Is it "618" for the crypto circle? What's the main issue with this market cycle?

TechFlow Selected TechFlow Selected

Is it "618" for the crypto circle? What's the main issue with this market cycle?

Before discussing the current market cycle, let's review the patterns of the previous bull market and the A-share bull market.

Author: Uncle Jian

"Has crypto ended? Did you make money in this bull run?"

Before discussing the current market cycle, let's review the patterns of the previous bull market and A-share bull runs.

1. Market Hype Logic

The widely recognized pattern in A-share bull markets is that brokers lead the rally first, followed by high-quality blue-chip sectors such as insurance, real estate, steel, coal, and non-ferrous metals. Finally come speculative stocks—flooding liquidity wildly chasing undervalued opportunities, with themes driving momentum and small-cap tokens skyrocketing. At the end of a bull market, opening brokerage accounts requires connections; students stop attending class, office workers quit their jobs, and even security guards and aunties start sharing stock tips. Listed companies aggressively conduct private placements and sell off shares while retail investors blindly buy in—only to be left holding the scraps after the party ends...

Looking back at the 2021 crypto bull market, we see similar dynamics. It began with the DeFi Summer narrative—TVL doubling rapidly and sending UNI and Aave soaring. Then came one-way rallies in BTC and ETH. During this period, nearly every theme and narrative experienced gains—ranging from several-fold to tens or even hundreds of times appreciation. In the mid-to-late stages, meme coins surged—with Doge and Shiba Inu leading the charge. After the meme wave faded, new narratives like blockchain gaming and metaverse projects (e.g., Axie Infinity and The Sandbox) exploded in popularity, triggering intense speculation. Once the hype died down, the market corrected due to various factors and never recovered its momentum.

