Andrew Kang's new article: Why I believe Ethereum cannot replicate Bitcoin's ETF success?

TechFlow Selected TechFlow Selected

Andrew Kang's new article: Why I believe Ethereum cannot replicate Bitcoin's ETF success?

After the ETF launch, ETH is expected to trade between $2,400 and $3,000.

Author: Andrew Kang

Translation: TechFlow

BTC ETFs opened the door for many new buyers to allocate bitcoin in their portfolios. The impact of ETH ETFs, however, is less obvious.

When Blackrock filed its ETF application, Bitcoin was priced at $25,000. I was strongly bullish on Bitcoin at that time. Since then, BTC has delivered a 2.6x return, while ETH has returned 2.1x. From cycle lows, both BTC and ETH have achieved a 4.0x return. So how much upside can an ETH ETF bring? I believe not much, unless Ethereum develops a compelling path to improve its economic value.

(See tweet)

Flow Analysis

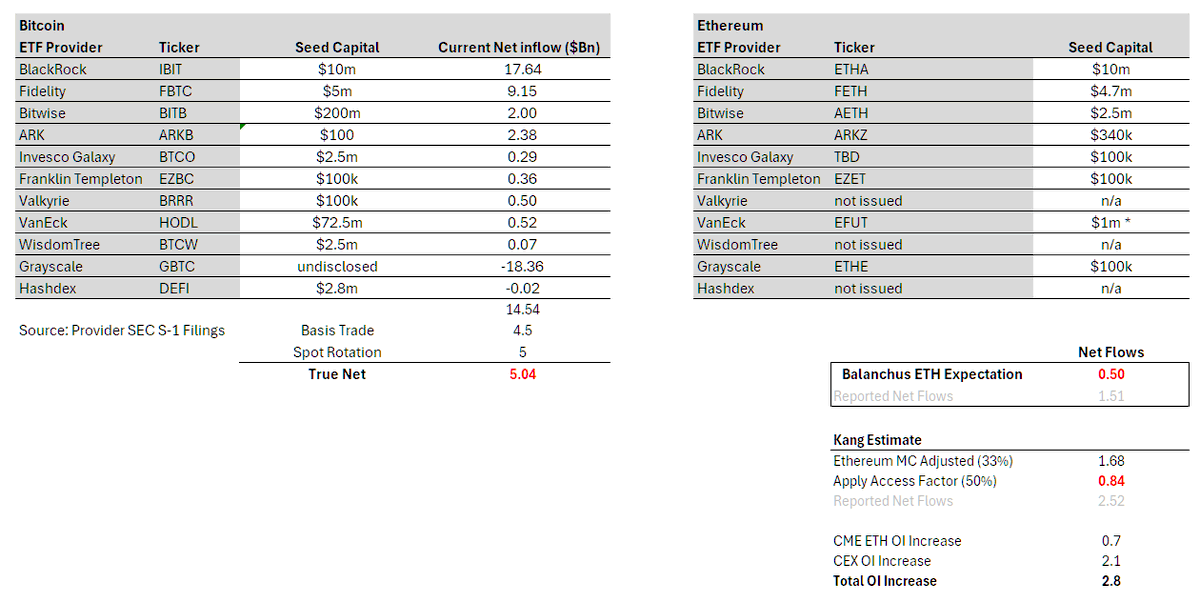

Bitcoin ETFs have accumulated $50 billion in assets under management (AUM), an impressive figure. However, if we break down net inflows since the launch of Bitcoin ETFs—excluding pre-existing GBTC AUM and rotation—the net inflow amounts to $14.5 billion. But even this isn’t true net inflow, as it includes significant delta-neutral flows such as basis trades (selling futures and buying spot ETFs) and spot rotations. Based on CME data and analysis of ETF holders, I estimate around $4.5 billion of net inflows are attributable to basis trading. ETF experts suggest large holders like BlockOne also converted substantial amounts of spot BTC into ETF shares—roughly $5 billion. After deducting these flows, the real net purchase volume for Bitcoin ETFs comes out to about $5 billion.

