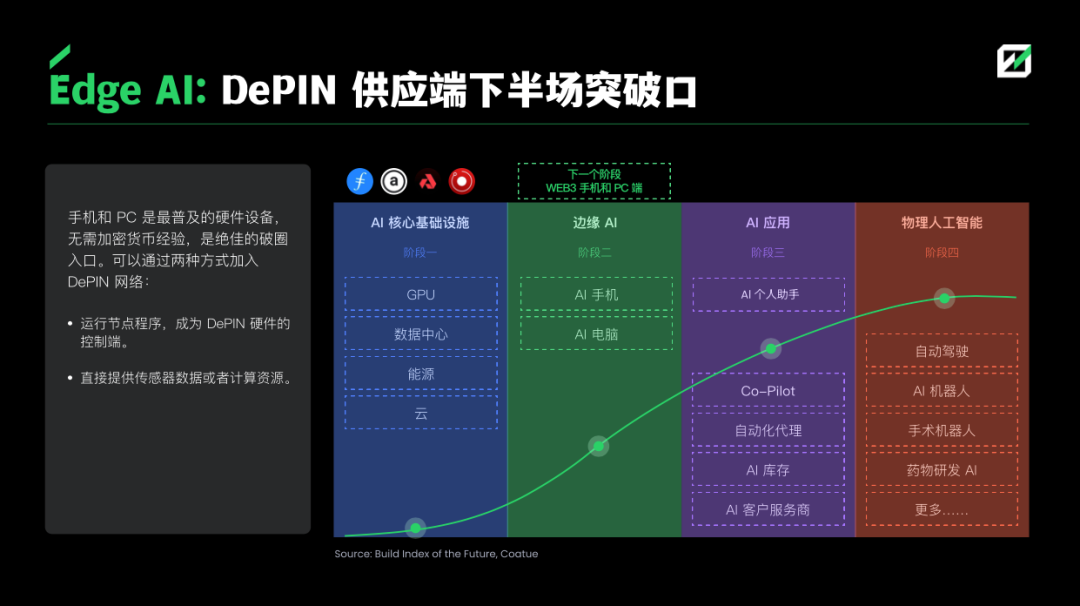

3. FMG has released an in-depth research report on DePIN, identifying three major trends in the sector: integration of the DePIN model with consumer products; edge-device economies and sharing economies based on Web3 smartphones; and unlocking DePIN liquidity through RWA models.

4. The meme coin surge reflects the current "narrative vacuum" in the market. With few compelling stories driving investment and a large number of altcoins continuously unlocking with high FDVs, investors are increasingly turning to memes. This cycle’s meme narrative has stronger foundations than the last, including institutional participation, exchange-provided liquidity, and higher community engagement.

5. The recent two major airdrops (ZKSync, EigenLayer) sparked immediate backlash, with terms like “ZKscam” and “EIGENscam” trending shortly after distribution. Poorly designed airdrop mechanisms have triggered strong community discontent. Airdropped tokens were allocated at nearly zero cost to users with extremely low retention rates, over half of whom immediately sold their tokens. As a result, projects are likely to grow less enthusiastic about airdrop-based growth strategies and will still need strong product development and grassroots marketing capabilities.

I. Market Overview

1.1 Crypto Market Data

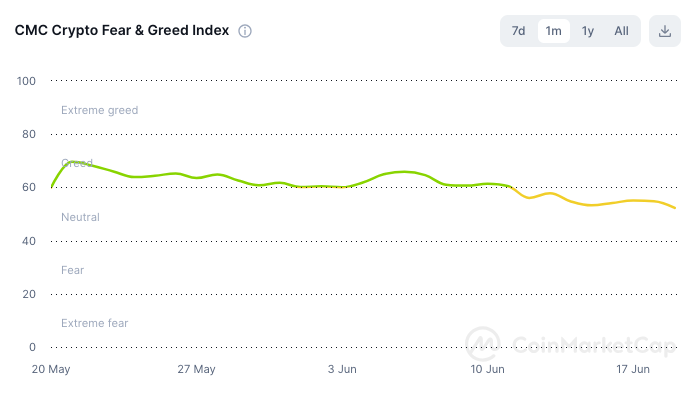

On June 19, the total crypto market cap was $2.38 trillion, down 5.92% from the beginning of the month. Bitcoin's market dominance reached 53.92%, slightly up from 52.66% at the start of the month. The Fear & Greed Index has been trending downward and currently sits at neutral levels.

As of June 19, the combined market cap of Bitcoin and Ethereum declined by 3.5% compared to the start of the month, while altcoins dropped by 15%.