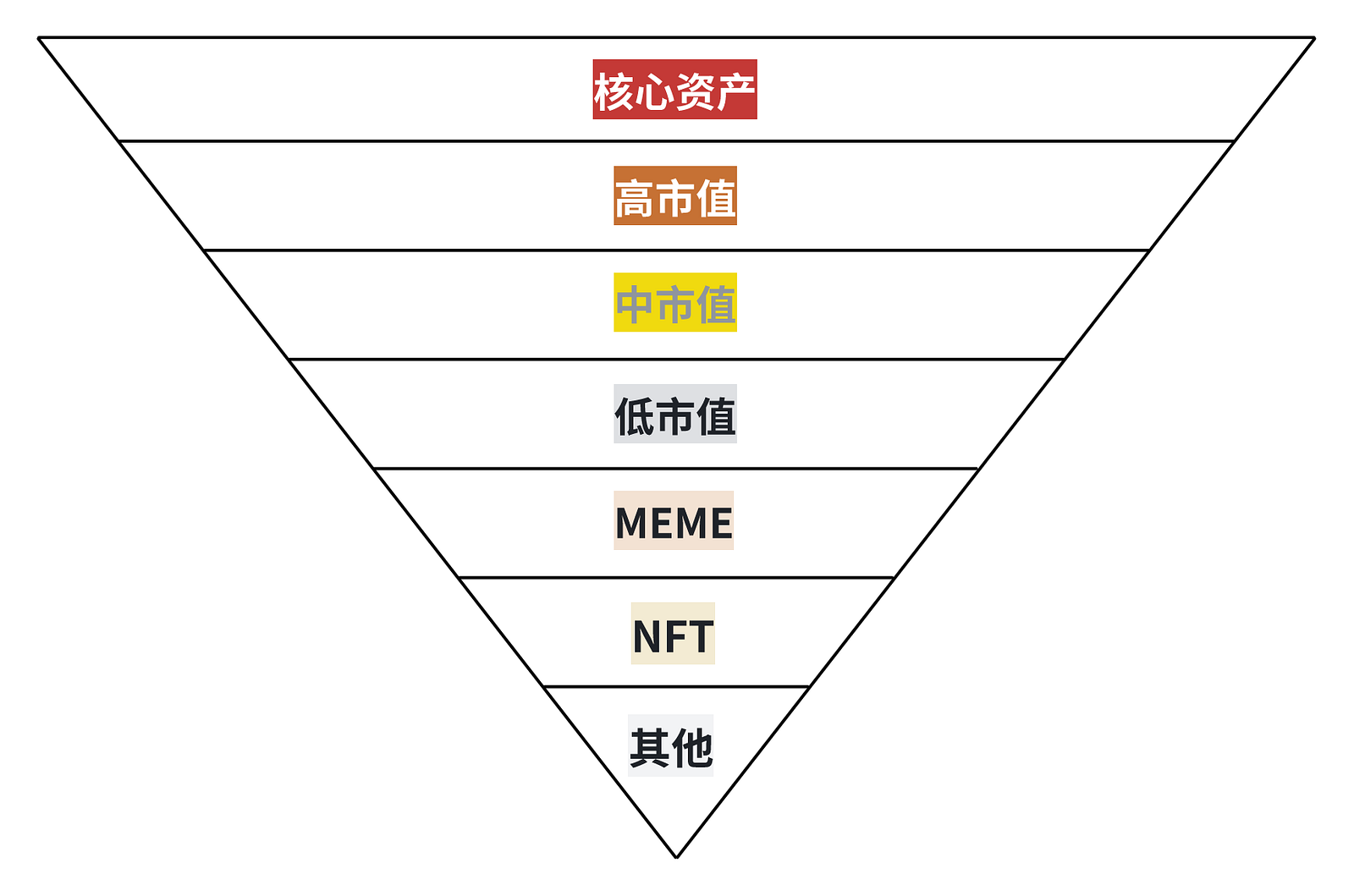

Comparing commonalities across different types of bull markets reveals a core logic: high-certainty, high-value assets are prioritized first, followed by thematic sectors with compelling narratives and media attention, and finally low-quality tokens, vaporware, and meme coins. However, with rapid development and iteration in blockchain over the past three years, we now have more narratives and sectors—such as Ethereum Layer 2s, restaking, inscriptions/ordinals, AI, and others. These emerging narratives will eventually replace older ones from the last cycle. Therefore, it’s hard to identify clear patterns or determine where we currently stand in the cycle based solely on themes. Instead, we can analyze market progression through market capitalization trends.

Core assets (i.e., BTC and ETH) → High market cap → Mid market cap → Low market cap → Memes → NFTs / Others

2. Changes and Differences in This Bull Run

-

So, did you make money in this bull market?

-

Do you feel your capital efficiency is low? Have your favorite sectors suddenly pulled back sharply?

-

Are value-based tokens underperforming meme coins? Are returns from trading serious projects slower than pumping shitcoins?

-

Is GameFi data hitting new highs and raising funds continuously, yet failing to produce breakout hits?

The most immediate feeling in this bull run is insufficient liquidity and weak profit-making effects—there’s no widespread "rising tide lifts all boats" phenomenon. While ETF approvals injected strong liquidity into BTC, this liquidity hasn’t spilled over into other sectors and niches. Although there are expectations of Fed rate cuts, it’s still uncertain whether the long-awaited easing will significantly improve conditions in the crypto market. We must recognize that funds released due to rate cuts may not flow directly into crypto—they might first fill liquidity gaps in equities and real estate. Only when those markets become saturated would excess capital possibly trickle into crypto.

Therefore, amid tight liquidity and ETF-driven flows, an extreme situation emerges: core assets rise while other segments stagnate or even decline—and memes surge briefly due to short-term speculative heat. But such meme-led rallies aren't sustainable, sometimes lasting only hours or days, which itself reflects capital scarcity.

Capital Scarcity:

Why does this capital shortage occur? The root cause lies in structural changes in fund flow and transmission. Capital injected via ETFs can only reach BTC and ETH—it cannot overflow layer by layer like water filling a reservoir system.

We can think of today’s crypto market as a series of isolated reservoirs, each representing a sector or niche. Water only spills from one reservoir to the next once the upper level is full. Based on timing from the last bull cycle, we can roughly outline how capital moves during a market upswing. Markets only seek lower-tier, undervalued opportunities when they can no longer find viable options or become saturated in the current tier. Downward movement usually happens out of necessity or because capital has peaked—each step down意味着 weakening profitability and rising risk.

Secondary Market Dragging Down Primary Market:

Take zk recently as an example—how many people lost years of effort overnight. This too reflects capital scarcity: the current primary market for farming airdrops simply cannot support so many participants. Ultimately, under conditions of limited secondary market liquidity and funding, many shift from secondary to primary seeking alpha. Yet few consider: what’s the point of the primary market if there’s no secondary market to exit into? For retail investors, making money in the primary space today is extremely difficult. Airdrop farmers can’t compete with professional studios and are easily victimized by sybil attacks. Ordinary users struggle to survive—the primary market has turned into a technological battleground.