From here, we can simply extrapolate to Ethereum. @EricBalchunas estimates Ethereum flows might be around 10% of BTC’s. This implies $500 million in genuine net purchases over six months, versus $1.5 billion in reported net flow. While Balchunas may be biased toward lower approval odds, I believe his lack of enthusiasm/pessimism about ETH ETFs is informative and reflects broader traditional finance sentiment.

Personally, my baseline assumption is 15%. Starting from BTC’s $5 billion in real net inflows, adjusting for ETH’s market cap (33% of BTC’s) and a 0.5 access factor*, we arrive at $840 million in true net buying and $2.52 billion in reported net flow. There are reasonable arguments that ETHE has less legacy overhang than GBTC, so in a more optimistic scenario, I see real net buying reaching $1.5 billion and reported net buying at $4.5 billion—approximately 30% of BTC’s flow.

In either case, actual net buying remains far below derivative-driven flows ahead of the ETF launch ($2.8 billion), excluding spot front-running activity. This suggests ETF pricing is already ahead of fundamentals.

*The access factor adjusts for differences in holder bases, reflecting that BTC benefits more than ETH from ETF availability due to institutional accessibility. For example, BTC functions as a macro asset attractive to institutions with access constraints—macro funds, pensions, endowments, sovereign wealth funds—while ETH acts more like a tech asset appealing to VCs, crypto funds, tech experts, and retail investors who face fewer barriers to crypto exposure. Comparing ETH vs. BTC CME open interest (OI) to market cap ratios yields roughly 50%.

Looking at CME data, prior to ETF approval, ETH’s OI was significantly lower than BTC’s—about 0.30% of supply compared to BTC’s 0.6%. Initially, I viewed this as “premature” positioning, but it could equally reflect smart money’s lack of interest in ETH ETFs. Street traders executed a strong trade on BTC; they tend to have good information, so if they aren’t repeating it with ETH, there’s likely a good reason—possibly indicating weaker flow intelligence.

How Did $5 Billion Push BTC from $40K to $65K?

Short answer: It didn’t. There were many other buyers in the spot market. Bitcoin is a globally validated asset, a key portfolio holding, and has numerous structural accumulators—Saylor, Tether, family offices, high-net-worth retail investors, etc. ETH has some structural buyers too, but I believe their scale is smaller than BTC’s.

Recall that before ETFs existed, Bitcoin was already held at levels equivalent to $69,000 / 1.2T+ BTC. Market participants and institutions already held massive amounts of spot crypto. Coinbase alone had $193 billion in custody, with $100 billion coming from its institutional program. In 2021, Bitgo reported $60 billion in AUC, and Binance held over $100 billion in custodial assets. Six months post-ETF launch, ETFs held just 4% of Bitcoin’s total supply—an important development, but only one part of the demand equation.