Based on historical patterns following the previous two Bitcoin halvings, the time between halving and the bull market peak ranges from 12 to 18 months. The price rise is not instantaneous but occurs with volatility and periodic pullbacks. This year’s halving took place on April 20, 2024, suggesting that market conditions may begin improving by the end of 2024.

Although net inflows this year are stronger than last year, they remain significantly below levels seen during the 2021–2022 bull markets. These inflows are insufficient to fuel a full bull run. According to JPMorgan estimates, net inflows into the crypto market this year have reached $12 billion, with $16 billion flowing into spot Bitcoin ETFs. However, since January, exchange reserves of Bitcoin have decreased by approximately 220,000 BTC (~$13 billion), indicating that most funds entering spot ETFs have been transferred from existing digital wallets rather than representing new capital.

1.2 Macro Monetary Environment

After the CPI data released on the evening of June 12 came in lower than expected, the crypto market rallied for several hours. However, during the FOMC meeting at 2:00 AM on June 13, the Federal Reserve unexpectedly signaled via its dot plot that it now expects only one rate cut this year—down from three previously forecasted in March. Following this announcement, the crypto market began weakening.

According to CoinShares, starting from March 22, the largest outflows since have totaled $600 million (as of week ending June 15), with Bitcoin experiencing outflows of $621 million. ETH, LIDO, and XRP saw minor inflows. Per sosovalue data, BTC spot ETFs have recorded daily outflows since June 13.

1.3 Crypto Adoption Forecast

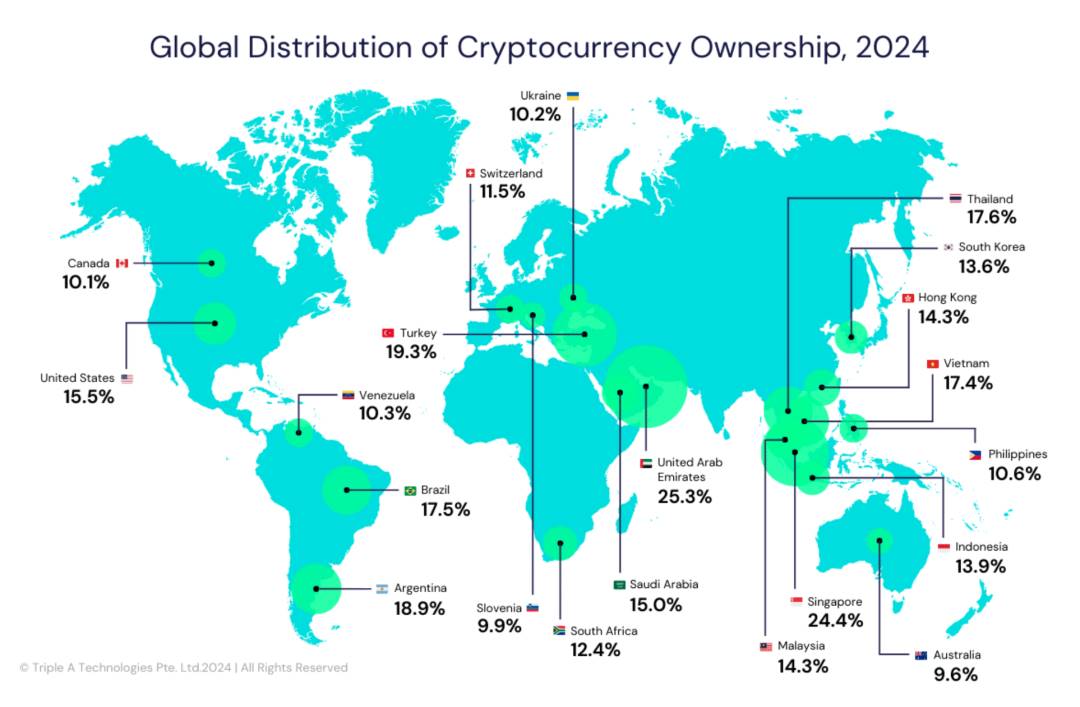

Triple-A’s 2024 Global State of Cryptocurrency Ownership report shows that the global digital currency user base reached 562 million in 2024 (equivalent to 6.8% of the world population), up from 420 million in 2023.

34% of cryptocurrency holders are aged 24–35, the largest share among all age groups, confirming that young people are the core demographic of the crypto community.

II. Crypto Market Trends and Narratives

2.1 AI and Crypto Convergence

Nvidia estimates that over 40,000 companies worldwide use GPUs for AI and accelerated computing, supported by a developer community exceeding 4 million. Looking ahead, the global AI market is projected to grow from $515 billion in 2023 to $2.74 trillion by 2032, at a CAGR of 20.4%. Meanwhile, the GPU market is expected to reach $400 billion by 2032, growing at a CAGR of 25%.