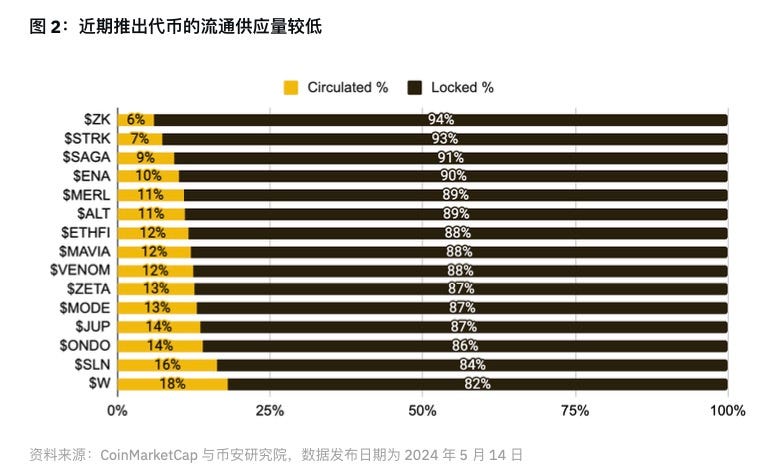

Moreover, the constant listing of high-market-cap tokens further squeezes overall liquidity. From BB and Not to recent io and zk, including future Blast—all launched with sky-high valuations that immediately cap upside potential. After new tokens list, capital inevitably diverts into them, further draining liquidity from altcoins. Judging from the debut performance of recent listings, it’s clear the market is starved for cash: launch prices were far below expectations, and cases like being able to buy NOT on day one and instantly gain 50% show widespread skepticism about the true value of new tokens.

High FDV Leading to Lack of Buyers:

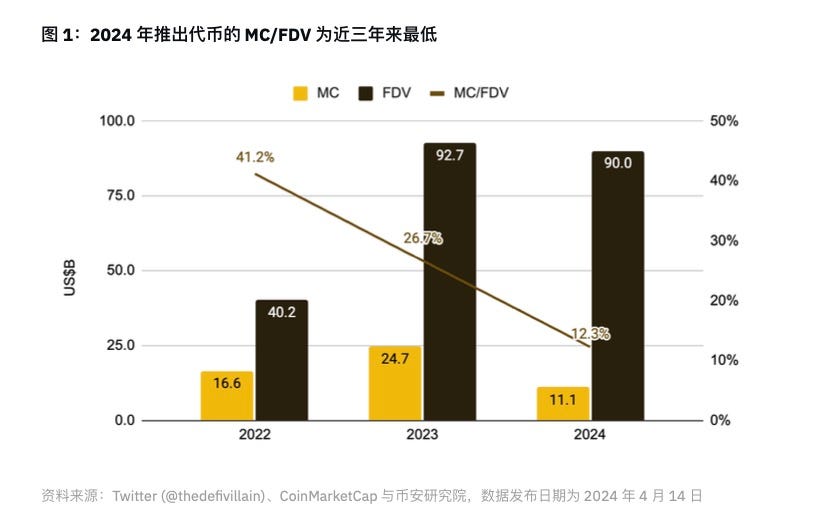

According to Binance Research's May 2024 report, "Observations and Thoughts on High Valuation, Low Circulating Supply Tokens," the current MC/FDV ratio is the lowest in nearly three years. The total FDV of tokens issued in the first five months of 2024 already approaches the entire annual sum of 2023. Binance noted that maintaining current token prices going forward would require $80 billion in liquidity.

With unchanged demand, low circulating supply allows prices to be pumped easily in the short term, inflating FDV. Take yesterday’s zk launch: nearly $1 billion in market cap despite massive unvested supply—doesn’t that seem a bit “high”?

Who benefits from high FDV?

-

From a project team perspective: high FDV may boost perceived valuation and increase future profit potential

-

From a VC perspective: high FDV implies higher potential valuations, boosting fund performance metrics

-

From an exchange perspective: high FDV doesn’t materially affect operations

-

From a retail investor perspective: high FDV often signals longer project runway and lower rug-pull risk. However, this also makes retail less willing to buy into high-FDV tokens, pushing them instead toward fully-circulating, fun meme tokens—Not being a prime example.

Thus, we’re stuck in a self-defeating bull market: retail refuses to buy VC-backed tokens due to massive unlock schedules caused by inflated FDVs; institutions avoid meme coins due to low intrinsic value and extreme volatility. Everyone plays their own game, and the market fails to form a unified consensus.

3. Conclusion

Market fundamentals today have fundamentally changed compared to previous years. Traditional investment frameworks need adjustment. We believe the poor profit-making environment in this bull market stems primarily from capital scarcity and the prevalence of high valuations with low circulating supply. This leads to weak spillover from secondary to primary markets, compounded by sybil attacks and studio dominance in airdrop farming—further eroding retail profitability.

We can’t precisely pinpoint where the current crypto market stands in the cycle, nor predict whether BTC will truly break $100,000. But identifying these underlying issues rationally is exactly what matters most right now. Perhaps only after gradually resolving these structural problems will the true, explosive crypto supercycle finally arrive.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News