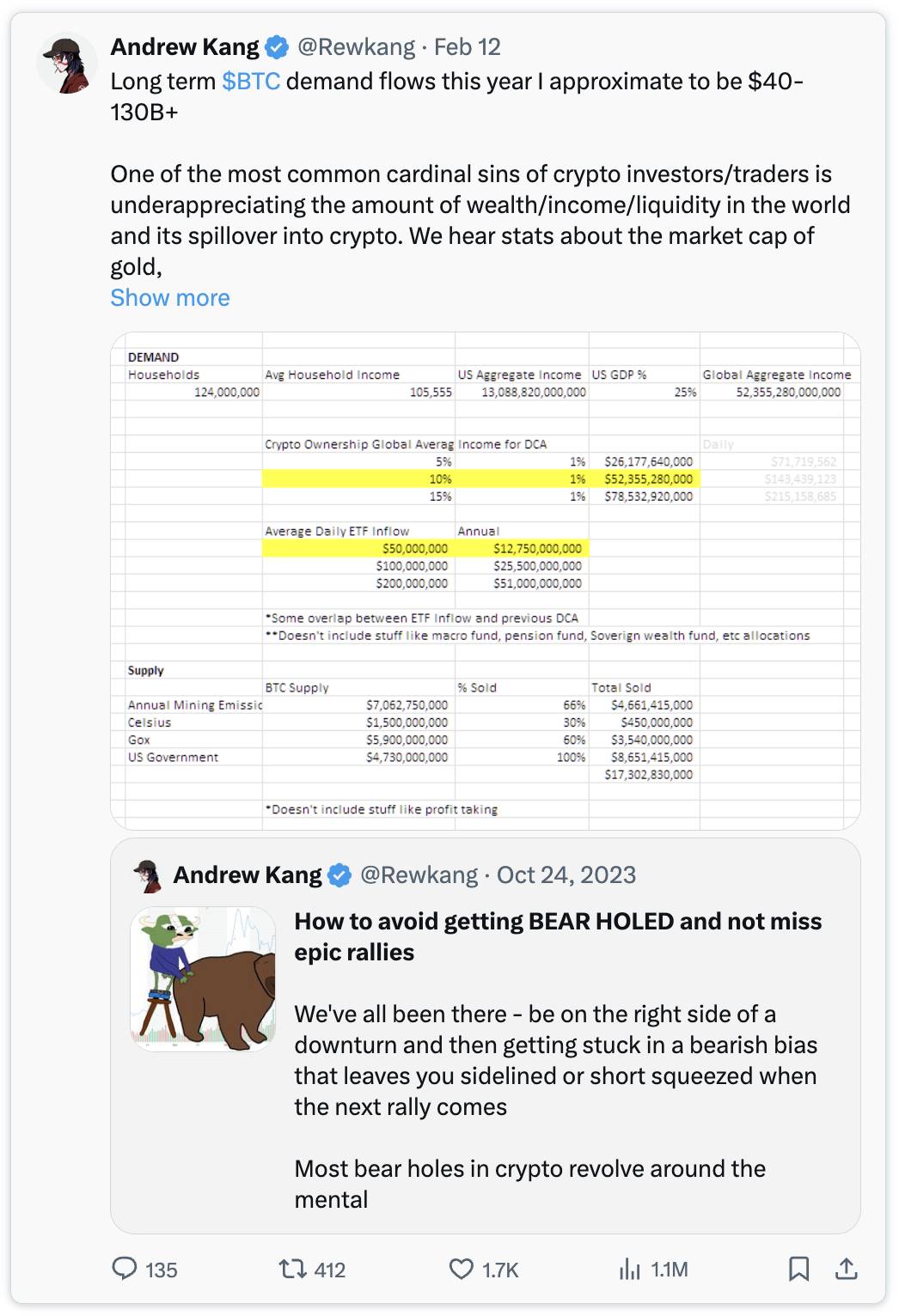

(See tweet)

Between MSTR and Tether alone, there were billions in additional buy-side pressure. Moreover, positions entering ETFs were initially underweight. At the time, a popular narrative was that ETF approval would be a “sell-the-news” event or market top. As a result, billions in short-, medium-, and long-term momentum selling occurred, which now needs to be bought back (a 2x flow effect). Additionally, once ETF flows showed strong volatility, short sellers also needed to cover. Remarkably, after issuance began, open interest actually declined.

ETH ETF positioning is very different. ETH is already up 4x from its lows, whereas BTC was only up 2.75x from pre-launch levels. Native crypto CEX open interest has increased by $2.1 billion, bringing OI close to all-time highs. The market is (semi) efficient. Naturally, many crypto natives observed the success of Bitcoin ETFs and positioned accordingly for similar outcomes with ETH.

I personally believe crypto-native expectations are exaggerated and disconnected from the real preferences of capital allocators. Those deeply embedded in crypto naturally have higher awareness and purchasing power regarding Ethereum. In reality, Ethereum’s adoption rate as a core portfolio allocation among non-crypto-native capital is significantly lower.