Analysts at Bitwise predict that the convergence of AI and crypto could unlock a $20 trillion market opportunity. Decentralized compute networks, tightly linked to the AI narrative, represent one of the most promising verticals in crypto with real potential for tangible demand.

2.2 Meme Narrative

Memes are increasingly accepted by mainstream crypto markets, with growing consensus that "consensus itself is value" and "existence is justified."

-

At the institutional level, Bybit reports that institutional allocation to meme coins has grown over 300% this year, peaking at nearly $300 million in April. Current favorites include DOGE, SHIB, and BONK.

-

At the exchange level, Binance has listed several meme coins such as PEPE, WIF, and BOME, providing ample liquidity and fueling investor enthusiasm.

-

At the community level, symbols carry strong unifying power. Memes act as a universal language enabling rapid consensus and efficient dissemination. Additionally, increasing celebrity involvement in memecoins enhances their virality—similar to how celebrities collected NFTs in the previous cycle.

-

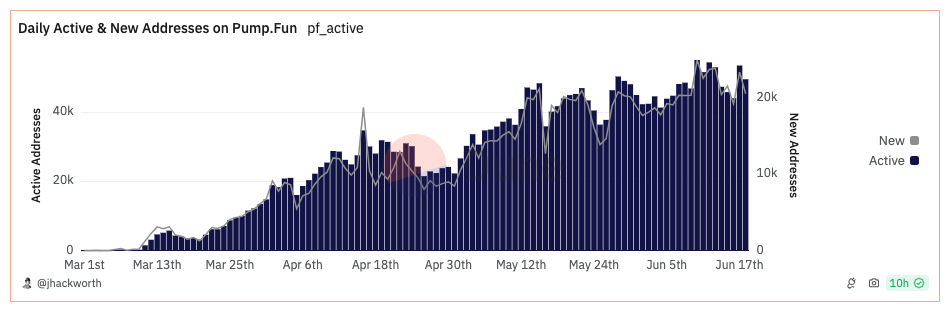

At the issuance platform level, Pump.fun has launched over 1 million memes and achieved $3.6 billion in trading volume, with new users steadily increasing. Supported by such platforms, memes have become a minimalist fundraising and listing mechanism.

III. Regulatory Landscape

Bloomberg ETF analysts Eric Balchunas and James Seyffart suggest the launch date for spot Ethereum ETFs could be moved forward to July 4. Their reasoning: SEC staff sent brief, non-substantive comments on S-1 filings to issuers last week, requiring revisions to be submitted by this Friday, June 21.

FMG’s previous crypto market update noted that the 19b-4 form was approved in May. Trading can only commence once the S-1 form becomes effective. The sudden progress signals a softer stance by the Biden administration on crypto policy, driven largely by electoral considerations. ARK Invest CEO and Chief Investment Officer Cathie Wood echoed this view at the Consensus conference, stating that crypto has become a political issue, which helped secure approval for spot Ethereum ETF applications.

Trump’s pro-crypto stance targeting America’s millions in the crypto industry has prompted strategic adjustments from Biden supporters on crypto policy. Biden’s re-election campaign has begun engaging key figures in the crypto sector, seeking guidance on “how the crypto community and policy should move forward.”

IV. Thematic Research: Fully Homomorphic Encryption (FHE)

Fully Homomorphic Encryption (FHE) is an advanced secure computation solution that allows unlimited arbitrary operations (including addition and multiplication) on encrypted data, ensuring privacy and security throughout data processing. Significant progress has been made globally in lightweight implementations of FHE. However, its high computational, storage, and communication overheads still fall short of meeting the performance requirements of resource-constrained edge devices in edge computing systems.

Opportunities brought by FHE:

1. Solving Privacy Issues in AI and Edge Computing

During the training of large language models, every stage involving data handling and transmission—including data distribution, model training, and parameter/gradient aggregation—poses risks to data privacy and security. Without resolving these concerns, large-scale adoption on the demand side remains unfeasible. Furthermore, leveraging edge computing resources requires guaranteed data privacy, making FHE a tailor-made privacy-preserving technology for such scenarios.

2. DePIN Hardware Acceleration

FHE computations require roughly 1,000 to 10,000 times more processing power than ZK proofs. Some hardware companies are actively developing specialized FHE chips.

Recently, projects associated with FHE have attracted significant venture capital funding, making FHE a hot technical topic within the crypto community. However, FHE applications remain in their earliest stages—we will continue monitoring developments closely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News