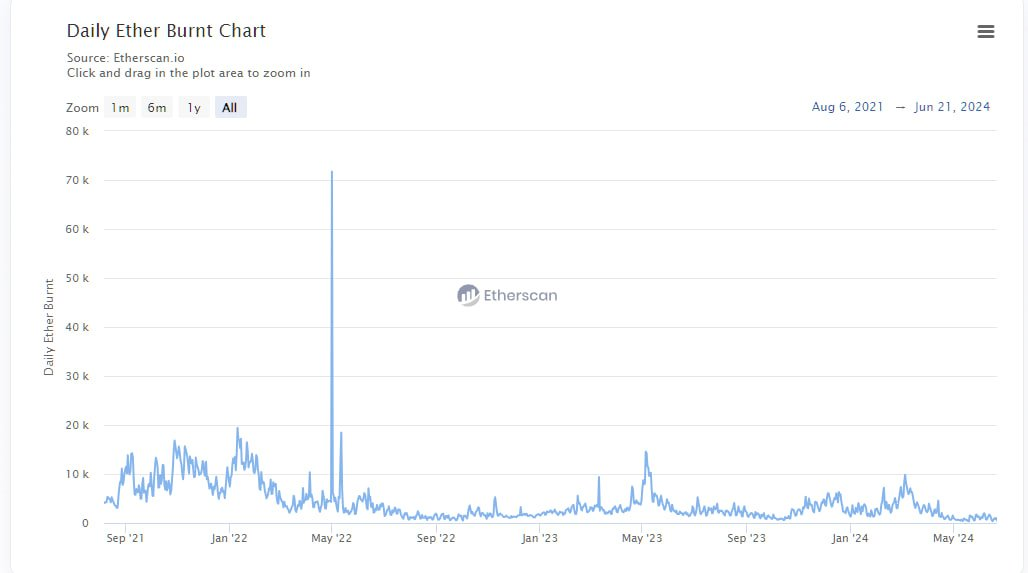

One of the most common pitches to traders is framing Ethereum as a "tech asset"—a global computer, a Web3 app store, a decentralized financial settlement layer. It's a nice story, and I bought into it during previous cycles. But when you look at the actual numbers, it becomes hard to justify.

In the last cycle, you could point to rising fee growth and argue DeFi and NFTs would generate increasing fees and cashflows, building a compelling tech-investment thesis similar to tech stocks. But in this cycle, quantifying fees works against the narrative. Most charts show flat or negative growth. Ethereum is a "cash machine," but with a 30-day annualized revenue of $1.5 billion, a PS ratio of 300x, and negative inflation-adjusted earnings/PE, how do analysts justify this valuation to their dad’s family office or macro fund boss?

I even expect fugazi (delta-neutral) flows to be relatively low in the first few weeks for two reasons. First, approval came as a surprise, leaving issuers little time to convince large holders to convert their ETH into ETF form. Second, the conversion is less attractive for holders because they’d have to give up mark-to-market gains, yield farming, or using ETH as staking collateral in DeFi. Note, however, that only 25% of ETH is currently staked.

Does this mean ETH will go to zero? Of course not. At some price level, it will be fairly valued, and it will move somewhat in tandem with BTC’s future rallies. Prior to ETF launch, I expected ETH to trade between $3,000 and $3,800. Post-ETF, my range is $2,400 to $3,000. However, if BTC rises to $100,000 by late Q4 2025 or early 2026, that could pull ETH to new all-time highs—but with a lower ETH/BTC ratio. Long-term, developments are promising—you must believe BlackRock/Fink is doing substantial work putting financial rails on-chain and tokenizing more assets. How much value this will bring to ETH, and on what timeline, remains uncertain.

I expect the ETH/BTC pair to continue declining, trading between 0.035 and 0.06 next year. Although our sample size is small, we’ve consistently seen lower highs in ETH/BTC each cycle, so this isn’t surprising.

Join TechFlow’s official community:

Telegram subscription group:

Twitter official account:

Twitter English account:

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News